- Home

- »

- Homecare & Decor

- »

-

Caravanning Market Size, Share And Trends Report, 2030GVR Report cover

![Caravanning Market Size, Share & Trends Report]()

Caravanning Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Caravans, Motor Caravan), By Tourist Type (Domestic, International), By Booking Mode, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-955-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Caravanning Market Summary

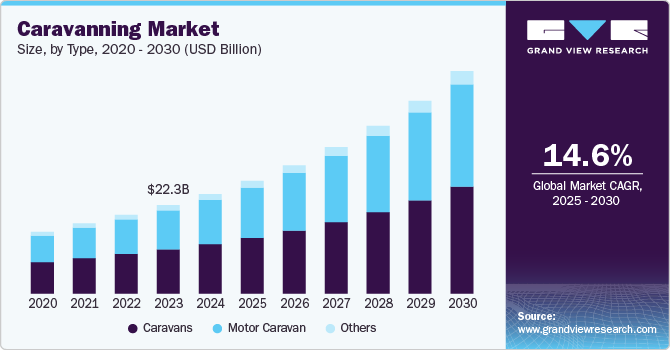

The global caravanning market size was estimated at USD 25,084.3 million in 2024 and is projected to reach USD 56,088.5 million by 2030, growing at a CAGR of 14.6% from 2025 to 2030. The expansion of the market is driven by increasing consumer interest in outdoor recreation and the rising demand for flexible, self-sufficient travel options.

Key Market Trends & Insights

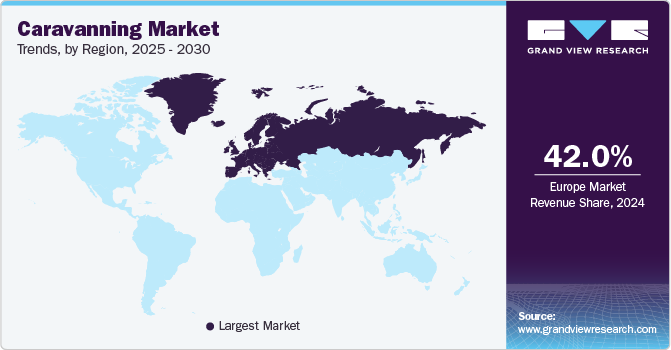

- In terms of region, Europe was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, caravans accounted for a revenue of USD 14,041.8 million in 2024.

- Motor Caravan is the most lucrative type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 25,084.3 Million

- 2030 Projected Market Size: USD 56,088.5 Million

- CAGR (2025-2030): 14.6%

- Europe: Largest market in 2024

In addition, advancements in caravan technology, including enhanced comfort features, eco-friendly designs, and the integration of smart systems, are attracting a broader range of travelers. The trend is particularly strong in regions like Europe and North America, where the culture of camping and adventure travel is well-established. Emerging markets also show considerable growth potential.

The caravanning market in Germany witnessed significant growth between 2019 and 2021, with the number of individuals identifying as caravanners increasing by over 2 million to reach 13.8 million. This 16% growth in just two years highlighted a notable trend of increasing interest in caravanning despite a general decline in the travel sector due to the COVID-19 pandemic.

The market also saw a substantial rise in the intention to purchase, with approximately 1.2 million Germans expressing plans to buy a caravan or motor caravan within the following 12 to 24 months, according to a 2021 survey commissioned by the Caravaning Industrie Verband (CIVD) and conducted by the Institut für Demoskopie Allensbach. The data revealed that 40% of potential buyers had rented a caravan or motor caravan prior to their purchase decision, indicating a shift toward experiential marketing in the industry.

A 2021 survey commissioned by the Caravaning Industrie Verband (CIVD) and conducted by the Institut für Demoskopie Allensbach identified seven distinct caravanning target groups, reflecting the diverse demographics engaging in this leisure activity. Among these groups, the "discoverers" and "flexible" segments each represented 17% of respondents, characterized by families seeking short trips and couples without children preferring less frequented destinations, respectively. The survey also indicated a clear preference for motor caravans, with 66% of prospective buyers leaning towards this option.

Price emerged as the most critical factor for 80% of respondents when considering purchases, with vehicle size being a significant consideration for 58%. Overall, these trends suggested that while the pandemic contributed to the increased popularity of caravanning, underlying values such as sustainability and family-oriented experiences played a crucial role in shaping the future of this market.

Type Insights

Caravan rentals accounted for a share of over 49% in 2024, driven by several key factors. These include a rising interest in outdoor leisure activities, the increasing popularity of eco-tourism, and overall expansion in the travel and tourism sector. A survey by the Outdoor Industry Association (OIA) revealed that participation in outdoor activities, including RV camping, grew from 50.7% in 2019 to 52.9% in 2020. Furthermore, the demand for affordable and flexible vacation options propels the market growth as travelers seek alternative ways to explore new destinations while saving on accommodation costs.

Motor caravan rentals are projected to grow at a CAGR of 15.2% from 2025 to 2030. Motor caravans allow travelers to change their plans on the go, allowing them to explore multiple destinations without the constraints of hotel bookings. Moreover, equipped with essential amenities such as kitchens, bathrooms, and sleeping areas, motor caravans provide a home-like experience that enhances comfort during travel.

Tourist Type Insights

Caravanning among domestic tourists accounted for a share of over 81% of the global market revenue in 2024, driven by a strong preference for local travel experiences. This trend highlights how individuals and families increasingly choose caravanning as a preferred method for exploring their home countries, especially as it allows for convenience and accessibility. For instance, in Germany, a nation known for its robust caravanning culture, the number of domestic caravanning enthusiasts has surged, reflecting a shift toward local exploration.

Caravanning among international tourists is projected to grow at a CAGR of 15.7% from 2025 to 2030, indicating a rising trend among travelers seeking unique and immersive experiences abroad. This growth can be attributed to an increasing interest in eco-tourism and adventure travel, where tourists opt for caravanning to explore diverse landscapes and cultures at their own pace. For example, in countries like Australia and New Zealand, international tourists embrace the concept of "freedom camping," allowing them to experience the great outdoors while enjoying the comfort of a mobile home. Furthermore, the rise of social media and travel influencers showcasing caravanning adventures abroad has contributed to the growing appeal, encouraging more travelers to consider this mode of travel for their next international getaway.

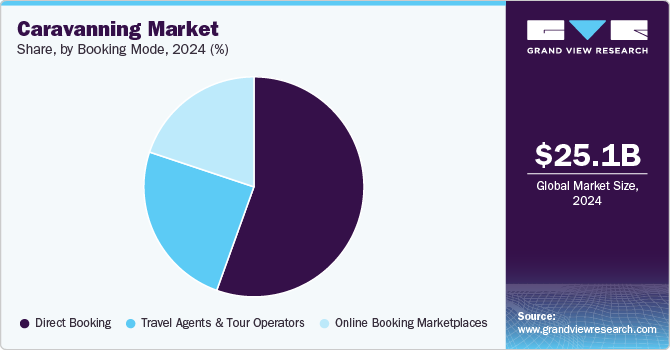

Booking Mode Insights

Direct booking accounted for a revenue share of over 55% in 2024. This trend reflects a significant consumer preference for booking directly with rental companies or caravan service providers, driven by the benefits of transparent pricing, personalized services, and loyalty programs. For instance, major rental companies have enhanced their websites to streamline the booking process, making it more user-friendly and efficient. Furthermore, direct bookings often provide customers with exclusive deals and better cancellation policies, encouraging travelers to bypass third-party platforms and engage directly with service providers.

Bookings on online marketplaces are projected to grow at a CAGR of 15.8% from 2025 to 2030.This growth is fueled by the increasing reliance on digital platforms for travel planning, particularly among younger consumers who favor convenience and variety. Online marketplaces offer a wide selection of rental options, allowing customers to compare prices and features across multiple providers. For instance, platforms like Outdoorsy and RVshare have gained popularity by connecting renters with local caravan owners, providing a unique and diverse inventory. As more travelers seek flexible booking options and user-generated reviews, the role of online marketplaces is set to grow.

Regional Insights

The caravanning market in North America accounted for a share of over 35% of the global market revenue in 2024, reflecting a significant trend toward outdoor leisure activities among U.S. consumers. This surge in popularity can be attributed to a growing desire for flexible travel options and a focus on health and wellness, leading many to seek safer, socially distanced vacation alternatives. The increase in RV ownership, with approximately 11.2 million households owning an RV as of 2023, further supports this trend. The U.S. National Park Service reported a notable uptick in visitation rates to national parks, indicating that more travelers are choosing caravanning as a way to explore the great outdoors while enjoying the comforts of home on the road.

U.S. Caravanning Market Trends

The caravanning market in the U.S. is expected to grow at a CAGR of 14.3% from 2025 to 2030. This growth is driven by several factors, including the increasing popularity of outdoor recreational activities, a surge in domestic travel, and a growing preference for flexible and cost-effective vacation options. Moreover, the COVID-19 pandemic has prompted many Americans to seek safer travel alternatives, with caravanning providing a means to explore natural landscapes while maintaining social distancing. With significant investments in infrastructure, such as the expansion of RV parks and campgrounds, the market is expected to attract a broader demographic, including younger travelers and families, further fueling its expansion.

Europe Caravanning Market Trends

The caravanning market in Europe accounted for a share of over 42% of the global market in 2024, with countries like Germany, the UK, and France leading the charge. The European market benefits from an extensive network of caravan parks and campsites, fostering an environment conducive to this style of travel. The European RV industry grew about 12% in new registrations in 2023, with Germany alone registering over 35,000 new motorhomes and caravans. In addition, the rise of eco-tourism and sustainability practices has encouraged European travelers to embrace caravanning, as it aligns with their desire for more environmentally friendly vacation options. The popularity of events such as the Caravan Salon Düsseldorf further showcases the region's commitment to caravanning, drawing in thousands of visitors each year who are eager to explore the latest innovations in the industry.

Asia Pacific Caravanning Market Trends

The caravanning market in Asia Pacific is expected to grow at a CAGR of 16.2% from 2025 to 2030. Key contributors to this growth include Australia, New Zealand, and India. Caravan tourism is gaining traction in India, offering travelers a unique blend of flexibility, adventure, and accommodation. This travel trend allows tourists to design their own journeys, allowing them to explore at their own pace while enjoying the comforts of mobile living. Though well-established in Western countries, caravan tourism is emerging in India, with states like Kerala, Maharashtra, and Goa leading the charge by introducing caravan parks and supportive tourism policies. Notably, companies like Wacation On Wheels have reported a remarkable increase in inquiries, with a 100% rise in 2021 compared to 2020, signaling a shift in consumer preferences toward this novel form of travel.

Key Caravanning Company Insights

The caravanning market is fragmented, with a diverse array of companies vying for market share across various segments. Key players include established manufacturers such as Thor Industries, which holds a significant portion of the market with its extensive lineup of recreational vehicles, and Forest River, known for its wide range of motorhomes and travel trailers. In addition, the rise of smaller, specialized companies focusing on eco-friendly and luxury caravanning solutions has further diversified the competition.

Key Caravanning Companies:

The following are the leading companies in the caravanning market. These companies collectively hold the largest market share and dictate industry trends.

- Apollo RV Holidays

- Campervan North America LLC

- Cruise America

- Road Bear RV

- Britz

- Motohom

- Roadsurfer GmbH

- McRent

- Camperbug

- DRM

Recent Developments

-

In April 2024, Schattdecor unveiled its new Caravan Selection for 2024/25, tailored to meet the diverse needs of the caravanning industry based on extensive trend and target group research. The latest collection, named INDEPENDENT, focuses on enhancing the design of motorhomes to align with the values of travelers who prioritize independence and self-sufficiency in nature. This selection features a natural yet modern aesthetic, incorporating wood, stone, and subtle metallic accents to create a comforting atmosphere within caravans.

-

In February 2022, Haven Leisure acquired the family-owned caravan holiday park, Richmond Holiday Centre. Haven Leisure continues to look for similar opportunities to expand its business further.

-

In January 2022, the UK-based holiday park operator Parkdean Resorts acquired Hanson European Caravan Transport, the static caravan transport company headquartered in Yorkshire, UK.

Caravanning Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 28.42 billion

Revenue forecast in 2030

USD 56.09 billion

Growth rate (revenue)

CAGR of 14.6% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, tourist type, booking mode, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Netherlands; China; Japan; India; Australia & New Zealand; Brazil; South Africa; UAE

Key companies profiled

Apollo RV Holidays; Campervan North America LLC; Cruise America; Road Bear RV; Britz; Motohom; Roadsurfer GmbH; McRent; Camperbug; DRM

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Caravanning Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global caravanning market based on type, tourist type, booking mode, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Caravans

-

Motor Caravan

-

Others

-

-

Tourist Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Domestic

-

International

-

-

Booking Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Direct Booking

-

Travel Agents & Tour Operators

-

Online Booking Marketplaces

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global caravanning Market was estimated at USD 25.08 billion in 2024 and is expected to reach USD 28.42 billion in 2025.

b. The global caravanning Market is expected to grow at a compound annual growth rate of 14.6% from 2025 to 2030 to reach USD 56.09 billion by 2030.

b. In 2024, the European caravanning market accounted for over 42% of the global market, with countries like Germany, the U.K., and France leading the charge. The European market benefits from an extensive network of caravan parks and campsites, fostering an environment conducive to this style of travel.

b. Some key players operating in the caravanning Market include Apollo RV Holidays, Campervan North America LLC, Cruise America, Road Bear RV, Britz, and Motohom.

b. Key factors that are driving the Caravanning market growth include increasing consumer interest in outdoor recreation and the rising demand for flexible, self-sufficient travel options.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.