- Home

- »

- Next Generation Technologies

- »

-

Carbon Accounting Software Market, Industry Report, 2033GVR Report cover

![Carbon Accounting Software Market Size, Share & Trends Report]()

Carbon Accounting Software Market (2025 - 2033) Size, Share & Trends Analysis Report By Deployment (Cloud, On-premises), By Enterprise Size, By End Use (Retail, Healthcare, Energy & Utilities), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-426-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Carbon Accounting Software Market Report Summary

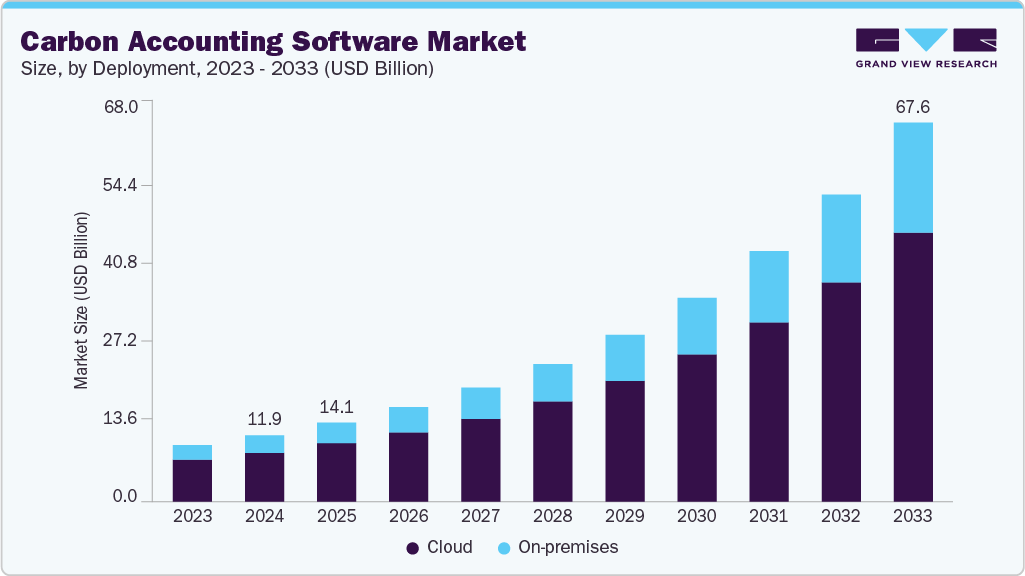

The global carbon accounting software market size was valued at USD 11.86 billion in 2024 and is projected to reach USD 67.58 billion by 2033, expanding at a CAGR of 22.1% from 2025 to 2033. This growth is driven by the increasing global awareness and regulatory pressure to reduce carbon emissions and address climate change.

Key Market Trends & Insights

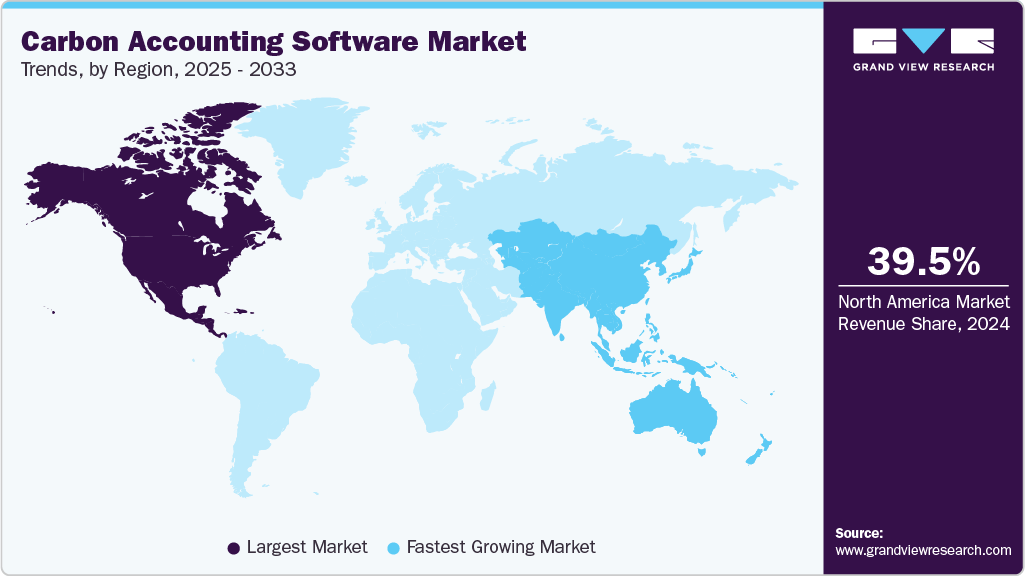

- North America dominated the global carbon accounting software market with the largest revenue share of 39.5% in 2024.

- The U.S. carbon accounting software industry led North America with the largest revenue share in 2024.

- By deployment, the cloud segment led the market, holding the largest revenue share of 73.3% in 2024.

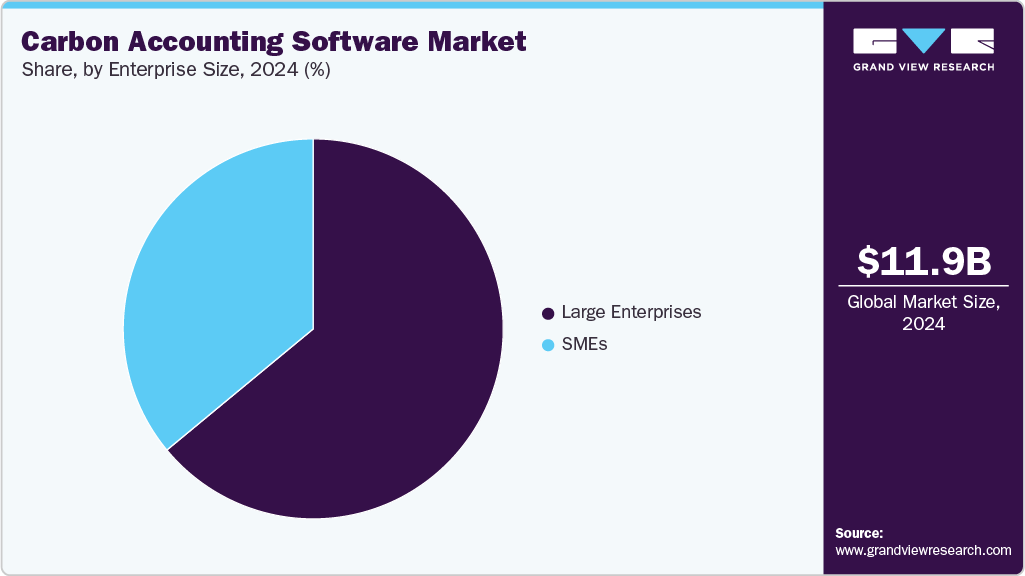

- By enterprise size, the large enterprises segment held the dominant market position in 2024.

- By end use, the energy & utilities held the dominant market position in 2024.

Market Size & Forecast

- 2024 Market Size: USD 11.86 Billion

- 2033 Projected Market Size: USD 67.58 Billion

- CAGR (2025-2033): 22.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Organizations across various industries are adopting carbon accounting software to accurately measure, track, and report their carbon footprints. This software facilitates compliance with stringent environmental regulations and supports corporate sustainability initiatives by providing real-time insights into carbon emissions across operations.The increasing emphasis on corporate sustainability is driving businesses to emphasize their environmental initiatives. Carbon accounting software enables companies to transparently monitor and report their carbon footprint, showcasing their dedication to sustainability and appealing to eco-conscious consumers and investors. The carbon accounting software industry also benefits from the increasing adoption of cloud-based solutions, which offer scalability and ease of access, making carbon accounting more accessible to small and medium-sized enterprises. With the ongoing global shift towards sustainability and the decarbonization of industries, the carbon accounting software market is poised for robust growth in the coming years, playing a crucial role in helping businesses meet their environmental objectives.

Many governments and regulatory bodies mandate organizations to report their carbon footprint and greenhouse gas (GHG) emissions as part of strict environmental regulations or voluntary initiatives like the Carbon Disclosure Project (CDP) or the Task Force on Climate-related Financial Disclosures (TCFD). Carbon accounting software aids organizations in meeting these regulatory requirements and standards by offering standardized reporting templates and efficient data management tools. These factors are generating significant opportunities for the adoption of carbon accounting software in the market.

Deployment Insights

The cloud segment led the carbon accounting software market in 2024, accounting for 73.3% share of the global revenue. Cloud-based solutions allow organizations to access carbon accounting tools from anywhere, enabling real-time tracking and management of emissions data across multiple locations. This accessibility is particularly beneficial for companies with distributed operations or remote teams. Additionally, cloud solutions reduce the need for significant upfront investments in IT infrastructure, making them more attractive to small and medium-sized enterprises. The automatic updates and maintenance provided by cloud service providers further enhance their appeal, ensuring that organizations stay compliant with the latest environmental regulations and standards. These advantages have driven the widespread adoption of cloud-based carbon accounting software.

The on-premises segment is predicted to experience significant growth in the coming years. Organizations with stringent data protection requirements, such as those in the financial services, healthcare, and government sectors, prefer on-premises solutions to maintain full control over their sensitive carbon emissions data. Additionally, on-premises deployments allow for greater customization to meet specific business needs and integration with existing IT infrastructure. As regulatory pressures intensify and the importance of precise carbon accounting grows, companies are increasingly investing in robust, on-premises solutions to ensure compliance while safeguarding their proprietary information, contributing to the segment's high growth over the forecast period.

End Use Insights

The energy & utilities segment accounted for the largest revenue share in 2024.Energy and utility companies are among the largest emitters of greenhouse gases, making them subject to stringent environmental regulations and reporting requirements. These organizations are under significant pressure to reduce their carbon footprint and transition to more sustainable practices. Carbon accounting software provides these companies with the tools to accurately track emissions across their operations, optimize energy use, and report compliance with environmental standards. The sector's focus on sustainability, coupled with regulatory demands, has driven the widespread adoption of carbon accounting software.

The transportation & logistics segment is anticipated to exhibit the fastest CAGR over the forecast period. As governments implement stricter environmental regulations and carbon reduction targets, companies within this segment are compelled to adopt advanced carbon accounting software to monitor and manage their emissions more effectively. The rise of green logistics initiatives, coupled with consumer demand for eco-friendly supply chains, is also pushing the industry towards more sustainable operations. Additionally, the growing adoption of electric and alternative fuel vehicles requires precise tracking of emissions reductions, further boosting the need for robust carbon accounting software in this sector.

Enterprise Size Insights

The large enterprises segment accounted for the largest revenue share of the carbon accounting software industry in 2024. Large enterprises often operate across multiple regions and industries, requiring advanced tools to accurately monitor and report their carbon emissions on a global scale. The need for comprehensive compliance with environmental regulations, coupled with the pressure to meet ESG standards, drives significant investment in advanced carbon accounting software. These solutions provide detailed insights, customizable reporting, and integration with broader enterprise systems, enabling large companies to manage their sustainability efforts and maintain transparency with stakeholders effectively.

The small and medium enterprises (SMEs) segment is anticipated to witness significant growth in the coming years. As environmental regulations become more stringent, SMEs are increasingly adopting carbon accounting software to ensure compliance and enhance their sustainability credentials. The growing availability of affordable, user-friendly cloud-based solutions makes it easier for SMEs to implement these tools without significant upfront costs. Additionally, the rising demand from consumers and partners for transparent environmental practices is prompting SMEs to invest in carbon management to remain competitive.

Regional Insights

North America dominated the carbon accounting software market with a revenue share of over 39.5% in 2024. The U.S. and Canadian governments have implemented rigorous reporting requirements for greenhouse gas emissions, compelling organizations across various industries to adopt carbon accounting software. Additionally, the growing focus on ESG practices among North American companies has driven demand for advanced tools to monitor and report carbon emissions. The presence of major market players and a high level of technological adoption in the region further contributed to North America's high share of the market. These factors, combined with increasing investor and consumer pressure for transparency in sustainability efforts, fueled the widespread adoption of carbon accounting solutions.

U.S. Carbon Accounting Software Market Trends

The U.S. carbon accounting software industry is expected to grow significantly in 2024. As the U.S. government enforces stricter environmental regulations and carbon reduction targets, businesses across various sectors are increasingly adopting carbon accounting software to ensure compliance and enhance their sustainability reporting. The U.S. market also benefits from a robust tech ecosystem, which facilitates the development and adoption of innovative carbon accounting solutions and contributes to the anticipated high growth rate.

Europe Carbon Accounting Software Market Trends

The Europe carbon accounting software industry is expected to witness significant growth over the forecast period. The European Union's ambitious climate goals, such as the European Green Deal and the commitment to becoming carbon-neutral by 2050, are pushing organizations to adopt advanced carbon accounting solutions. The region's proactive approach to environmental responsibility, coupled with government incentives and support for green technologies, is fueling the rapid adoption of carbon accounting software, leading to significant market growth during this period.

Asia Pacific Carbon Accounting Software Market Trends

The Asia Pacific carbon accounting software industry is anticipated to register rapid growth over the forecast period. As countries like China, India, and Japan implement stricter environmental regulations and carbon reduction initiatives, businesses are increasingly adopting carbon accounting software to comply with these requirements and reduce their environmental impact. The growing awareness of climate change and the need for sustainable practices among corporations in the region is also contributing to this trend.

Key Carbon Accounting Software Company Insights

Some key companies in the carbon accounting software industry areIBM Corporation and SAP SE.

-

IBM Corporation is a prominent player in the market through its Envizi ESG Suite, which enables organizations to measure, manage, and report Scope 1, 2, and 3 greenhouse gas emissions. The platform integrates with IBM’s environmental intelligence suite and cloud carbon calculator, providing advanced analytics, automation, and AI-driven insights for emissions tracking and sustainability reporting. Leveraging its strong enterprise presence and consulting expertise, IBM Corporation helps clients streamline ESG data collection and align with global reporting frameworks.

-

SAP SE offers an integrated suite of carbon accounting and sustainability tools designed to embed emissions data directly into enterprise systems. Its main solutions include SAP sustainability footprint management, which calculates corporate and product emissions (Scopes 1, 2, and 3), SAP sustainability data exchange for sharing carbon data across supply chains, and the recently launched SAP Green Ledger, which aligns emissions data with financial accounting to enable “transactional” carbon tracking. SAP’s tools are ERP-centric, leveraging SAP S/4HANA and related systems to pull in master and transactional data, thus allowing granular, auditable, and near-real-time insights rather than just averages.

Key Carbon Accounting Software Companies:

The following are the leading companies in the carbon accounting software market. These companies collectively hold the largest market share and dictate industry trends.

- IBM Corporation

- SAP SE

- Salesforce, Inc.

- Microsoft

- Persefoni AI

- Sphera

- Greenly

- Diligent Corporation

- SINAI Technologies

- Net0.

Recent Developments

-

In June 2024, SCS Consulting Services Inc. announced a partnership with carbon accounting platform developer Sustain.Life. This collaboration combines SCS's over 30 years of expertise in carbon accounting with Sustain.Life's comprehensive software solution. Together, they aim to help organizations streamline their carbon measurement, management, and reporting processes while ensuring these efforts meet regulatory compliance and assurance standards.

-

In May 2024, climatech company Notch launched its next-generation carbon accounting software platform, designed to help businesses of all sizes across various sectors achieve Net Zero goals while strengthening their commercial position. Notch’s unique partner model and extensive network of international collaborators empower businesses to develop comprehensive carbon reduction strategies that not only comply with increasingly stringent carbon regulations but also enhance operational performance. This approach creates a competitive advantage, making companies more appealing to clients, prospects, and investors.

-

In April 2024, Zevero, a platform dedicated to helping companies achieve net zero, was acquired by LEVELUP, a climate tech startup. The multi-million-pound deal will result in the two businesses merging under the Zevero brand, with plans to expand operations across Europe, the U.S., and Asia. This acquisition will bolster Zevero's presence in the global USD 15 billion carbon accounting market.

Carbon Accounting Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14.13 billion

Revenue forecast in 2033

USD 67.58 billion

Growth rate

CAGR of 22.1% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment, enterprise size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

IBM Corporation; SAP SE; Salesforce, Inc.; Microsoft; Persefoni AI; Sphera; Greenly; Diligent Corporation; SINAI Technologies; Net0.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Carbon Accounting Software Market Report Segmentation

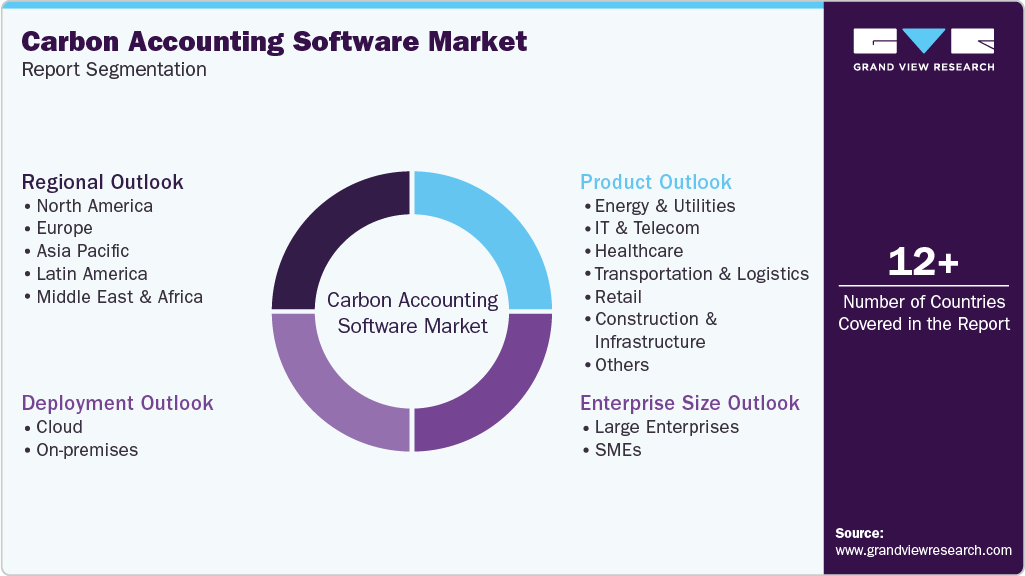

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global carbon accounting software market report based on deployment, enterprise size, end use, and region:

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

Cloud

-

On-premises

-

-

Enterprise Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Large Enterprises

-

SMEs

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Energy & Utilities

-

IT & Telecom

-

Healthcare

-

Transportation & Logistics

-

Retail

-

Construction & Infrastructure

-

Food & Beverages

-

Chemicals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global carbon accounting software market size was estimated at USD 11.86 billion in 2024 and is expected to reach USD 67.58 billion in 2025.

b. The global carbon accounting software market is expected to grow at a compound annual growth rate of 21.6% from 2025 to 2033 to reach USD 67.58 billion by 2033.

b. North America dominated the carbon accounting software market with a share of 39.5% in 2024. U.S. and Canadian governments have implemented rigorous reporting requirements for greenhouse gas emissions, compelling organizations across various industries to adopt carbon accounting software. Additionally, the growing focus on ESG practices among North American companies has driven demand for advanced tools to monitor and report carbon emissions.

b. Some key players in the carbon accounting software market include IBM Corporation, SAP SE, Salesforce, Inc., Microsoft, Persefoni AI, Sphera, Greenly, Diligent Corporation, SINAI Technologies, and Net0.

b. The rise in demand for transparency in environmental reporting, coupled with the growing adoption of ESG (Environmental, Social, and Governance) standards, is propelling carbon accounting software market expansion. Additionally, the integration of advanced technologies such as AI, machine learning, and IoT into carbon accounting solutions is enhancing their capabilities, making them more efficient and user-friendly.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.