- Home

- »

- Clinical Diagnostics

- »

-

Cardiac Biomarkers Market Size, Share, Industry Report, 2030GVR Report cover

![Cardiac Biomarkers Market Size, Share & Trends Report]()

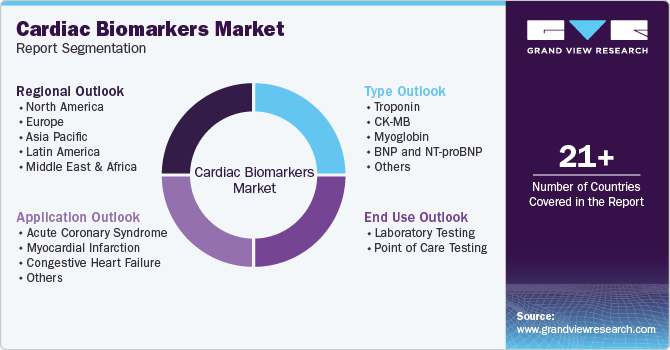

Cardiac Biomarkers Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Troponin, CK-MB, Myoglobin, BNP and NT-proBNP, Others), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-083-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cardiac Biomarkers Market Summary

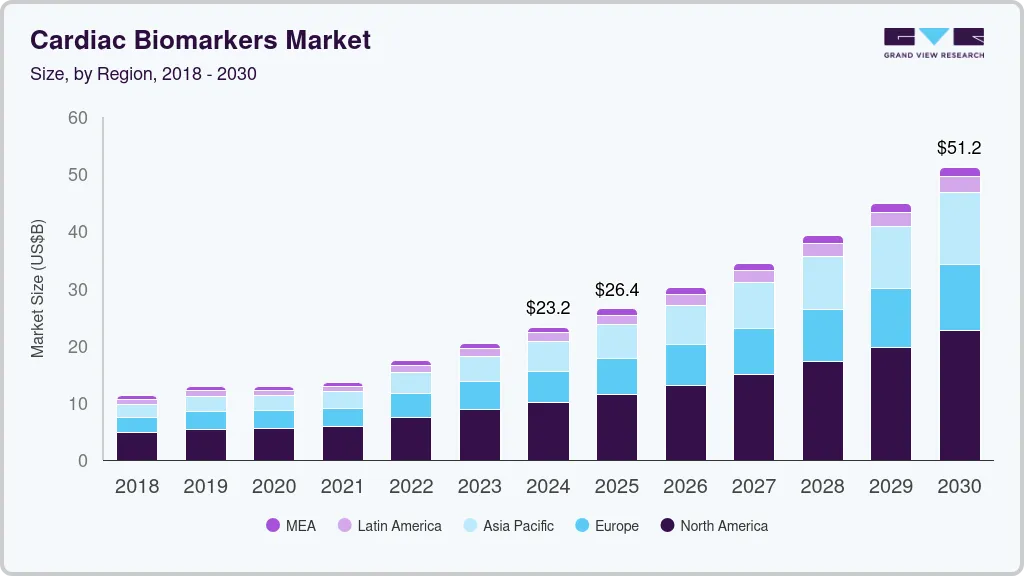

The global cardiac biomarkers market size was estimated at USD 23.24 billion in 2024 and is projected to reach USD 51.19 billion by 2030, growing at a CAGR of 14.1% from 2025 to 2030. Cardiac biomarkers are witnessing growth owing to factors such as the high prevalence of acute coronary syndrome and technological advancements in cardiac biomarkers.

Key Market Trends & Insights

- North America dominated the global cardiac biomarkers market with the largest revenue share of over 43.1% in 2024.

- The U.S. dominates the North America cardiac biomarkers industry with largest revenue share.

- By type, the troponin segment held the largest revenue share of over 35.3% in 2024.

- By application, acute coronary syndrome held the largest revenue share in 2024.

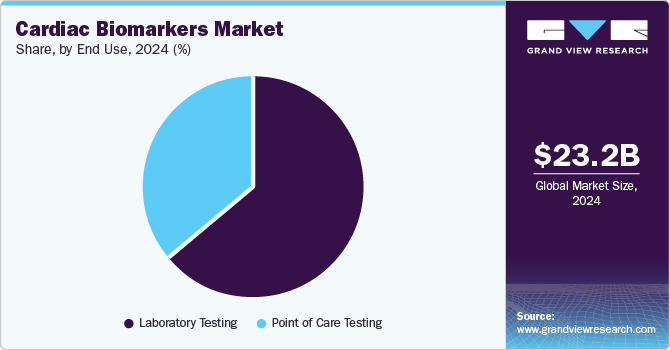

- By end use, the laboratory testing segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 23.24 Billion

- 2030 Projected Market Size: USD 51.19 Billion

- CAGR (2025-2030): 14.1%

- North America: Largest market in 2024

Additionally, rising demand for point-of-care (POC) cardiac testing kits and high specificity in detecting cardiac diseases, especially myocardial infarction, are contributing to this growth. Integration of advanced technologies such as AI and machine learning in biotechnology and diagnostic research have significantly improved the understanding, monitoring, and detection of cardiac biomarkers and will eventually drive the growth of the cardiac biomarkers market. According to a report published in December 2024 by Cornell University, researchers have developed a highly sensitive detection method for cardiac troponin I (cTnI) testing by using deep learning-enhanced chemiluminescence vertical flow. It enables rapid, low-cost, and precise quantification of cTnI, which is expected to deliver results in 25 minutes with a detection limit of 0.16 pg/mL.

Moreover, cardiac test kits contain an array of combination tests that detect the presence of biomarkers, facilitating the easier diagnosis of cardiac diseases. The increasing demand for these kits is due to the quick diagnosis and fast results obtained through them, which reduce the diagnostic time involved and expedite the treatment process. In addition, they diagnose chest pain and help identify risk factors prior to the occurrence of adverse cardiac events.

An increase in the prevalence of cardiovascular diseases is expected to boost segment growth. According to the WHO, 17.9 million people die every year from cardiovascular diseases, which is 32% of all deaths worldwide. The report published by the National Library of Medicine on Global Burden of Cardiovascular Diseases: Projections from 2025 to 2050 indicates a 90.0% increase in cardiovascular prevalence, 73.4% increase in crude mortality, and 54.7% increase in crude DALYs from 20.5 million cardiovascular deaths in 2025. Cardiovascular diseases are the leading cause of mortality and morbidity in the U.S. Companies are currently focusing on identifying cardiac biomarkers as they provide an increased understanding of the pathophysiology of cardiovascular diseases. Elecsys Troponin T-Gen 5 STAT, a cardiac biomarker by Roche Diagnostics, delivers results in 9 minutes and helps in quick decision-making.

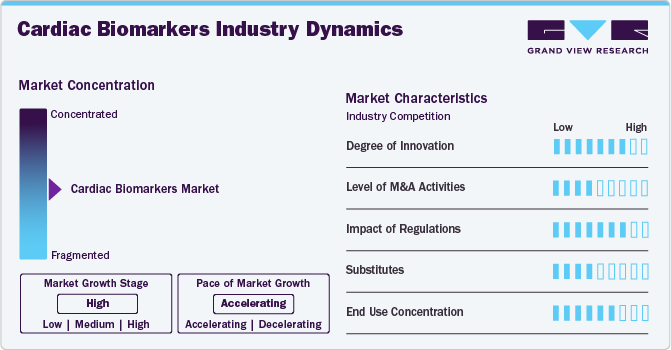

Market Concentration & Characteristics

The market growth stage is high, and the pace of the market growth is accelerating. The cardiac biomarkers industry is characterized by a high degree of innovation due to the rapid technological advancements driven by risk stratification, early detection, and personalized medicine approaches. For instance, in March 2024, Polymedco's troponin I assay, intended to be used with the Pathfast Biomarker Analyzer, received FDA approval for myocardial infarction diagnosis. This innovation aims to provide the most accurate and efficient diagnostics to assist the emergency department in the treatment of cardiovascular disease.

The cardiac biomarkers industry is characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including market maturity. Established players dominate the market. Even though the market has a moderate level of mergers and acquisition activity, strategic acquisitions and mergers have influenced the evolution significantly.

The cardiac biomarkers industry has a significant impact on market regulation. Regulation ensures the safety, quality, and efficacy of the product. For instance, in December 2023, the European Society of Anesthesiology and Intensive Care (ESAIC) released updated guidelines focused on the use of cardio troponin and B-type natriuretic peptides pre-, post-, and combined pre-and postoperative peptides in adult patients undergoing noncardiac surgery. The guidelines are for application which includes cardiac biomarkers as tools for risk prediction, prognostic factors, and for biomarker-enhanced management strategies.

Type Insights

The troponin segment held the largest revenue share of over 35.3% in 2024 and is expected to witness the fastest CAGR during the forecast period. Compared to other tests, the exponential growth can be attributed to factors such as diagnostic efficiency, specificity, and accurate predictive detection of cardiac events. The growing prevalence of myocardial infarction and stroke across the globe further boosts market growth. In July 2023, Mylab Discovery Solutions launched the Mybox+ diagnostic device powered by optical AI engines, which offers accurate, rapid results in clinical samples for over 30 diseases. This portable device is ideal for small labs and centers, allowing for the testing of cardiac markers (troponin), thyroid panels (T-3, T-4, TSH), and biomarkers (CRP, D-Dimer).

The CK-MB segment is expected to grow significantly over the forecast period. Advancements in point-of-care testing such as multiplexed development computation sensing can simultaneously detect various cardiac biomarkers, including CK-MB is driving the demand for the segment. For instance, a novel paper-based fluorescence vertical flow assay (fxVFA) combined with deep learning algorithms has been designed to quantify CK-MB alongside myoglobin and heart-type fatty acid-binding protein (FABP). This system delivers results in under 15 minutes using minimal serum volume, demonstrating high sensitivity and specificity, which is particularly beneficial in resource-limited settings.

Application Insights

Acute coronary syndrome held the largest revenue share in 2024 and is expected to witness the fastest CAGR of 14.9% during the forecast period. The disease burden is rapidly rising in low- and middle-income countries compared to high-income countries. Factors such as rapid urbanization and increased sedentary jobs are driving the incidence of disease. Cardiac troponin T and I biomarkers tests have emerged as the prime diagnostic methods for diagnosing the disease. In February 2023, Cardio Diagnostics launched PrecisionCHD, an integrated epigenetic-genetic blood test for early detection of coronary heart disease. The test uses genetic biomarkers, epigenetics, and a machine learning model to analyze genomic and epigenomic data. It maps a patient's biomarker profile to modifiable risk factors such as diabetes, hypertension, hypercholesterolemia, and smoking, which are critical drivers of coronary heart disease.

The myocardial infarction segment is expected to grow significantly over the forecast period. Myocardial infarction is anticipated to witness lucrative growth owing to its rising incidence globally. The enhanced focus of researchers on myocardial infarction is expected to create lucrative opportunities in the segment. For Instance, as per the report of News Medical Lifesciences, in Feb 2024, researchers developed and validated a novel prediction model based on biomarkers to evaluate imminent first myocardial infarction. The study observed that out of 800 analyzed proteins and 1000 metabolites, 48 and 43 were found to be related to short-term impending myocardial infarction (IMI) risk.

End Use Insights

The laboratory testing segment held the largest revenue share in 2024. This can be attributed to the advantages offered by laboratory testing, such as high sensitivity, specificity, scalability, and cost-efficiency. Furthermore, these laboratories facilitate the testing of all types of samples. Diagnostic laboratory services are crucial in clinical decision-making.

The point of care testing segment is expected to grow at the fastest CAGR during the forecast period. The segment has grown exponentially due to the increasing use and adoption of highly sensitive and easy-to-use point of care (POC) Troponin tests. The rising emphasis on providing effective, value-based healthcare services in the face of tight budgets enhances the importance of POC tests. In addition, these tests are the primary choice of medical professionals during emergencies for faster diagnosis of the patients. The demand for POC test kits for use in nursing homes and home healthcare is driven by the global aging population, which is on the rise.

Regional Insights

North America dominated the global cardiac biomarkers market with the largest revenue share of over 43.1% in 2024. This can be attributed to the developed healthcare system and the high adoption of cardiac biomarkers as a tool for diagnosing and predicting conditions. The need for biomarker testing to identify conditions such as acute myocardial infarction is increasing with the rising geriatric population, which drives the demand for testing products. The presence of key players such as Quidel Corporation and Danaher Corporation in the region is another factor adding to the growth of this market. According to the World Health Organization (WHO), 77 million adults above 18 years have type 2 diabetes, with 25 million prediabetics. This increases cardiovascular disease risk and puts additional pressure on the health system.

U.S. Cardiac Biomarkers Market Trends

The U.S. dominates the North America cardiac biomarkers industry with largest revenue share and is expected to grow at fastest growth rate in cardiac biomarkers industry. Integration of cardiac biomarkers with personalized medicine is expected to drive the demand for biomarkers in the region. However, biomarkers play an important role in personalized medicine as they assist in identifying individuals in need of specific treatment or at higher risk of adverse reactions. For Instance, according to a report published by the National Library of Medicine, 73% of cardiologists indicate that personalized medicine is expected to have a measurable impact on patient treatment in the next five years. Additionally, more than 9 out of 10 cardiologists believe that personalized medicine is expected to have a significant role in cardiovascular therapy within the next 10 years.

Europe Cardiac Biomarkers Market Trends

The Europe cardiac biomarkers market was identified as a lucrative region in 2024. The increasing prevalence of cardiovascular disease is expected to drive the growth of cardiac biomarkers. For Instance, an article published by WHO said cardiovascular disease is the leading cause of premature death and disability in Europe, accounting for over 42.5% of all annual deaths, which indicates that there are 10000 deaths every day. Additionally, men in the region are suspected to die 2.5 times more than women from cardiovascular disease.

Asia Pacific Cardiac Biomarkers Market Trends

Asia Pacific is expected to expand at the fastest CAGR during the forecast period owing to the rising affordability of advanced cardiac tests, modernization in the countries, and increasing disposable income. The growing incidence of cardiovascular diseases (CVDs) in this region has increased the demand for improved diagnostics, government funding for target disease and other research, and healthcare expenditure. India has a higher prevalence of CVDs than other developing countries.

The China cardiac biomarkers market held the largest market revenue share in 2024. An enhancement in diagnostic accuracy and speed is driving the demand for cardiac biomarkers in the country. For Instance, In October 2023, Mindray, a medical devices and solutions company based in China, launched new high-sensitivity troponin I (hs-cTnI) and NT-proBNP cardiac biomarkers. The launch expands its diverse portfolio of cardiac biomarkers for managing and diagnosing cardiovascular diseases (CVDs). The innovation enables rapid diagnosis, risk stratification, therapeutic monitoring, and early screening.

Key Cardiac Biomarkers Company Insights

Some of the key companies in the pore strips industry include Abbott, Siemens Healthcare GmbH, Quidel Corporation, and others. Key players are taking several strategic initiatives, such as product launches, geographical expansions, strategic collaborations, partnerships, and mergers and acquisitions in emerging and economically favorable regions.

-

Abbott offers comprehensive cardiac solutions, which are a natural fit for laboratories. Their assays and analyzers provide accurate, reliable results with rapid turnaround time, assisting healthcare professionals in improving patient care.

-

Siemens Healthcare Private Limited delivers a comprehensive range of cardiac biomarkers to help manage patients and diagnose cardiovascular diseases. Their offerings consist of natriuretic peptides (BNP and NT-proBNP), high-sensitivity troponin I assays, and related tests.

Key Cardiac Biomarkers Companies:

The following are the leading companies in the cardiac biomarkers market. These companies collectively hold the largest market share and dictate industry trends.

- Quidel Corporation

- Siemens Healthcare GmbH

- F. Hoffmann-La Roche Ltd.

- Danaher

- BIOMÉRIEUX

- Bio-Rad Laboratories, Inc.

- Randox Laboratories Ltd.

- Creative Diagnostics

- Life Diagnostics

Recent Developments

-

In June 2024, Siemens Healthineers introduced the NT-proBNPII assay to its Atellica Solution platform, enabling faster and more flexible diagnosis of heart failure by providing results in just 10 minutes and offering both BNP and NT-proBNP tests on the same platform. This advancement supports clinicians in reducing misdiagnosis, accurately diagnosing heart failure, and improving patient care efficiency across various healthcare settings.

-

In March 2024, Novo Nordisk entered into an agreement to acquire Cardio Pharmaceuticals, a German company, for over USD 1 billion. This acquisition aims to strengthen Novo Nordisk's pipeline in cardiovascular disease, with CDR132L potentially becoming a first-in-class therapy to halt or reverse the disease's progression.

Cardiac Biomarkers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 26.44 billion

Revenue forecast in 2030

USD 51.19 billion

Growth rate

CAGR of 14.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, UAE, South Africa, Saudi Arabia, Kuwait

Key companies profiled

Abbott; Quidel Corporation; Siemens Healthcare GmbH; F. Hoffmann-La Roche Ltd; Danaher; BIOMÉRIEUX; Bio-Rad Laboratories, Inc; Randox Laboratories Ltd; Creative Diagnostics; Life Diagnostics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cardiac Biomarkers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cardiac biomarkers market report based on type, application, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Troponin

-

CK-MB

-

Myoglobin

-

BNP and NT-proBNP

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Acute Coronary Syndrome

-

Myocardial Infarction

-

Congestive Heart Failure

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Laboratory Testing

-

Point of Care Testing

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cardiac biomarkers market size was estimated at USD 16.05 billion in 2022 and is expected to reach USD 18.47 billion in 2023.

b. The global cardiac biomarkers market is expected to grow at a compound annual growth rate of 14.6% from 2023 to 2030 to reach USD 47.88 billion by 2030.

b. North America dominated the cardiac biomarkers market with a share of 41.1% in 2022. This is attributable to the significant disease burden stemming from the high incidence of cardiovascular diseases in North America and the increasing popularity of PoC diagnostics. High awareness levels associated with advanced diagnostic & prognostic tools and supportive reimbursement policies facilitate adoption of novel technologies in the region.

b. Some key players operating in the cardiac biomarkers market include Abbott, Siemens Healthineers, Thermo Fisher Scientific, Inc., Becton, Dickinson and Company, bioMérieux SA, Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd, and Randox Laboratories Ltd.

b. Key factors that are driving the cardiac biomarkers market growth include the high prevalence of cardiovascular diseases such as Acute Coronary Syndrome (ACS), Acute Myocardial Infarction (AMI), ischemia, and Congestive Heart Failure (CHF) globally and the rising adoption of biomarkers as a prognostic tool.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.