- Home

- »

- Medical Devices

- »

-

Cardiac Surgery Instruments Market Size, Share Report, 2033GVR Report cover

![Cardiac Surgery Instruments Market Size, Share & Trends Report]()

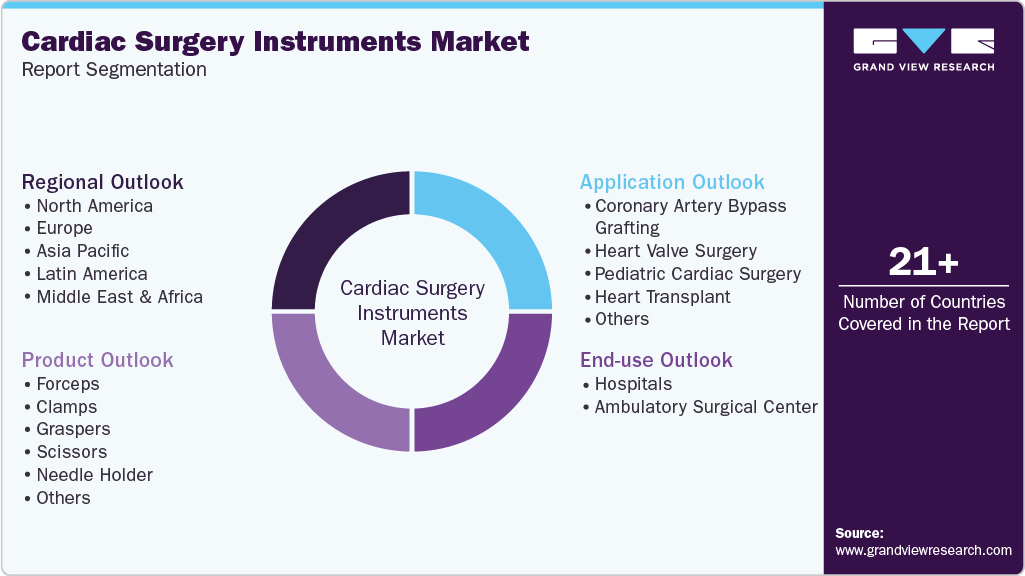

Cardiac Surgery Instruments Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Forceps, Clamps, Graspers, Scissors, Needle Holder), By Application, By End Use (Hospitals, Ambulatory Surgical Center), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-988-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cardiac Surgery Instruments Market Summary

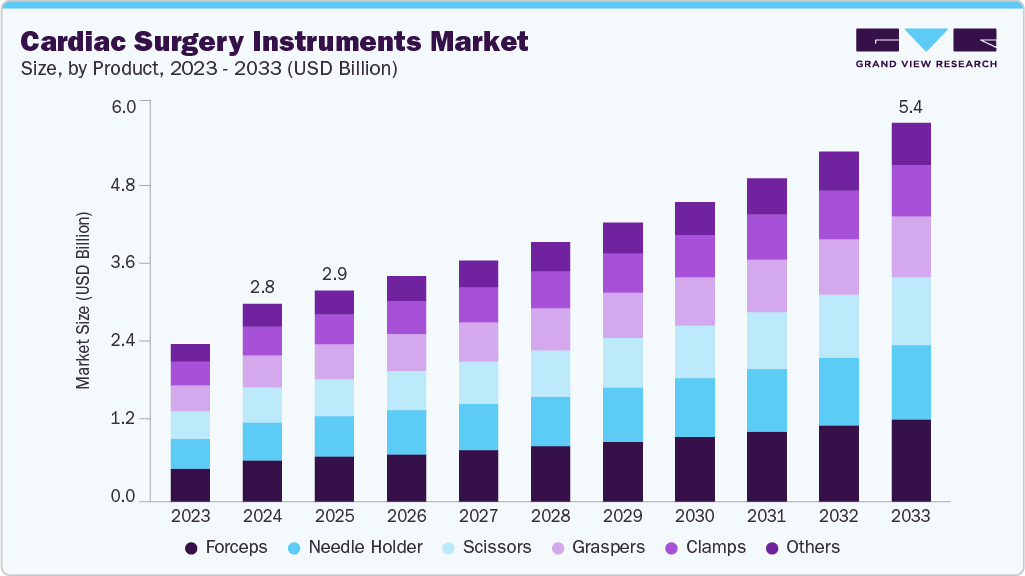

The global cardiac surgery instruments market size was estimated at USD 2.80 billion in 2024 and is projected to reach USD 5.36 billion, growing at a CAGR of 7.56% from 2025 to 2033. Rising prevalence of cardiovascular diseases, increasing adoption of advanced surgical techniques, and growing demand for precision-driven procedures are expected to drive the cardiac surgery instruments market.

Key Market Trends & Insights

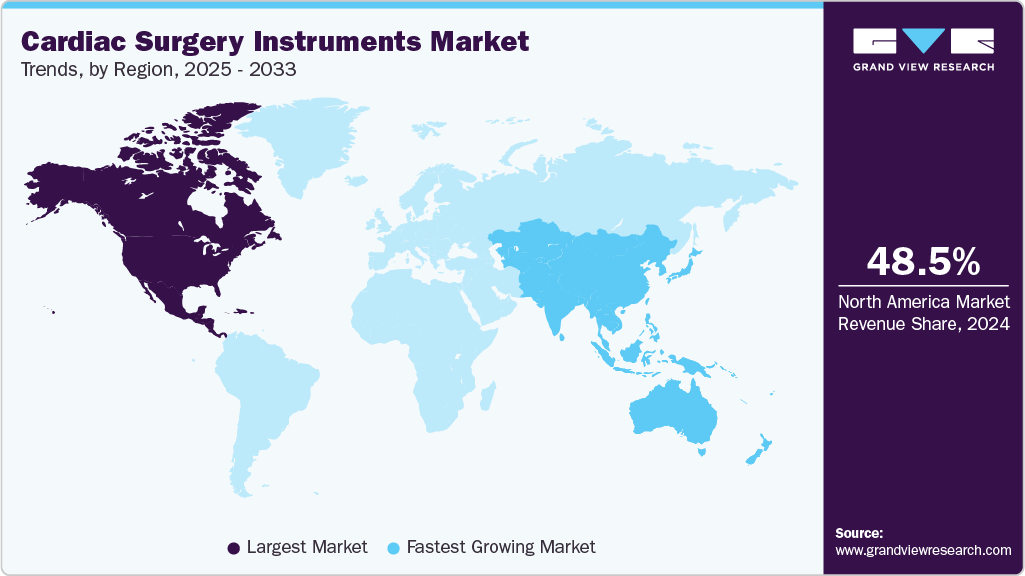

- The North America cardiac surgery instruments market dominated the global market in 2024, accounting for the largest revenue share of 48.49%.

- The U.S. cardiac surgery instruments market is anticipated to register the fastest growth rate during the forecast period.

- In terms of product, the forceps segment held the largest revenue share in 2024.

- In terms of the application segment, the coronary artery bypass grafting segment held the largest revenue share in 2024.

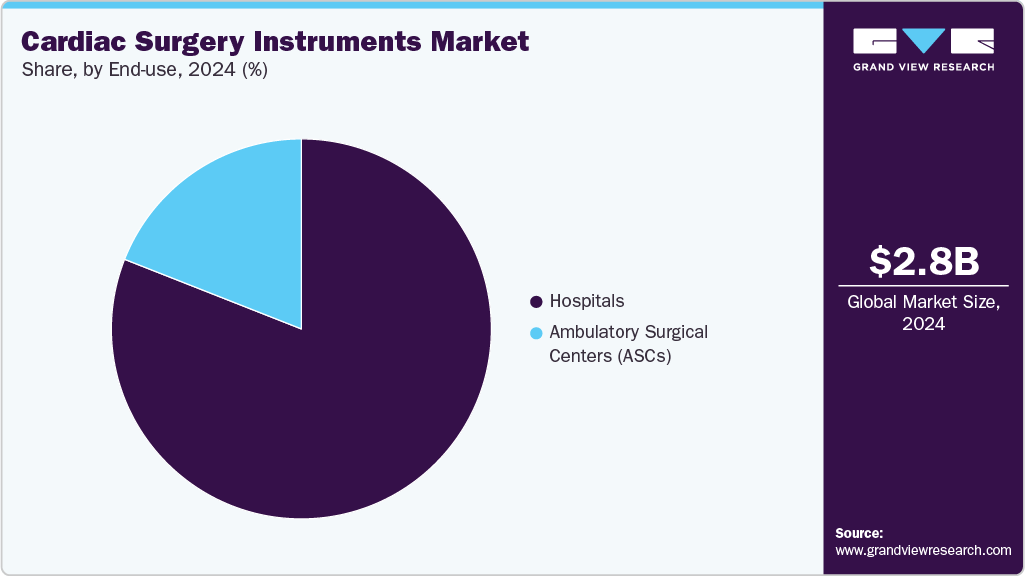

- In terms of the end use segment, the hospitals segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.80 Billion

- 2033 Projected Market Size: USD 5.36 Billion

- CAGR (2025-2033): 7.56%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The shift toward minimally invasive surgeries, coupled with technological advancements that enhance safety and efficiency, is further anticipated to support market expansion. In August 2025, the European Journal of Preventive Cardiology reported that global CVD prevalence will rise 90% by 2050, with deaths increasing from 20.5 million in 2025 to 35.6 million, while age-standardized mortality is projected to fall 30.5%. The rising prevalence of cardiovascular diseases is a primary driver for the cardiac surgery instruments market, as these conditions remain the leading cause of mortality worldwide and frequently necessitate surgical intervention. With aging populations and growing incidence of lifestyle-related disorders such as obesity, hypertension, and diabetes, the number of patients requiring procedures like coronary artery bypass grafting and valve repair continues to rise. In July 2025 , the World Health Organization (WHO) reported that cardiovascular diseases caused 19.8 million deaths in 2022 (32% of all deaths), with 85% from heart attack and stroke, and over three-quarters occurring in low- and middle-income countries.

The increasing adoption of advanced surgical techniques, including minimally invasive and robotic-assisted procedures, is fueling the need for specialized instruments designed for precision and efficiency. Surgeons and hospitals are shifting away from traditional open-heart approaches toward less invasive methods that require advanced toolkits with ergonomic designs, durability, and compatibility with hybrid operating rooms. In July 2022, Netcare Christiaan Barnard Hospital in South Africa introduced the first robotic-assisted cardiothoracic surgery program in the region using the da Vinci system. These techniques improve surgical accuracy and reduce recovery times, making them highly preferred by both healthcare providers and patients, thereby accelerating the demand for next-generation cardiac surgery instruments.

Growing demand for precision-driven procedures also plays a significant role in market expansion, as cardiac surgeries require exactness where even the smallest errors can have life-threatening consequences. The push for accuracy has led to innovations in instrument design, with micro-instruments, enhanced forceps, and sharper cutting tools becoming essential in complex surgeries such as pediatric and valve procedures. In May 2025, an article in the Annals of Cardiothoracic Surgery highlighted the adoption of fully robotic lateral access aortic valve replacement (RAVR) as a key advancement in minimally invasive surgery. The procedure demands high-precision handling, making forceps integral for tissue manipulation and suturing in confined operative fields.

The growing prevalence of cardiovascular diseases, combined with the expansion of cardiac surgical procedures worldwide, is driving steady demand for advanced cardiac surgery instruments. Hospitals and surgical centers are increasingly investing in high-quality tools to improve patient outcomes, reduce procedure times, and support minimally invasive techniques, highlighting the critical role of reliable instruments in modern cardiac care. Rising awareness of cardiovascular health and increasing healthcare infrastructure in emerging markets are further boosting demand, while innovations in instrument design continue to enhance surgical precision and safety.

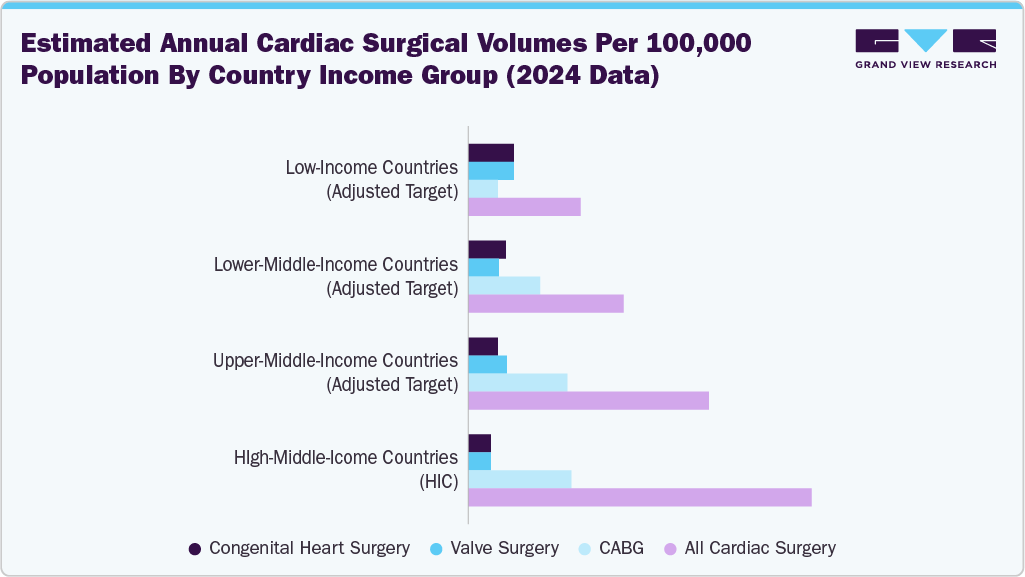

In June 2024, an article in Annals of Thoracic Surgery Short Reports highlighted that high-income countries perform an average of 123.2 cardiac surgeries per 100,000 population annually, while low- and middle-income countries perform 40-86 procedures per 100,000, reflecting a substantial global gap. With over 1 million cardiac surgeries worldwide each year, including CABG, valve, and congenital procedures, the study underscores the growing demand for cardiac surgery instruments to meet population needs. Expanding surgical capacity in LMICs could significantly increase procedure volumes, driving demand for specialized instruments.

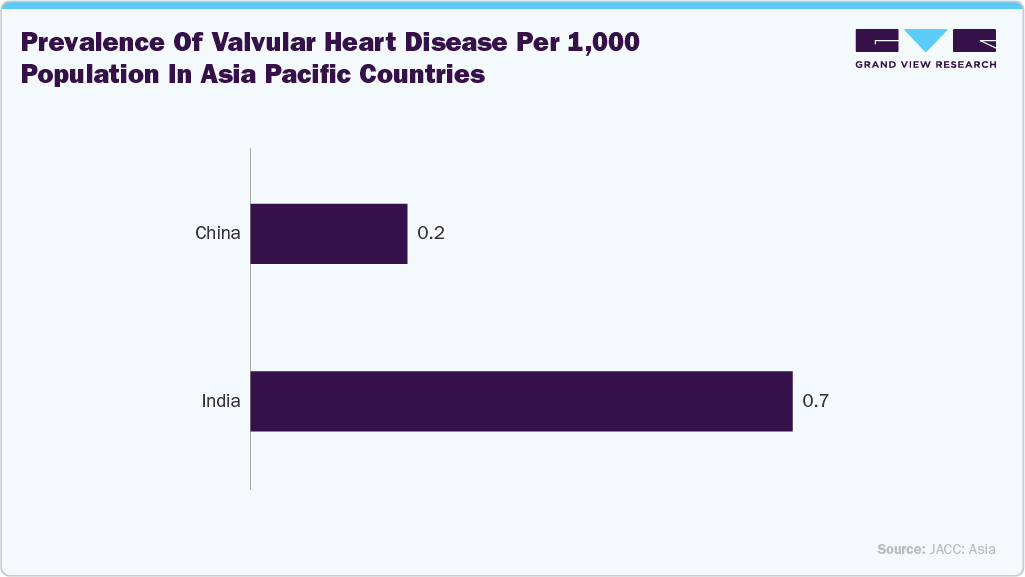

The high prevalence of rheumatic aortic stenosis in South Asia, particularly in India, is creating increased demand for specialized cardiac surgery instruments and devices. Hospitals in the region are facing a growing need for precise and durable tools to manage complex valvular procedures. At the same time, disparities in healthcare access and early diagnosis further emphasize the importance of expanding surgical capabilities. This trend is driving investment in high-quality instruments, training, and infrastructure to ensure effective treatment of valvular heart disease and improve patient outcomes across the Asia-Pacific region.

In June 2025, the article titled Epidemiology of Valvular Heart Disease in the Asia Pacific Region was published in JACC: Asia. The study reported that the prevalence of rheumatic aortic stenosis is notably higher in India (4.54 per 1,000) compared to China (1.86 per 1,000) and Bangladesh (1.3 per 1,000), underscoring the significant burden of rheumatic heart disease in South Asia. This disparity is attributed to differences in healthcare access, early diagnosis, and management strategies across the region. The findings highlight the need for targeted interventions and improved healthcare infrastructure to address valvular heart disease effectively in the Asia-Pacific region.

Market Concentration & Characteristics

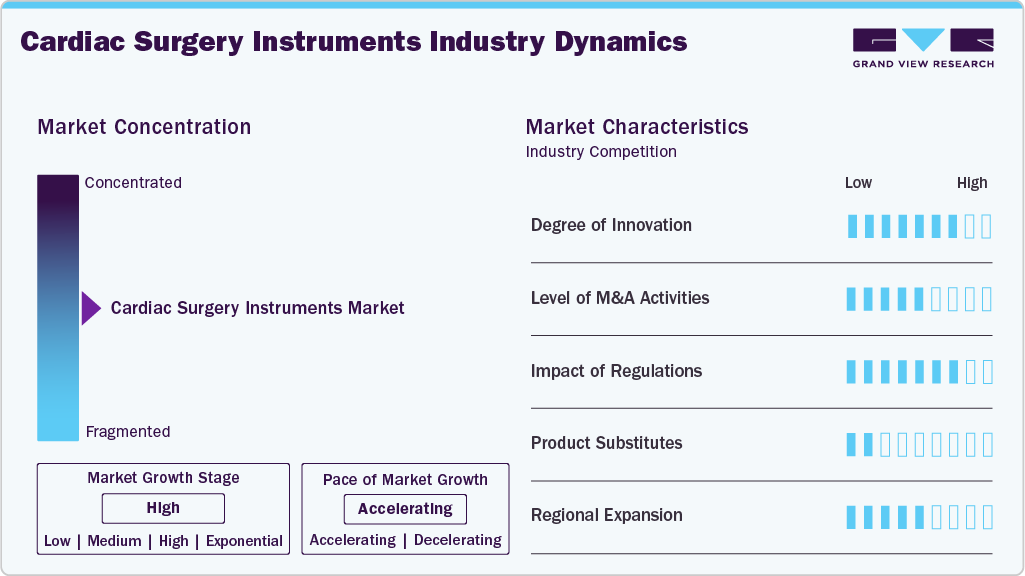

The cardiac surgery instruments industry shows a high degree of innovation, with advancements in minimally invasive tools, robotics, and precision engineering. Continuous R&D investment is enhancing surgical accuracy, safety, and efficiency, consolidating the role of innovation in the cardiac surgery instruments market. Companies are focusing on next-generation devices that integrate imaging and navigation support. Innovation is also shaping cost-efficiency and reducing procedural complications. In June 2024, Cureus published an article discussing how DeBakey forceps, with their atraumatic design and ergonomic features, have revolutionized cardiac surgery by enabling precise manipulation of delicate tissues and improving surgical outcomes.

The cardiac surgery instruments industry records a medium level of mergers and acquisitions, primarily to expand portfolios and strengthen geographic presence. These activities enable firms in the cardiac surgery instruments market to consolidate capabilities and maintain competitiveness. Collaborations are often aimed at integrating complementary technologies. Acquisitions also accelerate entry into fast-growing regional markets.

Regulatory impact is high in the cardiac surgery instruments industry, with stringent standards for safety, sterilization, and performance. Compliance dictates product development timelines and market entry, making regulation a defining factor in the cardiac surgery instruments market. Regulations also influence pricing, reimbursement, and procurement policies. Strict approval requirements drive manufacturers to maintain continuous quality improvements.

Substitutes are limited in the cardiac surgery instruments industry, as specialized surgical instruments remain essential for cardiac procedures. Robotic and catheter-based interventions present alternatives but do not eliminate the need for conventional instruments, keeping substitution risk low. Disposable devices are gaining adoption, but serve only selective procedures. The specialized nature of instruments makes substitution an unlikely long-term threat.

The cardiac surgery instruments industry shows medium geographical expansion, with growth focused on emerging economies experiencing rising cardiac disease incidence. Expansion efforts are reinforcing global reach and driving regional diversification within the cardiac surgery instruments market. Companies are leveraging distribution partnerships to strengthen their presence in Asia-Pacific and Latin America. Local manufacturing and product customization are also contributing to expansion.

Product Insights

The forceps segment led the cardiac surgery instruments market in 2024 by product, capturing the largest revenue share of 21.15%, and is expected to grow at the fastest CAGR during the forecast period. The prominence of forceps is due to their critical role in a variety of cardiac procedures, providing precision in tissue handling, suturing, and vessel control. Ongoing advancements in ergonomics, material strength, and design options, such as micro and atraumatic forceps, further reinforce their market position. For example, Surgical Holdings offers Babcock Lung Grasping Forceps, designed for atraumatic tissue handling in cardiothoracic surgeries. Made from high-quality stainless steel with fenestrated, rounded tips, these forceps ensure a secure yet gentle grip on delicate tissue, reducing the risk of damage.

The needle holder segment in the cardiac surgery instruments market is anticipated to witness a significant CAGR over the forecast period. This growth is driven by their critical role in ensuring secure and precise suturing during complex cardiac procedures, where stability and control are paramount. Advancements in designs, such as tungsten carbide inserts and enhanced grip ergonomics, are improving durability and efficiency, driving broader adoption. The rising demand for minimally invasive and delicate procedures is further supporting the needle holders’ market expansion. For instance, World Precision Instruments provides the Olsen-Hegar Needle Holder with Suture Scissors and Tungsten Carbide Inserts, designed to combine suturing and cutting in a single instrument. Its durable inserts ensure precision and extended usability during complex procedures.

Application Insights

By application, the coronary artery bypass grafting segment dominated the cardiac surgery instruments market in 2024 and accounted for the largest revenue share of 31.37%. The high share is driven by the increasing global prevalence of coronary artery disease, which remains one of the leading causes of cardiac interventions. CABG requires a broad set of specialized instruments, from forceps and clamps to needle holders and retractors, ensuring consistent demand. The rising number of aging patients, coupled with the growing adoption of advanced surgical techniques, has further reinforced CABG’s dominance in the market. In April 2025, AMT Medical raised USD 25 million to advance its ELANA Heart Bypass System, enabling minimally invasive, sutureless coronary bypass on a beating heart. The technology reduces complications and recovery time, impacting the demand for precision cardiac surgical instruments.

The heart valve surgery segment in the cardiac surgery instruments market is anticipated to witness the fastest CAGR over the forecast period. This growth is attributed to the rising incidence of valvular disorders, particularly aortic stenosis and mitral regurgitation, which demand surgical correction. The adoption of advanced prosthetic valves and the increasing preference for minimally invasive and robotic-assisted valve repair or replacement procedures are driving demand for precision surgical instruments. In June 2025, an article Epidemiology of Valvular Heart Disease in the Asia Pacific Region in JACC: Asia, reported rheumatic aortic stenosis prevalence in higher-income APAC countries such as Singapore, Japan, and South Korea, ranging from 0.14 to 0.5 per 1,000. Degenerative valvular diseases are rising due to aging populations, while bicuspid aortic valves make up a significant proportion of TAVR patients, reflecting unique anatomical considerations in APAC.

End Use Insights

The hospitals segment dominated the cardiac surgery instruments market in 2024 with a revenue share of 80.97%. Hospitals remain the primary centers for cardiac interventions, supported by advanced infrastructure, availability of specialized surgical teams, and high patient inflow. The concentration of complex procedures such as CABG, valve replacement, and pediatric cardiac surgery in hospital settings reinforces their dominant share. Significant investments in surgical technologies, combined with rising hospital admissions for cardiovascular diseases, continue to strengthen this segment’s leadership within the market. In January 2025, Atmospheric Pollution Research reported that air pollution in Ulaanbaatar, Mongolia, was linked to increased hospital admissions for cardiovascular disease, with higher risks during cold seasons and among women and people under 65. In December 2023, the University of Gothenburg highlighted that individuals with lower or declining aerobic fitness faced higher hospital admission rates, including for cardiovascular disease, with previously hospitalized people at greatest risk of readmission.

The ambulatory surgical center segment of the cardiac surgery instruments market is anticipated to register the fastest growth rate over the forecast period. Growth is driven by the increasing shift toward cost-effective, outpatient cardiac procedures supported by advancements in minimally invasive and robotic-assisted techniques. ASCs offer reduced hospital stays, quicker recovery, and lower treatment costs, making them attractive for both patients and healthcare providers. In February 2024, the American College of Cardiology (ACC) launched the Cardiovascular Ambulatory Surgery Center (CV ASC) Registry Suite to track cardiac procedures in ambulatory surgery centers (ASCs), providing benchmarks and insights to optimize care. This reflects the growing trend of outpatient cardiac interventions, supporting demand for cardiac surgery and interventional instruments.

Regional Insights

North America dominated the cardiac surgery instruments market in 2024. It accounted for the largest revenue share of 48.49% owing to the high prevalence of cardiovascular diseases, advanced healthcare infrastructure, and adoption of innovative surgical technologies. In May 2025, Yale highlighted advancements in minimally invasive and robotic-assisted cardiac surgeries, including mitral valve and coronary bypass procedures. These developments increase the demand for precision surgical instruments such as specialized forceps, needle holders, and clamps, designed for delicate tissue handling and enhanced control in constrained surgical spaces.

U.S. Cardiac Surgery Instruments Market Trends

The cardiac surgery instruments market in the U.S. held the largest share, 89.81%, in 2024. The market benefits from a high burden of cardiovascular diseases, advanced surgical infrastructure, and strong adoption of minimally invasive and robotic-assisted techniques. Continuous product innovation, favorable reimbursement frameworks, and the presence of major industry players reinforce the U.S. position as the leading national market within North America. In October 2024, the CDC reported that heart disease remains the leading cause of death in the U.S., responsible for over 919,000 deaths in 2023. High blood pressure, cholesterol, smoking, diabetes, and obesity are major risk factors, highlighting the need for preventive measures.

The Canada cardiac surgery instruments market is anticipated to register a significant growth rate during the forecast period. Rising incidence of cardiovascular disorders, increasing procedural volumes, and expanding access to advanced surgical technologies support market growth. In March 2025, Sunnybrook Health Sciences Centre launched a robotic mitral valve surgery program, using specialized cardiac surgery instruments including robotic needle holders, forceps, and precision suturing tools. The high-definition 3D camera and robotic instruments enhance visualization and suture accuracy, enabling minimally invasive procedures and faster patient recovery.

Europe Cardiac Surgery Instruments Market Trends

The Europe cardiac surgery instruments market is anticipated to register a significant growth rate during the forecast period, supported by rising cardiovascular disease prevalence and adoption of advanced surgical technologies. Continuous R&D in surgical tools and supportive reimbursement structures further strengthen the market outlook. In May 2024, WHO/Europe reported that cardiovascular diseases (CVDs) are the leading cause of death in the European Region, accounting for over 42.5% of all deaths, which translates to 10,000 deaths every day. Men are almost 2.5 times more likely to die from CVDs than women, and the probability of premature death (ages 30-69) is nearly five times higher in eastern Europe and central Asia compared with western Europe.

The Germany cardiac surgery instruments market is anticipated to register a considerable growth rate during the forecast period, driven by a strong healthcare system, high procedural volumes, and continuous investments in surgical innovations. In Germany, Digimed Medizintechnik manufactures and distributes cardiovascular instruments, implants, and sterilization containers with Teflon filters. Their product range includes atraumatic bulldog clamps, vascular clamps, forceps, scissors, retractors, and other specialized tools for cardiac, thoracic, and vascular surgery.

The UK cardiac surgery instruments market is anticipated to register a considerable growth rate during the forecast period supported by growing demand for minimally invasive procedures and favorable healthcare policies. Strong public healthcare infrastructure facilitates broad adoption of surgical innovations. Rising incidence of cardiovascular conditions is expected to fuel consistent demand. In December 2024 , according to the Office for Health Improvement & Disparities, over 1.8 million people in England had a GP-recorded diagnosis of coronary heart disease, with hospital admissions down 46% over the past 20 years.

Asia Pacific Cardiac Surgery Instruments Market Trends

Asia Pacific cardiac surgery instruments market is anticipated to be the fastest-growing region in the market owing to the rising prevalence of cardiovascular diseases, expanding healthcare infrastructure, and growing adoption of advanced surgical technologies. Increasing medical tourism, government-backed healthcare investments, and a rapidly aging population are further expected to accelerate regional demand. In March 2025 , according to a narrative review in JACC: Advances, Asia faces a rapidly rising cardiovascular disease burden with 10.8 million CVD-related deaths in 2019. Challenges include heterogeneous cardiometabolic risk, low health literacy, suboptimal primary care, and poor uptake of cardiovascular risk factor screening, particularly in low- and middle-income countries.

The Japan cardiac surgery instruments market is anticipated to register a significant growth rate during the forecast period, supported by technological leadership and high investment in healthcare innovation. Strong domestic manufacturing capabilities contribute to self-reliance in advanced surgical devices. In November 2024, according to the Journal of Ageing and Longevity, a study of 6,587 Japanese adults found history of stroke, chronic renal failure, weight gain ≥10 kg since age 20, high systolic BP, use of antihypertensive or hypoglycemic medications, and abnormal creatinine increased heart disease risk.

The China cardiac surgery instruments market is anticipated to register a significant growth rate during the forecast period, driven by large patient volumes, healthcare modernization, and increasing adoption of advanced cardiac procedures. Expanding hospital networks are creating strong procurement opportunities. In December 2024, an article published in the Chinese Medical Journal highlighted milestones from the first cardiac surgeries in the 1940s to 263,292 operations across 726 hospitals in 2022, including achievements in TOF, TGA, valve replacement, CABG, aortic surgery, LVAD implantation, and minimally invasive techniques.

The India cardiac surgery instruments market is anticipated to register a significant growth rate during the forecast period, supported by a rising patient pool, expansion of healthcare facilities, and growing penetration of advanced surgical solutions. Favorable government initiatives in healthcare access are boosting adoption. In March 2024, an article published in the Indian Journal of Thoracic and Cardiovascular Surgery reported that India performs around 550,000 PCI procedures and 50,000 congenital heart surgeries annually, with CABG mortality below 2%, approximately 60,000 heart valve procedures, 30,000 thoracic surgeries, and over 1,100 heart transplants completed by 2021.

Latin America Cardiac Surgery Instruments Market Trends

Latin America cardiac surgery instruments market is growing over the forecast period, driven by increasing cardiovascular disease prevalence and rising healthcare expenditure. Expansion of private healthcare providers is creating new demand avenues. Improvements in surgical training and skills are further supporting market uptake. In April 2025, The Lancet Global Health reported that among 614 cardiac surgery patients across 17 Latin American countries, 215 (35%) experienced postoperative complications, with 40 (6.5%) deaths, and cardiovascular complications showing the highest mortality. Limited access to critical care, where 40% of those who died never received ICU care, highlights gaps in postoperative management and the need for improved surgical outcomes.

The Brazil cardiac surgery instruments market is growing over the forecast period, supported by a high disease burden and strengthening hospital infrastructure. Ongoing investment in surgical innovation is fueling adoption. In January 2024, the Brazilian Journal of Cardiovascular Surgery published an article highlighting the pioneering use of advanced cardiac surgery instruments, including forceps, scalpels, and heart-lung machines, and the development of cardiac centers that significantly advanced cardiac surgery practices in Brazil.

Middle East & Africa Cardiac Surgery Instruments Market Trends

MEA cardiac surgery instruments market is growing over the forecast period, influenced by rising healthcare investments and gradual adoption of advanced surgical practices. Expansion of specialized cardiac care centers is boosting procedural volumes. In June 2025, East Arafat Hospital’s mobile cardiology unit performed 14 emergency cardiac catheterization procedures during Hajj, providing immediate on-site intervention and eliminating the need to transfer patients to specialized centers, while rapid air evacuation services further improved survival rates.

The South Africa cardiac surgery instruments market is growing over the forecast period, supported by increasing cardiovascular cases and improving access to surgical care. Strengthening private healthcare networks is fueling the procurement of advanced instruments. In April 2025, Wilmed Park Hospital in Klerksdorp, South Africa, announced the imminent launch of its state-of-the-art cardiac unit, featuring advanced catheterization labs and world-class cardiac care to improve accessibility and outcomes for patients in the Northwest Province, which is expected to drive demand for cardiac surgery instruments in the region.

Key Cardiac Surgery Instruments Company Insights

Key participants in the cardiac surgery instruments market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Cardiac Surgery Instruments Companies:

The following are the leading companies in the cardiac surgery instruments market. These companies collectively hold the largest market share and dictate industry trends.

- B. Braun Melsungen AG

- KLS Martin Group.

- Teleflex Incorporated

- Medline Industries, Inc.

- STILLE

- Sklar Corporation

- Wexler Surgical

- Murray Surgical

- Surtex Instruments Limited

- Scanlan International

- Delacroix-Chevailer

- BD

Recent Developments

-

In November 2023, Surtex Instruments launched the Infinex microsurgery series at MEDICA 2023, featuring diamond-dusted forceps, precision scissors, and needle holders that enhance grip, stability, and durability. The Magna, Maestro, and Onyx ranges combine craftsmanship with advanced coatings for cardiovascular and neurovascular procedures.

-

In May 2022 , Cardiac Services announced a partnership with Wexler Surgical to expand its surgical instrument portfolio. The collaboration introduced a wide range of cardiovascular and thoracic instruments, including clamps, forceps, needle holders, scissors, and retractors. The initiative emphasized quality, customization, and enhanced surgeon support through repair services and trial offerings.

Cardiac Surgery Instruments Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.99 billion

Revenue forecast in 2033

USD 5.36 billion

Growth rate

CAGR of 7.56% from 2025 to 2033

Actual data

2021 - 2024

Forecast data

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue & Volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

B. Braun Melsungen AG; KLS Martin Group.; Teleflex Incorporated; Medline Industries, Inc.; STILLE; Sklar Corporation; Wexler Surgical; Murray Surgical; Surtex Instruments Limited; Scanlan International; Delacroix-Chevailer; BD

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cardiac Surgery Instruments Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and analyzes industry trends in each sub-segments from 2021 to 2033. For this study, Grand View Research, Inc. has segmented the global cardiac surgery instruments market report based on product, application, end use, and region:

-

Product Outlook (Revenue USD Million, 2021 - 2033)

-

Forceps

-

Clamps

-

Graspers

-

Scissors

-

Needle Holder

-

Others

-

-

Application Outlook (Revenue USD Million, 2021 - 2033)

-

Coronary Artery Bypass Grafting

-

Heart Valve Surgery

-

Pediatric Cardiac Surgery

-

Heart Transplant

-

Others

-

-

End Use Outlook (Revenue USD Million, 2021 - 2033)

-

Hospitals

-

Ambulatory Surgical Center

-

-

Regional Outlook (Revenue USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cardiac surgery instruments market size was estimated at USD 2.80 billion in 2024 and is expected to reach USD 2.99 billion in 2025.

b. The global cardiac surgery instruments market is expected to grow at a compound annual growth rate of 7.56% from 2025 to 2033 to reach USD 5.36 billion by 2033.

b. North America dominated the cardiac surgery instruments market with a share of 48.49% in 2024. This is attributable to increasing number of surgeries, high adoption of advanced tools and devices, and the growing prevalence of cardiac disorders.

b. Some key players operating in the cardiac surgery instruments market include B. Braun Melsungen AG, KLS Martin Group., Teleflex Incorporated, Medline Industries, Inc., STILLE, Sklar Corporation, Wexler Surgical, Murray Surgical, Surtex Instruments Limited, Scanlan International , Delacroix-Chevailer, and BD.

b. Rising prevalence of cardiovascular diseases, increasing adoption of advanced surgical techniques, and growing demand for precision-driven procedures are expected to drive the cardiac surgery instruments market. The shift toward minimally invasive surgeries, coupled with technological advancements that enhance safety and efficiency, is further anticipated to support market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.