- Home

- »

- Medical Devices

- »

-

Cardiac Workstation Market Size, Industry Report, 2030GVR Report cover

![Cardiac Workstation Market Size, Share & Trends Report]()

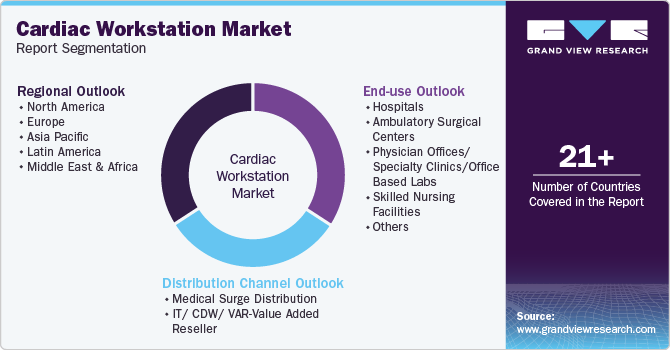

Cardiac Workstation Market (2025 - 2030 ) Size, Share & Trends Analysis Report By End-use (Hospitals, Ambulatory Surgery Centers), By Distribution Channel (Medical Surge Distribution, IT/CDW/VAR-value Added Reseller), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-561-0

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cardiac Workstation Market Summary

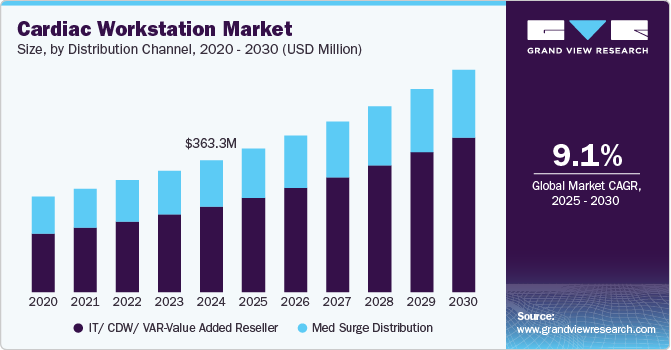

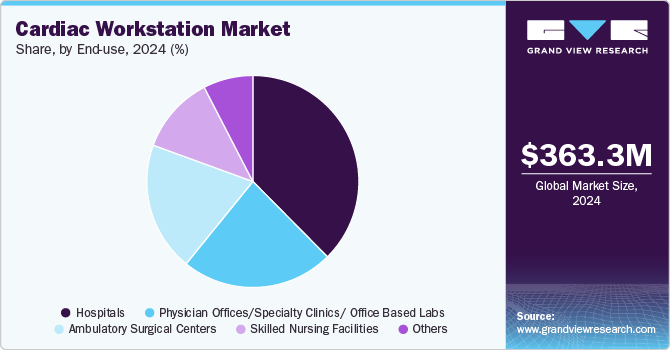

The global cardiac workstation market size was estimated at USD 363.26 million in 2024 and is projected to reach USD 610.90 million by 2030, growing at a CAGR of 9.10% from 2025 to 2030. The cardiac workstation market is driven by the rising prevalence of cardiovascular diseases, increasing electrocardiogram (ECG) procedures, and the growing geriatric population, which is more susceptible to heart conditions.

Key Market Trends & Insights

- North America held the largest revenue share of more than 40.05% in the market in 2024.

- The cardiac workstation market in the U.S. is poised to dominate the North American region.

- Based on distribution channel, the IT/CDW/VAR-(Value Added Reseller) segment held the largest share in 2024.

- Based on end use, the hospital segment dominated the end-use segment, with a revenue share of 37.58% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 363.26 Million

- 2030 Projected Market Size: USD 610.90 Million

- CAGR (2025-2030): 9.10%

- North America: Largest market in 2024

According to the data published by the Oxford University Press in November 2024, over 300 million ECGs are performed annually across the globe.

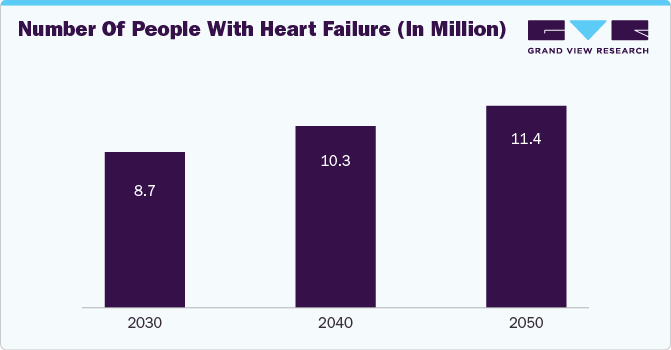

The rising incidence of cardiovascular diseases significantly drives the cardiac workstation market. According to the data published in the Journal of Cardiac Failure in January 2025, about 6.7 million individuals living in America over the age of 20 currently live with heart failure. This number is projected to increase by 70% over the forecast period, underscoring the growing burden of cardiovascular conditions. The incidence of heart failure in 2030, 2040, and 2050 is represented in the figure below. As the incidence of heart failure rises, there is a growing demand for advanced diagnostic and monitoring tools, such as cardiac workstations.

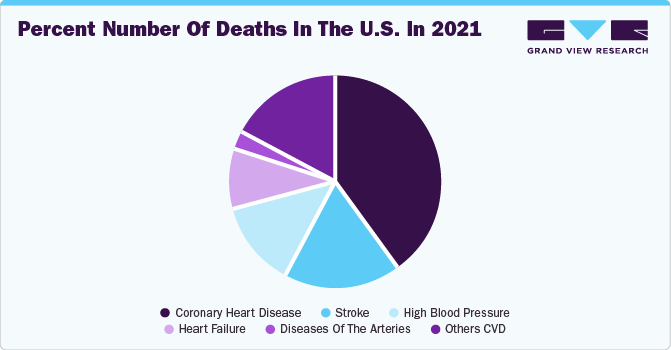

Moreover, according to the 2024 Heart Disease and Stroke Statistics Update by the American Heart Association, cardiovascular disease was the underlying cause of 931,578 deaths in the U.S. in 2021-surpassing deaths from all forms of cancer and chronic lower respiratory diseases combined. This alarming statistic highlights the critical need for timely diagnosis and efficient management of cardiovascular conditions. As a result, the demand for cardiac workstations, which support comprehensive cardiovascular assessment and streamline clinical workflows, is witnessing substantial growth.

The figure represented below illustrates the proportion of deaths attributed to cardiovascular diseases:

In addition, due to the growing burden of cardioavcular diseases across the globe, the number of ECG procedures is also increasing significantly. In the U.S. alone, over 100 million 12-lead ECGs are performed annually, making it the most commonly used diagnostic tool for detecting heart disease. Also, as per the data published in GE HealthCare’s article in February 2023, more than 300 million ECGs are conducted each year globally across both acute care and ambulatory settings. Thus, the extensive need and large number of ECG procedures undertaken yearly are anticipated to boost the demand for cardiac workstations to streamline workflows, improve diagnostic precision, and meet the growing demand for effective cardiac care.

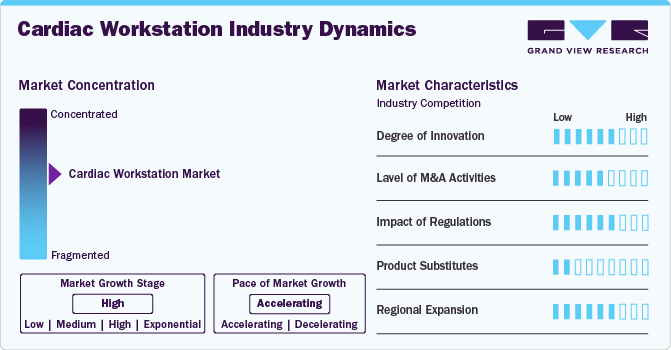

Market Concentration & Characteristics

The market growth stage is high, and the pace of the market growth is accelerating. The cardiac workstation market is characterized by growth due to the rising burden of cardiovacular diseases and the increasing number of ECG procedures.

Industry players and researchers are focusing on developing advanced cardiac workstation products. For instance, in June 2024, Royal Philips launched the Cardiac Workstation, an innovative cardiac care platform to enhance clinical decision-making and patient care in cardiology. This advanced platform utilizes sophisticated algorithms to analyze, access, and manage ECG data remotely or at the point of care. Such advancements are expected to drive significant market growth.

Regulatory oversight for cardiac workstations involves key bodies like the U.S. FDA and European MDR. The FDA's CDRH ensures the safety and effectiveness of cardiology and diagnostic devices, including cardiac workstations. Cardiac workstations in the U.S. are authorized as per the Radiology specialty regulations. For instance, according to the data published by the FDA in April 2025, PHILIPS CARDIAC WORKSTATION is classified and regulated under Radiology regulations.

Players in the cardiac workstation industry are strategically focusing on provincial expansion to capitalize on emerging prospects and broaden their market presence. For instance, in January 2024, Medtronic reported a strategic partnership with Cardiac Design Labs (CDL) to scale up, launch, and enhance access to CDL’s innovative diagnostic technology for long-term heart monitoring and diagnosis. Such increasing collaborations to extend the reach of cardiology devices are anticipated to support the growth of the cardiac workstation market in the coming years.

Distribution Channel Insights

The IT/CDW/VAR-(Value Added Reseller) segment held the largest share in 2024. It is also the fastest growing segment . These channels are vital intermediaries between manufacturers and end-users, bringing specialized expertise in customization, technology integration, and ongoing customer support. IT/CDW/VAR partners have in-depth knowledge of healthcare technology, allowing them to understand the specific needs and challenges healthcare providers face. They offer valuable guidance in selecting the most appropriate cardiac workstation, tailored to fit distinct clinical workflows, environments, and integration requirements.

The medical surge distribution segment is anticipated to grow significantly from 2025 to 2030. These distribution channels leverage their extensive supply networks, inventory management capabilities, and relationships with healthcare providers. These distributors ensure the timely availability of cardiac equipment, offering convenience and cost-effectiveness.

End-use Insights

The hospital segment dominated the end-use segment, with a revenue share of 37.58% in 2024. The dominance of this segment can be attributed to the increasing number of hospitals and rising investments in improving diagnostic capabilities and advanced technologies. In addition, several hospitals are focusing on establishing Cath labs. For instance, in February 2025, BM Birla Hospital launched its fourth Cath Lab in East India to enhance cardiovascular care. Such initiatives undertaken by the hospitals are anticipated to support the segment growth over the forecast period.

The physician offices/ specialty clinics/office-based labs segment is expected to experience the fastest growth during the forecast period. This segment growth can be attributed to several factors, including the rising shift toward outpatient cardiac care, cost efficiency, and the increasing burden of cardiovascular diseases. These settings benefit from compact, scalable workstations that streamline diagnostics, reduce hospital dependence, and enhance patient convenience with quicker, on-site evaluations and turnaround times.

Regional Insights

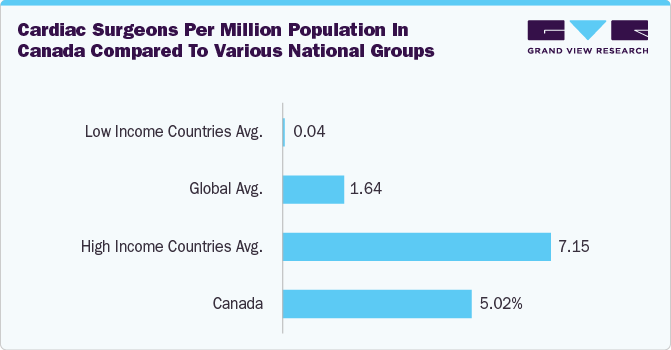

North America held the largest revenue share of more than 40.05% in the market in 2024. The key drivers of growth in the region include developed healthcare infrastructure in the countries. For instance, according to a June 2024 article in the Canadian Journal of Cardiology, Canada has a relatively strong cardiac care infrastructure, with 203 active cardiac surgeons, equating to 5.02 per million population. In addition, adult cardiac surgeons operate across 32 cardiac centers in the country, representing 0.79 centers per million population, slightly above the global average of 0.73.

Canada has favorable surgical outcomes, robust post-acute cardiac care systems, and significant healthcare spending. This existing infrastructure, paired with a growing need to optimize surgical workloads and diagnostic efficiency, is anticipated to drive the demand for advanced cardiac workstations.

U.S. Cardiac Workstation Market Trends

The cardiac workstation market in the U.S. is poised to dominate the North American region, driven by the strong presence of leading medical technology companies such as Philips N.V., Medtronic, GE HealthCare, and Baxter (Hillrom Services, Inc.). The availability of advanced healthcare infrastructure, widespread adoption of innovative diagnostic tools, and a high volume of cardiovascular procedures further fuel market growth.

Europe Cardiac Workstation Market Trends

The rising burden of cardiovascular diseases in Europe, particularly in the UK, is a key driver for the growth of the cardiac workstation market. According to a January 2024 report by the British Heart Foundation, over 39,000 people in England died prematurely from heart and circulatory diseases in 2022, an average of 750 deaths per week. This alarming trend reflects a broader concern across Europe, where cardiovascular conditions remain the leading cause of mortality. As healthcare systems respond to this growing challenge, there is an increasing demand for advanced diagnostic and monitoring technologies such as cardiac workstations. These systems enable faster, more accurate assessments and support clinical decision-making, making them vital tools in improving outcomes and managing the rising incidence of heart disease across the region.

The UK cardiac workstation market is driven by the increasing number of cardiovacular surgeries performed there. For instance, according to an article published by BMJ Publishing Group Ltd and the British Cardiovascular Society in October 2024, cardiovacular surgery remains a high-volume procedure in the UK, with approximately 28,000 adults undergoing cardiovacular surgical interventions yearly. This substantial surgical load highlights the need for advanced tools to streamline pre-operative planning, intraoperative monitoring, and post-operative care. Cardiac workstations, with their ability to integrate imaging, diagnostic data, and patient history, play a crucial role in enhancing surgical precision and efficiency. Thus, the adoption of cardiac workstations is expected to rise across the UK.

The France cardiac workstation market is projected to grow during the forecast period, driven by the increasing geriatric population, which is more prone to cardiac diseases and thus needs timely intervention through investigations such as ECG. In 2023, data published by Le Monde indicates that 26% of individuals in France are over 60 years old, which is equivalent to one in four inhabitants. By 2040, this figure is projected to rise to nearly one in three.

Asia Pacific Cardiac Workstation Market Trends

The cardiac workstation market in Asia is driven by a rising prevalence of cardiovascular diseases, increasing healthcare expenditure, and advancements in imaging technologies. Rapid urbanization and lifestyle changes contribute to growing cardiovacular cases, while government initiatives to improve healthcare infrastructure further support market expansion. In addition, the demand for early and accurate diagnosis is boosting the adoption of advanced ECG workstations, thus propelling market growth.

The China cardiac workstation market is expected to grow throughout the forecast period due to an aging population and increasing rates of cardiovascular disease. Growth is further supported by government investment in healthcare infrastructure and initiatives promoting the adoption of advanced medical technologies. For instance, in March 2025, the Shanghai Municipal Health Commission approved DeltaHealth Hospital Shanghai to operate as a wholly foreign-owned hospital in China dedicated exclusively to cardiovascular care.

The Japan cardiac workstation market is expected to grow significantly during the forecast period due to the rapidly aging population, rising prevalence of cardiovascular disease, and strong government focus on advanced healthcare technologies. In addition, Japan's commitment to digital health transformation supports market growth.

Latin America Cardiac Workstation Market Trends

The Latin American cardiac workstation market is expanding due to the rising prevalence of cardiovascular disease, the aging population, and increased demand for innovative medical technologies. Data from the Social Communication Coordination published in October 2023 indicates that in 2022, Brazil's total number of individuals aged 65 years and older was 22,169,101, representing 10.9% of the population..

Middle East and Africa Cardiac Workstation Market Trends

The MEA cardiac workstation market is expected to witness significant growth in the coming years due to rising cardiovascular disease rates, aging populations, and increased adoption of advanced technologies. Government initiatives, such as Saudi Arabia’s Vision 2030 and investments in healthcare infrastructure, are enhancing diagnostic capabilities.

Key Cardiac Workstation Company Insights

Medtronic, Koninklijke Philips N.V., GE HealthCare, Baxter (Hillrom Services, Inc.), AFC Industries, Inc., SCHILLER AG, EDAN Instruments, Inc., CONTEC MEDICAL SYSTEMS CO., LTD, Lepu Medical Technology(Beijing)Co., Ltd., and Cardioline S.P.A.. are some of the major players in the cardiac workstation market. Companies are expanding their portfolios of cardiac workstations to gain a competitive advantage in the coming years.

Key Cardiac Workstation Companies:

The following are the leading companies in the cardiac workstation market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Koninklijke Philips N.V.,

- GE HealthCare

- Baxter (Hillrom Services, Inc.)

- AFC Industries, Inc.

- SCHILLER AG

- EDAN Instruments, Inc.

- CONTEC MEDICAL SYSTEMS CO.,LTD

- Lepu Medical Technology(Beijing)Co.,Ltd.

- Cardioline S.P.A.

Recent Developments

-

In June 2024, Philips launched its new Cardiac Workstation in the EMEA region. This platform utilizes advanced algorithms to streamline the collection and processing of ECG data, facilitating faster clinical decision-making and improving patient care efficiency. The system is designed to alleviate administrative burdens, allowing healthcare providers to focus more on patient interaction.

Cardiac Workstation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 395.23 million

Revenue forecast in 2030

USD 610.90 million

Growth rate

CAGR of 9.10% from 2025 to 2030

Base year for estimation

2024

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic; Koninklijke Philips N.V.; GE HealthCare; Baxter (Hillrom Services, Inc.); AFC Industries, Inc.; SCHILLER AG; EDAN Instruments, Inc.; CONTEC MEDICAL SYSTEMS CO., LTD; Lepu Medical Technology (Beijing)Co., Ltd.; Cardioline S.P.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cardiac Workstation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global cardiac workstation market report on the basis of end-use, distribution channel, and region

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Physician Offices/ Specialty Clinics/ Office Based Labs

-

Skilled Nursing Facilities

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Surge Distribution

-

IT/ CDW/ VAR-Value Added Reseller

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cardiac workstation market size was estimated at USD 363.26 million in 2024 and is expected to reach USD 395.23 million in 2025.

b. The global cardiac workstation market is expected to grow at a compound annual growth rate of 9.10% from 2025 to 2030 to reach USD 610.90 million by 2030.

b. North America held the largest revenue share of more than 40.05% in the market in 2024. The key drivers of growth in the region include developed healthcare infrastructure in the countries and the presence of key players.

b. Some key players operating in the cardiac workstation market include Medtronic, Koninklijke Philips N.V., GE HealthCare, Baxter (Hillrom Services, Inc.), AFC Industries, Inc., SCHILLER AG, EDAN Instruments, Inc., CONTEC MEDICAL SYSTEMS CO., LTD, Lepu Medical Technology(Beijing) Co., Ltd., and Cardioline S.P.A.

b. Key factors that are driving the market growth include the rising prevalence of cardiovascular diseases, increasing electrocardiogram (ECG) procedures, and the growing geriatric population, which is more susceptible to heart conditions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.