- Home

- »

- Medical Devices

- »

-

Cardiovascular Devices Market Size, Industry Report, 2033GVR Report cover

![Cardiovascular Devices Market Size, Share & Trends Report]()

Cardiovascular Devices Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Diagnostic & Monitoring (ECG, Holter, Mobile Cardiac Telemetry), Surgical Devices (Pacemakers, Stents)), By Region, And Segment Forecasts

- Report ID: 978-1-68038-992-0

- Number of Report Pages: 240

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cardiovascular Devices Market Summary

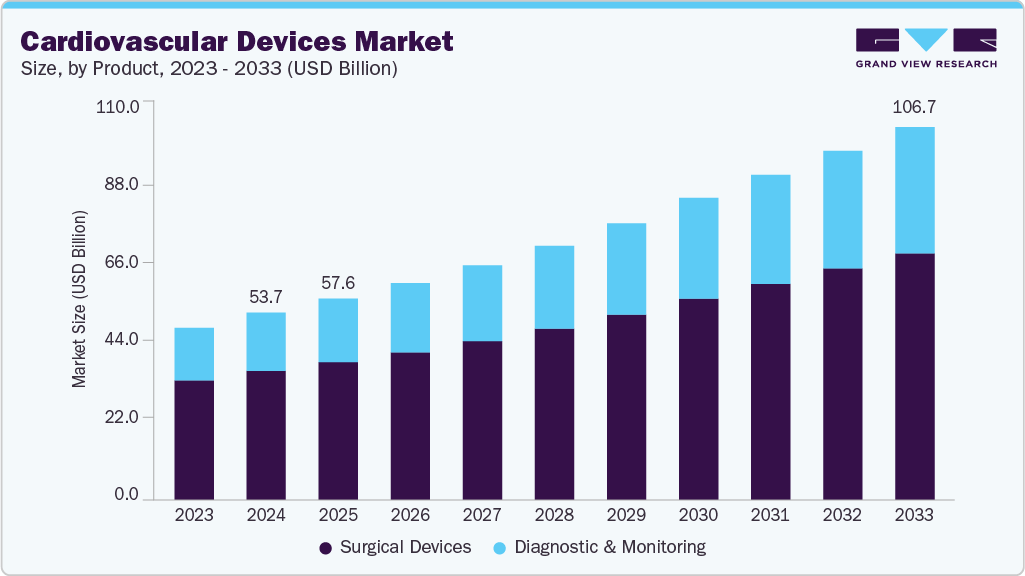

The global cardiovascular devices market size was estimated at USD 53.7 billion in 2024 and is projected to reach USD 106.7 billion by 2033, growing at a CAGR of 7.8% from 2025 to 2033. Cardiovascular disease is one of the most prevalent medical conditions worldwide.

Key Market Trends & Insights

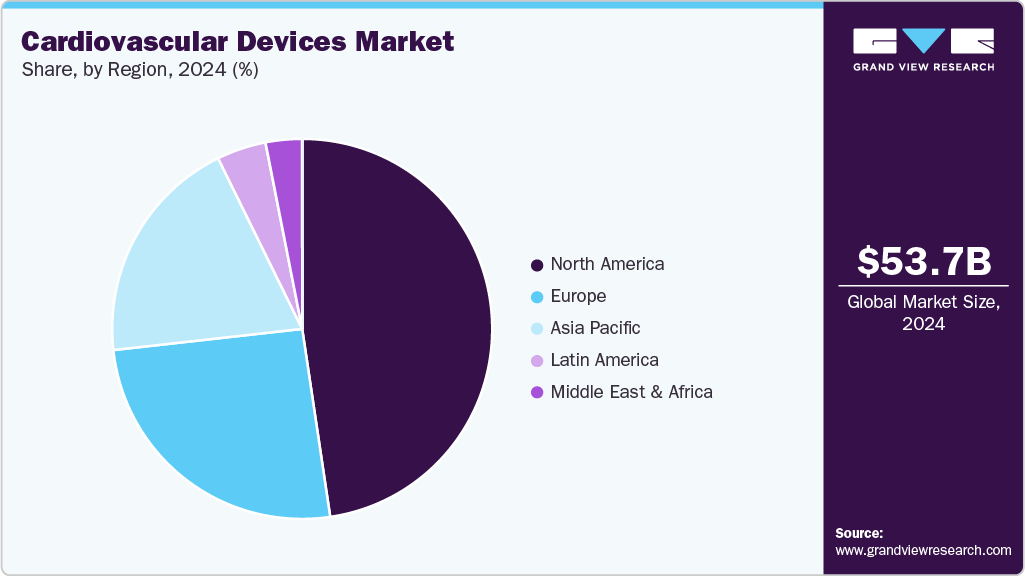

- North America dominated the market and accounted for the largest revenue share of 47.7% in 2024.

- Europe market is expected to grow at a significant rate over the forecast period.

- Based on product, the surgical devices segment accounted for the largest revenue share of 68.8% in 2024.

- Based on product, the diagnostics and monitoring devices segment is expected to grow at the fastest CAGR of 9.0% during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 53.7 Billion

- 2033 Projected Market Size: USD 106.7 Billion

- CAGR (2025-2033): 7.8%

- North America: Largest market in 2024

In January 2024, the American Heart Association (AHA) reported that cardiovascular disease (CVD) was the leading cause of death in the U.S., claiming 931,578 lives, surpassing deaths from all cancers and chronic respiratory diseases combined. Therefore, cardiovascular devices are crucial in accurately detecting and mitigating heart disorders, fueling market expansion. The main drivers of this market include rapid technical development, an increase in affordable and effective devices, and rising demand for minimally invasive procedures.

The surge in the number of cases of chronic cardiovascular disorders contributes to the market growth. Increasing cardiovascular disorders have led to an increased demand for cardiovascular devices. Heart or coronary artery stents are among the most essential cardiovascular devices. They facilitate the treatment of cardiac illnesses considered a serious risk to life, namely heart attacks, coronary disease, atrial fibrillation, and the expansion of clogged arteries. In May 2024, the WHO reported that cardiovascular diseases (CVDs) are the top cause of disability and premature death in Europe, accounting for over 42.5% of annual deaths, around 10,000 daily. Men are nearly 2.5 times more likely to die from CVDs than women, with young people (ages 30-69) in Eastern Europe and Central Asia facing a nearly fivefold higher risk compared to their Western European counterparts.

Key Facts on Cardiovascular Disease and Related Events in the U.S. (2024)

Statistic

Value

Total CVD deaths per day

2,552

Deaths from heart disease per day (including heart attacks)

1,905

Average time between heart attacks

Every 40 seconds

New heart attacks each year

Approximately 605,000

Recurrent heart attacks each year

Approximately 200,000

Silent heart attacks

Estimated 170,000

Average age at first heart attack (males)

65.6 years

Average age at first heart attack (females)

72.0 years

Source: American Heart Association, Inc. in January 2024 & GVR

The technologies adopted for developing cardiac devices and the indications for these devices have advanced substantially during the past decade. Due to this, cardiology devices are being used to treat a larger number of patients, which has yielded tremendous treatment and monitoring results. One such development that significantly benefits cardiology is artificial intelligence, which has better skills for monitoring specific heart problems. For instance, in May 2024, Medtronic announced the integration of AI into its Reveal Linq ICM devices in the U.S., Australia, and New Zealand. The AI update is to be introduced in Europe by the end of 2024.

The efforts adopted in response to the amplified demands for these devices in emerging nations have also boosted the market. The widespread usage of cutting-edge devices in developing countries results from easy accessibility. In October 2024, Boston Scientific Corporation received FDA approval for its FARAWAVE NAV Ablation Catheter for paroxysmal atrial fibrillation treatment and clearance for its FARAVIEW Software. These innovations are set to improve cardiac ablation procedures through enhanced visualization, exclusively integrating with Boston Scientific's cardiac mapping technology, including the latest OPAL HDx Mapping System.

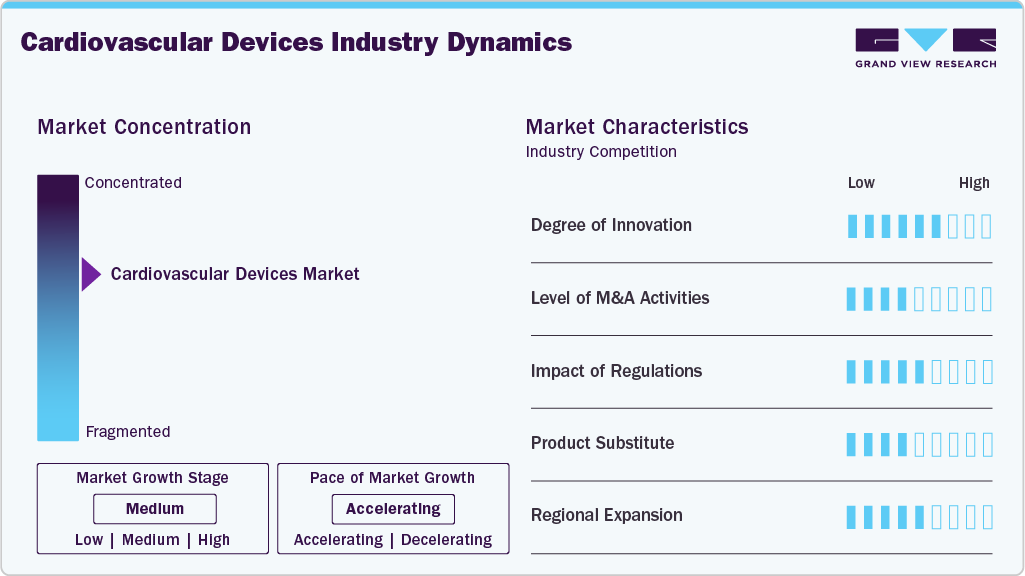

Market Concentration & Characteristics

The degree of innovation in the market is high, driven by technological advancements and increasing patient demand for minimally invasive procedures. Companies invest significantly in research and development to create next-generation devices such as bioresorbable stents, advanced imaging technologies, and wearable cardiac monitors. This focus on innovation enhances patient outcomes and helps manufacturers maintain competitive advantages in a rapidly evolving market landscape.

The level of mergers and acquisitions (M&A) activities within the market is moderate. Companies actively seek strategic partnerships and acquisitions to expand their product portfolios, access new technologies, and enter emerging markets. While there have been notable transactions, the overall pace remains steady rather than explosive, reflecting a calculated approach to growth within the industry.

The Impact of regulations on the market is high, as stringent regulatory frameworks govern product development, approval processes, and post-market surveillance. Regulatory bodies like the FDA in the U.S. impose rigorous standards to ensure safety and efficacy, which can lengthen time-to-market for new devices but ultimately enhance consumer trust in these products. in January 2024, Medtronic announced that it obtained CE Mark approval for its next-generation miniature, leadless pacemakers: the Micra VR2 and Micra AV2.

Product and service expansion in this sector is high, as manufacturers continuously seek to diversify their offerings to meet evolving patient needs. This includes developing new stents, valves, and diagnostic tools that cater to various cardiovascular conditions. The trend towards personalized medicine also drives expansion efforts, as companies aim to provide tailored solutions based on individual patient profiles.

Regional expansion within the market is moderate, with companies focusing on both established markets like North America and Europe while also exploring growth opportunities in Asia-Pacific and Latin America. Factors such as increasing healthcare expenditure, rising prevalence of cardiovascular diseases, and improving healthcare infrastructure contribute to this moderate expansion strategy across different regions.

Product Insights

The surgical devices segment accounted for the largest revenue share of 68.8% in 2024, owing to the rising number of domestic and international players to meet the growing demand for cutting-edge cardiovascular devices. The market would also be driven by key firms releasing new products. For instance, in May 2024, Abbott announced the introduction of the XIENCE Sierra Everolimus-Eluting Coronary Stent System in India.

Based on product, the cardiovascular devices market has been segmented into diagnostic & monitoring devices and surgical devices. The diagnostic and monitoring device segment is then segmented into ECG, Implantable Cardiac Monitors, Holter Monitors, Mobile Cardiac Telemetry, MRI, Cardiovascular Ultrasound, Cardiac Diagnostic Catheters, and PET Scanner. The surgical devices segment is categorized as Cardiac Resynchronization Therapy (CRT), Implantable Cardioverter Defibrillators (ICDs), Pacemakers, Coronary Stents, Catheters, Guidewires, Cannula, Valves, and Occlusion Devices.

The diagnostics and monitoring devices segment is expected to grow at the fastest CAGR of 9.0% during the forecast period. The Electrocardiogram (ECG) is projected to hold a substantial market share within this segment. The recent trend toward lightweight, compact, and affordable devices has made ECGs increasingly popular, particularly in the home healthcare sector. With the rising incidence of cardiovascular diseases, the demand for ECG monitoring is becoming more critical. Additionally, the rise of wireless ECG technology has enabled real-time patient monitoring and diagnosis, further propelling industry growth.

Regional Insights

North America cardiovascular devices market dominated the market and accounted for the largest revenue share of 47.7% in 2024, driven by the rising incidence of Atrial Fibrillation (AFib) & Cardiovascular Disease (CVD), supportive government initiatives, and technological advancements. In February 2024, an article in The Lancet Regional Health - Europe discussed that atrial fibrillation (AF) is quite common, with an estimated lifetime risk of approximately 1 in 3 to 5 people over the age of 45. AFib results in significant hospitalizations and deaths each year, emphasizing the urgent need for advanced cardiovascular devices.

Canada cardiovascular devices market is boosted by increasing AFib prevalence among aging populations, with significant government initiatives supporting healthcare advancements. Initiatives such as national research networks and provincial investments highlight Canada’s proactive approach to cardiovascular health.

U.S. Cardiovascular Devices Market Trends

Cardiovascular devices market in the U.S. is anticipated to grow over the forecast period. Rising CVD cases in the U.S. fuel the growth of the market. According to an American Heart Association (AHA) article published in January 2024, CVD results in about 2,552 deaths each day in the U.S. This significant burden of CVD on public health increased the critical need for effective management and treatment options within the U.S. market.

In October 2023, Abbott launched the Abbott HeartMates program to support heart patients by enabling participants to share their stories and connect with people going through similar heart health conditions. Under this program, the company started the campaign with Damar Hamlin, a professional football player, as its first ambassador.

Europe Cardiovascular Devices Market Trends

The Europe cardiovascular device market is expected to grow at a significant rate over the forecast period. The high mortality of CVDs is boosting the demand for cardiovascular devices in Europe. According to a WHO article published in May 2024, CVDs are the leading cause of disability and premature death in Europe. It is responsible for over 42.5% of all deaths annually, accounting for approximately 10,000 deaths every day. The significant impact of CVD emphasizes the urgent need for advanced cardiovascular device solutions.

The UK cardiovascular devices market is expected to grow over the forecast period. The rising CVD-related deaths and the increasing number of arrhythmia cases highlight the need for continued innovation and advancements in healthcare technology to reduce this trend effectively. According to a Guardian News & Media Limited article published in January 2024, the premature death rate due to CVD in the UK rose to 80 per 100,000 individuals.

The cardiovascular devices market in Germany is expected to grow over the forecast period. The rising number of cardiac surgery patients fuels the market growth. Effective monitoring is crucial for ensuring patient safety, optimizing surgical outcomes, and managing postoperative recovery. In January 2024, The Journal of Thoracic and Cardiovascular Surgery reported data from a German registry for 2023, detailing 168,841 cardiac and vascular procedures across 77 hospitals. The unadjusted in-hospital survival rates were 97.6% for 28,996 coronary artery bypass grafts, 97.7% for 39,859 heart valve procedures, and 99.2% for 19,699 pacemaker/ICD implants. Additionally, 2,982 extracorporeal life support procedures and 324 heart transplants were performed.

The cardiovascular devices market in France is expected to grow over the forecast period. France’s healthcare system offers relatively good coverage for arrhythmia, incentivizing hospitals and healthcare providers to adopt new & innovative devices. Launching new products and approvals is expected to support market growth over the forecast period. For instance, in January 2024, MicroPort Scientific Corporation announced the CE mark approval for TALENTIA and ENERGYA. These devices monitor the heart rhythm and deliver electrical shocks to regulate abnormal heartbeats if necessary.

Asia Pacific Cardiovascular Devices Market Trends

The Asia Pacific cardiovascular devices market is expected to experience rapid growth, with a projected CAGR of 8.2% from 2025 to 2033. The rising elderly population in the Asia Pacific contributes to the market growth. In May 2024, the Asian Development Bank (ADB) indicated that by 2050, nearly 1.2 billion people aged 60 and older will live in developing Asia and the Pacific, representing about a quarter of the overall population.

The China cardiovascular devices market is anticipated to grow over the forecast period. The increasing demand for advanced medical devices in China boosts demand for cardiovascular devices. In April 2024, Arineta revealed its collaboration with Shandong Yituo Medical Technology Development Co., Ltd. (SYMT). They are establishing a joint venture called Arineta (Shandong) Medical Equipment Co. Ltd., which will soon install its inaugural SpotLight Duo at a prominent healthcare facility in Jinan, China, to meet the increasing demand for high-quality cardiac CT services in the region.

The Japan cardiovascular devices market is expected to grow rapidly over the forecast period. Technological advancements fuel the cardiovascular devices market’s growth. In September 2024, Cardio Intelligence announced that it is testing its AI designed to detect paroxysmal atrial fibrillation to address Japan's rising stroke risk. Their SmartRobin AI series utilizes "explainable AI," analyzing over 100 million heartbeats to aid clinicians' diagnoses. The technology offers quick analysis, providing results for 24-hour ECGs in about three minutes and 7-day ECGs in around 15 minutes. The AI supports both continuous ECG tracking and AFib detection.

The cardiovascular devices market in India is anticipated to grow rapidly over the forecast period. Significant national and international collaborations have played a crucial role in driving the growth of the cardiovascular devices market in India. The enhanced availability of these devices has led to improved patient outcomes and greater adoption of CRM devices across the country. For instance, in January 2024, Cardiac Design Labs and Medtronic collaborated to launch an innovative heart rhythm monitoring technology in India called Padma Rhythms, an External Loop Recorder (ELR) patch. It offers comprehensive, long-term monitoring of heart rhythm to aid in diagnosis.

Latin America Cardiovascular Devices Market Trends

The Latin America cardiovascular devices market is witnessing a significant trend. The Latin America cardiovascular devices market is growing due to the rising incidence of CVD disorders and technological advancements. A February 2024 review in the International Journal of Cardiovascular Sciences highlighted that cardiovascular risk factors are common among women in Los Angeles. Factors such as PCOS, early menopause, and gestational diabetes, along with autoimmune diseases like lupus and rheumatoid arthritis, significantly increase these risks for women compared to men.

The cardiovascular devices market in Brazil is expected to grow over the forecast period. Rising healthcare expenditures and government initiatives aim to improve cardiac care infrastructure. For instance, in September 2024, Claritas launched its Brazilian subsidiary, Claritas NucMed Tech Brazil, to commercialize software solutions for nuclear medicine. The focus was on positron emission tomography (PET) and single photon emission computed tomography (SPECT) software suites. These products aimed to tackle challenges like high costs and access issues in Brazil. The registration process with ANVISA, Brazil’s medical device regulator, was underway at that time.

Middle East and Africa Cardiovascular Devices Market Trends

The cardiovascular devices market in the Middle East and Africa is poised to grow in the near future. The MEA region is witnessing a rise in the prevalence of CVDs, including cardiac arrhythmias, such as AFib and VT. A sedentary lifestyle, unhealthy diets, and an aging population contribute to the increasing burden of CVDs, driving the demand for cardiovascular devices for diagnosis & treatment in the region. Several countries in the MEA are increasing their healthcare expenditure to improve healthcare access and quality.

The cardiovascular devices market in Saudi Arabia is expected to grow over the forecast period. The growing prevalence of CVD cases drives the growth of the market. According to the article published by BMC Cardiovascular Diseases in March 2024, the prevalence of CVD among individuals aged 15 years and older in Saudi Arabia is 1.6%. This figure represents the percentage of the population within this age group affected by various cardiovascular conditions, including heart disease and related disorders. The data emphasizes a significant aspect of the country's health profile, providing insights into the extent of cardiovascular issues impacting Saudi Arabia's population.

The cardiovascular devices market in Kuwait is anticipated to grow over the forecast period. The government's initiatives to improve healthcare infrastructure and services played a significant role in the growth of the cardiovascular devices market in Kuwait. The government is investing heavily in healthcare infrastructure, including hospitals, clinics, and medical equipment, which has helped to improve the quality of healthcare services in the country. This has made it easier for patients to access CVD & AFib and receive timely treatment for their conditions.

Key Cardiovascular Devices Company Insights

Product launches, approvals, strategic acquisitions, and innovations are just a few of the important business strategies used by market participants to maintain and grow their global reach. In August 2024, GE HealthCare announced that its Vscan Air SL, a wireless handheld ultrasound system featuring Caption AI, obtained CE certification. This AI-driven technology aids in quick cardiac evaluations. Furthermore, their Revolution Apex platform enables ECG-less cardiac CT scanning, allowing healthcare providers to capture cardiac images without needing the patient's electrocardiogram.

Key Cardiovascular Devices Companies:

The following are the leading companies in the cardiovascular devices market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- GE HealthCare

- Edwards Lifesciences Corporation

- W. L. Gore & Associates, Inc.

- Siemens Healthcare GmbH

- BIOTRONIK SE & Co. KG

- Canon Medical Systems Asia Pte. Ltd.

- B. Braun SE

- LivaNova PLC

- Cardinal Health

- Medtronic

- Boston Scientific Corporation

Recent Developments

-

In October 2024, Koninklijke Philips N.V., unveiled its cutting-edge cardiology solutions during the Transcatheter Cardiovascular Therapeutics (TCT) annual meeting. These innovations focused on increasing clinical confidence, streamlining procedural efficiency, and enhancing patient outcomes in interventional procedures, ultimately aiming to deliver improved care to a wider audience.

-

In April 2024, Medtronic introduced its newest advancement in cardiac surgery, the Avalus Ultra valve. This state-of-the-art surgical aortic tissue valve is engineered to enhance ease of implantation and improve long-term patient management

-

In March 2024, Stryker introduced the LIFEPAK CR2 AED for cardiac care and an Evacuation Chair. The LIFEPAK CR2 helps rescuers deliver quick CPR and shock during sudden cardiac arrest, featuring QUIK-STEP electrodes for fast placement and a Shock Advisory System for ECG analysis.

-

In January 2024, Boston Scientific announced the U.S. FDA’s approval for the FARAPULSE PFA System, marking a significant advancement in EP devices. This system offers an innovative approach to cardiac ablation, highlighting Boston Scientific’s commitment to providing innovative solutions for treating heart rhythm disorders.

Cardiovascular Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 57.6 billion

Revenue forecast in 2033

USD 106.7 billion

Growth rate

CAGR of 7.8% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Abbott; GE HealthCare; Edwards Lifesciences Corporation; W. L. Gore & Associates, Inc.; Siemens Healthcare GmbH; BIOTRONIK SE & Co. KG; Canon Medical Systems Asia Pte. Ltd.; B. Braun SE; LivaNova PLC; Cardinal Health; Medtronic; Boston Scientific Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cardiovascular Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global cardiovascular devices market report based on product and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Diagnostic & Monitoring Devices

-

ECG

-

Implantable Cardiac Monitors

-

Holter Monitors

-

Mobile Cardiac Telemetry

-

MRI

-

Cardiovascular Ultrasound

-

2D

-

3D/4D

-

Doppler

-

-

Cardiac Diagnostic Catheters

-

PET Scanner

-

-

Surgical Devices

-

Cardiac Resynchronization Therapy (CRT)

-

CRT-Defibrillator

-

CRT-Pacemaker

-

-

Implantable Cardioverter Defibrillators (ICDs)

-

Single Chamber ICDs

-

Dual Chamber ICDs

-

-

Pacemakers

-

Conventional Pacemakers

-

Leadless Pacemakers

-

-

Coronary Stents

-

Catheters

-

Guidewires

-

Cannula

-

Valves

-

Occlusion Devices

-

-

-

Regional Outlook (Revenue in USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cardiovascular devices market size was estimated at USD 53.7 billion in 2024 and is expected to reach USD 57.6 billion in 2025.

b. The global cardiovascular devices market is expected to grow at a compound annual growth rate of 7.8% from 2025 to 2033 to reach USD 106.7 billion by 2033.

b. North America dominated the cardiovascular devices market with a share of 47.66% in 2024. This is attributable to the high adoption of advanced surgical treatments, rising awareness regarding commercially available products, and the presence of a considerably-sized target patient pool.

b. Some key players operating in the cardiovascular devices market include Medtronic; Becton, Dickinson and Company; Cardinal Health, Inc.; Boston Scientific Corporation; B. Braun Melsungen AG; Abbott Laboratories, Inc.; Cook Medical, Inc.; Terumo Cardiovascular Systems Corporation; and St. Jude Medical, Inc.

b. Key factors that are driving the market growth include increased prevalence of chronic heart ailments due to sedentary lifestyles along with the introduction of technologically advanced surgical procedures.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.