- Home

- »

- Healthcare IT

- »

-

Cardiovascular Digital Solutions Market Share Report, 2030GVR Report cover

![Cardiovascular Digital Solutions Market Size, Share & Trends Report]()

Cardiovascular Digital Solutions Market (2023 - 2030) Size, Share & Trends Analysis Report By Service Type (Unobtrusive Testing, CVD Health Informatics), By Component, By Deployment, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-031-9

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

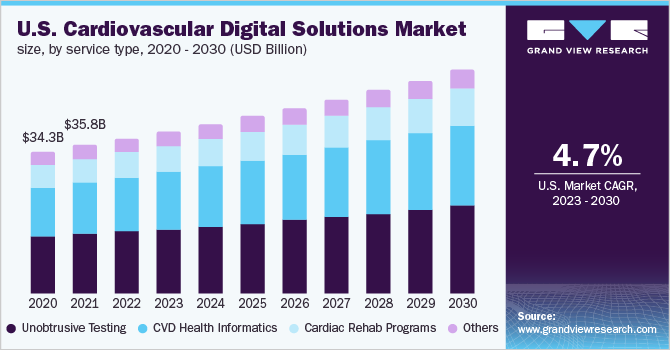

The global cardiovascular digital solutions market size was valued at USD 102.2 billion in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 4.8% from 2023 to 2030. Cardiovascular diseases are the most common cause of mortality and morbidity and require a detailed multi-parameter evaluation beyond the ECG. Digital solutions are important for monitoring patients, early detection, and intervention of cardiac conditions to make cardiac care more tailored and efficient. The increase in the prevalence of cardiovascular diseases globally and the rapid advancement in healthcare technology worldwide are some of the major factors driving the growth of the cardiovascular digital solutions market.

The COVID-19 pandemic caused a mild decline in the cardiovascular digital solutions market. The COVID-19 pandemic brought a global crisis for the major world economies, specifically the healthcare industry. Key players in the market continued to alter their plans in response to the constantly shifting circumstances. However, different countries and key players in the market had undertaken critical healthcare modifications until the emergency takes a back seat.

Service Type Insights

The unobtrusive testing segment accounted for the largest revenue share of 39.8% in 2022. Unobtrusive monitoring methods are being used to receive physiological signals and parameters disturbing the person's daily life such as heart rate, blood pressure, ECG, and blood glucose. The advancements in wireless communication technologies and unobtrusive technologies allow on-site detection of physiological information from remote locations in real-time.

The CVD Health informatics segment is expected to witness the fastest CAGR of 5.2% in the forecast period. CVD health informatics is a rapidly developing interdisciplinary field that focuses on the collection, processing, transmission, retrieval, storage, interpretation, and usage of data from the cardiovascular system for early detection and diagnosis of cardiovascular diseases. Informatics tools such as mobile health (m-Health), medical sensors, and communications technologies for health care are a preferable ways for patients to customize their healthcare options and adhere to proper self-management, and for professionals to evaluate the physiological factors in real-time and provide prompt responses in case of emergency.

Components Insights

The devices segment accounted for the largest revenue share of 74.3% in 2022 and is expected to continue its dominance with the fastest growth rate of 4.9% in the forecast period. This is owing to the recent developments in cardiovascular disease management with cardiac devices. Pacemakers, cardiac loop recorders, artificial heart valves, stents, automated external defibrillators, and other implantable electronic devices are some examples of cardiac devices. These cardiac management devices have been found to be very effective in keeping the heart functioning normally and monitoring irregular heartbeats in people with heart rhythm disorders and heart failure.

Cardiovascular health has become an important indicator of a patient’s recovery from chronic heart conditions. Therefore, it is important to incorporate cardiovascular health monitoring into the treatment plan. Technological advancements and recent software updates can help cardiologists and clinic personnel to do cardio testing easily with patients. Furthermore, smart software and AI are being used in the app algorithms and wearable devices to detect abnormal heart rates, arrhythmias, and other factors to inform the patients.

Deployment Insights

The cloud-based segment accounted for the largest revenue share of 67.7% in 2022 and is expected to continue its dominance with the fastest growth rate of 5.1% over the forecast period. The healthcare sector needs to find effective methods to increase its resources and cut costs and expenses to adhere to financial constraints. Healthcare providers and hospitals are adopting the cloud-based or Software-as-a-Service (SaaS) concept for their healthcare IT solutions as an alternative to the traditional approach where a hospital need to purchase and own technology exclusively.

Cloud-based models usually require a low initial investment and offer a clear total cost of ownership with the provider, which can manage the entire life cycle and support services, enable continuous adoption of new innovation, identify optimization opportunities, and help in managing the data.

End-use Insights

The hospitals & clinics segment accounted for the largest revenue share of 50.25% in 2022 and is expected to continue its dominance with the fastest growth rate of over 5.0% from 2023-2030. Efficient cardiac management can help hospitals and clinics to automate patient communication, increase their operational efficiency, and provide consistent and transparent cardiovascular treatment paths for patients. In cardiovascular management, it is common to implement methods that incorporate individual features of the patient. A tailored approach and planning the cardiac treatment in advance allow the optimization of procedures in a less invasive way for the patient.

The ambulatory care centers are expected to witness a CAGR of 4.7% during the forecast period. The ambulatory cardiac monitoring services, such as Philips MCOT (Mobile Cardiac Outpatient Telemetry), are useful in various situations. It enables real-time identification of clinically serious arrhythmias that may occur in Transcatheter aortic valve replacement (TAVR) patients after discharge as it continuously monitors the heart function and provides crucial data.

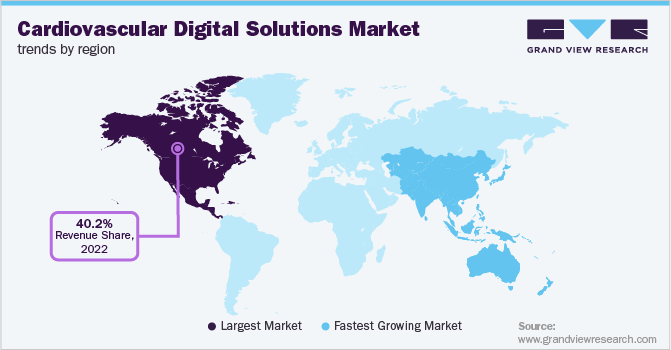

Regional Insights

North America dominated the market and accounted for the largest revenue share of 40.2% in 2022. This is owing to the rapid technological advancements in the medical sector and the highly developed health infrastructure of the region. In addition, the rise in the prevalence of cardiovascular conditions is further increasing the growth of the market. As per the article published by Future Science Group on “As per the article published by Future Science Group, an estimated 3.6 million heart failure hospitalizations and 7.6 million diagnosed prevalent chronic heart failure (CHF) cases were witnessed in North America in 2020.

The Asia Pacific cardiovascular digital solutions market is anticipated to witness rapid growth in the forecast period with a CAGR of 5.2%. The increase in the geriatric population and the development of cardiac health management technology in Asian countries are driving the growth of the regional market. As per the article published by JACC journals on "Epidemiological Features of Cardiovascular Disease in Asia" cardiovascular disease (CVD) continues to be the leading cause of death and premature death worldwide. Around 58% of the 18.6 million CVD fatalities that occurred globally in 2019 were in Asia. As the nation with the highest population density and the widest diversity of cultures, ethnicities, socioeconomic status, and health care systems, Asia Pacific faces numerous challenges in cardiovascular disease prevention and treatment.

Key Companies & Market Share Insights

The key companies operating in the cardiovascular digital solutions market are trying to enhance their product portfolio by updating their products and seeking for government authorizations and acquisitions to increase their client base and obtain a larger market share. Furthermore, the key companies in the market are executing strategies such as mergers, partnerships, new product and service launches, joint ventures, agreements, expansion, and collaboration to improve their position in the market.

In April 2022, GE Healthcare, a medical equipment, and technology provider collaborated with Medtronic, a medical device company. The collaboration was intended to focus on the exceptional demand and need for care at Office-Based Labs (OBLs) and Ambulatory Surgery Centers (ASCs). Under this collaboration, customers can access vast product portfolios, financial solutions, and another exceptional services.

In March 2022, Philips announced that the ACC 2022 workspace launch will facilitate its echocardiography technique. Cardiologists may use a consistent set of AI-driven medical images and quantification capabilities both on and off the cart echocardiography system to help in boosting productivity and consistency while also enhancing diagnostic accuracy. In November 2021, Philips collaborated with major institutes to bring its innovative spectral CT imaging into the interventional platform. The company had joined forces with clinical institutes such as Mayo Clinic and Baptist Health’s Miami Cardiac & Vascular Institute. Some of the prominent players in the global cardiovascular digital solutions market include:

-

iRythm Technologies, Inc.

-

Apple Inc.

-

GENERAL ELECTRIC COMPANY

-

Uber Diagnostics

-

AlivCor, Inc.

-

Verily Life Sciences LLC,

-

HeartFlow, Inc.

-

Bardy Diagnostics, Inc.

-

Bio Telemetry, Inc.

-

Koninkelijke Philips N.V.

-

eviCore healthcare

Cardiovascular Digital Solutions Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 106.9 billion

Revenue forecast in 2030

USD 148.6 billion

Growth rate

CAGR of 4.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, components, deployment, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Russia; Japan; China India; Australia; South Korea; Singapore; Brazil; Mexico; Colombia; Argentina; South Africa; Saudi Arabia; UAE; Israel

Key companies profiled

iRythm Technologies, Inc.; Apple Inc.; GENERAL ELECTRIC COMPANY; Uber Diagnostics; AlivCor, Inc.; Verily Life Sciences LLC; HeartFlow; Inc.; Bardy Diagnostics, Inc.; Bio Telemetry; Inc.; Koninklijke Philips N.V.; eviCore healthcare

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cardiovascular Digital Solutions Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the cardiovascular digital solutions market report based on product, portability, Component, end-use, and region:

-

Service Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Unobtrusive Testing

-

CVD Health Informatics

-

Cardiac Rehab Programs

-

Others

-

-

Components Outlook (Revenue, USD Million, 2017 - 2030)

-

Devices

-

Software

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud-Based

-

On-premise

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Hospitals & Clinics

-

Ambulatory care centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Singapore

-

-

Latin America

-

Brazil

-

Mexico

-

Colombia

-

Argentina

-

-

The Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Israel

-

-

Frequently Asked Questions About This Report

b. The global cardiovascular digital solutions market is expected to grow at a compound annual growth rate of 4.8% from 2023 to 2030 to reach USD 148.6 billion by 2030.

b. The global cardiovascular digital solutions market size was estimated at USD 102.2 billion in 2022 and is expected to reach USD 106.9 billion in 2023.

b. North America dominated the cardiovascular digital solutions market with a share of around 40% in 2022 owing to the highly developed healthcare infrastructure and the rising prevalence of cardiovascular diseases.

b. Some key players operating in the iRythm Technologies, Inc., Apple Inc., GENERAL ELECTRIC COMPANY, Uber Diagnostics, AlivCor, Inc., Verily Life Sciences LLC, HeartFlow, Inc., Bardy Diagnostics, Inc., Bio Telemetry, Inc., Koninklijke Philips N.V., eviCore healthcare.

b. Key factors driving the market growth include the increase in the geriatric population, increased technological advancements in cardiovascular disease management, and increased prevalence of cardiovascular conditions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.