- Home

- »

- Medical Devices

- »

-

Pacemaker Market Size And Share, Industry Report, 2030GVR Report cover

![Pacemaker Market Size, Share & Trends Report]()

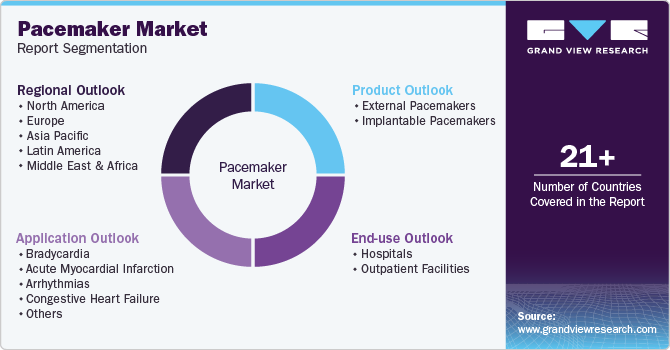

Pacemaker Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (External, Implantable), By Application (Arrhythmias, Congestive Heart Failure), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-336-2

- Number of Report Pages: 165

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pacemaker Market Summary

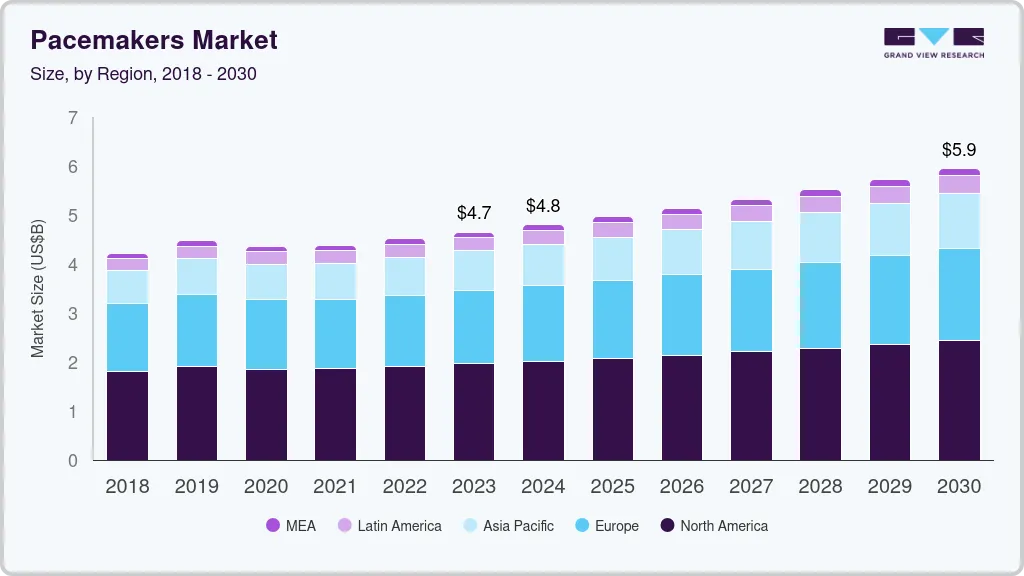

The global pacemaker market size was estimated at USD 5.5 billion in 2024 and is projected to reach USD 7.7 billion by 2030, growing at a CAGR of 5.7% from 2025 to 2030. The increasing prevalence of cardiovascular diseases, technological innovations in pacemaker design, and supportive regulatory and reimbursement frameworks drive the pacemaker industry growth.

Key Market Trends & Insights

- North America pacemaker market held the predominant position in the market in 2024, with a share of 43.4%.

- The U.S. pacemaker market held the largest revenue share of the pacemaker industry in the North America region in 2024.

- By product, the implantable pacemakers segment, categorized by product, held the largest market share of 68.0% in 2024.

- By application, in 2024, bradycardia held the largest market share of 27.5%.

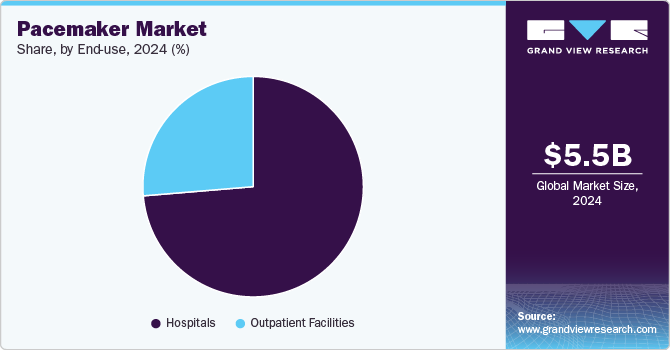

- By end-use, the hospital segment dominated the market with a revenue share of 73.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.5 Billion

- 2030 Projected Market Size: USD 7.7 Billion

- CAGR (2025-2030): 5.7%

- North America: Largest market in 2024

As reported by the CDC in October 2024, a person succumbs to cardiovascular disease every 33 seconds. The aging global population and the rising incidence of heart conditions continue to expand the pacemakers industry, while advancements such as leadless devices and remote monitoring improve patient outcomes.

Government policies and healthcare investments also foster greater market access, driving growth in developed and emerging regions.

The pacemaker industry is driven by the increasing prevalence of cardiovascular diseases (CVDs), particularly arrhythmia and heart failure, which create a growing need for the pacemaker industry. As global populations age, the incidences of heart conditions rise, making cardiac interventions such as pacemakers essential for managing irregular heart rhythms. In May 2024, the WHO announced that cardiovascular diseases (CVDs) are the top cause of disability and early death in the European Region, responsible for over 42.5% of deaths each year-approximately 10,000 daily. The risk of death from CVDs in men is nearly 2.5 times greater than that of women. In addition, the likelihood of dying young (between 30 and 69 years old) from a CVD is nearly five times more prevalent in Eastern Europe and Central Asia than in Western Europe. Advances in diagnostics and greater awareness of heart health also contribute to earlier detection and intervention, which increases the demand for pacemaker implantation.

Technological advancements propel the market through innovations such as leadless pacemakers, MRI-compatible devices, and rechargeable pacemakers, enhancing the devices' overall efficiency, reliability, and safety. These developments provide patients with more treatment options that are less invasive, offer longer battery life, and improve patient outcomes. Integrating remote monitoring capabilities, allowing healthcare professionals to track pacemaker function and heart rhythm in real-time, has expanded the market's potential by enabling more personalized care and reducing hospital visits. In February 2024, a group of researchers at the University of Chicago created a wireless device that harnesses light to control cardiovascular or neural functions in the body. These incredibly lightweight membranes, which are thinner than human hair, can be implanted through minimally invasive surgery and feature no moving components.

Regulatory support and favorable reimbursement policies significantly influence the pacemaker industry. Many governments and health organizations work to improve access to advanced cardiac care by offering reimbursement for pacemaker implantation, thereby making it more affordable for patients. In January 2024, Medtronic plc announced that it had obtained the CE Mark for its latest generation of miniature, leadless pacemakers, the Micra AV2 and Micra VR2. Recognized as the smallest pacemakers in the world, these new devices boast improved battery longevity and straightforward programming compared to their previous versions while still offering the numerous benefits of leadless pacing, such as a decreased likelihood of complications compared to conventional pacemakers.

Market Concentration & Characteristics

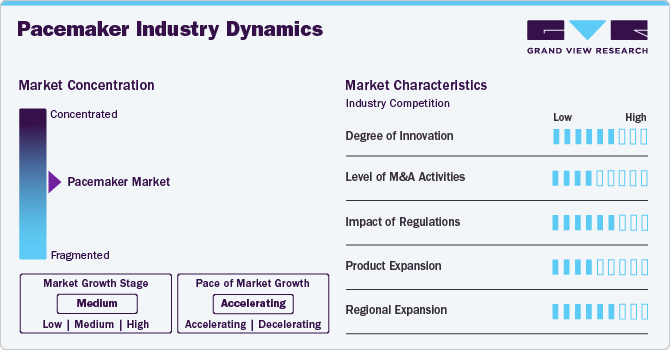

The degree of innovation in the pacemaker industry is high, with continuous advancements in device miniaturization, battery life, and remote monitoring technologies. Newer pacemakers offer features like MRI compatibility, leadless designs, and wireless communication, improving the patient experience and clinical outcomes. These innovations make pacemakers more reliable, less invasive, and easier to manage, with ongoing research exploring biocompatible applications and improved algorithms for heart rhythm management.

The level of mergers and acquisitions in the pacemaker industry is moderate. While there is some consolidation, particularly with larger companies acquiring smaller firms for their technological capabilities or niche market offerings, the overall pace of M&A activity is steady. Companies like Medtronic, Abbott, and Boston Scientific often engage in strategic acquisitions to enhance their product portfolios and expand their market share, particularly in emerging technologies like leadless pacemakers.

The impact of regulations on the pacemaker industry is high, as pacemakers are critical medical devices subject to strict regulatory standards. Companies must comply with regulations set by bodies like the FDA, EMA, and other global health authorities for safety, effectiveness, and quality assurance. Regulatory approval processes are lengthy, and any changes in guidelines can significantly impact product development timelines and market entry, making compliance a key consideration for market players.

Product expansion in the pacemaker industry is moderate as companies focus on enhancing existing pacemaker technologies. While there are new product innovations, such as the development of leadless and bioabsorbable pacemakers, the overall pace of expansion is steady. Companies add incremental improvements in battery life, device size, and remote monitoring capabilities rather than developing entirely new categories of pacemakers.

Regional expansion in the pacemaker industry is high, particularly in emerging markets in Asia-Pacific, Latin America, and the Middle East, with increasing demand for advanced cardiac care due to the rising prevalence of cardiovascular disease and improving healthcare infrastructure. Companies are actively targeting these regions with tailored marketing strategies, affordable solutions, and partnerships with local healthcare providers to expand their market presence and capture a larger share of the growing demand.

Product Insights

The implantable pacemakers segment, categorized by product, held the largest market share of 68.0% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. Implantable pacemakers are divided into two main categories: conventional and leadless. Conventional pacemakers can be classified into single-chamber, biventricular, and dual-chamber types. On the other hand, leadless pacemakers are categorized as single-chamber or dual-chamber. The growing demand for these devices for treating heart failure and arrhythmias and ongoing clinical trials is a major factor leading to market growth. In November 2024, HR24 (Heart Rhythm 24) focused on new Cardiac Implantable Electronic Devices (CIEDs) developments. The event emphasized device performance, longevity, and diagnostics advancements while addressing strategies to reduce complications and enhance patient outcomes.

Implantable pacemakers dominated the market due to their proven effectiveness in managing various heart rhythm disorders, particularly bradycardia (slow heart rate). These devices provide continuous, reliable pacing to ensure the heart beats properly, improving patient quality of life and preventing complications such as heart failure or stroke. In August 2024, Circulation featured an article on a dual-chamber leadless pacemaker system, which evaluated wireless atrioventricular synchrony. A multicenter trial with 384 patients found that 98% of beats were synchronous across different activities and heart rates. This system outperforms traditional pacemakers by minimizing complications and improving implantation while reliably maintaining performance at higher heart rates for patients needing synchronized pacing.

Application Insights

In 2024, bradycardia held the largest market share of 27.5%. The bradycardia segment dominated the market due to its widespread occurrence, particularly in aging populations. As a condition that causes the heart to beat too slowly, it can lead to fatigue, dizziness, and more serious health risks. Pacemakers are the primary solution to manage bradycardia, providing patients with a reliable means to restore normal heart function. An August 2024 article in Circulation found that male endurance skiers have a greater incidence of bradycardia and pacemaker implants than nonskiers, a pattern not observed in women. Male skiers with the most races and fastest times showed the highest rates of these conditions.

Arrhythmias represent the second-largest segment in the pacemaker industry due to the high prevalence of abnormal heart rhythms requiring intervention. Conditions such as atrial fibrillation, ventricular arrhythmias, and other electrical conduction disorders necessitate pacemaker implantation to restore normal heart function and prevent life-threatening complications. As heart disease becomes more common globally, the demand for pacemakers to treat arrhythmias continues to rise. A June 2024 article highlighted that atrial fibrillation (AF) is common in pacemaker patients. It suggested using interatrial septum (IAS) and Bachmann’s bundle pacing (BB) instead of right atrial appendage pacing (RAA) pacing, especially for those with conduction delays. Atrial ATP may help prevent AF progression, and alternative pacing sites, like His bundle pacing, could be more effective in preventing AF than conventional right ventricular pacing.

End-use Insights

The hospital segment dominated the market with a revenue share of 73.6% in 2024. Hospitals have become the dominant setting for pacemaker implantation and management because they have the necessary infrastructure, technology, and expertise. As the primary locations for cardiac surgeries and interventions, hospitals provide patients with comprehensive care, from diagnosis to post-surgery monitoring. In August 2024, HCA Florida Largo Hospital made history by being the first hospital on Florida's west coast to perform a dual chamber leadless pacemaker implant outside a clinical trial. This state-of-the-art device decreases the chances of infection. It is especially beneficial for patients, such as dialysis recipients, who do not have an appropriate location for conventional pacemakers.

The outpatient facilities segment is expected to grow at the fastest CAGR during the forecast period due to their ability to offer minimally invasive procedures, quicker recovery times, and cost-effective treatments. Many pacemaker implantations, especially with newer technologies like leadless pacemakers, can now be performed outpatient, reducing the need for extended hospital stays. This shift towards outpatient care allows patients to return home sooner, improving convenience and reducing healthcare costs. In February 2024, the Heart Rhythm Society (HRS) leadership met with CMS officials to address reimbursement concerns for dual-chamber leadless pacemakers in the outpatient setting. They requested that CMS consider pass-through payment under the OPPS to ensure separate reimbursement until a permanent pricing model is established.

Regional Insights

North America pacemaker market held the predominant position in the market in 2024, with a share of 43.4%. This large share is due to a well-established healthcare infrastructure and a significant aging population. The region is witnessing widespread adoption of advanced technologies, including leadless and MRI-compatible pacemakers. The U.S. plays a major role, with strong healthcare spending, supportive reimbursement policies, and rapid technological advancements driving market growth. In November 2024, research shared at the American Heart Association's Scientific Sessions revealed that refurbished pacemakers can be as safe and effective as brand-new ones. This trial included nearly 300 participants from seven countries, highlighting a potentially cost-effective solution for patients in low- and middle-income regions. Although reusing pacemakers is not allowed in the U.S., the FDA permits their re-sterilization for export purposes.

U.S. Pacemaker Market Trends

The U.S. pacemaker market held the largest revenue share of the pacemaker industry in the North America region in 2024. The high prevalence of cardiovascular diseases and access to cutting-edge healthcare technologies drive the U.S. market growth. The U.S. benefits from a robust healthcare system that facilitates the quick adoption of new technologies, including leadless pacemakers and devices with remote monitoring capabilities. In February 2024, UC San Diego Health achieved a milestone by becoming the first health system in San Diego to implant the innovative dual chamber leadless pacemaker system for treating arrhythmias. This device, which received FDA approval in July 2023, provides a less invasive alternative for managing irregular heartbeats. Atrial fibrillation, the leading form of arrhythmia, is expected to impact around 12.1 million individuals in the United States by 2030.

Europe Pacemaker Market Trends

Europe pacemaker market is anticipated to grow significantly over the forecast period due to the increasing incidence of cardiovascular diseases, particularly among older populations. Countries such as Germany, France, and Italy are key contributors, benefiting from strong healthcare systems and access to advanced medical technologies. The European market is influenced by the EU Medical Device Regulation (MDR), which ensures that pacemakers meet high safety and quality standards. Innovations such as leadless pacemakers and remote monitoring solutions are gaining traction across the continent. In August 2024, MicroPort CRM announced expanded labeling for its latest implantable pacemakers, ALIZEA, BOREA, and CELEA, featuring Left Bundle Branch Area Pacing (LBBAP). This new physiological pacing approach enhances the heart's natural conduction system. The Bluetooth-enabled devices maintain a compact size of 11cc with a projected lifespan of 13 years, incorporating advanced features for patient monitoring.

The UK pacemaker market is expected to grow at a healthy CAGR over the forecast period. In the UK, the market is shaped by the country's aging population and the rising incidence of heart conditions. The National Health Service (NHS) is significant in providing affordable access to pacemakers, ensuring widespread use nationwide. In September 2024, Abbott launched its AVEIR dual chamber leadless pacemaker system in the UK, claiming to be the world's first for treating arrhythmias. With over 2 million people in the UK affected by heart rhythm issues, the new system facilitates direct communication between leadless pacemakers in both heart chambers.

The pacemaker industry in Germany is expected to grow over the forecast period. The pacemaker market in Germany benefits from a strong healthcare system, high standards of medical care, and an aging population. As one of Europe’s largest medical device markets, Germany has wide access to advanced pacemaker technologies, supported by a robust reimbursement system under the country's public health insurance. In October 2023, an article from Medizinische Hochschule Hannover stated that Germany sees around 110,000 pacemakers implanted yearly.

The pacemaker market in France is expected to grow over the forecast period. In France, the pacemaker industry is driven by an increasing prevalence of cardiovascular diseases, particularly among the elderly. The country has a well-developed healthcare system, and the public health insurance system widely supports access to pacemakers. The increased incidence of arrhythmia is boosting the market growth. According to a CardioSignal by Precordior article published in December 2023, AFib affects over a million people in France, presenting a significant health challenge in the country.

Asia Pacific Pacemaker Market Trends

The Asia Pacific pacemaker market is expected to experience rapid growth, with a projected CAGR of 6.2% from 2025 to 2030. The market growth in the region is primarily due to the key players' penetration and abundant untapped opportunities. Significant investments in healthcare, particularly in Japan, China, and India, are enhancing cardiovascular diagnosis and treatment facilities. In October 2024, an article in Interventional Cardiology reported on the first implantation of the AVEIR VR leadless pacemaker in Kazakhstani patients. The study involved five male patients aged 14 to 77 with various symptoms and comorbidities. The procedure was successful, with all patients showing clinical improvement and no immediate complications, highlighting the benefits of leadless pacing technology.

The China pacemaker market is anticipated to grow over the forecast period. The pacemaker market in China is driven by an aging population and rising rates of cardiovascular diseases. The growing CVD burden in China fuels the demand for arrhythmia monitoring solutions. According to an NCBI article published in December 2023, China faces a substantial burden of CVDs, with around 330 million patients suffering from CVD. With an expanding healthcare infrastructure and a shift towards modern medical technologies, China is observing greater adoption of pacemakers, especially in urban areas.

The Japan pacemaker market is expected to grow rapidly over the forecast period. Japan has one of the most advanced healthcare systems globally, and its pacemaker industry is growing due to the country’s aging population and high prevalence of heart conditions. Japan has one of the most rapidly aging populations globally. According to the World Economic Forum in September 2023, in Japan, nearly a third of the population is over the age of 65, totaling approximately 36.23 million individuals. The Japanese market is known for the early adoption of medical technologies, including leadless pacemakers and devices with advanced features like remote monitoring.

The pacemaker market in India is anticipated to grow rapidly over the forecast period. India’s pacemaker industry is rapidly expanding due to increased cardiovascular diseases and a growing awareness of heart health. With a large, aging population and improving healthcare access, particularly in urban centers, the demand for pacemakers is rising. In November 2024, Manipal Hospital Dhakuria in Kolkata became the first in eastern India to implant an injectable pacemaker in a 65-year-old patient. This leadless device is deployed through a minimally invasive catheter and continuously monitors the heart’s electrical activity. It offers advantages such as potential upgrades to a dual-chamber configuration and Bluetooth-enabled remote monitoring, providing a safer alternative to traditional pacemakers.

Latin America Pacemaker Market Trends

The Latin America pacemaker market is witnessing a significant growth influenced by increasing rates of cardiovascular diseases, an aging population, and improving healthcare infrastructure. Growing investments by key companies in the arrhythmia market, such as Nihon Kohden, and supportive regulations are among the key factors expected to contribute to market growth in Latin America over the forecast period. In 2023, due to increased demand, Nihon Kohden reported double-digit growth in international sales for its first half, including Latin America and the U.S.

The pacemaker market in Brazil is expected to grow over the forecast period. Brazil is the largest market for pacemakers in Latin America, benefiting from a large population and a rising burden of cardiovascular diseases. For instance, in September 2023, the Brazilian government and various institutions launched initiatives to enhance care and outcomes for CVD patients. An important example includes Mount Sinai's collaboration with the Brazilian Clinical Research Institute to advance cardiovascular disease research and medical education.

Middle East And Africa Pacemaker Market Trends

The pacemaker market in the Middle East and Africa is poised to grow in the near future. The market is experiencing growth due to increasing cardiovascular disease rates and improving healthcare infrastructure in urban and rural areas. Countries such as the UAE, South Africa, and Egypt are adopting more advanced pacemaker technologies, driven by rising healthcare investments and a growing demand for cardiac care. In March 2024, Medicalgorithmics expanded its operations in the Middle East by signing an agreement with the Canadian Cardiac Centre. This partnership aimed to establish a new cardiology center in the UAE, focusing on heart arrhythmia diagnostics.

The pacemaker market in Saudi Arabia is expected to grow over the forecast period. Saudi Arabia's market is expanding as the country grapples with an increasing burden of cardiovascular diseases, partly due to lifestyle changes and an aging population. The growing prevalence of CVD is driving the market growth. According to an article published by BMC Cardiovascular Disorders in March 2024, the prevalence of CVD among individuals aged 15 & above in Saudi Arabia is 1.6%.

The pacemaker market in Kuwait is anticipated to grow over the forecast period. Kuwait has a small but growing pacemaker market, driven by an aging population and rising cardiovascular diseases. The country's healthcare system is well-developed, with universal healthcare coverage that ensures access to essential medical devices, including pacemakers. Kuwaiti patients benefit from advanced healthcare technologies, and the country is adopting newer pacemaker innovations like MRI-compatible devices.

Key Pacemaker Company Insights

Leading companies are enhancing their offerings and incorporating new technologies to expand their customer reach, secure a greater market share, and diversify their product range. These companies are making significant infrastructure investments, which enable them to develop, manufacture, and commercialize a high volume of drugs worldwide. In addition, to increasing their presence globally, companies engage in several strategic partnerships with distributors and other companies.

Key Pacemaker Companies:

The following are the leading companies in the pacemaker market. These companies collectively hold the largest market share and dictate industry trends.

- OSYPKA MEDICAL

- Boston Scientific Corporation

- Zoll Medical Corporation, an Asahi Kasei Group Company

- Medtronic

- BIOTRONIK SE & Co. KG

- MicroPort Scientific Corporation

- MEDICO S.R.L.

- Shree Pacetronix Ltd.

- Abbott

- OSCOR Inc

- Lepu Medical Technology (Beijing) Co., Ltd.

Recent Developments

-

In September 2024, Boston Scientific Corporation received FDA approval to extend the use of INGEVITY+ Pacing Leads for conduction system pacing (CSP) and for sensing the left bundle branch area (LBBA). This technique provides an alternative to traditional right ventricular pacing for individuals experiencing symptomatic bradycardia. By utilizing the heart's intrinsic electrical conduction system, it aims to enhance ventricular synchrony and decrease the long-term risk of heart failure associated with conventional pacing methods.

-

In June 2024, Abbott announced CE Mark approval for its AVEIR dual chamber (DR) leadless pacemaker, the first of its kind for dual chamber treatment of abnormal heart rhythms. This system features two small devices-AVEIR VR for the right ventricle and AVEIR AR for the right atrium-that wirelessly communicate to deliver coordinated therapy. Each device is about one-tenth the size of a traditional pacemaker, providing a new treatment option for patients with cardiovascular conditions.

-

In March 2024, MicroPort CRM unveiled the ALIZEA Bluetooth pacemaker system in the U.S., marking a significant advancement in cardiac care with its first implantation performed at PIH Health Downey Hospital. The ALIZEA system comprises an innovative pacemaker paired with VEGA pacing leads, allowing for real-time monitoring and management of heart rhythms. This technology facilitates remote patient monitoring, ensuring continuous care and timely interventions, enhancing patient outcomes and reducing the need for in-person follow-ups.

Pacemaker Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.8 billion

Revenue forecast in 2030

USD 7.7 billion

Growth rate

CAGR of 5.7% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

OSYPKA MEDICAL; Boston Scientific Corporation; Zoll Medical Corporation; Medtronic; BIOTRONIK SE & Co. KG; MicroPort Scientific Corporation; MEDICO S.R.L.; Shree Pacetronix Ltd.; Abbott; OSCOR Inc; Lepu Medical Technology (Beijing) Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pacemaker Market Report Segmentation

This report forecasts revenue growth at global, regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pacemaker market report based on product, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

External pacemakers

-

Single Chamber

-

Dual Chamber

-

-

Implantable pacemakers

-

Conventional

-

Single Chamber

-

Dual Chamber

-

Biventricular Chamber

-

-

Leadless

-

Single Chamber

-

Dual Chamber

-

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bradycardia

-

Acute Myocardial Infarction

-

Arrhythmias

-

Atrial Fibrillation

-

Heart Block

-

Long QT Syndrome

-

-

Congestive Heart Failure

-

Others

-

-

End use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pacemaker market size was estimated at USD 5.5 billion in 2024 and is expected to reach USD 5.8 billion in 2025.

b. The global pacemaker market is expected to grow at a compound annual growth rate of 5.7% from 2025 to 2030 to reach USD 7.7 billion by 2030.

b. North America dominated the pacemakers market with a share of 43.4% in 2024. This is attributable to developed healthcare infrastructure, the presence of planned reimbursement structure, greater per capita healthcare spending, and higher awareness among the population about advanced technologies.

b. Some key players operating in the pacemakers market include Medtronic; BIOTRONIK, Inc.; Boston Scientific Corporation; Abbott; ZOLL Medical Corporation; MEDICO S.p.A.; Vitatron; Pacetronix; and Cordis, Inc.

b. Key factors that are driving the pacemakers market growth include the increasing prevalence of cardiovascular diseases (CVDs), technological advancement, and the availability of reimbursement for the implantation of pacemakers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.