- Home

- »

- Food Additives & Nutricosmetics

- »

-

Carmine Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Carmine Market Size, Share & Trends Report]()

Carmine Market (2026 - 2033) Size, Share & Trends Analysis Report By Application (Bakery & Confectionery, Dairy & Frozen Products, Meat Products, Oil & Fat, Fruits & Vegetables), By Region (North America, Europe, Asia Pacific, Latin America), And Segment Forecasts

- Report ID: GVR-2-68038-432-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2026 - 2033

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Carmine Market Summary

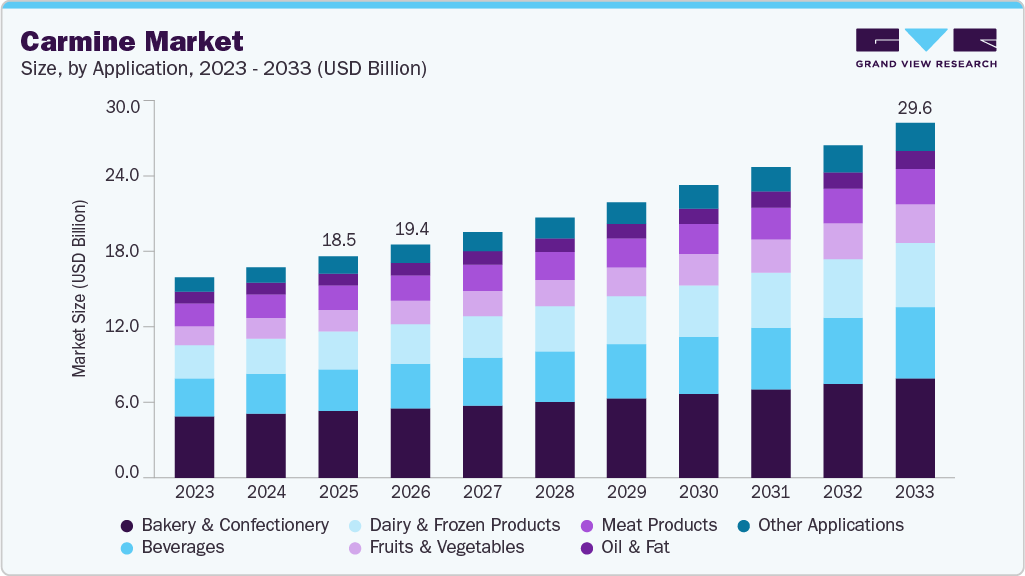

The global carmine market size was estimated at USD 18,521.6 million in 2025 and is projected to reach USD 29,570.8 million by 2033, growing at a CAGR of 6.2% from 2026 to 2033. The market is driven by the growing consumer preference for natural and clean-label food ingredients.

Key Market Trends & Insights

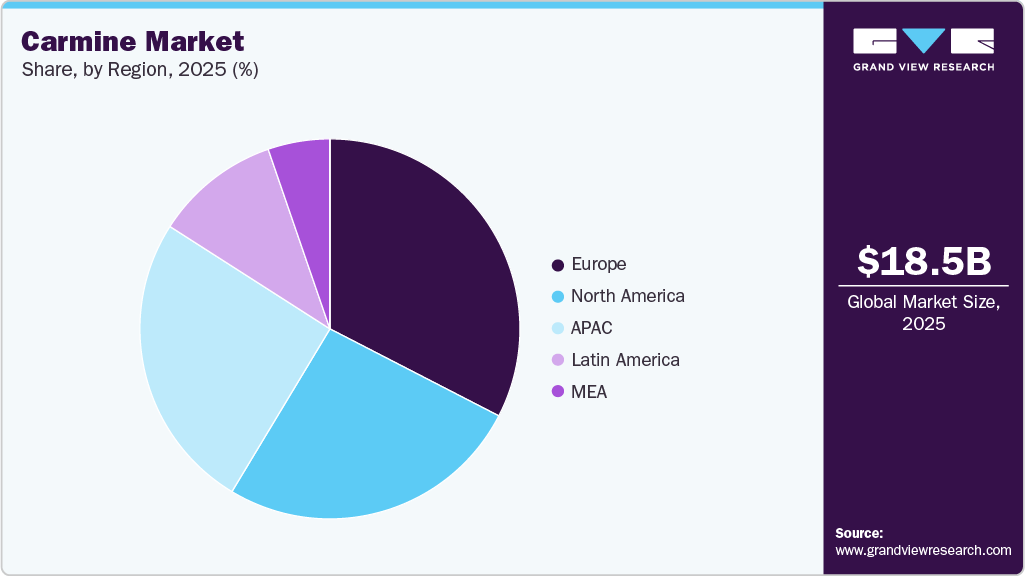

- Europe dominated the global carmine market with the largest revenue share of 32.6% in 2025.

- The U.S. carmine industry is expected to grow at a substantial CAGR of 4.8% from 2026 to 2033.

- By application, the fruit & vegetables segment is expected to grow at a significant CAGR of 7.5% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 18,521.6 Million

- 2033 Projected Market Size: USD 29,570.8 Million

- CAGR (2026-2033): 6.2%

- Europe: Largest Market in 2025

- Asia Pacific: Fastest Growing Market

As awareness of the potential health and environmental impacts of synthetic colorants increases, food and beverage manufacturers are actively reformulating products to replace artificial dyes with naturally derived alternatives. Carmine, being a natural colorant with strong red hues, benefits from this shift, particularly in applications where label transparency and ingredient authenticity influence purchasing decisions. Another key driver is the superior performance characteristics of carmine compared to many other natural red colorants. Carmine offers excellent heat, light, and pH stability, making it suitable for a wide range of food processing conditions, including baking, confectionery manufacturing, and dairy processing. These functional advantages allow manufacturers to achieve consistent coloration without compromising product quality, supporting continued demand despite the availability of alternative natural colors.

In addition, the expansion of processed food, beverage, and confectionery industries globally is supporting carmine consumption. Growth in premium confectionery, bakery products, flavored dairy items, and beverages has increased the need for reliable natural color solutions. In emerging markets, rising disposable incomes and urbanization are driving demand for visually appealing packaged foods, further reinforcing the role of carmine as a preferred natural red colorant in commercial food formulations

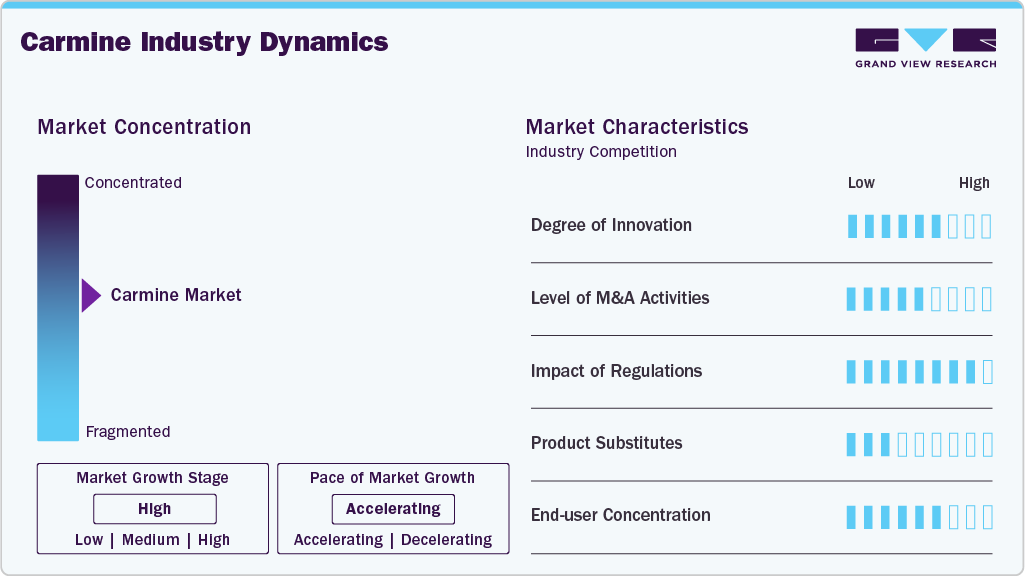

Market Concentration & Characteristics

The carmine market is highly concentrated, characterized by the dominance of a small number of specialized producers that control a significant share of global supply. Production of carmine is inherently constrained by its dependence on cochineal insects, which are cultivated primarily in a few geographies, notably Peru and parts of Latin America. This limited and geographically concentrated raw material base creates high entry barriers and gives established producers strong control over supply, quality, and pricing.

At the same time, the downstream market includes a broader set of formulators and distributors serving food, beverage, cosmetics, and pharmaceutical applications, which introduces some degree of fragmentation at the application level. However, concentration remains high at the upstream extraction and refinement stage, where stringent quality requirements, traceability, and regulatory compliance further restrict new entrants. Overall, the market structure reflects strong upstream concentration coupled with moderate downstream competition, reinforcing the strategic importance of supply security and long-term sourcing relationships.

Application Insights

The bakery & confectionery segment led the carmine industry with the largest revenue share of 30.1% in 2025. This driven by the widespread use of carmine as a natural red colorant in products such as candies, gummies, icings, fillings, and baked goods. Carmine offers excellent color stability under heat, light, and varying pH conditions, making it well suited for confectionery processing. The growing consumer preference for clean-label and naturally derived ingredients has reinforced its adoption in premium bakery and confectionery products. Strong demand from both artisanal and industrial confectionery manufacturers supports the segment’s leading position.

The fruits & vegetables segment is expected to grow fastest with a CAGR of 7.5% during the forecast period. The growth is driven by rising consumption of processed and value-added fruit and vegetable products. Carmine is increasingly used in products such as fruit preparations, preserves, sauces, and vegetable-based formulations to enhance visual appeal while maintaining a natural ingredient profile. Growth in ready-to-eat and convenience foods, along with increasing emphasis on natural coloration in processed foods, is accelerating demand. The segment’s expansion is further supported by clean-label trends and growing acceptance of natural colorants in food processing.

Regional Insights

The Europe carmine market accounted for the largest revenue share of 32.6% in 2025. The market is driven by strong demand for natural food colorants across bakery, confectionery, dairy, and processed food applications. The region has long favored natural additives due to stringent regulations on synthetic dyes and high consumer awareness around clean-label products. Carmine remains widely accepted in food formulations where performance stability is critical. However, growth is moderated by increasing demand for vegan and insect-free alternatives.

Germany is a key European market for carmine, characterized by strict food regulations and high-quality standards. Demand is driven by bakery, confectionery, and specialty food applications requiring stable natural red colorants. At the same time, strong vegan and sustainability movements are encouraging partial replacement with alternative natural colors. Germany also plays a role in formulation innovation within Europe.

Asia Pacific Carmine Market Trends

The Asia Pacific is expected to grow the fastest with a CAGR of 8.3% during the forecast period. Asia Pacific is the fastest-growing regional market for carmine, driven by rapid expansion of the food and beverage processing industry. Rising consumption of confectionery, flavored dairy products, and beverages, along with increasing acceptance of natural colorants, supports market growth. Improving regulatory clarity and growing urban populations further strengthen demand. The region is gaining global market share over the forecast period.

China represents a high-growth market for carmine, supported by rapid expansion of the food processing and confectionery sectors. Rising consumer awareness of natural ingredients and improving regulatory acceptance are driving adoption. Demand is particularly strong in candies, beverages, and processed fruit products. China is expected to gain market share over the forecast period.

North America Carmine Market Trends

North America represents a mature but stable market for carmine, supported by consistent demand from bakery, confectionery, and beverage applications. Clean-label trends and regulatory scrutiny of artificial colors continue to support carmine adoption. At the same time, growing vegan, allergen, and ethical labeling concerns are encouraging selective substitution in certain product categories. As a result, demand growth is steady rather than rapid.

The U.S. carmine market is driven by strong demand from bakery, confectionery, and beverage manufacturers seeking natural color alternatives. Clean-label reformulation and FDA-approved use of carmine support continued adoption. However, increasing consumer focus on vegan and allergen disclosures limits growth in certain applications. The market remains stable with selective substitution trends.

Latin America Carmine Market Trends

Latin America plays a strategically important role in the carmine market, both as a consumption region and a key raw material sourcing hub, particularly for cochineal insects. Regional demand is supported by growth in processed foods and traditional confectionery products. While domestic consumption is moderate, the region’s importance in global supply chains enhances its market relevance. Export-oriented production also influences regional market dynamics.

Middle East And Africa Carmine Market Trends

The Middle East & Africa carmine market is relatively small but gradually expanding, driven by growth in packaged foods, confectionery, and beverages. Adoption is influenced by regulatory, cultural, and religious considerations, which vary by country. Demand is mainly concentrated in urban centers and premium food segments. Overall growth remains modest compared to other regions.

Key Carmine Company Insights

Some of the key players operating in the market include Sensient Technologies Corporation, Givaudan, and IMBAREX.

-

Givaudan manufacturers and sells fragrances and flavors. The company offers a range of fragrances for fabric, personal care, hair and skin care, household care products. Givaudan’s flavors are mainly used in beverages, savory, snacks, sweet goods, and dairy industries. The company’s business portfolio includes the production and supply of essential oils and natural extracts for perfumes, cosmetics, aromatherapy, nutraceutical, and flavoring applications. It has capitalized various organic farming projects at its production sites located worldwide. The company has also invested in setting up recycling plants to convert extraction waste into compost and organic fertilizers. It has a wide network of suppliers for its production facilities with 185 locations worldwide, and 79 production sites. The company has regional offices located in North America, Europe, the Middle East & Africa, Asia Pacific, and Latin America.

Key Carmine Companies:

The following are the leading companies in the carmine market. These companies collectively hold the largest market share and dictate industry trends.

- Chr. Hansen A/S

- Sensient Technologies Corporation

- Givaudan

- IMBAREX

- Roha Dyechem Pvt Ltd

- Naturex S.A.

- Kalsec Inc.

- GNT Group B.V.

- Kanto Chemical Co., Inc.

- Kishida Chemical Co., Ltd.

- Clariant AG

- ADM

- Döhler Group

Recent Developments

-

In April 2023, Ruby Dye Industries has made a significant advancement in carmine production through an innovative extraction process that dramatically increases yield and cost efficiency. This new method utilizes modern technology to extract carmine pigment from cochineal insects, reducing both environmental impact and enhancing the sustainability of the supply chain.

Carmine Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 19,423.9 million

Revenue forecast in 2033

USD 29,570.8 million

Growth rate

CAGR of 6.2% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2024

Forecast period

2026 - 2033

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Application and region

Regional scope

North America; Europe; Asia Pacific: Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Chr. Hansen A/S; Sensient Technologies Corporation; Givaudan; IMBAREX; Roha Dyechem Pvt Ltd; Naturex S.A.; Kalsec Inc.; GNT Group B.V.; Kanto Chemical Co., Inc.; Kishida Chemical Co., Ltd.; ADM; Dohler Group; Clariant AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Carmine Market Report Segmentation

This report forecasts volume & revenue growth at the global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global carmine market report based on application, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Bakery & Confectionery

-

Dairy & Frozen Products

-

Meat Products

-

Oil & Fat

-

Fruits & Vegetables

-

Other Application

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the global carmine market are Chr. Hansen, The Hershey Company, DDW The Color House, Sensient Colors LLC, Proquimac, Chr. Hansen Holding A/S, Naturex, colorMaker, Inc., Biocon, and Roha.

b. The global carmine market size was estimated at USD 18,521.6 million in 2025 and is expected to reach USD 19,423.9 million by 2026

b. The global carmine market is anticipated to witness a 6.2% CAGR in terms of revenue over the forecast period.

b. The bakery & confectionery segment led the carmine industry with the largest revenue share of 30.1% in 2025. This driven by the widespread use of carmine as a natural red colorant in products such as candies, gummies, icings, fillings, and baked goods. Carmine offers excellent color stability under heat, light, and varying pH conditions, making it well suited for confectionery processing

b. The market is driven by the growing consumer preference for natural and clean-label food ingredients. As awareness of the potential health and environmental impacts of synthetic colorants increases, food and beverage manufacturers are actively reformulating products to replace artificial dyes with naturally derived alternatives.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.