- Home

- »

- Consumer F&B

- »

-

Carob Chocolate Market Size & Share, Industry Report, 2030GVR Report cover

![Carob Chocolate Market Size, Share & Trends Report]()

Carob Chocolate Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Bars, Chips), By Distribution Channel (Health & Specialty Stores, Supermarkets & Hypermarkets), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-689-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Carob Chocolate Market Summary

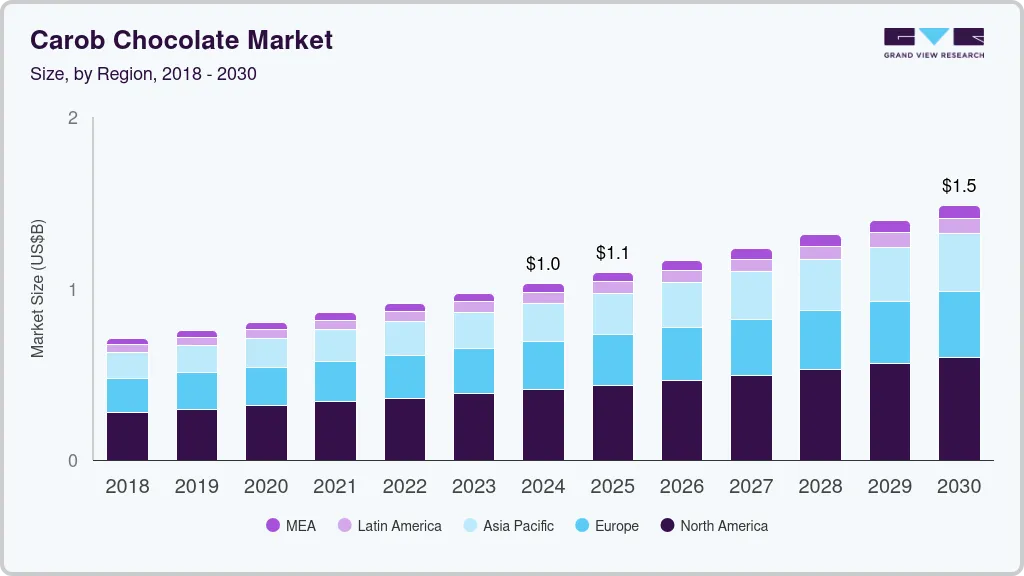

The global carob chocolate market size was estimated at USD 1.03 billion in 2024 and is projected to reach USD 1.48 billion by 2030, growing at a CAGR of 6.3% from 2025 to 2030. Increasing awareness about health and wellness has led to a growing demand for healthier food options. Carob, known for its naturally sweet flavor and caffeine-free properties, appeals to those seeking low-sugar and stimulant-free options.

Key Market Trends & Insights

- The North American carob chocolate industry dominated the global market with the largest revenue share of 39.8% in 2024.

- The U.S. carob chocolate industry is expected to grow significantly over the forecast period.

- By product, bars dominated the market with the largest revenue share of 40.9% in 2024.

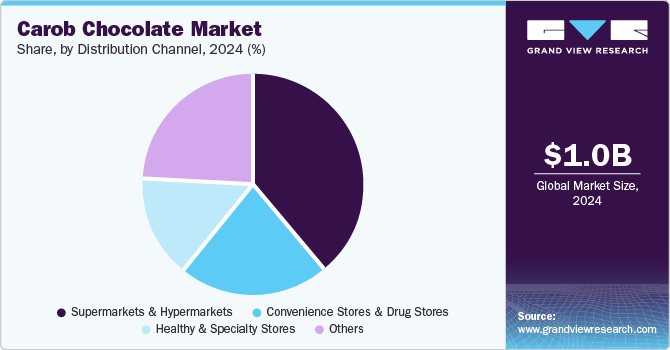

- By distribution channel, supermarkets & hypermarkets dominated the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.03 Billion

- 2030 Projected Market Size: USD 1.48 Billion

- CAGR (2025-2030): 6.3%

- North America: Largest market in 2024

Increasing awareness of carob's nutritional benefits, such as its rich fiber content and antioxidant properties, further boosts its popularity.

Carob powder is often perceived as a healthier alternative to cocoa powder because it is naturally sweet, low in fat, and contains no caffeine. It is also gluten-free and rich in fiber. Furthermore, because it has a naturally sweet flavor and is high in dietary fiber, it is used in the confectionery, bakery, and pet food sectors. Carob powder has various health benefits such as high in protein, fiber, and calcium. In addition, the powder is also considered caffeine-free, gluten-free, and vegan eliminating its further fortification with sugar thus making it a go-to choice for health-conscious consumers.

Carob powder possesses several functional properties that make it desirable in the food industry. It acts as a natural thickening agent, imparts a smooth texture to products, and enhances the flavor profile. These properties make this product a sought-after ingredient in various applications, including confectionery, bakery, and beverages. Additionally, carob trees are considered a sustainable crop due to their ability to thrive in arid regions with minimal water requirements. Moreover, these trees contribute to soil health and have a positive impact on the environment. The sustainability aspect of the production of this product appeals to environmentally conscious consumers. Such factors are expected to surge market growth in the coming years. In October 2024, Foreverland, secured USD 3.54 million in funding to advance its sustainable carob-based chocolate alternative. The investment will facilitate the establishment of a semi-finished product manufacturing facility and support the company’s expansion into the European market. Its flagship product, Choruba, a patented carob-derived ingredient, promises a delicious and eco-friendly alternative to traditional chocolate. Available in drops or liquid form, Choruba is set to be incorporated into various food products launching in the upcoming months.

Consumers are increasingly seeking natural and organic food products. Carob powder is derived from the pods of carob trees without the need for additional processing, making it a natural ingredient. Additionally, organic carob powder, which is produced without the use of synthetic chemicals, caters to the demand for organic food choices. This ingredient is used in various food and beverage applications. It is commonly used as a cocoa powder substitute in baked goods, chocolate products, hot beverages, and ice creams. The versatility of this ingredient opens opportunities in both commercial food production and home cooking further driving the market growth.

Product Insights

Bars dominated the market with the largest revenue share of 40.9% in 2024. Consumers appreciate the portability and ease of consumption that bars offer, making them a favored choice for on-the-go snacking. Moreover, the versatility of carob chocolate bars allows for diverse flavor combinations and innovative product offerings, catering to a wide range of taste preferences. This dominance in the market underscores the growing consumer preference for healthier and accessible snack alternatives, positioning carob chocolate bars as a prominent player in the confectionery industry. For instance, in December 2024, Caroboo, secured new listing with Holland & Barrett, the UK’s health & wellbeing store. With a growing consumer trend towards reduced caffeine intake and healthier indulgences, Caroboo offers an alternative to chocolate, crafted from the naturally sweet Mediterranean carob plant. These dairy-free, gluten-free bars contain no artificial sweeteners and 45% less sugar than traditional chocolate. Available in mint, orange, and salted caramel nutty flavors, Caroboo caters to those avoiding chocolate.

The chips segment is expected to grow at the fastest CAGR of 7.0% over the forecast period. This rapid expansion is attributed to the increasing consumer preference for healthier snacking options and the versatile appeal of carob chips in various culinary applications. Carob chips, known for their sweet taste and nutritional benefits, are gaining popularity among health-conscious consumers and those looking for dairy-free and caffeine-free alternatives. The ease of incorporating carob chips into baking, cooking, and as toppings further drives their demand, positioning them as a dynamic and fast-growing segment within the carob chocolate market. For instance, PANOS brands offer carob chips under the brand name Chatfield’s. These chips are perfect for baking, topping desserts, and enhancing various recipes. Made from just five simple ingredients, these vegan and kosher chips are free from the top eight allergens, making them a delicious option for the whole family.

Distribution Channel Insights

Supermarkets & hypermarkets dominated the market with the largest revenue share in 2024. The segment growth is attributed to the extensive reach and convenience these retail outlets offer consumers. Supermarkets and hypermarkets provide a wide array of carob chocolate products, allowing customers to explore different brands and varieties in one location. Their ability to attract many shoppers and offer competitive pricing further boosts their market share. As consumers prioritize convenience and accessibility, supermarkets and hypermarkets remain pivotal in driving sales within the carob chocolate market.

Convenience stores & drugstores are expected to grow at a significant CAGR over the forecast period. Convenience stores, known for their round-the-clock service and widespread locations, cater to busy individuals seeking healthier snack alternatives on the go. Similarly, drugstores, which often have dedicated sections for health foods, provide an ideal platform for carob chocolate products. As consumers prioritize convenience and health, these retail outlets are well-positioned to capture a growing share of the carob chocolate market.

Regional Insights

The North American carob chocolate industry dominated the global market with the largest revenue share of 39.8% in 2024. The region's growth is attributed to the growing consumer awareness of healthier food options and the increasing popularity of plant-based and dairy-free products. The region's well-established health and wellness culture has fueled the demand for carob chocolate, which is seen as a nutritious alternative to traditional chocolate. Furthermore, major market players and extensive distribution networks in North America have significantly contributed to the region's dominance. As consumers continue seeking healthier and innovative food products, the carob chocolate market in North America is expected to maintain its leading position.

U.S. Carob Chocolate Market Trends

The U.S. carob chocolate industry is expected to grow significantly over the forecast period. The increasing consumer demand for healthier and alternative chocolate options is expected to drive market growth in this country. With its natural sweetness and absence of caffeine and theobromine, Carob chocolate appeals to health-conscious consumers and those with dietary restrictions. Additionally, the rising awareness of the environmental impact of cocoa production is prompting consumers to seek more sustainable alternatives like carob chocolate. In October 2023, Azure Standard, the U.S.'s leading distributor of healthy foods and products, acquired Missy J's Carob & Sweet Treats. This acquisition aimed to elevate Missy J's brand, enhance access to retailers, expand product offerings, and improve marketing and online experience.

Europe Carob Chocolate Market Trends

The European carob chocolate industry held a considerable share in 2024. The region increasingly emphasizes health and wellness and expresses an increasing preference for natural and organic products, which is expected to drive market growth. European consumers are becoming more aware of the benefits of carob chocolate, such as its natural sweetness and absence of caffeine, which aligns with the rising demand for healthier snack alternatives. Additionally, the well-established market infrastructure and the presence of prominent carob chocolate brands in Europe have further bolstered its market share. For instance,

Asia Pacific Carob Chocolate Market Trends

The Asia Pacific carob chocolate industry is expected to grow at the fastest CAGR of 7.0% over the forecast period. The significant drivers are the increasing consumer awareness of healthier alternatives to traditional chocolates and the rising demand for plant-based products. Additionally, the Plant-Based Foods and Proteins Summit Asia 2023, held in Singapore, highlighted the rapid innovation and product launches driving consumption of plant-based products in the region. The expanding middle class population in countries such as China and India also drives the demand for premium and healthier food options. As more consumers in the Asia Pacific region become conscious of their dietary choices, the carob chocolate market is set to capitalize on these trends, positioning itself for significant expansion.

Key Carob Chocolate Company Insights

Some key companies in the carob chocolate market are Missy J's, CarobMe, The Carob Kitchen, The Australian Carob Co., Foundation Foods, D & D Chocolates, and others.

-

Missy J's specializes in organic, vegan, and gluten-free carob treats, including carob-covered peanuts, carob chips, and baking mixes. The mission is to provide healthier alternatives to traditional chocolate, free from unhealthy ingredients like white processed sugar and caffeine.

-

CarobMe provides a variety of premium organic vegan carob products, including carob bars, chips, and nuts. Renowned for their creamy and sweet flavor, CarobMe's items are made from single-origin Australian organic carob and are certified organic by Oregon Tilth.

Key Carob Chocolate Companies:

The following are the leading companies in the carob chocolate market. These companies collectively hold the largest market share and dictate industry trends.

- Missy J's

- CarobMe

- The Carob Kitchen

- The Australian Carob Co.

- Foundation Foods

- D & D Chocolates

- Iswari

- Caroboo

- SUPERTREATS LTD

- CarobWorld, Inc.

Carob Chocolate Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.09 billion

Revenue forecast in 2030

USD 1.48 billion

Growth Rate

CAGR of 6.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Belgium; Netherlands; China; Japan; India; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Missy J's; CarobMe; The Carob Kitchen; The Australian Carob Co.; Foundation Foods; D & D Chocolates; Iswari; Caroboo; SUPERTREATS LTD; CarobWorld, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Carob Chocolate Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global carob chocolate market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Bars

-

Chips

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience Stores & Drug Stores

-

Healthy & Specialty Stores

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Belgium

-

Netherlands

-

-

Asia Pacific

-

Japan

-

China

-

India

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.