Carpet Market Size & Trends

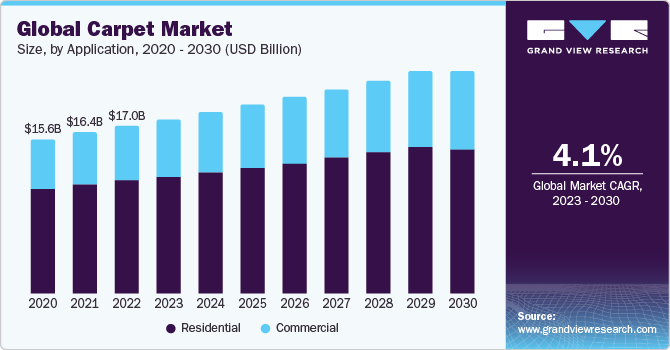

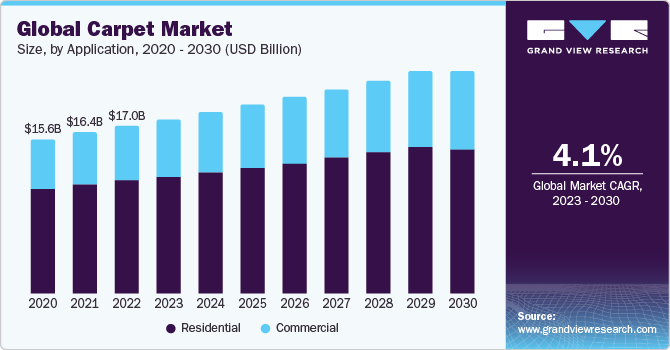

The global carpet market size was valued at USD 17,030.7 million in 2022 and is expected to grow at a CAGR of 4.1% over the forecast period. The demand for carpets is closely tied to the condition of the housing market, encompassing both the construction of new homes and the sales of existing ones. In periods of heightened housing demand, there is usually a parallel surge in the requirement for floor coverings, including carpets. For instance, in August 2023, it is reported that the sales of new single-family houses, as per estimates jointly released by the U.S. Census Bureau and the Department of Housing and Urban Development, were at a seasonally adjusted annual rate of 675,000. This figure represents an increase of 5.8 percent compared to the estimate of 638,000 in August 2022.

In the post-lockdown era, global attention has shifted towards environmental and social sustainability as the most prominent trends. Consumers are increasingly embracing eco-friendly shopping habits and adopting sustainable lifestyles. Specifically, younger generations such as Millennials and Gen Z place a higher emphasis on sustainable values compared to their predecessors. This shift has prompted the carpet market to implement sustainable practices, including the use of eco-friendly raw materials and the production of sustainable products.

Manufacturers in this industry are prioritizing the introduction of eco-conscious products to meet the growing global demand for sustainability. For example, in March 2021, Carpets Inter unveiled its latest collection of eco-friendly carpets known as EcoSoft. This innovative product is crafted from 5% postindustrial recycled PET sourced from millions of repurposed beverage bottles, along with 80% post-consumer recycled PET.

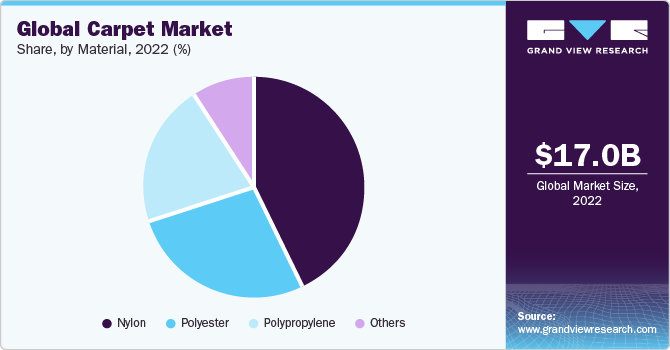

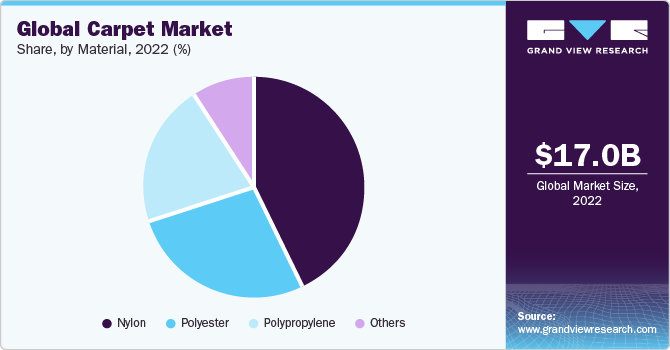

Material Insights

Based on material, the carpet market is segmented into nylon, polyester, polypropylene, and others. Nylon was observed to be the largest material segment in 2022. Nylon is a popular synthetic fiber known for its durability, stain resistance, and versatility, making it a preferred choice for many consumers. Moreover, ongoing research and development in fiber technology have led to advancements in nylon formulations, resulting in enhanced performance attributes. These innovations contribute to the popularity of nylon-based carpets.

Application Insights

On the basis of applications, the market is segmented into residential, and commercial. Residential was the largest application in 2022. The surge in demand for carpet, driven by a rise in renovation and remodeling activities, is a key driver of market expansion. These products are valued for their practical attributes, including floor heat insulation, slip resistance, and aesthetic enhancement. They have gained prominence in the realm of interior design, aligning with the growing consumer emphasis on interior aesthetics. The proliferation of e-commerce platforms and an overall improvement in living standards further contribute to market growth. For instance, the U.S. Houzz & Home Study of 2022 reported a notable 21% increase in home renovation spending in 2021 compared to the preceding year, marking the highest rate in four years.

Distribution Channel Insights

Based on distribution channels, the carpet market is segmented into hypermarket/supermarket, specialty stores, online, and others. The online segment is expected to be the fastest-growing segment over the forecast period. Online platforms offer an extensive selection of carpets, ranging from different styles, patterns, sizes, materials, and price points. This wide range of options allows consumers to find carpets that suit their specific preferences and needs.

Regional Insights

North America accounted for the largest revenue share in 2022. The swift growth in housing and construction endeavors, particularly in the U.S., is significantly driving market expansion in this region. Moreover, the escalating desire for new residences and the surging trend of home decoration are poised to elevate product demand in the foreseeable future. As evidenced by the National Association of Realtors (NAR) in the U.S., house sales surged to 6.12 million in 2021, marking an 8.5% increase compared to the preceding year.

Competitive Insights

Key players operating in the market are Mohawk Industries, Inc., Shaw Industries Group, Inc., Tarkett S.A, Milliken & Company, The Dixie Group Inc, Interface Inc., Oriental Weavers Carpet Co., Tai Ping Carpets International Limited, Victoria Plc, and Lowe's Companies Inc The market participants are constantly working towards new product development, M&A activities, and other strategic alliance to gain new market avenues. The following are some instances of such initiatives.

-

For instance, in September 2022, OBEETEE Carpets, a prominent carpet manufacturer, unveiled its latest collection in partnership with JJ Valayaa and inaugurated its flagship store in New Delhi.

-

In October 4, 2021, Shaw Industries Group, Inc. announced that its EcoWorx carpet tile has earned the prestigious Cradle to Cradle Certified Silver certification, meeting the stringent requirements of version 4.0 of this standard. Notably, this achievement places the product among the pioneers worldwide, marking it as the first in the global built environment sector and the very first U.S.-manufactured product to attain this distinction.