- Home

- »

- Next Generation Technologies

- »

-

Case Packing Machines Market Size, Industry Report, 2033GVR Report cover

![Case Packing Machines Market Size, Share & Trends Report]()

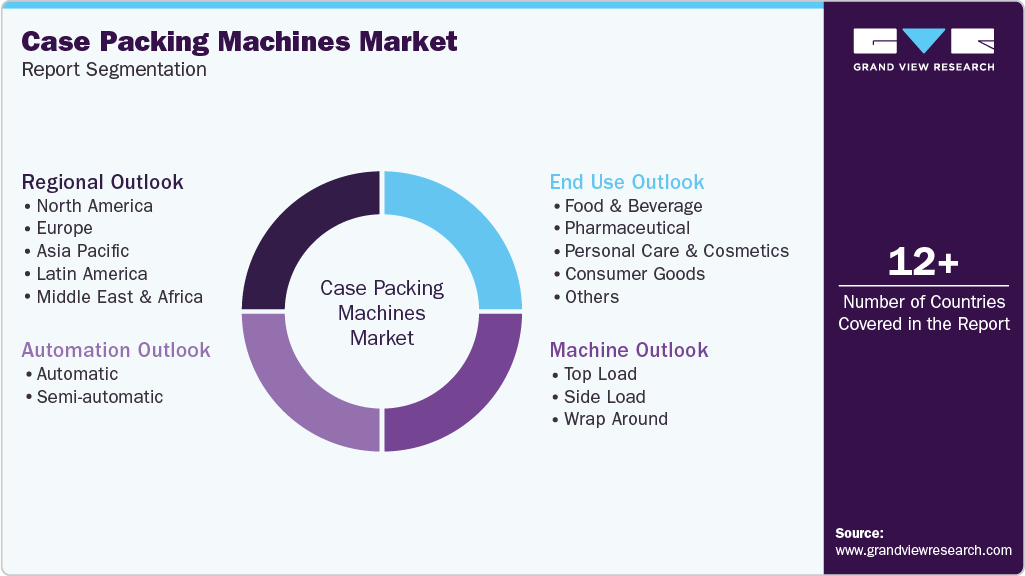

Case Packing Machines Market (2025 - 2033) Size, Share & Trends Analysis Report By Machine (Top Load, Side Load), By Automation (Automatic, Semi-automatic), By End Use (Food And beverage, Pharmaceutical), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-754-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Case Packing Machines Market Summary

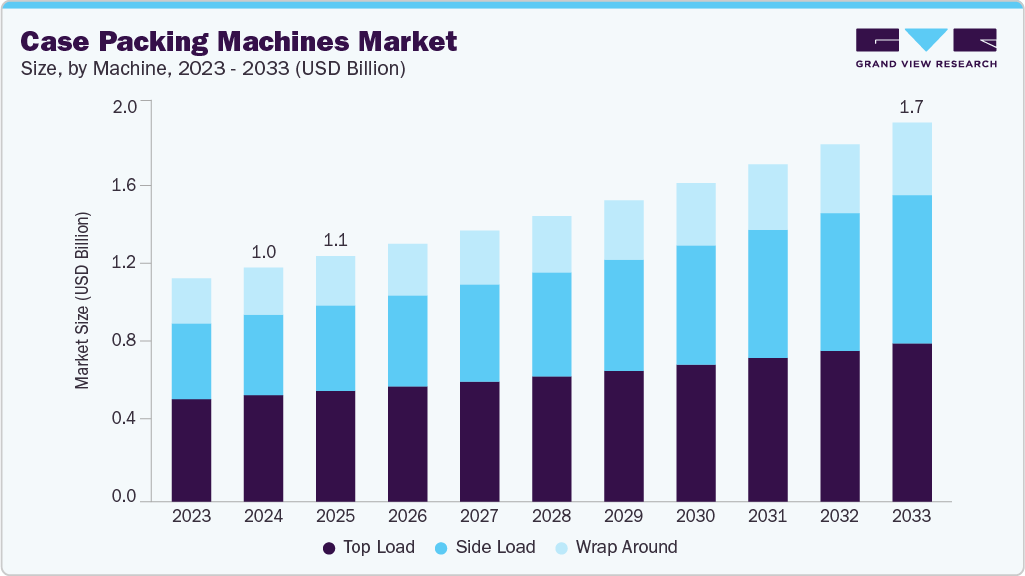

The global case packing machines market size was estimated at USD 1.07 billion in 2024 and is projected to reach USD 1.74 billion by 2033, growing at a CAGR of 5.6% from 2025 to 2033. The growth of the market is being driven by the rising demand for automation across key industries such as food and beverage, pharmaceuticals, cosmetics, and consumer goods.

Key Market Trends & Insights

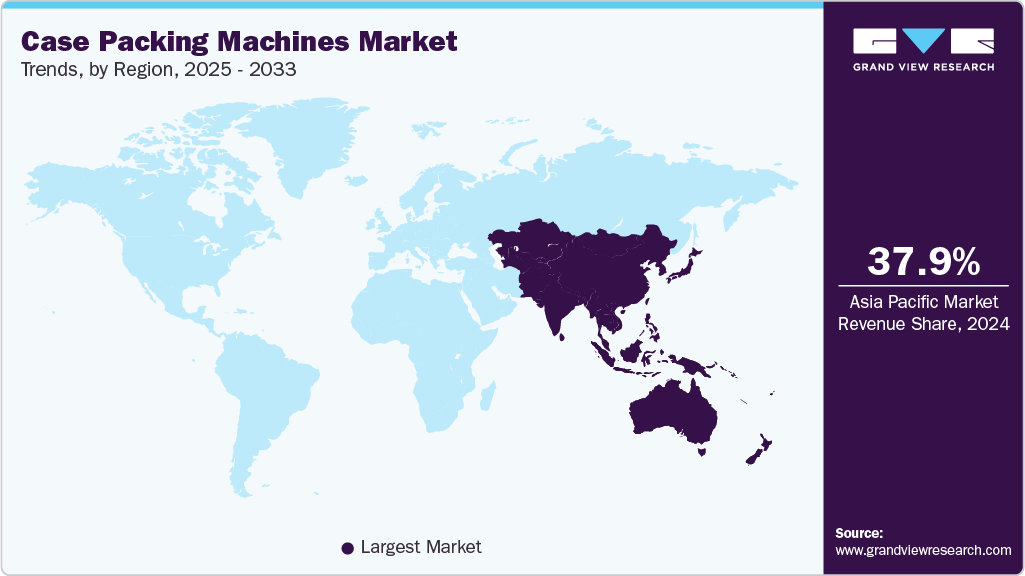

- Asia Pacific dominated the case packing machines industry and accounted for a share of 37.9% in 2024.

- The top load segment accounted for the largest share of 45.5% in 2024.

- The automatic segment dominated the market in 2024 and is expected to witness the fastest CAGR over the forecast period.

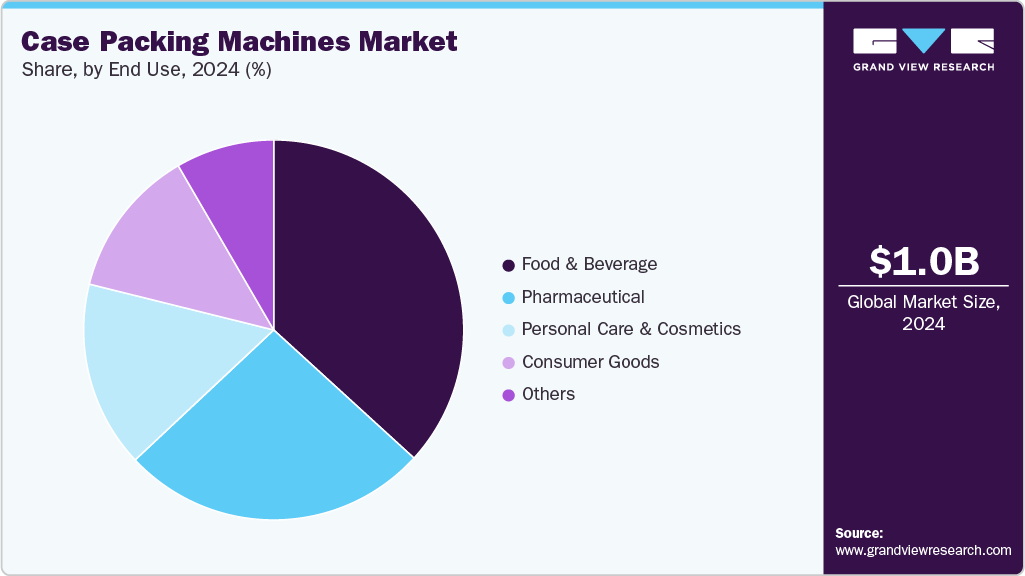

- The food and beverage segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.07 Billion

- 2033 Projected Market Size: USD 1.74 Billion

- CAGR (2025-2033): 5.6%

- Asia Pacific: Largest market in 2024

Manufacturers are under constant pressure to enhance operational efficiency, reduce labor dependency, and maintain consistency in packaging quality. Increasing emphasis on efficiency, cost optimization, and consistency in packaging quality has created strong momentum for the adoption of automated solutions. Expanding consumer demand for packaged goods, coupled with the need for high-speed and reliable packaging processes, has further accelerated market expansion. The focus on supply chain optimization and improved product safety has also been recognized as a major factor contributing to the overall growth of the sector.The market has been significantly shaped by advancements in automation and digital technologies. Case packing machines are being increasingly integrated with robotics, vision systems, and IoT-enabled sensors to enhance speed, flexibility, and operational intelligence. The adoption of predictive maintenance and data-driven performance tracking has been facilitated by Industry 4.0 solutions. Furthermore, the growing preference for smart packaging systems has led to the incorporation of AI-based software, enabling greater accuracy, minimal downtime, and efficient use of packaging materials.

Sustainability is becoming a decisive factor in packaging machinery investments. End users are looking for case packers that can efficiently handle eco-friendly materials such as recyclable and biodegradable cartons. Machine manufacturers are responding by developing systems that minimize waste, optimize material usage, and integrate with lightweight, recyclable packaging. This shift toward sustainable operations supports compliance with environmental regulations and aligns with consumer demand for greener supply chains, driving the adoption of next-generation case packing solutions.

High initial capital investments and maintenance costs have been recognized as key barriers for small and medium-sized enterprises. In addition, the complexity of integrating advanced automation solutions into existing production lines has posed challenges. Market expansion has also been limited in certain regions due to slower industrial adoption rates and the lack of skilled labor for operating sophisticated machinery. Furthermore, volatility in raw material costs and supply chain disruptions have been noted as factors restraining steady market growth.

Machine Insights

The top load segment accounted for the largest share of 45.5% in 2024. The growth of top load segment is being fueled by its suitability for handling lightweight, fragile, or irregularly shaped products across the food, cosmetics, and pharmaceutical industries. These machines are increasingly adopted where gentle product handling and precision placement are critical to avoid damage. Rising demand for flexible packaging formats and smaller batch sizes has further accelerated their adoption, as top load systems can be easily reconfigured for multiple product types.

The side load segment is expected to register a moderate CAGR of 7.1% during the forecast period. Side load case packing machines are experiencing strong growth due to their high-speed operations and ability to handle standardized packaging formats efficiently. They are widely deployed in large-scale food and beverage manufacturing, where high throughput and consistency are essential. Increased consumer demand for packaged convenience foods, beverages, and personal care products has resulted in greater investments in side load machines, particularly in regions with high-volume production facilities.

Automation Insights

The automatic segment dominated the market in 2024 and is expected to witness the fastest CAGR over the forecast period.The growth of segment is being propelled by the increasing need for efficiency, speed, and accuracy in large-scale packaging operations. These machines significantly reduce labor dependency, minimize errors, and enhance throughput, making them highly attractive for industries such as food and beverage, pharmaceuticals, and consumer goods. The rising adoption of Industry 4.0 and smart manufacturing practices has further accelerated demand, as automatic systems can be seamlessly integrated with robotics, sensors, and IoT technologies to enable real-time monitoring and predictive maintenance.

The semi-automatic segment is expected to witness a moderate CAGR over the forecast period. The segment’s growth is primarily driven byits cost-effectiveness and suitability for small and medium-sized enterprises. These machines strike a balance between automation and manual intervention, offering flexibility for businesses with lower production volumes or frequently changing packaging requirements. Their lower initial investment compared to fully automatic systems makes them an appealing option for companies in emerging markets or those expanding production capacity gradually.

End Use Insights

The food and beverage segment dominated the market in 2024. Rapid growth in packaged and ready-to-eat foods, coupled with the rising importance of shelf-ready packaging, is fueling adoption. Food companies are increasingly investing in flexible case packers that can handle a variety of product shapes and sizes, helping them meet diverse retail requirements and consumer preferences. In addition, stringent hygiene and safety regulations are prompting companies to adopt advanced, reliable machinery, further supporting market expansion in this sector.

The pharmaceutical segment is expected to witness the fastest CAGR over the forecast period. Pharmaceutical companies are heavily investing in automated packaging solutions to ensure compliance with strict labeling, safety, and traceability regulations. Case packing machines support precise, tamper-evident, and track-and-trace packaging, which is vital for safeguarding supply chains against counterfeiting and ensuring regulatory compliance. The continued growth of the pharmaceutical industry, driven by rising global healthcare needs and increased production of generics and biologics, is expected to provide significant growth opportunities for advanced case packers.

Regional Insights

Asia Pacific case packing machines industry dominated the global market with a revenue share of 37.9% in 2024, supported by its large-scale manufacturing base and expanding consumer markets. The region has witnessed significant demand growth across the food and beverage, consumer goods, and pharmaceutical sectors, driven by rising disposable incomes and urbanization. Rapid industrial automation, coupled with government initiatives to modernize manufacturing, has further reinforced the Asia Pacific’s leadership in this segment.

India’s case packing machines industry is expected to grow at the fastest growth rate during the forecast period. The country’s market growth is fueled by the expansion of its packaged food, pharmaceutical, and e-commerce industries. The country’s growing middle-class population and rising preference for convenience-oriented packaging formats have accelerated demand for efficient and flexible packaging solutions.

The China case packing machines industry held a substantial market share in 2024, driven by its robust manufacturing ecosystem and extensive exports of consumer and industrial goods. The food and beverage industry in China, supported by changing lifestyles and increased consumption of packaged products, has been a key driver of market expansion.

Europe Case Packing Machines Market Trends

Europe case packing machines industry is expected to register a moderate CAGR from 2025 to 2033. The region’s demand is primarily driven by the food and beverage, cosmetics, and personal care sectors, where packaging precision and sustainability are critical. Moreover, the increasing focus on eco-friendly solutions has pushed manufacturers to adopt energy-efficient and recyclable packaging systems.

The UK case packing machines industry is expanding rapidly, driven by a well-established food processing industry and rising consumer demand for packaged convenience products. The country’s strong e-commerce sector has also contributed to the increasing need for efficient and flexible packaging solutions.

The Germany case packing machines industry held a substantial market share in 2024, due to its advanced manufacturing base and high emphasis on automation. The German food, beverage, and pharmaceutical industries are key adopters of sophisticated case packing solutions, driven by strict regulatory standards and quality requirements.

North America Case Packing Machines Market Trends

The North America case packing machines industry is anticipated to grow at a CAGR of 6.2% during the forecast period. Manufacturers in the region are increasingly adopting advanced automated systems to improve productivity, reduce labor costs, and maintain consistent quality. The emphasis on sustainability and environmentally friendly packaging solutions has also been encouraging investments in modern, efficient case packing technologies.

U.S. Case Packing Machines Market Trends

The U.S. case packing machines industry held a dominant position in the North American region in 2024, driven by its highly developed food and beverage sector and pharmaceutical industry. High consumer demand for packaged goods, combined with labor shortages and rising wages, has accelerated the shift toward fully automated case packing systems.

Key Case Packing Machines Company Insights

Some of the key companies in the case packing machines industry include Schneider Packaging Equipment Company, Inc., Douglas Machine Inc., and Fallas Automation, among others. These companies are investing in automation, robotics, and modular designs to meet the evolving demands of food, beverage, pharmaceutical, and consumer goods industries. Strategic partnerships, mergers, and acquisitions are commonly pursued to expand geographical reach and enhance product portfolios.

-

Douglas Machine Inc., based in the U.S., is a prominent manufacturer specializing in case and tray packing solutions for the food, beverage, and household product industries. Known for its engineering excellence and customer-centric approach, the company delivers both semi-automatic and fully automated solutions tailored to client needs.

-

Schneider Packaging Equipment Company, Inc. is a U.S.-based manufacturer specializing in end-of-line packaging solutions, with a strong focus on case packing machines, robotic automation, and palletizing systems. The company is widely recognized for delivering highly customizable and innovative solutions that cater to the needs of industries such as food and beverage, pharmaceuticals, consumer goods, and e-commerce.

Key Case Packing Machines Companies:

The following are the leading companies in the case packing machines market. These companies collectively hold the largest market share and dictate industry trends.

- Schneider Packaging Equipment Company, Inc.

- Douglas Machine Inc.

- Fallas Automation

- Econocorp

- Mpac Group plc

- ADCO Manufacturing

- Combi Packaging System, LLC

- JOCHAMP

- Tekpak Automation

- SERPA PACKAGING SOLUTIONS

Recent Developments

-

In August 2025, Bradman Lake, a prominent UK-based provider of integrated packaging technologies, unveiled its newest innovation in case packing: the WR6X Robotic Wraparound Case Packer. Designed to address the requirements of modern manufacturing, the WR6X delivers a compact, high-speed solution that enables companies to boost packaging capacity while minimizing the need for extra factory space.

-

In October 2024,JBT Proseal introduced the CP3rs, a fully automatic, ultra-compact case packing system specifically designed for flexible production environments with space constraints. The CP3rs incorporates key industry-leading features, including rapid product changeovers in under one minute and outstanding throughput performance, while maintaining the efficiency and reliability.

Case Packing Machines Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.13 billion

Revenue forecast in 2033

USD 1.74 billion

Growth rate

CAGR of 5.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Machine, automation, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Schneider Packaging Equipment Company, Inc.; Douglas Machine Inc.; Fallas Automation; Econocorp; Mpac Group plc; ADCO Manufacturing; Combi Packaging System, LLC; JOCHAMP; Tekpak Automation; SERPA PACKAGING SOLUTIONS

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Case Packing Machines Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global case packing machines market report based on machine, automation, end use, and region.

-

Machine Outlook (Revenue, USD Million, 2021 - 2033)

-

Top Load

-

Side Load

-

Wrap Around

-

-

Automation Outlook (Revenue, USD Million, 2021 - 2033)

-

Automatic

-

Semi-automatic

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Food and Beverage

-

Pharmaceutical

-

Personal Care and Cosmetics

-

Consumer Goods

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global case packing machines market size was estimated at USD 1.07 billion in 2024 and is expected to reach USD 1.13 billion in 2025.

b. The global case packing machines market is expected to grow at a compound annual growth rate of 5.6% from 2025 to 2033 to reach USD 1.74 billion by 2030.

b. The top load segment accounted for the largest share of 45.5% in 2024. The growth of top load segment is being fueled by their suitability for handling lightweight, fragile, or irregularly shaped products across food, cosmetics, and pharmaceutical industries.

b. Some key players operating in the case packing machines market include Schneider Packaging Equipment Company, Inc., Douglas Machine Inc., Fallas Automation, Econocorp, Mpac Group plc, ADCO Manufacturing, Combi Packaging System, LLC, JOCHAMP, Tekpak Automation, and SERPA PACKAGING SOLUTIONS.

b. The growth of the case packing machines market is being driven by the rising demand for automation across key industries such as food and beverage, pharmaceuticals, cosmetics, and consumer goods.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.