- Home

- »

- Consumer F&B

- »

-

Cashew Nut Kernel Market Size, Share, Industry Report 2030GVR Report cover

![Cashew Nut Kernel Market Size, Share & Trends Report]()

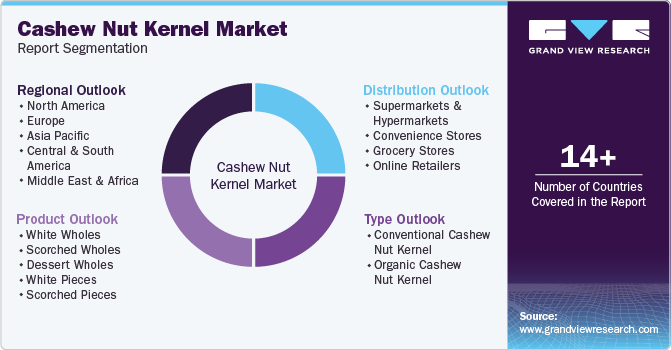

Cashew Nut Kernel Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (White Wholes, Scorched Wholes, Dessert Wholes, White Pieces, Scorched Pieces), By Type, By Distribution, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-506-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cashew Nut Kernel Market Summary

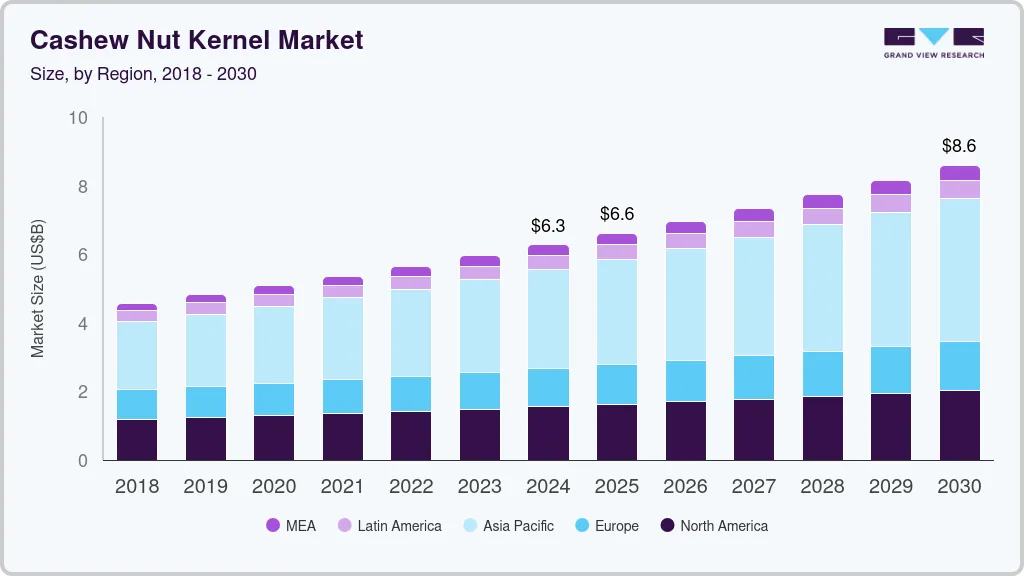

The global cashew nut kernel market size was estimated at USD 6.27 billion in 2024 and is projected to reach USD 8.60 billion by 2030, growing at a CAGR of 5.4% from 2025 to 2030. This market's growth is driven by several interrelated factors that reflect changing consumer preferences, health trends, and market dynamics.

Key Market Trends & Insights

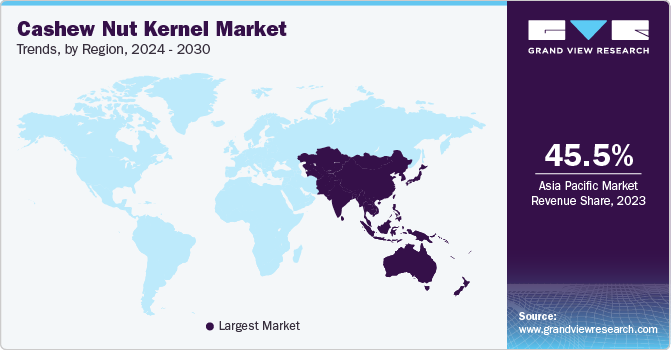

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- Country-wise, the U.S. cashew nut kernel market was valued at USD 1.7 billion in 2023.

- By product, White whole cashew nut kernel was the largest product category with a revenue share of 49.5% in 2023.

- By distribution, the supermarkets and hypermarkets segment dominated the market in 2023.

Market Size & Forecast

- 2024 Market Size: USD 6.27 Billion

- 2030 Projected Market Size: USD 8.60 Billion

- CAGR (2025-2030): 5.4%

- Asia Pacific: Largest market in 2023

The rising awareness of health benefits associated with cashew nuts has significantly contributed to their popularity. Cashews are rich in healthy fats, proteins, vitamins and minerals, making them nutritious snacks. Consumers are increasingly seeking healthy alternatives to traditional snacks, leading to a surge in demand for cashew-based products. This trend is particularly evident in regions like Europe and North America, where consumers are willing to pay a premium for health-oriented products.The industry has seen an increase in the availability of flavored and processed products. Innovations such as cashew butter, milk, and various flavored snacks have broadened the appeal of cashews beyond traditional consumption. This diversification caters to different consumer tastes and dietary preferences, including veganism and gluten-free diets. The growth of ready-to-eat snacks has further fueled this trend, as cashews are often incorporated into convenient food options.

The Asia-Pacific region stands out as the largest consumer of cashew nuts, with countries like India and China driving significant demand. In India, cashews are integral to culinary traditions, while in China, there is a growing preference for diverse nut flavors in snacks. The increased consumption in these regions reflects cultural shifts toward incorporating healthier ingredients into diets. As these markets expand, they present substantial opportunities for producers and exporters.

The rise of e-commerce has transformed how consumers access cashew kernels. Online platforms allow for greater visibility and availability of various cashew-based snacks and ingredients. The convenience of online shopping aligns with modern consumer lifestyles, further boosting sales. Additionally, traditional retail channels are adapting by increasing their offerings of health-oriented snack options, including cashews.

Consumers are increasingly concerned about the ethical implications of their food choices. The demand for sustainably sourced and produced cashews is rising, particularly in developed markets where consumers prioritize brands that demonstrate social responsibility. This trend is reflected in the willingness of consumers to pay more for products that have positive societal or environmental impacts.

Economic growth in developing countries has increased disposable incomes, enabling consumers to spend more on premium food products like cashews. As urbanization continues to rise, so does the demand for convenient and nutritious snack options. This economic backdrop supports the expansion of the cashew kernel market as more consumers can afford to incorporate these healthy nuts into their diets.

One of the primary challenges in the cashew nut kernel market is the disruption in the supply chain due to inconsistent weather patterns and crop failures. In 2024, for instance, there was a notable reduction in in-shell arrivals by approximately 25% compared to the previous year, which raised concerns about production forecasts and market stability. Weather-related issues such as dry spells or excessive rainfall can severely affect fruit development, leading to lower yields and impacting the supply of cashew nuts.

Product Insights

White whole cashew nut kernel was the largest product category for the market, with a revenue share of 49.5% in 2023. This growth is primarily driven by increasing consumer demand for high-quality, nutritious snacks. As health consciousness rises globally, consumers gravitate toward whole cashews for their rich nutrient profile, including healthy fats and essential minerals. Additionally, the versatility of white wholes in various culinary distribution channels, such as baking and confections, further enhances their market appeal.

Scorched wholes comprise about 20% of the market share and are growing due to their unique flavor profile that appeals to consumers seeking diverse snacking options. The increasing popularity of flavored snacks has led to a rise in demand for scorched cashews, which are often used in gourmet snacks and specialty dishes. This trend aligns with the broader movement toward innovative snack products that provide both taste and health benefits.

White pieces cashew nut kernel are expected to grow at a CAGR of 5.7% from 2024 to 2030. White pieces are experiencing growth due to their cost-effectiveness and versatility in food processing. These pieces are commonly used in various snacks and processed foods, appealing to manufacturers looking for affordable yet nutritious components. The increasing demand for ready-to-eat meals and snacks drives the use of white pieces in food formulations. In contrast, scorched pieces are growing as consumers look for flavorful snack options. Their unique taste makes them popular in mixed nut blends and snack bars. The trend toward healthier snacking options has encouraged manufacturers to include scorched pieces in their products, capitalizing on the growing preference for bold flavors without compromising on nutrition.

Distribution Insights

Supermarkets and hypermarkets were the preferred distribution channels for cashew nut kernels in 2023. The increasing consumer preference for convenient shopping experiences significantly influences the growth of cashew nut kernel sales through supermarkets and hypermarkets. Supermarkets and hypermarkets provide a one-stop shopping destination where consumers can easily find various cashew products, including plain, flavored, and organic options. Expanding these retail formats into Tier 1 and Tier 2 cities enhances accessibility, allowing more consumers to purchase cashew kernels for regular grocery shopping. Additionally, attractive promotions and discounts offered by these retail outlets incentivize bulk purchases, further driving sales volume. As health-conscious consumers seek nutritious snack options, the visibility and availability of cashew products in these retail environments contribute to their growing popularity.

Moreover, the rising trend of healthy eating is propelling the demand for cashew nut kernels in supermarkets and hypermarkets. With increasing consumers adopting plant-based diets and looking for nutritious snacks, cashews are becoming a favored choice due to their rich flavor and health benefits. Retailers are capitalizing on this trend by allocating more shelf space for cashew products and actively promoting them in healthy eating campaigns. This strategic focus enhances brand visibility and aligns with consumer demands for quality health-oriented snacks. As supermarkets and hypermarkets continue to adapt to changing consumer preferences by offering a diverse range of cashew products, their role in boosting sales type is expected to grow even further.

Online type of cashew nut kernel is expected to grow at a CAGR of 5.7% from 2024 to 2030. The increasing consumer preference for convenience and accessibility in shopping primarily drives the growth of cashew nut kernel sales through online channels. The rise of e-commerce platforms has transformed how consumers purchase food products, allowing them to browse various cashew products from the comfort of their homes. This trend particularly appeals to health-conscious consumers who seek nutritious snacks like cashews but may not find them readily available in local stores. Online retailers often offer a broader selection, including organic and specialty cashew products, catering to diverse dietary preferences. Additionally, frequent promotional offers and discounts online incentivize bulk purchases, further boosting sales through these channels.

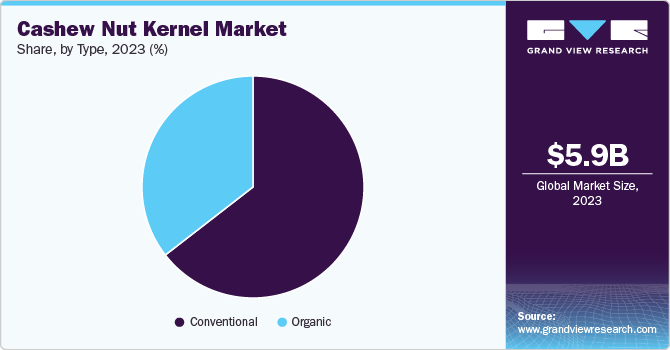

Type Insight

Conventional cashew nut kernels market accounted for a revenue share of 64.5% in 2023. Conventional cashew nut kernels are produced using traditional agricultural practices that may involve synthetic chemicals and fertilizers. This segment remains significant due to its cost-effectiveness; conventional cashews are generally cheaper than their organic counterparts, making them accessible to a broader consumer base. The convenience of availability and lower price point appeal to budget-conscious consumers prioritizing value over organic certification. Moreover, conventional cashews still offer nutritional benefits, which helps maintain their market presence despite growing competition from organic options. As long as cost remains a primary concern for many consumers, conventional cashew nuts will continue to hold a substantial share of the market.

Organic cashew nut kernels are cultivated without synthetic pesticides, fertilizers, or genetically modified organisms (GMOs), promoting a cleaner and more environmentally friendly product. This segment has grown rapidly due to increasing consumer awareness about health and environmental sustainability. Health-conscious consumers increasingly opt for organic products to avoid potential pesticide residues and chemical exposure, which enhances the appeal of organic cashews. Additionally, the demand for organic foods reflects a broader trend toward clean eating and sustainable agriculture practices. As consumers prioritize health and environmental impact, the organic cashew market will continue expanding.

Regional Insights

North America cashew nut kernel market is expected to grow at a CAGR of 4.6% from 2024 to 2030. The growth of the cashew nut kernel market in North America is primarily driven by increasing consumer awareness of the nutritional benefits associated with cashew nuts. As health-conscious eating trends gain momentum, more consumers are incorporating cashews into their diets as nutritious snacks. The U.S. Food and Drug Administration (FDA) endorsement states that consuming nuts can reduce the risk of heart disease has further fueled interest in cashews. Additionally, the rise of ready-to-eat snacks featuring cashews as a key ingredient supports this growth trend, as manufacturers target young and older consumers with innovative product offerings.

U.S. Cashew Nut Kernel Market Trends

The U.S. cashew nut kernel market was valued at USD 1.7 billion in 2023 and is expected to grow at a CAGR of 4.7% from 2024 to 2030. Specifically, the demand for cashew nut kernels is particularly pronounced in the United States due to increasing per capita consumption and a shift toward convenient, health-oriented snacks. The U.S. leads the North American market in cashew consumption, with significant sales concentrated in states like California, Florida, New York, Texas, and New Jersey. The popularity of cashew-based products such as cashew butter and dairy alternatives has also contributed to this growth, as consumers seek plant-based options that align with their dietary preferences. Furthermore, enhanced processing capacities and advanced technologies within the U.S. have allowed for higher-quality products tailored to meet consumer expectations, reinforcing the country’s position as a major player in the cashew market.

Asia Pacific Cashew Nut Kernel Market Trends

The cashew nut kernel market in Asia Pacific is significantly influenced by changing dietary preferences and an increasing awareness of health benefits associated with cashew consumption. As consumers in countries like India and China adopt healthier eating habits, there is a growing trend toward incorporating cashews into daily diets as nutritious snacks. In India, for instance, cashew nuts are often roasted, salted, and flavored to cater to local tastes, enhancing their appeal. Similarly, in China, the demand for diverse nut flavors is rising, with cashews becoming a popular choice during snack times. This shift toward healthier snacking options is driving manufacturers to innovate and expand their product offerings, thereby boosting sales in the region.

Additionally, the Asia-Pacific region benefits from robust production capabilities and a strong export market. Countries such as Vietnam and India are not only major producers but also key exporters of cashew kernels. The region's low processing costs and high production volumes facilitate a steady supply of cashews to meet growing domestic and international demand. The increasing popularity of cashews in various culinary distribution channels, including confectionery and savory dishes, further supports market growth. As consumer awareness continues to rise regarding the nutritional value of cashews-such as their role in heart health and weight management-the demand for these nuts is expected to increase significantly across the Asia-Pacific region.

Key Cashew Nut Kernel Company Insights

The competitive landscape of the cashew nut kernel market is characterized by a mix of established players and emerging companies, all vying for market share in a rapidly growing sector. Major players include Olam International, Cargill, Archer Daniels Midland Company, and Kraft Heinz Company, who dominate the market through extensive type networks and diverse product offerings. These companies are focusing on expanding their portfolios to include organic and specialty cashew products, responding to the rising consumer demand for healthy snacks. Additionally, they are investing in supply chain efficiencies to ensure consistent quality and availability of cashew kernels, which is crucial for maintaining competitiveness in this dynamic market.

Key Cashew Nut Kernel Companies:

The following are the leading companies in the cashew nut kernel market. These companies collectively hold the largest market share and dictate industry trends.

- Nestlé S.A.

- Archer Daniels Midland Company

- Bunge Limited

- The Kraft Heinz Company

- John B. Sanfilippo & Son Inc.

- Vietnam Cashew Corporation (VINACAS)

- Lien Anh Co. Ltd

- Haldiram Foods International Private Limited

- Alphonsa Cashew Industries

- Diamond Foods LLC

- Emerald Nuts LLC

- Aurora Products Inc.

- Aryan Food Ingredients Limited

- CBL Natural Foods Private Limited

- Nutsco Inc.

- Delicious Cashew Company

- Nutty Yogi

- Wonderland Foods

- Bismi Cashew Company

- Divine Foods

Cashew Nut Kernel Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.61 billion

Revenue Forecast in 2030

USD 8.60 billion

Growth rate (Revenue)

CAGR of 5.4% from 2025 to 2030

Actuals

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, distribution, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S, Canada, Mexico, Germany, U.K., France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, UAE

Key companies profiled

Nestlé S.A.; Archer Daniels Midland Company;Bunge Limited; The Kraft Heinz Company; John B. Sanfilippo & Son Inc.; Vietnam Cashew Corporation (VINACAS); Lien Anh Co. Ltd; Haldiram Foods International Private Limited; Alphonsa Cashew Industries; Diamond Foods LLC; Emerald Nuts LLC; Aurora Products Inc.; Aryan Food Ingredients Limited; CBL Natural Foods Private Limited; Nutsco Inc.; Delicious Cashew Company; Nutty Yogi; Wonderland Foods; Bismi Cashew Company; Divine Foods

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cashew Nut Kernel Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cashew nut kernel market report on the basis of product, type, distribution channel and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Conventional Cashew Nut Kernel

-

Organic Cashew Nut Kernel

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

White Wholes

-

Scorched Wholes

-

Dessert Wholes

-

White Pieces

-

Scorched Pieces

-

-

Distribution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Grocery Stores

-

Online Retailers

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global cashew nut kernel market was valued at USD 5.95 billion in 2023 and is expected to reach USD 6.27 billion in 2025.

b. The global cashew nut kernel market is expected to grow at a CAGR of 5.4% from 2024 to 2030 to reach USD 8.60 billion by 2030.

b. White whole cashew nut kernel was the largest product category for the market with revenue of USD 2.95 billion in 2023. This growth is primarily driven by increasing consumer demand for high-quality, nutritious snacks. As health consciousness rises globally, consumers gravitate towards whole cashews for their rich nutrient profile, including healthy fats and essential minerals. Additionally, the versatility of white wholes in various culinary distribution channels, such as baking and confections, further enhances their market appeal.

b. Some of the key players operating in the market include Nestlé S.A.; Archer Daniels Midland Company;Bunge Limited; The Kraft Heinz Company; John B. Sanfilippo & Son Inc.; Vietnam Cashew Corporation (VINACAS); Lien Anh Co. Ltd; Haldiram Foods International Private Limited; Alphonsa Cashew Industries; Diamond Foods LLC; Emerald Nuts LLC; Aurora Products Inc.; Aryan Food Ingredients Limited; CBL Natural Foods Private Limited; Nutsco Inc.; Delicious Cashew Company; Nutty Yogi; Wonderland Foods; Bismi Cashew Company; Divine Foods

b. The rising awareness of health benefits associated with cashew nuts has significantly contributed to their popularity. Cashews are rich in healthy fats, proteins, vitamins, and minerals, making them nutritious snacks. Consumers are increasingly seeking healthy alternatives to traditional snacks, leading to a surge in demand for cashew-based products. This trend is particularly evident in regions like Europe and North America, where consumers are willing to pay a premium for health-oriented products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.