- Home

- »

- Pharmaceuticals

- »

-

Castrate-resistant Prostate Cancer Market Size Report, 2030GVR Report cover

![Castrate-resistant Prostate Cancer Market Size, Share & Trends Report]()

Castrate-resistant Prostate Cancer Market (2025 - 2030) Size, Share & Trends Analysis Report By Therapy (Chemotherapy, Hormonal Therapy, Immunotherapy, Radiotherapy), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-237-3

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Castrate-resistant Prostate Cancer Market Summary

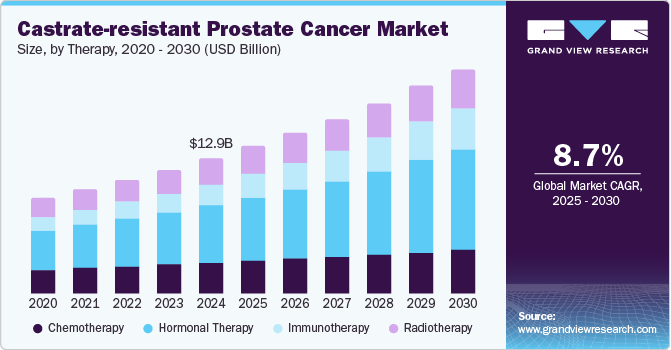

The global castrate-resistant prostate cancer market size was estimated at USD 12.95 billion in 2024 and is projected to reach USD 21.44 billion by 2030, growing at a CAGR of 8.7% from 2025 to 2030. This growth is driven by the rising prevalence of prostate cancer, particularly among aging populations, which is contributing to the increased incidence of castrate-resistant prostate cancer (CRPC).

Key Market Trends & Insights

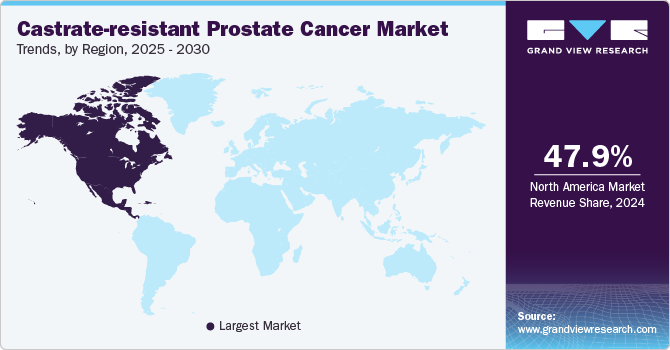

- The North America castrate-resistant prostate cancer market held the largest revenue share of 47.9% in 2024.

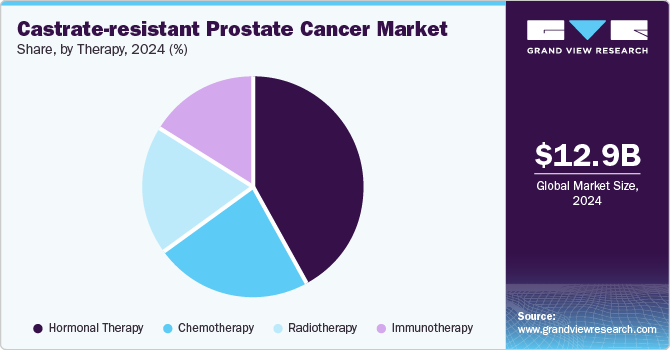

- Based on therapy, the hormonal therapy segment dominated the global castrate-resistant prostate cancer market with a revenue share of 42.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 12.95 Billion

- 2030 Projected Market USD 21.44 Billion

- CAGR (2025-2030): 8.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In addition, advancements in therapeutic options, including next-generation hormonal therapies, chemotherapy, and immunotherapies, are playing a pivotal role in driving market expansion. The increasing awareness of prostate cancer and the importance of early diagnosis and treatment are also contributing to market growth.

Prostate cancer is the second most common cancer in men worldwide, with approximately 1,467,854 new cases diagnosed globally in 2022. Recent advancements in targeted therapies for castrate-resistant prostate cancer (CRPC) have significantly transformed treatment options, offering new hope for patients. Key developments include androgen receptor inhibitors such as enzalutamide and abiraterone, which target AR signaling pathways and have shown substantial efficacy in extending survival and delaying disease progression in patients resistant to standard hormone therapies.

The approval of PARP inhibitors such as olaparib and rucaparib marks a significant step forward, particularly for patients with genetic alterations impairing DNA repair mechanisms. Immunotherapy with drugs such as pembrolizumab enhances the immune system's ability to attack cancer cells, although its effectiveness in prostate cancer varies. Innovations in PSMA-targeted therapies, such as 177Lu-PSMA-617, deliver radioactive substances directly to prostate cancer cells, improving survival rates. Ongoing research into combination therapies aims to enhance treatment efficacy by combining various targeted therapies, more effectively addressing the complex biology of CRPC.

Therapy Insights

The hormonal therapy segment dominated the global castrate-resistant prostate cancer market with a revenue share of 42.2% in 2024 due to the effectiveness of advanced hormonal therapies in managing CRPC. Hormonal therapies, such as androgen receptor inhibitors such as enzalutamide and abiraterone, target the androgen signaling pathways that drive the progression of CRPC. These therapies have been proven to significantly extend survival and delay disease progression in patients who have become resistant to traditional hormone therapies. The broad acceptance and established clinical benefits of hormonal therapies have cemented their position as the leading treatment option for CRPC.

The immunotherapy segment is projected to grow at a CAGR of 11.9% from 2025 to 2030, driven by the increasing recognition of immunotherapy's potential to provide durable responses and improve overall survival in CRPC patients. Immunotherapy, including immune checkpoint inhibitors such as pembrolizumab, enhances the body's immune system to recognize and attack cancer cells. Although the effectiveness of immunotherapy in prostate cancer has been variable, ongoing research and clinical trials are exploring its use in combination with other treatments to enhance its efficacy. The growing investment in immunotherapy research and the promising results from recent studies are expected to drive significant advancements and adoption in this segment.

Regional Insights

North America castrate-resistant prostate cancer market held the largest revenue share of 47.9% of the global castrate-resistant prostate cancer market in 2024, driven by the high prevalence of prostate cancer in the region, coupled with the robust healthcare infrastructure and significant investment in cancer research and treatment. The presence of leading pharmaceutical companies and ongoing clinical trials for advanced CRPC therapies further enhance the market growth. In addition, the increasing awareness of prostate cancer and the importance of early detection and treatment contribute to the substantial market share in North America. Government initiatives and funding for cancer research also play a crucial role in supporting the development and adoption of innovative CRPC treatments.

U.S. Castrate-resistant Prostate Cancer Market Trends

The U.S. dominated the North American castrate-resistant prostate cancer market in 2024 due to the high incidence of prostate cancer among American men, which drives the demand for effective CRPC treatments. The U.S. healthcare system's emphasis on advanced medical technologies and innovative therapies supports the widespread adoption of new CRPC treatment options. Moreover, major biopharmaceutical companies and leading research institutions in the U.S. facilitate the development and commercialization of cutting-edge therapies. Government initiatives, such as the National Cancer Institute's funding programs, further bolster research and development efforts, making the U.S. a key player in the CRPC market.

Europe Castrate-resistant Prostate Cancer Market Trends

Europe castrate-resistant prostate cancer market accounted for a significant market share of the total revenue of the global castrate-resistant prostate cancer market in 2024, driven by the high prevalence of prostate cancer and the strong emphasis on early diagnosis and comprehensive treatment approaches. European countries, particularly Germany, France, and the UK, have well-established healthcare systems prioritizing cancer research and advanced treatment options. The European Union's regulatory framework supports the development and approval of innovative therapies, facilitating market growth. Furthermore, collaborative research initiatives and clinical trials across Europe contribute to the availability of cutting-edge CRPC treatments, enhancing patient outcomes.

Asia Pacific Castrate-resistant Prostate Cancer Market Trends

Asia Pacific castrate-resistant prostate cancer market is anticipated to grow fastest throughout the forecast period, driven by the increasing prevalence of prostate cancer in densely populated countries such as China, Japan, and India. Rising healthcare expenditure and improving access to advanced medical treatments contribute to the expanding market. In addition, the growing awareness of prostate cancer and the importance of early detection and treatment drive demand for CRPC therapies. Government initiatives and investments in healthcare infrastructure further support market growth. The presence of emerging biopharmaceutical companies and ongoing research collaborations in the region are expected to introduce innovative treatment options, propelling the market forward.

Key Castrate-resistant Prostate Cancer Company Insights

Some of the key companies in the castrate-resistant prostate cancer market include Sanofi, Johnson & Johnson Services, Inc., Pfizer, Inc., and Astellas Pharma, Inc.

-

Johnson & Johnson Services, Inc. has made substantial contributions to the CRPC market with its drug Erleada (apalutamide). Erleada has demonstrated a statistically significant improvement in overall survival compared to other treatments, making it a preferred option for patients with metastatic castration-sensitive prostate cancer.

-

Sanofi is a key player in the CRPC market, primarily through its immunotherapy drug, Jevtana (cabazitaxel). Jevtana has shown significant efficacy in treating metastatic CRPC, improving overall survival rates.

Key Castrate-resistant Prostate Cancer Companies:

The following are the leading companies in the castrate-resistant prostate cancer market. These companies collectively hold the largest market share and dictate industry trends.

- Sanofi

- Johnson & Johnson Services, Inc.

- Pfizer, Inc.

- Astellas Pharma, Inc.

- Bayer AG

Recent Developments

-

In June 2024, AstraZeneca completed the acquisition of Fusion Pharmaceuticals. This strategic move strengthens AstraZeneca's oncology portfolio, particularly in the promising field of radio conjugates. Fusion's lead program, FPI-2265, is a potential treatment for metastatic castration-resistant prostate cancer. This acquisition enhances AstraZeneca's R&D capabilities and global footprint, particularly in Canada.

-

In May 2024, Novartis announced the acquisition of Mariana Oncology, a preclinical-stage biotech company focused on developing novel radioligand therapies (RLTs). This strategic move strengthens Novartis' position in the RLT field, building upon its existing portfolio of two approved RLTs and a robust pipeline of clinical and preclinical programs. Mariana Oncology's innovative approach to RLT development aligns with Novartis' commitment to addressing unmet needs in oncology.

-

In March 2024, Johnson & Johnson completed the acquisition of Ambrx Biopharma. Ambrx's innovative synthetic biology platform enables the development of advanced antibody-drug conjugates (ADCs). This acquisition strengthens J&J's oncology pipeline, particularly with ARX517, a promising PSMA-targeting ADC for metastatic castration-resistant prostate cancer.

Castrate-resistant Prostate Cancer Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14.11 billion

Revenue forecast in 2030

USD 21.44 billion

Growth Rate

CAGR of 8.7% from 2024 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Therapy, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Norway, Sweden, Denmark, China, Japan, India, Thailand, South Korea, Australia, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Sanofi; Johnson & Johnson Services, Inc.; Pfizer, Inc.; Astellas Pharma, Inc.; Bayer AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Castrate-resistant Prostate Cancer Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global castrate-resistant prostate cancer market report based on therapy and region.

-

Therapy Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemotherapy

-

Hormonal Therapy

-

Immunotherapy

-

Radiotherapy

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global castrate-resistant prostate cancer market size was estimated at USD 8,479.46 million in 2019 and is expected to reach USD 9,256.31 million in 2020.

b. The global castrate-resistant prostate cancer market is expected to grow at a compound annual growth rate of 8.4% from 2019 to 2027 to reach USD 16,163.09 million by 2027.

b. Hormonal therapy dominated the castrate-resistant prostate cancer market with a share of 83.1% in 2019. This is attributable to increasing market penetration of Xtandi (enzalutamide) and the launch of Erleada (apalutamide) in the U.S., Europe, & Japan.

b. Some key players operating in the castrate-resistant prostate cancer market include Sanofi; Johnson & Johnson Services, Inc.; Pfizer, Inc.; Astellas Pharma, Inc.; Dendreon Pharmaceuticals LLC; and Bayer AG.

b. Key factors that are driving the castrate-resistant prostate cancer market growth include the increasing global burden of castrate-resistant prostate cancer, supported by an unhealthy lifestyle.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.