- Home

- »

- Animal Health

- »

-

Cattle Management Software Market Size Report, 2030GVR Report cover

![Cattle Management Software Market Size, Share & Trends Report]()

Cattle Management Software Market (2025 - 2030) Size, Share & Trends Analysis Report By Sector (Dairy, Meat), By Software Type (Monitoring, Trading/ Marketing), By End-use (Milk Harvesting Management, Health Management), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-125-6

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cattle Management Software Market Trends

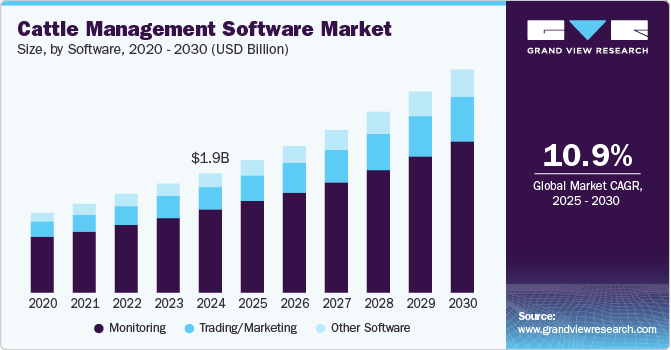

The global cattle management software market size was estimated at USD 1.90 billion in 2024 and is anticipated to grow at a CAGR of 10.96% from 2025 to 2030. Key factors expected to drive the market include increasing application of artificial intelligence (AI), rise in product launches, growing startup culture, and rising R&D initiatives. The primary driver for this market is the growing technological advancements in the field of cattle management software. These advancements are in various forms like hands-free monitoring, automated technologies, penetration of Artificial Intelligence (AI), and implementation of novel technologies like drones, to name a few. For instance, in April 2023, Advantech Co. Ltd. launched a system that uses AI for early monitoring and detection of health complications in livestock. This system uses artificial intelligence (AI) and infrared vision to measure each cow's body temperature.

The system provides access to veterinary professionals and delivers daily scanning of farm animals along with comprehensive findings. It enhances the lives of farmers and their livestock as well as the general food security of their communities, with the potential for future expansion to identify growth, feeding, and environmental conditions.

Furthermore, in February 2024, the Universitat Autònoma de Barcelona (UAB) with funding from the EU, developed a platform called ClearFarm. It monitors a wide range of factors related to the behavior of the animals, their physical and mental health, their impact on the environment, and their productivity through various sensors installed throughout the farms and on the animals. The platform gathers these data and employs an algorithm to provide precise, audience-specific information on animal welfare. On one hand, a website gives farmers access to up-to-date information on the health of the animals, with an emphasis on indicators of danger that can help them anticipate issues and implement solutions. However, customers can also find out about the health background of the animal product that they buy by scanning a QR code on the packaging, for instance, which will take them to a website featuring this data.

The field of cattle management is going to experience a substantial change as a result of such developments. These methods are ground-breaking for safeguarding animals from preventable diseases and are an initial effort towards strengthening animal welfare.

Apart from the growing technological advancements, this market is also driven by the support initiatives taken by various other entities in this industry to enhance the monitoring of livestock animals like cattle, poultry, and pigs. For instance, in April 2024, the Government of Punjab, India partnered with Brazilian experts for curbing diseases in livestock animals. With the help of proper monitoring tools, this initiatives aims to monitor and study occurrence of diseases in livestock and formulate prevention & management plans to prevent possible outbreaks. This partnership will also explore joint development of vaccines & other veterinary medicines.

Furthermore, in January 2024, Astrocast partnered with Digitanimal for development of cattle management software solution known as Satellite IoT (SatIoT). The two companies are collaborating jointly to commercialize a tracking device that links to the worldwide satellite network of Astrocast. The SatIoT-based collar will enable farmers to track cattle remotely. As a result, they will be able to oversee their herds and use remote agricultural methods. The companies aim to make it possible for all farmers worldwide to track and link their animals to the cloud.

In addition, as recently as June 2024, the USDA initiated a monitoring & surveillance program in the U.S. to track spread of avian influenza in the livestock population. Under this program, the farmers and producers are required to conduct a weekly monitoring and testing of the herd to ensure timely detection and treatment of the disease. By encouraging the use of innovative monitoring tools and technologies, these kinds of initiatives drive the market by helping farmers track and manage their herds with greater proficiency and by lowering the possibility of disease outbreaks.

Because of this, the market is anticipated to grow significantly, propelled by the growing need for effective livestock management and disease prevention. Governments, companies, and trained professionals working together will speed up the development and adoption of advanced cattle management software systems.

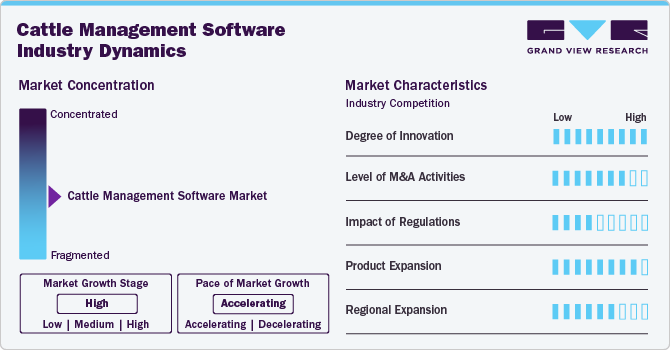

Market Concentration And Characteristics

The degree of innovation in this market is estimated be very high. This can be owed to growing development of cattle management software systems with advanced and evolving technologies like AI, Internet-of-things (IoT), and drones, among others. With no dearth of challenges in this livestock management industry, innovators are encouraged to develop efficient tools to improve current practices.

The market is experiencing low-moderate level of M&A activities. Larger businesses are attempting to acquire relatively smaller enterprises in an effort to dominate the market space. These initiatives also contribute to the companies' product portfolios' revenue growth by improving current solutions or introducing new ones. For instance, in March 2024, GEA acquired CattleEye, an agricultural software company that uses AI to monitor dairy cows. This system uses a 2D camera and software to analyze cows' movement and body data to help farmers assess their herd's health.

Impact of regulation is moderate in this market. Regulations impact cattle management software systems by guaranteeing adherence to environmental, health, and safety standards, safeguarding personal information, and advancing animal welfare. They affect economic costs, market access, and innovation; adherence provides a competitive advantage. To remain compliant and viable in the market, companies require to stay up to date with changes in regulations. The global authorities are actively working to improve regulations and initiate programs to increase farmers' adoption of these technologies while maintaining meticulous supervision.

The market has high-level of product substitutes. The deciding factor for adoption of these technologies is its cost to the farmer. Despite the presence of some globally recognized players like Delaval, GEA, Affimilk Ltd.; each and every country has a presence of alternative solutions to rival the international brands. These domestic companies capture the country-level market by providing cattle management software solutions at a cheaper cost, hence increasing the competition.

The market is experiencing moderate impact of regional expansion. Companies are expanding their business across the globe by penetrating their technology into leading livestock producing countries. For example, in 2024, Dairymaster announced its entry into China with a partnership with Beijing Kingpeng Global Husbandry Technology Co., LTD (KPGH) for implementing the former’s technology into large number of farms across the country.

Software Insights

The monitoring segment dominated the market with a revenue share of over 62% in 2024. These software solutions enable farmers and livestock managers to track various metrics like animal health, feeding habits, growth rates, and reproductive cycles in real time. This data helps in early detection of diseases, improving herd health, and optimizing feeding schedules, leading to better productivity and profitability. As precision farming and data-driven decision-making become more prevalent, the demand for such monitoring systems is driving growth in the cattle software management market. Additionally, the integration of sensors, GPS tracking, and IoT-enabled devices into these software solutions offers precision farming benefits, reducing labor costs and allowing for early detection of health issues. This results in fewer veterinary expenses and better decision-making, further driving the adoption of monitoring software in the cattle management market. As technology advances, the functionality and accuracy of monitoring software improve, reinforcing its dominance.

The other software segment is anticipated to grow at a fastest CAGR from 2025 to 2030. The other software includes E-prescription, Inventory, etc. E-prescription software in cattle plays a significant role in driving the cattle software management market by streamlining the veterinary prescription process. It allows veterinarians to digitally prescribe medications, improving accuracy, reducing human errors, and ensuring compliance with regulatory guidelines. This software enhances efficiency in cattle health management, supports better tracking of prescribed treatments, and simplifies data recording, which is critical for both herd health and individual animal management. The integration of e-prescription functionality into cattle management systems also helps farmers manage medication schedules, optimize treatment plans, and ensure that drug withdrawal periods are adhered to, which is vital for livestock intended for food production.

Modality Insights

The on-premise segment dominated the market in 2024. On-premise modality in cattle software management offers farms direct control over their data and operations, which can drive market growth. By implementing software systems on-site, farms can ensure greater security, reduce latency, and maintain control over sensitive data. This approach is particularly valuable in areas with limited or unreliable internet access, where cloud solutions may be less feasible. Additionally, the ability to customize software for specific farm needs enhances efficiency, leading to better health monitoring, feeding schedules, and overall cattle management. As farms increasingly recognize the advantages of on-premise solutions, demand for these systems continues to rise.

The cloud segment is anticipated to grow at a fastest CAGR from 2024 to 2030. Cloud modality in cattle management is driving the cattle software management market by offering several advantages over traditional on-premise solutions. Cloud-based systems provide real-time data access from any location, allowing farmers and cattle managers to monitor herd health, track performance, and manage resources more efficiently. These systems also offer scalability, reducing the need for large upfront investments in IT infrastructure. Cloud-based cattle management solutions integrate data analytics and predictive tools, enhancing decision-making related to health management, breeding, and nutrition. Additionally, they facilitate easier collaboration between veterinarians, suppliers, and farm personnel, further boosting market demand.

Application Insights

The milking harvesting management segment dominated the market with a revenue share of over 30% in 2024. Its crucial role in dairy revenue and productivity gains accounts for its dominance. Technological developments in data analytics and automated milking systems improve farm management and monitoring effectiveness. Through early identification of issues and stress reduction, these systems enhance animal health. They also save labor costs and connect traceability and quality standards requirements. Their adoption is further fueled by the growing consumer demand for premium dairy products and the scalability of these solutions, which provide a substantial return on investment.

The health management segment is expected to grow with the highest CAGR from 2025 to 2030. With increasing demand for efficient livestock management, software solutions help farmers and veterinarians track and monitor the health of cattle. These systems can monitor vital parameters, track medical histories, and schedule vaccinations or treatments, ensuring timely intervention to maintain herd health. Software tools help in early detection of diseases, reducing outbreaks and ensuring timely medical intervention, which optimizes herd health. Moreover, integration with wearable devices and IoT technology enables continuous health monitoring, providing real-time data on cattle health, which enhances decision-making for disease control and prevention.

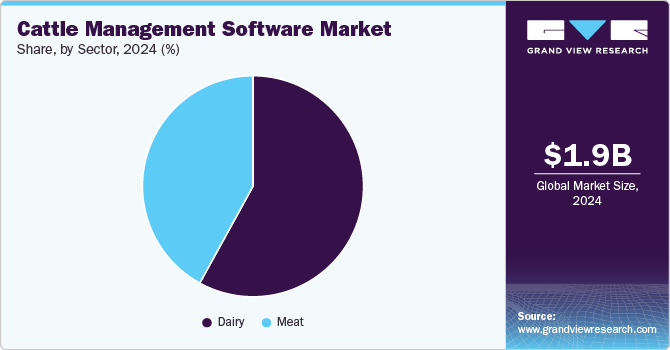

Sector Insights

The dairy segment dominated the cattle management software market in terms of share in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. The dairy sector is dominated by countries like India and China, among others. These countries are the leading producers of milk and have the largest bovine population in the world. These factors result in the adoption of various advanced technologies to ensure that dairy production does not get affected due to health complications. Authorities in these countries are involved in collaborating with global experts to ensure effective monitoring and treatment practices are used for the livestock population. Furthermore, the segment is also driven by the large scale consumption of dairy products like milk, cheese, and others. For example, according to 2023 data by FAO, between the periods 1992 to 2022 the production of milk has increased by about 77% owing to the high demand.

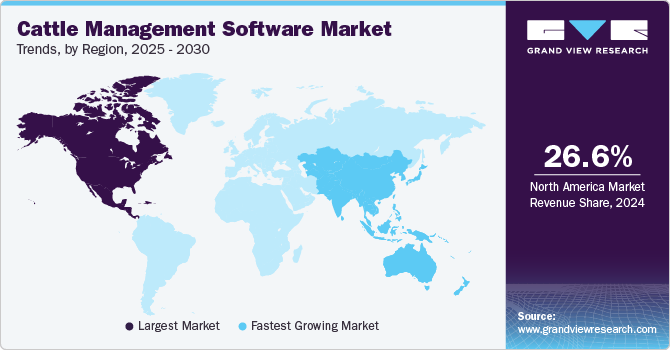

Regional Insights

It is anticipated that the North American cattle management software market dominated with a revenue share of 26.64% in 2024, due to the increased demand for technology to monitor sick animals due to the prevalence of zoonotic diseases. With 18.0% of the world's production in 2023, the United States is the world's top producer of bovine meat, according to data released by National Beef Wire in June 2024. This is the factor that motivates the need to stop foodborne and zoonotic illnesses linked to livestock animals. Furthermore, the cattle management software market is expanding due to the steady advancements in sensor technology.

U.S. Cattle Management Software Market Trends

The cattle management software market in the U.S. is growing as a result of increasing animal health care spending and the rising adoption of cattle management software equipment for production animals. USDA estimates that agriculture production expenditures in 2022 reached USD 457.2 billion, up 15.2% from USD 392.9 billion in 2021. Additionally, it is projected that the rising demand for milk production will strengthen the industry’s growth. According to the International Service for the Acquisition of Agri-biotech Applications (ISAAA), the demand for meat and milk production is anticipated to double by 2050 in developing countries, where the population is expected to double. This increasing demand in the future is expected to drive the country’s market growth.

Europe Cattle Management Software Market Trends

The European cattle management software market is expected to grow due to favorable trade organizations, like the European Free Trade Association (EFTA), between Liechtenstein, Iceland, Norway, & Switzerland, which has facilitated trade between countries and increased growth opportunities in the region. With rising awareness and environmental issues, Europe is experiencing growth of milk-producing cattle. According to 2023 publications from The Vegan Society, about 2.6 million individuals i.e. 3.2% of the population of Germany are vegans and this trend is expected to rise in the future. This has raised the demand for milk and its derivatives, to fulfill calcium & protein requirements, creating new avenues for regional market growth.

In 2024, the cattle management software market in Germany possessed the largest share of the European market. Growing animal adoption is expected to fuel the market in Germany. As per March 2024 AHDB data, Germany has the highest dairy cow population in Europe i.e. around 17% of the overall population. Furthermore, the country has over 50,000 agricultural holdings that conduct dairy farming. According to the International Committee for Animal Recording (ICAR), 50% of German farms specialize in livestock.

Asia Pacific Cattle Management Software Market Trends

The Asia Pacific (APAC) market is growing at the highest CAGR of over 12.71% over the forecast period. The Asia Pacific region's population is increasing, its metropolitan areas are rapidly urbanizing, and disposable income is rising, all of which have contributed to an increase in the share of food consumed that comes from animals. Furthermore, since the 1900s, the region has continuously benefited from global livestock production, and expansion in this sector is anticipated to continue during the forecast period. Moreover, the growth of the market in the region can be attributed to the significantly higher number of cattle. For instance, China and India are home to more than 30% of all cattle worldwide. Since there are so many cattle, there is a greater demand for the production of meat and milk.

The cattle management software market in India is expected to grow at the fastest rate in the Asia Pacific region over the forecast period. This can be attributed to the government sector's growing involvement in promoting accurate and timely health monitoring and treatment practices in the nation. For example, The Prime Minister of India launched a digital platform called "Bharat Pashudhan" in March 2024 to increase the traceability of livestock animals in India.

Latin America Cattle Management Software Market Trends

The Latin America cattle management software market is expected to continue to grow during the forecast period. Various factors such as the high prevalence of diseases and rising demand for monitoring equipment are positively influencing the market growth. Favorable government initiatives & intervention in the livestock sector are expected to fuel the cattle management software market growth in Latin America.

The cattle management software market in Brazil is driven by the large number of cattle herds and high beef production. For instance, according to the 2024 data by USDA, Brazil has the second-largest cattle herd, accounting for about 192 million head. Moreover, the country is the world’s largest exporter of beef. This has increased awareness regarding animal health among owners and subsequently the demand for veterinary medicines in the country. The market is also driven by the fact that the country is one of the largest producers of meat in the world. According to January 2024 data by GeeksforGeeks, the country ranks third in the world for meat production.

Middle East & Africa Cattle Management Software Market Trends

In the Middle East, countries like Saudi Arabia and the UAE are investing in modern agricultural practices, including the adoption of cattle management software, to enhance livestock production efficiency. This investment is driven by the increasing demand for dairy and meat products, coupled with a focus on sustainable farming practices. Moreover, Government initiatives to modernize agricultural practices and improve food security also fuel the demand for software solutions that offer real-time monitoring, breeding management, and optimized feed programs.

Growing concerns for animal health, a rise in the frequency of zoonotic illnesses, and an increase in livestock production are the main factors driving the South African cattle management software market. In terms of vegetation, climate zones, and animal resources, South Africa is richly diverse. The livestock business in the country has been characterized by a dual system of sophisticated commercial sectors employing contemporary technologies versus a developing sector that includes emerging and smallholder farmers. As a result, the country's use of livestock management software systems rises, propelling the industry. Favorable initiatives undertaken by certain companies are creating growth opportunities, which is boosting market growth.

Key Cattle Management Software Company Insights

Market companies are actively involved in bringing novel technologies into the cattle management software industry. They are engaged in launching novel and enhanced solutions to disrupt the market by providing better alternatives to the existing products. For instance, In April 2024, Merck launched SENSEHUB Dairy Youngstock, which has activity monitoring capabilities for use in the cattle population. Industry players are also forming crucial alliances with other players to either develop innovative technologies or enhance their existing products with an aim of dominating the market.

Key Cattle Management Software Companies:

The following are the leading companies in the cattle management software market. These companies collectively hold the largest market share and dictate industry trends.

- Afimilk Ltd.

- DeLaval

- BouMatic

- Merck & Co., Inc.

- Zoetis (Performance Livestock Analytics)

- Lely

- GEA Group Aktiengesellschaft

- Fullwood Packo

- Fancom BV

- PsiBorg Technologies Pvt. Ltd

- Breedr

- Cattlesoft Inc.

- DigitalBeef, LLC

- Prudence Technology Pvt. Ltd.

Recent Developments

-

In July 2024, Fancom BV collaborated with OptiFarm for the development of a novel livestock management software using AI models. The testing of this product is currently underway in select locations in the Netherlands.

-

In April 2024, BouMatic partnered with Brolis Sensor Technology to develop integrations between the technologies of both companies to launch novel products for dairy farming.

-

In March 2024, Nikon launched NiLIMO, a platform that utilizes AI to enable the farmer to monitor their livestock animals for 24 hours and 365 days a year. The AI used in this system notifies the owner at the time of the calving period of the livestock.

-

In January 2024, Practo India launched Verdant Impact, an animal husbandry platform for livestock that has RFID-based health monitoring and telemedicine features.

-

In September 2023, John Deere and DeLaval partnered to develop a digital system for farm and herd monitoring of dairy operations.

Cattle Management Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.10 billion

Revenue forecast in 2030

USD 3.53 billion

Growth rate

CAGR of 10.96% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Sector, software, modality, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Afimilk Ltd.; DeLaval; BouMatic; Merck & Co., Inc.; Zoetis (Performance Livestock Analytics); Lely; GEA Group Aktiengesellschaft; Fullwood Packo; Fancom BV; PsiBorg Technologies Pvt. Ltd; Breedr; Cattlesoft Inc.; DigitalBeef, LLC; Prudence Technology Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cattle Management Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cattle management software market report based on sector, software, modality, application & region:

-

Sector Outlook (Revenue, USD Million, 2018 - 2030)

-

Dairy

-

Meat

-

-

Software Outlook (Revenue, USD Million, 2018 - 2030)

-

Monitoring

-

Trading/ Marketing

-

Other Software

-

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Milking Harvesting Management

-

Breeding Management

-

Feeding Management

-

Health Monitoring

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

India

-

China

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cattle management software market size was estimated at USD 1.90 billion in 2024 and is expected to reach USD 2.10 billion in 2025.

b. The global cattle management software market is expected to grow at a compound annual growth rate of 10.96% from 2025 to 2030 to reach USD 3.53 billion by 2030.

b. North America dominated the cattle management software market with a share of 26.64% in 2024. This is attributed to the high penetration of digital tools in cattle farming as well as the presence of key companies in the region. Increased innovation to identify individual cattle throughout their lives and taking accurate action for each cattle support market growth.

b. Some key players operating in the cattle management software market include Afimilk Ltd.; DeLaval; BouMatic; Merck & Co., Inc.; Zoetis (Performance Livestock Analytics); Lely; GEA Group Aktiengesellschaft; Fullwood Packo; Fancom BV; PsiBorg Technologies Pvt. Ltd; Breedr; Cattlesoft Inc.; DigitalBeef, LLC; Prudence Technology Pvt. Ltd.

b. The market is driven by a combination of factors that reflect the evolving needs and demands of the livestock industry and technological advancements. The increasing need to streamline operations, improve efficiency, and enhance overall farm profitability are the key factors contributing to market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.