- Home

- »

- Consumer F&B

- »

-

CBD Gummies Market Size & Share, Industry Report, 2030GVR Report cover

![CBD Gummies Market Size, Share & Trends Report]()

CBD Gummies Market (2025 - 2030) Size, Share & Trends Analysis Report By Concentration (High, Low), By Distribution Channel (Online, Offline), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-3-68038-853-4

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

CBD Gummies Market Summary

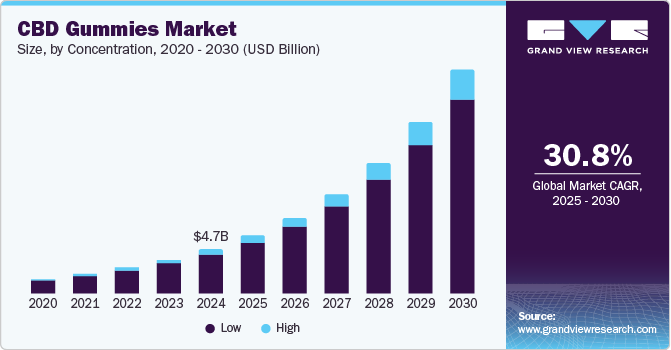

The global CBD gummies market size was estimated at USD 4.75 billion in 2024 and is projected to reach USD 23.80 billion by 2030, growing at a CAGR of 30.8% from 2025 to 2030. CBD gummies have gained popularity as a convenient way to consume cannabidiol (CBD), a non-psychoactive compound that is obtained from the cannabis plant.

Key Market Trends & Insights

- The North America CBD gummies market accounted for the largest revenue share of 46.8% globally in 2024.

- The U.S. accounted for a dominant revenue share in the regional market in 2024.

- Based on concentration, the low concentration segment accounted for a dominant revenue share of 88.8% in the global CBD gummies industry in 2024.

- In terms of concentration, the high concentration segment is expected to grow at the fastest CAGR from 2025 to 2030 in the CBD gummies market.

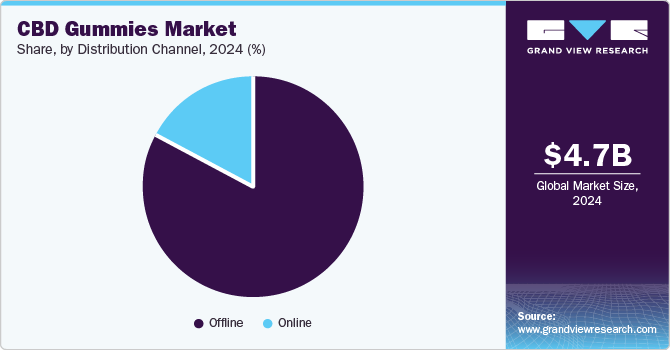

- On the basis of distribution channel, the offline segment accounted for a dominant revenue share in the global CBD gummies industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.75 Billion

- 2030 Projected Market Size: USD 23.80 Billion

- CAGR (2025-2030): 30.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing market

Growing awareness regarding the perceived benefits of this product has resulted in a noticeable expansion of related businesses, such as the CBD gummies industry. The non-psychoactive nature of CBD makes it an appealing option for wellness-focused individuals. Furthermore, in several economies, the legal status of CBD products has improved, making them more accessible to consumers. Legalization or regulation of CBD for medical use has thus helped reduce stigma and increase public trust in products such as gummies.

CBD gummies have become immensely popular among consumers on account of their anti-depressant, anti-anxiety, pain relief, and neuroprotective properties. Increasing workload among students and working professionals has resulted in a steady rise in the prevalence of anxiety and depression cases globally. According to a report by the World Health Organization (WHO), around 3.8% of the global population suffers from depression, which includes 5% of adults and 5.7% of individuals above 60 years of age. A number of studies and surveys conducted over the years have highlighted the role of CBD in addressing this condition. Some studies suggest that CBD can help regulate serotonin levels in the brain. Serotonin is a neurotransmitter that plays a key role in mood regulation, and imbalances in serotonin levels are often linked to depression. CBD may act on serotonin receptors, potentially helping improve mood and reducing symptoms of depression. With depression being closely related to suicide incidences that have steadily increased worldwide, it is expected that further positive developments in understanding the role of CBD in this area can lead to the development of effective solutions. This is expected to result in a healthy expansion of the CBD gummies industry.

CBD gummies offer a convenient, pre-dosed form of CBD, making it easy for consumers to incorporate these products into their daily routine without the need to measure or prepare tinctures or oils. Additionally, gummies are considered a discreet way to consume cannabidiol, which appeals to individuals wanting to avoid the social stigma that sometimes surrounds CBD oil or vaping. The availability of gummies in different flavors is another major market driver, as flavoring them helps mask any bitterness found in other forms, such as CBD oil. This has made gummies an attractive option for younger consumers and older adults who may be seeking a natural remedy but prefer a more familiar, easy-to-consume product. Many CBD gummy brands have successfully marketed their products as part of a lifestyle choice, associating them with relaxation, stress relief, and a balanced, healthy life. This emotional connection with consumers helps drive industry demand.

High-profile endorsements and testimonials by celebrities and wellness influencers contribute to the growing popularity of CBD products, encouraging more people to try CBD gummies. A notable example is the well-known American businesswoman and writer Martha Stewart, who has launched several products in recent years through this category. In November 2023, Martha Stewart CBD unveiled a range of need-based CBD gummy products, expanding the brand’s wellness portfolio. These products have been developed to address stress, lack of sleep, and discomfort due to soreness and aches. The Sleep CBD Gummies have 25mg CBD with 3mg melatonin; the Chill CBD Gummies contain 25mg CBD with 50mg L-Theanine; and the Extra Strength CBD Gummies contain 30mg CBD. Several brands are focusing on direct-to-consumer (D2C) business models, enabling consumers to have more choices and educating buyers about CBD, thus driving interest and sales.

Concentration Insights

The low concentration segment accounted for a dominant revenue share of 88.8% in the global CBD gummies industry in 2024. The growing number of first-time or casual users has enabled the strong demand for such products, who prefer starting with lower concentrations to gauge their body’s response. Low concentration gummies provide a less intense experience, allowing users to increase their intake gradually. These gummies are especially appealing to individuals who want to experience the potential benefits of CBD, such as relaxation or mood enhancement, without any psychoactive effects or feeling overwhelmed by stronger doses. People seeking mild relief from stress, minor anxiety, or insomnia may find that low concentration gummies provide adequate benefits without the need for higher doses. Low concentration options also make it easier for manufacturers to adhere to regulations established by local or national authorities, resulting in better product visibility and sales.

The high concentration segment is expected to grow at the fastest CAGR from 2025 to 2030 in the CBD gummies market. The demand for high concentration CBD gummies is driven by factors such as the need for stronger therapeutic effects, ease of dosage, cost-effectiveness for regular users, and increased consumer awareness of CBD’s potential health benefits. These gummies appeal to experienced users, those with specific health conditions, and people seeking effective and convenient alternatives to traditional medications. Such solutions are often sought by individuals dealing with chronic pain, inflammation, or conditions such as arthritis. These consumers may need stronger doses of CBD to experience noticeable therapeutic effects. Products such as Sunmed Full Spectrum Anytime CBD Gummies, Cornbread Hemp Full-Spectrum CBD Gummies, and CBDfx Mixed Berry CBD Gummies are some notable strong potency options available in the market.

Distribution Channel Insights

The offline segment accounted for a dominant revenue share in the global CBD gummies industry in 2024. The high penetration of "head shops" in several major metropolitan cities worldwide, with a substantial existing clientele and loyal local customer base, presents a major avenue for segment growth. Consumers prefer physical outlets for buying authentic and premium-quality products, with retail pharmacies providing CBD products with a specific prescription. With the growing acceptance and legalization of CBD in various economies, major pharmacy chains have begun stocking a range of gummies from different brands. Moreover, many consumers still prefer shopping in a personal capacity to better understand their purchase. They generally have queries regarding the quality, dosage, and benefits of CBD products, and the availability of a knowledgeable sales associate helps address these queries. The use of in-store displays, promotional campaigns, and product samples also helps foster trust among casual and first-time users.

On the other hand, the online segment is expected to witness the fastest CAGR from 2025 to 2030 in the global market. Online platforms provide access to a wide variety of products, a convenient buying experience, and flexible payment options, which appeal to consumers. Major brands involved in the market have shifted their focus to omnichannel strategies that can ensure high sales and revenue generation. These platforms provide a comprehensive overview of CBD products, their potency, and their therapeutic impact, creating more confidence in buyers to make informed purchasing decisions. Online delivery platforms are profiting from the continued legalization of CBD-based products, improving customer access. For instance, in January 2025, DoorDash announced the launch of a new category for hemp-derived THC and CBD products, available for on-demand delivery in select states across the U.S. This has enabled eligible customers to order various hemp-derived items, including beverages, gummies, and topicals, directly from merchants such as DashMart and Total Wine & More.

Regional Insights

The North America CBD gummies market accounted for the largest revenue share of 46.8% globally in 2024. The growth of the regional market is being driven by increasing consumer awareness regarding CBD, changing perceptions of cannabis, and the rising interest in natural wellness products. Regional consumers are increasingly seeking natural alternatives to pharmaceuticals for managing widely prevalent conditions such as anxiety, pain, insomnia, and stress. CBD gummies, as a natural, non-intoxicating product, are gaining popularity for their perceived health benefits. Regional economies have implemented several regulations that are expected to shape the market and encourage manufacturers and distributors to launch new products. For instance, in Canada, CBD is regulated as part of the broader cannabis laws. The Cannabis Act, which took effect in October 2018, legalizes both CBD and THC products, although they are subject to strict regulations. CBD gummies can be sold legally; however, they may only be sold by licensed producers and must contain no more than 10 mg of THC per product.

U.S. CBD Gummies Market Trends

The U.S. accounted for a dominant revenue share in the regional market in 2024, aided by the rising awareness about mental health conditions such as anxiety, depression, and insomnia in the economy. This has encouraged people to seek natural remedies for these issues, with CBD being a notable non-intoxicating alternative to other forms of treatment. The legalization of cannabis for both medical and recreational use across all 50 states in the economy has significantly boosted market opportunities. The Farm Bill of 2018 allowed the legal growth of industrial hemp with a THC concentration of no more than 0.3%, increasing the accessibility of CBD products. According to a survey conducted by Healthline to gather insights regarding CBD usage in the U.S., 25% of the respondents stated that CBD products were already a part of their lifestyle or were willing to try them. Such instances showcase the rising popularity of CBD-based products among American citizens, which has helped aid industry growth.

Europe CBD Gummies Market Trends

Europe accounted for a substantial revenue share in the global market in 2024. CBD products, including gummies, are legal in most European Union (EU) countries and subject to certain criteria. The EU allows the sale of CBD products derived from industrial hemp as long as the THC content is below 0.2%. Regional economies are free to develop and implement their regulations regarding cannabis consumption, which influences market growth. For instance, in Germany, CBD gummies are widely available and legal as long as they comply with the THC limit of 0.2%. They can be found in health stores and online platforms. Netherlands is also well-known for its liberal stance regarding cannabis, making CBD gummies legal and resulting in their strong sales. These factors influence the cultural acceptance of CBD in Europe, with countries such as Switzerland and the UK exhibiting a more relaxed attitude towards CBD products while others maintain stricter views and regulations.

Asia Pacific CBD Gummies Market Trends

The Asia Pacific market is expected to advance at the fastest CAGR from 2025 to 2030 in the global CBD gummies market. Urbanization and the growing adoption of Western cultures have resulted in significant awareness regarding cannabis-based products. Moreover, there is an increasing acceptance of CBD for its potential therapeutic benefits, including pain relief, anxiety management, and improved sleep quality. Many regional economies are beginning to loosen their regulations surrounding these products, enabling manufacturers to expand their presence. For instance, Australia has seen increased consumer interest in CBD-infused products, although they are still subject to prescription requirements. The rapid adoption of online shopping has further made CBD gummies more accessible to consumers across Asia, enabling companies to reach a broader audience and cater to the increasing demand for convenient health products.

The Australia CBD gummies market is anticipated to advance at the highest CAGR from 2025 to 2030 in the Asia Pacific region. Increasing awareness among consumers regarding this product's health and wellness benefits, coupled with the well-established online sales channel, is expected to encourage manufacturers to launch new CBD-based products, including gummies, in the country. The Australian government's regulatory framework surrounding CBD products has been relatively strict. Products must meet specific guidelines regarding dosage and quality, which reassures consumers and helps build confidence in the safety and efficacy of the products. In 2021, the Australian Therapeutic Goods Administration (TGA) made CBD products available over-the-counter (OTC) in pharmacies, with a prescription, for conditions such as anxiety and insomnia. Such initiatives have made it easier for consumers to access CBD products legally, thereby fueling product demand.

Key CBD Gummies Market Company Insights

Some major companies involved in the global CBD gummies industry include CV Sciences, Green Roads, and NextEvo Naturals, among others.

-

CV Sciences is a U.S.-based organization that develops consumer wellness products specializing in plant-based nutrition and nutraceuticals. The company uses hemp extracts and other well-researched natural ingredients to create premium offerings. The +PlusCBD brand develops and sells CBD-infused products such as softgels, gummies, oils, and topicals. These products have been indicated for improving sleep, stress relaxation, and pain relief, among other applications. Notable CBD gummies offered by the brand include Aura Illuminate Gummies 20ct, Aura Serene Gummies 20ct, Reserve Collection Sleep Gummies 60ct, and Reserve EXTRA CBD Gummies. The Reserve EXTRA CBD Gummies contain 25mg CBD and 5mg THC, with three variants of 30ct, 60ct, and 10ct available for purchase.

-

Green Roads is an American organization based in Florida involved in developing hemp-derived products, including CBD oils, gummies, topicals, softgels, and capsules. These products have been developed to help improve sleep, reduce stress and anxiety levels, enhance muscle and joint health, and increase energy and focus. Some of the popular offerings by Green Roads include Cherry Lime Pie THC Relax Gummies - (30ct) 4680mg, Kiwi Kush THC Relax Gummies - (30ct) 4680mg, Wildberry THC Relax Gummies - (30ct) 900mg, and Electric Blue THC Relax Gummies - (30ct) 900mg, among others.

Key CBD Gummies Companies:

The following are the leading companies in the CBD gummies market. These companies collectively hold the largest market share and dictate industry trends.

- CV Sciences, Inc.

- BellRock Brands

- Sunday Scaries

- Green Roads

- Medix CBD

- NextEvo Naturals

- Purekana LLC

- Diamond CBD

- PJ Marketing LLC

- Charlotte's Web, Inc.

Recent Developments

-

In November 2024, CV Sciences announced that it had entered into a purchase agreement to acquire Extract Labs, Inc., which manufactures and distributes premium cannabinoid offerings, including gummies, tinctures, and topicals. Products by Extract Labs are sold using business-to-business (B2B) and business-to-consumer (B2C) channels. Extract Labs is FDA-registered and GMP-certified and is expected to enable CV Sciences to improve its sales to new and current clients. The acquisition is expected to be completed during the first quarter of 2025.

-

In October 2023, NextEvo Naturals announced the launch of an extra strength version of its CBD gummies, called Extra Strength Daily Wellness CBD Gummy. The product contains 20 mg of vegan, non-GMO, and THC-free fast-absorbing cannabidiol. The Berry Mix-flavored products are available in 60ct or 90ct, making them ideal for home and on-the-go consumption. Additionally, the company has also revised product labeling to include ‘Calm’, ‘Recovery’, ‘Sleep’, and ‘Daily Wellness’ to highlight the solutions provided by each offering.

CBD Gummies Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.21 billion

Revenue forecast in 2030

USD 23.80 billion

Growth rate

CAGR of 30.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Concentration, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; South Africa

Key companies profiled

CV Sciences, Inc.; BellRock Brands; Sunday Scaries; Green Roads; Medix CBD; NextEvo Naturals; Purekana LLC; Diamond CBD; PJ Marketing LLC; Charlotte's Web, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global CBD Gummies Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global CBD gummies market report based on concentration, distribution channel, and region:

-

Concentration Outlook (Revenue, USD Million, 2018 - 2030)

-

High

-

Low

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.