- Home

- »

- Healthcare IT

- »

-

CBD Nutraceuticals Market Size, Industry Report, 2030GVR Report cover

![CBD Nutraceuticals Market Size, Share & Trends Report]()

CBD Nutraceuticals Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (CBD Tinctures, Capsules & Softgels), By Application, By Distribution Channel (Retail Stores, Online, Pharmacies), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-156-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

CBD Nutraceuticals Market Summary

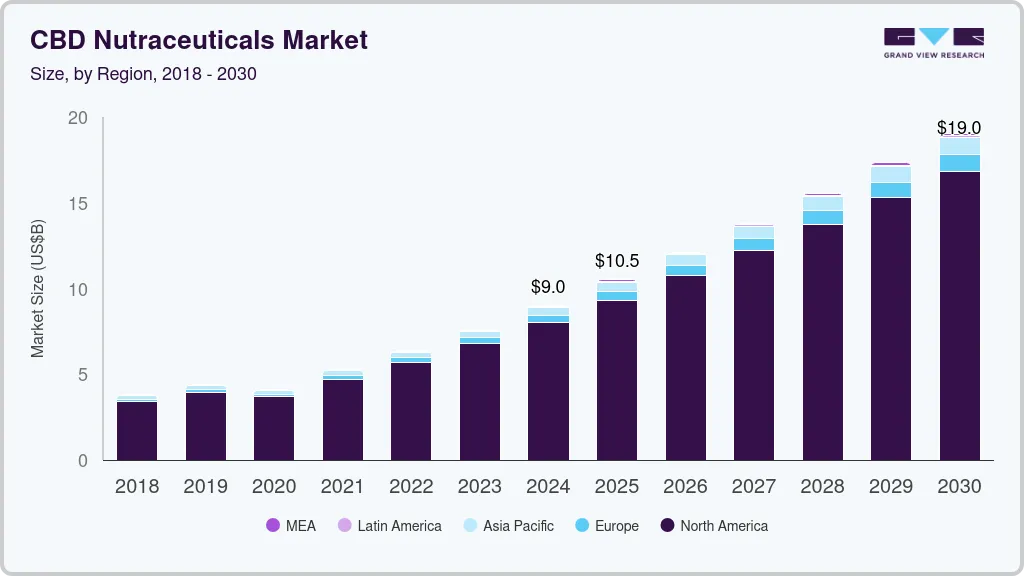

The global CBD nutraceuticals market size was estimated at USD 8.99 billion in 2024 and is projected to reach USD 19.04 billion by 2030, growing at a CAGR of 12.6% from 2025 to 2030. Growing awareness regarding the medical benefits of cannabidiol, including its remedial properties, increasing consumer preference for plant-based supplements, rising legalization of cannabis in different countries, and growing research on the use of cannabis are key factors driving the growth.

Key Market Trends & Insights

- North America dominated the overall CBD nutraceuticals industry with a 88.9% market share in 2024.

- U.S. dominated the CBD nutraceuticals industry in terms of revenue share in 2024.

- By product, the CBD tinctures segment accounted for the largest revenue share of 41.2% in 2024

- By application, the pain management segment accounted for the largest revenue share of 37.0% in 2024.

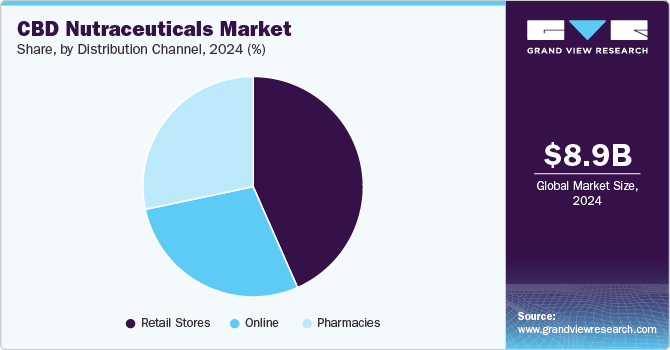

- By distribtion channel, the retail stores segment accounted for the largest revenue share of 43.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.99 Billion

- 2030 Projected Market Size: USD 19.04 Billion

- CAGR (2025-2030): 12.6%

- North America: Largest market in 2024

- Europe: Fastest growing market

For instance, as of February 2024, 47 states, the District of Columbia, and three territories (Puerto Rico, Guam, and the U.S. Virgin Islands) allow for the use of cannabis for medical purposes. Growing competition in the CBD nutraceuticals sector leads companies to launch new products and increase their geographical reach, boosting market growth. For instance, in November 2023, Charlotte’s Web broadened its product range by introducing the ReCreate portfolio, including launching four new gummy products. These products are distinguished by their broad-spectrum CBD content and the inclusion of functional botanical ingredients.With growing consumer demand for solutions to support top health concerns such as mood, stress, and sleep, CBD is set to boost the dietary supplement category. Furthermore, increasing R&D activities in CBD dietary supplements boosted the market growth. For instance, according to data published by Nutringredients USA in September 2023, a recent scientific review undertaken by Canopy Growth Corporation and Charlotte’s Web has concluded that daily dietary supplements with CBD dosages between 70 mg and 160 mg are safe and do not cause liver damage.

Growing demand for hemp protein among athletes, bodybuilders, and the vegan population is expected to further drive the market for CBD nutraceuticals over the forecast period. Hemp protein powder is a high-quality plant-based protein that contains twenty amino acids and can be easily digested by the human body. It contains more dietary fiber than soy protein or rice protein. Thus, its adoption is increasing due to the growing consciousness among consumers about the core ingredients in nutritional supplements. For instance, in February 2024, Manitoba Harvest, a wholly owned subsidiary of Tilray Brands, Inc., partnered with Brightseed, a Bioactives company, to transform the functional fiber market by introducing Manitoba Harvest Bioactive Fiber. It is beneficial for gut health and is derived from the husks (outer shells) of hemp seeds.

Growing awareness and educational programs regarding cannabis further drive the growth of the CBD nutraceuticals industry. For instance, in November 2023, the University of Mississippi created a new online graduate program concentrating on medical cannabis and dietary supplements. With years of experience in cannabis research under the Marijuana Project, funded by the National Institute on Drug Abuse, the university is well-equipped in this field. The newly introduced Master of Science in Dietary Supplements and Medical Cannabis is designed to educate students on the chemistry, biology, and toxicology related to medical cannabis.

Market Concentration & Characteristics

The CBD nutraceuticals is characterized by a high degree of innovation owing to increased R&D activities on the use of cannabis and its medicinal properties, rising product demand due to its health benefits without intoxication and new product launches. For instance, in November 2023, Martha Stewart CBD introduced CBD gummies to address specific needs such as stress, sleep, and soreness and aches. The company introduced Sleep CBD Gummies, Chill CBD Gummies, and Extra Strength CBD Gummies .

The CBD nutraceuticals market is characterized by a medium-level merger and acquisition activity. Companies adopt a diverse range of growth strategies to strengthen their market positions and revenues, further facilitating market growth. For instance, in May 2021, Aphria, a cannabis company, and Tilray Brands, Inc., a cannabis researcher, cultivator, and distributor, merged their business to create cannabis-focused consumer packaged goods (“CPG”) company.

The CBD nutraceuticals industry is flourishing owing to the rising number of countries devising a systematic regulatory framework for the cultivation and sale of cannabis. Wide acceptance and rising awareness of CBD nutraceuticals in various countries, majorly for wellness, are gaining more traction.

However, the presence of alternatives such as herbal nutraceuticals, such as Garcinia Cambogia, raspberry ketones, echinacea, and turmeric, which have long ruled the global nutraceuticals space, is restraining market growth.

Several market players are expanding their business into new regions and countries to strengthen their market position and product portfolio. For instance, in January 2024, CURE, a New York-based company, aims to launch its CBD-based dietary supplements and functional beverages in Japan by April.

Product Insights

The CBD tinctures segment accounted for the largest revenue share of 41.2% in 2024. One key factor driving the demand is the growing usage of CBD tinctures owing to their high bioavailability compared to oils in relieving severe pain, anxiety, and stress, among other things. The availability of these tinctures in various volumes and concentrations that suit individual requirements is expected further to fuel the segment's growth over the forecast period. Following are some examples of CBD tinctures,

-

Lazarus Naturals Full Spectrum CBD Oil Tincture

-

Leaf Remedys CBD Tincture

-

Extract Labs Daily Support Hemp Tincture

-

CBDistillery Relief + Relax Full Spectrum CBD Oil

-

CBDFx Calming Tincture

-

Joy Organics Organic Broad Spectrum CBD Oil

-

Zatural Full-Spectrum CBD Oil

The capsules and softgels segment is anticipated to grow at the fastest CAGR over the forecast period. Capsules and softgels are more convenient and travel friendly. Moreover, many users dislike the taste and texture of tinctures, making them difficult for daily consumption. Thus, they are switching to capsules and soft gels, which are easy to consume and available in premeasured doses. Furthermore, the rise in launches of CBD-based softgels boosts market growth. For instance, in March 2023, Irwin Naturals Inc. introduced CBD 25mg Softgels under the Irwin Naturals Cannabis brand. This new offering is now available across Canada via the Starseed Medicinal Medical Group platform.

Application Insights

The pain management segment accounted for the largest revenue share of 37.0% in 2024. The geriatric population is more susceptible to chronic pain than acute pain, thereby boosting the demand for pain management medication. OTC pain medicine containing CBD provides relief with different benefits for various chronic pain issues. For instance, according to an article published by The Royal Australian College of General Practitioners (RACGP) in October 2021, about 600,000 Australians are currently using cannabis for self-medication, primarily due to chronic pain. The CBD stops the absorption of anandamide—a compound associated with pain regulation in the body—which leads to a rise in the anandamide level in the bloodstream, thereby reducing the severity of pain experienced by a patient.

The stress & anxiety relief segment is anticipated to grow at the fastest CAGR over the forecast period. Medical cannabis is known to provide positive results in reducing stress and anxiety. It has been proven to be effective by various research and clinical studies. Thus, such benefits of medical cannabis are anticipated to increase its adoption by patients and physicians for reducing depression & anxiety. Following are the CBD products available in the market for anxiety:

-

CBDfx Full Spectrum Mixed Berry CBD Gummies

-

CBDistillery Ahhh Distilled Full Spectrum CBD Oil, 500 mg

-

Sunday Scaries Extra Strength CBD Gummies

-

CBDfx CBD Bath Bombs, 200 mg

Distribution Channel Insights

The retail stores segment accounted for the largest revenue share of 43.4% in 2024. The growing partnership of manufacturers with retailers to expand their distribution network is the leading factor contributing to segment growth. For instance, in January 2021 , Geocann partnered with Pathway Health Corp. to provide VESIsorb-formulated medical cannabis products to rapidly evolving brands of Canadian retail pharmacies.

The online sales segment is expected to register the fastest CAGR throughout the forecast period. Companies in the CBD nutraceuticals field are trying to supply their products through all the available sales channels, especially online, to reach remote locations. These channels provide the consumers with a detailed description of the product content, quality certification, ingredients, and dosage, attracting them to this sales channel. All these factors are anticipated to fuel the segment's growth over the forecast period.

Moreover, Online stores are preferred owing to changing consumer preferences and a high standard of living, which, in turn, is anticipated to drive the cannabidiol market. For instance, in January 2025, Curaleaf Holdings, a provider of consumer cannabis products, launched Select Zero Proof 2.5 mg Hemp THC Seltzer, a hemp-derived THC product. The new dosage and flavor options are available through major retailers, the company's online storefront, and on-demand delivery services in select states.

Regional Insights

North America dominated the overall CBD nutraceuticals industry with a 88.9% market share in 2024. The market is primarily driven by rising consumer awareness, increased adoption of CBD in various applications, and favorable regulatory policies in countries such as the U.S. and Canada. The presence of robust healthcare infrastructure and well-equipped research and development centers working on scientific advancements in the use of CBD and innovations related to the adoption of CBD in foods, cosmetics, and medicines have contributed to the growth of this industry in recent years.

U.S. CBD Nutraceuticals Market Trends

U.S. dominated the CBD nutraceuticals industry in terms of revenue share in 2024. The popularity of CBD-infused foods is rapidly rising due to the various health benefits associated with CBD. Furthermore, market players are introducing new products in the country, driving market growth. For instance, in October 2021, PAO Group, Inc., a biopharmaceutical company, launched RelaxRX CBD, a sleep aid, its first CBD Nutraceutical product, in the market.

Europe CBD Nutraceuticals Market Trends

The Europe CBD nutraceuticals industry is anticipated to witness the fastest CAGR during the forecast period. The growth is attributed to rising new cases of chronic health disorders, growing awareness about CBD health benefits, and the availability of multiple products in the region. Moreover, growing clinical research on the potential use of cannabis for treating a wide range of medical issues is anticipated to boost the market growth.

Germany CBD nutraceuticals market is anticipated to register a considerable growth rate during the forecast period. Favorable government initiatives and rising investments in the cannabis industry fuel market growth. For instance, in April 2024, Germany implemented the Cannabis Act, which enacted a new cannabis consumption act and amended numerous other laws, such as the Medicinal Cannabis Act and the Narcotic Act. This act is expected to significantly influence the CBD nutraceuticals market in Germany during the forecast period.

Asia Pacific CBD Nutraceuticals Market Trends

Asia Pacific CBD nutraceuticals industry held a significant revenue share in 2024. The potential for the legalization of CBD and the increasing acceptance of CBD for medicinal use primarily drives this market. The countries in this region are considered emerging markets for cannabis and its derivatives. There is potential for growth in the region due to favorable climatic conditions and increasing awareness about cannabis and its medical benefits. Thus, such factors boost market growth.

India CBD nutraceuticals market is anticipated to register a considerable growth rate during the forecast period. Various initiatives undertaken by key companies in the region are expected to boost the growth of the CBD market. For instance, in February 2023, a medical cannabis workshop was organized by Awshad, a Delhi-NCR-based cannabis wellness startup, at the PHD chamber in New Delhi. The primary objective of the workshop was to educate healthcare professionals on the application of CBD.

Latin America CBD Nutraceuticals Market Trends

Latin America is witnessing considerable growth in the CBD nutraceuticals industry. Some countries, such as Argentina, Chile, Peru, Colombia, and Brazil, have legalized CBD for medical purposes. Moreover, hemp's beneficial protein & fatty acid profiles and high nutritional values are expected to drive the demand for hemp products.

Argentina CBD nutraceuticals market is anticipated to register a considerable growth rate during the forecast period. In February 2023, Argentina established a new national agency, ARICCAME, to expand the country's cannabis industry. The move is expected to create new jobs and export opportunities for the nation. Speaking at the conference launching ARICCAME, Economy Minister Sergio Massa emphasized the potential for Argentina to meet the high global demand for industrial exports in the cannabis sector.

Middle East & Africa CBD Nutraceuticals Market Trends

The Middle East and Africa region is experiencing lucrative growth in the India CBD nutraceuticals industry is anticipated to register a considerable growth rate during the forecast period. market. Cannabis regulations are quite stringent in Africa. Countries such as Uganda, Zimbabwe, Lesotho, Malawi, South Africa, Morocco, Rwanda, Ghana, Zambia, and Eswatini have legalized cannabis cultivation for scientific research & medicinal purposes. Such legalization in those countries is expected to boost market growth over the forecast period.

South Africa CBD nutraceuticals market is anticipated to register a considerable growth rate during the forecast period. Possible legalization of the production and cultivation of cannabis and increasing the patient population eligible for medical marijuana treatments are expected to propel the market growth in the country.

Key CBD Nutraceuticals Company Insights

Key participants in the CBD nutraceuticals market are focusing on developing innovative business growth strategies such as product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key CBD Nutraceuticals Companies:

The following are the leading companies in the CBD nutraceuticals market. These companies collectively hold the largest market share and dictate industry trends:

- Charlotte's Web, Inc.

- Elixinol

- Medical Marijuana, Inc.

- CV Sciences, Inc.

- Irwin Naturals

- Diamond CBD.

- Foria Wellness

- Medterra CBD

- Green Roads

- Isodiol International Inc

Recent Developments

-

In June 2024, Rodedawg International Industries, Inc., a cannabis manufacturer and distributor, introduced the Nutrient CBD, which includes five innovative SKUs, such as two CBD Oil Tinctures, two CBD Creams, and one CBD Roll-On, to meet the various needs of consumers seeking natural and effective wellness solutions.

-

In May 2024, CV Science Inc. acquired Elevated Softgels LLC, one of the key companies in the encapsulated softgels and tinctures industry. With this acquisition, CV Sciences aims to strengthen its position in CBD nutraceuticals market globally.

CBD Nutraceuticals Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.50 billion

Revenue forecast in 2030

USD 19.04 billion

Growth rate

CAGR of 12.6% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Netherlands; Switzerland; Italy; France; Poland; Czech Republic; Croatia; China; India; South Korea; New Zealand; Japan; Australia; Argentina; Brazil; Chile; Columbia; Uruguay; Israel; South Africa

Key companies profiled

Charlotte's Web, Inc.; Elixinol; Medical Marijuana, Inc.; CV Sciences, Inc.; Irwin Naturals; Diamond CBD; Foria Wellness; Medterra CBD; Green Roads; Isodiol International Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global CBD Nutraceuticals Market Report Segmentation

This report forecasts revenue growth and provides at regional and country levels an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the CBD Nutraceuticals market report based on product, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

CBD Tinctures

-

Capsules & Softgels

-

CBD Gummie

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Pain Management

-

Stress & Anxiety Relief

-

Sleep Support

-

Skin Health & Beauty

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail Stores

-

Online

-

Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

Netherlands

-

Switzerland

-

Italy

-

France

-

Poland

-

Czech Republic

-

Croatia

-

-

Asia Pacific

-

China

-

India

-

South Korea

-

New Zealand

-

Japan

-

Australia

-

-

Latin America

-

Argentina

-

Brazil

-

Chile

-

Columbia

-

Uruguay

-

-

Middle East and Africa

-

Israel

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global CBD nutraceuticals market size was estimated at USD 8.99 billion in 2024 and is expected to reach USD 10.50 billion in 2025.

b. The global CBD nutraceuticals market is expected to grow at a compound annual growth rate of 12.6% from 2025 to 2030 to reach USD 19.04 billion by 2030.

b. CBD Tinctures dominated the CBD nutraceuticals market with a share of 41.4% in 2024.

b. Some key players operating in the CBD nutraceuticals market include Charlotte's Web; Elixinol; Medical Marijuana, Inc.; CV Sciences, Inc.; Irwin Naturals; and Diamond CBD.

b. Key factors that are driving the market growth include growing consumer preference for plant-based supplements and rising awareness regarding the medical benefits of cannabidiol including its remedial properties.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.