- Home

- »

- Alcohol & Tobacco

- »

-

CBD Pouches Market Size & Share, Industry Report, 2033GVR Report cover

![CBD Pouches Market Size, Share & Trends Report]()

CBD Pouches Market (2025 - 2033) Size, Share & Trends Analysis Report By Content (Up To 10 mg, 10 mg–20 mg), By Type (Flavored, Unflavored), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-966-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

CBD Pouches Market Summary

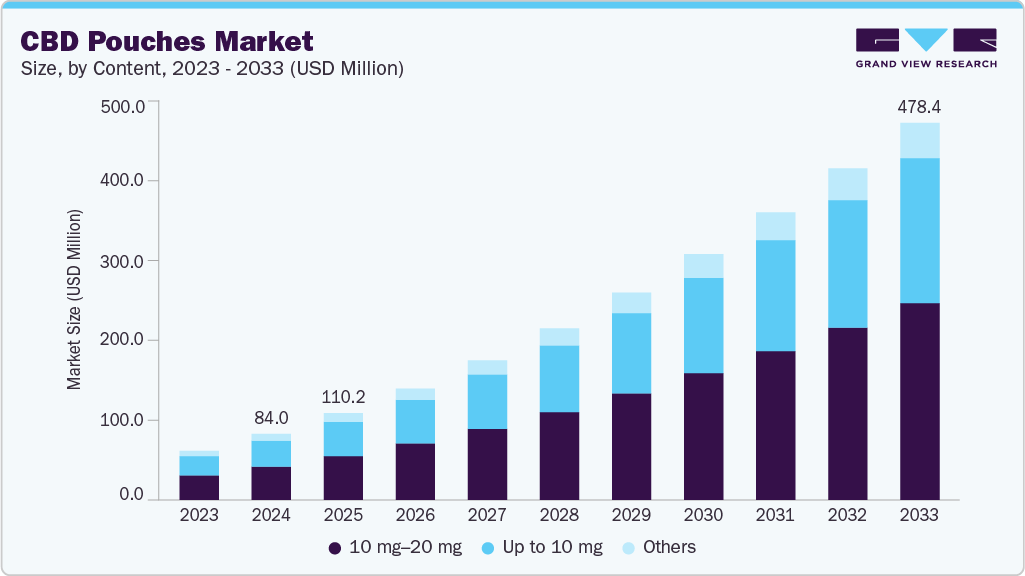

The global CBD pouches market size was estimated at USD 84.03 million in 2024 and is expected to reach USD 478.41 million by 2033, growing at a CAGR of 20.1% from 2025 to 2033. Rising awareness of CBD’s health benefits, particularly its role in alleviating chronic issues like anxiety and pain, is playing a key role in driving demand for CBD pouches.

Key Market Trends & Insights

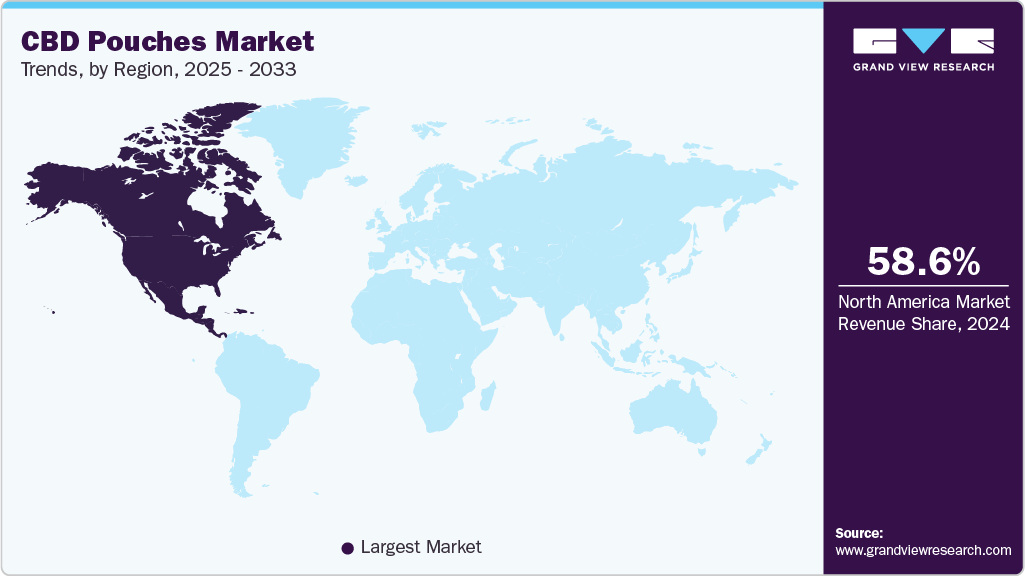

- North America led the market with a share of 58.6% in 2024.

- By content, the 10 mg-20 mg segment led the market and accounted for a share of 50.4% in 2024.

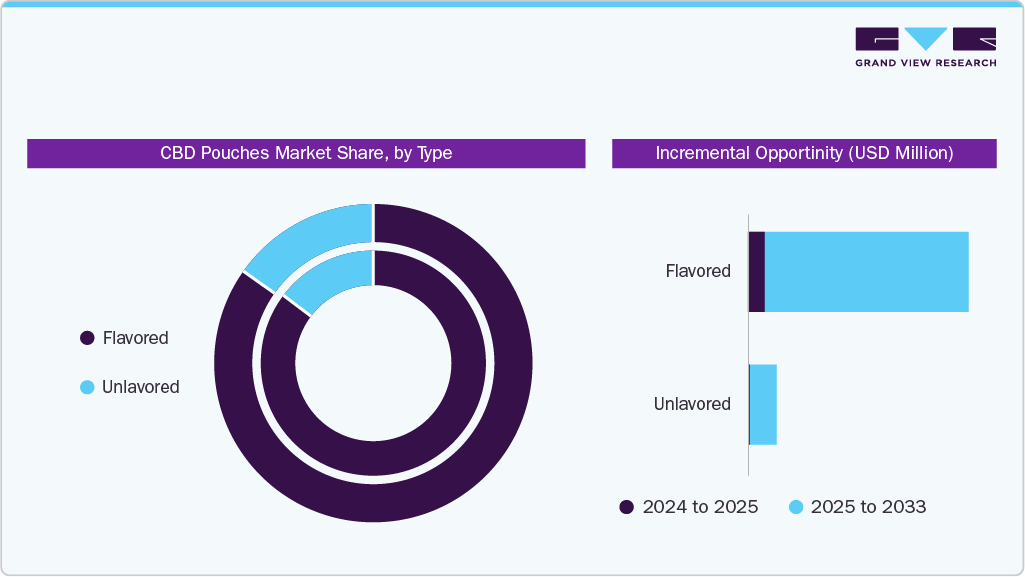

- By end use, the flavored segment dominated the global market, with a share of 86.5% in 2024.

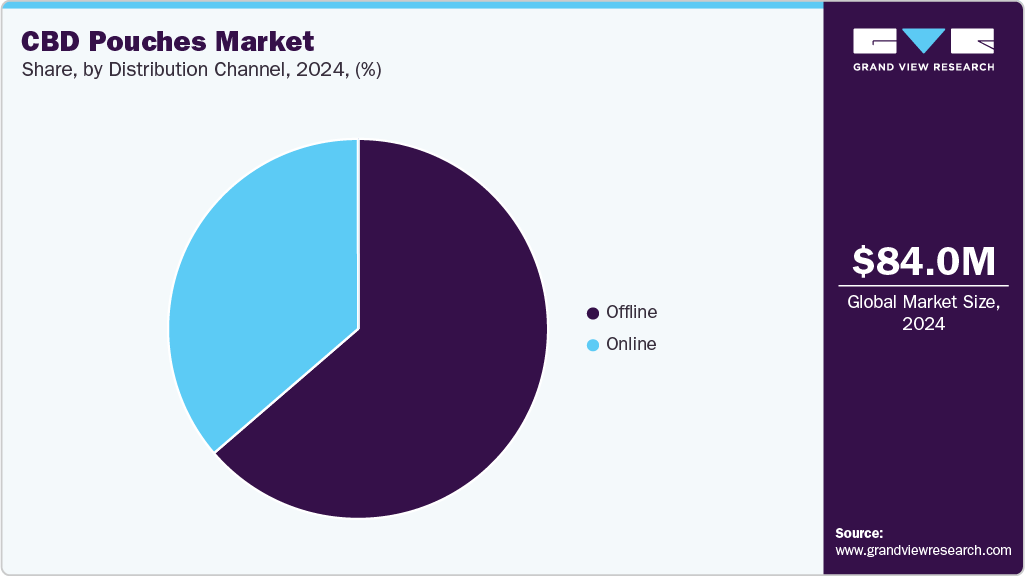

- By distribution channel, the offline sales segment held a revenue share of 63.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 84.03 Million

- 2033 Projected Market Size: USD 478.41 Million

- CAGR (2025-2033): 20.1%

- North America: Largest market in 2024

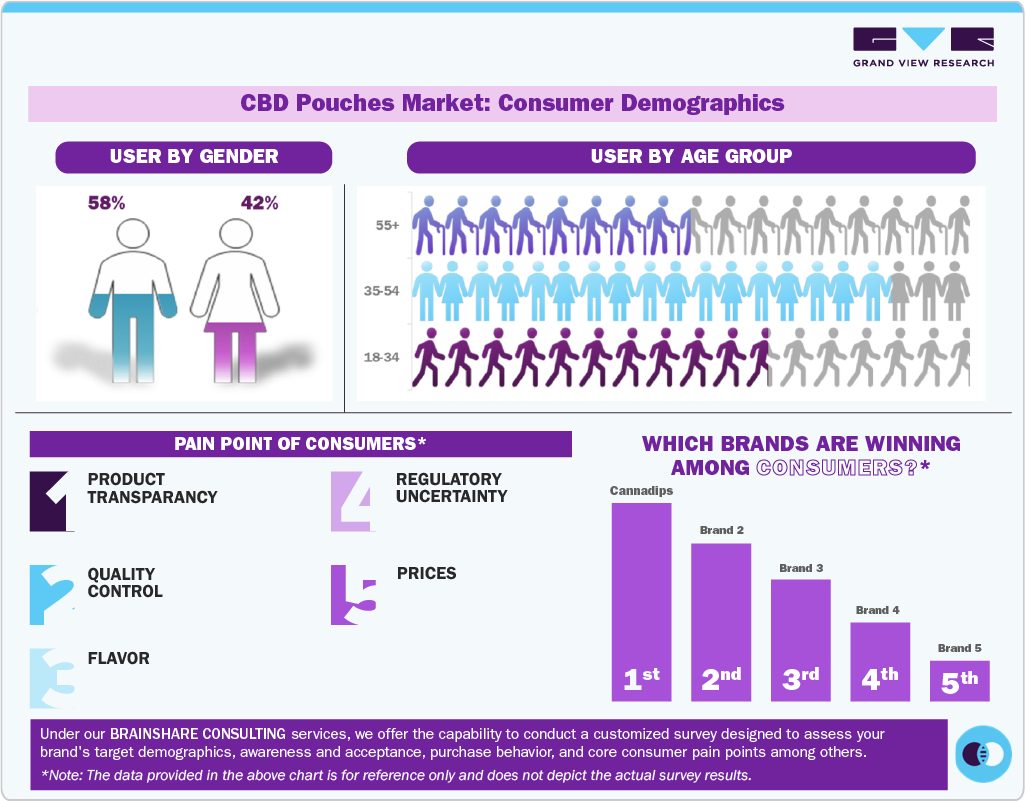

The category gained further legitimacy in 2018 when the U.S. Food and Drug Administration (FDA) approved Epidiolex, a CBD-derived drug, for the treatment of seizures associated with Lennox-Gastaut and Dravet syndromes. Such regulatory validation has enhanced consumer confidence and contributed to the growing popularity of CBD pouches as an easy-to-use, wellness-focused product. Consumers are increasingly turning to natural and alternative wellness options, with cannabis gaining popularity due to its potential benefits in easing anxiety, relieving pain, and improving sleep. CBD pouches offer a convenient and fast-acting alternative to traditional forms like edibles or oils, eliminating the need for ingestion or specialized equipment. Their discreet and portable nature appeals to users who prefer a subtle consumption method, especially in public or on the go. Additionally, the flexibility of CBD pouches for both therapeutic and recreational use continues to drive their market expansion.CBD is gaining traction across all age groups. According to the 2024 Forbes Health Survey, 32% of respondents aged 18-25 reported using CBD, while 90% of individuals aged 77 and above indicated usage. CBD brands must focus on attracting and retaining consumers across this wide demographic spectrum to ensure long-term success. Currently, many people discover CBD products, including pouches, through word-of-mouth. As a result, targeted marketing strategies that build awareness and trust among diverse consumer segments are essential for sustained growth.

The rising demand for smokeless alternatives to conventional tobacco products has positively impacted the CBD pouch market. Many consumers are now opting for pouches as a harm-reduction method, seeking safer and more health-conscious ways to consume nicotine or cannabis. The ease of use and portability of CBD pouches further enhance their appeal. Additionally, the legalization of cannabis in various countries has increased accessibility and helped normalize its use. This shift has diminished the stigma around cannabis consumption, prompting more people to explore the potential wellness benefits of CBD products.

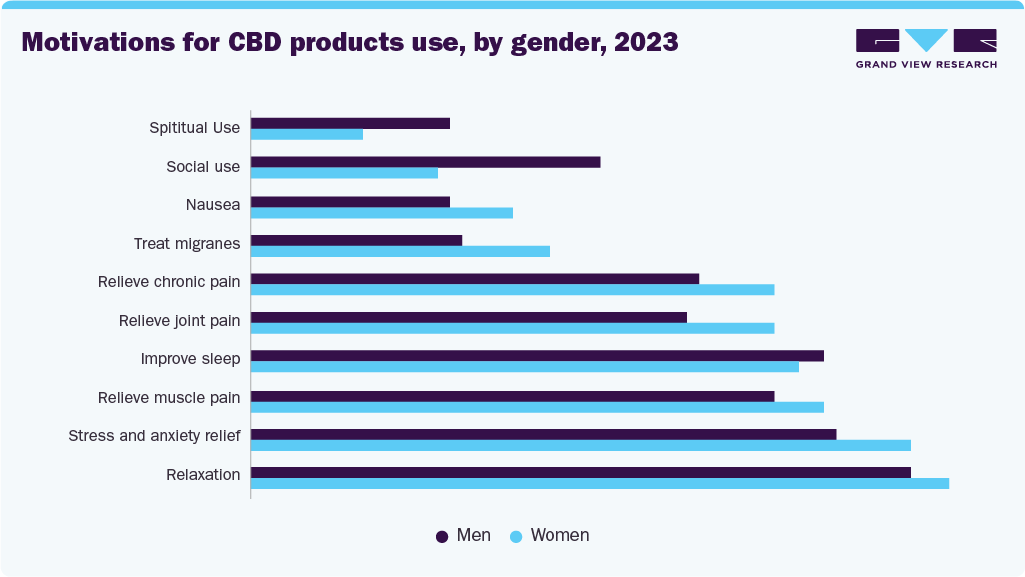

The most common reasons for using CBD among both genders are relaxation and stress or anxiety relief, with women showing a slightly higher tendency in these areas, likely reflecting a greater focus on emotional well-being. Women also report higher usage for managing chronic pain, joint pain, migraines, and nausea, which may be attributed to gender-specific health concerns such as hormonal fluctuations or autoimmune conditions. In contrast, men show a stronger preference for using CBD for social and spiritual purposes, suggesting a more lifestyle-oriented or recreational approach. Certain motivations, such as improving sleep and relieving muscle pain, are relatively balanced across genders, indicating shared wellness goals.

Consumer Demographic Insights

Content Insights

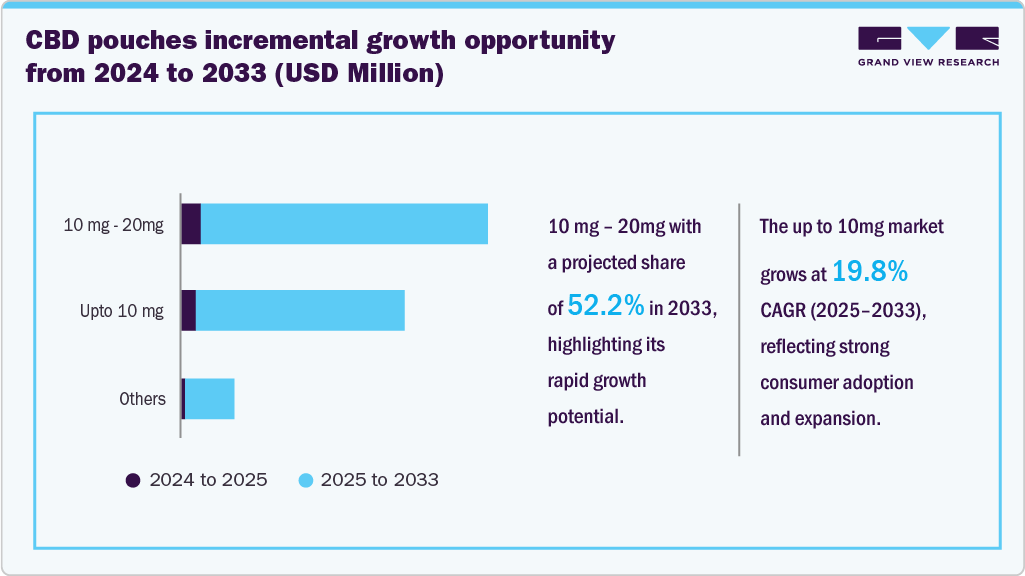

The 10 mg-20 mg is the largest segment, accounting for a share of 50.4% in 2024. Safety and effectiveness are major drivers behind the growing popularity of CBD pouches, with dosages ranging from 10mg to 20mg. This dosage range is widely regarded as both safe and beneficial for users seeking the therapeutic effects of CBD without the risk of side effects associated with higher concentrations. These pre-measured pouches offer a convenient, hassle-free experience, eliminating manual dosing and making them ideal for on-the-go use. AROMA KING, a new entrant in the market, is a brand of nicotine and CBD pouches developed by the Polish company Symetricus spółka zoo. The brand provides 20mg CBD pouches in various flavors, including Blueberry Ice, Candy Tobacco, and Exotic Ice.

The up to 10 mg segment is anticipated to witness a CAGR of 19.8% from 2025 to 2033. CBD pouches with a lower dosage of up to 10mg are well-suited for beginners or those new to CBD. They offer a mild starting point, allowing users to adjust their intake based on individual needs and tolerance gradually. These pouches provide a convenient, discreet way to experience the potential benefits of CBD without disrupting daily routines. Their ease of use, simply placing a pouch in the mouth, makes them an appealing, on-the-go option, contributing to their growing market demand.

Type Insights

Flavored CBD pouches were the largest segment, accounting for a share of 86.5% in 2024. Flavored CBD pouches cater to consumers seeking variety and a more enjoyable taste experience. With options ranging from fruit and mint to coffee and unique blends like cucumber lemon, these flavors appeal to a broad audience and help mask the natural taste of CBD. This approach is especially effective in attracting new users who may be hesitant to try unflavored products, encouraging them to incorporate CBD into their wellness routines. Brands like FlowBlend (Montana, U.S.) offer flavors like Orange Tang, Spearmint, Cherry Blast, and Coffee. At the same time, Cannadips CBD's Humboldt Collection includes Tangy Citrus, Natural Mint, Tropical Mango, and Fresh Wintergreen.

Unflavored CBD pouches are the fastest-growing segment and are expected to grow at a CAGR of 17.8% from 2025 to 2033. Growing awareness of CBD’s potential benefits has boosted demand for unflavored options as more consumers seek clean, additive-free products. Unflavored CBD pouches attract those who prefer a pure, natural experience without artificial flavors or added sugars, valuing product authenticity and simplicity. These options are especially appealing to health-conscious users who prioritize minimal ingredients. In June 2023, HiGH FiVE launched STiRiBLES, fast-acting, dissolvable THC powders that allow users to customize their cannabis intake by adding it to foods or beverages. The line also includes an unflavored STiRiBLES THC stick pack for those seeking a more neutral option.

Distribution Channel Insights

The sales of CBD pouches through offline channels held a share of around 63.7% in 2024.CBD pouches are widely available through various offline distribution channels, including specialty stores, pharmacies, wellness centers, health stores, medical outlets, and dispensaries. Dispensaries remain the most popular choice due to their extensive product availability and ease of access. Offline channels appeal to consumers who value seeing and evaluating products firsthand before purchasing. The option for immediate product access, without the wait or complexity of online orders, makes physical retail locations a key driver in the growing sales of CBD pouches.

Sales of CBD pouches through online channels are the fastest-growing segment, and are expected to grow at a CAGR of 20.7% from 2025 to 2033. The primary driver of the online distribution channel is the convenience and accessibility it provides. It enables consumers to browse and purchase CBD pouches from the comfort of their homes. Since CBD pouches are often used for personal health purposes like stress relief or pain management, online shopping offers a discreet and private purchasing experience. Additionally, online platforms allow CBD pouch brands to extend their reach beyond local markets and connect with a global audience. E-commerce enables manufacturers to expand their customer base and boost sales. Brands like FlowBlend and Cannadips have gained popularity online by offering nicotine- and tobacco-free CBD pouches that are discreet, fast-acting, and positioned as healthier alternatives to traditional tobacco products.

Regional Insights

The North America CBD pouches market accounted for the largest revenue share of 58.57% in 2024. Growing awareness of CBD's potential health benefits, such as pain relief, reduced anxiety, and improved sleep, is fueling demand for CBD products, including pouches. As more consumers turn to natural and alternative remedies, the market continues to expand across the U.S. CBD pouches are available in various flavors, strengths, and formulations, catering to diverse consumer preferences. Ongoing product innovation is a key factor driving market growth, helping to attract new users and retain existing customers. Jake's Mint Chew, for instance, offers an assortment of flavored CBD pouches online, including options like root beer, French vanilla, apple cider, maple, straight mint, and cinnamon.

The CBD pouches market in Canada is forecast to grow at a CAGR of 20.8% from 2024 to 2033. There has been a significant increase in awareness and acceptance of CBD and its potential health benefits among Canadians. As more people become aware of the therapeutic properties of CBD, there is a growing demand for convenient and discreet forms of consumption, such as CBD pouches. The focus on health and wellness has increased in Canada, with consumers actively seeking natural alternatives for managing stress, anxiety, pain, and other health conditions. The expansion of e-commerce and online retail platforms has made it easier for consumers to access CBD products, including pouches. Ontario Cannabis Store is an online retail platform for recreational cannabis in Ontario. It offers a selection of CBD products and other cannabis-infused products.

Europe CBD Pouches Market Trends

The CBD pouches industry in Europe held over 30.8% share of the global revenue in 2024.Rising consumer awareness of the therapeutic benefits of CBD pouches is fueling demand across Europe. With a growing focus on health and wellness, many Europeans are turning to natural, plant-based remedies to address various health concerns. CBD’s organic origins make it popular for those seeking alternative solutions. Additionally, increasing recognition of mental health challenges has led more consumers to explore CBD for its potential calming and stress-relieving effects. The discreet format of pouches further adds to their appeal, allowing users to manage stress and anxiety conveniently and without drawing attention.

The CBD pouches market in the UK is set to grow at a CAGR of about 22.8% from 2025 to 2033.The growing preference for natural and plant-based remedies drives the popularity of CBD products like pouches in the UK. As more consumers seek alternative solutions for managing health concerns, CBD’s botanical origin appeals to those focusing on wellness and clean living. Moreover, its perceived calming effects boost its acceptance among individuals seeking stress relief and relaxation.

Asia Pacific CBD Pouches Market Trends

The CBD pouches industry in Asia Pacific is set to grow at a CAGR of around 20.5% from 2025 to 2033. The growing governmental acceptance of cannabis products across the Asia Pacific region is creating significant opportunities for market expansion. For example, in February 2024, Aurora Cannabis acquired MedReleaf Australia, a licensed medical cannabis company, to strengthen its presence in the region's emerging legal cannabis market. At the same time, demand for CBD products is rising rapidly as consumers become increasingly aware of their potential health benefits, including relief from chronic pain, inflammation, insomnia, appetite loss, depression, and anxiety.

Central & South America CBD Pouches Market Trends

The CBD pouches industry in Central & South America is set to grow at a CAGR of about 16.2% from 2025 to 2033. Several Central and South American countries, including Chile, Colombia, Brazil, Argentina, and Peru, have legalized cannabis for medical, recreational, or industrial use, contributing to a global surge in cannabis-related investments. These nations are actively working to build regulated domestic markets while positioning themselves as key players in cannabis exports. Countries like Colombia and Jamaica have become attractive to foreign investors due to their competitive cost structures and scientific expertise. In Colombia, for example, the legalization of medical cannabis has drawn approximately USD 500 million in foreign investment, according to the industry association Asocolcanna.

Middle East & Africa CBD Pouches Market Trends

The CBD pouches industry in Middle East & Africa is set to grow at a CAGR of about 10.4% from 2025 to 2033. The market in the Middle East and Africa is still in its early stages but holds strong growth potential. In the Middle East, attitudes toward cannabis products vary due to differing legal frameworks and cultural perspectives. However, progress is being made in parts of the region. In South Africa, for instance, the private use of cannabis has been legalized, paving the way for increased demand for CBD products. In November 2023, South African lawmakers passed a long-anticipated bill permitting adults to possess and cultivate marijuana. Brands like Cannadips are tapping into this emerging market, offering Mint-flavored CBD pouches that deliver a smooth and refreshing mint experience, balancing sweetness and coolness without overpowering.

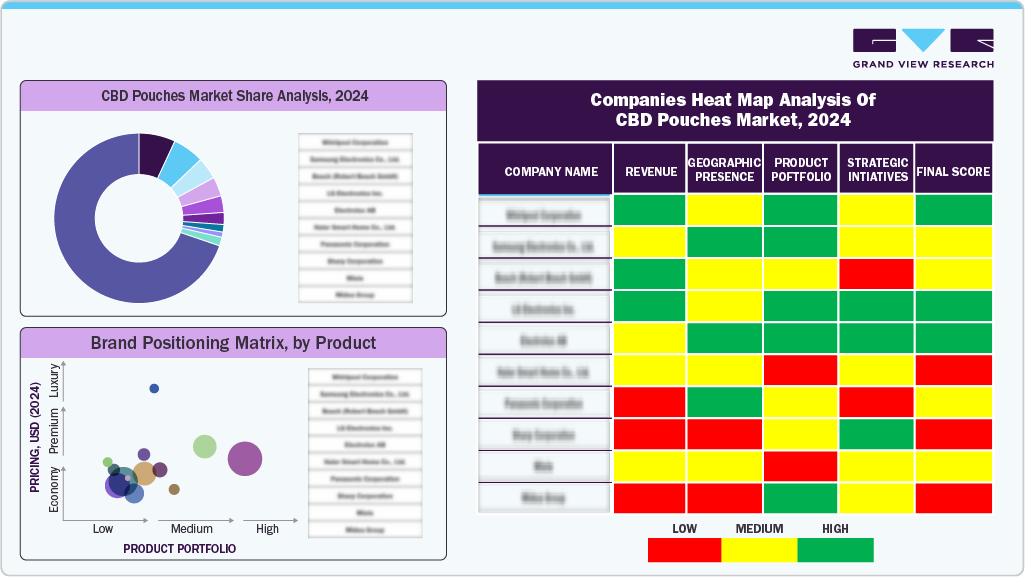

Key CBD Pouches Company Insights

Leading players in the CBD pouches market include Cannadips, Jake's Mint Chew, Vibe CBD+CBG, FlowBlend, Chill.com, Metolius Hemp Company, Canndid, Chillbar, V&YOU, and Nicopods ehf. The global market is highly competitive, with manufacturers focused on expanding the availability of CBD pouches across both retail and online platforms. These companies are also actively developing innovative delivery systems and technologies to improve the effectiveness and bioavailability of CBD. Additionally, the market is seeing the entry of major tobacco firms, bringing substantial resources and industry experience. As consumer acceptance of CBD pouches grows and demand for convenient, discreet formats continues to rise, the market is poised for significant expansion in the coming years.

Key CBD Pouches Companies:

The following are the leading companies in the CBD pouches market. These companies collectively hold the largest market share and dictate industry trends.

- Cannadips

- Jake's Mint Chew

- Vibe CBD+CBG

- FlowBlend

- Chill.com

- Metolius Hemp Company

- Canndid

- Chillbar

- Comp9

- V&YOU

- Nicopods ehf.

Recent Developments

-

In November 2024, Cannadips partnered with Dark Horse Cannabis to bring their smokeless cannabis pouches to Arkansas, marking the brand’s first cannabis-specific product rollout outside California. The move included various flavors and formulations designed for discreet, fast-acting consumption via Arkansas dispensaries.

-

In February 2023, Cannadips Europe, a SpectrumLeaf brand known for its premium CBD snus products, collaborated with Haypp Group to launch the innovative Cannadips Terpene Pouch Collection. Available on Haypp’s e-commerce platform snusbolaget.se, these pouches harness the natural properties of plant-derived terpenes in a convenient, easy-to-use format. Completely free from tobacco, nicotine, CBD, and THC, the collection is designed as a healthier alternative for snus users seeking a cleaner, plant-based experience.

-

In January 2023, Cannadips Europe partnered with Snushus AG to launch the All Natural CBD snus pouches, including five flavors in the Core Collection, 10 flavors in the Limited Edition, 3 in the CBG+Caffeine Line, and 4 in the Terpene Range (no CBD) in Switzerland. Through this partnership, the company is selling all five flavors of the Core Collection online at both Snushus.ch (and Snushus.eu) and in all Snushus stores across Switzerland. This strategy helped the company to expand its market share in Switzerland and Europe.

CBD Pouches Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 110.19 million

Revenue Forecast in 2033

USD 478.41 million

Growth Rate

CAGR of 20.1% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Report updated

July 2025

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Content, type, distribution channel, and region

Regional scope

North America, Europe, Asia Pacific, Central and South America, Middle East and Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Spain, Sweden, Denmark, Norway, Netherlands, Japan, Australia, Thailand, and Brazil

Key companies profiled

Cannadips; Jake's Mint Chew; Vibe CBD+CBG; FlowBlend; Chill.com; Metolius Hemp Company; Canndid; Chillbar; Comp9; V&YOU; Nicopods ehf.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global CBD Pouches Market Report Segmentation

This report forecasts revenue growth at regional levels and provides an analysis of the latest trends and opportunities in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the CBD pouches market report based on content, type, distribution channel, and region:

-

Content Outlook (Revenue, USD Million, 2021 - 2033)

-

Up to 10 mg

-

10 mg-20 mg

-

Others

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Flavored

-

Unflavored

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Sweden

-

Denmark

-

Norway

-

Netherlands

-

-

Asia Pacific

-

Japan

-

Australia

-

Thailand

-

-

Central and South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global CBD pouches market was estimated at USD 84.03 million in 2024 and is expected to reach USD 110.19 million in 2025.

b. The CBD pouches market is expected to grow at a compound annual growth rate of 20.1% from 2025 to 2030 to reach USD 478.41 million by 2030.

b. North America dominated the CBD pouches market with a share of 58.57% in 2024. This whopping market share is mainly attributed to the high demand for CBD pouches owing to increasing consumer awareness of the potential health benefits of CBD and the growing popularity of smokeless tobacco alternatives.

b. Some of the key market players in the CBD pouches market are Cannadips; Jake's Mint Chew; Vibe CBD+CBG; FlowBlend; Chill.com; Metolius Hemp Company; Canndid; Chillbar; V&YOU; and Nicopods ehf.

b. Key factors that are driving the CBD pouches market growth include traction among people as they are safer alternatives to smoking and numerous health benefits associated with it. Moreover, the introduction of new flavors, formulations, and dosages by manufacturers in response to changing consumer preferences is expected to further drive the market over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.