- Home

- »

- Biotechnology

- »

-

Cell Culture Media Storage Containers Market Report, 2030GVR Report cover

![Cell Culture Media Storage Containers Market Size, Share & Trends Report]()

Cell Culture Media Storage Containers Market Size, Share & Trends Analysis Report By Product (Storage Bags, Storage Bottles), By Application (Biopharmaceutical Production, Diagnostics), By End-use (CROs & CMOs), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-134-4

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

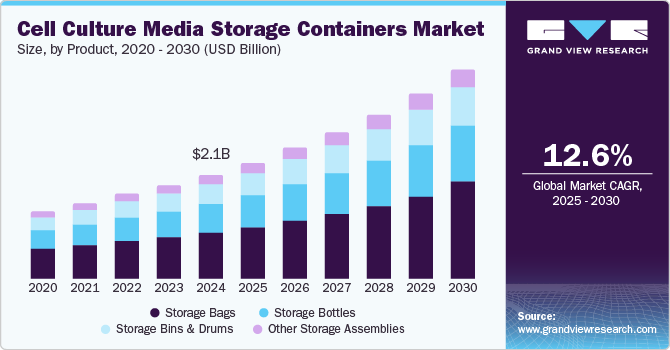

The global cell culture media storage containers market size was estimated at USD 2.11 billion in 2024 and is projected to witness a CAGR of 12.55% from 2025 to 2030. Major growth factors for the global cell culture media storage containers industry include rising demand for biologics, cell-based therapies, and increased incidence of chronic diseases. Furthermore, the biopharmaceutical market is experiencing an increased need for media storage solutions for applications such as decontamination, large-scale purification, and cell storage.

The biopharmaceutical industry depends heavily on cell culture techniques for producing vaccines, monoclonal antibodies, and recombinant proteins. These processes require large cell culture media storage to support production. As the biopharmaceutical sector grows, the demand for cell culture media containers is also expected to increase. Moreover, the increasing R&D projects and activities in the biopharmaceutical market are anticipated to drive the demand for the storage containers.

For instance, in October 2024, The UK government introduced a new funding initiative called the Life Sciences Innovative Manufacturing Fund (LSIMF) as part of its recent budget announcement. This fund will allocate up to USD 675 million (approximately Euro 520 million) in capital grants to enhance investments in the manufacturing sector for drugs and medical technologies. The initiative is designed to bolster the country's health resilience and leverage its renowned research and development capabilities in the life sciences sector. Such initiatives for R&D activities have fueled the growth of the cell culture media storage containers industry.

The COVID-19 outbreak boosted the demand for cell culture medium storage containers, as companies in the pharmaceutical and healthcare sectors emphasized high-quality and secure packaging and storage solutions. Furthermore, increased research conducted during the pandemic to produce vaccines and drugs to combat the pandemic drove the demand for cell culture media storage containers. Cytiva and other biopharmaceutical manufacturers are currently navigating significant challenges related to supply and demand dynamics. A major issue for those engaged in process development (PD) and manufacturing is the insufficient capacity among suppliers, which complicates the timely and complete procurement of necessary materials. This situation can result in manufacturing interruptions, delaying timelines, or causing unexpected downtime. The ability to source materials is crucial in preventing supply disruptions, delays, and shortages.

Single-use components, particularly single-use bags used for storing liquid cell culture media and buffers, have been notably impacted by these supply chain challenges. For instance, Cytiva experienced firsthand during the COVID-19 pandemic how dependence on third-party suppliers can adversely affect PD and manufacturing processes, leading to longer wait times for essential raw materials. In response to these challenges, during the COVID-19 pandemic, Cytiva established its production line for single-use bags at its HyClone facility in Logan, Utah.

Furthermore, the widespread availability of technologically improved containers and an increased emphasis on manufacturers building novel containers are expected to fuel the cell culture media storage containers industry. Among the key developments are improved materials, optimized closures, and expanded features for simplicity, sterility, and scalability. Containers of various shapes, sizes, features, and colors are available from market leaders. For instance, Corning Inc. provides break-resistant, leak-proof, & freezer-safe bottles in various sizes. VWR International also offers polycarbonate and polystyrene bottles in various shapes, including square, octagonal, and circular. Container design improvements by industry participants are projected to boost market expansion. For instance, in October 2022, Single Use Support GmbH, an Austrian solution provider, expanded its product offering with new single-use bioprocess bags using IRIS. The single-use bags are employed in important process phases such as drug ingredient preservation, filling and draining, freezing and thawing, storage, and transportation.

Increased R&D activities in the biopharmaceutical industries are projected to boost market expansion. According the data provided by the India Brand Equity Foundation, there were around 2700 biotech companies in India in 2020, with a projected increase to 10,000 by 2024. In addition, Seed Scientific reported in 2021 that nearly 6,600 biotech companies are involved in research and development in the US. Cell culture media bags promote the growth of target cells by supplying the necessary nutrients to develop pharmaceutical products. As a result, the growing need for biopharmaceuticals propels the market of cell culture media storage containers industry.

Product Insights

The storage bags segment held the largest market share of 41.58% in 2024 and is also expected to be the fastest-growing segment during the forecast period. The increased demand is attributed to increased research & development initiatives worldwide to combat developing diseases such as cancer. Furthermore, cell culture medium bags cut production costs by reducing sterilizing and cleaning processes. The advantages of cell culture medium storage bags, such as their lightweight, high barrier, and reduced contamination, make them ideal for the biopharmaceutical business. Hence, propelling the segment growth. Moreover, numerous pharmaceutical & biotechnology companies have invested heavily in R&D to develop novel vaccines, treatments, and testing kits. As a result, the need for cell culture media storage bags in research applications has increased significantly, providing the market with enormous growth opportunities.

The storage bottles segment is expected to grow significantly during the forecast period. Media bottles, particularly glass and rigid plastic, are durable and resistant to punctures and leaks. This reduces the risk of media contamination compared to bags, which may be more prone to damage. Moreover, bottles maintain shape and structure, ensuring consistent storage conditions and preventing media spills or leaks during handling or transportation.

Application Insights

The biopharmaceutical production segment held the largest market share of 51.20% in 2024. Cell culture media storage containers are utilized in biopharmaceutical research at all stages of the drug development process, from discovery to manufacturing and production. The growing interest in biologics has resulted in significant growth in the global industry, as scientists require media to assure the viability of cells. Furthermore, increased demand for vaccines for multiple illnesses is propelling the market forward.

The tissue engineering and regenerative medicine segment will witness the highest CAGR from 2025 to 2030. Growing adoption rates of tissue engineering in patient treatment, such as implantation of organs, and increasing awareness related to personalized medicine contribute to market growth. In addition, rising awareness about regenerative medicines and cell & gene therapy in which tissue or organ is safely grown in laboratory conditions with the help of cell culture techniques. Thus, storage containers will be required to avoid contamination and further boost the cell culture media storage containers industry growth.

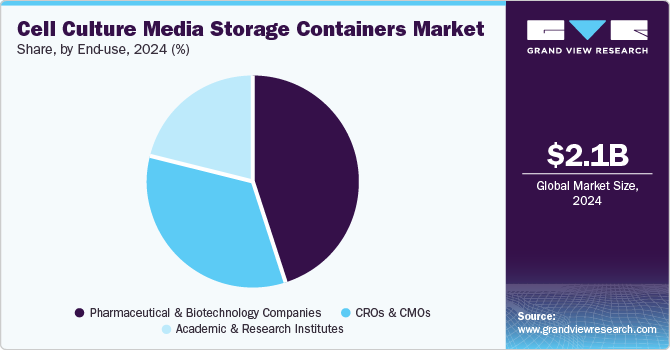

End-use Insights

The pharmaceutical & biotechnology companies segment held the largest market share of 44.55% in 2024. The biopharmaceutical industry actively uses cell culture techniques to produce monoclonal antibodies, vaccines, and recombinant proteins. These techniques necessitate vast amounts of cell culture media storage to enable manufacturing. Hence, the need for cell culture media containers will rise as the biopharmaceutical industry expands. Furthermore, rising R&D initiatives and activities in the biopharmaceutical sector are expected to fuel demand for storage containers.

The CROs & CMOs segment will witness the highest CAGR from 2025 to 2030. The rise in demand is due to increased biologics, recent pandemic occurrences that have resulted in new treatments, the demand for personalized medications and orphan drugs, and the desire for innovative technology. Growth is also expected to be driven by factors such as increasing outsourcing trends, globalization of clinical trials, & demand for CROs & CMOs to conduct clinical trials. Hence, propels the cell culture media storage containers industry growth.

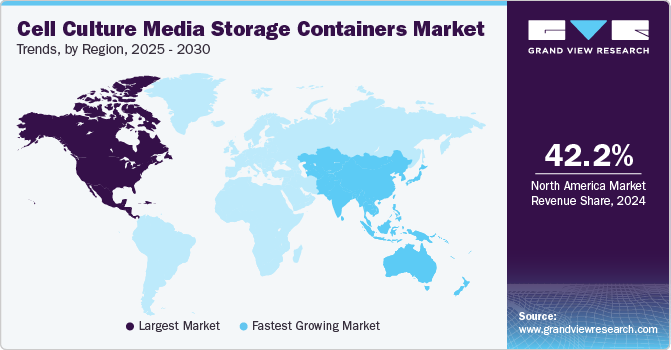

Regional Insights

North America cell culture media storage containers market held the largest market share of 42.18% of the global cell culture media storage containers market in 2024. The large share is owing to the increasing adoption rates of cell culture techniques due to their advantages, such as cost-effectiveness and high productivity. The presence of sophisticated healthcare infrastructure, growing demand for biologics, and increasing awareness of storage containers coupled with relatively higher healthcare expenditure levels in the region contribute to the market growth.

U.S. Cell Culture Media Storage Containers Market Trends

The U.S. leads the market due to the continuously increasing use of cell culture technology. In addition, the presence of major players in the market is a key factor facilitating ease of access to cell culture media storage products. Major players in the market operating in the U.S. include Thermo Fisher Scientific, Cytiva, and Merck.

Europe Cell Culture Media Storage Containers Market Trends

Increased regulatory support by the government for biologics & vaccines to meet the growing demand is projected to fuel the cell culture media storage containers market growth in the European region. Moreover, key players are now adopting strategies to address and minimize future challenges within the region.

The UK's cell culture media storage containers market held a significant share in 2024. The presence of organizations, such as Cancer Research UK, provides scope for developing new cell culture media by investigating custom cell growth requirements. Research grants in the country facilitate the uptake of cell culture products. Hence, driving the market for media storage containers.

The cell culture media storage containers market in Germany is anticipated to grow significantly over the forecast period. Germany is the largest producer of biopharmaceuticals approved in the EU. Increased production of APIs for monoclonal antibodies and biologics creates a lucrative market for cell culture media storage container offerings.

Asia Pacific Cell Culture Media Storage Containers Market Trends

Asia Pacific cell culture media storage containers market is expected to experience the fastest CAGR of 13.85% from 2025 to 2030. Key factors such as the presence of untapped opportunities, economic development, improving healthcare infrastructure, and favorable initiatives by the government and manufacturers in biopharmaceutical and biotechnology sector are some factors accounting for this rapid growth. Furthermore, the increasing median age of the population and rising production of vaccines, drugs, and others contribute to the overall growth of the global industry.

The cell culture media storage containers market in China is anticipated to witness lucrative growth over the forecast period. The market in China is highly saturated with local players, although the low cost of production drives global investments in the nation for manufacturing.

Japan cell culture media storage containers marketis witnessing rapid growth over the forecast period. Japan is anticipated to account for a significant share of the Asia Pacific market, as it has one of the region's most developed pharmaceutical and biotechnology sectors. Moreover, the high prevalence of chronic diseases and the COVID-19 pandemic have led to increased R&D activities for developing novel therapies and vaccines, thus creating high demand for cell culture media storage solutions.

MEA Cell Culture Media Storage Containers Market Trends

Middle East and African countries have a very low global market share due to a lack of awareness, infrastructure, and skilled personnel in these regions. Saudi Arabia’s market is anticipated to grow significantly over the forecast period owing to the increasing adoption of cell culture technology and ongoing economic development.

Saudi Arabia's cell culture media storage containers market is expected to grow over the forecast period. The growth of Saudi Arabia's cell culture media storage containers market can primarily be attributed to various initiatives undertaken by the government to expand the biotechnology sector in the country. Organizations such as the King Abdullah University of Science and Technology (KAUST) facilitate biotechnology R&D activities in Saudi Arabia

The cell culture media storage containers market in Dubai is anticipated to grow moderately over the forecast period. The rising adoption of stem cell therapies in the country is the major factor driving the growth of the cell culture media storage containers industry.

Key Cell Culture Media Storage Containers Company Insights

The continuous demand for cell culture media storage containers by multiple applications has created numerous market opportunities for major players to capitalize on. They are implementing various strategies, including partnerships through mergers and acquisitions, geographical expansion, and strategic collaborations to expand their market presence.

Key Cell Culture Media Storage Containers Companies:

The following are the leading companies in the cell culture media storage containers market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Danaher

- Sartorius AG

- Greiner Bio-One International GmbH

- Corning Incorporated

- VWR International, LLC.

- Saint Gobain

- Diagnocine

- HiMedia Laboratories

View a comprehensive list of companies in the Cell Culture Media Storage Containers Market

Recent Developments

-

In July 2024, Merck, a prominent science and technology company, commenced commercial production at its first GMP-compliant manufacturing line for cell culture media (CCM) in China. This initiative is backed by an investment of approximately USD 7.3 million (€6.6 million) at the Life Science Center in Nantong, a key industrial center in the Yangtze River Delta region. This investment aims to meet the increasing local demand for high-quality custom CCM essential for biopharmaceuticals, vaccines, and innovative therapeutics.

-

In June 2024, FUJIFILM Diosynth Biotechnologies announced a $1.2 billion expansion of its cell culture contract manufacturing site in Holly Springs, North Carolina. The expansion will include additional cell culture bioreactors and manufacturing space.

-

In July 2023, Merck announced expanding its facilities in Lenexa, Kansas, USA, adding 9,100 square meters of lab space and cell culture medium manufacturing capability. Investing in the region is part of the strategy to diversify and grow our supply chain to meet current & future demand for cell culture medium. Hence, it will increase the storage container requirement and drive the growth of the cell culture media storage containers industry.

-

In April 2023, Merck KGaA, the company, launched Ultimus, a single-use process container film, to provide superior strength & leak resistance in single-use assemblies.

Global Cell Culture Media Storage Containers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.35 billion

Revenue forecast in 2030

USD 4.26 billion

Growth rate

CAGR of 12.55% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico, Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; Merck KGaA; Danaher; Sartorius AG; Greiner Bio-One International GmbH; Corning Incorporated; VWR International, LLC.; Saint Gobain; Diagnocine; HiMedia Laboratories

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Cell Culture Media Storage Containers Market Segmentation

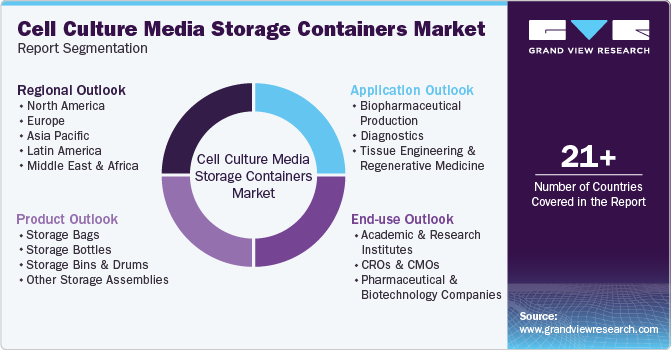

This report forecasts global, regional, and country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global cell culture media storage containers market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Storage Bags

-

Storage Bottles

-

Storage Bins & Drums

-

Other Storage Assemblies

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Biopharmaceutical Production

-

Diagnostics

-

Tissue Engineering and Regenerative Medicine

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic & Research Institutes

-

CROs & CMOs

-

Pharmaceutical & Biotechnology Companies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cell culture media storage containers market size was estimated at USD 2.11 billion in 2024 and is expected to reach USD 2.36 billion in 2025.

b. The global cell culture media storage containers market is expected to grow at a compound annual growth rate of 12.55% from 2025 to 2030 to reach USD 4.26 billion by 2030.

b. By product, the storage bags segment accounted for the largest share of 41.58% in 2024. Due to the increasing demand and frequent use in the storage of cell culture media and reduced contamination, the segment growth is boosted.

b. Some key players operating in the cell culture media storage containers market include Thermo Fisher Scientific Inc., Merck KGaA, Danaher, Sartorius AG, Greiner Bio-One International GmbH, Corning Incorporated, VWR International, LLC., Saint Gobain, Diagnocine, HiMedia Laboratories among others.

b. Major growth factors for the global cell culture media storage containers market include rising demand for biologics along with cell-based therapies and an increase in chronic diseases. Furthermore, the biopharmaceutical market is experiencing an increased need for media storage solutions for applications such as decontamination, large-scale purification, cell storage, etc. Thus propelling the market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."