- Home

- »

- Medical Devices

- »

-

Cell & Gene Therapy Contract Research Organizations Market Report, 2033GVR Report cover

![Cell & Gene Therapy Contract Research Organizations Market Size, Share & Trends Report]()

Cell & Gene Therapy Contract Research Organizations Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Drug Discovery, Preclinical, Clinical), By Service (Regulatory Strategy, Clinical Monitoring), By Indication, By Modality, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-672-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cell & Gene Therapy Contract Research Organizations Market Summary

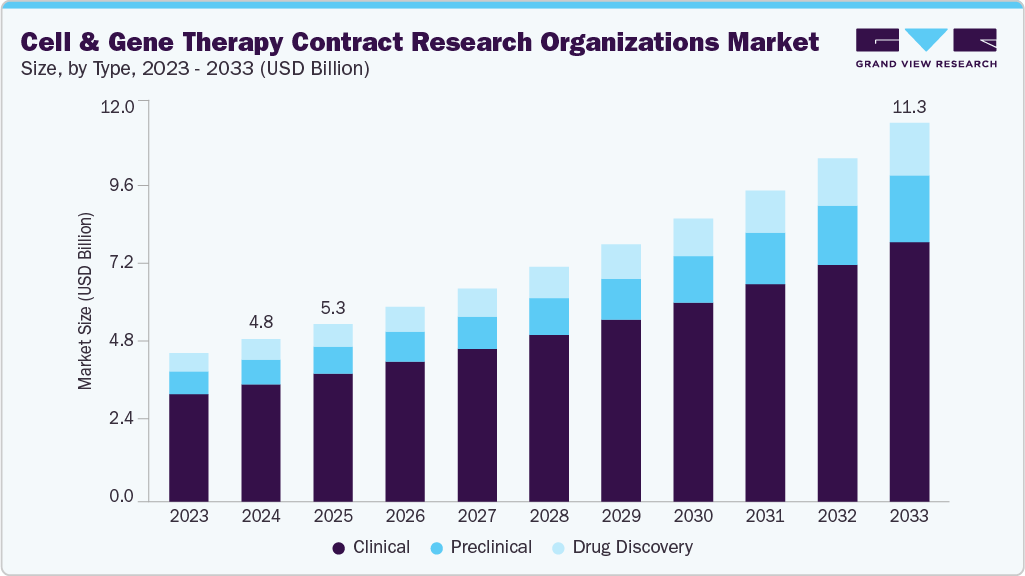

The global cell & gene therapy contract research organizations market size was estimated at USD 4.84 billion in 2024 and is projected to reach USD 11.26 million by 2033, growing at a CAGR of 9.89% from 2025 to 2033. The growth is due to the rising clinical trial volume in CGT, increased outsourcing by biotech firms, regulatory complexity, and global expansion, among others.

Key Market Trends & Insights

- The North America cell & gene therapy contract research organizations market held the largest revenue share of 50.90% in 2024.

- The cell & gene therapy contract research organizations industry in the U.S. is expected to grow significantly over the forecast period.

- By type, the clinical segment led the market with the largest revenue share of 72.34% in 2024.

- Based on phase, the phase III segment led the market with the largest revenue share in 2024.

- By service, the clinical monitoring segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.84 Billion

- 2033 Projected Market Size: USD 11.26 Billion

- CAGR (2025-2033): 9.89%

- North America: Largest market in 2024

- Asia-Pacific: Fastest growing market

The growth of the cell & gene therapy contract research organizations industry is fueled by the rapid expansion of clinical pipelines, especially in oncology, hematologic, and rare genetic disorders. Sponsors are increasingly turning to CROs due to the high complexity, regulatory scrutiny, and cost intensity of CGT trials. These therapies demand specialized logistics, personalized manufacturing coordination, and sophisticated data handling capabilities that most small to mid-sized biotech firms prefer to outsource. Moreover, the global increase in Investigational New Drug (IND) applications for ATMPs has heightened demand for regulatory support, trial design, and long-term safety monitoring services.

Advancements in gene-editing platforms such as CRISPR and viral and non-viral delivery technologies are transforming CGT development, thereby intensifying the need for expert-led preclinical and clinical research support. CROs offering integrated solutions across discovery, preclinical validation, vector analytics, and GMP compliance are gaining a competitive edge. Additionally, increased funding, strategic partnerships, and industry consolidation have enhanced the CRO ecosystem’s capacity to scale with the innovation surge. This ecosystem shift has positioned specialized CROs as essential partners in accelerating CGT approvals and global trial execution.

Opportunity Analysis

The Cell & Gene Therapy (CGT) CRO market presents a high-growth opportunity driven by the surge in early-phase research, regulatory complexity, and the sharp rise in advanced clinical therapy trials. Most biotech companies developing CGT candidates operate with limited in-house infrastructure and depend on specialized CROs for protocol design, patient recruitment, GMP-grade sample handling, and regulatory submissions.

This shift has created demand for CROs with technical capabilities in viral vector analytics, immunogenicity, and long-term patient monitoring. The decentralization of trials, increasing cell therapy manufacturing in Asia-Pacific, and the FDA's accelerated approval pathways for rare diseases are intensifying the outsourcing trend.

Technological Advancements

Rapid technological advancements in cell and gene therapy have significantly expanded the capabilities and complexity of clinical trials, creating substantial opportunities for specialized CROs. Innovations such as CRISPR-based gene editing, novel viral vectors, and next-generation sequencing require CROs to continuously upgrade their platforms and expertise to support precise, safe, and efficient therapy development. Automated cell processing technologies and digital monitoring tools enhance trial accuracy and patient adherence, enabling real-time data collection and analysis.

The integration of artificial intelligence and machine learning into trial design and biomarker discovery further optimizes clinical endpoints and accelerates decision-making. CROs that invest in these cutting-edge technologies and demonstrate strong regulatory compliance stand to attract more partnerships with sponsors seeking to reduce development timelines and costs while ensuring product quality and patient safety.

Pricing Analysis

The pricing model for the cell & gene therapy contract research organizations market is typically structured around a combination of fixed fees and variable costs tied to the complexity and scope of services provided. Key cost drivers include patient enrolment numbers, trial phase, manufacturing scale, and regulatory requirements. Early-stage services such as preclinical research and biomarker development usually incur substantial fixed costs due to specialized technology and expertise. At the same time, clinical trial management fees often depend on per-patient charges and site management complexity. Manufacturing of cell and gene therapy products commands premium pricing because of stringent Good Manufacturing Practice (GMP) standards and personalized batch production.

Service Category

Estimated Pricing Range (USD)

Description

Preclinical Research

USD 200,000 + - USD 1,000,000+

Early-stage safety, toxicology, and efficacy studies before human trials

Clinical Trial Management

USD 2,000 - USD 5,000 per patient enrolled

Monitoring, site management, and patient recruitment for Phase I-III trials

Cell Manufacturing Services

USD 50,000 - USD 500,000+ per batch

Production of clinical-grade cell and gene therapy products

Biomarker Development

USD 100,000 - USD 500,000+

Development and validation of genomic/proteomic biomarkers

Data Management & Analytics

USD 50,000 - USD 300,000+

Data collection, integration, and advanced analytics

Regulatory Consulting

USD 20,000 - USD 150,000+

Guidance on compliance, submissions, and approvals

Type Insights

Based on type, the cell & gene therapy CRO industry is classified into drug discovery, preclinical, and clinical. The clinical segment accounted for the largest revenue share in the cell and gene therapy CRO industry of 72.34% in 2024. The growth is due tothe increasing number of clinical trials involving advanced therapies, particularly in Phase I and II, where safety and efficacy assessments are critical. Cell and gene therapies require highly specialized trial designs, stringent regulatory oversight, and intensive patient monitoring, all of which drive demand for outsourcing to experienced CROs.

The preclinical segment is anticipated to grow at the fastest CAGR during the forecast period. The segment growth is driven due to the rising demand for early-stage safety and efficacy evaluations of complex cell and gene therapy candidates before human trials. These therapies often require tailored in vivo and in vitro studies, including immunogenicity testing, biodistribution analysis, and vector safety profiling, which demand specialized CRO expertise.

Service Insights

Based on service, the cell & gene therapy CRO market is segregated into project & clinical trial management, regulatory strategy, data management & medical writing, clinical monitoring, quality management / GMP compliance, biostatistics & safety monitoring, patient & site recruitment, technology transfer, and others. The clinical monitoring segment held the largest market share in 2024 due to the critical need for real-time oversight and quality assurance in complex cell and gene therapy trials. These therapies involve sensitive biological materials, strict dosing protocols, and intensive patient follow-up, making accurate and continuous monitoring essential to ensure patient safety and protocol adherence. Clinical monitoring services support compliance with Good Clinical Practice (GCP) and regulatory guidelines by detecting deviations, managing adverse events, and verifying data integrity across multiple trial sites.

The regulatory strategy segment is anticipated to grow at the fastest CAGR over the forecast period. The growth of the segment is due to the increasing complexity of global regulatory pathways for cell and gene therapies. These therapies often involve novel mechanisms, such as genome editing or autologous cell modification, which require customized regulatory strategies to meet evolving standards from agencies like the FDA, EMA, and PMDA.

Indication Insights

Based on indication, the cell & gene therapy contract research organizations industry is segregated into oncology, CNS Disorders, infectious diseases, immunological disorders, cardiovascular diseases, respiratory diseases, diabetes, ophthalmology, pain management, and others. The oncology segment held the largest market share in 2024 due to the high concentration of cell and gene therapy clinical trials targeting various cancers, particularly hematologic malignancies such as leukemia, lymphoma, and multiple myeloma. Therapies like CAR-T cells and gene-modified immune cells have demonstrated groundbreaking results in treating cancers resistant to conventional treatments, prompting a surge in R&D investment and trial activity.

The CNS disorders segment is anticipated to grow at the fastest CAGR over the forecast period. The growth is due to the rising focus on gene and cell-based therapies for previously untreatable or poorly managed neurological conditions such as Parkinson’s disease, Alzheimer’s disease, amyotrophic lateral sclerosis (ALS), and rare inherited neurodegenerative disorders. Traditional treatment options for these disorders often offer limited efficacy and fail to address the underlying causes, creating a strong incentive for the development of regenerative and gene-modifying therapies.

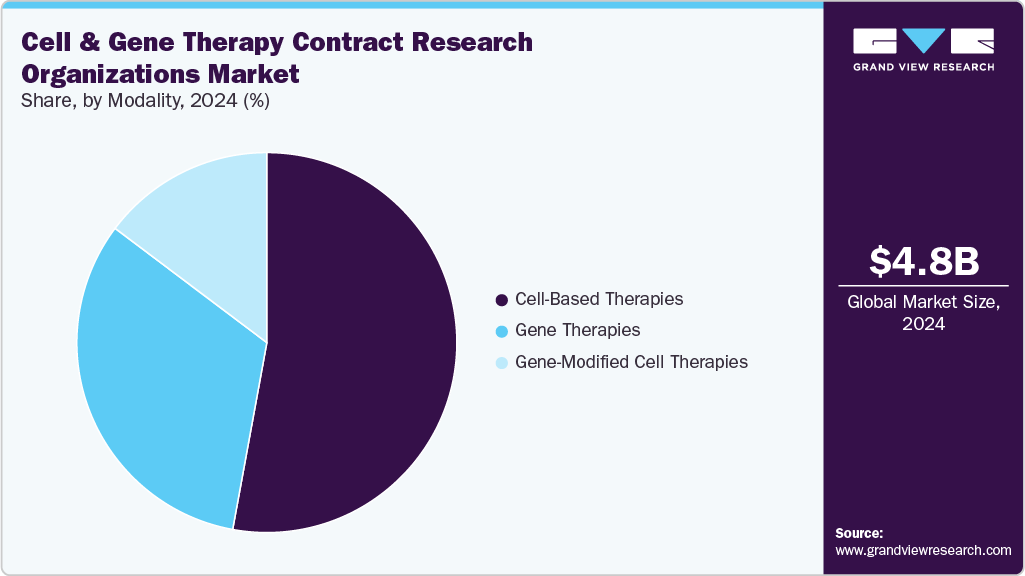

Modality Insights

Based on modality, the cell & gene therapy contract research organizations market is segregated into cell-based therapies, gene therapies, and gene-modified cell therapies. The cell-based therapies segment held the largest market share in 2024 due to its widespread clinical adoption, established manufacturing protocols, and demonstrated therapeutic success, particularly in oncology and regenerative medicine. These therapies, which include autologous and allogeneic stem cell treatments, have seen accelerated development owing to their ability to repair or replace damaged tissues and modulate immune responses in conditions such as cancer, autoimmune diseases, and musculoskeletal disorders.

In addition, the gene therapies segment is anticipated to witness the fastest CAGR growth during the forecast period. This growth can be attributed to the increasing number of gene therapy candidates entering clinical pipelines, driven by advances in gene editing tools such as CRISPR, AAV-based vectors, and lipid nanoparticle delivery systems. Gene therapies offer the potential for curative treatment of a wide range of genetic, metabolic, and rare disorders by directly addressing the root cause at the molecular level.

Regional Insights

North America accounted for the largest revenue share in 2024, due to its well-established biopharmaceutical ecosystem, significant R&D investments, and presence of leading biotech companies and research institutions. The U.S., as the largest contributor, benefits from supportive regulatory frameworks like the FDA’s regenerative medicine advanced therapy (RMAT) designation, which accelerates development timelines.

U.S. Cell & Gene Therapy Contract Research Organizations Market Trends

The cell & gene therapy contract research organizations industry in the U.S. held the largest share in 2024. The country’s growth is due to favorable intellectual property laws and robust venture capital funding accelerate pipeline growth. Regulatory initiatives, including streamlined IND and BLA pathways, encourage expedited clinical development.

Europe Cell & Gene Therapy Contract Research Organizations Market Trends

The cell & gene therapy contract research organizations industry in Europe is expected to grow significantly due to the supported regulatory environment under the European Medicines Agency (EMA) and strong government initiatives promoting advanced therapy medicinal products (ATMPs). Countries like Germany, the UK, and France invest heavily in translational research and clinical trial infrastructure.

The cell & gene therapy contract research organizations market in Germany held the largest share in 2024, owing to the country's strong regulatory framework that supports ATMP development and manufacturing. Its advanced healthcare system and patient registry networks facilitate efficient clinical trial recruitment and monitoring.

The UK cell & gene therapy contract research organizations market’s growth is driven by government initiatives like the Accelerated Access Collaborative and NHS innovation programs that support rapid adoption of cell and gene therapies. The presence of world-renowned research institutions and a vibrant biotech startup ecosystem fosters pipeline growth.

Asia Pacific Cell & Gene Therapy Contract Research Organizations Market Trends

Asia Pacific is expected to be the fastest-growing market during the forecast period, due toincreasing R&D investments, expanding healthcare infrastructure, and supportive government policies across countries like China, Japan, and India. Rising disease burden, improving clinical trial regulations, and cost advantages attract global sponsors to outsource development activities.

The cell & gene therapy contract research organizations market in China held the largest share in 2024. The growth is due to substantial government funding, including national plans targeting biotech innovation and regenerative medicine. Regulatory reforms by the National Medical Products Administration (NMPA) have accelerated clinical trial approvals and streamlined gene and cell therapy development.

The Japan cell & gene therapy contract research organizations market is expected to grow over the forecast period. The country’s advanced healthcare system, high patient standards, and focus on rare and genetic diseases support a growing pipeline of cell and gene therapies. Collaborative efforts between academia, industry, and government enhance translational research, while CROs benefit from increasing outsourcing trends to manage complex clinical trials and manufacturing processes.

The cell & gene therapy contract research organizations market in India is anticipated to grow at a lucrative CAGR over the forecast period. This can be attributed to increasing biopharma investments, expanding clinical research infrastructure, and improving regulatory frameworks tailored for advanced therapies. Cost-effective clinical trial execution, large patient pools, and growing expertise in cell and gene therapy research make India an attractive outsourcing destination.

Key Cell & Gene Therapy Contract Research Organizations Company Insights

Several key players are acquiring various strategic initiatives to strengthen their market position, offering diverse services to customers. The prominent strategies adopted by companies are service launches, mergers & acquisitions/joint ventures, mergers, partnerships & agreements, expansions, and others to increase market presence & revenue and gain a competitive edge, driving the market growth.

Key Cell & Gene Therapy Contract Research Organizations Companies:

The following are the leading companies in the cell & gene therapy contract research organizations market. These companies collectively hold the largest market share and dictate industry trends.

- Altasciences

- Allucent

- Labcorp

- Linical

- Medpace

- Thermo Fisher Scientific Inc.

- Precision Medicine Group, LLC.

- QPS Holdings

- Syneos Health

- ICON plc

Recent Developments

-

In June 2024, QPS announced the launch of new laboratory services to support clinical trials and cell therapy development, enhancing its capabilities in the CRO market. This expansion significantly broadens QPS’s comprehensive full-service global CRO portfolio, strengthening its ability to support advanced cell and gene therapy development.

-

In October 2024, Thermo Fisher Scientific, Inc. announced the launch of Accelerator Drug Development, its comprehensive 360° suite of contract development and manufacturing (CDMO) and contract research organization (CRO) drug development solutions. This new offering was unveiled ahead of CPHI Milan 2024, scheduled to take place in Milan, Italy, from October 8-10, 2024.

Cell & Gene Therapy Contract Research Organizations Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.29 billion

Revenue forecast in 2033

USD 11.26 billion

Growth rate

CAGR of 9.89% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, service, indication, modality, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; Kuwait; UAE

Key companies profiled

Altasciences; Allucent; Labcorp; Linical; Medpace; Thermo Fisher Scientific Inc.; Precision Medicine Group, LLC.; QPS Holdings; Syneos Health; ICON plc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cell & Gene Therapy Contract Research Organizations Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global cell & gene therapy contract research organizations market report based on type, service, indication, modality, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Drug Discovery

-

Target Validation

-

Lead Identification

-

Lead Optimization

-

-

Preclinical

-

Clinical

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Project & Clinical Trial Management

-

Regulatory Strategy

-

Data Management & Medical Writing

-

Clinical Monitoring

-

Quality Management / GMP Compliance

-

Biostatistics & Safety Monitoring

-

Patient & Site Recruitment

-

Technology Transfer

-

Others

-

-

Indication Outlook (Revenue, USD Million, 2021 - 2033)

-

Oncology

-

CNS Disorders

-

Infectious Diseases

-

Immunological Disorders

-

Cardiovascular Diseases

-

Respiratory Diseases

-

Diabetes

-

Ophthalmology

-

Pain Management

-

Others

-

-

Modality Outlook (Revenue, USD Million, 2021 - 2033)

-

Cell-Based Therapies

-

Gene Therapies

-

Gene-Modified Cell Therapies

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cell & gene therapy contract research organizations market size was estimated at USD 4.84 billion in 2024 and is expected to reach USD 5.29 billion in 2025.

b. The global cell & gene therapy contract research organizations market is expected to grow at a compound annual growth rate of 9.89% from 2025 to 2033 to reach USD 11.26 billion by 2033.

b. North America dominated the cell & gene therapy contract research organizations market with a share of 50.90% in 2024. This is attributable due to its well-established biopharmaceutical ecosystem, significant R&D investments, and presence of leading biotech companies and research institutions.

b. Some key players operating in the cell & gene therapy contract research organizations market include Altasciences, Allucent, Labcorp, Linical, Medpace, Thermo Fisher Scientific Inc., Precision Medicine Group, LLC., QPS Holdings, Syneos Health, ICON plc

b. Key factors that are driving the market growth include rising clinical trial volume in CGT, increased outsourcing by biotech firms, regulatory complexity and global expansion, among others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.