- Home

- »

- Biotechnology

- »

-

Cell Separation Market Size, Share & Growth Report, 2030GVR Report cover

![Cell Separation Market Size, Share & Trends Report]()

Cell Separation Market Size, Share & Trends Analysis Report By Technique (Surface Marker, Filtration), By Cell Type (Human, Animal), By Application (Cancer Research, Stem Cell Research), By Product, By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-707-0

- Number of Report Pages: 135

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Cell Separation Market Size & Trends

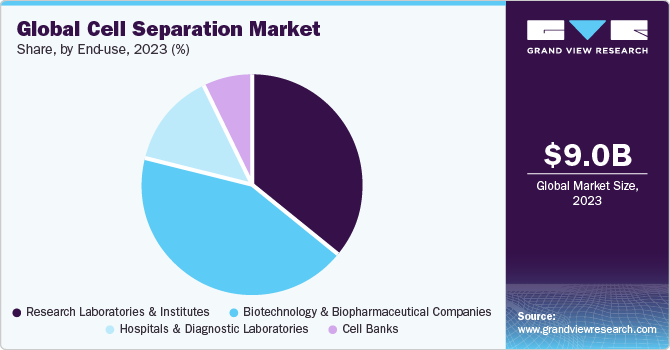

The global cell separation market size was estimated at USD 9.05 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 9.94% from 2024 to 2030. Cell separation plays an important role in various applications including biologics designing and development, therapeutic protein production, in-vitro diagnostics, and other research applications. Rising prevalence of chronic and infectious diseases, such as cancer and COVID-19, along with continuous government initiatives to improve the biotechnology industry are major factors boosting market growth. Product innovation is one of the key growth determinants of the market.

Various companies, such as NanoString Technologies, Levitas Bio, and Bionano Genomics, have undertaken product development strategies and expanded their offering. For instance, in April 2022, Levitas Bio announced the launch of LeviCell EOS System, their next-generation platform for cell separation. The new product enables a targeted selection of viable cells and has a relatively higher throughput than the company's existing products. In addition, the COVID-19 pandemic has provided researchers with an opportunity to investigate and comprehend this novel infectious virus and to discover therapies and diagnostic aids for it.

For instance, in March 2020, the U.S. President signed an emergency spending bill, wherein, USD 3 billion is accounted to be used for the R&D of vaccines, medical treatments, and test kits. This has significantly boosted the demand for cell separation tools in research applications.Cell separation or isolation techniques are widely used to develop and manufacture biologics, such as monoclonal antibodies and recombinant proteins. These products have been gaining traction over the past few decades. With the substantial growth of specialty drugs and personalized medicine, the demand for biologics has been increasing.

According to CAS (A division of the American Chemical Society), it was estimated that biologics will grow to USD 399.5 billion by 2025. Moreover, the funding and current high demand have also motivated startups to enter the cell separation industry, despite the high cost of R&D. StartUs Insights identified and analyzed 957 startups in the field of cell and molecular biology solutions that are contributing to the sector growth. For instance, in October 2023, Veeda Group, in partnership with Atal Incubation Centre - Centre for Cellular and Molecular Biology (AIC - CCMB), newly introduced a half-day symposium in Hyderabad.

The event, titled “Integrated Phase I Trial Solutions for Emerging Biopharmaceuticals: Addressing Development Challenges and Accelerating Timelines,” focused on optimizing processes and overcoming challenges in the development of New Chemical Entities (NCEs) and Large Molecules. Furthermore, the growing prevalence of chronic diseases has increased the demand for diagnostics solutions and research applications. As per the American Cancer Society, in 2023, in the U.S. alone, more than 1.9 million new cases of cancer are projected to be diagnosed. According to the World Health Organization (WHO), 58 million people worldwide are suffering from chronic hepatitis C infectionwith approximately 1.5 million new infections occurring every year.

Instruments and related products can render accurate and effective results and have indispensable applications in the fields of disease diagnosis and scientific research. However, these products have high prices, which could, to some extent, restrict market growth. The techniques also involve a wide range of expenses for equipment, reagents, kits, sera, and services. The experimental setup and the reagents utilized for certain applications are pricey. These factors are anticipated to limit the industry growth to a certain extent during the forecast period.

End-use Insights

Biotechnology and biopharmaceutical companies segment held the largest revenue share of 42.9% in 2023 and is expected to hold its position throughout the study period. These companies are involved in extensive R&D activities for the development of new-generation therapeutics, which require cell separation techniques. Furthermore, increasing research activities by commercial organizations to develop efficient vaccines and therapeutics for COVID-19 are anticipated to create high demand for cell separation solutions, thereby supporting segment growth.

Research laboratories and institutes segment is estimated to display gradual growth of 9.25% from 2024 to 2030 due to the increasing R&D initiatives by research institutions to develop novel therapies in oncology and neuroscience. The growing number of research institutes and laboratories across the globe is also anticipated to be a major driver of segment growth. For instance, in April 2022, Curate Biosciences collaborated with the City of Hope, a research and treatment organization for cancer in the U.S. to assess the company’s product, Curate Cell Processing System, for highly developed cell separation and intends to combine the platform with workflow to produce CAR-T cell immunotherapy.

Regional Insights

North America dominated the global market and held the largest revenue share of 39.8% in 2023. This can be attributed to the presence of well-established pharmaceutical & biotech industriesand the high adoption of technologically advanced solutions in the U.S. Furthermore, extensive research activities by research universities in the field of cell therapies have created a huge demand for cell separation solutions. In addition, the high prevalence of chronic and infectious diseases, including the outbreak of COVID-19, has led to an increase in the demand for cell separation solutions for research and clinical applications.

Asia Pacific is projected to witness the fastest growth of 15.63% from 2024 to 2030 due to thegrowing pharmaceutical and biotechnology industries in emerging economies, such as China and India. In addition, growth in healthcare expenditure and a rise in market penetration of major global players in key Asia Pacific countries are expected to drive region’s growth. Furthermore, continuous stem and gene therapy research initiatives in Japan, China, and South Korea have boosted the demand for cell separation solutions in this region.

Market Dynamics

Stem cell research is anticipated to propel the advancements in the field of cell separation, thus driving market growth. This is attributed to a rising number of R&D activities and demand for personalized medicines & regenerative medicines. For instance, as per the article published in August 2023, researchers utilize a grouping of cytokines, such as hepatocyte growth factor (HGF), oncostatin M (OSM), epidermal growth factor (EGF), fibroblast growth factor-2 (FGF2), and leukemia inhibitory factor (LIF) to guide mesenchymal stem cells toward a hepatocyte-like cell fate.

Additional cytokines, such as Activin A, are essential for directing induced pluripotent stem cells and embryonic stem cells into endoderm cells-the innermost layer in developing embryos. Meanwhile, cytokines, such as interleukin-3 (IL-3), play a crucial role in facilitating stem cell migration. Thus, anticipated to drive industry growth. Increasing investments in stem cell research is also contributing to the industry expansion. For instance, in September 2023, UC Irvine has been designated as one of CIRM's cell and gene therapy manufacturing facilities, which has been granted with USD 2 million.

This funding empowers the campus stem cell center to make strides in advancing regenerative medicine. Similarly, in October 2023, under the Accelerating Cures initiative, the Maryland Stem Cell Research Commission (MSCRC) has been assigned with approximately USD 4 million grands to impel the stem cell innovations within the U.S. This investment is designed to bolster research efforts and drive the development of stem cell companies, with the goal of translating scientific progressions into tangible outcomes. Thus, these investments are projected to propel industry growth.

Product Insights

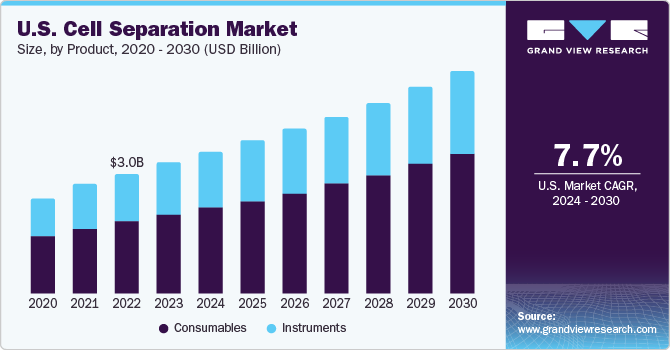

In 2023, consumables segment dominatedthe market and accounted for the largest revenue share of 61.94%. This segment held the largest share due to repeated purchases of consumables. In addition, rising investments in R&D by pharmaceutical and biopharmaceutical companies for the development of advanced biologics including monoclonal antibodies and vaccines are driving the segment growth. Thus, the demand for consumables is also expected to remain high during the forecast period.The instruments segment is estimated to exhibit a lucrative growth rate of 8.41% during the forecast period due to various product advancements.

Technological advancement in instruments provides efficient cell separation in research, diagnostics, and therapeutics application. Thus, the industry for instruments is anticipated to witness significant growth during the forecast period. However, the high cost of instruments is expected to restrain market growth to a certain extent.Companies have initiated building sustainable technology to gain a competitive edge in the market. For instance, in March 2022, Element Biosciences disclosed details regarding upcoming Aviti DNA sequences. The product is anticipated to be a new benchtop instrument since the company stated that it can reduce reagent usage and cut-down costs to approximately USD 7 per Gb.

Cell Type Insights

The animal cells segment held the largest revenue share of 53.7% in 2023. The growing focus of government, private, and healthcare companies on new drug discoveries and development is a key factor driving the segment's growth. Drug discovery and development involve animal cells' use to examine efficacy, the pharmacokinetics of new drug molecules, and preliminary toxicity.Human cell segment is anticipated to exhibit the fastest growth rate of 12.47% from 2024 to 2030.

Rising focus on human & cancer research and varied applications of isolated human cells in biopharmaceutical development, clinical trials, and research are among the major factors contributing to its largest share. Moreover, favorable reimbursement policies pertaining to personalized medicine in developed countries boost the demand for human cell isolation.

Technique Insights

Centrifugation segment dominated the market with a revenue share of 42.3% in 2023. This is due to the extensive usage of this technique by academic institutes, research laboratories, and biotechnology and biopharmaceutical companies. Centrifugation is one of the most important steps in the process. Density gradient centrifugation and differential centrifugation are most used for cell isolation/separation processes.

Surface marker technique is expected to witness the fastest growth of 12.37% from 2024 to 2030. Rising investments in manufacturing infrastructure by companies and product advancements are prime factors supporting the growth of this segment. Manufacturers are engaged in the usage of advanced surface markers for production to ensure a better quality of the end product.

Application Insights

Biomolecule isolation segment dominated the market with a share of 29.5% in 2023. This segment also witnessed strong upward momentum and is anticipated to continue being the fastest-growing segment with a CAGR of 11.44% from 2024 to 2030. Growing focus on the production of biopharmaceuticals, including biosimilar, monoclonal antibodies, and recombinant proteins, is the most predominant factor contributing to its highest share. Also, increasing government funding for new drug development propels market growth.The cancer research segment is projected to exhibit lucrative growth of 10.13% from 2024 to 2030.

Rising investment in cell-based research by companies and research laboratories is a key factor that can be attributed to segment growth. Several public-private organizations are investing heavily in cancer research owing to increasing global incidence of cancer, thus, driving the demand for innovative cell separation solutions.Furthermore, the emergence of precision medicine for cancer treatment is anticipated to enhance market growth. For instance, PerkinElmer is expanding its offering with advanced technology for cancer research. This initiative is anticipated to boost the cancer research segment.

Key Companies & Market Share Insights

Key players are engaged in organic and inorganic growth strategies, such as product-line expansion, collaborations, partnerships, mergers, and acquisitions, to garner high market share. For instance, in May 2023, Akadeum Life Sciences launched a new series of products, namely leukopak human immune cell isolation and T-cell activation/expansion kits for cell therapy R&D. Through this development, the company strengthens the company’s Leukopak cell isolation product lines.

Key Cell Separation Companies:

- Thermo Fisher Scientific, Inc.

- BD

- Danaher

- Terumo Corp.

- STEMCELL Technologies Inc.

- Bio-Rad Laboratories, Inc.

- Merck KGaA

- Agilent Technologies, Inc.

- Corning Inc.

- Akadeum Life Sciences

Cell Separation Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.87 billion

Revenue forecast in 2030

USD 17.43 billion

Growth rate

CAGR of 9.94% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report Update

November 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, cell type, technique, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; BD; Danaher; Terumo Corp.; STEMCELL Technologies Inc.; Bio-Rad Laboratories, Inc.; Merck KgaA; Agilent Technologies, Inc.; Corning Inc.; Akadeum Life Sciences

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cell Separation Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the cell separation market report based on product, cell type, technique, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumables

-

Reagents, Kits, Media, and Sera

-

Beads

-

Disposables

-

-

Instruments

-

Centrifuges

-

Flow Cytometers

-

Filtration Systems

-

Magnetic-activated Cell Separator Systems

-

-

-

Cell Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Human Cells

-

Animal Cells

-

-

Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Centrifugation

-

Surface Marker

-

Filtration

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Biomolecule Isolation

-

Cancer Research

-

Stem Cell Research

-

Tissue Regeneration

-

In Vitro Diagnostics

-

Therapeutics

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Research laboratories and institutes

-

Biotechnology and biopharmaceutical companies

-

Hospitals and diagnostic laboratories

-

Cell banks

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Singapore

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cell separation market size was estimated at USD 9.05 billion in 2023 and is expected to reach USD 9.87 billion in 2024.

b. The global cell separation market is expected to grow at a compound annual growth rate of 9.94% from 2024 to 2030 to reach USD 17.43 billion by 2030.

b. The consumables segment dominated the market for cell separation in 2023 and accounted for the largest revenue share of 61.9%. This is due to repeated purchases of consumables for cell-based research. In addition, rising investments in R&D by pharmaceutical and biopharmaceutical companies for the development of advanced biologics such as monoclonal antibodies and vaccines are also driving the segment growth.

b. Some of the key players in the cell separation market are Thermo Fisher Scientific, Inc., BD, Danaher, Terumo Corporation, STEMCELL Technologies Inc., Bio-Rad Laboratories, Inc., Merck KGaA, Miltenyi Biotec, GenScript, and Corning Incorporated

b. The increasing interest of biopharmaceutical companies and researchers across the world in cancer and stem cell research is a major factor boosting the growth of the cell separation market. Advanced cell isolation products deliver improved separation of biological molecules including proteins, nucleic acids, chromatin, protein complexes for subsequent analysis. These factors are expected to drive the market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."