- Home

- »

- Pharmaceuticals

- »

-

Cell Penetrating Peptide Market Size & Share Report, 2030GVR Report cover

![Cell Penetrating Peptide Market Size, Share & Trends Report]()

Cell Penetrating Peptide Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Protein Derived CPPs, Synthetic CPPs, Chimeric CPPs), By Application (Drug Delivery, Gene Delivery), By End-use (Hospitals & Clinics, CRO), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-167-1

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cell Penetrating Peptide Market Trends

The global cell penetrating peptide market size was estimated at USD 1.47 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 10.08% from 2024 to 2030. Cell penetrating peptides reveal significant versatility, finding applications across various therapeutic areas, including infectious diseases, regenerative medicine, oncology, and neurodegenerative diseases. Moreover, the ongoing R&D activities find novel applications of CPPs, thereby expanding the pipeline of CPP-based applications. For instance, Peptomyc, a key player in the market, is involved in developing a novel CPP targeting the Myc-oncoprotein for cancer treatment.

Pharmaceutical & biotechnology companies and academic research centers are participating in the market as active CPP research and development organizations. For instance, according to the Penn Medicine report, next generation of gene and cell therapies could potentially be powered by an improved gene editing technique developed by the Perelman School of Medicine, University of Pennsylvania. In comparison to existing techniques, the CRISPR gene editing based on unique cell-penetrating peptides promises potential benefits for modifying the cellular genomes.

Improved knowledge of cellular interactions & peptides, growing need for efficient drug delivery, and recent developments in peptide synthesis are the key factors anticipated to drive the cell penetrating peptide (CPPs) market over the forecast period. For instance, in May 2023, Fujitsu introduced the Biodrug Design Accelerator to manage the research process for the discovery of peptide drugs. This platform enables efficient communication among researchers regarding synthesis & testing and improves the overall efficiency of peptide drug development. Such favorable initiatives are expected to support the demand for CPPs over the projected period.

Additionally, cell penetrating peptide therapeutics, with their high specificity and potential for targeted treatments, are gaining attention as a promising avenue for addressing complex diseases. The growing demand for personalized medicine and precision therapies further propels the trend in innovative cell penetrating peptide therapies. CPPs can be tailored to interact with specific molecular targets, leading to enhanced therapeutic outcomes and reduced side effects. These capabilities are expected to propel the market in the near future.

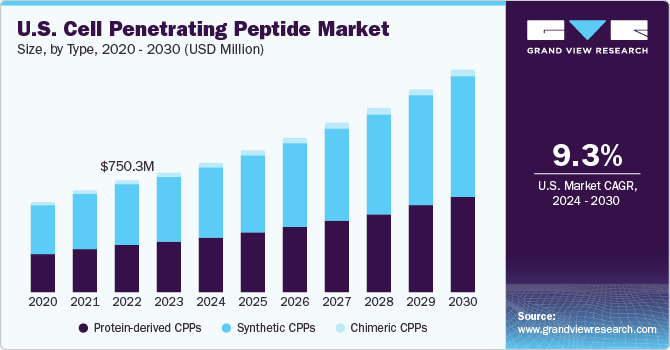

Type Insights

Synthetic CPPs held the largest market share of 54.72% in 2023 and are projected to maintain the dominance over the forecast period. Various computational and chemical approaches are aiding the production of long-lasting and more stable CPPs guiding the formulation of advanced and novel therapeutics. Thus, natural peptides are increasingly modified into novel synthetic peptides with cell permeability, improved specificity, cancer cell cytotoxicity, and higher therapeutic efficacy. According to a PubMed article published in May 2023, a large number of synthetic anti-cancer CPPs kill cancer cells by pore formation or membrane lysis via necrosis and apoptosis. Such capabilities are boosting the segment growth.

Protein-derived CPPs are predicted to grow with a significant CAGR over the forecast period. Protein-derived CPPs offer a promising path for the delivery of novel therapeutics capable of addressing unmet medical needs for treating numerous diseases. The inclination toward personalized medicine, where treatments are tailored to particular patient profiles, has stimulated interest in targeted drug delivery methods using cell penetrating peptides. These CPPs can be modified to selectively deliver therapeutics to specific tissues or cell types, perfectly aligning with the principles of personalized medicine. These factors are contributing to the segment growth.

Application Insights

Drug delivery segment held the largest market share in 2023. CPPs are one of the finest alternatives for hastily internalizing drugs through the cellular membrane. CPPs have gained traction in recent years because of their low cytotoxicity and transduction efficiency. The cell penetrating peptide-cargo complex is an efficient and effective method of delivering numerous chemotherapeutic agents for the treatment of several diseases, which has increased the segment share. Moreover, cell penetrating peptide has become another novel approach to overcome a few limitations of current therapeutic agents. These capabilities are contributing to the segment growth.

Gene delivery segment is expected to grow at the fastest growth rate during the study period. Gene delivery using cell penetrating peptides has shown promising results in the development of transgenic plants. For instance, as per the article published by Multidisciplinary Digital Publishing Institute in the Journal Molecules in April 2023, CPPs were used to transfer DNA to plants. CPPs transport payloads covalently or noncovalently and internalize CPP-cargo complexes into cells either. Such applications of gene delivery are expected to fuel the market over the forecast period.

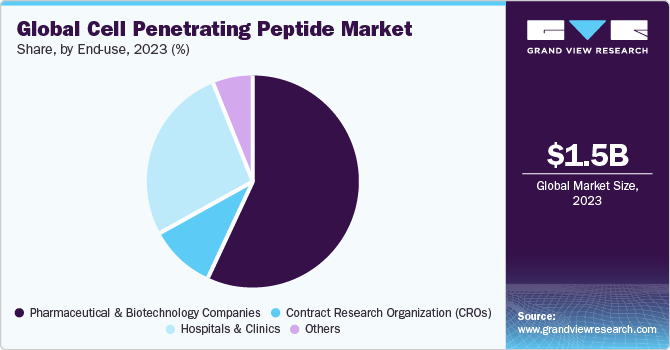

End-use Insights

Pharmaceutical & biotechnology segment accounted for the highest market share in 2023. Pharmaceutical and biotechnology companies employ CPPs imaging and biosensing for the characterization of therapy monitoring purposes & detection of therapeutic antibodies. Moreover, pharmaceutical and biotechnology companies are increasingly employing cell penetrating peptide technology for developing therapeutic solutions for difficult to treat diseases. They are used in cancer therapy, enzyme replacement therapy, vaccine development, and anti-inflammation therapy using antisense peptide nucleic acids. Such applications of CPPs in pharmaceutical and biotechnology companies are driving the segment growth.

Contract Research Organizations (CROs) are expected to have substantial growth during the projected timeframe. CROs perform research on an outsourcing basis to support biotechnology & pharmaceutical companies and provide cost-effective services. These entities provide services pertaining to the development and synthesis of cell penetrating peptides, especially to companies with budget restraints. In addition, increasing trends of outsourcing research and development services in the pharmaceutical industry are anticipated to fuel the segment growth.

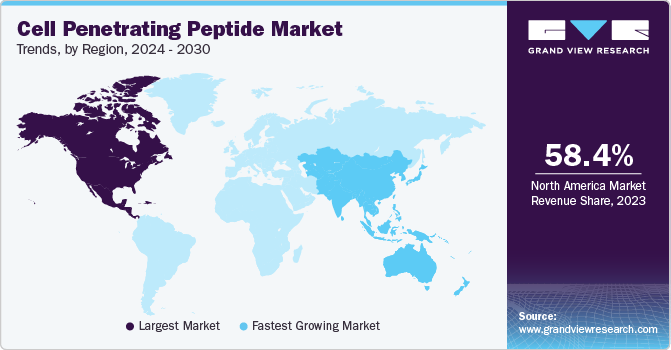

Regional Insights

North America accounted for the largest revenue share of 58.44% in 2023 owing to the adoption of effective products along with technologically advanced production facilities across the region. Increasing prevalence of diseases, such as cancer, cardiovascular disorders, respiratory diseases, infectious diseases, metabolic disorders, and others, is expected to drive market growth. According to the Cancer Atlas, cancer is the leading cause of death in Canada and the second leading cause of death after heart disease in the U.S., accounting for around 1.9 million new cases in the region every year. These factors are contributing to the significant share of the region.

Asia Pacific is estimated to grow at the fastest CAGR during the forecast period. Increasing initiatives for scientific research & positive economic growth coupled with high unmet needs are some of the key growth drivers of this market. Moreover, the evolving healthcare regulatory scenario in the high-growth countries is expected to attract international players to capitalize and invest in the available opportunities. Positive changes, such as favorable government initiatives to support research activities and an urge to avail of high-end medical treatment, are expected to drive regional market growth.

Key Companies & Market Share Insights

Companies are undertaking strategic initiatives such as collaborations, geographic expansion, and strategic agreements for product portfolio expansion to maximize their market share. To sustain their presence in the market, industry players are further concentrating on acquisitions & mergers and product approval.

-

In July 2023, Revance Therapeutics, Inc., announced that the supplemental Biologic License Application for DAXXIFY was accepted for review by the U.S. FDA for the treatment of cervical dystonia in adults.

-

In July 2022, Altamira Therapeutic announced the results of its study on cell-penetrating peptides, which can be utilized as an effective platform for cancer therapy. Such initiatives are expected to boost the market during the review period.

Key Cell Penetrating Peptide Companies:

- Pepscan

- Creative Peptides

- Cupidpeptides

- AltaBioscience Ltd

- AnaSpec

- Peptomyc

- BioAlps

- Sarepta Therapeutics, Inc.

- REVANCE THERAPEUTICS

- PolyPeptide Group

- Bachem

Cell Penetrating Peptide Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.60 billion

Revenue forecast in 2030

USD 2.85 million

Growth rate

CAGR of 10.08% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Pepscan; Creative Peptides; Cupidpeptides; AltaBioscience Ltd; AnaSpec; Peptomyc; BioAlps; Sarepta Therapeutics, Inc.; REVANCE THERAPEUTICS; PolyPeptide Group; Bachem

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

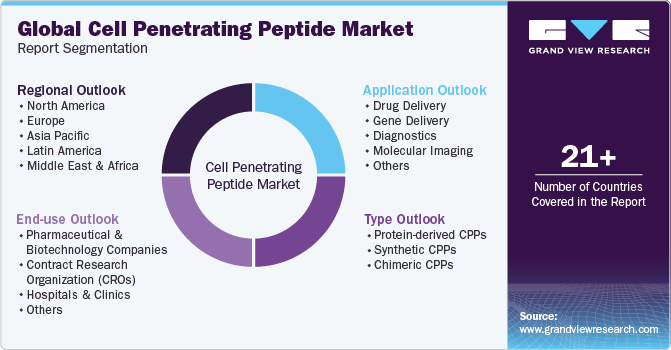

Global Cell Penetrating Peptide Market Report Segmentation

This report forecasts revenue growth at global, regional and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global cell penetrating peptide market report based on type, application, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Protein-derived CPPs

-

Synthetic CPPs

-

Chimeric CPPs

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Delivery

-

Gene Delivery

-

Diagnostics

-

Molecular Imaging

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical and Biotechnology Companies

-

Contract Research Organization (CROs)

-

Hospitals and Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cell penetrating peptide market size was estimated at USD 1.47 billion in 2023 and is expected to reach USD 1.60 billion in 2024.

b. The global cell penetrating peptide market is expected to grow at a compound annual growth rate of 10.08% from 2024 to 2030 and is expected to reach USD 2.85 billion by 2030.

b. The synthetic cell penetrating peptides segment is expected to dominate the cell penetrating peptide market with a share of 54.72% in 2023 due to the use of various computational and chemical approaches in the production of long-lasting and more stable CPPs guiding the formulation of advanced and novel therapeutics.

b. Some key players operating in the cell penetrating peptide market include Pepscan, Creative Peptides, Cupidpeptides, AltaBioscience Ltd, Sarepta Therapeutics, Inc., REVANCE THERAPEUTICS, PolyPeptide Group, and Bachem, among others.

b. Increasing adoption of cell penetrating peptides in diagnostic & research applications, ongoing R&D activities find novel applications of CPPs, and high specificity & potential for targeted treatments are the major factors driving the cell penetrating peptide market growth over the forecast period.

b. North America held the largest share of 58.44% in 2023 and is expected to register a lucrative growth rate over the forecast period. It is attributable to the increasing demand to novel & effective treatment options and adoption of effective products along with technologically advanced production facilities across the region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.