- Home

- »

- Clinical Diagnostics

- »

-

Cellular Health Screening Market Size, Industry Report, 2033GVR Report cover

![Cellular Health Screening Market Size, Share & Trends Report]()

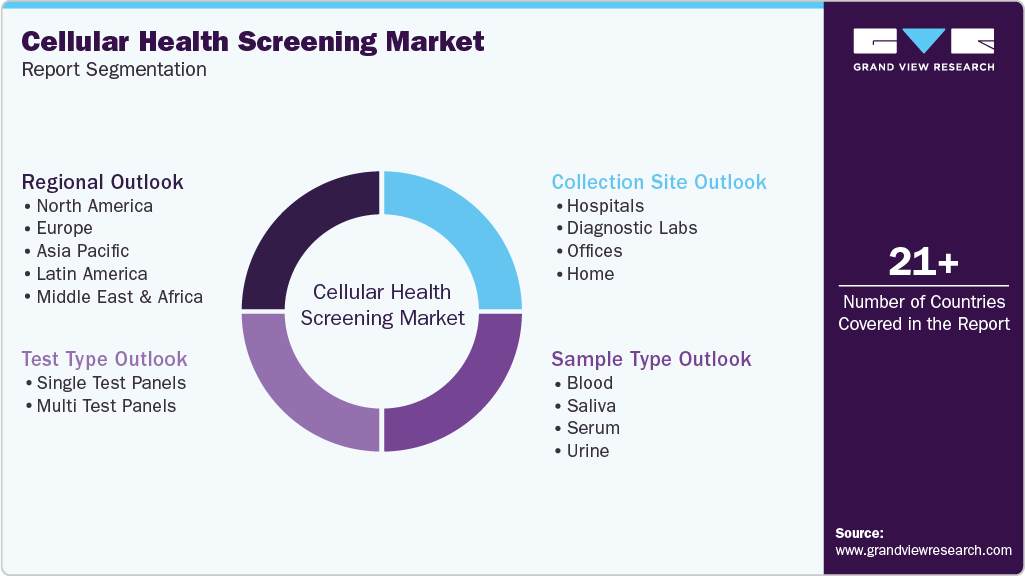

Cellular Health Screening Market (2025 - 2033) Size, Share & Trends Analysis Report By Test Type (Single Test Panels, Multi Test Panels), By Sample Type (Blood, Serum, Urine, Saliva), By Collection Site, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-972-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cellular Health Screening Market Summary

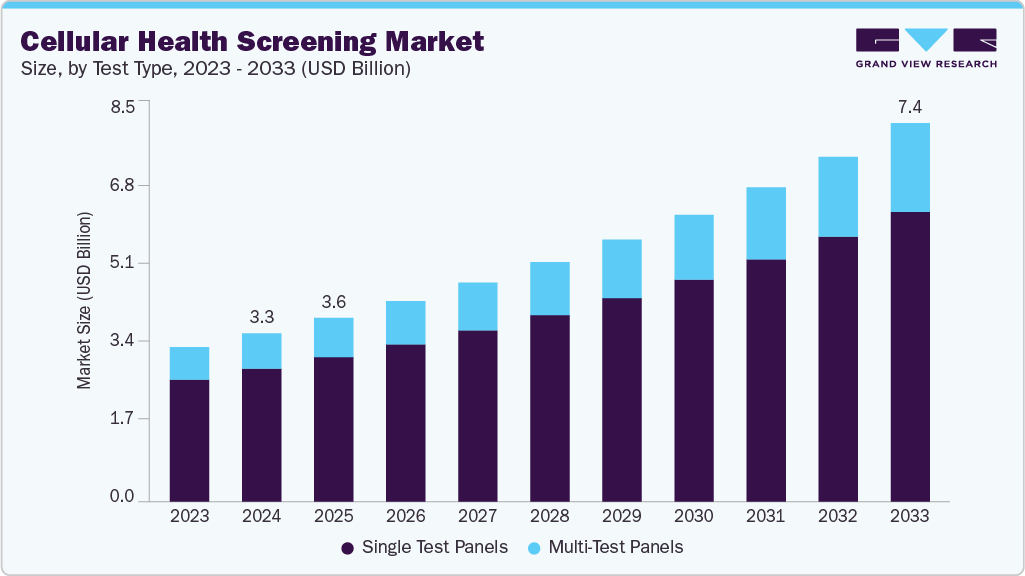

The global cellular health screening market size was estimated at USD 3.30 billion in 2024 and is projected to reach USD 7.41 billion by 2033, growing at a CAGR of 9.5% from 2025 to 2033. An aging global population and the prevalence of age-related chronic diseases drive the market growth. Over the projected period, the importance of precision medicine is expected to increase, driven by the need to analyze biomarkers for aging and overall cellular health.

Key Market Trends & Insights

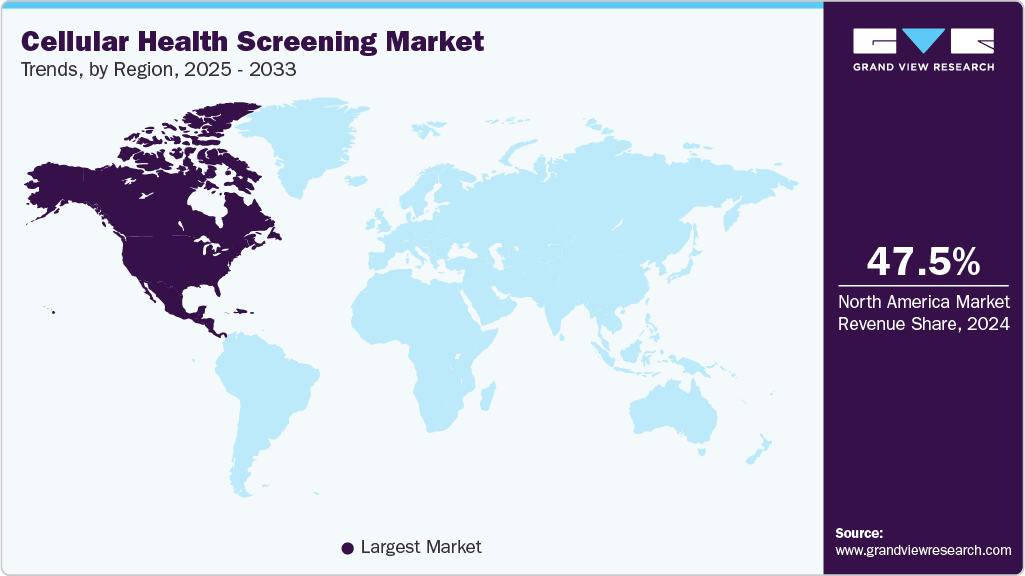

- The North America cellular health screening market held the largest global revenue share of 47.5% in 2024.

- The Asia Pacific cellular health screening industry is anticipated to grow at the fastest CAGR of 10.8% over the forecast period.

- By test type, the single test panels segment held the highest market share of 78.9% in 2024.

- By sample type, the blood segment held the highest market share of 47.3% in 2024.

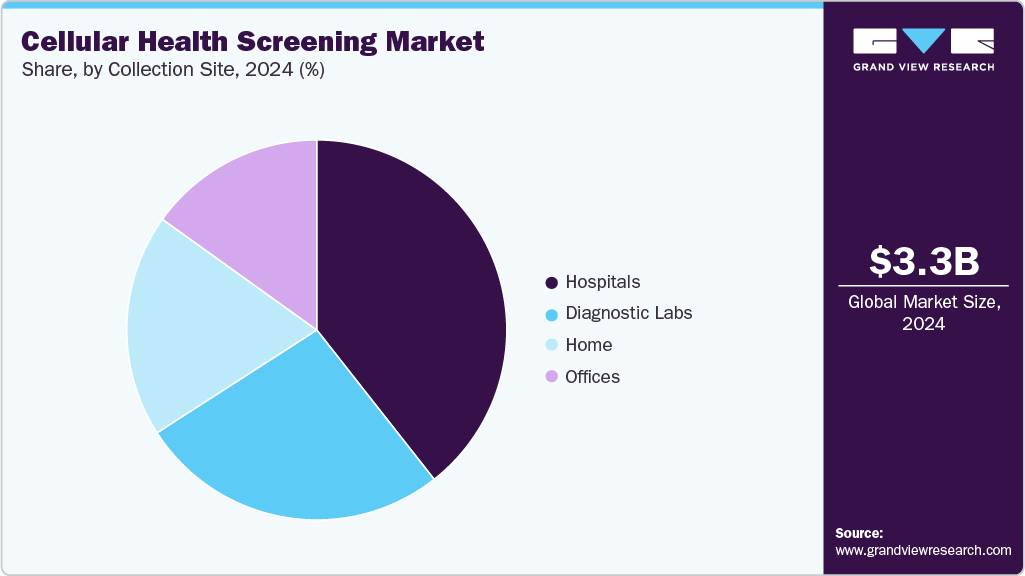

- By collection site, the hospitals segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.3 Billion

- 2033 Projected Market Size: USD 7.41 Billion

- CAGR (2025-2033): 9.5%

- North America: Largest Market in 2024

- Asia Pacific: Fastest growing market

The use of home diagnostic tests is significantly rising globally. The growing number of campaigns to educate the public about the signs of chronic diseases and how to prevent them in order to contain disease epidemics is expected to fuel the growth of the cellular health screening industry. As a result, there is a significant demand for cellular health screening kits and services, driven by increased patient awareness. Additionally, the use of these devices helps optimize prompt treatment decisions, increases the effectiveness of care provided, and dramatically lowers diagnostic costs, especially in resource-constrained countries with inadequate laboratory facilities.

Numerous studies have shown a connection between malignancies and telomere length. Telomere shortening as a tumor suppressor turns out to be a significant factor in cancer that has progressed more severely. Although it has been demonstrated that a range of variables, including infections, inflammation, and stress, affect the length of telomeres, inflammation causes oxidative stress, which, in turn, leads to telomere erosion. According to research, telomere maintenance plays a significant role in how aging and related disorders are affected by environmental, lifestyle, and genetic factors. As a result, it is crucial to understand how quickly telomeres change in order to comprehend biological aging and hereditary diseases. Furthermore, telomere length loss has been linked to pathologies associated with aging, including cancer, cardiovascular illnesses, and weakened immune systems. The need for cellular health screening is projected to increase over the years, driven by the rising incidence of chronic diseases, which in turn fuels the market.

Growing awareness campaigns by numerous organizations worldwide have played a significant role in increasing the demand for testing-based preventive healthcare products and services. One of the key factors anticipated to drive the market during the forecast period is collaborative efforts by organizations such as the CDC, the U.S. Preventive Services Task Force (USPSTF), the National Cervical Cancer Coalition, and the WHO.

In addition, major industry companies are launching campaigns to raise awareness about vaginal and cervical cancer screening to prevent mortality. For instance, according to an article published by theguardian.com, in February 2022, an awareness campaign was launched in England to increase life-saving screening. The Department of Health and Social Care launched this campaign.

Test Type Insights

The single-test panel segment dominated the global cellular health screening market, with the largest revenue share of 78.9% in 2024. Among the cellular health screening tests for telomere, inflammation, oxidative stress, and heavy metals, the telomere single test panel is expected to grow at the fastest rate over the forecast period. This can be attributed to various research studies that have shown a correlation between telomere length and multiple molecular and cellular functions. Moreover, the launch of new testing devices for detecting telomere length further contributes to growth. TeloNostiX revolutionized the diagnosis of Telomere Biology Disorders (TBDs) through advanced telomere length analysis.

The multi-test panels segment is projected to grow at the fastest CAGR of 10.8% over the forecast period. The utilization of these panels for screening multiple biomarkers during a single run has resulted in several advantages, including diagnostic competence, precision, and reduced costs in healthcare settings. These reasons are expected to increase the inclination toward multi-test panels over single-use panels in the future.

Sample Type Insights

The blood sample segment held the largest revenue share of the cellular health screening industry in 2024 and is expected to grow at the fastest CAGR over the forecast period. The frequent use of blood samples by clinicians, combined with the application of diagnostic kits for evaluating various disease conditions, organ functioning, and risk factor analysis, is a factor supporting the growth of this segment. Additionally, the launch of new diagnostic devices that use blood for detection and screening is boosting market growth. In March 2024, the start-up Babson Diagnostics announced that its BetterWay blood-testing system, which enables routine tests such as cholesterol, liver, kidney, and thyroid panels, can be performed using just a few drops of blood from a finger prick, rather than conventional methods of blood collection.

The urine segment held the second-largest market share in 2024, and is expected to grow at a lucrative CAGR during the forecast period. Urine collection is patient-friendly, as it is non-invasive and much quicker, as it doesn’t require technically trained personnel or venous access, and can be easily performed, making it particularly attractive for both clinical and home-based screening settings. In September 2024, PreAnalytiX GmbH introduced the PAXgene Urine Liquid Biopsy Set, a non-invasive solution designed for the collection and immediate stabilization of cell-free DNA from urine.

Collection Site Insights

The hospital segment held the largest share in the cellular health screening market in 2024. The use of diagnostic kits for both inpatients and outpatients for health screening is one of the major factors contributing to growth. Moreover, the presence of medical professionals and the recommendation of diagnostic tests for disease identification are driving the market's growth. The presence of sample collection sites, skilled professionals, and advanced diagnostic techniques in one place is anticipated to further contribute to the development.

The home segment is anticipated to register the fastest growth over the forecast period. This can be attributed to the increasing awareness regarding health and self-sampling adoption in major markets. The adoption of self-sampling is due to its user-friendliness and the fact that it doesn’t require specific infrastructure or trained professionals.

Regional Insights

North America dominated the cellular health screening market, accounting for a 47.5% revenue share in 2024. This dominance is driven by an increase in consumer awareness, advanced healthcare infrastructure, and the growing adoption of personalized and preventive health solutions. Rising health consciousness and an increasing focus on improving healthy life expectancy (HALE) have driven individuals toward regular wellness monitoring and cellular diagnostics.

U.S. Cellular Health Screening Market Trends

The U.S. cellular health screening industry accounted for the largest share in North America in 2024, driven by its mature healthcare infrastructure, high per-capita healthcare spending, rapid adoption of new diagnostics, and strong private and public R&D investment. In April 2024, Simple HealthKit expanded access to at-home diagnostics and follow-up care in the U.S., via a partnership that broadened its home-collection test offerings in major retail channels.

Europe Cellular Health Screening Market Trends

Europe represented a significant revenue share in the cellular health screening industry in 2024. The market is experiencing growth driven by several key factors. The increasing emphasis on national health priorities around early detection, harmonized clinical standards, and strong collaborations between academic centres and industry is driving the growth.

Asia Pacific Cellular Health Screening Market Trends

The Asia Pacific cellular health screening industry is anticipated to grow at the fastest CAGR of 10.8% over the forecast period. The market is expanding rapidly due to the rapid growth of healthcare infrastructure in emerging economies and a growing population, resulting in a larger patient pool. The factors driving the market growth include the increasing adoption and awareness of telomere performance programs by countries, growing awareness of healthy life expectancy, heightened government attention to preventive healthcare, the growing geriatric population, and the rising prevalence of chronic disorders.

The cellular health screening market in India is experiencing significant growth, driven by the expansion of private diagnostics networks, rising health awareness, government screening initiatives, and the increasing popularity of home-collection and mobile diagnostic services, which reach urban and semi-urban populations.

Latin America Cellular Health Screening Market Trends

The Latin America cellular health screening industry is a growing, multi-segment opportunity driven by the expansion of cervical cancer screening (HPV + Pap), rising interest in liquid biopsy / cfDNA oncology screening, broader adoption of preventive health, and the growth of private lab networks. Several countries are implementing or expanding HPV-based screening, and the movement from cytology-only programs to HPV molecular testing and POC options accelerates adoption.

MEA Cellular Health Screening Market Trends

The MEA cellular health screening industry is experiencing significant growth, as governments and healthcare systems increasingly emphasize the importance of prevention and healthy aging; cellular health screening is viewed as an integral part of life expectancy and wellness strategies. The increased acceptance of at-home sample collection and direct-to-consumer (D2C) testing is fueling demand, as people become more aware of “cellular health” and telomere testing. With growing interest in bio-age testing, telomere testing, and other cellular health markers, these technologies are well-positioned for the wellness segment in affluent MEA markets.

Key Cellular Health Screening Company Insights

Some of the key companies in the cellular health screening market include Life Length; Cell Science Systems; and OPKO Health, Inc. The market is fragmented: a mix of specialist telomere labs, large diagnostics incumbents with broad test menus, niche panel providers, and direct-to-consumer (D2C) wellness players. Mature players, such as Quest Diagnostics, LabCorp/LabCorp Holdings, and OPKO, dominate by distribution, lab scale, or broad test portfolios. Specialist labs such as SpectraCell Laboratories, Life Length (Spain), Telomere Diagnostics / Repeat Diagnostics, Genova Diagnostics, TruDiagnostic are focused leaders in telomere length or biological-age assays-trusted by clinicians, researchers, and consumers.

Key Cellular Health Screening Companies:

The following are the leading companies in the cellular health screening market. These companies collectively hold the largest market share and dictate industry trends.

- Life Length

- SpectraCell Laboratories, Inc.

- RepeatDx

- Cell Science Systems

- Quest Diagnostics Incorporated

- Laboratory Corporation of America Holdings

- OPKO Health, Inc.

- Genova Diagnostics (GDX)

- Immundiagnostik AG

- DNA Labs India

Cellular Health Screening Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.60 billion

Revenue forecast in 2033

USD 7.41 billion

Growth rate

CAGR of 9.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Test type, sample type, collection site, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK.; Germany; Italy; France; Spain; Sweden; Denmark; Norway; Russia; Japan; China; India; Australia; South Korea; Singapore; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key company profiled

Life Length; SpectraCell Laboratories, Inc.; RepeatDx; Cell Science Systems; Quest Diagnostics Incorporated; Laboratory Corporation of America Holdings; OPKO Health, Inc.; Genova Diagnostics (GDX); Immundiagnostik AG; DNA Labs India

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cellular Health Screening Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global cellular health screening market report based on test type, sample type, collection site, and region:

-

Test Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Single Test Panels

-

Telomere Tests

-

Oxidative Stress Tests

-

Inflammation Tests

-

Heavy Metals Tests

-

-

Multi Test Panels

-

-

Sample Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Blood

-

Saliva

-

Serum

-

Urine

-

-

Collection Site Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Diagnostic Labs

-

Offices

-

Home

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Singapore

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cellular health screening market size was estimated at USD 3.30 billion in 2024 and is expected to reach USD 3.60 billion in 2025.

b. The global cellular health screening market is expected to grow at a compound annual growth rate of 9.5% from 2024 to 2033 to reach USD 7.41 billion by 2033.

b. The single test panels segment dominated the cellular health screening market in 2024 with a revenue share of 78.94%.

b. Some key players operating in the cellular health screening market include Titanovo; Telomere Diagnostics Inc.; Cell Science Systems; Life Length; Genova Diagnostics; Spectracell Laboratories; Repeat Diagnostics Inc.; Segterra, Inc.; Quest Diagnostics; Labcorp Holdings; Immundiagnostik AG; BioReference Laboratories; Cleveland Heartlab, Inc.; Zimetry LLC: and DNA Labs India.

b. Key factors that are driving the cellular health screening market growth include rising adoption of telomere performance programs and awareness related to the importance of healthy adjusted life expectancy (HALE).

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.