- Home

- »

- Pharmaceuticals

- »

-

Central Nervous System Therapeutics Market Report, 2033GVR Report cover

![Central Nervous System Therapeutics Market Size, Share & Trends Report]()

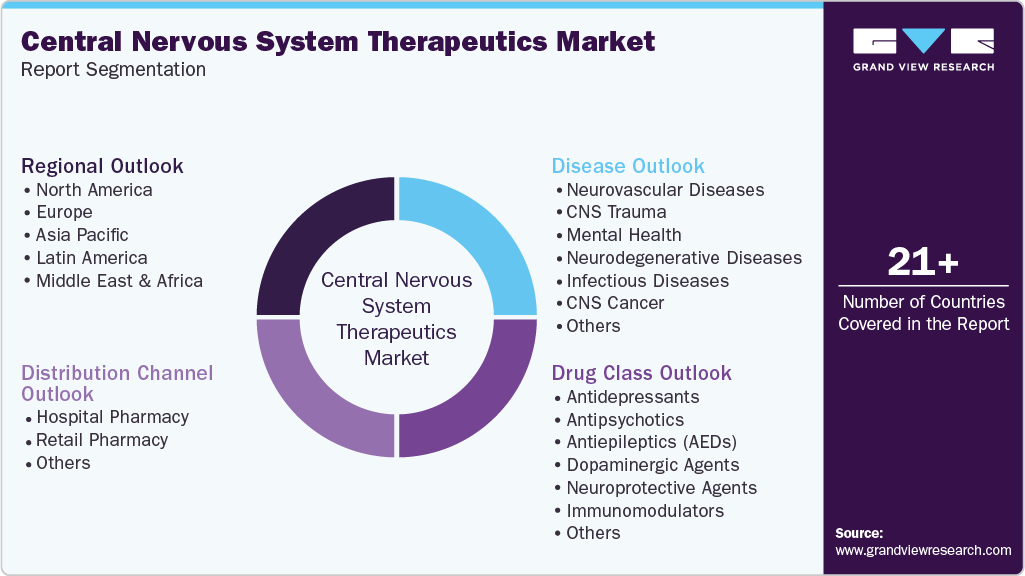

Central Nervous System Therapeutics Market (2026 - 2033) Size, Share & Trends Analysis Report By Disease (Neurovascular Diseases, CNS Trauma), By Drug Class, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-516-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Central Nervous System Therapeutics Market Summary

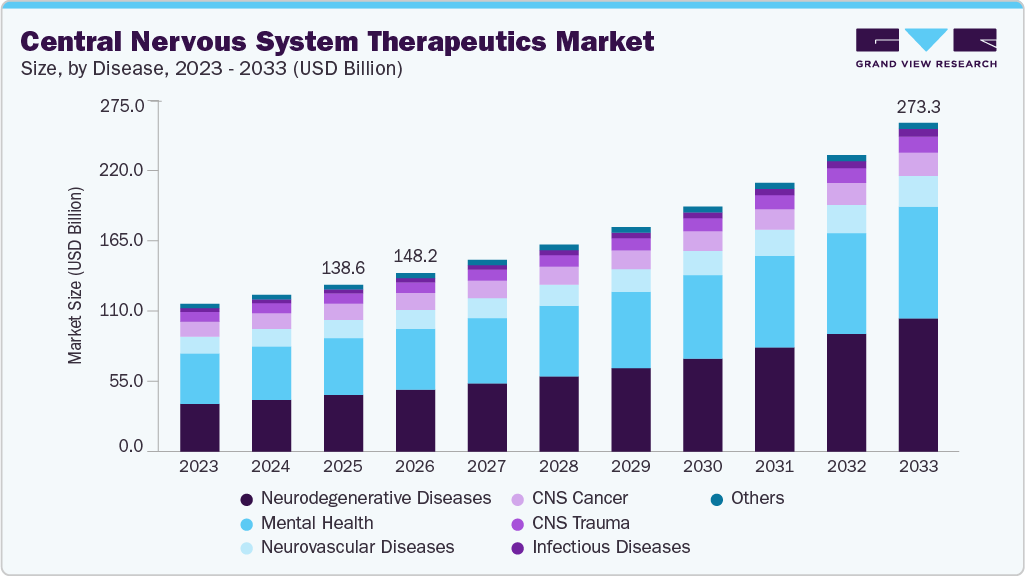

The global central nervous system therapeutics market size was estimated at USD 138.59 billion in 2025 and is projected to reach USD 273.32 billion by 2033, growing at a CAGR of 9.1% from 2026 to 2033. The central nervous system (CNS) therapeutics market is experiencing robust growth, driven largely by the rising prevalence of neurological and psychiatric disorders.

Key Market Trends & Insights

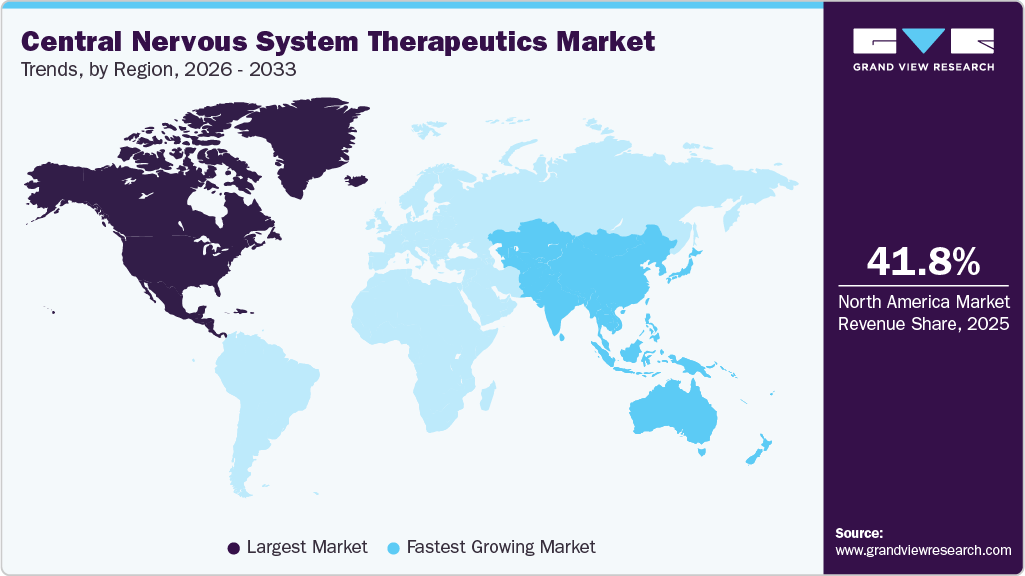

- North America central nervous system therapeutics market held the largest share of 41.80% of the global market in 2025.

- The central nervous system therapeutics industry in the U.S. is expected to grow significantly over the forecast period.

- By disease, the mental health segment held the highest market share of 34.13% in 2025.

- By drug class, the antidepressants segment held the highest market share in 2025.

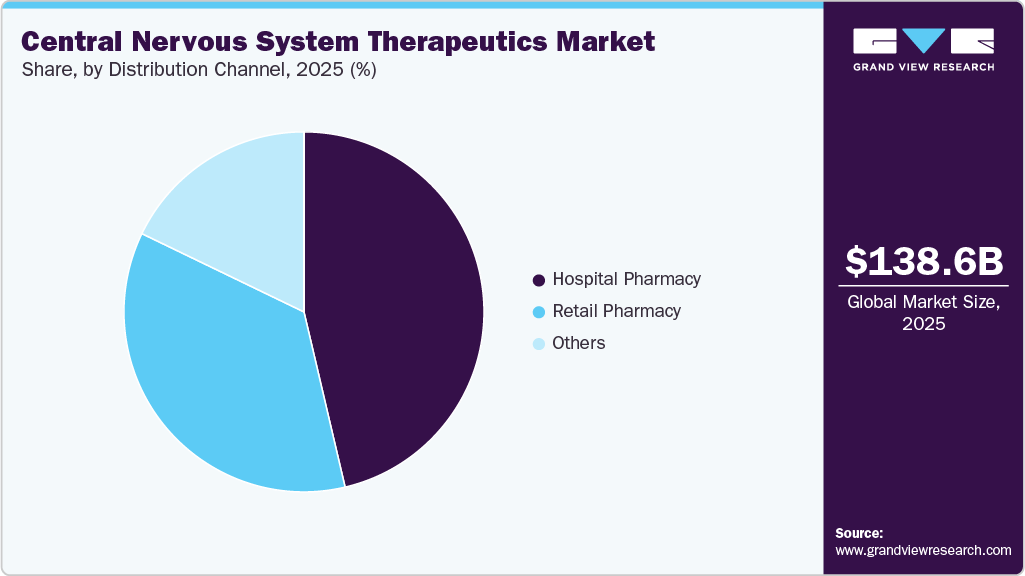

- By distribution channel, the hospital pharmacy segment held the highest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 138.59 Billion

- 2033 Projected Market Size: USD 273.32 Billion

- CAGR (2026-2033): 9.1%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

As the global population ages, coupled with the impact of modern lifestyle choices, the incidence of diseases such as Alzheimer’s disease, Parkinson’s disease, epilepsy, multiple sclerosis, and mental health disorders is steadily increasing. This expanding disease burden is catalyzing significant demand for new and improved therapeutic options. As the need for effective treatments grows, pharmaceutical and biotechnology companies are ramping up investments in CNS drug development, and governments are offering increased support for research initiatives.

The global aging population is one of the most significant drivers of rising disease prevalence in the CNS therapeutics market. According to the WHO, the ratio of the world’s population aged 60 years and older is anticipated to double by 2050, from approximately 12% in 2015 to 22%. Neurodegenerative diseases, including Alzheimer’s disease, Parkinson’s disease, and other dementias, are primarily age-related and are becoming more prevalent as life expectancy increases. Alzheimer’s disease, which currently affects more than 55 million people worldwide, is predicted to nearly triple by 2050. Similarly, Parkinson’s disease affects an estimated 10 million people globally, and this number is expected to rise due to the aging population. As a result, there is a growing demand for effective treatments, particularly those that can delay the progression of these debilitating diseases or modify their course. Despite the increasing prevalence, current treatment options for neurodegenerative diseases remain limited, with no cure available. This has led to increased investment in novel therapies, including disease-modifying treatments and targeted drug delivery systems aimed at overcoming the blood-brain barrier.

Beyond aging, modern lifestyle factors such as stress, poor diet, sedentary behavior, and environmental pollution are contributing to the rising prevalence of both neurological and psychiatric disorders. These factors have been linked to an increase in stroke, migraine, and mental health conditions such as anxiety, depression, schizophrenia, and bipolar disorder. Mental health issues are becoming a leading cause of disability worldwide. The WHO estimates that over 300 million people suffer from depression globally, and the number is steadily increasing. This growing prevalence of psychiatric disorders is pushing for new therapeutic options that address the root causes of conditions such as depression and schizophrenia. The need for treatments that are more effective, have fewer side effects, and offer better long-term outcomes has never been greater.

The rising prevalence of Alzheimer’s disease is expected to boost market growth. Alzheimer’s disease is a global epidemic, and its diagnosis rate is about 25% globally. The diagnosis rate of Alzheimer’s disease is high in developed countries. In North America and some European countries, the diagnosis rate of Alzheimer’s disease is nearly 50%, whereas, in developing countries such as India & China, it varies from 10%-15% of total Alzheimer’s cases. In addition, according to NCBI, in 2021, about 6.2 million people aged 65 and above living in America were suffering from Alzheimer's disease, which is estimated to increase to around 13.8 million by 2060.

Furthermore, an increase in the incidence and cost burden of dementia associated with Alzheimer's disease worldwide is expected to boost market growth. According to the Alzheimer's Society, there are around 900,000 people living with dementia in the UK, and it is projected to rise to 1.6 million by 2040 and the incidence of dementia will be 209,600 in the same year.

Alzheimer’s disease is becoming the most common cause of death in neurodegenerative diseases and a common cause of physical disability. The disease is most common in females as compared to males. For instance, two in three people with the disease are women. The age distribution for Alzheimer’s disease across the globe includes 4% aged 65 or younger, 13% aged between 65 and 74, 44% aged 75 to 84, and 38% aged 85 or older.

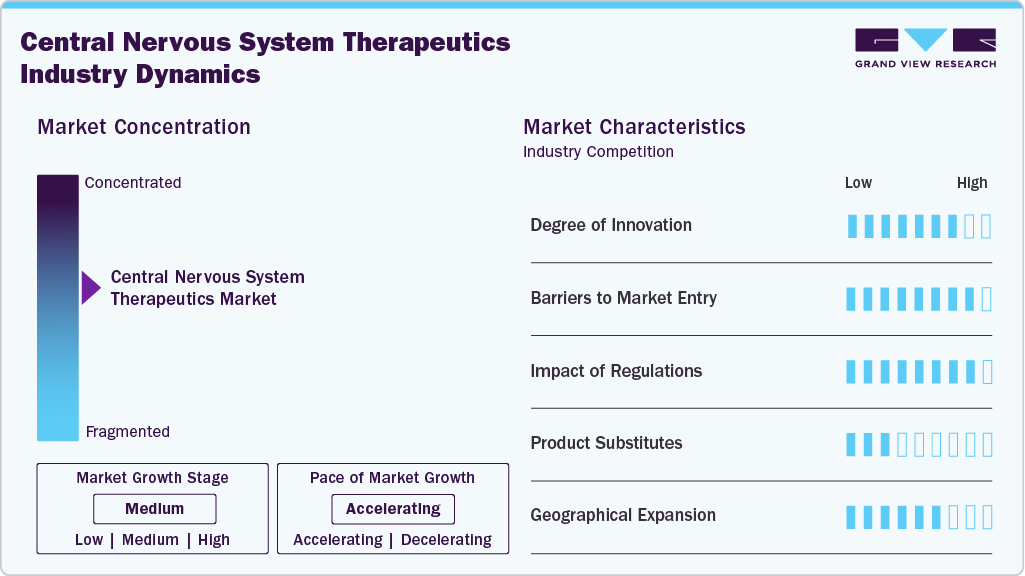

Market Concentration & Characteristics

The Central Nervous System therapeutics market demonstrates a high degree of innovation driven by the need to address complex neurological and psychiatric disorders with limited treatment options. Pharmaceutical companies are prioritizing disease modifying therapies, novel drug classes, and improved formulations to enhance efficacy and patient adherence. Innovation is particularly strong in neurodegenerative and rare CNS conditions where unmet medical need remains significant. Continuous investment in clinical research supports differentiated treatment pipelines. This emphasis on innovation sustains competitive intensity among established players.

Barriers to entry in the CNS therapeutics market are high due to substantial research and development costs and long clinical trial durations. CNS drugs face elevated failure rates because of complex brain biology and difficulty in demonstrating clear clinical endpoints. New entrants must also invest heavily in safety studies due to potential neurological side effects. Manufacturing and distribution of specialized CNS treatments further increase capital requirements. These factors favor large pharmaceutical companies with established expertise.

Regulatory frameworks play a critical role in shaping CNS therapeutics development and commercialization. Treatments affecting the central nervous system are subject to stringent safety and efficacy evaluations given their potential impact on cognition and behavior. Regulatory authorities often require extensive clinical data, resulting in prolonged approval timelines. While accelerated pathways exist for high unmet needs, compliance requirements remain rigorous. This regulatory environment increases development costs but enhances treatment credibility.

Product substitution in the CNS therapeutics market primarily arises from generic drugs and alternative pharmacological classes used for similar indications. As patents expire on branded therapies, generic versions gain rapid adoption due to lower costs. Physicians may also switch between therapeutic classes based on patient response and tolerability. Non pharmacological interventions may complement treatment but do not fully replace drug therapies. The presence of substitutes limits pricing flexibility for premium CNS treatments.

Geographical expansion of CNS therapeutics is driven by rising disease prevalence and improving access to neurological care worldwide. North America and Europe remain dominant due to advanced healthcare infrastructure and high diagnosis rates. Emerging markets in Asia Pacific and Latin America are witnessing increased demand as awareness and treatment access improve. Pharmaceutical companies are expanding regional footprints through regulatory approvals and local partnerships. This global expansion supports long term growth of CNS treatment markets.

Disease Insights

The mental health segment dominated the market with the largest revenue share of 34.13% in 2025, driven by the rising prevalence of disorders such as depression, anxiety, bipolar disorder, and schizophrenia across all age groups. Increasing diagnosis rates and improved access to psychiatric care supported higher treatment adoption. Long term pharmacotherapy requirements for chronic mental health conditions contributed to sustained revenue generation. Expanding use of combination therapies improved treatment outcomes and patient adherence. Continuous product launches with enhanced safety and tolerability profiles strengthened prescriber confidence. Growing awareness of mental health conditions further accelerated demand for effective therapeutic solutions.

The neurodegenerative diseases segment is projected to grow at a CAGR of 11.6% over the forecast period, fueled by the rapidly aging global population and the increasing prevalence of conditions such as Alzheimer’s disease, Parkinson’s disease, and multiple sclerosis. Longer life expectancy has led to a larger patient pool requiring long term disease management. Advances in diagnostic capabilities have improved early identification of neurodegenerative disorders, supporting timely treatment initiation. Rising clinical focus on slowing disease progression has expanded demand for novel and combination therapies. Ongoing research efforts continue to strengthen treatment pipelines targeting underlying disease mechanisms. Growing caregiver awareness has further increased treatment adherence and continuity.

Drug Class Insights

The antidepressants segment dominated the market with the largest revenue share of 24.77% in 2025 due to the high prevalence of depression and anxiety disorders worldwide. Widespread clinical use across multiple indications supported consistent prescription volumes. Long term treatment duration contributed to sustained revenue generation within this segment. Availability of multiple drug classes enabled personalized treatment selection based on patient response. Strong clinician familiarity reinforced continued adoption across primary and specialty care settings. Ongoing improvements in safety and tolerability further strengthened demand for antidepressant therapies.

The immunomodulators segment is projected to grow at a CAGR of 12.3% over the forecast period owing to increasing treatment demand for chronic neuroinflammatory and autoimmune related central nervous system disorders. Rising prevalence of conditions such as multiple sclerosis has expanded the eligible patient population. Improved clinical understanding of immune mediated disease pathways has supported wider therapeutic adoption. Long term disease management requirements contribute to consistent treatment utilization. Expanding availability of targeted immunomodulatory therapies enhances clinical outcomes. Growing physician preference for therapies that slow disease progression further supports segment growth.

Distribution Channel Insights

The hospital pharmacy segment dominated the market with the largest revenue share of 46.46% in 2025, due to the high volume of patients receiving treatment for complex neurological and psychiatric conditions in hospital settings. Specialized inpatient and outpatient services supported centralized medication dispensing. Greater reliance on physician supervision for dose initiation and adjustment increased hospital pharmacy utilization. Availability of a wide range of branded and specialty CNS drugs strengthened this channel’s role. Hospitals also managed severe and acute cases requiring continuous monitoring. Established procurement systems ensured consistent drug availability and supported higher revenue contribution.

The retail pharmacy segment is projected to grow at a CAGR of 8.8% over the forecast period due to the rising number of patients requiring long term management of chronic central nervous system disorders. Increased outpatient treatment and follow up care have shifted prescription refills toward retail settings. Broad geographic presence of retail pharmacies improves patient access and treatment continuity. Growing preference for convenient medication dispensing supports higher adoption. Expansion of branded and generic CNS drug availability strengthens retail channel offerings. Improved patient awareness of treatment adherence further contributes to sustained growth.

Regional Insights

North America held the largest central nervous system therapeutics market share of 41.80% in 2025, driven by high prevalence of neurological and psychiatric disorders across the region. Strong healthcare infrastructure supports early diagnosis and continuous treatment adoption. Advanced clinical research accelerates introduction of newer therapies for complex CNS conditions. Well-established pharmaceutical companies maintain broad therapeutic portfolios in this segment. High patient awareness increases demand for effective CNS treatments. Widespread access to specialized care contributes to sustained market leadership.

U.S. Central Nervous System Therapeutics Market Trends

U.S. Central Nervous System Therapeutics Market leads with substantial revenue due to significant burden of depression, anxiety, and neurodegenerative diseases among the population. High treatment uptake reflects widespread screening and regular follow-ups. Large investment in drug development expands treatment options and therapeutic classes. Extensive clinical trials within the country add depth to the treatment pipeline. Strong payer coverage supports patient access to CNS medications. Continued innovation sustains market growth and competitive dynamics.

Europe Central Nervous System Therapeutics Market Trends

Europe Central Nervous System Therapeutics Market shows steady expansion supported by comprehensive healthcare delivery for chronic CNS conditions. Broad availability of psychiatric and neurology specialists enhances patient management pathways. Research collaborations across countries enrich treatment development and knowledge sharing. High proportion of elderly population elevates demand for CNS therapies. Reimbursement mechanisms help maintain treatment continuity for patients. Ongoing launches of improved CNS drugs advance market depth.

The UK Central Nervous System Therapeutics Market demonstrates robust activity with increasing treatment initiation for mental health and neurological disorders. Growing emphasis on early intervention strengthens therapeutic demand. Expanding clinical evidence supports adoption of new treatment modalities. Health service networks enable structured patient care for chronic conditions. Rising diagnosis rates contribute to consistent treatment consumption. Pharmaceutical presence ensures ongoing therapy introductions.

The Germany Central Nervous System Therapeutics Market maintains strong performance with widespread clinical focus on complex CNS conditions. High standard of healthcare promotes early detection and ongoing treatment evaluation. Active participation in multinational clinical programs enhances therapeutic options. Established pharmaceutical research base contributes to advanced drug availability. Aging population expands long-term treatment needs. Patient education increases adherence to prescribed CNS medications.

The France Central Nervous System Therapeutics Market records stable growth as neurological and psychiatric diseases remain prevalent. Well-organized healthcare pathways facilitate regular treatment access. Continuous demand arises from stress-related and mood disorders. Diverse range of approved CNS therapies supports clinical decision flexibility. Growing patient consultations amplify prescription rates. Active medical community engagement fosters updated treatment practices.

Asia Pacific Central Nervous System Therapeutics Market Trends

Asia Pacific central nervous system therapeutics market is expected to register the fastest CAGR of 10.1% over the forecast period driven by rising disease prevalence and expanding treatment access. Increasing healthcare investments enhance service reach in urban and semi-urban areas. Growing patient awareness accelerates therapy uptake. Pharmaceutical entrants expand regional footprint with new approvals. Rapid population growth contributes to higher treatment demand. Evolving clinical research activity supports innovative therapy adoption.

The Japan Central Nervous System Therapeutics Market shows consistent growth with high incidence of neurodegenerative and psychiatric disorders among older adults. Strong medical networks ensure structured treatment regimens. Favorable patient acceptance of long-term therapy reinforces stability. Local research institutions contribute to therapy refinement and evidence generation. Market maturity supports varied drug portfolios for CNS conditions. Incremental innovation enhances treatment quality and patient outcomes.

The China Central Nervous System Therapeutics Market grows rapidly as diagnosis of CNS disorders increases alongside expanding healthcare coverage. Rising urban healthcare demand drives greater treatment utilization. Continued investment in pharmaceutical R&D expands domestic treatment development. Increasing hospital capacities improve patient access to specialized care. Growing middle-class population increases healthcare expenditure on CNS treatments. Enhanced clinical training supports broader treatment application.

Latin America Central Nervous System Therapeutics Market Trends

Latin America Central Nervous System Therapeutics Market expands with rising awareness and diagnosis of mental health and neurological conditions. Improving healthcare reach strengthens treatment uptake across key countries. Pharmaceutical companies introduce a broader range of CNS therapies to meet regional needs. Patient education campaigns increase engagement with treatment plans. Incremental improvements in healthcare delivery support continuity of care. Growing urban populations contribute to higher therapeutic demand.

The Brazil Central Nervous System Therapeutics Market registers steady growth with increasing treatment rates for anxiety, depression, and neurological disorders. Expanding healthcare services improve access to specialist care. Rising awareness enhances patient engagement in treatment decisions. Local pharmaceutical presence enriches available treatment options. Broader prescribing practices support consistent medication usage. Urban population growth sustains market demand.

Middle East & Africa Central Nervous System Therapeutics Market Trends

Middle East & Africa Central Nervous System Therapeutics Market shows gradual growth with increasing recognition of CNS disorders and treatment importance. Expanding clinical services in major cities improves diagnosis rates. Pharmaceutical distribution networks enhance availability of CNS medications. Rising patient health awareness supports greater engagement with treatments. Focus on training specialists strengthens treatment quality. Urbanization drives consistent demand for effective CNS therapies.

The Saudi Arabia Central Nervous System Therapeutics Market grows with increasing focus on mental health and neurological disease treatment. Expanding healthcare facilities support structured patient care. Rising treatment adoption reflects higher diagnosis and follow-up engagement. Pharmaceutical companies expand product offerings to meet market needs. Increasing public dialogue on mental health encourages therapy initiation. Enhanced clinical expertise improves quality of CNS care.

Key Central Nervous System Therapeutics Company Insights

Biogen and Novartis AG are expanding their Central Nervous System therapeutics portfolios through continued development of treatments targeting neurodegenerative and autoimmune related neurological disorders, with emphasis on disease progression control. Otsuka Pharmaceutical Co., Ltd. and Eli Lilly and Company focus on strengthening psychiatric treatment offerings for conditions such as depression, schizophrenia, and bipolar disorder through ongoing clinical programs. Merck & Co., Inc. and AstraZeneca invest in novel therapeutic pathways to improve long term management of complex CNS conditions. Takeda Pharmaceutical Company Limited and Johnson & Johnson Services, Inc. maintain diversified CNS pipelines addressing both rare and chronic disorders. Teva Pharmaceutical Industries Ltd. and Pfizer, Inc. support market reach through extensive branded and generic CNS portfolios. Competitive intensity remains high as companies refine treatment strategies and expand global clinical development efforts.

Key Central Nervous System Therapeutics Companies:

The following are the leading companies in the central nervous system therapeutics market. These companies collectively hold the largest market share and dictate industry trends.

- Biogen

- Otsuka Pharmaceutical Co., Ltd.

- Eli Lilly and Company

- Merck & Co., Inc.

- AstraZeneca

- Takeda Pharmaceutical Company Limited.

- Novartis AG

- Teva Pharmaceutical Industries Ltd.

- Johnson & Johnson Services, Inc.

- Pfizer, Inc.

Recent Developments

-

In January 2025, Eisai Co., Ltd. and Biogen announced that the U.S. FDA has approved the Supplemental Biologics License Application (sBLA) for once-every-four-weeks lecanemab-irmb (LEQEMBI) intravenous (IV) maintenance dosing for the treatment of Alzheimer's disease (AD) in patients with mild cognitive impairment (MCI) in the U.S.

-

In January 2025, Gene therapy firm Capsida Biotherapeutics is advancing its first neurodegenerative disease therapy in partnership with AbbVie after the pharma giant exercised a USD 40 million option for the program.

-

In July 2024, The U.S. FDA approved Kisunla for the treatment of adults with early symptomatic Alzheimer's disease (AD), including individuals with mild cognitive impairment (MCI) and those in the mild dementia stage of AD with confirmed amyloid pathology.

Central Nervous System Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 148.22 billion

Revenue forecast in 2033

USD 273.32 billion

Growth rate

CAGR of 9.1% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Disease, drug class, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key company profiled

Biogen; Otsuka Pharmaceutical Co., Ltd.; Eli Lilly and Company; Merck & Co., Inc.; AstraZeneca; Takeda Pharmaceutical Company Limited.; Novartis AG; Teva Pharmaceutical Industries Ltd.; Johnson & Johnson Services, Inc.; Pfizer, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Central Nervous System Therapeutics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global central nervous system therapeutics market report based on disease, drug class, distribution channel, and region:

-

Disease Outlook (Revenue, USD Million, 2021 - 2033)

-

Neurovascular Diseases

-

CNS Trauma

-

Mental Health

-

Anxiety Disorders

-

Epilepsy

-

Mood Disorders

-

Psychotic Disorders

-

Others

-

-

Neurodegenerative Diseases

-

Alzheimer’s Disease

-

Parkinsosn’s Disease

-

Multiple Sclerosis

-

Huntington’s Disease

-

Amytrophic Lateral Sclerosis

-

Others

-

-

Infectious Diseases

-

CNS Cancer

-

Others

-

-

Drug Class Outlook (Revenue, USD Million, 2021 - 2033)

-

Antidepressants

-

Antipsychotics

-

Antiepileptics (AEDs)

-

Dopaminergic Agents

-

Neuroprotective Agents

-

Immunomodulators

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global CNS therapeutic market size was estimated at USD 138.59 billion in 2025 and is expected to reach USD 148.22 billion in 2026.

b. The global CNS therapeutic market is expected to grow at a compound annual growth rate of 9.1% from 2026 to 2033 to reach USD 273.32 billion by 2033.

b. North America dominated the CNS therapeutic market with a share of 41.80% in 2025. This is attributable to the rising number of reported cases of neurodegenerative disorders & mental health and the high adoption of advanced therapeutics.

b. Some key players operating in the CNS therapeutic market include Biogen, F. Hoffmann-La Roche Ltd, AbbVie Inc., Johnson & Johnson Services, Inc, Novartis AG, Eisai Co., Ltd., Eli Lilly and Company, GlaxoSmithKline plc., and others.

b. Key factors that are driving the CNS therapeutic market growth include rising demand for effective therapeutic options, growing geriatric population prone to various CNS diseases, increasing awareness regarding mental health across the world.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.