- Home

- »

- Medical Devices

- »

-

Centrifugal Blood Pumps Market Size & Share Report, 2030GVR Report cover

![Centrifugal Blood Pumps Market Size, Share & Trends Report]()

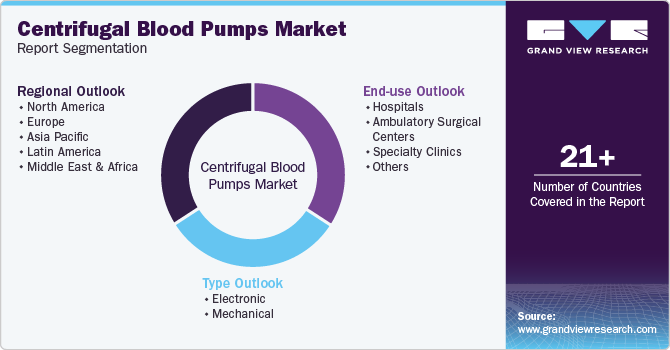

Centrifugal Blood Pumps Market Size, Share & Trends Analysis Report By Type (Electrical, Mechanical), By End-use (Hospitals, Ambulatory Surgical Centers), By Region (North America, Europe), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-290-7

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Centrifugal Blood Pumps Market Trends

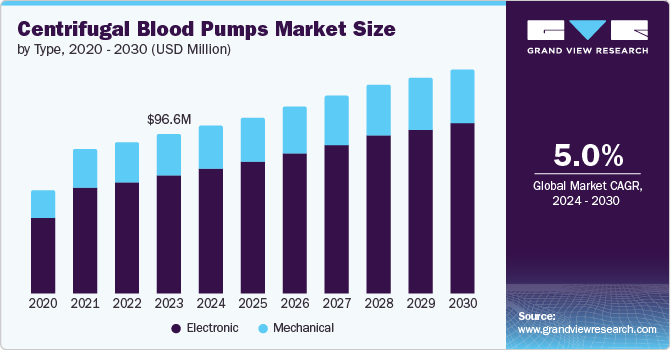

The global centrifugal blood pumps market was estimated at USD 96.6 million in 2023 and is projected to grow at a CAGR of 5.0% from 2024 to 2030. The market is primarily driven by the increasing prevalence of cardiovascular diseases, technological advancements in pump design, a growing geriatric population, and rising demand for minimally invasive procedures. Successful regulatory approvals and clinical trials, along with heightened patient awareness regarding treatment options contribute to market growth.

Mechanical cardiac assist devices such as centrifugal blood pumps have achieved widespread acceptance for the treatment of cardiac insufficiency. Their prime task is to maintain blood circulation and provide sufficient oxygen supply to body tissue and organs if the natural heart is failing. Cardiac fibrillation or cardiogenic shock requires efficient means of cardiac support. For such purposes, continuous centrifugal blood pumps are used. Rising cases of cardiac-related disorders including cardiac fibrillation are expected to favor the market growth. As per the CDC, coronary heart disease is among the most common type of heart disease, and around 371,506 people died in 2022 due to this. Also, as per the WHO, about 17.9 million people die of cardiovascular disorders each year. Hence, the increasing prevalence of cardiovascular diseases globally is anticipated to boost the market growth.

Centrifugal pumps offer the advantage of decreased trauma to red blood cells and a less pronounced systemic inflammatory response compared with roller pumps. Centrifugal pumps and roller pumps are used in ECLS. Both techniques have theoretical advantages in terms of biocompatibility and complications. Roller pumps may induce high arterial pressure levels, leading to negative venous pressure levels and disruption of connections with the risk of endothelial damage in cannulated veins. These complications highlight the need for thorough pressure monitoring and regulation. Centrifugal pumps act through a spinning rotor to generate blood flow. This technique avoids high pressures in the case of distal circuit occlusion, fostering the market growth.

Innovations in pump technology have greatly enhanced the efficiency and safety of centrifugal blood pumps, driving their adoption in healthcare facilities. Modern designs incorporate features such as biocompatible materials, improved flow dynamics, and miniaturization that allow for less invasive procedures. For instance, devices like the HeartMate 3 Left Ventricular Assist Device (LVAD) utilize advanced magnetic levitation technology to reduce wear and tear on components while providing continuous blood flow with minimal hemolysis. Such advancements improve patient outcomes and expand the application scope of these devices.

The global increase in the elderly population is another critical factor contributing to market growth. Older adults are more susceptible to heart-related ailments due to age-related physiological changes and comorbidities. According to a report by the United Nations, by 2050, there will be approximately 2 billion people aged 60 years or older worldwide. This demographic shift necessitates enhanced cardiac care solutions, including centrifugal blood pumps that can assist patients with severe heart conditions or those awaiting transplants.

Industry Dynamics

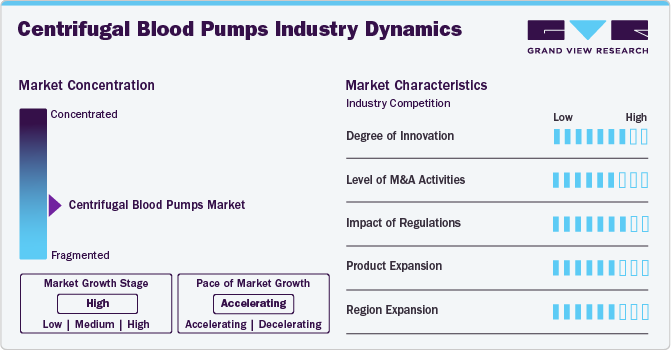

There is a high degree of innovation in the centrifugal blood pumps market. It is characterized by continuous advancements in technology aimed at improving performance, safety, and patient outcomes. Innovations include the development of miniaturized pumps that enhance biocompatibility and reduce hemolysis, as well as the integration of smart technologies such as real-time monitoring systems that provide feedback on pump performance and patient status. For instance, a March 2024 study published in Scientific Reports focused on designing a centrifugal pump for use as a ventricular assist device. The research examined various geometrical parameters and analyzed 58 blade designs, ultimately identifying a configuration with a 45° inlet and 55° outlet angle that significantly improved performance, increasing total head by at least 20% compared to an FDA benchmark pump.

The level of M&A activities within the centrifugal blood pump market has been notably high, driven by the need for companies to consolidate resources, expand product portfolios, and enhance technological capabilities. Major players are increasingly acquiring smaller firms with innovative technologies or specialized expertise to gain competitive advantages.In November 2022, Johnson & Johnson announced its acquisition of Abiomed Inc. for approximately USD 17.3 billion, enhancing its heart technology offerings. This acquisition aligns with J&J’s strategy to focus on higher returns in its pharmaceutical and medical technology sectors following the planned spin-off of its consumer unit.

The impact of regulations is significant, as regulatory bodies such as the FDA (U.S. Food and Drug Administration) impose stringent guidelines governing device approval processes. Compliance with these regulations ensures that products meet safety and efficacy standards before reaching the market. While these regulations can pose challenges for manufacturers due to lengthy approval timelines and extensive testing requirements, they ultimately foster innovation by encouraging companies to invest in research and development to meet regulatory demands. Evolving regulations related to quality management systems (QMS) necessitate ongoing adjustments in manufacturing practices.

The presence of product substitutes in the centrifugal blood pump market influences competitive dynamics significantly. Alternatives such as axial flow pumps or other types of mechanical circulatory support devices offer different benefits or features that appeal to healthcare providers based on specific clinical scenarios. The effectiveness of these substitutes impact pricing strategies and market share among centrifugal blood pump manufacturers. As healthcare professionals evaluate various options based on factors such as ease of use, patient outcomes, cost-effectiveness, and compatibility with existing systems, manufacturers continuously innovate their offerings to maintain a competitive edge.

Regional expansion plays a critical role in shaping the centrifugal blood pump market landscape. Companies are increasingly targeting emerging markets where there is a rising prevalence of cardiovascular diseases coupled with improving healthcare infrastructure. Regions such as Asia-Pacific are witnessing significant growth due to increasing investments in healthcare technology and rising awareness about advanced treatment options among patients and providers alike. Established markets such as North America and Europe continue to see steady demand driven by aging populations and higher rates of chronic conditions requiring surgical interventions.

Type Insights

The electronic segment held the largest market share of 74.3% in 2023. Electronic centrifugal blood pumps offer advantages such as energy conservation and process optimization that permit centrifugal blood pump systems to reduce the expense of cardiopulmonary bypass surgeries. Electronic centrifugal blood pumps offer the advantage of less pronounced systemic inflammatory response and decreased trauma to red blood cells compared to roller pumps, enhancing segment growth. In February 2023, a study published in Micromachines examined a screw centrifugal blood pump, optimizing both pressure generation and hemolysis levels using a combined random forest and multi-objective gray wolf optimization algorithm. After validating the algorithm’s accuracy, three optimized models were compared to a baseline model based on various fluid dynamics metrics. The final optimized design achieved a 24% increase in pressure generation while reducing hemolysis by 48%.

The mechanical segment is expected to grow at the fastest CAGR over the forecast period. Mechanical centrifugal blood pumps are widely used in circulatory assist procedures and conventional adult cardiopulmonary bypass procedures, fostering segment growth. However, due to technological advancements demand mechanical centrifugal pumps increases, thereby limiting the demand for mechanical centrifugal pumps. For instance, Medtronic Bio-Console 560, is a mechanical pump designed for compatibility with various heart-lung machines. This pump features an ergonomic design with an intuitive control panel, allowing for efficient operation during cardiac procedures. It is widely used in clinical settings for its reliability and effectiveness in maintaining blood circulation during surgeries.

End-use Insights

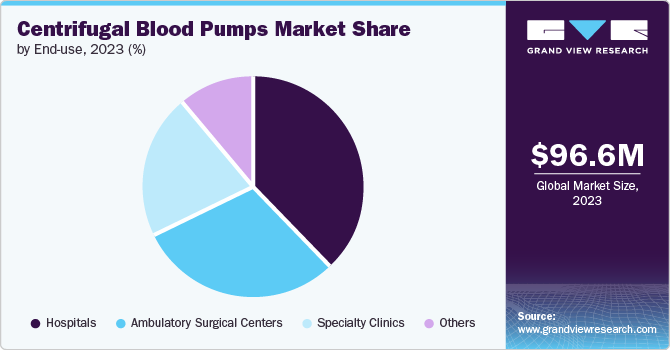

The hospitals segment dominated the market in 2023 with a market share of 38.5%. The presence of advanced healthcare facilities and a skilled workforce providing a superior and wide range of cardiac treatment is expected to fuel the segmental growth. An increasing number of patient admissions in hospitals suffering from cardiac disorders is also anticipated to fuel market growth.In 2023, the Cleveland Clinic, a renowned healthcare institution, experienced a significant surge in demand for its cardiovascular services. The clinic performed over 5,600 heart surgeries, a notable increase compared to the previous year, reflecting the growing need for specialized cardiac care.

The ambulatory care centers segment is expected to witness the fastest CAGR over the forecast period. Growing awareness of ambulatory care centers especially in the U.S., Europe, and SEA countries are expected to fuel the growth of the ambulatory surgery centers segment. The segment is inclusive of ambulatory surgery, ambulatory care for patients, and organ transport systems. Rising investments for expanding ASC business and supporting reimbursement policies are expected to boost segment growth. According to Definitive Healthcare's SurgeryCenterView product, there are nearly 9,100 active ambulatory surgery centers (ASCs) in the U.S. This figure highlights the growing prevalence of ASCs as a vital component of the healthcare system, providing efficient and specialized surgical services.

Regional Insights

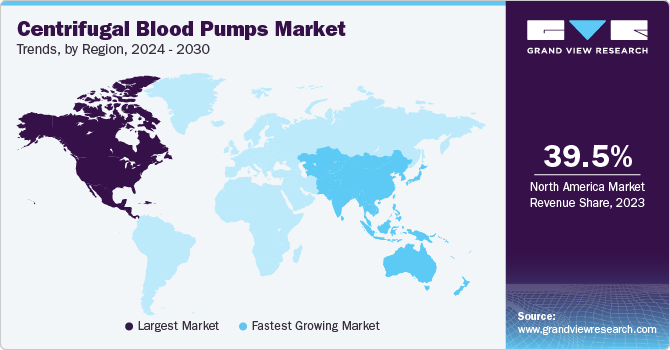

North America dominated the market and accounted for a 39.5% share in 2023. Rising R&D expenditure, increasing prevalence of cardiovascular disorders, and rising initiatives by key market players in developing advanced centrifugal blood pumps in the U.S. and Canada are factors that contributed to North America’s leading market share in 2023. The presence of technologically advanced healthcare infrastructure is predicted to foster the number of treatments leading to surged demand for centrifugal pumps. The increasing occurrence of cardiovascular disorders across the U.S. and Canada is anticipated to create demand for centrifugal blood pumps for ECMO, ventricular assistance, and cardiopulmonary bypass.

U.S. Centrifugal Blood Pumps Market Trends

The market in the U.S. is expected to grow at a significant pace over the forecast period. The market is characterized by rapid technological advancements and a growing prevalence of cardiovascular diseases. The market is driven by an increasing number of heart surgeries. According to the article published by the National Institutes of Health May 2023, approximately 400,000 CABG surgeries are performed annually in the U.S. The integration of innovative features such as miniaturization and improved biocompatibility in centrifugal pumps contribute to market growth. Furthermore, the presence of key players like Abbott Laboratories and Medtronic enhances competition and innovation within this sector.

Europe Centrifugal Blood Pumps Market Trends

Europe is identified as a lucrative region in this industry. Improved healthcare infrastructure services and a rising number of research activities specifically for cardiovascular disorders are expected to contribute to the region’s market growth. An increasing number of types receiving CE approval is expected to drive the market demand among hospitals, ambulatory surgical centers, and others. In December 2022, Ebara Pumps Europe SpA introduced the 3E/3ES model, a vertical, single centrifugal pump designed for global markets outside Japan. This mono-block, closed-coupled pump features aligned suction and discharge ports, facilitating straightforward installation in piping systems.

The centrifugal blood pumps market in the UK is expected to grow over the forecast period due to an aging population and rising incidences of heart-related ailments. The National Health Service (NHS) invests significantly in advanced medical technologies, including centrifugal pumps for cardiac support. Regulatory approvals for new devices accelerate their adoption in clinical settings. There is a growing emphasis on outpatient care and minimally invasive procedures, which are driving demand for portable and efficient blood pumps.

France centrifugal blood pumps market is anticipated to grow over the forecast period. France market is influenced by a robust healthcare system that prioritizes advanced cardiac care. The French government’s commitment to improving healthcare infrastructure has led to increased funding for hospitals, facilitating the acquisition of state-of-the-art medical devices. Moreover, collaborations between medical device manufacturers and research institutions are fostering innovation in pump design and functionality.

The centrifugal blood pumps market in Germany is expected to grow over the forecast period. Germany stands out as one of the largest markets for centrifugal blood pumps in Europe due to its well-established healthcare system and high expenditure on medical technology. The country’s focus on research and development has led to significant innovations in pump technology, enhancing patient outcomes. Germany's healthcare system demonstrates a robust capacity for managing severe heart failure through the implantation of nearly 1,000 permanent ventricular assist devices (VADs) each year which include centrifugal pumps as critical components. This substantial number of annual VAD procedures highlights the nation's advanced infrastructure and expertise in providing treatment options for patients with critical cardiac conditions. Furthermore, regulatory frameworks support swift approval processes for new devices, encouraging market growth.

Asia Pacific Centrifugal Blood Pumps Market Trends

Asia Pacific market is anticipated to witness the fastest CAGR from 2024 to 2030 in the market. The rising focus on making advanced treatment accessible and improvements in healthcare policies in emerging countries such as India and Japan are anticipated to fuel the regional growth. Emerging economies are experiencing a rising number of advanced interventional cardiac procedures, leading to a surging adoption rate of centrifugal blood pumps. Additionally, the rising adoption of cardiac assist devices for cardiopulmonary bypass is estimated to accelerate regional growth.

The centrifugal blood pumps market in China is expected to grow over the forecast period owing to increasing healthcare investments and a rising burden of cardiovascular diseases among its large population. The Chinese government has implemented policies aimed at improving access to advanced medical technologies in rural areas. According to World Health Organization, 270 million individuals suffer from hypertension alone, there is a pressing need for effective cardiac support solutions. Local manufacturers are emerging alongside international players, contributing to competitive pricing and enhanced product availability.

Japan centrifugal blood pumps market is anticipated to grow at a significant CAGR over the forecast period. Japan’s centrifugal blood pump market benefits from its aging demographic and high standards of healthcare delivery. The country boasts some of the most advanced medical facilities globally; thus, there is a high demand for innovative cardiac devices that can improve surgical outcomes., Japan’s focus on robotic-assisted surgeries drives demand for compact and efficient blood pumping solutions.

The centrifugal blood pumps market in India is anticipated to grow at a rapid rate over the forecast period. India presents significant growth potential for the centrifugal blood pump market due to its rapidly evolving healthcare sector and increasing prevalence of lifestyle-related diseases such as diabetes and hypertension. Government initiatives aimed at enhancing healthcare infrastructure led to greater accessibility of advanced cardiac care technologies across urban and rural regions alike. In May 2023, a report from the National Institutes of Health indicated that approximately 300,000 cardiac procedures are conducted annually. There is a burgeoning demand for cost-effective yet reliable blood pumping solutions.

Middle East And Africa Centrifugal Blood Pumps Market Trends

The market in Middle East and Africa is projected to grow in near future due to increasing investments in healthcare infrastructure coupled with rising incidences of cardiovascular diseases. Countries such as UAE and South Africa lead this trend through public-private partnerships aimed at upgrading hospital facilities with modern medical equipment. Furthermore, awareness campaigns about heart health are contributing to higher rates of diagnosis and treatment-seeking behavior among populations.

The centrifugal blood pumps market in Saudi Arabia is expected to grow over the forecast period.The growth is fueled by government initiatives focused on enhancing healthcare services under Vision 2030 reforms. Investments into state-of-the-art hospitals have increased access to advanced cardiac treatments including those utilizing centrifugal pumps. Collaborations with international firms facilitate knowledge transfer regarding best practices in cardiac care technology deployment.

Kuwait centrifugal blood pumps market is anticipated to witness growth over the forecast period. Kuwait’s market is characterized by a growing emphasis on specialized cardiac care facilities supported by governmental health policies aimed at reducing cardiovascular disease mortality rates. As part of its national health strategy, Kuwait invests heavily into modernizing its healthcare infrastructure which includes acquiring cutting-edge medical devices like centrifugal pumps that enhance surgical efficacy during complex procedures.

Key Centrifugal Blood Pumps Company Insights

Key players operating in the market are undertaking various initiatives to strengthen their market presence and increase the reach of their types and services. Strategies such as expansion activities and partnerships are playing a key role in propelling the market growth.

Key Centrifugal Blood Pumps Companies:

The following are the leading companies in the centrifugal blood pumps market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- LivaNovaplc

- Qura srl

- Abbott Laboratories

- Terumo Corporation

- Braille Biomedica Ltd.

- Getinge AB

- 3M

- Baxter International

Recent Developments

-

In April 2023, Abbott Laboratories received two new FDA clearances for its CentriMag Blood Pump, allowing for extended use in adults requiring extracorporeal membrane oxygenation (ECMO) during critical life support situations. This longer-term support option provides physicians with additional time to evaluate patient care strategies. Additionally, Abbott introduced the CentriMag Pre-connected Pack, which streamlines the setup process of the life support system, enhancing its deployment in hospitals.

-

In November 2022, LivaNova PLC announced that it received FDA 510(k) clearance for its LifeSPARC system, a next-generation pump and controller designed for extracorporeal membrane oxygenation (ECMO). The company utilized real-world data gathered during the COVID-19 pandemic to support this new indication.

-

In October 2021, a study published in Frontiers in Physiology introduced a new wearable and portable centrifugal blood pump designed to enhance performance for heart failure patients. This innovative pump features parallel inlet and outlet pipes and a ring cavity to optimize fluid dynamics, maintaining effective hydrodynamic and hemolytic performance similar to traditional pumps without significant degradation.

Centrifugal Blood Pumps Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 101.6 million

Revenue forecast in 2030

USD 136.1 million

Growth Rate

CAGR of 5.0% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, and Kuwait

Key companies profiled

Medtronic; Getinge AB; Terumo Corporation; LivaNovaPlc; Abbott Laboratories; Qura Srl; Braille Biomedica Ltd; 3M; Baxter International

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Centrifugal Blood Pumps Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global centrifugal blood pumps market report based on type, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Electronic

-

Mechanical

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Specialty Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The hospitals segment dominated the centrifugal blood pumps market and captured the highest revenue share of 38.5% in 2023.

b. North America dominated the centrifugal blood pumps market and accounted for the largest revenue share of 39.5% in 2023.

b. The global centrifugal blood pumps market size was estimated at USD 96.6 million in 2023 and is expected to reach USD 101.6 million in 2024.

b. The global centrifugal blood pumps market is expected to grow at a compound annual growth rate of 5.0% from 2024 to 2030 to reach USD 140.0 million by 2030.

b. The electronic segment accounted for the largest revenue share of 74.3% in 2023 in the centrifugal blood pumps market.

b. Some key players operating in the centrifugal blood pumps market include Medtronic, LivaNova plc., Qura srl, Abbott Laboratories, Terumo Corporation, Braille Biomedica Ltd., Getinge AB, and 3M.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."