- Home

- »

- Medical Devices

- »

-

Ventricular Assist Device Market Size, Industry Report, 2030GVR Report cover

![Ventricular Assist Device Market Size, Share & Trends Report]()

Ventricular Assist Device Market (2021 - 2028) Size, Share & Trends Analysis Report By Product, By Type Of Flow (Pulsatile Flow, Continuous Flow), By Application, By Design, By Region, And Segment Forecasts

- Report ID: 978-1-68038-603-5

- Number of Report Pages: 131

- Format: PDF

- Historical Range: 2016 - 2019

- Forecast Period: 2021 - 2028

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Ventricular Assist Device Market Summary

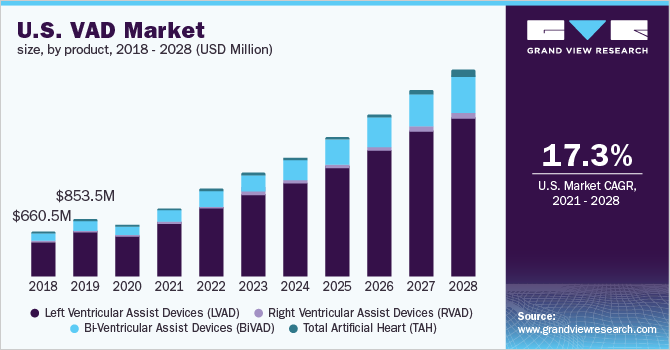

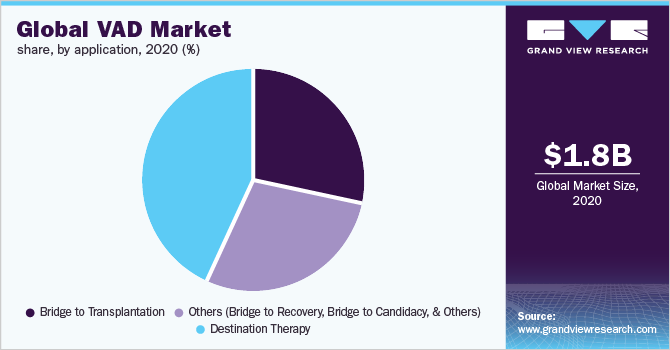

The global ventricular assist device market size was valued at USD 1.8 billion in 2020 and is projected to reach USD 7.5 billion by 2028, growing at a CAGR of 17.6% from 2021 to 2028. Some of the major factors anticipated to drive the demand for Ventricular Assist Devices (VADs) include the growing global geriatric population suffering from the rising prevalence of chronic disorders like diabetes, neurological disorders, cardiovascular diseases, hypertension, and stroke.

Key Market Trends & Insights

- The North America region accounted for the highest share in the ventricular assist device market at 54.1% in 2020.

- Asia Pacific VAD market is anticipated to witness the highest CAGR of 19.3% over the forecast period.

- By product, the LVAD segment dominated the market and accounted for the largest revenue share of 80.5% in 2020.

- By design, the implantable devices segment dominated the market and accounted for the largest revenue share of 71.5% in 2020.

- By application, the destination therapy segment dominated the market in 2020 with a market share of 43.1%.

Market Size & Forecast

- 2020 Market Size: USD 1.8 Billion

- 2028 Projected Market Size: USD 7.5 Billion

- CAGR (2021-2028): 17.6%

- North America: Largest market in 2020

Rapid globalization coupled with the pursual of unhealthy lifestyles in both developed and developing nations are contributing to the growing risk of chronic ailments. The growing prevalence of cardiovascular diseases is, in turn, expected to drive the demand for ventricular assist devices. Moreover, these diseases increase the risk of organ failure and due to the deficiency of organ donors and delay in organ transplantations, the demand for VADs is expected to rise over the forthcoming years.

The surge in the prevalence of chronic conditions and decline in organ transplantations is one of the key factors responsible for the growth of the market for VAD. In addition, the rapid growth in the geriatric population and increasing natality are key impact-rendering drivers for the market over the forecast period. The market for VAD is constantly evolving, and the key players are investing in product innovation and development. Technological advancements coupled with timely regulatory approvals, in the form of small-size devices with features like infection control are expected to drive the market for VAD. In June 2020 Berlin Heart announced the completion of the requirement for the Post Market Approval (PMA) by the U.S. FDA in June 2017 for EXCOR Pediatric VAD. In addition, benefits associated with the adoption of VADs include improved abidance rate, functionality, and durability enhance the product adoption rate and thereby, support market growth.

The rising prevalence of cardiovascular diseases and increasing risks of organ failures is supporting the growth in organ transplant demand. The shortage of organ donors delays the organ transplantation procedure. As per United Network for Organ Sharing, nearly 121,016 people need organ transplantation and approximately 77,725 people are on the active waiting list. According to Organ Procurement and Transplantation Network, 3,582 candidates are registered on the waiting list for heart transplants as of June 2020. The rapidly growing patient pool suffering from irreversible end-stage heart failure and waiting for heart transplantation have led to an increase in demand for ventricular assist devices due to a shortage of donor organs. As per estimates, 20 million Americans and Europeans suffer from degenerative cardiac illnesses and most of them are on the waiting list for a heart transplant. The abovementioned factors are accelerating the growth of the market for VAD. Furthermore, VAD procedures have proven improved results and have increased applicability and durability associated with left ventricular assist devices (LVAD) have enhanced treatment options for end-stage heart failure.

Advancements in the novel VADs for surgical interventions, especially in the pediatric patient population suffering from cardiac disorders are expected to boost the demand for these. For instance, the U.S. FDA graded the continuous-flow LVADs, Micromed HeartAssist 5TM Pediatric VAD, and the Berlin HeartTM EXCOR pediatric VAD for pediatric patients. Berlin HeartTM EXCOR is approved for use as a bridge-to-transplantation device since 2011.

Treatment options available for bi-ventricle failure due to end-stage heart failure are bi-ventricular assist devices or total artificial heart. The total artificial heart (TAH) is an automatic device replacing the ventricles, is recommended in end-stage heart failure patients. The benefits associated with total artificial heart are blood flow restoration, increased survival, and improved quality of life. The growing VAD market is receiving recognition in the form of investments by private equity firms and venture capitalists to promote product development. For instance, in January 2021, CorWave raised USD 40.0 million in a Series C funding round led by three new investors and returning investors, including Novo Holdings, Bpifrance, Sofinnova Partners, Seventure, Ysios Capital, European Commission, the Singaporean family office M&L Healthcare, and Financière Arbevel for its implantable heart pump based on a novel technology, the wave membrane pump.

The ongoing Covid-19 pandemic has negatively impacted the market for VAD with the temporary lockdowns and travel restrictions imposed by the government which led to a decline in the number of surgical procedures. For instance, ABIOMED Impella heart pump's global revenue was impacted in Q4 of FY2020 owing to lower patient utilization and the significant impact of the COVID-19 pandemic on surgeries, elective medical procedures, and fewer patients seeking treatment at hospitals. The continuous strain of the pandemic caused deferrals of elective surgical interventions and negatively impacted the growth of the market for VAD by decreasing the product demand.

Product Insights

In 2020, the Left Ventricular Assist Devices (LVAD) segment dominated the market for VAD and accounted for the largest revenue share of 80.5%. This growth is owing to the numerous procedures of LVAD implantations recorded amongst patients. By 2018, Abbott implanted its HEARTMATE II LVAD in over 26,6000 patients suffering from heart failure globally. As per the American College of Cardiology report, readmissions post LVAD implantation were costlier and led to extended hospitalization periods. Furthermore, with the patient pool suffering from end-stage cardiac failure is increasing and the shortage of available therapeutic procedures, the market for VAD is expected to grow over the forthcoming years. Additionally, the American Heart Association recorded improvements in LVADs patients in aspects of functionality, patient welfare, and increased life span, which supports the adoption rate of LVADs. Also, the market players are focusing on their merger and collaboration strategies to tackle the deficiency of organ donors and cater to the increasing order for LVADs for the bridge to transplantation patients.

The Bi-ventricular Assist Devices (BiVAD) segment is anticipated to register the fastest growth rate of 18.7% over the forthcoming years. The increased use of pneumatically driven BiVADs in TAH transplantation is expected to boost product demand. BiVADs are more effective than LVADs in individuals diagnosed with severely decompensate heart failure as they enable efficient working in the heart ventricles. The abovementioned benefits of BiVADs are expected to boost the market for VAD and support the rapid adoption rate.

Type Of Flow Insights

In 2020, the non-pulsatile or continuous flow segment dominated the market for VAD and accounted for the largest revenue share of 92.5% owing to the benefits of the continuous flow VADs over pulsatile VADs. Continuous flow VADs have minimal noise, lesser rotating parts, lower maintenance, and rare replacements. These benefits make continuous flow VADs are the popular choice of treatment among researchers and physicians. Product development in the continuous flow VADs segment focuses on eliminating moving parts in the machines. The key players, such as Abbott and Terumo Heart Inc, have launched HeartMate 3 LVADs and DuraHeart, respectively, since they do not possess any rotating parts that use magnetic levitation technology instead.

The pulsatile flow VADs segment is anticipated to expand at the fastest rate over the forecast period due to the increasing incidence of heart failure and cardiovascular diseases. According to the WHO, in 2016, approximately 17.9 million people died from cardiovascular diseases, accounting for 31% of global deaths. According to the data published by American Heart Association, in March 2018, pulsatile mechanical ventricular assist devices became a standard treatment for patients with severe heart failure as a bridge to transplantation or in part as a rehabilitation aid.

Design Insights

In 2020, the implantable devices segment dominated the market for VAD and accounted for the largest revenue share of 71.5%. This growth is owing to the rising preference for long-term therapy methods by patients ineligible for heart transplant interventions, and therefore this segment is anticipated to grow at a lucrative rate over the forthcoming years. The market for VAD is witnessing the introduction of new players with innovative devices. For instance, FineHeart SARL a medical technology company is focused on developing miniature embedded, pulsatile-flow VAD. Similarly, Abbott’s HeartMate 3 LVAD is incorporated with a magnetically levitated (MagLev) technology-based heart pump developed to lessen the damage caused by blood running through pumps during the blood flow optimization process. In addition, implantable devices are expected to record the fastest growth over the forecast period. Transcutaneous VAD compared to an implant device, is a VAD used briefly during or post-cardiac surgery. Patients with transcutaneous VAD are restricted to the clinical facility bed due to the external setup of the VAD control unit and thereby limiting the usage of these devices and restraining growth.

Application Insights

In 2020, the destination therapy segment dominated the market for VAD and accounted for the largest revenue share of 43.1%. This growth is attributable to the increase in end-stage cardiac failure incidences and cardiovascular diseases. LVADs are used in destination therapy applications for heart patients who are not eligible to undergo heart transplant surgeries. Key players in the market are Jarvik Heart Inc.; Abbott; and Medtronic. Many of these companies’ products are in the pipeline for FDA approval.

On the other hand, the bridge to transplantation segment is expected to record the fastest growth rate over the forecast period. VADs in the bridge to transplantation is used for a brief period (2 to 6 months only) in stabilizing patients from their physiological stress of the transplantation surgical process. Furthermore, VAD use in bridge to transplantation is gaining wide-scale adoption and acceptance owing to the enhancements in technology and decline in VAD-related complications.

Regional Insights

North America dominated the ventricular assist devices market and accounted for the largest revenue share of 54.1% in 2020. The availability of regulated reimbursement policies and coverages, increasing awareness regarding VADs such as bridge-to-recovery, destination therapies, and bridge-to-transplant are anticipated to drive the market for VAD in the forthcoming years. U.S. population accounts for the highest number of obese citizens, making them susceptible to cardiovascular diseases. Furthermore, the development of technologically developed healthcare facilities in the U.S. is expected to drive the treatment numbers and provide impetus to market growth. The presence of favorable reimbursement policies and insurance coverages reducing out-of-pocket expenditure is expected to boost growth by supporting the rising treatment rate.

In Asia Pacific, the market for VAD is anticipated to witness the highest CAGR of 19.3% over the forecast period owing to the advancement in healthcare facilities and favorable government strategies such as the “Make in India” movement to boost private and public partnerships in India. Similarly, favorable initiatives in other Southeast Asian countries undertaken by public and private players are expected to drive Asia Pacific growth. Moreover, the rising medical tourism market in Asia Pacific providing high-quality and cost-effective treatment services is boosting regional growth.

Key Companies & Market Share Insights

Key market players are continuously investing in the development of advanced ventricular assist devices to gain a competitive edge over others in the market, which is expected to drive the growth of the market for VAD. For instance, In June 2020, the company received the FDA approval for its First-in-Human Trial of Impella ECP, which will be studied in high-risk percutaneous coronary intervention patients. In addition, they are also adopting various strategies such as mergers and acquisitions and expanding their manufacturing facilities to strengthen their business and expand their device’s reach. Some of the prominent players in the ventricular assist device (VAD) market include:

-

Abiomed

-

Medtronic

-

Abbott

-

Berlin Heart

-

Cardiac Assist, Inc.

-

Jarvik Heart, Inc.

-

ReliantHeart, Inc.

-

Sun Medical Technology Research Corp

Ventricular Assist Device Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 2.4 billion

Revenue forecast in 2028

USD 7.5 billion

Growth Rate

CAGR of 17.6% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Revenue, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type of flow, design, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; Spain; Italy; France; Russia; Japan; China; India; Singapore; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Abiomed; Medtronic; Abbott; Berlin Heart; Cardiac Assist, Inc.; Jarvik Heart, Inc.; ReliantHeart, Inc.; Sun Medical Technology Research Corp

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research, Inc. has segmented the global ventricular assist device market report on the basis of product, type of flow, design, application, and region:

-

Product Outlook (Revenue, USD Million, 2016 - 2028)

-

Left Ventricular Assist Device

-

Right Ventricular Assist Device

-

Bi-Ventricular Assist Device

-

Total Artificial Heart

-

-

Type Of Flow Outlook (Revenue, USD Million, 2016 - 2028)

-

Pulsatile Flow

-

Continuous Flow

-

-

Application Outlook (Revenue, USD Million, 2016 - 2028)

-

Bridge to Transplant

-

Destination Therapy

-

Others (Bridge to Recovery, Bridge to Candidacy, and Others)

-

-

Design Outlook (Revenue, USD Million, 2016 - 2028)

-

Implantable Ventricular Assist Device

-

Transcutaneous Ventricular Assist Device

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

Spain

-

Italy

-

France

-

Russia

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Singapore

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global VAD market size was estimated at USD 1.8 billion in 2020 and is expected to reach USD 2.4 billion in 2021.

b. The global VAD market is expected to grow at a compound annual growth rate of 17.6% from 2021 to 2028 to reach USD 7.5 billion by 2028.

b. Non-pulsatile or continuous flow devices dominated the VAD market with a share of 92.6% in 2020. This is attributed to the preference of these devices over devices with pulsatile flow type as they make minimal noise, have fewer rotating parts, and require lesser maintenance and replacement.

b. Some key players operating in the VAD market include Medtronic; Abbott; Berlin Heart GmbH; ReliantHeart Inc.; Abiomed Inc.; CHF Solutions, Inc.; and Cardiac Assist Inc.

b. Key factors driving the VAD market growth include the increasing prevalence of cardiovascular disorders, mainly hypertension, ventricular septal defect, heart failure, stroke, and others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.