- Home

- »

- Alcohol & Tobacco

- »

-

Champagne Market Size And Share, Industry Report, 2030GVR Report cover

![Champagne Market Size, Share & Trends Report]()

Champagne Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Prestige Cuvée, Blanc De Noirs, Blanc De Blancs, Rosé Champagne, Others), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-513-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Champagne Market Summary

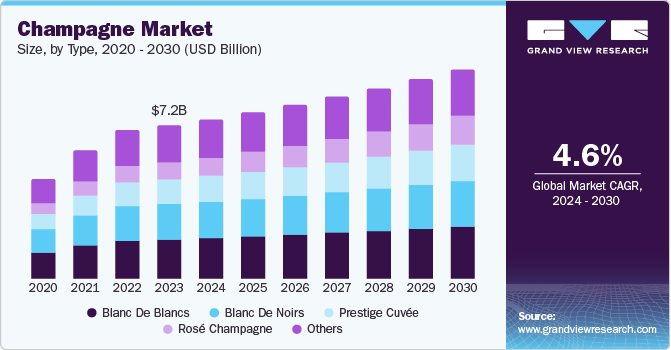

The global champagne market size was valued at USD 7.19 billion in 2023 and is projected to reach USD 9.83 billion by 2030, growing at a CAGR of 4.6% from 2024 to 2030. Champagne is associated with special occasions and other celebrations, and the growing trend of marking significant life events with celebratory drinks is a major driver of the market.

Key Market Trends & Insights

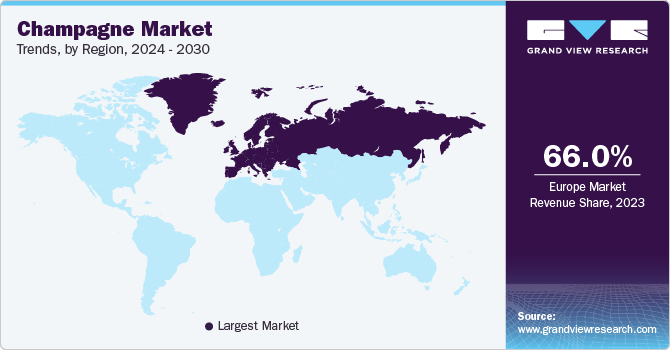

- Europe accounted for the largest revenue share of 66.0% in 2023.

- The U.S. market is expected to witness significant growth over the forecast period.

- Based on type, blanc de blancs dominated the champagne market with a revenue share of 26.0% in 2023.

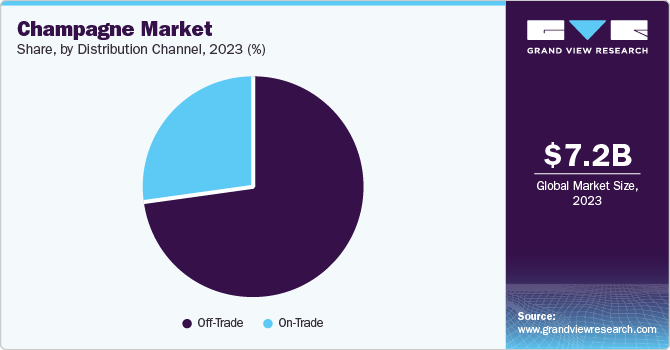

- Based on distribution channel, the off-trade segment dominated the champagne market in 2023. off-trade channels, including supermarkets, liquor stores.

Market Size & Forecast

- 2023 Market Size: USD 7.19 Billion

- 2030 Projected Market Size: USD 9.83 billion

- CAGR (2024-2030): 4.6%

- Europe: Largest market in 2023

- Asia Pacific: Fastest growing market

Additionally, rising corporate events and promotional activities frequently incorporate champagne, driving its demand in the market. Innovation in product offerings is another significant driver of the Champagne market. Producers continuously experiment with new blends, packaging, and product variations to attract consumer segments. For instance, in June 2024, Laurent-Perrier launched Heritage, a multi-vintage blend. It is an intermediate option between the producer's basic non-vintage champagne and higher-end offerings. These innovations attract new consumers and encourage repeat purchases among existing customers pursuing new experiences. Developing sustainable and organic champagne options also meets the growing consumer demand for environmentally friendly and ethically produced goods.

Regions such as France's Champagne-Ardenne attract tourists annually for their champagne production. These visitors often participate in vineyard tours, tastings, and other wine-related experiences, leading to direct purchases and increased brand awareness. Wine tourism aids educate consumers about the production process, heritage, and distinct qualities of champagne, promoting a deeper appreciation and preference for these products. The storytelling aspect, where brands highlight their rich history and craftsmanship, also resonates with consumers who value tradition and authenticity in their luxury purchases, driving its demand.

Type Insights

Blanc de Blancs dominated the champagne market with a revenue share of 26.0% in 2023. As culinary experiences evolve, consumers are increasingly interested in how champagne complements their meals. Blanc de Blancs's crisp acidity and mineral content make it an ideal choice for pairing with various cuisines, particularly seafood and light dishes. This versatility enhances dining experiences and encourages consumers to explore different food and champagne combinations, driving demand in the market.

Rosé champagne segment is anticipated to witness the fastest CAGR over the forecast period. The pink shade of rosé champagne captures consumers' attention, making it a popular choice for celebrations, special occasions, and romantic events. Additionally, introducing new blends, styles, and packaging options has diversified the market and attracted new consumers. Producers experiment with different varieties, fermentation techniques, and aging processes to create unique, high-quality rosé champagnes. For instance, in June 2024, Lanson launched a rosé champagne, Le Rosé Création 67. Its blend is made without malolactic fermentation. It comprises 52% Pinot Noir, 34% Chardonnay, and 14% Meunier from Grand and Premier Crus.

Distribution Channel Insights

The off-trade segment dominated the champagne market in 2023. Off-trade channels, including supermarkets, liquor stores, and online retail platforms, allow consumers to purchase champagne easily and conveniently. These channels stock various champagne brands, types, and price points, catering to different consumer preferences and budgets. This extensive selection allows consumers to experiment with different champagnes and discover new favorites. This convenience and wide selection drive the demand for off-trade channels.

The on-trade is projected to grow at the fastest CAGR during the forecast period. Restaurants, bars, hotels, and clubs provide a unique environment for enjoying champagne, often enhancing the overall experience with ambiance, service, and presentation. Additionally, companies collaborate with restaurants, bars, and hotels to host exclusive events, tastings, and promotional nights featuring limited-edition releases, special menus, and unique experiences. These targeted marketing to increase visibility and consumer interest, driving sales in the on-trade channel.

Regional Insights

The North America champagne market is expected to witness significant growth over the forecast period. Influencers, celebrities, and social media platforms often showcase champagne as a luxurious beverage, influencing consumer perceptions and preferences. Champagne's visibility in widespread culture and endorsements by high-profile personalities enhance its consumption and drive consumer demand. Social media and campaigns featuring champagne contribute to its consumption among younger and other consumers.

U.S. Champagne Market Trends

The U.S. market is expected to witness significant growth over the forecast period. The increasing number of Champagne bars in the U.S. significantly drives the market by enhancing consumer access. These specialized bars provide a dedicated space for consumers to explore champagne offerings, including rare and premium labels. The rise of champagne bars also promotes social interactions and special events centered on champagne. For instance, in November 2023, RH Guesthouse New York announced the opening of its Champagne & Caviar Bar. The bar offers champagnes and vodkas, and its menu features dishes with the highest grades of Petrossian caviar and classic caviar service.

Europe Champagne Market Trends

Europe accounted for the largest revenue share of 66.0% in 2023. Through targeted marketing campaigns, champagne houses emphasize their product's unique qualities, heritage, and exclusivity. These efforts highlight champagne's craftsmanship, terroir, and luxury positioning, discerning consumers who value premium and authentic experiences. Collaborations with high-profile events, sponsorships, and media campaigns enhance brand visibility and desirability. The differentiation and promotion of champagne brands ensure a robust market presence and drive consumer demand.

France market is expected to witness significant growth over the forecast period. Wine education programs, tastings, and events have become more prevalent, enabling consumers to understand champagne's unique qualities. As consumers become more informed about different champagne styles, production methods, and pairing options, their interest in and demand for high-quality champagne grows. This educational trend in France supports the market by encouraging consumers to explore and consume champagne in various settings.

Asia Pacific Champagne Market Trends

Asia Pacific is expected to grow at the fastest CAGR over the forecast period. Expanding e-commerce and retail channels has significantly influenced the champagne market in Asia Pacific. Online retail platforms offer consumers a convenient way to purchase champagne, providing a wide selection, detailed product information, and customer reviews. The ability to shop online and have champagne delivered directly to their doorsteps. Additionally, direct-to-consumer channels allow champagne producers to offer exclusive products and special editions, attracting enthusiasts and collectors and driving further market growth.

China champagne market is expected to witness significant growth over the forecast period. The inflow of international tourists and business travelers contributes to higher champagne consumption in hotels, resorts, and dining establishments. Tourists often pursue luxurious and memorable experiences, including premium beverages such as champagne. Moreover, high-end restaurants and dining establishments feature champagne as a key part of their beverage offerings, pairing it with gourmet dishes and creating exceptional dining experiences. These factors combined are driving the demand for champagne in China.

Key Champagne Company Insights

Some of the key companies in the champagne market include Champagne Nicolas Feuillatte, Veuve Clicquot, Perrier-Jouët, Taittinger, and others.

-

Champagne Nicolas Feuillatte is a leading brand in France and internationally. Its product offerings include various Champagnes, such as Brut Réserve and Palmes d'Or. It also offers a selection of rosé champagnes, including the Brut Rosé.

-

Veuve Clicquot is the leading company in the champagne market. The company is based in France and is part of the LVMH group. Its product offerings in champagne include Yellow Label Brut, Rosé, La Grande Dame, Demi-Sec, and others.

Key Champagne Companies:

The following are the leading companies in the champagne market. These companies collectively hold the largest market share and dictate industry trends.

- Moët & Chandon

- Laurent-Perrier

- Champagne Piper-Heidsieck

- Champagne Nicolas Feuillatte

- Perrier-Jouët

- Veuve Clicquot

- Univins et Spiritueux

- Taittinger

- Louis Roederer

- Cook’s Champagne Cellars, Madera, CA.

Recent Developments

-

In March 2024, Piper-Heidsieck announced a three-year partnership as the Official Champagne of the Miami Open. During the two weeks tournament, visitors to the Champagne Garden are able to consume champagne such as Rosé, Cuvée Brut, or Riviera of Piper-Heidsieck.

-

In August 2023, Global Airlines announced a partnership with Laurent Perrier. Global Airlines and Laurent Perrier have signed a Memorandum of Understanding (MOU) to collaborate on providing passengers with an onboard experience. Laurent Perrier is served on all Global Airlines transatlantic flights starting from 2024.

Champagne Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.49 billion

Revenue forecast in 2030

USD 9.83 billion

Growth Rate

CAGR of 4.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, South Korea, Australia & New Zealand, South Africa, Brazil.

Key companies profiled

Moët & Chandon; Laurent-Perrier; Piper-Heidsieck; Champagne Nicolas Feuillatte; Perrier-Jouët; Veuve Clicquot; Univins et Spiritueux; Taittinger; Louis Roederer; Cook’s Champagne Cellars, Madera, CA.;

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Champagne Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the champagne market report based on type, distribution channel, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Prestige Cuvée

-

Blanc De Noirs

-

Blanc De Blancs

-

Rosé Champagne

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Trade

-

Off-Trade

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia & New Zealand

-

-

Middle East & Africa

-

South Africa

-

-

Central & South America

-

Brazil

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.