- Home

- »

- Consumer F&B

- »

-

Cheese Market Size, Share, Growth & Trends Report, 2030GVR Report cover

![Cheese Market Size, Share & Trends Report]()

Cheese Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Cheddar, Mozzarella, Parmesan), By Source (Animal, Plant), By Type (Natural, Processed), By Distribution Channel (B2C, B2B), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-240-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cheese Market Summary

The global cheese market size was estimated at USD 194.6 billion in 2023 and is projected to reach USD 283.4 billion by 2030, growing at a CAGR of 5.6% from 2024 to 2030. This is attributed to evolving consumer tastes and preferences for diverse and exotic flavors in food products, growing demand for plant-based cheese products, introduction of new and unique cheese varieties, and the globalization of culinary trends.

Key Market Trends & Insights

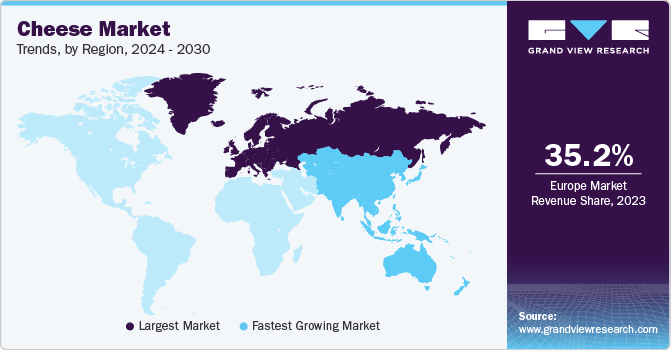

- The cheese market in Europe held a share of 35.16% in 2023.

- The U.S. cheese market accounted for a share of 75% in 2023.

- Based on product, the cheddar cheese sales accounted for a share of 36.50% in 2023.

- Based on source, the animal-based cheese segment accounted for a revenue share of 98.40% in 2023.

- Based on type, the natural cheese type segment held a revenue share of 80.09% in 2023..

Market Size & Forecast

- 2023 Market Size: USD 194.6 Billion

- 2030 Projected Market Size: USD 283.4 Billion

- CAGR (2024-2030): 5.6%

- Europe: Largest market in 2023

The cheese industry is undergoing a shift towards sustainability and efficiency, acknowledging the environmental impact of traditional cheese-making processes. In response to concerns about waste generated during whey separation, innovative techniques utilizing specialized protein blends, particularly micellar casein, are gaining traction.

Micellar casein allows for eco-friendlier cheese production by avoiding whey separation, thereby reducing costs, and enhancing sustainability. The adoption of matured technology involves creating a stable, emulsified pre-cheese mixture, resulting in a glossy, white base that undergoes high-temperature treatments. This not only addresses environmental concerns but also proves advantageous in regions with limited dairy resources, such as Southeast Asia, Middle East, and Sub-Saharan Africa. The integration of specialized proteins into cheese-making processes is a sustainable evolution in food technology, promising a new generation of cheeses that are not only delicious but also responsibly made.

Micellar casein, with its unique structural and functional characteristics, contributes to higher protein content, water retention, heat stability, and nutritional benefits in cheeses. In March 2023, Daiya Foods, a leading plant-based food brand known for its plant-based cheese products, announced an investment in fermentation technology to create a plant-based cheese that closely mimics traditional dairy-based cheese. By combining traditional cheese-making methods with modern technology, the company aims to revolutionize consumers' experience in the plant-based cheese category. This investment in natural fermentation is a major step towards achieving parity with dairy-based products.

Market Concentration & Characteristics

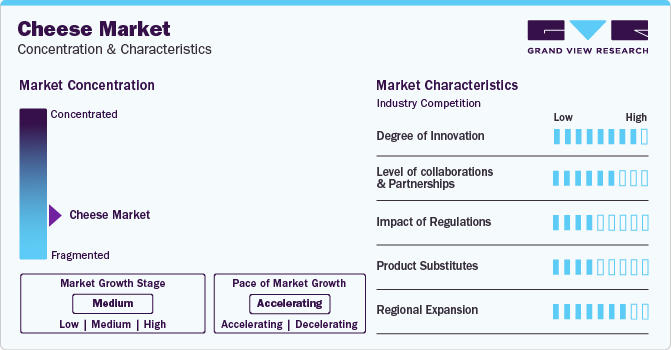

The market growth stage is medium, and the pace of its growth is accelerating.

The cheese market is anticipated to witness a high degree of innovation, driven by the high demand for diverse flavors and a rise in plant-based cheese alternatives. Consumers' evolving tastes and preferences are fostering a climate where manufacturers are compelled to introduce novel varieties and creative plant-based cheese options to cater to a more discerning and health-conscious customer base, thus driving innovation in the market.

The level of collaborations and partnerships in the market is moderately high. Companies are forging collaborations and partnerships to enhance market presence, leverage expertise, and introduce diverse cheese products. In December 2022, Britannia Industries anticipated a fivefold growth in its cheese business over the next five years through a joint venture with French cheese maker Bel. The partnership, with Bel acquiring a 49% stake in Britannia's subsidiary, Britannia Dairy, aims to capitalize on the growing cheese market in India. The collaboration involves producing and selling co-branded products under “Britannia” and “The Laughing Cow” trademarks, expanding the cheese product portfolio.

Product Insights

Cheddar cheese sales accounted for a share of 36.50% in 2023. This is mainly due to its widespread popularity and versatile applications. Known for its rich and sharp flavor profile, cheddar is a widely consumed cheese variety used in various culinary preparations, including sandwiches, burgers, and as a standalone snack. Its ability to complement a range of dishes, coupled with consumer preferences for its distinctive taste, contributed to its significant share.

The mozzarella cheese segment is projected to grow at a CAGR of 5.0% from 2024 to 2030. The mozzarella cheese segment has witnessed technological advancements in the production process. Advanced stretching and molding techniques offer flexibility in shaping, enhancing the visual appeal of mozzarella cheese. In addition, smart packaging and preservation methods extend the shelf life of mozzarella cheese while maintaining freshness, meeting the market demand. These technological enhancements not only optimize production but also elevate the overall quality and consistency of mozzarella cheese, sustaining its popularity and relevance in the culinary world.

Source Insights

The animal-based cheese segment accounted for a revenue share of 98.40% in 2023. This is attributed to the traditional and widespread consumption of cheese derived from animal milk, reflecting established preferences and familiar tastes among consumers. The popularity of conventional cheese and high demand for cheese derived from cow milk, goat milk, etc. will drive segment growth. The plant-based cheese segment is projected to grow at a CAGR of 12.5% from 2024 to 2030.

This growth is driven by shifting consumer preferences towards plant-based diets, driven by health and environmental considerations due to increasing awareness about lactose intolerance and a growing vegan & flexitarian population. This is also encouraging innovation and investment in this sector to meet the rising demand for sustainable and cruelty-free alternatives to traditional dairy products. The plant-based cheese segment is further categorized into soy-based, cashew-based, almond-based, coconut-based cheese, etc.

Type Insights

The natural cheese type segment held a revenue share of 80.09% in 2023. According to Agriculture and Agri-Food Canada, the unprocessed cheese/natural cheese segment dominates the Western European market, constituting 87% of retail sales, with a preference for hard cheese over soft varieties. Emerging trends in the demand for natural cheese include a rise in snacking culture, increasing consumer awareness of dairy as a nutritious snack, and demand for lactose-free and organic cheese. The processed cheese segment is projected to grow at a CAGR of 4.0% from 2024 to 2030. Processed cheese is sold in different forms, such as slices, cubes & blocks, spreads, and grated & shredded forms.

Cheese slices accounted for a revenue share of around 60% in 2023. The demand for processed cheese, particularly processed cheese slices, is driven by a preference for convenience as these slices are pre-portioned and easy to use, making them ideal for quick snacks, sandwiches, and food preparation. Processed cheese slices also offer consistent quality, uniformity in thickness, and easy melting properties, enhancing their versatility in various culinary applications. In addition, the extended shelf life and convenient packaging contribute to their popularity among consumers seeking convenient and long-lasting dairy options.

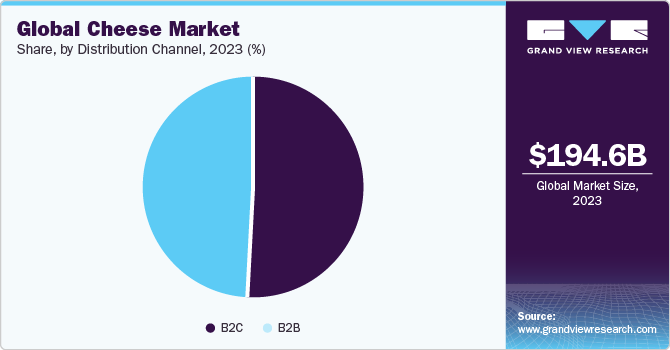

Distribution Channel Insights

The B2C distribution channel segment accounted for a share of more than 50% in 2023. This is attributed to the growing consumer preference for convenient, diverse, and high-quality cheese options. The culinary trend coupled with increased at-home cooking experiences has resulted in an increased demand for cheese via hypermarkets/supermarkets. Retailers in various markets are revitalizing their specialty cheese programs by diversifying their offerings. Some are emphasizing domestic cheeses due to stable pricing compared to fluctuating import prices. For instance, the growing variety in retail in the U.S. includes U.S. versions of European favorite cheeses, reducing shipping costs. Retailers are enhancing cheese display spaces, conducting in-store promotions, and organizing themed events to boost specialty/artisanal cheese sales.

The B2B distribution channel segment is projected to grow at a CAGR of 5.9% from 2024 to 2030. It includes both the food service industry and food & beverage processing industry. Among food & beverage applications, cheese-based snacks accounted for a revenue share of 37.02% in 2023. The growing demand for healthy and culinary snacks is driving product demand in snack applications. Manufacturers are innovating exciting and locally inspired flavors in cheese to appeal to consumers, particularly in Asia. Furthermore, according to an article in Glanbia Nutritionals in 2022, one in three U.S. cheese consumers sees cheese as a healthier alternative to other snacks and treats, which has led to global food companies tapping into the demand for healthier cheese-based snacks.

Regional Insights

North America is expected to grow at a CAGR of 5.2% from 2024 to 2030. Natural and clean-label cheese is growing in popularity in North America, with a strong emphasis on health, being the primary driver.

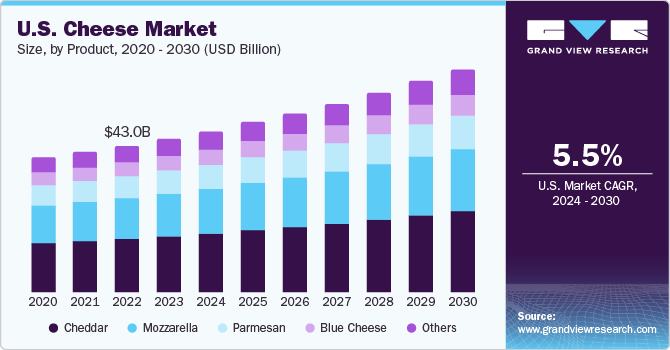

U.S. Cheese Market Trends

The U.S. cheese market accounted for a share of 75% in 2023. In 2022, the USDA data revealed that cheese consumption played a pivotal role in offsetting the decline in fluid beverage milk sales, setting a record of nearly 40 pounds per person in 2022, a half-a-pound increase from 2021. The per capita cheese consumption in the U.S. increased from 32.7 pounds in 2010 to 39.8 pounds in 2022 owing to changing consumer preferences and growing demand for American cheeses, such as Monterey jack, cheddar, pepper jack, etc.

Europe Cheese Market Trends

The cheese market in Europe held a share of 35.16% in 2023. The demand for cheese is growing in Western European countries due to evolving consumer preferences, increased adoption in diverse culinary applications, and introduction of innovative cheese varieties, catering to a widening consumer base. Western Europe is a mature cheese market characterized by a strong per capita cheese consumption of about 20.96 Kgs in 2022. According to Agriculture and Agri-Food Canada, Europe is witnessing a growth in demand for natural and private-label cheese offerings.

Key Cheese Company Insights

The global cheese market is fragmented. Key companies are actively innovating and undergoing partnerships to gain a competitive advantage. Recognizing the evolving consumer preferences, these companies are actively capitalizing on the rising demand for healthier options, artisanal varieties, and plant-based alternatives. By emphasizing innovation and collaborations, market leaders aim to cater to diverse tastes and dietary trends, ensuring a diversified product portfolio that aligns with the growing consumer segments seeking specialized and sustainable cheese choices.

Key Cheese Companies:

The following are the leading companies in the cheese market. These companies collectively hold the largest market share and dictate industry trends.

- Arla Foods Group

- Fonterra Co-operative Group Ltd.

- Glanbia Plc

- Saputo Cheese USA Inc.

- Bel Brands USA, Inc.

- FrieslandCampina

- Daiya Foods, Inc.

- Kite Hill

- Lactalis International

- Sargento Foods Inc.

Recent Developments

-

In August 2023, Agrocorp International launched HerbY-Cheese, a plant-based, nut-free cheese range under the brand HerbYvore in Singapore. The company collaborated with the Singapore Institute of Technology (SIT) to develop sustainable plant protein extraction methods. The partnership enabled the successful development and commercialization of HerbY-Cheese, which includes dairy-free alternatives to cheddar, mozzarella, and parmesan. HerbY-Cheese is available for purchase online and in selected local establishments, catering to consumers looking for sustainable and nutritious dairy alternatives

-

In March 2023, PlantWise, a plant-based dairy alternative company introduced vegan cheese spreads, shreds, and cheesy nuggets that taste and spread like dairy cheeses. PlantWise's unique natural fermentation process creates an authentic cheese flavor similar to dairy cheese

-

In October 2022, Armored Fresh, a subsidiary of Korean company Yangyoo, launched a plant-based cheese in over 100 markets in NYC with plans to expand to New Jersey and nationwide. Made from almond milk and plant-based lactic acid, the cheese offers a similar protein content to animal-based cheese and is available in three varieties. The company raised significant funding and aims to enter the U.S. market through national grocery retailers

Cheese Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 204.7 billion

Revenue forecast in 2030

USD 283.4 billion

Growth rate

CAGR of 5.6% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, source, type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; Brazil; South Africa; Saudi Arabia

Key companies profiled

Arla Foods Group; Fonterra Co-operative Group Ltd.; Glanbia Plc; Saputo Cheese USA Inc.; Bel Brands USA, Inc.; FrieslandCampina; Daiya Foods, Inc.; Kite Hill; Lactalis International; Sargento Foods Inc.

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cheese Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the cheese market report on the basis of product, source, type, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cheddar

-

Mozzarella

-

Parmesan

-

Blue Cheese

-

Others

-

-

Source Outlook (Revenue, USD Billion, 2018 - 2030)

-

Animal-based

-

Cow Milk Cheese

-

Goat Milk Cheese

-

Sheep Milk Cheese

-

-

Plant-based

-

Soy-based

-

Cashew-based

-

Almond-based

-

Coconut-based

-

Others

-

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Natural

-

Processed

-

Slices

-

Block

-

Spreads

-

Others

-

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

B2C/Retail

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

Online

-

Others

-

-

B2B

-

Food Service

-

Food & Beverage Processing

-

Snacks

-

Sauces, Dressings, Dips, & Condiments

-

Bakery & Confectionery

-

Ready Meals

-

Others

-

-

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global cheese market size was estimated at USD 194.6 billion in 2023 and is expected to reach USD 204.7 billion in 2024.

b. The global cheese market is expected to grow at a compound annual growth rate of 5.6% from 2024 to 2030 to reach USD 283.4 billion by 2030.

b. Europe dominated the cheese market with a share of more than 35% in 2023. The region has a rich and diverse cheese heritage with a long history of cheese production and consumption. European countries are renowned for their traditional and artisanal cheese varieties, which have gained global recognition and popularity.

b. Some of the key market players include Arla Foods Group, Fonterra Co-operative Group Limited, Glanbia plc, Saputo Cheese USA Inc., Bel Brands USA, Inc., FrieslandCampina, Daiya Foods, Inc., Kite Hill, Lactalis International, and Sargento Foods Inc.

b. Key factors that are driving the cheese market growth include evolving consumer preferences toward diverse and exotic cheese flavors, the rising popularity of plant-based cheese alternatives, and continuous innovation in introducing new and unique cheese varieties. The globalization of culinary trends and increased awareness of health-conscious choices also contribute to the market's growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.