- Home

- »

- Advanced Interior Materials

- »

-

Chemical Injection Skids Market Size & Share Report, 2030GVR Report cover

![Chemical Injection Skids Market Size, Share & Trends Report]()

Chemical Injection Skids Market Size, Share & Trends Analysis Report By Function (Antifoaming, Corrosion Inhibition, Demulsifying), By End-use (Oil & Gas, Energy & Power, Fertilizer), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-011-8

- Number of Report Pages: 151

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Chemical Injection Skids Market Trends

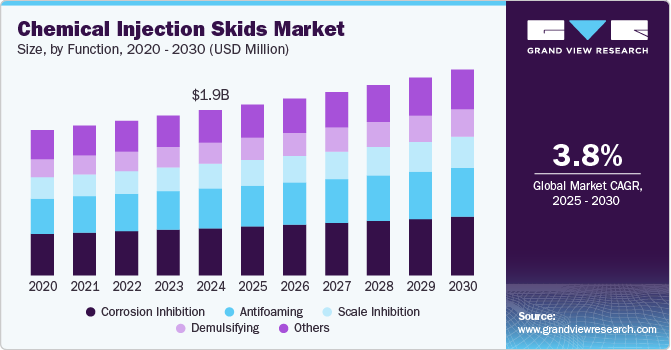

The global chemical injection skids market size was estimated at USD 1,907.8 million in 2024 and is anticipated to grow at a CAGR of 3.8% from 2025 to 2030. The market is experiencing significant growth, driven by the increasing demand for efficient and safe chemical handling across various industries, including oil and gas, water treatment, and pharmaceuticals. As companies seek to enhance operational efficiency and ensure compliance with stringent environmental regulations, the adoption of automated chemical injection systems is on the rise. These systems not only improve precision in chemical dosing but also reduce the risk of spills and leaks, making them a preferred choice for many operators.

In addition, technological advancements in chemical injection skid design, such as the integration of IoT and remote monitoring capabilities, are further propelling market growth. These innovations allow for real-time data analysis and remote management, which enhances operational efficiency and reduces downtime. As industries increasingly prioritize sustainability and safety, the demand for sophisticated chemical injection skids is expected to continue expanding, reflecting a broader trend towards automation and smart technology in industrial processes.

Drivers, Opportunities & Restraints

The chemical injection skids market is primarily driven by the rising demand for efficient chemical management solutions in sectors such as oil and gas, water treatment, and chemical processing. Increasing regulatory requirements for environmental safety and sustainability are prompting companies to adopt automated systems that ensure precise chemical dosing and minimize waste. Moreover, the need for enhanced operational efficiency and cost reduction is pushing industries to invest in advanced chemical injection technologies, further boosting market growth.

There are significant opportunities for growth in the chemical injection skids market, particularly with the integration of smart technologies such as IoT and AI. These advancements enable predictive maintenance, real-time monitoring, and improved data analytics, allowing for enhanced decision-making and operational efficiency. In addition, the growing focus on sustainable practices presents an opportunity for manufacturers to develop eco-friendly chemical injection solutions, catering to an increasingly environmentally-conscious market.

The chemical injection skids market faces several restraint, including fluctuating raw material prices and supply chain disruptions, which can impact production costs and timelines. Furthermore, the market is susceptible to stringent regulatory changes, which could necessitate costly modifications to existing systems. In addition, the rising competition from alternative technologies and the emergence of innovative solutions could pose challenges for traditional chemical injection skid manufacturers in maintaining market share.

Function Insights

“The demand for the demulsifying function segment is expected to grow at a significant CAGR of 4.5% from 2025 to 2030 in terms of revenue.”

The corrosion inhibition function segment led the market and accounted for a share of 28.6% in 2024.The demand for corrosion inhibitors within the chemical injection skids market is experiencing significant growth, driven by the increasing need to protect infrastructure and equipment in various industries, particularly oil and gas, power generation, and water treatment. As facilities face challenges such as harsh operating environments and the potential for equipment degradation, the application of corrosion inhibitors becomes critical to prolonging asset lifespan and reducing maintenance costs. The integration of these inhibitors into chemical injection skids allows for precise dosing and monitoring, ensuring optimal performance and efficacy.

The demand for demulsifying agents within the chemical injection skids market is steadily increasing, primarily due to the need for effective separation of water and hydrocarbons in various industrial processes, particularly in the oil and gas sector. Chemical injection skids equipped with demulsifying capabilities enable precise control and optimization of chemical dosing, ensuring effective emulsion breaking while minimizing waste and environmental impact. This growing emphasis on optimizing separation processes and improving overall operational efficiency is driving the rising demand for demulsifying agents in the market.

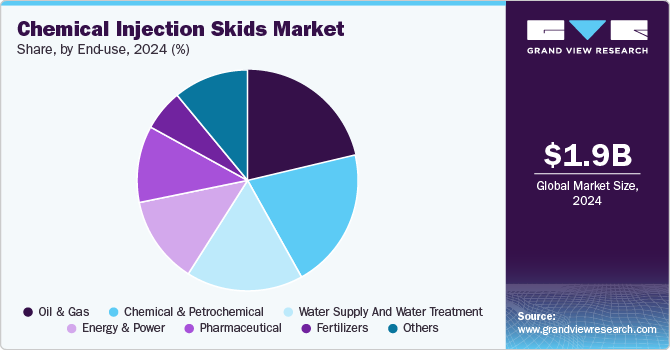

End-use Insights

“The demand for the water supply and water treatment end use segment is expected to grow at a significant CAGR of 4.9% from 2025 to 2030 in terms of revenue.”

The oil & gas end use segment led the market and accounted for a share of 21.5% in 2024. The chemical injection skids market is experiencing robust demand in the oil and gas industry, primarily driven by the sector's need for efficient chemical management solutions to enhance production and maintain operational integrity. As companies navigate the challenges of aging infrastructure, harsh environmental conditions, and stringent regulatory requirements, the integration of automated chemical injection systems becomes essential for precise dosing of chemicals such as corrosion inhibitors, biocides, and demulsifies.

The demand for chemical injection skids in the water supply and water treatment industry is on the rise, driven by the increasing need for effective water management solutions and the treatment of wastewater. As municipalities and industries prioritize safe and clean water supply, the use of chemical injection systems for precise dosing of coagulants, disinfectants, and pH adjusters becomes essential. These systems enhance the efficiency of water treatment processes, ensuring compliance with regulatory standards and improving overall water quality.

Regional Insights

“India to witness fastest market growth at 5.5% CAGR”

North America region accounted for 30.7% of the global market share in 2024. The demand for chemical injection skids is significantly driven by the robust oil and gas sector, particularly in regions like Texas and Alberta. The adoption of advanced automation technologies in these industries has prompted operators to seek efficient chemical management solutions to enhance production and maintain regulatory compliance. For example, companies in the Permian Basin are increasingly implementing chemical injection skids to optimize the use of corrosion inhibitors and demulsifiers, ensuring the integrity of pipelines and maximizing hydrocarbon recovery.

U.S. Chemical Injection Skids Market Trends

The chemical injection skids market in the U.S. is expected to grow at a CAGR of 3.3% from 2025 to 2030. The U.S. market for chemical injection skids is experiencing growth due to the surge in shale oil production and the need for effective chemical management in hydraulic fracturing operations. Operators are increasingly utilizing these skids to precisely inject chemicals that mitigate issues related to scaling and corrosion. An example is the use of chemical injection skids in the Bakken Formation, where precise chemical dosing is essential to enhance recovery rates and protect well integrity.

The chemical injection skids market in the Canada is expected to grow at a CAGR of 3.7% from 2025 to 2030. In Canada, the demand for chemical injection skids is largely influenced by the oil sands sector, where maintaining equipment longevity and operational efficiency is critical. Operators are implementing these systems to manage chemicals used in bitumen extraction processes effectively. For instance, chemical injection skids are utilized in Alberta’s oil sands operations to optimize the dosing of surfactants and solvents, ensuring smoother extraction processes and reducing environmental impact.

The chemical injection skids market in the Mexico is expected to grow at a CAGR of 4.4% from 2025 to 2030. The chemical injection skids market in Mexico is growing due to the government's efforts to revitalize its oil and gas sector. With increasing investments in offshore drilling and exploration, there is a rising need for efficient chemical handling systems. An example is the deployment of chemical injection skids in the Gulf of Mexico, where companies are focusing on enhancing production efficiency and minimizing downtime through precise chemical dosing.

Europe Chemical Injection Skids Market Trends

The chemical injection skids market in Europe held a share of about 27.3% in 2024. In Europe, the demand for chemical injection skids is largely influenced by stringent environmental regulations and the transition to sustainable practices across industries. The water treatment sector, in particular, is adopting these systems to enhance chemical dosing precision. For example, in the UK, wastewater treatment plants are increasingly utilizing chemical injection skids to improve the efficiency of nutrient removal processes, ensuring compliance with EU regulations.

Germany's chemical injection skids market held 28.4% share in the European market. Germany's market for chemical injection skids is driven by its strong industrial base and commitment to sustainability. The chemical and automotive industries are significant consumers of these systems for effective chemical management. An example is the use of chemical injection skids in automotive manufacturing plants, where they are employed to manage lubricants and cleaning agents efficiently, thereby enhancing operational efficiency and reducing waste.

UK chemical injection skids market held 14.5% share in the Europe market. In the UK, the demand for chemical injection skids is growing in the oil and gas sector, particularly in the North Sea. Operators are focusing on optimizing chemical usage to enhance production while adhering to environmental regulations. For instance, chemical injection skids are employed in offshore platforms to accurately dose inhibitors and demulsifies, ensuring effective processing of crude oil and minimizing environmental impact.

Asia Pacific Chemical Injection Skids Market Trends

The chemical injection skids market in Asia Pacific accounted for a market share of 35.3% in 2024. The Asia Pacific region is witnessing a surge in demand for chemical injection skids, driven by rapid industrialization and increasing investments in infrastructure. The oil and gas industry in countries like Indonesia and Malaysia is a major contributor to this growth. For example, chemical injection skids are utilized in offshore drilling operations in Malaysia to enhance the efficiency of chemical dosing for production optimization and corrosion management.

China chemical injection skids market held 35.3% share in the Asia Pacific market. China's chemical injection skids market is fueled by rapid industrialization and the need for effective chemical management in various sectors, including petrochemicals and water treatment. The country's focus on reducing pollution and enhancing environmental sustainability is driving the adoption of advanced chemical injection systems. An example can be seen in large-scale wastewater treatment facilities in cities like Shanghai, where chemical injection skids are used to optimize chemical dosing and improve treatment efficiency.

India chemical injection skids market held 13.0% share in the Asia Pacific market. In India, the demand for chemical injection skids is driven by the expanding water treatment sector, as urbanization and population growth necessitate improved water management solutions. Companies are investing in these systems to enhance the efficiency of wastewater treatment plants. For instance, cities like Delhi are implementing chemical injection skids to optimize the dosing of coagulants and disinfectants, ensuring compliance with environmental standards and improving public health outcomes.

Middle East & Africa Chemical Injection Skids Market Trends

In the Middle East & Africa, the demand for chemical injection skids is significantly influenced by the region's vast oil and gas reserves, particularly in countries such as Saudi Arabia and the UAE. The need for enhanced production efficiency and effective corrosion management drives operators to invest in advanced chemical injection systems. For example, in Saudi Aramco's oil fields, chemical injection skids are utilized to precisely dose corrosion inhibitors and biocides, ensuring the longevity of infrastructure while optimizing hydrocarbon recovery in the harsh desert environment.

In Saudi Arabia, the market for chemical injection skids is expanding rapidly, fueled by the nation's focus on maintaining its position as a leading oil exporter. The need to enhance production efficiency and prolong the lifespan of aging oil fields is driving operators to integrate more advanced chemical management systems. Furthermore, ongoing investments in infrastructure and diversification efforts within the energy sector are likely to further elevate the demand for reliable and efficient chemical injection solutions, aligning with the Kingdom's Vision 2030 initiative.

Latin America Chemical Injection Skids Market Trends

In Latin America, the demand for chemical injection skids is driven by the growth of the oil and gas sector, especially in Brazil and Argentina. The focus on enhancing recovery rates and minimizing downtime is prompting operators to invest in advanced chemical management solutions. An example can be seen in Brazil's pre-salt oil fields, where chemical injection skids are employed to optimize the use of chemicals for well stimulation and maintenance.

The demand for chemical injection skids in Brazil is witnessing significant growth, driven by the country's thriving oil and gas sector, particularly in pre-salt oil fields. As operators seek to optimize production and ensure efficient chemical management for enhanced oil recovery, the adoption of sophisticated chemical injection systems becomes crucial. In addition, environmental regulations are prompting companies to invest in advanced technologies that minimize risks and improve safety, further propelling the market for these skids.

Key Chemical Injection Skids Market Company Insights

Some of the key players operating in the chemical injection skids market include SPX FLOW Inc., IDEX Corporation.

-

SPX FLOW Inc. is a leading global provider of engineered solutions and technologies, specializing in the development and manufacturing of high-performance equipment for various industries, including food and beverage, energy, and industrial applications. Headquartered in Charlotte, North Carolina, SPX FLOW focuses on innovative products such as pumps, valves, mixers, and process systems designed to enhance efficiency and reliability. With a commitment to sustainability and customer-centric solutions, the company leverages advanced engineering and technology to meet the evolving needs of its clients across diverse markets worldwide.

-

IDEX Corporation is a diversified global company based in Lake Forest, Illinois, known for its innovative fluid and metering solutions across various sectors, including health and wellness, industrial, and fire and safety. The company operates through multiple segments, providing a wide range of products such as pumps, valves, and flow measurement devices. IDEX is dedicated to delivering high-quality, reliable solutions that enhance operational efficiency and safety for its customers. With a strong emphasis on research and development, IDEX continues to expand its portfolio and maintain a competitive edge in the marketplace.

Dencil Fluidtek Systems Pvt. Ltd.; and Petrak Industries Inc. are some of the emerging players in the chemical injection skids market.

-

Dencil Fluidtek Systems Pvt. Ltd. is a prominent Indian company specializing in the design and manufacture of innovative fluid management solutions, including chemical injection systems and pumping solutions. Based in Pune, the company focuses on providing high-quality products for various industries, including oil and gas, petrochemicals, and water treatment. With a commitment to engineering excellence and customer satisfaction, Dencil Fluidtek leverages advanced technology and industry expertise to deliver customized solutions that enhance operational efficiency and safety for its clients.

-

Petrak Industries Inc. is a leading manufacturer based in the U.S., recognized for its expertise in producing high-performance chemical injection systems and related equipment. The company specializes in designing solutions that cater to the oil and gas, petrochemical, and water treatment sectors, offering a range of products including pumps, skids, and control systems. With a focus on innovation and reliability, Petrak Industries is dedicated to meeting the diverse needs of its customers while adhering to stringent quality and safety standards in all its operations.

Key Chemical Injection Skids Market Companies:

The following are the leading companies in the chemical injection skids market. These companies collectively hold the largest market share and dictate industry trends.

- Milton Roy Company

- AES Arabia Ltd.

- Petronash

- Lewa GmbH

- SPX FLOW Inc.

- INTECH

- Integrated Flow Solutions LLC

- Petroserve International

- Carotek Inc.

- IDEX Corporation

Recent Developments

-

In June 2023, Euro Mechanical released a new chemical injection skid package with a modular design that can be customized for different project needs. The skid package is compliant with several industry standards, including ASME B31.3, AWS D1.1, and ATEX.

Chemical Injection Skids Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,974.5 million

Revenue forecast in 2030

USD 2,375.0 million

Growth rate

CAGR of 3.8% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Function, end-use, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Argentina; South Africa; UAE

Key companies profiled

Milton Roy Company; AES Arabia Ltd.; Petronas; Lewa GmbH; SPX FLOW Inc.; INTECH; Integrated Flow Solutions LLC; Petroserv International.; Carotek Inc.; IDEX Corporation; Seko SpA; Haskel International Inc.; Dencil Fluidtek Systems Pvt. Ltd.; Petrak Industries Inc.; ENPRO Industries Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Chemical Injection Skids Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the chemical injection skids market on the basis of function, end-use, and region:

-

Function Outlook (Revenue, USD Million, 2018 - 2030)

-

Antifoaming

-

Corrosion Inhibition

-

Demulsifying

-

Scale Inhibition

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Energy & Power

-

Fertilizer

-

Chemical & Petrochemical

-

Water Supply & Water Treatment

-

Pharmaceutical

-

Other

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global chemical injection skids market size was estimated at USD 1,907.8 million in 2024 and is expected to reach USD 1,974.5 million in 2025.

b. The global chemical injection skids market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.8% from 2025 to 2030 to reach USD 2,375.0 million by 2030.

b. The corrosion inhibition function segment led the market and accounted for a share of 28.6% in 2024. The demand for corrosion inhibitors within the chemical injection skids market is experiencing significant growth, driven by the increasing need to protect infrastructure and equipment in various industries, particularly oil and gas, power generation, and water treatment.

b. Some of the key players operating in the chemical injection skids market include Milton Roy Company; AES Arabia Ltd.; Petronas; Lewa GmbH; SPX FLOW Inc.; INTECH; Integrated Flow Solutions LLC; Petroserv International.; Carotek Inc.; IDEX Corporation; Seko SpA; Haskel International Inc.; Dencil Fluidtek Systems Pvt. Ltd.; Petrak Industries Inc.; ENPRO Industries Inc., among others.

b. The chemical injection skids market is experiencing significant growth, driven by the increasing demand for efficient and safe chemical handling across various industries, including oil and gas, water treatment, and pharmaceuticals.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."