- Home

- »

- Clinical Diagnostics

- »

-

Chemiluminescence Immunoassay Market Size Report, 2030GVR Report cover

![Chemiluminescence Immunoassay Market Size, Share & Trends Report]()

Chemiluminescence Immunoassay Market Size, Share & Trends Analysis Report By Product (Instruments, Consumables), By Sample Type (Blood, Urine), By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-152-8

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

“2030 chemiluminescence immunoassay market size value to reach USD 15.50 billion”

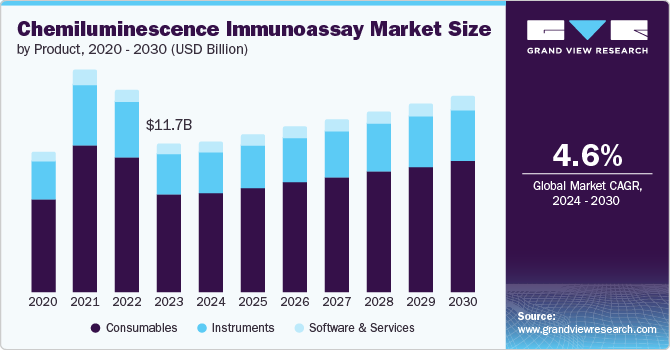

The global chemiluminescence immunoassay market size was estimated at USD 11.71 billion in 2023 and is projected to grow at a CAGR of 4.6% from 2024 to 2030. The market growth can be attributed to the growing emphasis on early disease detection and increased efforts by pharmaceutical companies in drug discovery and development, particularly for chronic diseases such as infectious diseases, autoimmune diseases, cardiovascular diseases, diabetes, obesity, and cancer.

In recent years, the number of cases of infectious diseases has increased significantly. However, due to the work of global organizations and the World Health Organization, antiviral treatments have effectively controlled the diseases. Moreover, diagnosis has played a significant role in managing the diseases.

According to the IDF Diabetes Atlas, approximately 537 million adults have diabetes, representing 1 in 10 people. This number is projected to increase to 643 million and 783 million by 2030 and 2045, respectively. Most of those affected, over 75%, reside in low- and middle-income countries. In one year, diabetes-related deaths totaled 6.7 million, or one death every five seconds. The growing prevalence of infectious and chronic diseases is driving the expansion of the CLIA industry.

CLIA is a state-of-the-art immunoassay method that is one of the most recent advancements in the industry. The CLIA technique has various benefits compared to traditional methods like ELISA and RIA. Despite its numerous advantages, the CLIA technique still has several associated limitations. One example is the considerable setup cost required, a significant disadvantage of the CLIA method. The market growth is expected to be hindered due to the challenge of adopting expensive devices in emerging economies like India, Brazil, and South Africa.

Product Insights

The consumables segment dominated the market with a share of 66.2% in 2023 and is anticipated to grow at the fastest CAGR over the forecast period. This can be credited to the growing need for supplies like reagents and stains in therapeutic drug monitoring, endocrinology, and disease diagnosis.

The instruments segment is anticipated to experience considerable growth over the forecast period. In 2023, the segment was led by automated instruments, which are widely used in high-volume testing settings, such as large hospitals and research institutes, where efficiency and accuracy are crucial. A rise in the instrument sector is due to the growing efforts of leading companies to create and launch advanced CLIA systems.

Sample Type Insights & Trends

The blood sample type segment led the market and accounted for a share of 55.8% in 2023. This is due to the rising incidence of chronic diseases, such as cancer and cardiovascular disorders, which often require frequent blood-based testing for diagnosis, monitoring, and treatment management. Blood-based CLIA tests offer high sensitivity and specificity, making them valuable tools for detecting biomarkers linked to these conditions.

The urine sample type segment is expected to experience significant growth during the forecast period. The increasing use of urine-based tests for disease diagnosis and monitoring drives this growth. Urine tests are non-invasive and cost-effective, making them popular for routine health checkups and disease surveillance.

Application Insights & Trends

The infectious disease segment held the largest share of over 29.6% in 2023. The expansion of CLIA technology is attributed to the introduction of new tests for diagnosing infectious diseases. This diversity of applications highlights the adaptability and significance of CLIA technology in addressing complex medical conditions and driving healthcare innovations.

The oncology segment is projected to grow at the fastest CAGR of 4.4% over the forecast period. According to a 2020 report by the World Health Organization, cancer was a significant cause of mortality worldwide, responsible for approximately 10 million deaths that year. The growing incidence of cancer cases and the increasing awareness of early cancer detection in developing countries are key drivers propelling the market’s growth.

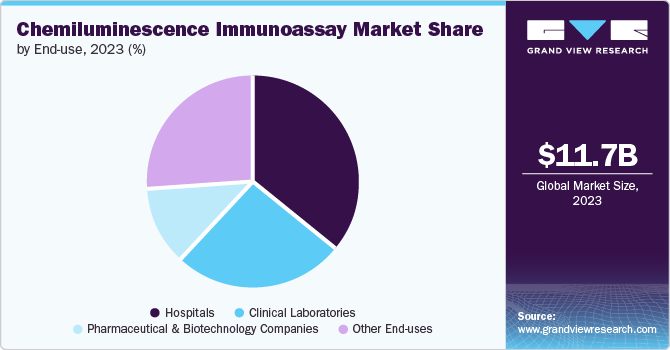

End-use Insights

The hospitals segment dominated the market and accounted for a revenue share of 35.7% in 2023. This is due to the growing need for CLIA solutions in hospitals and the increasing number of hospital visits caused by the rising occurrence of cancer and infectious diseases. Moreover, the rise in hospital admissions due to the new coronavirus outbreak is anticipated to boost the need for CLIA solutions within hospital settings.

The pharmaceutical & biotechnology companies segment is expected to grow at the fastest CAGR of 5.8% from 2024 to 2030. This is due to the high sensitivity and specificity of CLIA technology, making it an ideal tool for detecting biomarkers associated with various health conditions. Pharmaceutical and biotech companies use CLIA for research, development, and manufacturing of diagnostic kits & reagents.

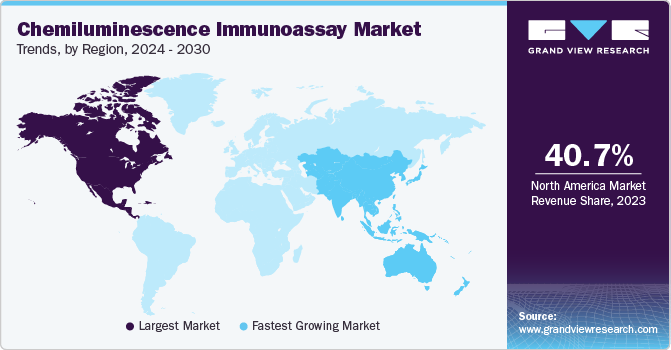

Regional Insights & Trends

The North America chemiluminescence immunoassay market held the largest share of 40.7% in 2023 and is expected to dominate the market over the forecast period. The presence of established healthcare infrastructure, widespread utilization of advanced CLIA solutions, and increasing frequency of chronic diseases are key contributors to the regional market growth.

U.S. Chemiluminescence Immunoassay Market Trends

The chemiluminescence immunoassay market in the U.S. accounted for a share of 34.9% of the global market. This is fueled by the industry’s partnerships with local companies to tackle technological hurdles in creating valuable chemicals, ingredients, and products from renewable biomass, providing an alternative to conventional feedstock. These items are used in consumer and industrial areas, such as personal care, food and nutrition, household items, and agriculture.

Europe Chemiluminescence Immunoassay Market Trends

The Europe chemiluminescence immunoassay market held a substantial share in 2023, driven by the increased incidence of chronic & infectious diseases and the need for efficient & accurate diagnostic solutions. Other key factors fueling market growth include the presence of major industry players with solid R&D capabilities, advancements in technology, and increased healthcare investments.

The chemiluminescence immunoassay market in the UK is expected to experience promising growth in the coming years. There is an anticipated increase in investments in CLIA technologies due to the government’s focus on improving healthcare infrastructure, promoting development, and strengthening diagnostic capabilities.

Asia Pacific Chemiluminescence Immunoassay Market Trends

The Asia Pacific chemiluminescence immunoassay market is projected to grow at the fastest CAGR of 6.5% over the forecast period. One of the main factors driving the regional market growth is the rising recognition of chronic diseases in developing economies like China and India. Moreover, increasing acceptance of CLIA systems and the introduction of new CLIA systems by domestic companies are expected to aid the advancement of the local market.

The chemiluminescence immunoassay market in China is expected to have significant growth in the coming years. In China, the biotechnology sector and its related industries are making quick progress, as experts from the China National Center of Biotechnological Development point towards the country’s growing status as a biotechnology powerhouse. As biotechnologies become more widespread, China and other local participants are proactively creating guidelines and ethical frameworks to foster the expansion of this emerging industry.

Key Chemiluminescence Immunoassay Company Insights

New entrants in the CLIA market are leveraging inorganic growth strategies, such as forming strategic partnerships and collaborations, to outshine their competitors. Prominent market participants drive growth through strategic acquisitions, mergers, and joint ventures.

Key Chemiluminescence Immunoassay Companies:

The following are the leading companies in the chemiluminescence immunoassay market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott Laboratories

- Beckman Coulter Inc.

- DiaSorin S.p.A.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- F. Hoffmann-La Roche AG

- Siemens Healthineers

- Ortho Clinical Diagnostics

Recent Developments

-

In May 2023, PerkinElmer officially launched Revvity, a novel science-based solutions company, which utilizes cutting-edge innovation to enhance lives by offering a comprehensive range of products

-

In December 2022, approval was granted to Sysmex in Japan for the manufacturing and marketing of the HISCL β-Amyloid 1-42 Assay Kit and the HISCL β-Amyloid 1-40 Assay Kit to detect amyloid beta (Aβ) levels in the blood

Chemiluminescence Immunoassay Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.86 billion

Revenue forecast in 2030

USD 15.50 billion

Growth rate

CAGR of 4.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, sample type, application, end-use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abbott Laboratories; Beckman Coulter Inc.; DiaSorin S.p.A.; Shenzhen Mindray Bio-Medical Electronics Co., Ltd.; F. Hoffmann-La Roche AG; Siemens Healthineers; Ortho Clinical Diagnostics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs

Global Chemiluminescence Immunoassay Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the chemiluminescence immunoassay market report based on product, application, sample type, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Automated

-

Semi-automated

-

-

Consumables

-

Software & Services

-

-

Sample Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood

-

Urine

-

Saliva

-

Other Sample Types

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Therapeutic Drug Monitoring

-

Oncology

-

Cardiology

-

Endocrinology

-

Infectious Disease

-

Autoimmune Disease

-

Other Applications

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinical Laboratories

-

Pharmaceutical & Biotechnology Companies

-

Other End-uses

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Mexico

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."