Market Size & Trends

The China arthroscopy market size was valued at USD 365.1 million in 2024 and is projected to grow at a CAGR of 5.0% from 2025 to 2030. This growth is driven by the increasing prevalence of joint-related disorders. The rising incidence of sports injuries and the growing aging population are leading to a higher demand for minimally invasive surgical procedures. The Chinese population is becoming more aware of the benefits of arthroscopy, including reduced postoperative pain, faster recovery times, and improved surgical outcomes. Technological advancements in arthroscopic instruments and the increasing penetration of minimally invasive procedures also support market expansion.

The prevalence of joint-related disorders such as osteoarthritis and rheumatoid arthritis in China has been increasing significantly. According to the Global Burden of Disease Study, the age-standardized incidence rate for musculoskeletal disorders in China was 3,764.99 per 100,000 people. The prevalence of knee osteoarthritis alone was around 8.8% among adults, with a higher incidence in women compared to men. The growing aging population and rising rates of obesity are major contributing factors to this trend. This increasing burden of joint-related disorders has led to a higher demand for minimally invasive surgical procedures, such as arthroscopy, which offer effective treatment options with reduced postoperative pain and faster recovery times.

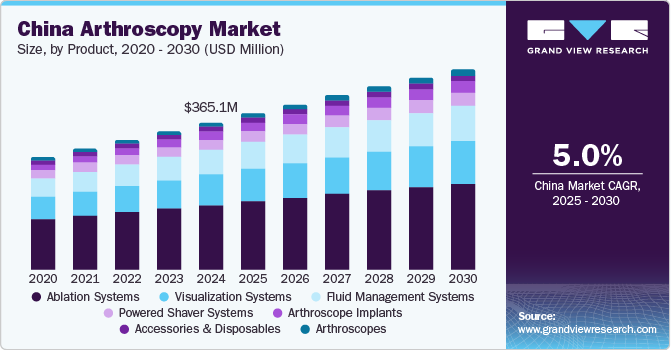

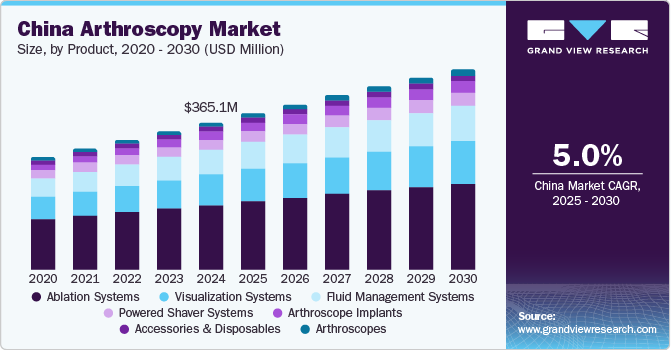

Product Insights

The ablation systems segment accounted for the largest share of 91.6% in 2024. Ablation systems are widely used during arthroscopic surgeries to remove damaged or diseased soft tissue, making them essential for various joint procedures. The dominance of this segment is driven by the rising prevalence of chronic pain disorders such as osteoarthritis and rheumatoid arthritis, as well as the growing preference for minimally invasive surgical techniques. These systems offer significant benefits, including reduced postoperative pain, quicker recovery times, and improved surgical outcomes, contributing to their widespread adoption.

The arthroscopes segment is expected to grow at a CAGR of 7.0% from 2025 to 2030. Arthroscopes are specialized instruments that visualize, diagnose, and treat joint problems through small incisions. The projected growth of this segment is attributed to technological advancements that enhance the precision and effectiveness of arthroscopic procedures. In addition, the increasing awareness among patients and healthcare providers about the benefits of minimally invasive surgeries, such as shorter hospital stays and faster recovery times, drives the demand for arthroscopes. As the Chinese population continues to age and the incidence of joint-related disorders rises, the arthroscopes segment is poised for significant expansion.

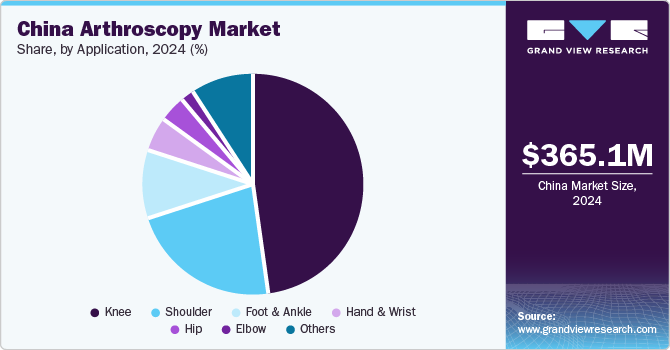

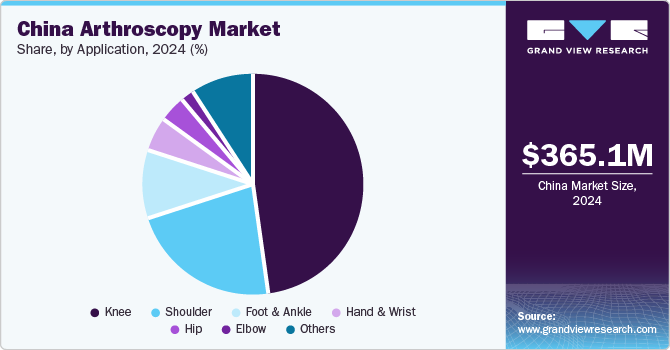

Application Insights

The knee segment dominated the China arthroscopy market in 2024, primarily due to the high prevalence of knee-related disorders such as osteoarthritis and sports injuries. The knee is one of the most commonly affected joints, and the demand for minimally invasive arthroscopic procedures to treat these conditions is substantial. Advances in arthroscopic technology and techniques have made knee surgeries more effective and less invasive, leading to quicker recovery times and better patient outcomes. This has driven the widespread adoption of knee arthroscopy, making it the leading application segment in the market.

The foot and ankle segment is projected to grow the fastest over the forecast period attributed to the increasing incidence of foot and ankle injuries, particularly among athletes and the aging population. As people become more active and the population ages, the demand for treatments for foot and ankle disorders rises. Minimally invasive arthroscopic procedures offer effective solutions for these conditions, increasing their popularity. Moreover, advancements in arthroscopic instruments and techniques specific to the foot and ankle are expected to drive market expansion in this segment further.

Key China Arthroscopy Company Insights

Some of the key companies in the China arthroscopy market include Zhejiang Shendasiao Medical Instrument Co., Ltd., TITMED, Shrek, Xuzhou Hengjia Electronic Technology Co., Ltd., and others.

-

Zhejiang Shendasiao Medical Instrument Co., Ltd. specializes in producing minimally invasive surgical instruments, including laparoscopy, gynecological laparoscopy, and orthopedic instruments.

-

Xuzhou Hengjia Electronic Technology Co., Ltd. is a comprehensive joint-stock entity that specializes in the production, management, development, and commercialization of advanced medical devices. The company emphasizes minimally invasive endoscopic technologies and offers a range of products that include high-definition endoscope cameras, LED cold light sources, and integrated endoscopic camera systems.

Key China Arthroscopy Companies:

- Zhejiang Shendasiao Medical Instrument Co., Ltd.

- TITMED

- Shrek

- Xuzhou Hengjia Electronic Technology Co., Ltd.

- Tonglu Wanhe Medical Instrument Co., Ltd.

- Stryker

- Smith & Nephew plc

- Zimmer Biomet

- Johnson & Johnson

- Arthrex, Inc.

China Arthroscopy Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 387.3 million

|

|

Revenue forecast in 2030

|

USD 495.3 million

|

|

Growth Rate

|

CAGR of 5.0% from 2024 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, application

|

|

Key companies profiled

|

Zhejiang Shendasiao Medical Instrument Co., Ltd.; TITMED; Shrek; Xuzhou Hengjia Electronic Technology Co., Ltd.; Tonglu Wanhe Medical Instrument Co., Ltd.; Stryker; Smith & Nephew plc; Zimmer Biomet; Johnson & Johnson; Arthrex, Inc.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

China Arthroscopy Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the China arthroscopy market report based on product and application.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Hip

-

Knee

-

Shoulder

-

Foot and Ankle

-

Hand and Wrist

-

Elbow

-

Others