- Home

- »

- Medical Devices

- »

-

China Ligation Devices Market Size, Industry Report, 2033GVR Report cover

![China Ligation Devices Market Size, Share & Trends Report]()

China Ligation Devices Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Appliers, Accessories), By Application (Gynecology Surgery, Cardiothoracic Surgery), By Procedure (Minimally Invasive Surgery, Open Surgery), By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-667-0

- Number of Report Pages: 135

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

China Ligation Devices Market Size & Trends

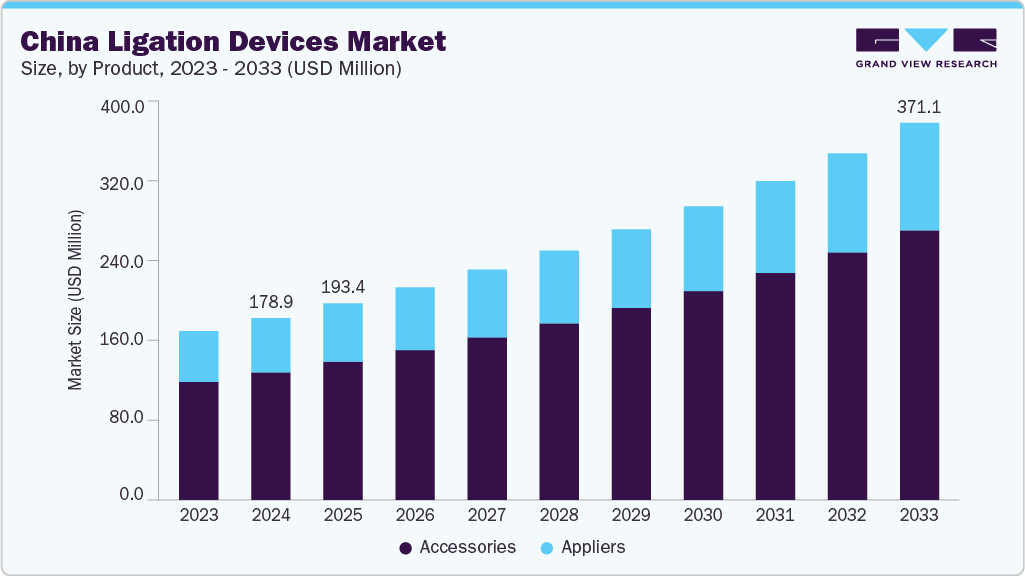

The China ligation devices market size was valued at USD 178.9 million in 2024 and is expected to reach USD 371.1 million by 2033, growing at a CAGR of 8.49% from 2025 to 2033. The aging population and the increasing prevalence of chronic diseases, such as cardiovascular ailments and cancers, are significantly driving the demand for minimally invasive surgical procedures where ligation devices are crucial. Furthermore, the Chinese government's ongoing investments in healthcare infrastructure, including the expansion and modernization of hospitals and surgical facilities, are fueling the adoption of advanced medical technologies. The rising awareness among both medical professionals and patients regarding the benefits of minimally invasive surgeries, such as reduced recovery times and lower complication rates, is also contributing to market expansion.

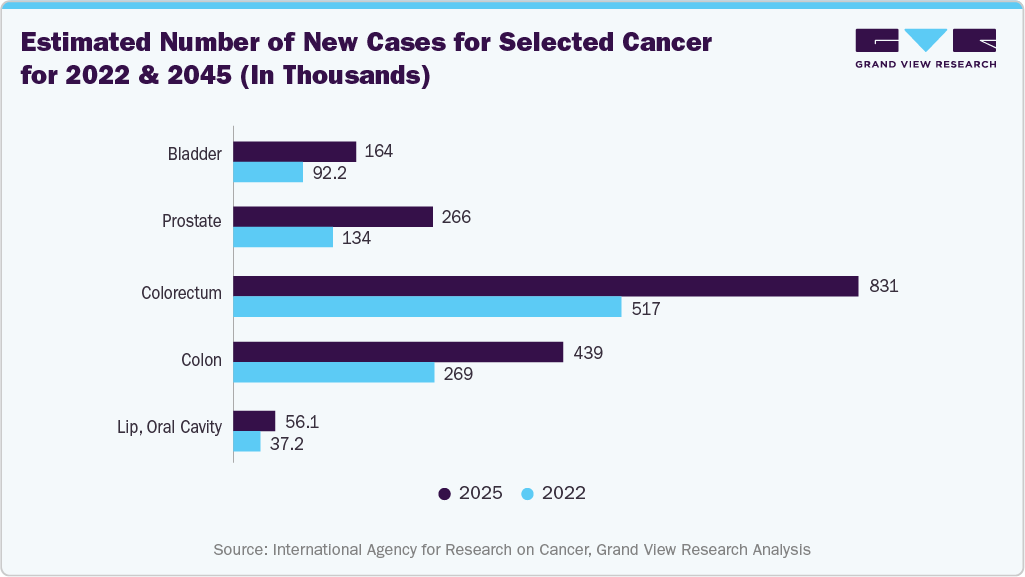

China is witnessing a significant rise in the country’s surgical interventions owing to the growing geriatric population base and the rising prevalence of chronic and degenerative diseases. As the population in the country ages, the prevalence of age-related conditions such as cardiovascular disease, urologic disorders, and colorectal cancer is expected to increase, thereby fueling the demand for surgical treatment involving ligation. According to the report released by the Ministry of Civil Affairs and China National Committee on Ageing, in 2023, China’s population aged 60 & above reached nearly 297 million (21.1% of the total), with those 65 and older at 216.76 million (15.4%). Geriatric patients undergoing procedures such as hernia repairs, bowel resections, and prostatectomies benefit from the reduced operative time and lower risk of complications offered by advanced ligation systems.

The Chinese government's focus on improving healthcare infrastructure and expanding insurance coverage also plays a crucial role. Increased healthcare spending and access to advanced medical technologies are making surgical procedures more accessible to a larger segment of the population. The market is also influenced by the rising disposable incomes of Chinese citizens, leading to increased healthcare spending and affordability to adopt advanced medical treatments. Moreover, technological advancements, with a growing demand for advanced ligation devices that offer improved precision, safety, and ease of use, further contribute to the market growth in the country.

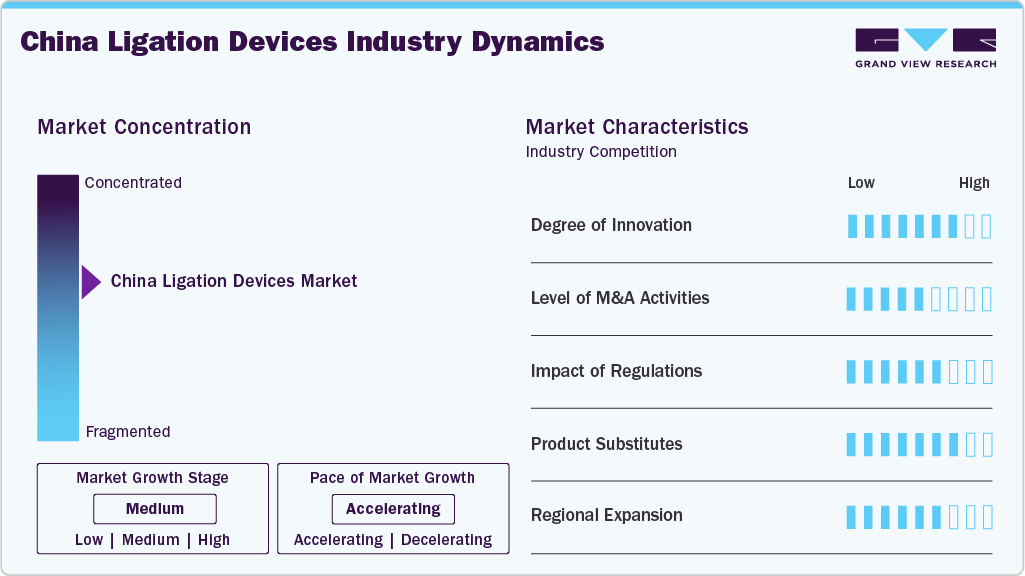

Market Concentration & Characteristics

The market is characterized by increasing disease prevalence requiring surgical interventions, a growing geriatric population, and an increasing preference for minimally invasive procedures. Moreover, continuous innovation in ligation device technology, including the development of advanced materials and designs, is enhancing the precision and effectiveness of surgical procedures, further driving market growth.

The industry is witnessing a significant degree of innovation, fueled by efforts to simplify device operation, enhance patient results, and reduce adverse events. The focus is on enhancing device ergonomics, improving material biocompatibility, and enhancing surgical precision to address the specific needs of Chinese surgeons and patients. Manufacturers are increasingly enhancing features such as enhanced hemostasis capabilities, advanced tissue sealing technologies, and minimally invasive surgical (MIS) compatibility to align with the growing demand for less invasive procedures.

Mergers and acquisitions in the industry involve the consolidation of companies through various transactions, including mergers and acquisitions. M&A activities are driven by the market players to acquire innovative technologies, expand market reach, and gain a competitive edge in a rapidly growing healthcare sector. The focus of these deals often involves acquiring companies with advanced product portfolios or strong distribution networks.

The industry is significantly influenced by regulatory dynamics, primarily driven by the National Medical Products Administration (NMPA). The NMPA's stringent approval processes for medical devices, including ligation devices, directly impact market entry and product availability. These regulations require stringent clinical trials and comprehensive documentation, which can extend the time-to-market and increase costs for manufacturers. Furthermore, the NMPA's classification system for medical devices, which categorizes ligation devices based on risk levels, influences the types of devices available, the pricing strategies of manufacturers, and the overall competitive landscape. The NMPA also actively monitors the market post-approval, conducting inspections and surveillance to ensure compliance with quality standards and safety regulations, which further influence the market.

The industry is witnessing a significant threat from substitutes. Some of the primary market substitutes of ligation devices include advanced energy devices such as ultrasonic and radiofrequency surgical systems, which can seal vessels and tissues using heat, thereby potentially minimizing the need for clips and ligatures in some surgeries. Additionally, suture-based methods also offer an alternative, particularly in procedures where surgeon preference or cost concerns about high-end technologies influence the adoption. However, ligation devices offer several distinct advantages, including their cost-effectiveness in selecting procedures and better patient outcomes, strengthening their position in the market.

China's ligation devices industry is witnessing significant regional expansion. This growth is fueled by increasing healthcare infrastructure investments in less developed regions, leading to greater accessibility of advanced medical technologies. As hospitals and clinics expand their services, the demand for ligation devices, crucial for various surgical procedures, rises correspondingly. Furthermore, the government's focus on enhanced healthcare access is accelerating the adoption of these devices in previously underserved areas, thereby fueling the regional expansion in the market.

Product Insights

The accessories segment accounted for the largest revenue share in 2024 and is expected to witness the fastest growth over the forecast period. Ligation clips and clip removers are essential surgical tools that allow secure vessel closure and allow for correction of misplaced clips when necessary. These devices are frequently utilized in gynecological, laparoscopic, urological, and general surgeries. Offered in metallic, polymer, and absorbable forms, each variant provides distinct benefits related to strength, biocompatibility, and compatibility with imaging. Advances in clip design and material science have resulted in the creation of more efficient and biocompatible clips, further accelerating their adoption.

The applier segment is expected to witness significant growth as these essential tools enable surgeons to efficiently and effectively ligate vessels and tissues with minimal trauma to the patient. Used to apply ligating clips or sutures, appliers are witnessing significantly increased adoption due to their enhanced precision and ease of use, especially in minimally invasive procedures. Moreover, their ability to deliver consistent and secure ligation, reducing the risk of complications such as bleeding or leakage, which is crucial for patient safety and recovery times, is further contributing to the increasing demand of appliers.

Application Insights

The gastrointestinal and abdominal segment accounted for the largest revenue share in 2024. This can be attributed to the increasing prevalence of related diseases and the rising demand for minimally invasive surgical procedures. Moreover, the technological advancements in ligation devices have led to improved precision and efficacy in procedures such as appendectomies, cholecystectomies, and various gastrointestinal surgeries. The demand for advanced ligation devices in gastrointestinal and abdominal surgeries is expected to witness significant growth, supported by the growing adoption of advanced surgical techniques.

The urological segment is expected to witness the fastest growth over the forecast period. The increasing prevalence of urological diseases, such as prostate cancer and benign prostatic hyperplasia (BPH), has fueled demand for effective treatment options, including ligation devices used in procedures such as prostatectomy and vasectomy. According to the World Cancer Research Fund, an estimated 134,156 new cases of prostate cancer were reported in China in 2022. Moreover, prostate cancer accounted for 47,522 deaths in the country in 2022. Such a high prevalence of urological conditions in the country is expected to drive the segment's growth over the forecast period.

Procedure Insights

Minimally invasive surgeries (MIS) dominated the market in 2024 owing to their several clinical advantages. The growing adoption of minimally invasive techniques, such as laparoscopy and robotic surgery, has driven demand for specialized ligation devices for these procedures. These devices enable surgeons to achieve greater precision, improved visualization, and perform complex tasks through small incisions. With benefits such as reduced patient trauma, quicker recovery, and fewer post-operative complications, Minimally Invasive Surgery (MIS) has become the preferred approach for both patients and surgeons, thereby driving the demand for ligation devices suited to these methods.

The open surgery segment is anticipated to experience significant growth due to its continued preference in specific clinical scenarios where minimally invasive techniques may not be suitable. This is particularly evident in resource-limited settings, where access to advanced laparoscopic or robotic systems is limited, making open surgical techniques more accessible. Additionally, open surgery is preferred for complex procedures that require direct visualization and tactile feedback, which are often critical for ensuring precision and safety. The segment’s growth is further supported by the need to effectively manage intraoperative challenges, such as controlling significant bleeding or navigating complex anatomical variations, where reliable and secure ligation is crucial.

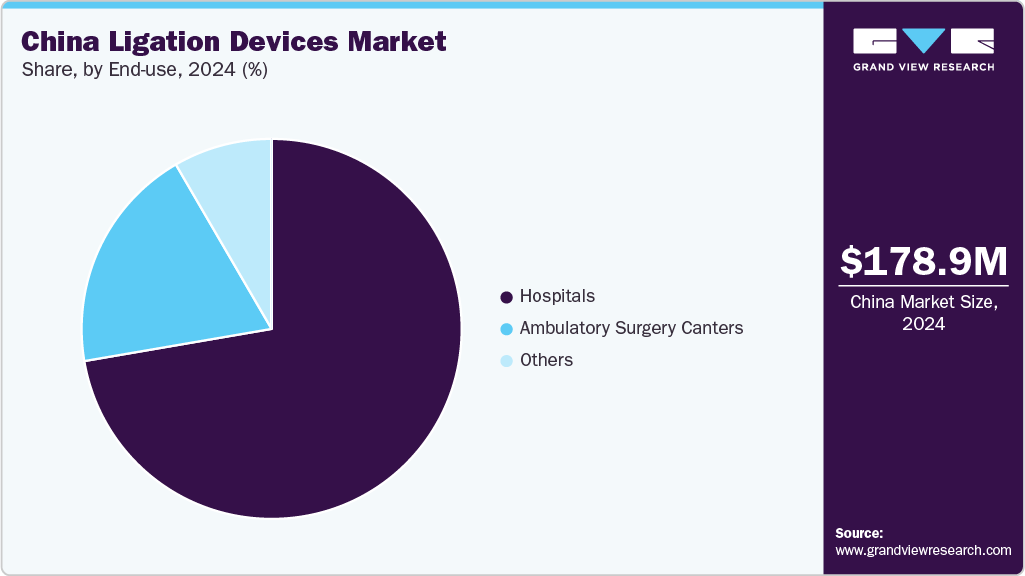

End Use Insights

The hospital segment held the largest market share in 2024, driven by the critical role hospitals play in adopting and advancing ligation devices, particularly with the growing use of minimally invasive and robotic-assisted surgeries. These devices, such as clips, clip appliers, and clip removers, are crucial for securing vessel ligation, controlling bleeding, and managing soft tissue across a wide range of procedures, including general, gynecological, urological, gastrointestinal, and cardiovascular surgeries. Hospitals integrate these tools into both conventional and robotic systems to enhance surgical precision, improve patient outcomes, and shorten recovery times.

The growth of ambulatory surgical centers (ASCs) is expected to witness the fastest growth driven by the expanding preference for outpatient surgical procedures, supported by healthcare reforms and investments in decentralized surgical infrastructure. ASCs are increasingly equipped to handle minimally invasive surgeries, which commonly utilize ligation devices such as clip appliers and ligating clips for vessel closure, bleeding control, and tissue management. Additionally, ASCs offer reduced hospitalization costs and shorter patient recovery times, aligning with the Chinese government's goals to reduce pressure on public hospitals, further fueling the segment's growth.

Key China Ligation Devices Companies Insights

Key players operating in the China ligation devices market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key China Ligation Devices Companies:

- Medtronic plc

- Johnson & Johnson (Ethicon Inc.)

- Olympus Corporation

- Teleflex Inc.

- ConMed Corporation

- Qingdao DMD Medical Technology Co., Ltd.

- Qingdao Conston Medical Technology Co., Ltd.

- Tianjin Zhichao Medical Technology Co., Ltd.

- Hangzhou Sunstone Technology Co., Ltd.

- Sinolinks Medical Innovation, Inc.

Recent Developments

-

In November 2024, Medtronic acquired Netherlands-based Fortimedix Surgical to enhance its surgical and endoscopy portfolio. The deal adds Fortimedix’s flexible, articulating instruments originally developed for its symphonX (FMX314) Surgical Platform, including Clip Applier ligation tools, to Medtronic’s robotic lineup.

-

In February 2025, Teleflex announced plans to spin off into two public companies by mid‑2026. RemainCo will retain its Surgical business, focusing on hospitals and ORs, with a product lineup that includes single-use and reusable devices such as metal and polymer ligating clips, fascial closure systems for laparoscopic surgery

China Ligation Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 193.39 million

Revenue forecast in 2033

USD 371.05 million

Growth rate

CAGR of 8.49% from 2025 to 2033

Actual Data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, procedure, end-use

Regional scope

China

Key companies profiled

Medtronic plc; Johnson & Johnson (Ethicon Inc.); Olympus Corporation; Teleflex Inc.; ConMed Corporation; Qingdao DMD Medical Technology Co., Ltd.; Qingdao Conston Medical Technology Co., Ltd.; Tianjin Zhichao Medical Technology Co., Ltd.; Hangzhou Sunstone Technology Co., Ltd.; Sinolinks Medical Innovation, Inc.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

China Ligation Devices Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the China ligation devices market report based on product, application, procedure and end-use:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Appliers

-

Disposable

-

Reusable

-

-

Accessories

-

Clips

-

Clip remover

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Gastrointestinal and abdominal surgery

-

Gynecological surgery

-

Cardiothoracic surgery

-

Urological surgery

-

Other

-

-

Procedure Outlook (Revenue, USD Million, 2021 - 2033)

-

Minimally Invasive Surgery (MIS)

-

Laparoscopic

-

Robotic-assisted

-

Others

-

-

Open surgery

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Ambulatory Surgical Centers (ASCs)

-

Other

-

Frequently Asked Questions About This Report

b. The China ligation devices market size was valued at USD 178.9 million in 2024 and is expected to reach a value of USD 193.39 million in 2025.

b. The China ligation devices market is expected to grow at a compound annual growth rate of 8.49% from 2025 to 2030 to reach USD 371.1 million by 2030.

b. The gastrointestinal and abdominal segments accounted for the largest revenue share in 2024. This can be attributed to the increasing prevalence of related diseases and the rising demand for minimally invasive surgical procedures.

b. Some key players operating in the China ligation devices market includes Medtronic plc; Johnson & Johnson (Ethicon Inc.); Olympus Corporation; Teleflex Inc.; ConMed Corporation; Qingdao DMD Medical Technology Co., Ltd.; Qingdao Conston Medical Technology Co., Ltd.; Tianjin Zhichao Medical Technology Co., Ltd.; Hangzhou Sunstone Technology Co., Ltd.; Sinolinks Medical Innovation, Inc.

b. Key factors driving the growth of the China ligation devices market include the aging population and the increasing prevalence of chronic diseases. Furthermore, the Chinese government's ongoing investments in healthcare infrastructure, including the expansion and modernization of hospitals and surgical facilities, are fueling the adoption of advanced medical technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.