- Home

- »

- Paints, Coatings & Printing Inks

- »

-

China Physical Vapor Deposition Market Size Report, 2030GVR Report cover

![China Physical Vapor Deposition Market Size, Share & Trends Report]()

China Physical Vapor Deposition Market Size, Share & Trends Analysis Report By Product (Thermal Evaporation, Sputter Deposition), By Application (Semiconductor & Electronics), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-200-6

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

The China physical vapor deposition market size was valued at USD 677.3 million in 2024 and is projected to grow at a CAGR of 8.4% from 2025 to 2030. The increasing demand for advanced microelectronics and data storage solutions is a significant contributor, as PVD coatings are essential for enhancing the performance and durability of these devices. In addition, the rising adoption of PVD in the solar energy sector, due to its ability to improve the efficiency and longevity of solar panels, is another critical driver.

The medical equipment industry also plays a vital role, with PVD coatings being used to enhance the wear resistance and biocompatibility of surgical instruments and implants. Furthermore, ongoing advancements in PVD technology, coupled with stringent environmental regulations promoting the use of eco-friendly coating processes, are expected to further propel market growth.

Various environmental protection regulations and technological advancements have significantly influenced the China Physical Vapor Deposition (PVD) market. The Ministry of Ecology and Environment (MEE) has implemented stricter emission standards under the Air Pollution Prevention and Control Action Plan, which compels PVD manufacturers to adopt cleaner technologies and reduce volatile organic compounds (VOCs). Additionally, implementing the New Energy Vehicle (NEV) policy has increased the demand for PVD processes to produce high-performance coatings for automotive components. The "Made in China 2025" initiative further encourages the development of advanced manufacturing technologies, including PVD, by providing financial incentives and support for research and development.

Product Insights

The sputter deposition segment accounted for 47.3% of the total revenue generated in the market in 2024 attributed to its widespread application across various industries, including electronics, automotive, and aerospace. Sputter deposition is highly valued for its ability to produce thin films with excellent uniformity and adhesion, which are critical for enhancing the performance and durability of electronic components and optical devices. The method’s versatility in depositing a wide range of materials, from metals to dielectrics, further boosts its adoption. Additionally, advancements in sputtering technology, such as magnetron sputtering, have improved deposition rates and film quality, making it a preferred choice for high-precision applications.

The arc vapor deposition segment is expected to grow at a CAGR of 9.0% over the forecast period driven by its unique advantages in producing hard, wear-resistant coatings, essential for extending the lifespan of cutting tools, molds, and other high-stress components. Arc vapor deposition is particularly effective in creating dense, adherent coatings with superior hardness and corrosion resistance, making it ideal for applications in the manufacturing and heavy machinery sectors. The increasing focus on improving the efficiency and durability of industrial equipment is fueling the demand for arc vapor deposition technologies. Furthermore, ongoing research and development efforts are enhancing the process’s capabilities, such as reducing droplet formation and improving coating uniformity, which is expected to expand its application scope.

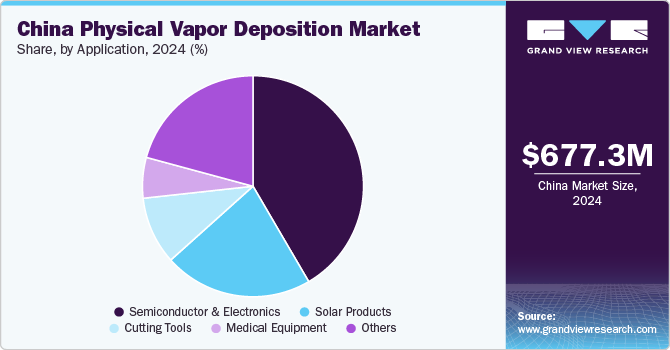

Application Insights

The semiconductor & electronics segment dominated the market in 2024. The demand for advanced microelectronics, including integrated circuits, memory devices, and display technologies, has surged, driven by the proliferation of consumer electronics, the expansion of 5G networks, and the growth of the Internet of Things (IoT). PVD processes are essential for creating thin films and coatings that enhance the performance, reliability, and miniaturization of semiconductor components. The ability of PVD to deposit materials with high precision and uniformity is crucial for the fabrication of complex electronic devices.

The solar products segment is projected to grow at the fastest rate over the forecast period, driven by the increasing adoption of renewable energy sources and the government’s strong support for solar energy initiatives. PVD technologies are pivotal in producing high-efficiency solar cells and panels, as they enable the deposition of thin-film coatings that improve the light absorption and electrical conductivity of photovoltaic materials. The push towards achieving carbon neutrality and reducing greenhouse gas emissions has led to significant investments in solar energy infrastructure. Policies such as subsidies for solar panel installations and incentives for research and development in solar technologies are accelerating the growth of this segment.

Key China Physical Vapor Deposition Company Insights

Some of the key companies in the China physical vapor deposition market include Advanced Energy Industries, Inc., Applied Materials, Inc., Intevac, Inc., Oerlikon Balzers, and others.

-

Applied Materials, Inc. is a prominent player in materials engineering solutions and a key contributor to the China PVD market. The company provides advanced PVD equipment and technologies essential for the fabrication of semiconductor devices and other electronic components.

-

Intevac, Inc. specializes in high-productivity thin-film processing systems. The company’s PVD solutions are widely used to produce hard disk drives, solar cells, and other advanced materials.

Key China Physical Vapor Deposition Companies:

- Advanced Energy Industries, Inc.

- Applied Materials, Inc.

- Intevac, Inc.

- Oerlikon Balzers

- Impact Coatings AB

View a comprehensive list of companies in the China Physical Vapor Deposition Market

Recent Developments

-

In August 2024, Chinese researchers developed a strategy to enhance the resistance of plasma spray-physical vapor deposition (PS-PVD) thermal barrier coatings (TBCs) against molten CMAS (CaO–MgO–Al2O3–SiO2) corrosion. By using laser texturing to create a super-hydrophobic surface and adding a thin Al-film layer, they significantly improved the TBCs' resistance to high-temperature molten CMAS infiltration. This method, combining laser-textured micro-nano structures with Al-modification, shows promise in addressing the vulnerability of PS-PVD TBCs in extreme conditions.

China Physical Vapor Deposition Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 732.2 million

Revenue forecast in 2030

USD 1.1 billion

Growth rate

CAGR of 8.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application

Key companies profiled

Advanced Energy Industries, Inc.; Applied Materials, Inc.; Intevac, Inc.; Oerlikon Balzers; Impact Coatings AB

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

China Physical Vapor Deposition Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the China physical vapor deposition market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Thermal Evaporation

-

Sputter Deposition

-

Arc Vapor Deposition

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Semiconductor & Electronics

-

Solar Products

-

Cutting Tools

-

Medical Equipment

-

Others

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."