- Home

- »

- Power Generation & Storage

- »

-

China Stationary Lead Acid Battery Market Size Report, 2030GVR Report cover

![China Stationary Lead Acid Battery Market Size, Share & Trends Report]()

China Stationary Lead Acid Battery Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Telecommunication, Transportation infrastructure, Building, Utilities, Oil & gas, Off-grid renewable), And Segment Forecasts

- Report ID: GVR-1-68038-161-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

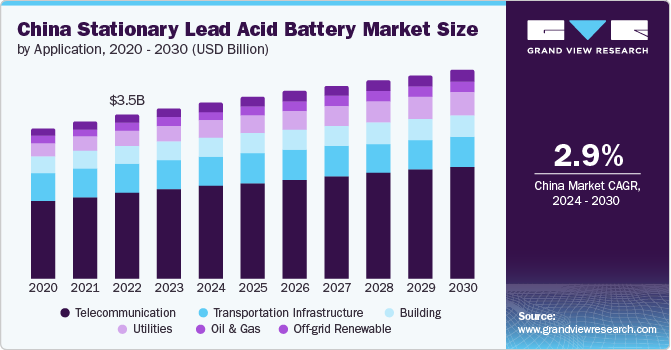

The China stationary lead acid battery market size was valued at USD 3,568.8 million in 2023 and is expected to grow at a CAGR of 2.9% from 2024 to 2030. The market is anticipated to be driven by huge demand in telecommunication, grid energy storage systems, and household off-grid electric power systems.

China is the world's largest producer, exporter, and consumer of lead-acid batteries. In 2018, China produced 27.81 million passenger vehicles. Lead-acid batteries are utilized in electric vehicles to start the motor and light the engine. According to the IEA, China accounted for the highest sales of 3.3 million electric vehicle sales in 2021 globally. Due to the rising popularity of electric vehicles, the market for stationary lead-acid batteries is expected to grow quickly in the coming years.

The robust manufacturing base of batteries in China along with the commitment of its government toward infrastructure development is expected to drive the battery market. Furthermore, the growing FMCG companies in China are expected to augment the demand for stationary lead acid batteries, thereby driving the market growth over the forecast period. In addition, rapid industrialization, increasing government infrastructure spending, and increasing FDIs are expected to promote market growth.

Growing demand for automotive industry, which is among the largest end users of lead-acid batteries across the country is expected to augment the market growth. Rising awareness about the technical limitations of batteries, such as low energy density and weight of the battery, is expected to restrict the market growth.

Increasing demand for lead acid batteries in automotive, which are widely used for starting, lighting and igniting offers an ideal choice for the industry. Their applications in the uninterruptible power supplies meeting the current hour need will fuel market demand. In addition, rising demand for the recycling of lead-acid batteries, which has become a profitable business, is likely to help reduce the volume of lead being dumped into the environment. This is expected to contribute to the market growth over the coming years.

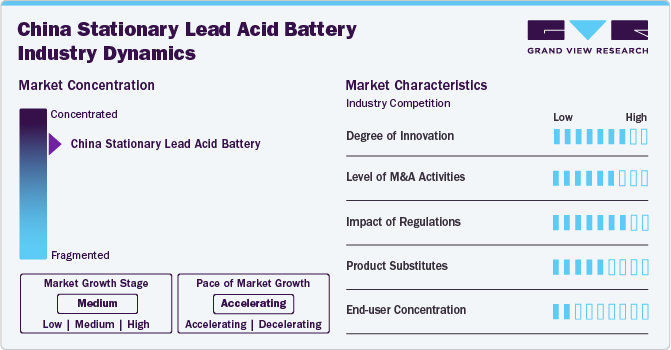

Market Concentration & Characteristics

The stationary lead acid battery market in China is characterized by a significant concentration of both domestic and international players. Some of the leading and prominent companies in the market are Chaowei Power Holdings, Tianneng Battery Group, and Leoch International Technology. These companies have established strong distribution networks and advanced manufacturing capabilities, which have enabled them to dominate the market. In addition, multinational companies like Johnson Controls and Exide Technologies also have a presence in China, contributing to the competitive landscape.

The market is primarily driven by the growing demand for energy storage solutions, particularly in the renewable energy sector, telecommunication networks, and uninterruptible power supplies (UPS). The Chinese government's focus on renewable energy projects and infrastructure development further propels the market growth. Stationary lead acid batteries are favored for their reliability, cost-effectiveness, and robustness in various applications despite the rise of alternative technologies such as lithium-ion batteries.

Technological advancements and innovations in battery design and manufacturing processes have led to improvements in the performance and lifespan of lead acid batteries. Companies are investing in research and development to enhance battery efficiency, reduce environmental impact, and comply with stringent regulations on battery disposal and recycling. The market also witnesses a trend towards the adoption of advanced lead acid batteries, such as valve-regulated lead acid (VRLA) batteries, which offer better safety and maintenance-free operation.

Drivers, Opportunities & Restraints

China's robust economic and industrial growth significantly drives the stationary lead acid battery market. As the world's second-largest economy, China has experienced rapid industrialization and urbanization over the past few decades. This has led to an increasing demand for reliable power backup and energy storage solutions across various sectors, including manufacturing, telecommunications, and transportation. Stationary lead acid batteries are crucial for ensuring uninterrupted power supply in industrial operations, thereby propelling their demand.

The expansion of telecommunications infrastructure in China is a major driver for the stationary lead acid battery market. With the proliferation of mobile and internet services, there is a growing need for reliable backup power solutions to ensure seamless operation of telecommunications networks. Lead acid batteries are widely used in base stations, data centers, and other critical telecommunications infrastructure due to their cost-effectiveness and reliability. The ongoing rollout of 5G technology further intensifies the demand for these batteries to support the enhanced network capabilities.

One of the significant restraints in the stationary lead acid battery market in China is the growing environmental and regulatory challenges. Lead acid batteries contain hazardous materials such as lead and sulfuric acid, which pose environmental risks if not disposed of properly. The Chinese government has been tightening environmental regulations to reduce pollution and ensure safe disposal of hazardous waste. These stringent regulations increase compliance costs for manufacturers, impacting their profitability and operational efficiency.

Application Insights

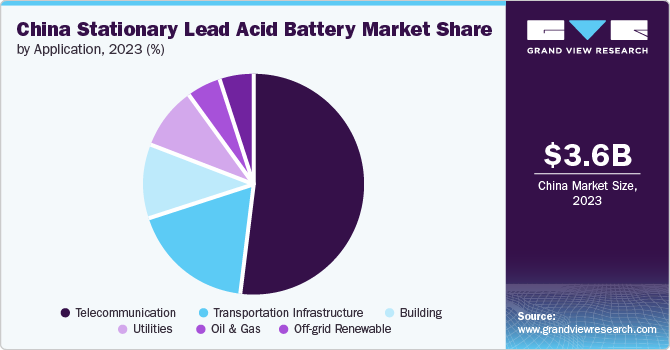

The application segment has been further divided into telecommunication, transportation infrastructure, building, utilities, oil & gas, and off-grid renewable based on its applications.

Telecommunication held the largest revenue share of 53% in 2023. Stationary lead acid batteries are widely used in the telecommunication sector for uninterrupted power systems (UPS) systems. Batteries for network operations, backups, broadband, DSL, fiber optic distribution and other such applications are used widely and in critical cases. They are widely used in energy storage and power backups. Lead acid batteries are widely used in the telecommunication industry for standby applications. The demand for VRLA batteries is expected to grow significantly as flooded batteries demand regular maintenance. Chinese telecommunication sector is growing steadily owing to the rapid growth of China’s 5G and gigabit optic fiber network. As of 2021, China had 1.43 million base stations, which makes it the largest 5G network in the world.

Transportation infrastructure held a significant revenue share of the market. Stationary lead acid battery finds application in EV power stations, docking facilities, refueling stations and airports. Chinese electric vehicle industry is growing rapidly, with 1.15 million EV power stations as of 2021, making it the world’s largest EV charging stations network. Stationary lead acid batteries are also utilized in residential and commercial buildings in UPS systems for backup power. An increase in the construction of buildings like warehouses, corporate offices, hospitals, and schools is expected to augment the growth of the stationary lead acid battery market in China.

The utilities segment includes power generation and energy storage. The growing demand for heavy-duty and efficient energy storage and backup systems in power transmission and renewable power generation sectors is another driving factor that is likely to provide lucrative opportunities in the market. According to U.S. Energy Information Administration, as of 2021, China is the 5th largest producer of oil & gas globally. Demand for stationary lead acid batteries in UPS systems in oil & gas production facilities is expected to be driven by the growth of the oil & gas industry over the forecast period. According to Asia Europe Clean Energy Solar Advisory, China’s annual solar cell production capacity increased to 600 GW from 361 GW, which is expected to foster the demand for lead acid batteries used in solar inverters in the country.

Key China Stationary Lead Acid Battery Company Insights

The stationary lead acid battery market in China is competitive with key participants involved in R&D. The vendors striving for constant innovations is an important factor for companies performing well in this industry.

Key China Stationary Lead Acid Battery Companies:

- Camel group

- Chaowei Power Holdings Limited

- Chilwee

- China Shipbuilding Industry Corporation

- Desay Battery Co.

- GS Battery

- Leoch battery

- Narada

- Shuangdeng

- Tianneng Group

China Stationary Lead Acid Battery Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.69 billion

Revenue forecast in 2030

USD 4.37 billion

Growth rate

CAGR of 2.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application

Country scope

China

Key companies profiled

Tianneng Group; Chaowei Power Holdings Limited; China Shipbuilding Industry Corporation; Desay Battery Co.; Chilwee; Camel group; GS Battery; Shuangdeng; Narada; Leoch battery; Xiongtao vision

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

China Stationary Lead Acid Battery Market Report Segmentation

This report forecasts revenue growth of China stationary lead acid battery market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. Forthis study, Grand View Research has segmented the China stationary lead acid battery market report based on application.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Telecommunication

-

Transportation infrastructure

-

Building

-

Utilities

-

Oil & gas

-

Off-grid renewable

-

Frequently Asked Questions About This Report

b. The China stationary lead acid battery market size was estimated at USD 3,568.8 million in 2023 and is expected to reach USD 3.69 billion in 2024.

b. The China stationary lead acid battery market is expected to witness a compound annual growth rate of 2.9% from 2024 to 2030 to reach USD 4.37 billion by 2030.

b. The telecommunication was the largest application segment accounting for about 52.0% of the total revenue in 2023 owing to growing telecom network in the country

b. Some of the major players operating in the China stationary lead acid battery market include Camel group, Chaowei Power Holdings Limited, China Shipbuilding Industry Corporation, Leoch battery.

b. Key factors driving the growth of the China stationary lead acid battery market include robust battery manufacturing base and growth of industries like transportation and FMCG using stationary lead acid battery as their power backup solution

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.