- Home

- »

- Medical Devices

- »

-

China Wearable Medical Devices Market Size Report, 2033GVR Report cover

![China Wearable Medical Devices Market Size, Share & Trends Report]()

China Wearable Medical Devices Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Diagnostic, Therapeutic), By Site (Handheld, Headband, Strap), By Grade Type, By Application, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-246-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

China Wearable Medical Devices Market Summary

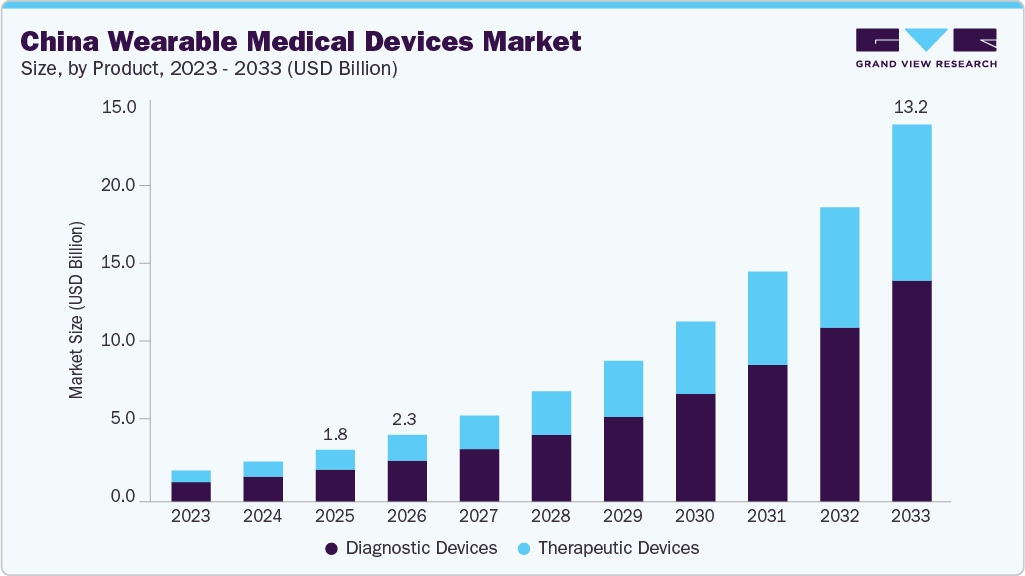

The China wearable medical devices market size was estimated at USD 1.80 billion in 2025 and is projected to reach USD 13.24 billion by 2033, growing at a CAGR of 28.25% from 2026 to 2033. The market is expanding due to the rising use of smartwatches and health bands equipped with ECG, SpO₂, heart-rate, and sleep-tracking functions offered by leading domestic brands such as Huawei and Xiaomi.

The growth is also supported by increasing diagnoses of hypertension and diabetes, wider enrollment in health management programs by insurers, and the adoption of remote monitoring tools by hospitals for cardiac and respiratory conditions. Government action under “Healthy China 2030” is further increasing the demand for continuous health data tracking.

The rising demand for round-the-clock health monitoring is a major driver of the China wearable medical devices industry, as consumers seek continuous insights into their health status rather than occasional check-ups. Growing awareness of chronic conditions such as hypertension, diabetes, and cardiovascular diseases, combined with the need for early detection, has made real-time tracking essential. Wearable devices equipped with sensors for heart rate, blood pressure, sleep, and activity offer users a convenient way to monitor their health 24/7, promoting proactive self-management. In addition, China’s expanding digital health ecosystem, telemedicine adoption, and employer wellness programs further encourage widespread use of devices that deliver continuous data. This shift toward uninterrupted monitoring enhances personal health management and accelerates the adoption of medical-grade wearables across the country.

The figure below shows the number of wearable device users recorded across 31 provinces in China between 2022 and 2024 data collected from mobile phones and Huawei Watch D, demonstrating broad national engagement with digital health technologies. This widespread geographic participation underscores strong adoption of smart health monitoring tools among diverse population groups and socioeconomic segments.

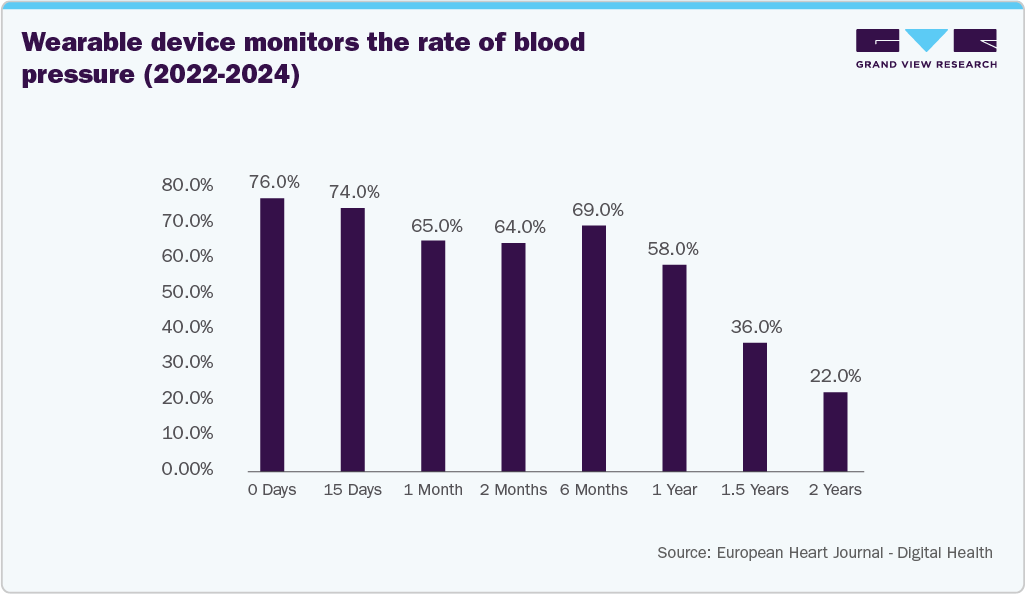

The figure below shows the rate of blood pressure monitoring by wearable devices from day 0 to 2 years, at which 75, 918 participants received a risk alarm, driven by rising awareness of real-time cardiovascular tracking. Their increasing use reflects growing consumer preference for continuous, noninvasive monitoring to manage hypertension and overall heart health.

Growing awareness of fitness and preventive health is a significant driver of the China wearable market. As consumers prioritize active lifestyles, they are turning to smartwatches, fitness bands, and health-monitoring wearables to track daily activity, sleep quality, heart rate, and calorie expenditure. Social media-driven fitness trends, government initiatives promoting healthy living, and rising participation in sports and outdoor activities further boost demand. Younger consumers view wearables as essential tools for setting goals and maintaining motivation. The integration of advanced sensors and AI-based insights enhances user experience by providing personalized feedback. Together, these factors fuel strong adoption of wearables across urban and semi-urban populations in China.

Moreover, according to China’s General Administration of Sport (GAS), about 39% of China’s population regularly participated in physical exercise in 2023. In 2024, the National Health Commission issued new weight-management guidelines warning that, if current trends continue, overweight and obesity rates among Chinese adults and children could rise to 70.5% and 31.8%, respectively, by 2030.

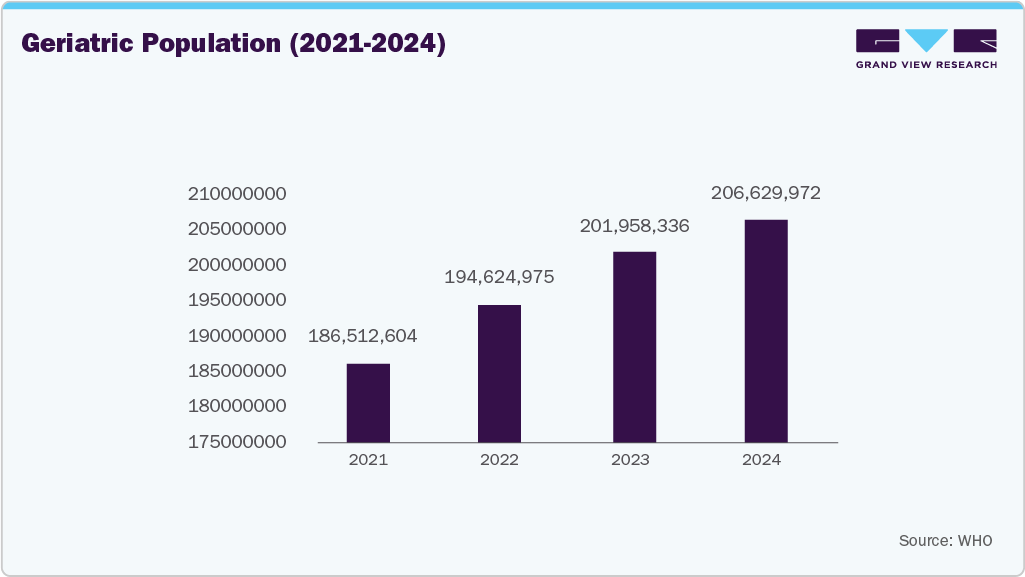

As China’s geriatric population has steadily increased from 2021 to 2024, the demand for continuous health monitoring and disease management has also risen sharply. Older adults face higher risks of chronic conditions such as cardiovascular diseases, diabetes, respiratory disorders, and mobility limitations, making wearable medical devices essential for daily health tracking and timely intervention. This demographic shift is significantly accelerating the growth of the China wearable medical devices market, as both families and healthcare providers rely on smart monitoring tools to support healthy aging and reduce hospital burden.

The table below shows the geriatric population statistics in China from 2021 to 2024, highlighting the rise in the elderly population and its growing impact on healthcare demand.

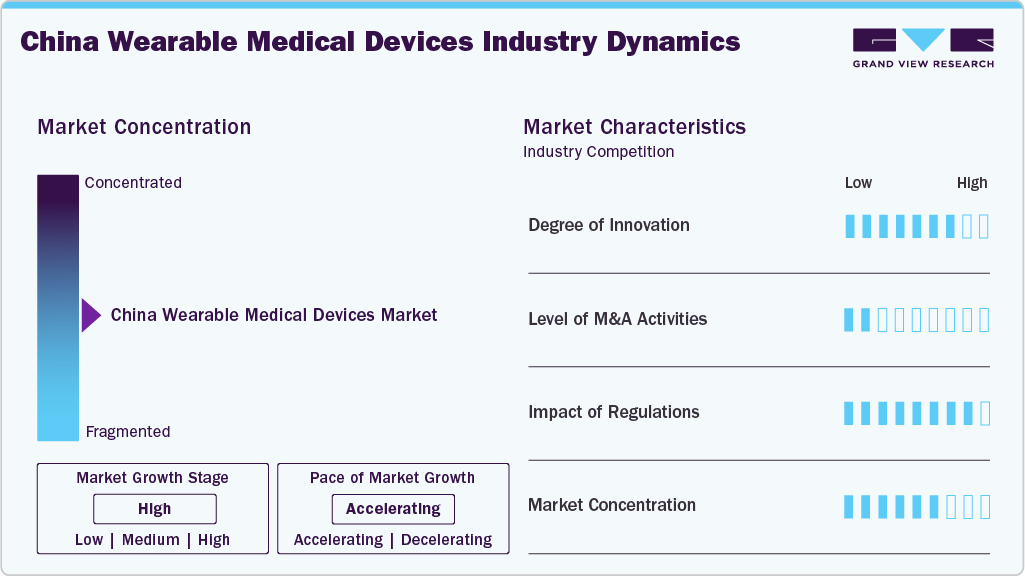

Market Concentration & Characteristics

The China wearable medical devices market’s growth is fueled by rising demand for continuous, real-time health monitoring as chronic diseases, lifestyle disorders, and an aging population place greater pressure on healthcare systems. The adoption of smart, clinically validated wearables is increasing as consumers and providers seek accurate physiological tracking, early diagnostics, and remote patient management solutions. Advancements in sensors, connectivity, and AI-driven analytics are accelerating uptake across fitness, clinical, and home-care settings. Growing integration of wearables into telehealth platforms, along with supportive government initiatives for digital health, is further strengthening market expansion while improving patient outcomes and enabling proactive disease management.

The market exhibits a high level of innovation, supported by rapid advancements in multi-parameter sensors, AI-driven analytics, and IoT-enabled real-time monitoring. Continuous improvements in diagnostic wearables-such as heart-rate, ECG, SpO₂, sleep, and neuromonitoring devices-are enhancing accuracy, user comfort, and data interoperability. Strong progress in therapeutic wearables, including insulin pumps, neurostimulation devices, and respiratory therapy systems, reflects China’s shift toward technology-driven chronic disease management. Emerging innovations in smart clothing, shoe sensors, headbands, and clinical-grade monitoring platforms further accelerate adoption.

M&A activity in China’s wearable medical devices industry is moderate but strategically significant, focused on strengthening digital health capabilities, expanding product portfolios, and enhancing chronic disease management solutions. Global and domestic players increasingly acquire technology startups specializing in biosensors, AI algorithms, and remote monitoring software.

Regulation plays a central role in shaping the China wearable medical devices market. Devices must comply with NMPA classification rules, clinical evaluation guidelines, UDI requirements, AI/algorithm validation standards, and strict cybersecurity frameworks under the PIPL and Data Security Law. These requirements increase development timelines and raise the burdens of documentation and testing, especially for clinical-grade devices, such as ECGs, insulin monitors, and neuromonitoring systems.

The market is moderately concentrated, featuring a blend of strong domestic players, including Huawei, Xiaomi, and local medical-device manufacturers, as well as global leaders such as Abbott, Omron, Apple, and Medtronic. Large consumer-electronics brands dominate the high-volume, consumer-grade segment with extensive distribution networks and aggressive R&D. Meanwhile, clinical-grade segments, such as ECG, RPM, insulin monitoring, and neurostimulation, are shared among specialized domestic innovators and multinational companies with stronger regulatory expertise.

Product Insights

The diagnostic devices segment led the China wearable medical devices market, with the largest revenue share in 2025, driven by China’s rapid adoption of smart health monitoring, the rising chronic disease burden, and growing reliance on wearables for vital sign, sleep, and cardiac tracking. Advancements in sensor accuracy, smartphone integration, and increased use in remote-care programs further reinforced this segment’s dominance.

Therapeutic-device wearables segment is projected to grow at the fastest CAGR during the forecast period. That growth is driven by increasing demand for chronic-disease management, remote care, and home-health support, especially devices focused on therapy such as pain management, respiratory support, rehabilitation, and other clinical uses rather than just monitoring. These devices go beyond simple monitoring and actively intervene to improve health outcomes. Therapeutic devices encompass a range of products, including pain management devices, insulin-monitoring devices, rehabilitation devices, and respiratory devices. Several factors, including the increasing prevalence of chronic diseases, advancements in technology, and a growing emphasis on personalized medicine, drive the growth of therapeutic devices.

Site Insights

The strap, clip, bracelet segment led the China wearable medical devices industry, with the largest revenue share in 2025, due to strong consumer adoption of smartwatches and fitness bands, superior comfort and wearability, and broad functionality across heart rate, activity, sleep, and oxygen monitoring. Continuous innovations, seamless smartphone integration, and high usage in both consumer wellness and remote-care programs further reinforced this segment’s leadership. The segment is also expected to record the highest growth during the forecast period, driven by the expanding use of multifunctional smartwatches.

The shoe-sensors segment is projected to register a significant CAGR during the forecast period, driven by rising demand for gait analysis, fall detection, mobility monitoring, and rehabilitation support, especially among elderly and chronic-disease patients. As wearable sensors become more compact, accurate, and connected (via 5G/IoT), shoe-sensor devices are gaining traction for home health, remote patient monitoring, and physiotherapy applications. This shift toward smart footwear supports a move beyond wrist/strap wearables, strengthening the shoe-sensors site category substantially.

Application Insights

The home-healthcare segment held the largest revenue share of the China wearable medical devices market in 2025, supported by the growth in chronic disease cases, the aging population in China, and the rising use of continuous monitoring outside hospital settings. The segment expanded as providers increased remote-care programs and faced pressure to manage costs and reduce inpatient volume. The launch of NMPA-cleared multi-parameter wearables increased clinical use in home environments, strengthening the position of home-based monitoring within the wearable medical device market in China.

The remote patient monitoring (RPM) segment is expected to record a significant CAGR during the forecast period, supported by rising chronic-disease incidence, increasing preference for home-based care, and expanding digital-health infrastructure. Wider adoption of connected sensors, cloud platforms, and AI-driven analytics is enhancing clinical decision-making and enabling continuous, real-time tracking of vital parameters. Hospitals, payers, and home-care providers are increasingly integrating RPM to reduce hospitalization costs, prevent complications, and improve patient outcomes, driving sustained momentum for this segment across the wearable medical device market.

Grade Type Insights

The consumer-grade wearable medical devices segment held the largest revenue share of the China wearable medical devices industry in 2025, due to high user adoption, broad retail availability, and strong integration with mobile health platforms in China. Growth was supported by the rising use of wearables for tracking vital data, the expansion of insurer and employer wellness programs, and the increasing acceptance of self-management tools for chronic conditions. Companies in China continued to scale up production, lower unit costs, and integrate clinical-grade features into consumer devices, which sustained the segment's lead in the national wearable medical device market.

The clinical wearable medical devices segment is projected to record the fastest CAGR during the forecast period, driven by the wider adoption of these devices in hospitals and outpatient settings, the increasing use of remote patient monitoring, and the rising clinical demand for continuous data capture in China. Health systems are expanding digital-care pathways, and providers are deploying wearable sensors for cardiac tracking, glucose monitoring, rehabilitation support, and post-procedure follow-up. Regulatory bodies in China are also approving more clinical-grade devices, enabling broader procurement and integration, which supports sustained growth in this segment across the national market.

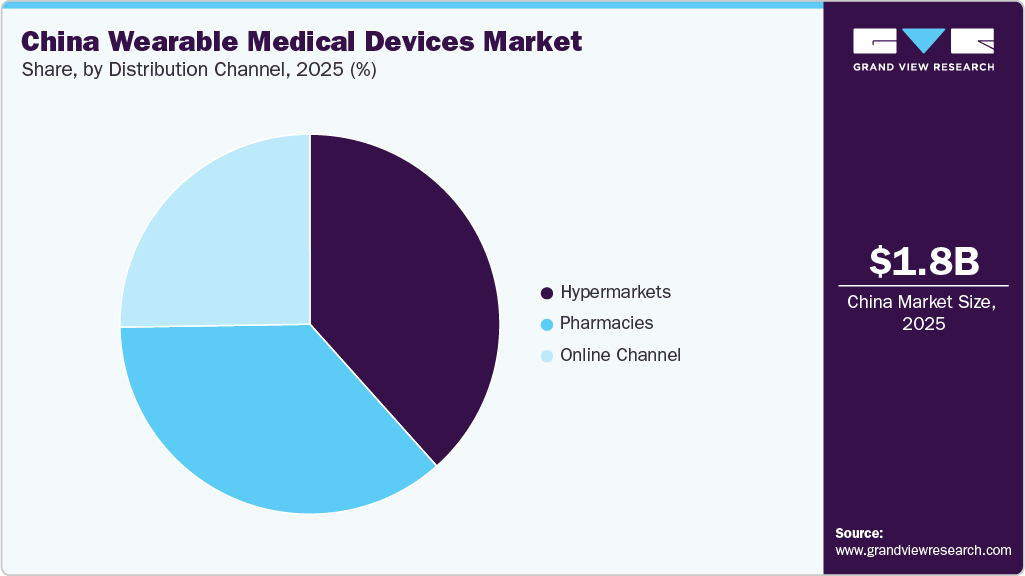

Distribution Channel Insights

The hypermarkets segment held the largest revenue share of the China wearable medical devices market in 2025, due to strong footfall, broad product availability, and established distribution networks across major cities in China. Consumers continued to purchase wearable medical devices through physical retail channels for convenience, in-person verification, and access to bundled promotions. Hypermarket chains expanded shelf space for health technology and partnered with leading manufacturers to secure a steady supply. These factors supported higher sales volumes and reinforced the segment’s lead within the national distribution landscape for wearable medical devices.

The online channel is expected to register the fastest growth rate during the forecast period, driven by the rising use of e-commerce platforms, wider adoption of digital payments, and increasing direct-to-consumer purchases of wearable medical devices in China. Manufacturers and retailers are expanding their online listings, integrating telehealth links, and utilizing data-driven marketing to drive demand. Online platforms are increasing sales of health devices through livestreaming, subscription programs, and brand partnerships. These factors are raising online volumes and driving steady expansion of this distribution channel.

Key China Wearable Medical Devices Company Insights

Key players in China’s wearable medical device market are expanding their product pipelines, strengthening distribution networks, and increasing integration with digital health platforms. Companies such as Huawei, Xiaomi, CONTEC Medical Systems Co. Ltd., and Omron Corporation are advancing sensor capability, enhancing data-tracking features, and forming collaborations with hospitals, insurers, and telehealth providers. Firms are also investing in regulatory approvals, manufacturing scale, and ecosystem partnerships to support the wider adoption of their products across consumer and clinical use cases.

Key China Wearable Medical Devices Companies:

- CONTEC Medical Systems Co. Ltd.

- Huawei Technologies Co., Ltd.

- Xiaomi

- Omron Corporation

- Abbott Laboratories Shanghai Co. Ltd. (Abbott)

- Medtronic

- Apple, Inc.

- Alphabet Inc.

- Cortivision

- Tekscan, Inc.

- Koninklijke Philips N.V.

- GE HealthCare

- Insulet Consulting (Shenzhen) Co., Ltd.

- Samsung

Recent Developments

-

In March 2025, Xiaomi announced Watch S4, featuring an upgraded algorithm for continuous monitoring of heart rate, blood oxygen, stress, and sleep with 98% accuracy. The device delivers one-tap 60-second health insights, advanced L1+L5 GNSS tracking, and supports over 150 sports modes.

-

In June 2025, Ypsomed opened its first China production site in Changzhou’s high-tech industrial park in June 2025. The facility manufactures injection systems for the domestic market, enabling faster response to customer needs, reduced logistics risks, and more efficient, sustainable product delivery

-

In February 2024, Contec Medical received a design patent for its Handheld Nebulizer, authorized in February 2024, under application number CN202330450017.7. The announcement notes that it is a newly granted patent, with a related update on a Portable Sputum Aspirator certification.

-

In February 2024, Contec Medical reported that its subsidiary received a Medical Device Registration Certificate from the Hebei Provincial Drug Administration for the Portable Sputum Aspirator on February 26. The approval adds to the company’s product lineup and supports its business growth.

China Wearable Medical Devices Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 2.34 billion

Revenue forecast in 2033

USD 13.24 billion

Growth rate

CAGR of 28.25% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, site, grade type, and distribution channel

Country scope

China

Key companies profiled

CONTEC Medical Systems Co. Ltd.; Huawei Technologies Co., Ltd.; Xiaomi; Omron Corporation; Abbott Laboratories; Shanghai Co. Ltd. (Abbott); Medtronic; Apple, Inc.; Alphabet Inc.; Cortivision; Tekscan, Inc.; Koninklijke Philips N.V.; GE HealthCare; Insulet Consulting (Shenzhen) Co., Ltd.; Samsung

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

China Wearable Medical Devices Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the China wearable medical devices market report based on product, site, application, grade type, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Diagnostic Devices

-

Vital Sign Monitor

-

Heart Rate Monitors

-

Activity Monitors

-

Electrocardiographs

-

Pulse Oximeters

-

Spirometers

-

Blood Pressure Monitors

-

Others

-

-

Sleep Monitoring Device

-

Sleep Trackers

-

Wrist Actigraphs

-

Polysomnographs

-

Others

-

-

Electrocardiographs Fetal & Obstetric Devices

-

Neuromonitoring Devices

-

EEG

-

EMG

-

Others

-

-

-

Therapeutic Devices

-

Pain Management Devices

-

Neurostimulation Devices

-

Others

-

-

Insulin Monitoring Devices

-

Insulin Pumps

-

Others

-

Autoinjectors

-

Other Insulin Devices

-

-

-

Rehabilitation Devices

-

Accelerometers

-

Sensing Devices

-

Ultrasound Platform

-

Others

-

-

Respiratory Therapy Devices

-

Ventilators

-

CPAP

-

Portable oxygen concentrators

-

Others

-

-

-

-

Site Outlook (Revenue, USD Million, 2021 - 2033)

-

Handheld

-

Headband

-

Strap, Clip, Bracelet

-

Shoe Sensors

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Sports & Fitness

-

Remote Patient Monitoring

-

Home Healthcare

-

-

Grade Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Consumer-grade Wearable Medical Devices

-

Clinical Wearable Medical Devices

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmacies

-

Online Channels

-

Hypermarkets

-

Frequently Asked Questions About This Report

b. The China wearable medical devices market size was estimated at USD 1.81 billion in 2025 and is expected to reach USD 2.34 billion in 2026.

b. The China wearable medical devices market is projected to grow at a CAGR of 28.13% from 2026 to 2033 to reach USD 13.24 billion by 2033.

b. Based on product, diagnostic devices segment held the largest revenue share in 2025, driven by China’s rapid adoption of smart health monitoring, rising chronic disease burden, and growing reliance on wearables for vital-sign, sleep, and cardiac tracking.

b. Some of the key players operating in the CONTEC Medical Systems Co. Ltd.; Huawei Technologies Co., Ltd.; Xiaomi; Omron Corporation; Abbott Laboratories; Shanghai Co. Ltd. (Abbott); Medtronic; Apple, Inc.; Alphabet Inc.; Cortivision; Tekscan, Inc.; Koninklijke Philips N.V.; GE HealthCare; Insulet Consulting (Shenzhen) Co., Ltd.; Samsung

b. Key factors driving the market growth include the increasing usage of advanced technologies, growing financing, grants, and investments. In addition, increasing interest in health monitoring among athletes and fitness admirers is anticipated to bolster market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.