- Home

- »

- Communication Services

- »

-

Clinical Communication And Collaboration Market Report, 2030GVR Report cover

![Clinical Communication And Collaboration Market Size, Share & Trends Report]()

Clinical Communication And Collaboration Market (2025 - 2030) Size, Share & Trends Analysis Report By Component, By Deployment (On-premises, Hosted), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-788-9

- Number of Report Pages: 175

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Clinical Communication And Collaboration Market Summary

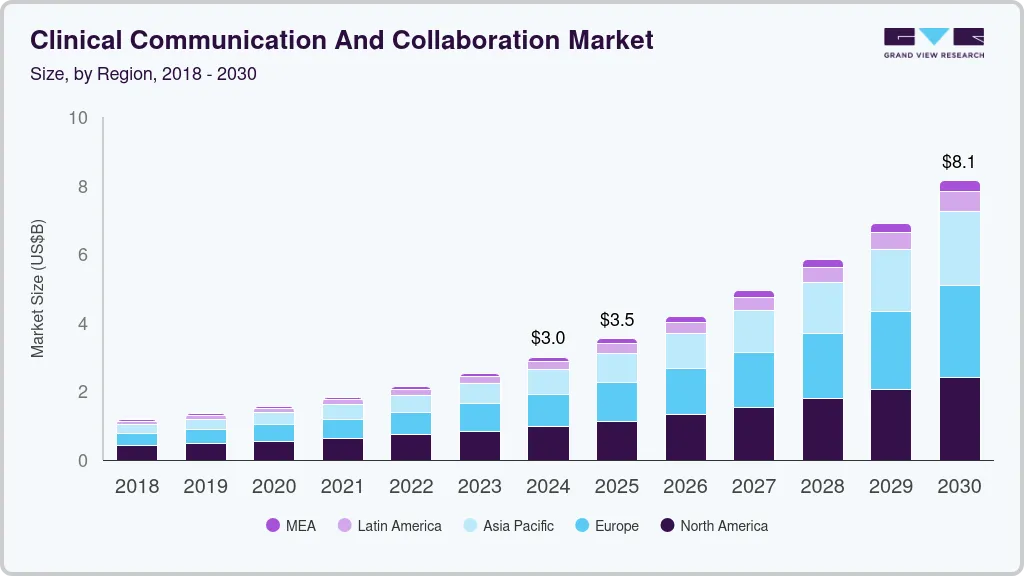

The global clinical communication and collaboration market size was estimated at USD 2.99 billion in 2024 and is projected to reach USD 8.14 billion by 2030, growing at a CAGR of 18.1% from 2025 to 2030. The increasing demand for seamless communication among healthcare professionals is a primary driver of the Clinical Communication & Collaboration (CC&C) market.

Key Market Trends & Insights

- The North America market held the largest share of over 32% in 2024.

- Asia Pacific is witnessing significant growth in the clinical communication & collaboration market.

- Based on deployment, the on-premises segment holds the highest revenue share of 51% in 2024.

- Based on component, the solution segment dominated the CC&C market, with the share in 2024.

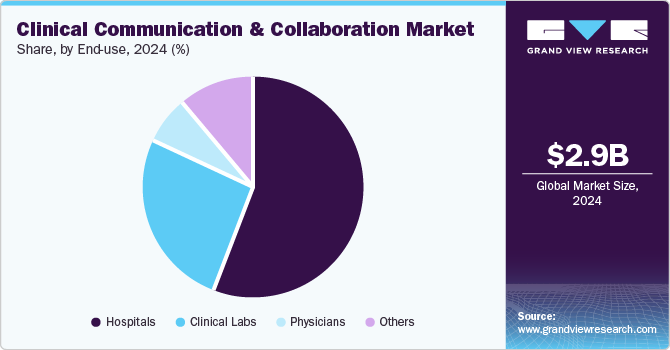

- Based on end use, the hospitals segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.99 Billion

- 2030 Projected Market Size: USD 8.14 Billion

- CAGR (2025-2030): 18.1%

- North America: Largest market in 2024

Hospitals and clinics require efficient systems to facilitate the secure exchange of patient data, support multidisciplinary teams, and ensure timely interventions. The rise in chronic diseases and the need for better patient outcomes are also driving adoption, along with an emphasis on reducing medical errors and improving workflow efficiency.

Technological innovations are playing a pivotal role in shaping the CC&C market. The integration of artificial intelligence (AI), machine learning, and cloud-based platforms is enhancing communication capabilities, enabling real-time data sharing and remote consultations. Mobile applications that allow instant messaging, voice calls, and video conferencing are becoming standard tools in healthcare environments. The use of encrypted communication channels ensures patient data security, further advancing the adoption of CC&C solutions.

Governments worldwide are recognizing the importance of robust healthcare communication systems and are supporting initiatives that promote the use of CC&C technologies. Policies aimed at improving healthcare infrastructure, along with mandates for adopting electronic health records (EHRs), are driving the adoption of these solutions. Financial incentives, grants, and regulatory frameworks that focus on patient data security and interoperability are also encouraging healthcare providers to invest in CC&C platforms.

The CC&C market presents significant growth opportunities driven by the increasing adoption of telemedicine, especially in remote areas. The expansion of 5G networks is also expected to enhance the capabilities of CC&C platforms, providing faster and more reliable communication. Additionally, the growing emphasis on value-based care and patient-centric healthcare models offers opportunities for solution providers to develop specialized tools that improve patient engagement and care coordination.

Deployment Insights

The on-premises segment holds the highest revenue share of 51% in 2024, due to the preference of healthcare institutions for robust and secure infrastructure. Many hospitals and healthcare facilities favor on-premises solutions for the control they provide over sensitive patient data, ensuring compliance with stringent regulatory frameworks like HIPAA and GDPR. On-premises solutions also offer flexibility to customize platforms according to specific clinical needs, enhancing their appeal for larger organizations that demand high levels of data protection and reliability.

The hosted segment is witnessing tremendous CAGR of over 19% CAGR from 2025 to 2030, driven by the increasing demand for scalable and cost-effective solutions. Hosted services, including cloud-based platforms, allow healthcare providers to enhance communication and collaboration without the need for significant investments in IT infrastructure. The growing adoption of telemedicine, remote consultations, and digital health initiatives has accelerated the shift toward hosted solutions, offering flexibility, ease of implementation, and accessibility from any location, further fueling the segment’s rapid expansion.

Component Insights

The solution segment dominated the CC&C market, with the share in 2024, primarily due to the need for advanced communication tools that streamline clinical workflows. Solutions like secure messaging, video conferencing, and Electronic Health Record (EHR) integration are crucial for improving care coordination and patient outcomes. With the increasing complexity of healthcare operations, these solutions enable seamless communication between doctors, nurses, and other medical staff, ensuring timely access to information and effective collaboration across different departments. This high demand for comprehensive, innovative solutions keeps this segment in a leading position.

The service segment is experiencing significant growth as healthcare providers increasingly rely on external expertise for the implementation, maintenance, and optimization of communication platforms. Services such as consulting, training, and technical support are becoming essential as organizations adopt new technologies and face the challenges of integrating these tools into existing systems. The shift towards digital transformation in healthcare, along with the need for continuous improvement in communication infrastructure, is propelling the demand for specialized services that ensure operational efficiency and smooth transitions.

End Use Insights

The hospitals segment held the highest market share in 2024, driven by their need to manage large volumes of patient data and coordinate care among diverse medical teams. The complexity of hospital operations, which involves multiple departments and specialists, necessitates robust communication platforms that enable real-time collaboration and data sharing. Hospitals are also investing in advanced solutions to improve patient care, reduce medical errors, and enhance staff productivity. With the increasing focus on integrated care, the hospital segment continues to hold a dominant position in the CC&C market.

The clinical labs segment is witnessing significant growth due to the rising need for seamless communication between labs and healthcare providers. As diagnostic testing becomes more integral to patient care, there is a growing demand for efficient collaboration tools that facilitate the timely exchange of lab results, consultations, and follow-up care. The adoption of digital health solutions that integrate lab data into clinical workflows is driving the expansion of this segment, allowing labs to play a more active role in improving diagnostic accuracy and overall healthcare delivery.

Regional Insights

The North America market held the largest share of over 32% in 2024, driven by the region's advanced healthcare infrastructure and widespread adoption of digital health solutions. The high demand for real-time communication tools in hospitals and clinics, along with strong support from healthcare providers for improving patient care, boosts the region's leadership. Furthermore, the presence of key market players, coupled with favorable government policies that encourage healthcare technology innovation, has solidified North America's significant share in the global market. The need for efficient communication to reduce medical errors and enhance care coordination further contributes to this strong market performance.

U.S. Clinical Communication And Collaboration Market Trends

The U.S. clinical communication & collaboration market held a dominant position with the share of 65% in 2024, due to the increasing need for efficient communication channels in healthcare settings. The growing emphasis on improving patient outcomes, reducing costs, and adhering to strict regulatory standards has led to greater adoption of advanced CC&C solutions. In particular, hospitals and health systems are increasingly investing in integrated communication platforms to streamline workflows, manage patient information, and ensure better coordination among healthcare teams. The shift towards value-based care and the expanding telehealth services sector in the U.S. are also major factors propelling this market’s growth.

Europe Clinical Communication And Collaboration Market Trends

The Europe market is experiencing steady growth, propelled by the increasing adoption of digital healthcare technologies across the region. European countries are focusing on enhancing patient care, reducing medical errors, and improving workflow efficiencies, which drives the demand for advanced communication tools in healthcare settings. The region's strong emphasis on patient safety, adherence to strict healthcare regulations, and increasing investment in digital health transformation are key factors fostering market growth. Furthermore, growing awareness among healthcare providers about the benefits of real-time communication systems, coupled with government initiatives aimed at modernizing healthcare supports the expansion of the CC&C market in Europe

Asia Pacific Clinical Communication And Collaboration Market Trends

Asia Pacific is witnessing significant growth in the clinical communication & collaboration market, driven by the rapid digitalization of healthcare and increasing government investments in improving healthcare infrastructure. Countries like China, India, and Japan are leading this growth, with rising demand for advanced communication solutions in their healthcare systems. The region's expanding population, rising prevalence of chronic diseases, and increased focus on telemedicine are major factors contributing to the market's expansion. Additionally, the growing number of private healthcare providers and the need for efficient communication tools in hospitals to manage large patient volumes have spurred market growth across the Asia Pacific.

Japan's clinical communication & collaboration market is witnessing gradual growth due to the country’s focus on digital healthcare transformation. The Japanese healthcare system, known for its aging population and advanced medical technologies, is increasingly adopting communication tools to improve patient care coordination and streamline hospital operations. Japan’s government initiatives to promote telemedicine and the use of digital health technologies are further enhancing the market's growth. Additionally, the country's focus on enhancing patient experience and reducing healthcare costs has led to a surge in the demand for real-time communication platforms among healthcare providers.

China clinical communication & collaboration market is expected to witness growth over the forecast period. China is emerging as a key player in the market, with rapid growth fueled by the country's ongoing healthcare reforms and investments in digital health technologies. The government’s push to modernize the healthcare system, improve patient care standards, and implement telehealth services are significant contributors to the market's expansion. Moreover, China's large population and increasing prevalence of chronic diseases necessitate efficient communication tools for healthcare providers to manage patient information and collaborate in real-time. The country’s fast-growing healthcare industry, coupled with the adoption of AI-driven communication platforms, is expected to further accelerate market growth.

Key Clinical Communication And Collaboration Company Insights

Some of the key companies in the clinical communication & collaboration market include Avaya LLC, Oracle, andCisco Systems, Inc. Organizations are focusing on increasing the customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Avaya LLC is a global leader in business communication solutions, specializing in digital communication, collaboration, and contact center technologies. Founded in 2000, Avaya provides innovative solutions that help businesses of all sizes improve their communications infrastructure and customer engagement. The company focuses on offering unified communications (UC), contact center (CC), and cloud-based collaboration tools. Avaya’s solutions empower businesses to enhance productivity, customer service, and operational efficiency.

-

Oracle Clinical Communication & Collaboration (Oracle CCC) is a powerful healthcare communication platform designed to improve clinical workflows, patient care, and collaboration among healthcare professionals. Oracle CCC integrates various communication channels, such as voice, messaging, and video, into a unified platform that allows seamless interactions between clinical staff, patients, and other healthcare entities.

Key Clinical Communication And Collaboration Companies:

The following are the leading companies in the clinical communication and collaboration market. These companies collectively hold the largest market share and dictate industry trends.

- TNS Inc. (AGNITY Inc.)

- Avaya LLC

- Oracle

- Cisco Systems, Inc.

- Halo Health Systems

- HILLROM & WELCH ALLYN (Baxter International)

- Intel Corporation

- Microsoft

- NEC Corporation

- Spok Holdings Inc.

Recent Developments

-

In August 2023, TigerConnect, a trusted leader in clinical collaboration for healthcare, announced that its Physician Scheduling solution has been recognized as a validated vendor by KLAS Research in the Physician Scheduling category.

-

In May 2022, Mobile Heartbeat today announced an integration partnership Stryker Corporation. The partnership benefits Mobile Heartbeat’s Inbound Alerting API, that receives alerts for bed exit.

-

In December 2021, Oracle Corporation has acquired Cerner Corporation, Cerner is a key provider of digital information systems used in hospitals and health systems to help healthcare professionals improve patient care.

Clinical Communication And Collaboration Market Report Scope

Report Attribute

Details

Market size in 2025

USD 3.35 billion

Revenue forecast in 2030

USD 8.14 billion

Growth rate

CAGR of 18.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2017 - 2023

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment, component, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

TNS Inc. (AGNITY Inc.); Avaya LLC; Oracle; Cisco Systems, Inc.; Halo Health Systems; HILLROM & WELCH ALLYN (Baxter International); Intel Corporation; Microsoft; NEC Corporation; Spok Holdings Inc

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clinical Communication And Collaboration Market Report Segmentation

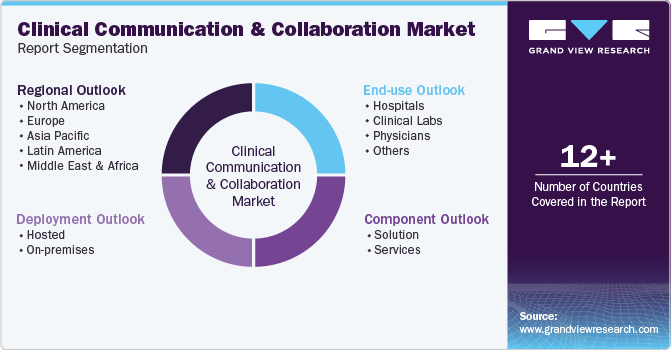

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global clinical communication & collaboration market report based on deployment, component, end use, and region.

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

Hosted

-

On-premises

-

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Solution

-

Services

-

-

End Use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Hospitals

-

Small Hospitals

-

Medium Hospitals

-

Large Hospitals

-

-

Clinical Labs

-

Physicians

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global clinical communication and collaboration market size was estimated at USD 2.99 billion in 2024 and is expected to reach USD 3.53 billion in 2025.

b. The global clinical communication and collaboration market is expected to grow at a compound annual growth rate of 18.1% from 2025 to 2030 to reach USD 8.14 billion by 2030.

b. The solution segment dominates the clinical communication and collaboration market, with the share of 61.3%, in 2024, primarily due to the need for advanced communication tools that streamline clinical workflows. Solutions like secure messaging, video conferencing, and EHR (Electronic Health Record) integration are crucial for improving care coordination and patient outcomes. With the increasing complexity of healthcare operations, these solutions enable seamless communication between doctors, nurses, and other medical staff, ensuring timely access to information and effective collaboration across different departments. This high demand for comprehensive, innovative solutions keeps this segment in a leading position.

b. Some of the key players operating in the clinical communication and collaboration market include TNS Inc. (AGNITY Inc.), Avaya LLC, Oracle, Cisco Systems, Inc., Halo Health Systems, HILLROM & WELCH ALLYN (Baxter International), Intel Corporation, and Microsoft.

b. The increasing demand for seamless communication among healthcare professionals is a primary driver of the Clinical Communication & Collaboration (CC&C) market. Hospitals and clinics require efficient systems to facilitate the secure exchange of patient data, support multidisciplinary teams, and ensure timely interventions. The rise in chronic diseases and the need for better patient outcomes are also driving adoption, along with an emphasis on reducing medical errors and improving workflow efficiency

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.