- Home

- »

- Healthcare IT

- »

-

Clinical Trials Management System Market Size Report, 2033GVR Report cover

![Clinical Trials Management System Market Size, Share & Trends Report]()

Clinical Trials Management System Market (2026 - 2033) Size, Share & Trends Analysis Report By Solution Type, By Delivery Mode (Web & Cloud-based, On-premise), By Component (Software, Services), By End-user, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-150-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Clinical Trials Management System (CTMS Market Summary

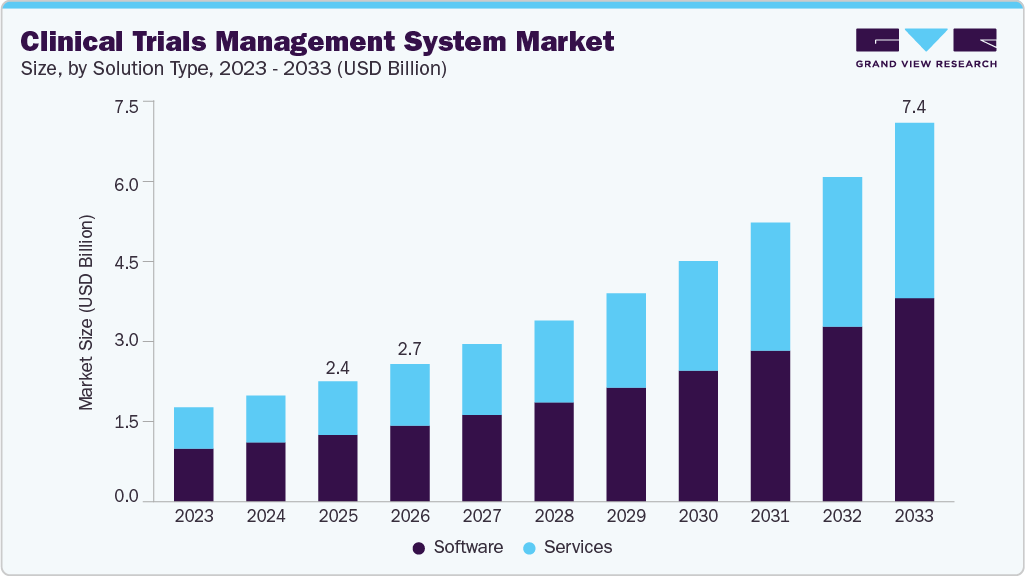

The global clinical trials management system (CTMS) market size was estimated at USD 2.35 billion in 2025 and is projected to reach USD 7.40 billion, growing at a CAGR of 15.59% from 2026 to 2033. This growth is primarily driven by the accelerated adoption of digital solutions across clinical trials, increasing trial complexity, and the growing preference for decentralized and hybrid trial models.

Key Market Trends & Insights

- North America dominated the market with the largest revenue share of 50.41% in 2025.

- U.S. dominated the market in North America with the largest share in 2025.

- Based on solution type, the enterprise segment led the market with the largest revenue share of 75.24% in 2025.

- Based on component, the software segment led the market with the largest revenue share of 55.57% in 2025.

- Based on delivery mode, the web & cloud-based segment led the market with the largest revenue share in 2025.

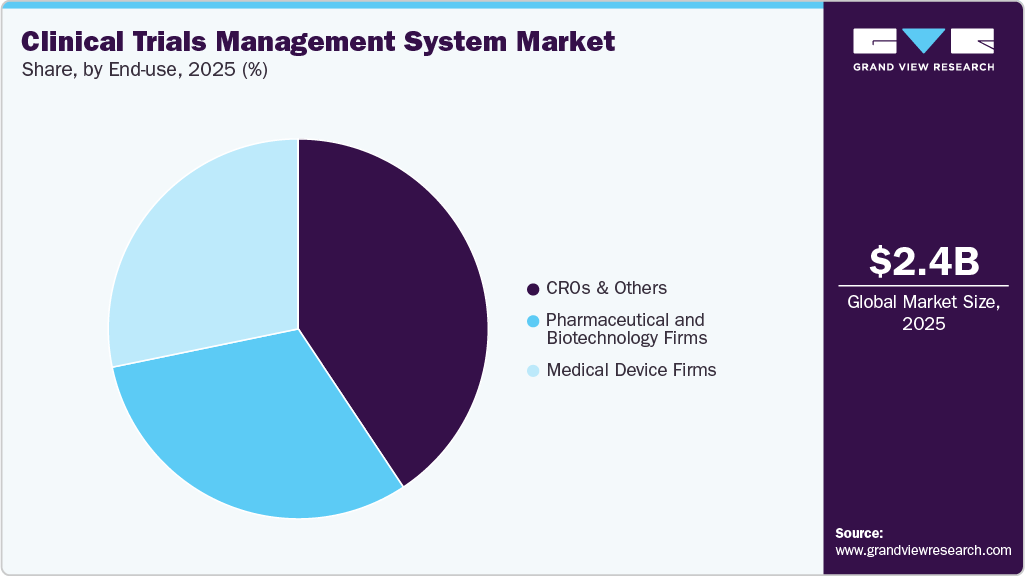

- Based on end use, the CRO and other segments held the market with the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 2.35 Billion

- 2033 Projected Market Size: USD 7.40 Billion

- CAGR (2026-2033): 15.59%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

In addition, strategic initiatives by key industry players such as technology upgrades, partnerships, and platform integrations combined with a steady rise in the number of clinical studies globally, are expected to further fuel market expansion. The growing volume of clinical trials is driving the growth of the clinical trial management system market, as sponsors and CROs require robust platforms to manage increasing study complexity, multi-site coordination, and regulatory documentation. For instance, according to Invest India, around 18,000 new clinical trials were registered in India in 2024, marking a 50% increase compared to 2023, highlighting the surge in trial activity.

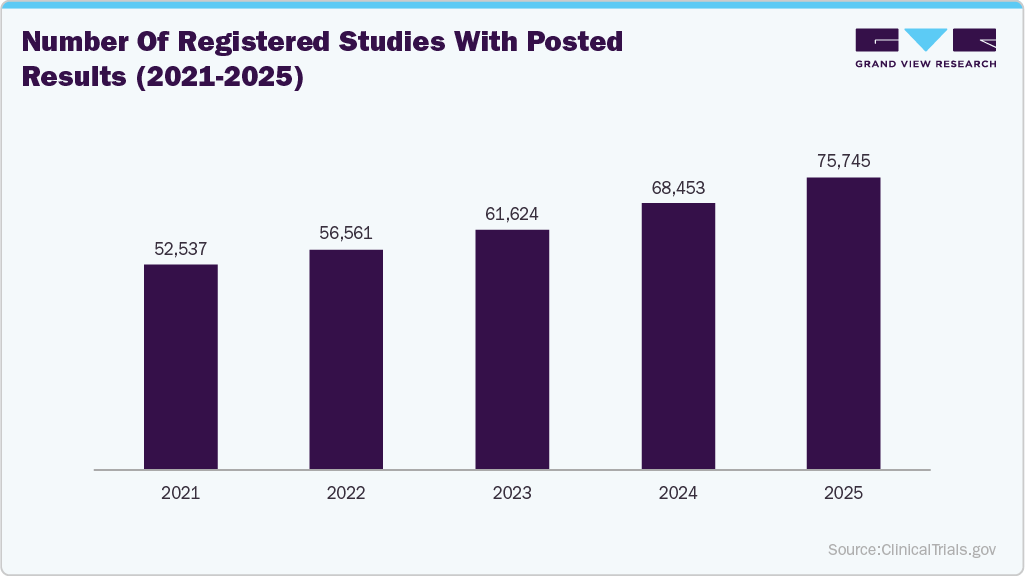

Similarly, the number of registered studies with posted results in ClinicalTrials.gov from 2021 to 2025 has shown a steady year-on-year increase, reflecting growing regulatory emphasis on transparency and timely disclosure of clinical trial outcomes. This highlights stronger compliance with global reporting requirements and increased accountability among sponsors, while also reinforcing the need for digital systems that can efficiently track study milestones, results submission, and regulatory timelines.

In addition, increasing R&D investments by life science and medical device companies, coupled with the growing prevalence of acute & chronic disorders, are driving the surge in clinical trials. This trend is expected to boost the demand for solutions such as CTMS, facilitating efficient management of diverse clinical trials and ultimately improving patient outcomes.

Below are some of the notable funding and investment strategies:

-

In January 2026, Infinitopes, a clinical-stage biotechnology company focused on cancer vaccines, announced the successful second close of its seed funding round, raising an additional USD 15.4 million and bringing total seed financing to USD 35.1 million.

“I'm honoured to welcome leading US West Coast biofund Amplify Bio and ecosystem champions for better patient care, Macmillan, onto our cap table. This new funding unlocks our potentially groundbreaking Phase I/IIa trial, enabling proof-of-concept evaluation of Infinitopes' AI/ML-precision targeted, off-the-shelf vaccine platform to prevent recurrence after surgical resection. We aim to lead the development of innovative medicines that bring hope to patients suffering from cancers with unmet medical needs. We anticipate sharing our early findings at major conferences later this year."

- Jonathan Kwok, Chief Executive Officer of Infinitopes

-

In August 2024, The UK government announced a joint public-private investment programme worth up to USD 537 million (£400 million) to strengthen the country’s clinical research ecosystem. As part of the initiative, 18 new clinical trial hubs will be established nationwide to accelerate research timelines. The programme aims to provide NHS patients with earlier access to innovative treatments while positioning the UK as a global hub for cutting-edge health and clinical research.

-

In June 2022, GSK plc announced a USD 1.34 billion (£1 billion) investment over the next decade to accelerate research and development focused on infectious diseases that disproportionately affect lower-income countries. The investment will support the development of next-generation vaccines and medicines targeting malaria, tuberculosis, HIV, neglected tropical diseases, and antimicrobial resistance (AMR). These conditions continue to place a significant burden on vulnerable populations, accounting for over 60% of the disease burden in many lower-income regions.

AI-Driven CTMS

AI-Powered CTMS integrates artificial intelligence and machine learning to provide real-time insights, predictive analytics, and intelligent resource optimization. These platforms leverage machine learning and natural language processing to automate data validation, identify anomalies, and predict patient dropout or protocol deviations.

AI-enhanced systems streamline data cleaning, enable real-time monitoring and reporting, and provide actionable insights that facilitate proactive trial management, reducing trial duration and costs. Integrated AI capabilities improve patient engagement through adaptive user interfaces and personalized alerts, increasing data completeness and quality. In addition, several market players are also forming strategic partnerships to accelerate the deployment of AI-driven CTMS solutions; for instance, in March 2025, Jeeva Clinical Trials launched a CRO Partnership Program featuring a unified, AI-driven CTMS to accelerate clinical trials in obesity, dermatology, oncology, and rare diseases.

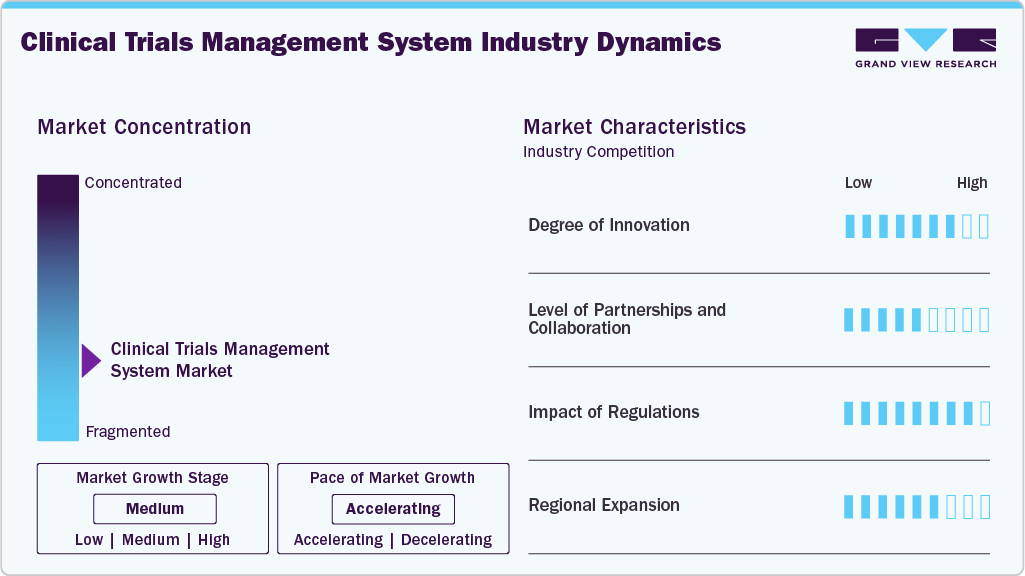

Market Concentration & Characteristics

Market players are investing in technological advancements, such as software upgrades, software and service integration, adoption of AI, and advanced analytics, to enhance their market presence and revenue. For instance, in March 2025, Suvoda launched Sofia, an AI assistant on its platform designed to simplify clinical trial management by enabling drug supply managers to quickly access, analyze, and visualize trial supply data through natural language queries, improving operational efficiency while maintaining regulatory compliance and data privacy. Sofia also supports global operations with multilingual capabilities, creates data visualizations, and provides reliable, expert-backed responses to users.

“When creating Sofia, we asked ourselves: What if clinical trial staff had an AI assistant that could alleviate their administrative burdens. Sofia became our answer. It's an exciting opportunity to streamline the management of clinical trials.”

- E.K. Koh, Chief Product Officer at Suvoda.

Many market players are acquiring smaller companies to bolster their position in the CTMS industry. This approach enables businesses to broaden their capabilities, diversify their product portfolios, and strengthen their expertise. For instance, in August 2023, Sitero acquired Clario’s software solutions business, including its eClinical product suite (CTMS, eConsent, EDC, RTSM/IRT, Patient and Site Payments). The suite is being rebranded and integrated into Sitero's Mentor platform, which will continue supporting existing Clario customers and expand clinical solutions

CTMS industry players must adhere to various regulations to ensure the safety and security of clinical trials. Key guidelines include FDA 21 Code of Federal Regulations (CFR) Part 11, General Data Protection Regulation (GDPR), HIPAA, EU GMP Annex 11, and GCP compliance. Compliance with these regulations expedites the approval process for any software or system used in clinical trials.

CTMS companies employ geographic expansion strategies to sustain their presence in emerging markets and reach untapped regions, attracting customers from these areas. This strategy typically involves establishing new facilities or engaging in mergers and acquisitions in new locations.

Case Study: Accelerating CTMS Implementation with Clario (Bioclinica CTMS)

Background:

FHI 360, a CRO, needed a rapid CTMS deployment for multiple studies. Traditional systems required 5-6 months of configuration and training, causing delays, high costs, and heavy resource use, creating a need for a faster, lower-risk solution.

Solution:

FHI 360 implemented Clario’s Bioclinica CTMS, a cloud-based platform built on pre-configured, industry best-practice templates, significantly reducing deployment complexity and time.

Implementation Approach

-

Standardized CTMS templates covering ~90% of operational requirements

-

Limited customization focused on study-specific needs (~10%)

-

Phased rollout with validation checkpoints

-

Targeted user training to support rapid adoption

CTMS Implementation Comparison:

Parameter

Traditional CTMS

Clario (Bioclinica CTMS)

Implementation timeline

5-6 months

2-3 weeks (standard); ~8 weeks including validation

Configuration model

Heavy, study-specific customization

Pre-configured, best-practice templates

Customization effort

High

Limited

IT & internal resource dependency

Extensive

Minimal

Cost structure

High upfront investment

Subscription-based, scalable

Time to value

Delayed

Rapid study readiness

User adoption

Slower due to prolonged rollout

Faster with phased deployment

Scalability for future studies

Requires reconfiguration

Easily reusable

Results and Impact:

-

Significant reduction in implementation time, enabling faster study readiness

-

Lower operational and financial risk compared to traditional CTMS models

-

Improved system adoption through quicker access and focused training

-

Reusable CTMS framework for future studies

Solution Type Insights

The enterprise segment dominated the market by solution type, with the largest market share of 75.24% in 2025. The growth is attributed to key benefits, including providing comprehensive insights into deviations and accruals, robust reporting capabilities, scalable solutions, streamlined regulatory process management, and enhanced billing compliance. Enterprise software solutions are designed to integrate multiple facets or application packages, allowing organizations to handle various challenging tasks using a single software platform. For instance, Real Time's Enterprise CTMS offers comprehensive solutions for centralized recruitment, resource management, accounting, regulatory compliance, and aggregate reporting across universities and other large site networks.

The site segment is expected to experience significant growth during the forecast period due to the associated benefits of onsite CTMS solutions. Site clinical trial management software solutions manage onsite contracts and payments, study subject rosters, calendar tracking, and document maintenance for small or medium-sized businesses. Some pharmaceutical companies prefer onsite software solutions to maintain complete control and access over the trial process. The use of local servers and VPN connections with onsite solutions further enhances data security, thereby contributing to the segment's growth.

Component Insights

The software segment dominated the market with the largest share of 55.57% in 2025. CTMS software is a user-friendly tool designed to streamline clinical trial management by overseeing regulatory procedures, trial planning, site and country progress, activity monitoring, finance, and supplies. It is commonly deployed at both site and enterprise levels, often through subscription-based models. In addition, CTMS software helps optimize and simplify clinical document management processes, ensuring data security and quality. Consequently, leading players in the industry are introducing products leveraging CTMS software to address various needs within healthcare organizations. For instance, in October 2023, Signant Health launched Signant Biotech, a clinical research methodology that utilizes software and services to meet the evolving requirements of small and medium-sized biopharmaceutical companies.

The services segment is anticipated to exhibit the fastest growth during the forecast period. This growth is driven by increasing demand for training and assistance in software installation and system upgrades to keep pace with advancing IT technology. CTMS service providers offer cost-effective solutions to establish or enhance the technological infrastructure for efficient trial management. For example, PHARMASEAL's Engility, operating on a software-as-a-service model, offers an affordable enterprise CTMS suitable for organizations conducting multiple concurrent trials, ranging from small-scale to large-scale operations.

Delivery Mode Insights

Web & cloud-based segment dominated the market in 2025. With widespread adoption among end-users, this segment is projected to maintain its dominance and exhibit rapid growth throughout the forecast period. These solutions facilitate clinical trial data management through third-party providers, offering scalable hosting options. In addition, cloud-based technologies offer the advantage of seamless data accessibility from various devices, including laptops, mobiles, workstations, and tablets, via CTMS software. Moreover, the introduction of cloud-based CTMS solutions by companies further fuels the growth of this segment.

On-premise segment is poised for significant growth in the forecast period. On-premise delivery involves installing solutions on computers or hardware within the organization. Despite requiring installation within the organization's premises, these solutions offer remote access, leading to reduced costs associated with power consumption and system maintenance. Furthermore, established companies often find it challenging to transition all their healthcare IT applications to the cloud. Consequently, some organizations opt for a hybrid approach, combining both on-premise and cloud-based services to create a flexible working environment.

End-use Insights

CRO and other segments held a significant market share in 2025 and are anticipated to experience the fastest CAGR throughout the forecast period. This growth is attributed to the rising number of partnerships, the outsourcing of clinical trials to contract research organizations, and the increasing prevalence of decentralized trials. For example, in September 2023, MedRhythms collaborated with Curavit Clinical Research, a CRO, for its decentralized clinical trial focusing on chronic stroke.

Medical device firms’ segment is poised for substantial growth over the forecast period. This growth is from the increased significance of enterprise CTMS within leading medical diagnostic and device organizations, aiming to streamline workflows, proactively address performance issues, and efficiently deploy critical resources. In addition, various governments have initiated efforts to promote the safe and effective conduct of clinical trials for medical devices. For instance, in May 2023, the U.S. FDA issued draft guidance for investigators, sponsors, and other stakeholders regarding the implementation of decentralized clinical trials (DCTs) for medical devices, drugs, and biological products. Consequently, the increasing number of clinical trials for medical devices is expected to drive the adoption of CTMS by medical device firms.

Regional Insights

North America clinical trials management system market dominated the global industry, capturing a significant share of 50.41% in 2025. This dominance is driven by the presence of technologically advanced research institutions, universities, medical device manufacturers, and pharmaceutical companies, all of which actively utilize CTMS. Moreover, the region benefits from improved healthcare facilities. In addition, favorable government policies aimed at promoting clinical trials are anticipated to further boost the regional market. For instance, in January 2023, the Canadian government launched training platforms, a clinical trial consortium, and research projects aimed at enhancing the health outcomes of its citizens. Furthermore, approximately 22 projects received approximately USD 60.0 million in funding to support clinical trial designs, phases, and objectives aligned with the priorities of the Bio manufacturing and Life Sciences Strategy (BLSS).

U.S Clinical Trials Management System Market Trends

U.S. dominated the CTMS market in North America, with the largest share in 2025. Technological advancements in CTMS solutions have notably enhanced their accessibility and user-friendliness. In addition, numerous companies are strategically entering the national market to bolster their market standing. For instance, in February 2024, Ergomed Group, a UK-based CTMS provider, extended its footprint in the U.S. by inaugurating a new office in Cambridge, Massachusetts.

Europe Clinical Trials Management System Market Trends

CTMS market in Europe is projected to experience substantial growth at a significant CAGR throughout the forecast period. This growth is driven by the benefits associated with CTMS, including improved transparency, enhanced data quality and accuracy, and shortened timelines for clinical studies. Furthermore, organizations across Europe are implementing various initiatives to encourage clinical trials, thereby fostering increased adoption of CTMS. For example, in May 2023, the European Clinical Research Infrastructure Network (ECRIN) commemorated International Clinical Trial Day, with a particular emphasis on the challenges and opportunities presented by Decentralized Clinical Trials

CTMS market in Germany is poised for significant growth during the forecast period. According to data from Verdict Media Limited, Germany contributed to 5% of global medical devices clinical trial activities in 2022. Moreover, the German Clinical Trials Register (DRKS) serves as the primary repository for conducted trial studies in the country, hosting over 15,000 trial studies, with an addition of 2,000 studies annually.

CTMS market in the UK is also expected to witness substantial growth in the forecast period. This growth is driven by initiatives spearheaded by the UK government to encourage clinical trials. For example, in May 2023, the government allocated USD 132.21 million in funding to accelerate clinical trials. This funding facilitated access to advanced technologies utilized in clinical trials, including CTMS solutions.

Asia Pacific Clinical Trials Management System Market Trends

CTMS market in the Asia Pacific region is poised to experience the fastest CAGR during the forecast period. This growth is driven by factors such as a substantial patient pool, increasing outsourcing trends, and significant investments by multinational corporations (MNCs) and contract research organizations (CROs) in clinical research and drug discovery. Key markets for clinical research outsourcing among major pharmaceutical and biotech companies include India and China, which are expected to drive the demand for CTMS solutions significantly.

CTMS market in China is projected to witness significant growth in the forecast period. The country's high healthcare expenditure presents ample investment opportunities for clinical research expansion. Many companies in China are forming strategic partnerships to access CTMS solutions. For example, in December 2023, Oncoshot collaborated with Zhejiang Ablaze Medicine, a China-based provider of clinical trial management solutions, to develop an AI-driven drug development program.

Japan dominated the Asia Pacific CTMS market in 2025. This growth is primarily attributed to the high volume of clinical trials conducted in the country. According to data from Verdict Media Limited, Japan accounted for 4.7% of global clinical trial activity in 2022, with 54.0% being industry-sponsored trials and 46.0% non-industry-sponsored.

Latin America Clinical Trials Management System Market Trends

Growth of the clinical trials management system market in Latin America is driven by the region’s increasing role as a global clinical research hub, particularly in Brazil, and Argentina. These countries are experiencing substantial pharmaceutical research and development growth, fueled by government incentives and expanding healthcare infrastructure

Middle East & Africa Clinical Trials Management System Market Trends

Growth of the clinical trials management system market in Middle East and Africa is attributed to region’s growing prominence as a destination for clinical trials due to its diverse patient populations and expanding healthcare infrastructure. Countries such as Saudi Arabia, the UAE, South Africa, and Egypt are witnessing increased clinical research activity, particularly in therapeutic areas such as oncology, cardiovascular diseases, and infectious diseases.

Key Clinical Trials Management System Company Insights

The CTMS market remains moderately fragmented, characterized by the presence of both large established vendors and a wide base of small and mid-sized players. Competition is increasingly driven by technology-led differentiation, with companies actively integrating advanced capabilities such as AI and ML to enhance trial planning, site management, and data-driven decision-making. In parallel, strategic partnerships and collaborations with CROs, technology providers, and life sciences sponsors are being leveraged to expand platform functionality and accelerate market penetration.

Key Clinical Trials Management System Companies:

The following key companies have been profiled for this study on the clinical trials management system market.

- IQVIA, Inc.

- Medidata (Dassault Systèmes)

- Oracle

- Datatrak International, Inc. (Rebranded as Fountayn in 2022)

- SimpleTrials

- Ennov (Parexel’s Informatics division separated to form Calyx in January 2021, and its Enterprise Technology division was acquired by Ennov in February 2024.)

- RealTime Software Solutions, LLC

- Veeva Systems

- Wipro Limited

- PHARMASEAL International Ltd.

- Advarra Inc.

- Clario (ERT and Bioclinica)

- Merative

- Clinion

- Anju Software

- ICON, plc

- Suvoda LLC (In April 2025 merged with Greenphire)

Recent Developments

-

In July 2025, PHARMASEAL announced a technical integration partnership with Viedoc, combining PHARMASEAL's Engility advanced Clinical Trial Management System (CTMS) platform with Viedoc's Electronic Data Capture (EDC) technology. This partnership delivers a unified, cloud-based solution to simplify trial oversight, accelerate study timelines, improve data quality, and ensure regulatory compliance and operational efficiency for life science companies managing clinical trials globally.

“Our partnership with Viedoc brings together data management and clinical operational technologies that offer customers a choice of selecting the best-of-breed solutions for their clinical trials. By integrating these complementary technologies, both process and data interoperability is increased, which improves the overall execution of clinical trials.”

- Daljit Cheema, CEO of PHARMASEAL.

-

In March 2025, Jeeva Clinical Trials launched its CRO Partnership Program to accelerate next-generation clinical trials through a unified, AI-driven Clinical Trial Management System (CTMS). This program targets niche CROs in obesity, dermatology, oncology, and rare diseases, offering a real-time collaborative platform that streamlines workflows, enhances patient retention, compliance, and reduces study costs with automated processes and scalable global trial capabilities.

“Rare disease trials are already complex enough without the added burden of fragmented trial management. Jeeva’s AI-powered CTMS offers a way to streamline operations and ensure regulatory compliance.”

- Robert Freishtat, MD, President of Uncommon Cures

-

In January 2024, BSI Life Sciences announced its latest client, Ocular Therapeutix, for its cloud-based Clinical Trial Management System.

-

In July 2023, RealTime Software Solutions acquired Devana Solutions, a SaaS provider specializing in clinical trial workflow and analytics, to create a comprehensive end-to-end site platform by integrating Devana’s business development and data analytics capabilities with RealTime’s suite of clinical trial software products, enhancing connectivity between centralized operations and site-based clinical teams.

“Devana’s platform perfectly complements our already robust suite of clinical trial software solutions, Devana has been a trusted partner since 2018, offering CTMS-integrated study startup and pipeline administration capabilities that streamline data collection by eliminating the need to input critical study information into separate systems.”

- Stephen Johnson, CEO of RealTime. “

-

In April 2022, Bristol Myers Squibb globally implemented Veeva Systems CTMS to drive end-to-end trial management. The implementation enabled Bristol Myers Squibb to establish agile, unified, and simple trial processes to make clinical trials swift and more efficient.

Clinical Trials Management Systems Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 2.69 billion

Revenue forecast in 2033

USD 7.40 billion

Growth rate

CAGR of 15.59% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution type, component, delivery mode, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

IQVIA, Inc.; Medidata (Dassault Systèmes); Oracle; Datatrak International, Inc. (Rebranded as Fountayn in 2022); SimpleTrials; Ennov (Parexel’s Informatics division separated to form Calyx in January 2021, and its Enterprise Technology division was acquired by Ennov in February 2024); RealTime Software Solutions, LLC; Veeva Systems; Wipro Limited; PHARMASEAL International Ltd.; Advarra Inc.; Clario (ERT and Bioclinica); Merative; Clinion; Anju Software; ICON, plc; Suvoda LLC (in April 2025 merged with Greenphire)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clinical Trials Management System Market Report Segmentation

This report forecasts revenue growth and provides at global, regional, and country levels an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global clinical trials management systems market report based on solution type, component, delivery mode, end-use, and region:

-

Solution Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Enterprise

-

Site

-

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Services

-

-

Delivery Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

Web & Cloud Based

-

On Premise

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical and Biotechnology Firms

-

Medical Device Firms

-

CROs & Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global clinical trials management system market size was estimated at USD 2.35 billion in 2025 and is expected to reach USD 2.69 billion in 2026.

b. The global clinical trials management system market is expected to grow at a compound annual growth rate of 15.59% from 2026 to 2033 to reach USD 7.40 billion by 2033.

b. North America held approximately 50.41% of the clinical trials management system market in 2025. This dominance is driven by the presence of technologically advanced research institutions, universities, medical device manufacturers, and pharmaceutical companies, all of which actively utilize CTMS.

b. Key factors that are driving the CTMS market growth include accelerated adoption of digital solutions across clinical trials, increasing trial complexity, and the growing preference for decentralized and hybrid trial models. In addition, strategic initiatives by key industry players such as technology upgrades, partnerships, and platform integrations combined with a steady rise in the number of clinical studies globally, are expected to further fuel market expansion.

b. Some key players operating in the CTMS market include IQVIA, Inc., Medidata (Dassault Systèmes), Oracle, Datatrak International, Inc. (Rebranded as Fountayn in 2022), SimpleTrials, Ennov (Parexel’s Informatics division separated to form Calyx in January 2021, and its Enterprise Technology division was acquired by Ennov in February 2024), RealTime Software Solutions, LLC, Veeva Systems, Wipro Limited, PHARMASEAL International Ltd., Advarra Inc., Clario (ERT and Bioclinica), Merative, Clinion, Anju Software, ICON, plc, Suvoda LLC (in April 2025 merged with Greenphire)

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.