- Home

- »

- Medical Devices

- »

-

Clinical Trial Patient Recruitment Services Market Report 2033GVR Report cover

![Clinical Trial Patient Recruitment Services Market Size, Share & Trends Report]()

Clinical Trial Patient Recruitment Services Market (2025 - 2033) Size, Share & Trends Analysis Report By Service (Patient Recruitment & Registry Services, Patient Retention Services), By Phase, By Therapeutic Area, By Age Group, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-922-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Clinical Trial Patient Recruitment Services Market Summary

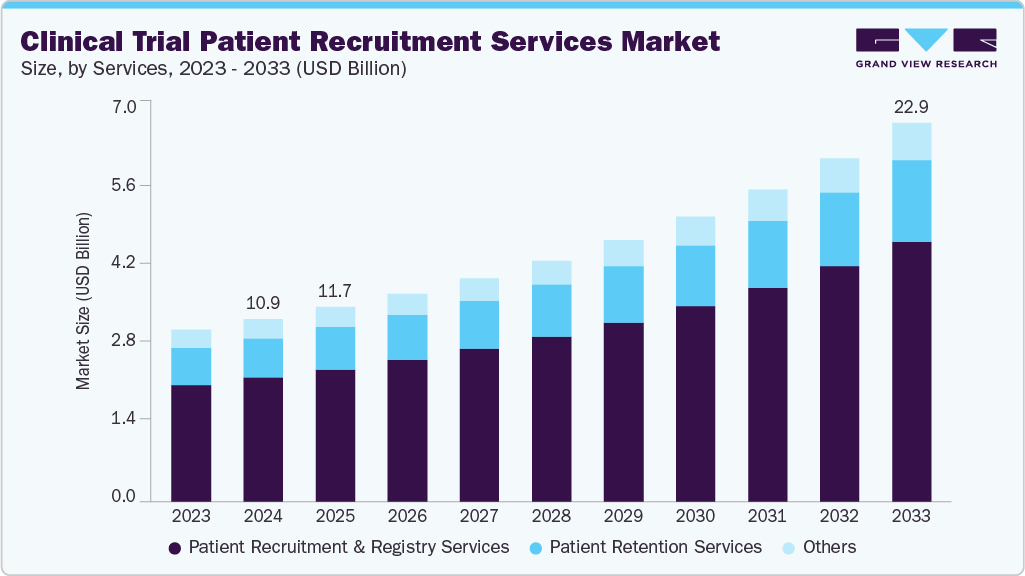

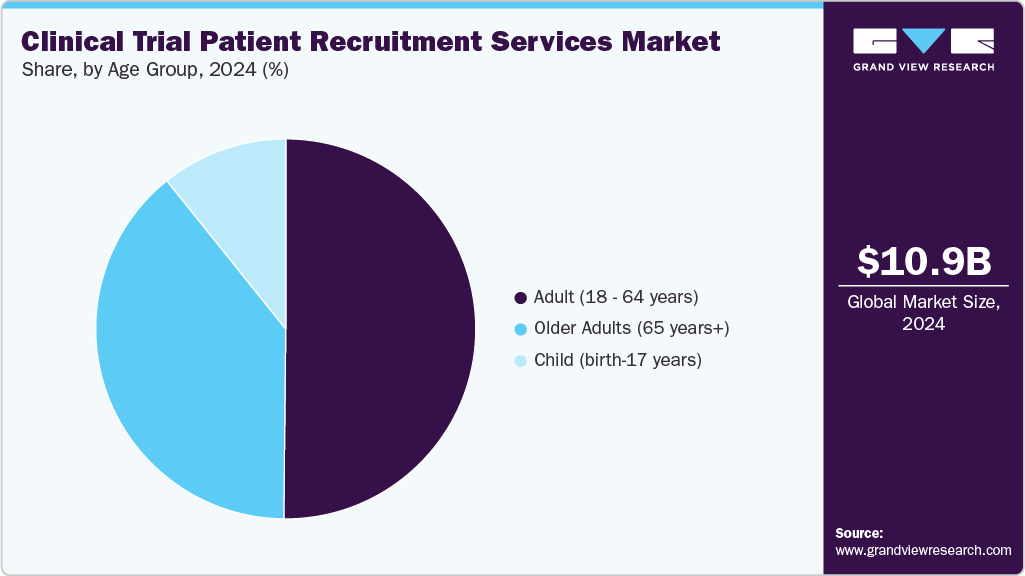

The global clinical trial patient recruitment services market size was valued at USD 10.99 billion in 2024 and is projected to reach USD 22.85 billion by 2033, growing at a CAGR of 8.72% from 2025 to 2033. The market growth is driven by an increasing number of clinical trials for rare & chronic diseases, and increasing use of recruitment technologies, which enhance the processes of patient identification & engagement.

Key Market Trends & Insights

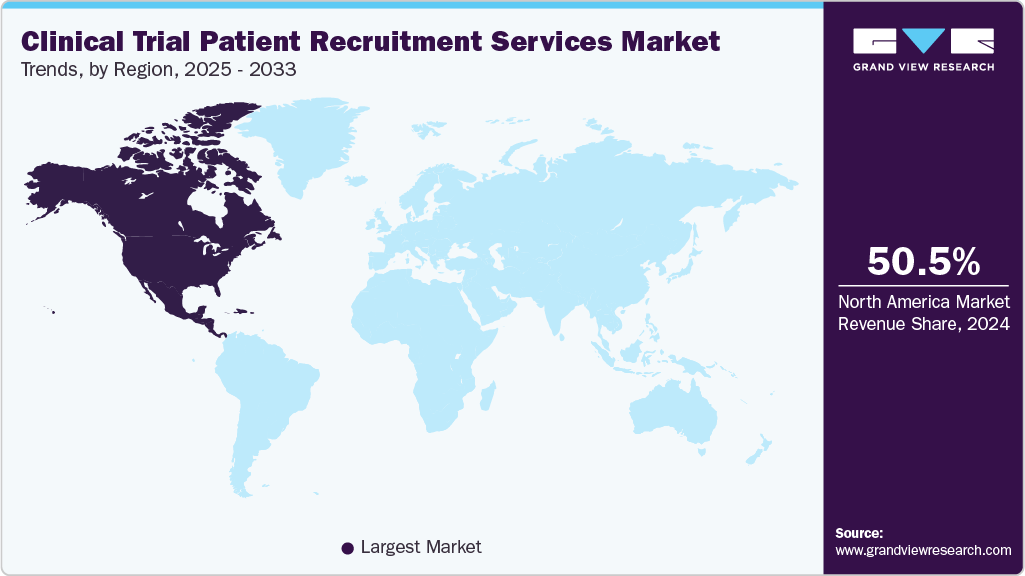

- North America clinical trial patient recruitment services market held the largest share of 50.50% of the global market in 2024.

- The clinical trial patient recruitment services in U.S. is expected to grow significantly over the forecast period.

- Based on service, the patient recruitment & registry services segment held the largest market share of 68.01% in 2024.

- Based on phase, phase III segment held the highest market share in 2024.

- Based on therapeutic area, oncology dominated with largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 10.99 Billion

- 2033 Projected Market Size: USD 22.85 Billion

- CAGR (2025-2033): 8.72%

- North America: Largest market in 2024

Some other factors contributing to market growth are the growing complexity of clinical trial protocols and the increasing funding for clinical research activities, which is encouraging for high R&D spending and outsourcing trends. In addition, emphasis on patient diversity, decentralized trials, and using AI-based analytics to improve enrollment efficiency further drives the market growth.Many pharmaceutical companies outsource various tasks, from basic research to late-stage manufacturing. The contract research organizations (CROs) play a crucial role in patient recruitment as intermediaries between sponsors & study participants. Most CROs utilize their resources, expertise, and networks to identify and enroll candidates for clinical trials. These CROs collaborate with sponsors to understand the study requirements & to develop effective recruitment strategies. In addition, most clinical trial patient recruitment service providers implement strong data security measures and comply with strict privacy regulations to protect the participants' information. Also, outsourcing clinical trial patient recruitment offers numerous benefits for pharmaceutical companies by utilizing the expertise of specialized recruitment services. This supports companies to save time, money, & resources while ensuring the timely recruitment of participants, further boosting efficiency and improving participant diversity.

According to a May 2024 report, Merck & Co. recorded an R&D expenditure of USD 30.5 billion in 2023, demonstrating its strong commitment to advancing innovation and drug development. This surge in R&D activities has resulted in a growing number of clinical trials worldwide, intensifying the need for efficient patient recruitment solutions.

Moreover, regulatory bodies like the FDA, EMA, and MHRA are implementing reforms emphasizing patient diversity, transparency, and faster trial approvals. For instance, in September 2025, the European Commission, Heads of Medicines Agencies (HMA), and EMA introduced new clinical trial targets under the Accelerating Clinical Trials (ACT) EU initiative to accelerate approvals, enhance multinational participation, and promote patient diversity. These reforms encourage inclusion of underrepresented populations and multinational participation, necessitating broader patient outreach capabilities. Recruitment service providers leverage global networks and digital tools to identify diverse patient groups that meet new regulatory expectations. As a result, these evolving frameworks enhance the importance of specialized recruitment services capable of meeting compliance, diversity, and enrollment speed requirements, further propelling market demand.

In addition, digital technology such as artificial intelligence (AI), electronic health records (EHR), and predictive analytics has made it possible to develop a strong patient recruiting strategy. In contrast, drug manufacturers have historically utilized TV commercials, radio, and print media for patient recruitment. These tools enable real-time patient identification, enhance pre-screening accuracy, and reduce manual workloads. AI-driven recruitment platforms can automatically match patients to trials based on clinical history and eligibility criteria, minimizing human error and improving speed. For instance, in June 2024, TrialX launched an AI-powered Clinical Trial Finder that utilizes NLP and machine learning to match patient data with eligibility criteria, providing personalized trial options by relevance and location, enhancing accessibility and accelerating recruitment efficiency. Digital engagement channels like telehealth and wearable monitoring enhance patient participation and retention. Thus, pharmaceutical and biotech companies increasingly adopt these technologies to reduce costs and shorten trial timelines.

Opportunity Analysis

The clinical trial patient recruitment services market offers significant opportunities driven by rising demand for efficient patient enrollment, which has led sponsors to collaborate with specialized recruitment providers that can reduce timelines & improve patient engagement. Besides, implementing digital recruitment platforms & AI-driven matching tools is evolving the traditional practices by enhancing targeting accuracy, optimizing outreach efforts, and minimizing screening failures. In addition, emphasis on diversity and trial populations is expected to drive recruitment companies to adopt personalized communication strategies, offer multilingual support, and utilize decentralized trial models to encourage broader participation. Moreover, the surging prevalence of chronic and rare diseases further expands market potential, creating opportunities for recruitment specialists skilled in managing complex eligibility criteria. Companies that focus on advanced data analytics, forge digital health partnerships, and prioritize diversity in recruitment strategies are strategically positioned to gain market share and provide measurable value to global biopharmaceutical sponsors. Such factors are expected to drive the market.

Impact of U.S. Tariffs on Clinical Trial Patient Recruitment Services Market

U.S. tariffs can significantly impact the clinical trial patient recruitment services market by increasing the cost of imported technologies, software, and medical devices essential for trial operations. Higher expenses may be passed on to sponsors, potentially reducing budgets for recruitment and retention initiatives. Tariffs can also disrupt global partnerships, limiting access to international patient databases, digital platforms, and analytics tools. Smaller CROs and service providers may face operational challenges, affecting efficiency and scalability. Thus, sponsors might experience delays, higher costs, and reduced flexibility in trial execution, ultimately influencing market growth and adoption of advanced recruitment solutions.

Technological Advancements

Technological advancements are transforming the clinical trial patient recruitment services market, driven by AI-powered patient matching, mobile health (mHealth) applications, digital recruitment platforms, telemedicine, virtual trials, and real-world data analytics. Regulatory requirements revolutionize clinical trial patient recruitment services by improving efficiency, reach, and precision. In the market, AI-driven patient matching leverages algorithms to analyze electronic health records & identify eligible participants, which reduces enrollment times. Furthermore, mobile health applications facilitate real-time communication and monitoring, enhancing patient engagement and retention throughout the trial process. Besides, the digital recruitment platforms exploit social media and online databases to target a broader range of populations, thus expanding access to clinical trials. In addition, telemedicine & virtual trials enable remote participation, effectively minimizing geographic barriers and enhancing patient convenience. Moreover, real-world data analytics is crucial for integrating insights from healthcare databases, wearables, and patient registries to uncover patterns that optimize recruitment strategies. Thus, these innovations create a data-driven, patient-centric recruitment ecosystem that increases enrollment speed and diversity and improves trial outcomes while lowering costs. This ongoing digital transformation is reshaping sponsors' and CROs' strategies for patient recruitment, making clinical trials more inclusive, flexible, and scalable globally.

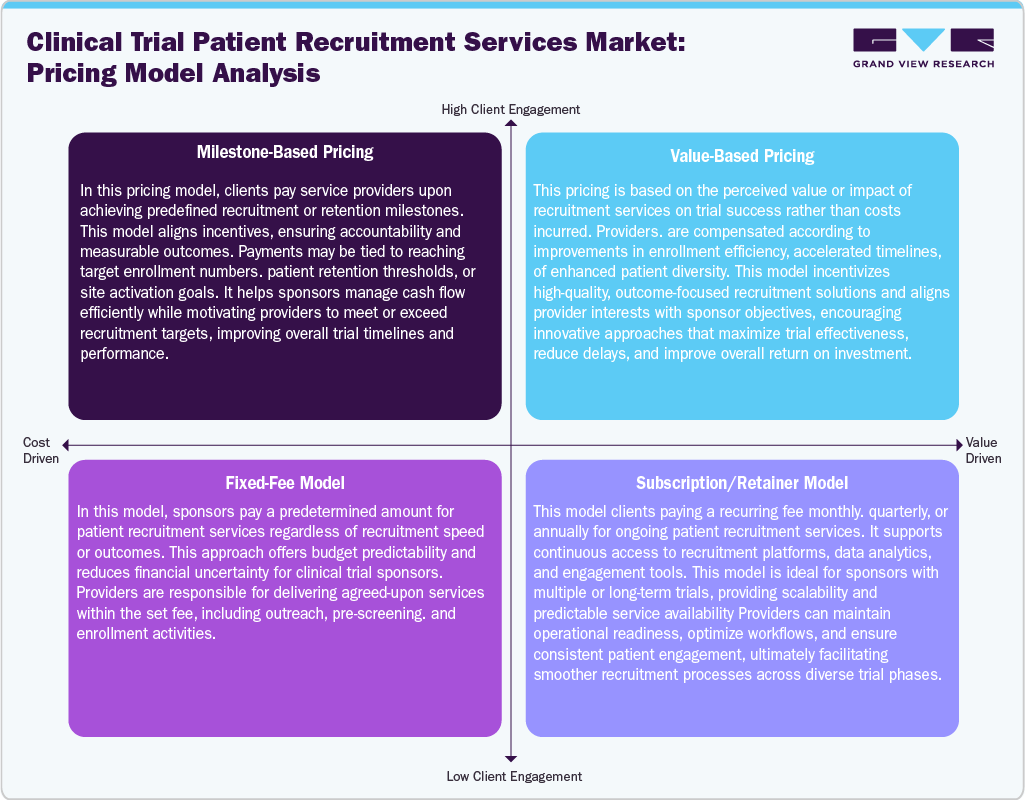

Pricing Model Analysis

The clinical trial patient recruitment services market employs various pricing models, such as milestone-based pricing, value-based pricing, fixed-fee model, and subscription/retainer model, which customize the project’s scope, client requirements, and performance outcomes. The milestone-based pricing ties the payments to specific achievements, such as patient enrollment targets or completing trial phases, promoting accountability and performance-oriented returns. Besides, value-based pricing focuses on the quality and effectiveness of recruitment outcomes, requiring clients to compensate based on quicker enrollment times or improved patient retention rates. In addition, the fixed-fee model provides predictable costs through a one-time or phase-specific charge, making it well-suited for projects with clear parameters and stable demands. Moreover, the subscription or retainer model ensures ongoing access to recruitment platforms, digital tools, and dedicated support teams, catering to continuous trial requirements. Thus, each model offers unique advantages to ensure performance, maintain cost control, or offer scalability, allowing sponsors and CROs to better align their financial frameworks with recruitment objectives, operational flexibility, and partnerships in an ever-changing clinical research landscape.

Market Concentration & Characteristics

The clinical trial patient recruitment services market growth stage is high, and growth is accelerating. The market is characterized by the level of merger & acquisitions activities, degree of innovation, regulatory impact, product expansion, and regional expansions.

The clinical trial recruitment services is evolving with emerging technologies that have a potential to positively impact clinical trial services. Key trends driving innovation include changes in industry standards, adaptive trial designs, and the introduction of comprehensive patient recruitment services. For instance, in July 2025, PhaseV launched the ClinOps AI platform, utilizing causal machine learning and real-time patient data to revolutionize clinical trial operations with precision-guided site selection, faster decision-making, and enhanced trial performance monitoring.

Stringent global regulatory standards and the need to comply with HIPAA (US), GDPR (Europe), and regional data protection laws. These regulations drive quality, compliance, and transparency in clinical trial patient recruitment services. It further supports maintaining patient privacy, advertising, informed consent, and transparency.

Mergers and acquisitions (M&A) in clinical trial patient recruitment services are surging, driven by enhancing the patient recruitment process and retention within clinical trials. For instance, in September 2024, SubjectWell acquired Trials24 to enhance global patient recruitment, combining advanced digital solutions, multilingual engagement, and a 13 million member patient network to set a new standard in diverse, patient-centric clinical trial enrollment.

The clinical trial patient recruitment services market is experiencing rapid service expansion driven by digital transformation, AI-powered matching platforms, and global outreach strategies. Companies are integrating multilingual engagement centers, real-world data analytics, and personalized patient communication to improve enrollment diversity and retention.

Clinical trial patient recruitment services is witnessing rapid regional expansion attributed to regional distribution of clinical studies which is gradually shifting from developed nations to emerging economies. The increasing cost of clinical research has led pharmaceutical companies to shift toward regions such as Europe, Latin America, Asia Pacific, and the Middle East for enhanced patient recruitment and cost savings.

Service Insights

On the basis of service, in 2024, patient recruitment & registry services segment held the largest market share in the market, accounting for a revenue share of 68.01%. The segment growth is driven by an increasing number of clinical trials, rising prevalence of chronic and rare diseases, and the growing need for diverse and representative patient populations. Besides, growing technological advancements further enhance recruitment accuracy and speed, supporting the segment growth. In addition, rising requirements for faster trial timelines, improved retention rates, and post-market surveillance are expected to drive the adoption of integrated recruitment and registry solutions across pharmaceutical, biotech, and CRO organizations globally. For instance, in September 2025, Anova launched its global clinical registry, AnovaOS, to accelerate patient recruitment, enhance real-world data use, support post-market surveillance, and speed clinical trial timelines for global sponsors. Registries enhance long-term engagement, ensure data accuracy, and support diverse participant inclusion.

On the other hand, the patient retention segment is expected to grow at the fastest CAGR over the forecast period. The segment growth is driven by a strong focus on patient-centric design, effective communication, and improved participant experience. Companies are also adopting digital health tools, personalized communication, and real-time monitoring to reduce dropout rates and improve trial completion. Integrating mobile apps, virtual follow-ups, and behavioral analytics enhances patient experience, adherence, and data reliability, which is expected to drive the growth. In addition, the increasing use of AI-driven analytics and digital tools such as mobile health apps, telemedicine, and wearable devices enables continuous engagement and real-time monitoring, reducing dropout rates, further contributing to market growth. Such factors are expected to drive the market growth.

Phase Insights

On the basis of phase segment, in 2024, phase III held the largest revenue share due to the large-scale participant requirements and complex study designs.The phase III clinical trial represents the most extensive and critical stage of drug development, aimed at confirming a treatment’s safety, efficacy, and overall benefit-risk profile in large patient populations. The phase has an increased requirement for effective patient recruitment for multiple sites, involving thousands of participants. In addition, the growing requirement of engagement models targeted at education tools, community outreach programs, and partnerships with patient advocacy organizations to improve enrollment and retention is expected to drive the segment growth. Moreover, sponsors increasingly use digital recruitment platforms, social media campaigns, and real-world data analytics to efficiently identify candidates, reduce delays, and maintain trial timelines.

On the other hand, the phase I segment is expected to grow at the fastest CAGR over the forecast period, driven by the increasing number of early-stage studies and demand for rapid participant enrollment. Recruiting participants for phase I clinical trials requires careful consideration to ensure the inclusion of individuals who meet study objectives and provide meaningful data. For instance, in 2024, Phase I trials comprised 42.2% of clinical studies in China, up from 39.2% in 2023, primarily targeting metabolic disorders and cardiovascular health. South Korea dominated in significant Phase I activity at 33.4% in 2023. The selection criteria include age, gender, health status, and prior treatments. While many trials recruit healthy volunteers, some involve diagnosed patients to assess treatment safety and preliminary efficacy in relevant populations.

Therapeutic Area Insights

On the basis of therapeutic area segment, the oncology segment dominated the market in 2024. This segment is driven by the rising number of cancer diagnoses, increasing cancer prevalence and the expanding pipeline of targeted and immuno-oncology therapies. According to ClinicalTrials.gov, there are approximately 18,997 clinical trials related to oncology currently registered with patients recruiting. Moreover, the growing prevalence of cancer and the demand for effective treatments for various types of cancer are anticipated to further propel the market. Moreover, investment in R&D, and patient-centric approaches, telemedicine, and partnerships with oncology centers improve engagement and accessibility is expected to drive the segment growth. For instance, in October 2025, Flourish Research partnered with Valkyrie Clinical Trials to expand into oncology, combining expertise and patient access to accelerate innovative cancer therapies and advance lifesaving treatments for patients with unmet medical needs.

On the other hand, CNS disorders segment is expected to witness the fastest growth over the forecast period. CNS disorders comprise 600 common neurological disorders as well as over 5000 rare neurological condition. CNS disorders account for about 8.0% of the global health burden, affecting a significant number of populations. About 50 million Americans are affected by neurological disorders, and the numbers are similar across the globe. The incidence of neurological disorders is anticipated to increase with the growing elderly population, which is expected to drive the market over the estimated time period. Such factors are expected to drive the market.

Age Group Insights

On the basis of the age group segment, the adult (18 - 64 years) segment dominated the market in 2024. The segment growth is driven by growing prevalence of chronic and lifestyle-related diseases, expanding clinical research activities, and growing technological advancements like AI-based patient matching, digital outreach, and telehealth improve recruitment efficiency. Studies indicated that seven chronic diseases hypertension, diabetes, lung disease, heart disease/stroke, arthritis, neurological disorders, and cancer often develop early, especially in Indian adults aged 45-64, based on competing risk analysis across age groups. Besides, large number of people are categorized as adults, which suffer from disorders that drives the demand for effective treatment options. Besides, the growing number of clinical studies registered with adult participants is anticipated to boost the segment growth. Such factors are expected to drive the segment growth.

Older adults aged 65 years and above are expected to witness the fastest growth driven by increasing prevalence of age-related diseases and rising need for targeted therapies. Besides, most of the recruitment strategies for this age group is focused on tailored engagement, accessibility, and safety monitoring, ensuring participation while addressing health complexities, ultimately enhancing trial diversity and data relevance for this population. Such factors are expected to drive the segment growth.

Regional Insights

North America market held the largest market share of 50.50% in 2024. This growth can be attributed to various factors, such as an increasing volume of ongoing clinical trials, strong clinical research infrastructure, complex protocol demands, high R&D investment, and widespread adoption of digital recruitment technologies. In addition, the region benefited from advanced healthcare systems, diverse patient populations, and supportive regulatory frameworks. Besides, the growing use of AI, real-world data, decentralized trial models, real-world data integration, and targeted social-media outreach are enhancing recruitment efficiency. Some key players, such as IQVIA, Parexel, PRA Health Sciences, and Syneos Health, utilize large databases, patient registries, and CRO partnerships. Such factors are expected to drive the market growth.

U.S. Clinical Trial Patient Recruitment Services Market Trends

The clinical trial patient recruitment services market in the U.S. held the largest share in 2024, owing to rising clinical research activity, increasing demand for diverse patient populations, and well-established pharmaceutical companies and contract research organizations (CROs) in the country. Major companies are advancing through AI, data analytics, and patient engagement networks to improve enrollment efficiency. For instance, in April 2025, ProofPilot partnered with Inspire to enhance patient participation by connecting Inspire's global health community with clinical trials, offering an entire digital experience that boosts engagement and accelerates recruitment success. Such aforementioned factors are expected to drive the market growth.

Europe Clinical Trial Patient Recruitment Services Market Trends

The clinical trial patient recruitment services market in Europe is anticipated to experience significant growth due to regulatory modernization, developed infrastructure for clinical trials, and the presence of skilled personnel to support market growth in the region. In addition, CROs, such as PPD, Inc., and Icon Plc, have centers in European countries, including the UK, Germany, and France, which are expected to contribute further to market growth in this region. Moreover, the European Medicines Agency announced in September 2025 a clinical trial framework, featuring a centralized online platform, streamlined approvals, and mandatory transparency, which enhances efficiency and accelerates recruitment timelines.

The Germany clinical trial patient recruitment services market held the largest share in 2024. This market is driven by robust healthcare infrastructure, a large patient base, and a strong presence of pharmaceutical and biotechnology companies. Some other factors contributing to market growth are the expanding pharmaceutical industry and the increasing demand for CRO services offering clinical trial patient recruitment services for new pharmaceutical drug development. Furthermore, stringent regulations and evolving industry standards require CROs to comply with proper manufacturing practices, ensuring compliance & prioritizing patient safety is expected to drive the market growth.

In addition, CROs, such as PPD, Inc., and Icon Plc, have centers in European countries, including the UK, Germany, and France, which are expected to contribute further to market growth in this region. Moreover, the European Medicines Agency announced in September 2025 a clinical trial framework, featuring a centralized online platform, streamlined approvals, and mandatory transparency, which enhances efficiency and accelerates recruitment timelines.

The UK clinical trial patient recruitment services market is anticipated to grow over the forecast period. This growth is primarily due to the growing need for CROs, government investments, advanced healthcare infrastructure, and streamlined NHS integration. For instance, in August 2024, a public-private investment initiative included the creation of 18 clinical trial hubs, aiming to accelerate patient recruitment and enhance trial efficiency. This initiative reflects the government's commitment to promoting clinical research and aims to attract global sponsors and boost trial participation. Such factors are expected to drive the market growth.

Asia Pacific Clinical Trial Patient Recruitment Services Market Trends

Asia Pacific is projected to register a significant CAGR during the forecast period. This growth can be attributed to increased offshore clinical trials, rising demand for pharmaceutical products, and large & diverse patient populations in the region, which drives market growth. In addition, the developed hospital networks and the availability of skilled medical practitioners further support the development of the clinical trial patient recruitment services market in the Asia Pacific region. Moreover, countries such as Japan, China, and India are increasingly focusing on expanding due to the presence of developed pharmaceutical companies & CROs in the region and the higher cost-efficiency of conducting clinical trials compared to other countries, further creating growth opportunities in the market.

The China clinical trial patient recruitment services market is expanding rapidly due to its large population, growing disease burden, and strong government support for clinical research. Besides, increasing adoption of digital recruitment platforms, AI-driven patient matching, and integrating electronic health records are expected to improve enrollment efficiency. In addition, rising participation of domestic and global pharmaceutical companies, along with regulatory reforms accelerating trial approvals, further boosts market growth. Moreover, increasing patient awareness, expanding clinical trial sites, and focusing on oncology and chronic diseases enhance recruitment capabilities and trial diversity across China. According to the April 2025 report, China offers rapid digital recruitment, cost-efficient site management, and physician incentives. Western biotechs increasingly conduct early-phase trials in China, where recruitment now rivals or surpasses Western timelines.

The Japan clinical trial patient recruitment services market is second-largest in the Asia Pacific region. The country is strengthening its position in the market by innovation in decentralized clinical trials (DCTs), growing focus on patient-centric models, and access to broader populations through home-based trial solutions. For instance, in May 2025, DCT Japan, the country's first DCT-focused provider, expanded partnerships with multiple medical institutions across seven difficult-to-recruit disease areas by building nationwide networks of visiting nurses and sites. This enhances recruitment efficiency and access to a diverse patient pool, boosting market competitiveness.

The clinical trial patient recruitment services market in India is expected to experience significant growth at a significant CAGR during the forecast period. The country has become one of the most preferred sites for clinical trials due to the presence of a large, diversified patient pool, a rapidly developing healthcare sector, availability of highly educated physicians, and cost competitiveness. Besides, the services are in increasing demand as they offer significant benefits to the existing facilities of CROs. These factors are expected to contribute to the market's growth in the upcoming years. Such factors are expected to drive the market.

Latin America Clinical Trial Patient Recruitment Services Market Trends

The Latin America clinical trial patient recruitment services market is expanding, driven by a large, treatment-naive population, ethnic diversity ideal for global studies, and lower trial costs. Besides, faster recruitment timelines compared to Western regions and improving regulatory harmonization under agencies like ANVISA and COFEPRIS are supporting the market growth. Besides, growing investments from global CROs and increased adoption of digital recruitment tools are positioning Latin America as a strategic destination for multinational clinical trials. These factors are expected to drive the market growth.

The Clinical Trial Patient Recruitment Services Market in Brazil is advancing due to growing pharmaceutical investments and government support for clinical research. Expanding research institutions and increasing adoption of digital recruitment platforms support faster recruitment timelines. The country's diverse genetic pool attracts global sponsors seeking more representative trial outcomes. As international CROs expand operations, collaborations with Brazilian hospitals increase, which is expected to drive the country's position as a major recruitment destination in the Latin America region.

Middle East and Africa Clinical Trial Patient Recruitment Services Market Trends

The Middle East & Africa are emerging as competitive regions in the clinical trial patient recruitment services market, driven by growing government investments in healthcare infrastructure, rising prevalence of chronic diseases, and increasing interest from multinational pharmaceutical companies. Countries like the UAE, Saudi Arabia, and South Africa are establishing clinical research hubs and accelerating ethical approval processes, contributing to the market. In addition, expanding access to diverse patient populations, digital recruitment tools, and partnerships with global CROs enhances recruitment speed and boosts the region's market attractiveness. Such factors are expected to drive the market over the estimated time period.

The South Africa Clinical Trial Patient Recruitment Services Market is witnessing growth due to growing clinical research activity, genetically diverse population, rising disease burden, and increasing focus on cost-effective research. Government support through agencies like SAHPRA and improving regulatory timelines and strong hospital networks is attracting global sponsors. In addition, increasing digital health adoption and community-based recruitment programs enhance patient engagement, contributing to market growth. With expanding oncology and infectious disease trials, South Africa is positioning itself as a strategic recruitment destination. Such factors are expected to drive the market.

The UAE clinical trial patient recruitment services market is emerging as a competitive hub, driven by modern healthcare infrastructure and a diverse expatriate population ideal for multiethnic clinical studies. Strategic initiatives by the Dubai Health Authority and partnerships with global pharma firms are improving patient engagement and recruitment efficiency. For instance, in June 2022, the Department of Health-Abu Dhabi partnered with Sanofi to advance clinical research in oncology, rare metabolic diseases, diabetes, and vaccines. The initiative includes AI-powered population screening and patient recruitment protocols.

Key Clinical Trial Patient Recruitment Services Company Insights

Market players are undertaking various strategic initiatives, such as the launch of new product innovations, collaborations, partnerships, and mergers & acquisitions, to strengthen their service offering and provide a competitive advantage. For instance, in September 2024, SubjectWell mentioned the acquisition of Trials24, a provider of digital patient recruitment solutions. This acquisition will enhance SubjectWell's ability to connect patients to transformative healthcare across the globe.

Key Clinical Trial Patient Recruitment Services Companies:

The following are the leading companies in the clinical trial patient recruitment services market. These companies collectively hold the largest market share and dictate industry trends.

- Clara Health

- Antidote

- BBK Worldwide

- Clariness

- Clinical Site Services (CCSi)

- Worldwide Clinical Trials

- Thermo Fisher Scientific Inc. (PPD Inc.)

- IQVIA Inc

- Veristat

- Elligo Health Research

- AutoCruitment

- MMG (Omnicom Health Group)

- Praxis

- Science37

- StudyKik

Recent Developments

-

In February 2025, Inovalon launched the Clinical Research Patient Finder, an AI-powered platform that integrates with EHRs to identify eligible patients in real time. The tool streamlines recruitment, minimizes manual errors, and enhances trial efficiency for sponsors and research sites ultimately accelerating access to life-saving therapies and transforming clinical trial operations.

-

In July 2024,DocMode Health Technologies announced the launch of its clinical research services. This expansion aims to provide solutions that include data analysis, clinical trial management, regulatory compliance, & others. The solutions are designed to support healthcare providers, pharmaceutical companies, and researchers in conducting high-quality clinical studies efficiently & effectively.In addition, the services include coordination & management of multi-centre clinical trials to facilitate broader and diverse patient recruitment & data collection

-

In April 2024, AutoCruitment announced the completion program for Electronic Medical Records (EMR) Capture & Intelligence, which is part of its patient recruitment technology platform. This AI technology simplifies the processes of obtaining consent, capturing, standardizing, and reviewing EMR for clinical research sites and patients.

Clinical Trial Patient Recruitment Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.71 billion

Revenue forecast in 2033

USD 22.85 billion

Growth Rate

CAGR of 8.72% from 2025 to 2033

Actual Data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD Million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Services, phase, therapeutic area, age group, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Thailand, South Korea, Australia, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait, Oman, Qatar

Key companies profiled

Clara Health, Antidote, BBK Worldwide, Clariness, Clinical Site Services (CCSi), Worldwide Clinical Trials, Thermo Fisher Scientific Inc. (PPD Inc.), IQVIA Inc, Veristat, Elligo Health Research, AutoCruitment, MMG (Omnicom Health Group), Praxis, Science37, StudyKik

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clinical Trial Patient Recruitment Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global clinical trial patient recruitment services market based on service, phase, therapeutic area, age group and region:

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Patient recruitment & registry services

-

Patient retention services

-

Others

-

-

Phase Outlook (Revenue, USD Million, 2021 - 2033)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2021 - 2033)

-

Respiratory diseases

-

Pain and anesthesia

-

Oncology

-

Central nervous system

-

Cardiovascular

-

Endocrine

-

Anti-infective

-

Others

-

-

Age Group Outlook (Revenue, USD Million, 2021 - 2033)

-

Child (birth-17 years)

-

Adult (18 - 64 years)

-

Older adults (65 years+)

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Oman

-

Qatar

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.