- Home

- »

- Healthcare IT

- »

-

Clinical Trials Support Software Solutions Market Report 2033GVR Report cover

![Clinical Trials Support Software Solutions Market Size, Share & Trends Report]()

Clinical Trials Support Software Solutions Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (eCOA, CTMS, EDC & CDMS), By Delivery Mode (Web And Cloud Based, On-premises), By Phase (I, II, III), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-697-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Clinical Trials Support Software Solutions Market Summary

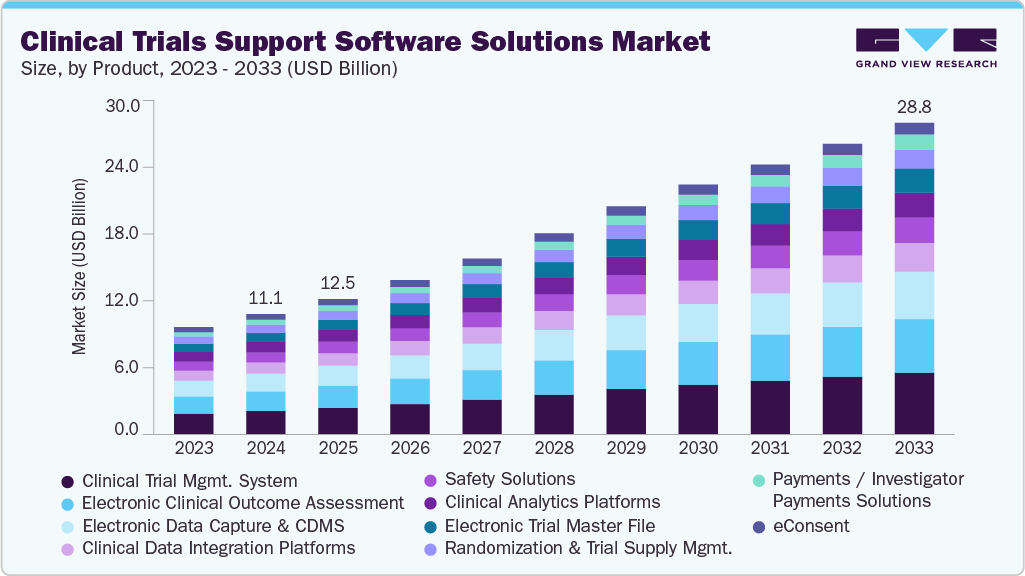

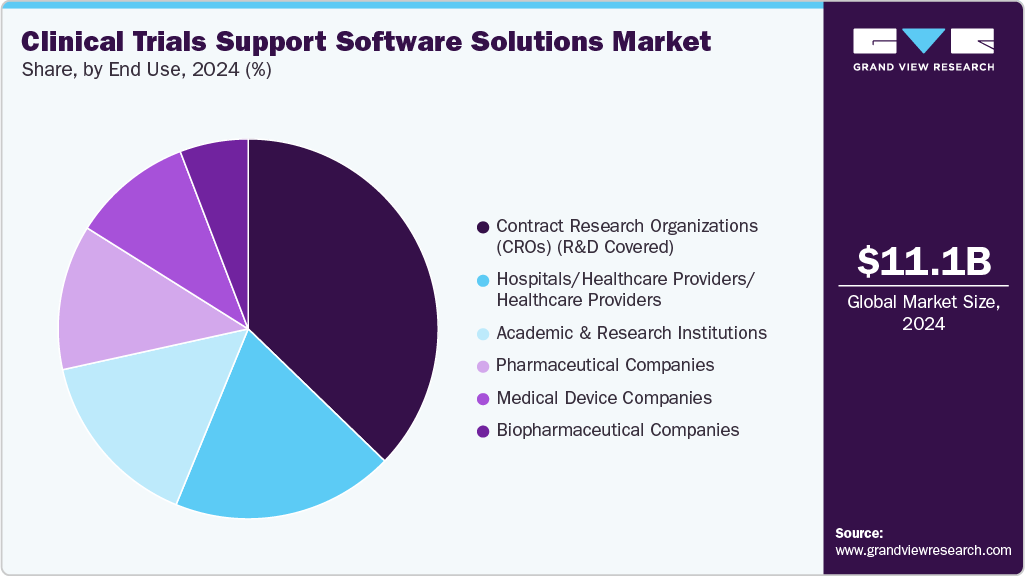

The global clinical trials support software solutions market size was estimated at USD 11.12 billion in 2024 and is projected to reach USD 28.76 billion by 2033, growing at a CAGR of 10.9% from 2025 to 2033. Increasing research and development activities by biopharma and pharma companies are among the key trends escalating market growth.

Key Market Trends & Insights

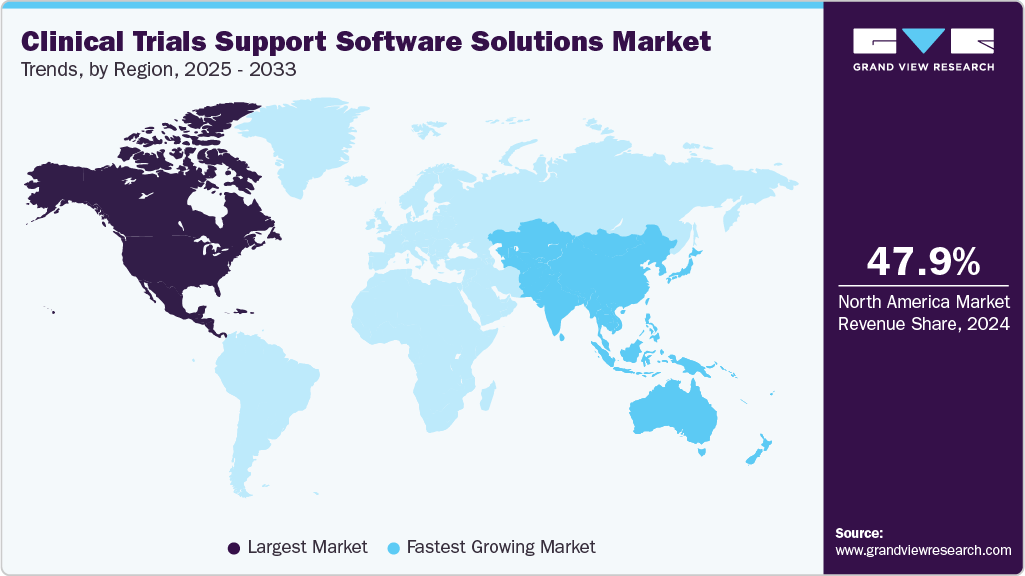

- North America dominated the market and accounted for a 47.87% share in 2024.

- The clinical trials support software solutions market in the U.S. has seen significant growth over the forecast period, owing to the rising prevalence of lifestyle-associated diseases such as diabetes and cardiac disorders.

- By product, the clinical trial management system segment led the market with a share of over 18.68% in 2024.

- By phase, phase III emerged as the leading application segment in 2024 and accounted for 53.38% of the market share.

- By end-use, contract research organizations were the leading segment in 2024 and accounted for 37.24% of the market share.

Market Size & Forecast

- 2024 Market Size: USD 11.12 Billion

- 2033 Projected Market Size: USD 28.76 Billion

- CAGR (2025-2033): 10.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In addition, the growing incorporation of software solutions in clinical trials is also projected to provide a fillip to the market growth. Furthermore, the increasing outsourcing and externalization of clinical trials by the majority of the prominent pharmaceutical and biotechnological companies is presumed to be responsible for driving the market at an unprecedented rate throughout the forecast period.The stringent regulatory framework for clinical trials and a growing emphasis on safety monitoring significantly drive the adoption of clinical trial support software solutions in developed markets. For instance, agencies such as the U.S. Department of Health and Human Services (HHS) and the National Institutes of Health (NIH) are tightening clinical trial registration requirements and actively promoting clinical data transparency and sharing. Global health authorities are increasingly implementing strategic policies to strengthen clinical trial governance and promote the use of digital technologies in research settings. For instance, in May 2025, the World Health Organization (WHO) introduced the global action plan to strengthen clinical trial ecosystems, which prioritizes the adoption of digital solutions, greater transparency in trial registration and data sharing, and integration of trials into national health systems.

The surging demand for integrated software solutions among pharmaceutical and biopharmaceutical companies is also serving as a major growth catalyst. These solutions streamline various aspects of clinical trials, from study planning and data capture to safety reporting and regulatory compliance. In addition, increasing government grants to support research activities, along with a rapidly widening end use base that includes CROs, academic institutions, and healthcare providers, is expected to further boost the adoption of clinical trials supporting software solutions during the forecast period.

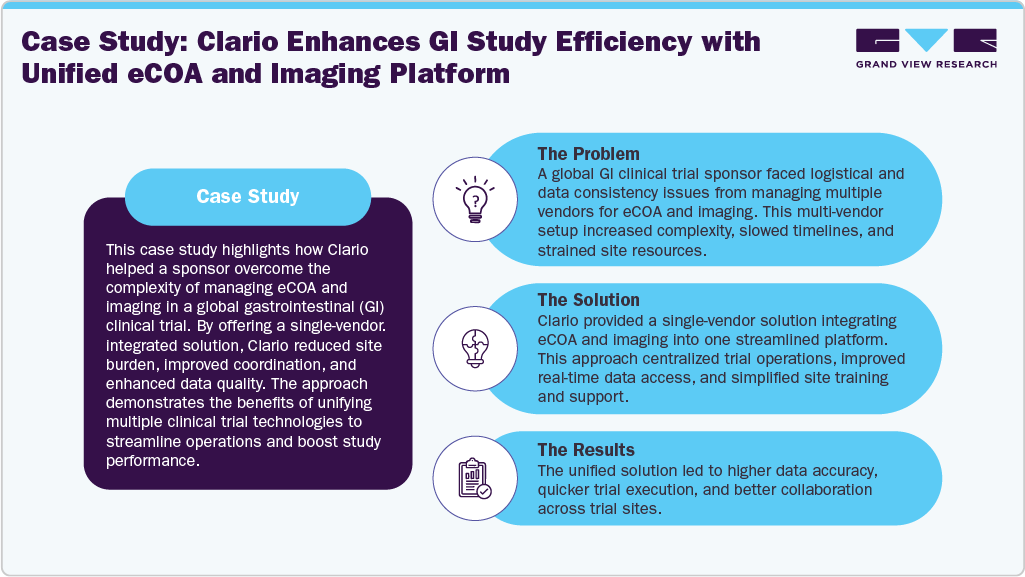

Key market players such as Cytel, Dassault Systèmes (via Medidata), Veeva Systems, IQVIA, Castor, Saama, Oracle, Parexel, Clario, Curebase, and Suvoda (post-merger with Greenphire) operate in a landscape characterized by increased strategic consolidation, AI innovation, and portfolio expansion. In April 2025, Suvoda merged with Greenphire to create a unified platform that integrates randomization, supply management, eConsent, eCOA, patient-centric payments, budgeting, and logistics, streamlining operations across the patient-to-site spectrum.

Companies are rapidly advancing toward integrated, AI-powered ecosystems that centralize trial functions and enable greater automation, scalability, and compliance. Recent developments reflect a strong focus on embedding solutions directly into clinical workflows, enabling real-time data capture, protocol optimization, and decentralized trial execution.

For instance, in January 2025, Medrio launched an AI-enabled reporting solution aimed at addressing the growing complexity of clinical trial data, offering real-time insights, automated workflows, and customizable dashboards to enhance trial oversight and decision-making. AI and machine learning are being leveraged to enhance patient-trial matching, predictive analytics, and risk-based monitoring, while the integration of payment automation and remote engagement tools is improving site satisfaction and trial efficiency. These trends indicate a shift from siloed point solutions to unified platforms capable of managing the entire clinical trial lifecycle driving faster, smarter, and more inclusive research outcomes.

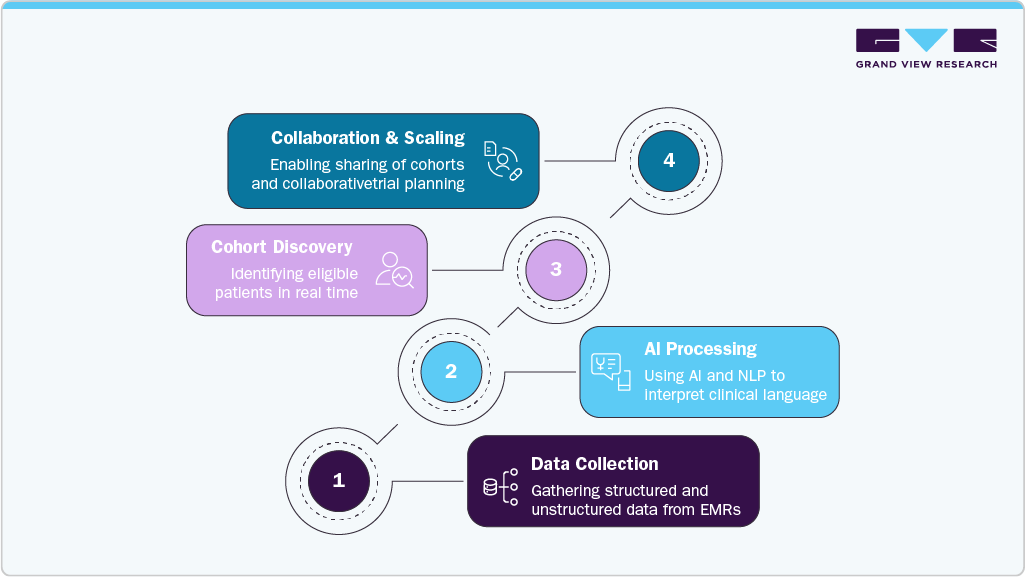

AI-Powered Clinical Trial Matching: Deep6 AI

AI-powered clinical trial matching, as enabled by platforms like the one from Deep 6 AI, represents a transformative advancement in the clinical trial support solutions market. This technology uses artificial intelligence and natural language processing (NLP) to analyze vast amounts of structured and unstructured data from electronic health records (EHRs) to identify patients who meet complex trial eligibility criteria with high precision and speed. Unlike traditional recruitment methods, which often depend on manual chart reviews that are time-consuming and prone to mistakes, AI-powered matching automates and speeds up the process. It enables clinical research teams to identify eligible patients in real time, often finding candidates who might otherwise be overlooked due to complex or subtle clinical data. This method not only boosts recruitment rates and shortens trial timelines but also promotes inclusivity by recognizing diverse and underrepresented patient groups.

By integrating directly into provider workflows and supporting collaboration between sites and sponsors, AI-driven trial matching aligns closely with the industry’s move toward decentralized and patient-centric trial models. As clinical research becomes increasingly data-heavy, AI-powered matching is emerging as a vital tool within the broader clinical trial support solutions market, boosting efficiency, accuracy, and scalability throughout the trial process.

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaborations activities, degree of innovation, and regional expansion. For instance, the clinical trials support software solutions market is slightly fragmented, with many product & service providers entering the market. The degree of innovation, the level of partnerships & collaboration activities, and the impact of regulations on the industry are high. However, the regional expansion observes moderate growth.

The degree of innovation in the industry is high owing to the rapid evolution of digital health technologies and the growing demand for more efficient clinical trial processes. Numerous players introduce new AI-integrated products to optimize trial design, patient recruitment, and real-time monitoring. For instance, in March 2024, PhaseV announced that it would demonstrate AI/ML-powered clinical trial design and analysis capabilities at the CMO Summit 360°.

The level of partnerships & collaboration activities by key players in the industry is high, reflecting the industry's need for integrated, interoperable, and technologically advanced solutions in clinical research. For instance, in June 2023, Syneos Health collaborated with uMotif Limited, leveraging an advanced digital platform that incorporates robust Electronic Clinical Outcome Assessment (eCOA) and Electronic Patient-reported Outcomes (ePRO) capabilities. This partnership aims to accelerate the pace of clinical trials, expediting the delivery of groundbreaking medications to patients more efficiently.

The impact of regulations on the market is high. Stringent regulatory requirements-such as those from the FDA (21 CFR Part 11), European Medical Agency (GCP), and ICH guidelines drive demand for robust, compliant digital platforms that ensure data integrity, security, and traceability throughout the clinical trial process. However, evolving regulations, particularly those encouraging decentralized trials, real-world evidence, and interoperability, such as the FDA’s Digital Health initiatives and EMA’s guidance on electronic systems, have created opportunities for innovation in the clinical trials support solutions market.

The level of regional expansion in the industry is moderate, owing to the globalization of clinical trials and the increasing demand for digital health infrastructure across emerging markets. For instance, in October 2023, Lokavant received an investment of USD 8 million from Mitsui & Co. Ltd. for expanding its AI and Predictive Clinical Trial Intelligence into the Asia-Pacific region.

Product Insights

CTMS segment dominated the market for clinical trials support software solutions and accounted for the largest revenue share of 18.68% in 2024, owing to its central role in managing complex trial operations across multiple sites and phases. These systems streamline protocol planning, subject tracking, financial management, and regulatory compliance, making them indispensable for sponsors and CROs aiming to improve operational efficiency and ensure data integrity. The increasing complexity of clinical trials, coupled with the need for real-time visibility and centralized control, continues to drive widespread adoption of CTMS solutions.

Payments/investigator payment solutions are projected to register the highest CAGR, driven by the growing emphasis on streamlining financial workflows and enhancing transparency in investigator compensation. These solutions automate complex payment processes, reduce administrative burden, and ensure timely, accurate reimbursements to sites and investigators, which in turn improves site engagement and retention.

Delivery Mode Insights

The cloud and web-based segment dominated the market for clinical trials support software solutions in 2024. The segment's dominance can be attributed to associated benefits such as easy accessibility, usability, and lower investments required. Web and cloud-based products are easily customizable, owing to which providers can customize the presentation of information for different user groups. These products have a greater level of interoperability. The segment is poised to maintain its position throughout the forecast.

On-premise delivery mode involves installing services and solutions on computers present within the organization. Though the software needs to be installed within the organization’s premises, it can be accessed from remote locations, providing the benefit of reduced costs due to power consumption and system maintenance. The on-premise solution is the most commonly preferred solution due to its benefits, such as security and ease of access. The preference for these services is mainly due to complete access to information and full control within the premises.

Phase Insights

The Phase III segment dominated the market and accounted for the largest revenue share of 53.38% in 2024. Spiraling needs for the incorporation of clinical data management software to curb overall cost and improve process efficiency are contributing to the growth of the segment. An increasing number of drugs successfully reaching phase III is providing a significant push to the growth of the segment.

The phase I segment is estimated to be the most promising segment during the forecast years owing to the high significance of these systems to predict future outcomes and eliminate drug candidates possessing the least probability of success. Developments in biological modeling systems and personalized medicine technologies are leading to a boom in the development of newer drugs. A large number of phase I trials and complex management and analysis of data acquired during various studies are expected to propel the growth of the segment.

End Use Insights

The CROs segment dominated the market with the largest revenue share in 2024. The segment is projected to rise at a remarkable CAGR owing to the growing inclination of pharmaceutical companies to reduce overall expenditure. The rising usage of eClinical solutions in research is further widening the scope of segment growth. Benefits involved in outsourcing clinical trials to CROs are responsible for the heightened growth of this segment. These benefits include cost advantages, increased efficiency of services, enhanced productivity, and a higher focus on core areas of development critical to a company’s growth.

The biopharmaceutical companies segment is expected to witness significant growth over the forecast period. This is driven by the increasing reliance on digital tools to optimize clinical trial workflows. These solutions help biopharma researchers streamline data management, monitor trial progress, and identify procedural inefficiencies, leading to faster and more accurate study outcomes. The push for innovation, coupled with complex clinical protocols and regulatory compliance needs, is accelerating adoption across the sector.

Regional Insights

North America clinical trials support software solutions market held the largest share of 47.87% in 2024, driven by a growing patient population and the high prevalence of lifestyle-related conditions such as diabetes and cardiovascular diseases. The region benefits from advanced healthcare infrastructure, strong government funding, and the presence of key industry players. For instance, in January 2023, the Government of Canada launched a national clinical trials consortium and research projects to enhance trial effectiveness, further propelling the adoption of clinical trial software solutions across the region.

U.S. Clinical Trials Support Software Solutions Market Trends

The clinical trials support software solutionsmarketin the U.S.is driven by the region's advanced healthcare ecosystem, strong pharmaceutical presence, and supportive regulations, such as the FDA's 21 CFR Part 11 are fostering the adoption of digital and AI-enabled clinical trial solutions. For instance, in June 2025 launched a new Partner Program was launched aimed at accelerating clinical trial startup times by offering access to pre-configured technology stacks and operational support. The initiative emphasizes faster onboarding, greater control over trial execution, and transparent pricing, ultimately improving efficiency and scalability for CROs and sponsors.

Europe Clinical Trials Support Software Solutions Market Trends

The clinical trials support software solutions market in Europe is expected to grow significantly. This growth is attributed to the region's emphasis on personalized medicine, increasing clinical trials in oncology and rare diseases, and strong regulatory frameworks. Countries such as Germany and the UK are at the forefront, focusing on improving healthcare systems and the digital economy. Further, in January 2022, the European Commission, the European Medicines Agency (EMA), and the Heads of Medicines Agencies launched the Accelerating Clinical Trials in the EU initiative. This initiative aims to transform the design and conduct of clinical trials. The initiative focuses on harmonizing clinical trial processes, fostering innovation, and integrating clinical research into the European health system, thereby supporting the adoption of clinical trial support software solutions.

The UK clinical trials support software solutions market is growing due to strong technological infrastructure, high healthcare spending, and increasing rates of chronic diseases. The rising use of cloud-based solutions, valued for their flexibility, scalability, and cost-efficiency, is streamlining research operations. These factors, along with a supportive regulatory environment, are fueling the demand for advanced software solutions in clinical research across the UK.

The clinical trials support software solutions market in Germany held a significant share of the European industry in 2024. The large elderly population is a key factor driving growth in Germany. According to UN population data, one in every 20 Germans is over 80 years old, and this number is expected to increase until 2050. Challenges faced by the elderly include a high risk of chronic diseases such as cardiovascular issues, diabetes, neurovascular disorders, and weakened immune systems. Consequently, the German government is launching initiatives and investing in clinical trials related to these diseases, thereby boosting the market’s growth.

Asia Pacific Clinical Trials Support Software Solutions Market Trends

The clinical trials support software solutions market in Asia-Pacific is expected to grow at a significant CAGR of 14.0% during the forecast period. High unmet medical needs and the increasing prevalence of chronic diseases such as cancer, cardiovascular conditions, and infectious diseases drive the demand for software solutions in this area. An increasing number of trials are outsourced to countries such as China, India, Korea, and Japan due to their large patient populations and lower costs. This outsourcing trend is further boosting the adoption of clinical trials support software solutions in these regions.

Japan clinical trials support software solutions market is propelled by substantial R&D efforts by biopharmaceutical firms, rising integration of software solutions in clinical trials, and increasing demand for safety monitoring. Further, Japan is a significant player in the global pharmaceutical and clinical research industry. The country's pharmaceutical companies and research institutions conduct numerous clinical trials. Therefore, the adoption of clinical trials support software solutions has become essential for efficient data collection, management, and analysis during these trials.

The clinical trials support software solutions market in China holds a prominent position in the Asia-Pacific clinical trials support software market, driven by the increasing number of clinical trials and substantial government investments in healthcare research and technology. The country's focus on improving the quality of clinical trials and data management, along with the modernization of healthcare infrastructure, contributes to market growth.

Latin America Clinical Trials Support Software Solutions Market Trends

The clinical trials support software solutions market in Latin Americais expected to grow steadily. The presence of untapped opportunities in emerging countries, such as Brazil, is expected to propel the growth of the clinical trials support software solutions market in Latin America. The region’s regulatory landscape is evolving, with a growing focus on compliance with ICH-GCP standards. Governments are prioritizing improvements to clinical trial infrastructure to attract more international studies, which in turn is accelerating the adoption of trial technologies.

Middle East & Africa Clinical Trials Support Software Solutions Market Trends

The clinical trials support software solutions market in the Middle East & Africa is driven by the development of health amenities and increased funding toward medical research and technology. The GCC countries are new to clinical research, but with technological advancements and increasing digitization, the countries are overcoming the challenges faced on the technological front and are witnessing significant growth.

Key Clinical Trials Support Software Solutions Companies Insights

Key players operating in the clinical trials support software solutions market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Clinical Trials Support Software Solutions Companies:

The following are the leading companies in the clinical trials support software solutions market. These companies collectively hold the largest market share and dictate industry trends.

- Cytel Inc. (acquired by Nordic Capital and Astorg)

- Dassault Systemes

- Veeva Systems

- IQVIA

- Castor

- Saama

- Oracle

- Parexel International Corporation

- Clario (formerly Bioclinica and ERT)

- RealTime Software Solutions, LLC

- Curebase

- Suvoda LLC (merged with Greenphire in April 2025)

- ICON Plc

- Medidata

- Thermo Fisher Scientific Inc.

- Greenphire

- TELEMEDICINE TECHNOLOGIES S.A.S.

Recent Developments

-

In June 2025, Medpace, partnered with Voximetry to incorporate its Torch AI-powered dosimetry software into radiopharmaceutical clinical trials. This collaboration enables precise, patient-specific radiation dose assessments using Voximetry’s GPU-accelerated, cloud-based platform, enhancing safety evaluation and trial efficiency.

“Voximetry’s industry-leading technology, deep domain expertise in advanced dosimetry, and strong commitment to service excellence and regulatory compliance, is what make them the right partner. “

- Scott Holland, Senior Director of Scientific Affairs at Medpace.

-

In June 2024, IQVIA launched One Home, a unified clinical trial technology platform designed to simplify and accelerate decentralized clinical trials by integrating patient-centric tools, services, and data management into a single solution.

“With site capacity becoming a real challenge for the industry, we believe it is our role and responsibility to deliver a solution that brings industry stakeholders together and relieves the burden on research sites,”

- Bernd Haas, senior vice president, IQVIA Digital Products and Solutions.

-

In April 2024, PhaseV and Quanticate have partnered to combine AI-powered adaptive clinical trial design with expert biostatistics and data management, enabling clinical trial sponsors to improve patient recruitment, reduce time to market, and enhance study quality.

“There is currently a great need in the pharmaceutical industry to leverage flexible, dynamic, and adaptive trial designs based on simulations, bayesian-statistics, machine learning and accumulation of data throughout a trial while continuing to maintain the highest scientific integrity, PhaseV's platform allows trial teams to seamlessly evaluate and execute all types of designs. “

- David Underwood, CEO of Quanticate.

-

In June 2023, ICON plc announced the latest release of its Digital Platform, supporting seamless integration of site, sponsor, and patient services with harmonized data delivery. The platform is customizable for various therapeutic areas and study designs, offering end-to-end solutions for patient services in clinical trials, including a user-friendly mobile app, direct data capture for in-home services, eCOA, telehealth visits, eConsent, and digital health technology management.

“This newest version of the Digital Platform enables the efficient capture and delivery of quality data from a range of decentralised clinical trial services. Its ease of use enables greater patient centricity, reducing the barriers to trial participation and enhancing the equity, diversity and inclusion of patient populations.”

-Steve Cutler, CEO, ICON

Clinical Trials Support Software SolutionsMarket Report Scope

Report Attribute

Details

Market size value in 2025

USD 12.53 billion

Revenue forecast in 2033

USD 28.76 billion

Growth rate

CAGR of 10.9% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, delivery mode, phase, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Cytel Inc. (acquired by Nordic Capital and Astorg); Dassault Systemes; Veeva Systems; IQVIA; Castor; Saama; Oracle; Parexel International Corporation; Clario (formerly Bioclinica, and ERT); RealTime Software Solutions, LLC; Curebase; Suvoda LLC, (merged with Greenphire in April 2025); ICON Plc; Medidata; Thermo Fisher Scientific Inc.; Greenphire; TELEMEDICINE TECHNOLOGIES S.A.S.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Clinical Trials Support Software Solutions Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global clinical trials support software solutionsmarket report based on product, delivery mode, phase, end use, and regions.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Electronic Clinical Outcome Assessment (eCOA) / ePRO)

-

Electronic Data Capture (EDC) & CDMS

-

Clinical Analytics Platforms

-

Clinical data integration platforms

-

Safety solutions

-

Clinical Trial Management System (CTMS)

-

Randomization and Trial Supply Management (RTSM)

-

Electronic Trial Master File (eTMF)

-

eConsent

-

Payments / Investigator Payments Solutions

-

Electronic Investigator Site File (eISF)

-

Patient Matching / Feasibility Solutions

-

-

Delivery Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

Cloud and Web Based

-

On-Premise

-

-

Phase Outlook (Revenue, USD Million, 2021 - 2033)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV (Post-marketing)

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals/Healthcare Providers/Healthcare providers

-

Contract Research Organizations (CROs) (R&D covered)

-

Academic & Research Institutions

-

Pharmaceutical Companies

-

Biopharmaceutical Companies

-

Medical Device Companies

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global clinical trials support software solutions market size was estimated at USD 11.12 billion in 2024 and is projected to reach USD 12.53 billion by 2025

b. The global clinical trials support software solutions market is expected to grow at a compound annual growth rate of 10.9% from 2025 to 2033 to reach USD 28.76 billion by 2033.

b. North America dominated the clinical trials support software solutions market with a share of 47.87% in 2024. This is attributable to growing patient population and the high prevalence of lifestyle-related conditions such as diabetes and cardiovascular diseases. The region benefits from advanced healthcare infrastructure, strong government funding, and the presence of key industry players

b. Some key players operating in the clinical trials support software solutions market include Cytel Inc. (acquired by Nordic Capital and Astorg), Dassault Systemes, Veeva Systems, IQVIA, Castor, Saama, Oracle, Parexel International Corporation, Clario (formerly Bioclinica, and ERT), RealTime Software Solutions, LLC, Curebase, and Suvoda LLC, ( merged with Greenphire in April 2025)

b. Key factors that are driving the market growth include increasing research and development activities by biopharma and pharma companies, technology advancements and the growing incorporation of software solutions in clinical trials.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.