- Home

- »

- Healthcare IT

- »

-

Cloud-based Dental Practice Management Software Market Report, 2030GVR Report cover

![Cloud-based Dental Practice Management Software Market Size, Share & Trends Report]()

Cloud-based Dental Practice Management Software Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Patient Communication, Billing & Insurance), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-922-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

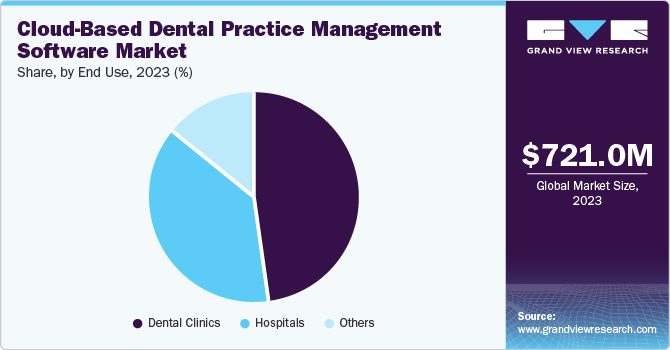

The global cloud-based dental practice management software market size was valued at USD 721.0 million in 2023 and is projected to grow at a CAGR of 11.4% from 2024 to 2030. The dental industry is fueled by the growing need for effective dental practice management solutions that enhance workflow efficiency and patient care. The market expansion is propelled by ongoing technological advancements in the sector, positive government initiatives in the oral healthcare industry, and a growing number of dental practices.

In the U.S., the Health Information Technology for Economic and Clinical Health (HITEC) Act plays a crucial role in promoting and expediting the adoption of health information technology. Its primary objective is to enhance healthcare delivery and provide patients with top-notch services.

Healthcare IT systems, especially in specialized dental offices, are anticipated to increase insurance coverage. Over the past few years, dental clinics have witnessed a rise in patient visits. The increase in dental clinics can be credited to the growing awareness and the need for oral healthcare. Additionally, the upward trajectory of cosmetic dentistry is expected to boost the demand for DPM platforms. These factors are expected to drive the demand for oral treatments in the future, leading to the adoption of cloud-based dental practice management (DPM) software.

In recent years, there has been a surge in dental appointments. This can be attributed to the rise in the prevalence of cavities and other oral issues and the rise in consciousness regarding oral care and hygiene. The shift in dietary habits towards fast and sugary foods has contributed to the rising oral problems. According to the National Center for Health Statistics, dental caries affects 13% of children and 26% of adults in the U.S. This is expected to drive cloud-based DPM software market growth.

The rise in patient volume at dental clinics has posed challenges for dentists regarding scheduling appointments and managing patient data, highlighting the need for DPM software such as Dentrix Ascend, Tab32, and other solutions. The recent surge in oral health awareness has resulted in more frequent preventive dental visits every six months in many countries. The growing consciousness about oral health and the subsequent increase in patient visits are key drivers propelling the market forward.

Application Insights

The insurance management software segment dominated with a market share of 23.9% in 2023. Dental offices face the challenges of dealing with numerous insurance providers with unique policies and requirements as demand for effective insurance claim processing and revenue cycle management in dental practices continues to rise. Cloud-based insurance management software has emerged to simplify claims procedures and monitor payments and disbursals. This software plays a vital role in maintaining the financial stability of dental practices. Moreover, these software solutions often integrate seamlessly with the electronic health record (EHR) systems, facilitating smooth data exchange and alleviating administrative burdens on dental staff.

The payment processing segment is anticipated to witness a steady CAGR during the forecast period. The segment growth can be attributed to several key factors. Firstly, there has been significant growth in the adoption of business intelligence tools, which has empowered dentists to gain valuable insights for their patients. Additionally, the rising number of tertiary oral hospitals has contributed to the expansion of this segment. Lastly, the rise in the spending capacity of the population has enabled them to access premium services easily. As a result, many DPM software companies are now offering business intelligence solutions to assist dentists in optimizing their resources and maximizing revenue generation.

End Use Insights

The dental clinics segment is the leading segment, accounting for 47.8% of the market in 2023 due to the growing number of clinics and rising adoption of EHRs. Major dental support organizations such as Heartland Dental, Aspen Dental, and Great Expressions Dental Centers oversee approximately 250 to 1,000 practices each. These organizations are broadening their reach by acquiring smaller practices. While this consolidation may limit the overall market, the mergers and acquisitions between small practices and larger entities is fueling the segment growth.

With their robust infrastructure, hospitals attract a significant number of patients, and to effectively handle this patient volume and facility, hospitals are investing heavily in advanced cloud-based DPM software. Based on cloud technology, this software offers ample storage capacity through servers, enabling the storage of vast amounts of patient data - making it particularly suitable for large hospitals with high patient volumes. Cloud-based DPM software also provides business analysis on a monthly or annual basis, leading to the development of effective treatment plans. Solo dental practitioners can use this information to optimize their resources and finances.

Regional Insights

North America cloud-based dental practice management software market dominated with a share of 47.7% in 2023. The strategic presence of major players such as Henry Schein One & Curve Dental and the rapid adoption of oral care services by baby boomers are the key factors responsible for the regional market growth.

Asia Pacific Cloud-based Dental Practice Management Software Market Trends

Asia Pacific cloud-based dental practice management software market is expected to witness significant expansions in the foreseeable future. The market growth is supported by the increasing investments made by healthcare IT companies in the region and the improving economic conditions and healthcare infrastructure. Notably, China is anticipated to witness substantial growth during the forecast period, attributed to the rise in the elderly population, higher expenditure on oral care, and the rapid adoption of cutting-edge technologies.

Key Cloud-based Dental Practice Management Software Company Insights

Mergers, acquisitions, and various innovative technological solutions contribute to the large share captured by a few industry giants. The market is projected to grow due to partnerships and acquisitions aimed at moving into cloud.

-

Dentiflow is a software company specializing in cloud-based solutions for dental practices. The company’s platform integrates various aspects of dental practice management, including appointment scheduling, patient records, billing, and treatment planning. Recently, the company has been focusing on expanding its feature set to include more advanced analytics and reporting tools, helping dental practices make data-driven decisions.

-

Dentidesk is a cloud-based dental practice management software company offering solutions for dental professionals. DENTIDESK's software is known for its user-friendly interface and accessibility, allowing dental staff to access and manage practice information from any device with an internet connection. The company focuses on tools that enhance practice efficiency, improve patient communication, and facilitate better financial management for dental offices.

Key Cloud-Based Dental Practice Management Software Companies:

The following are the leading companies in the cloud-based dental practice management software market. These companies collectively hold the largest market share and dictate industry trends.

- Dentiflow

- DENTIDESK

- CD Newco, LLC

- Tab32

- Henry Schein One, LLC

- Planet DDS

- Good Methods Global Inc

- Carestream Dental LLC

Recent Developments

-

In June 2024, CA-Tab32, a prominent cloud-based dental practice management platform, recently obtained SOC 2 attestation. This attestation serves as an independent assessment and external audit, affirming that the company effectively upholds the security commitments it offers to its valued customers.

-

In November 2022, Pearl, the provider of dental AI solutions worldwide, and Curve Dental, a well-known cloud-based dental software firm, collaborated to incorporate Pearl's Second Opinion disease detection features into Curve Dental's comprehensive Superhero practice management platform. This partnership between Pearl and Curve offers a wide array of FDA-cleared clinical AI capabilities to the 70,000 users of Curve across the U.S. and Canada.

Cloud-Based Dental Practice Management Software Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 800.1 million

Revenue forecast in 2030

USD 1.53 billion

Growth Rate

CAGR of 11.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2018 to 2030

Report coverage

Revenue forecast; company share; competitive landscape; growth factors and trends

Segments covered

Application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Australia; Thailand; South Korea; Malaysia; Brazil; Argentina; UAE; South Africa; Kuwait; Saudi Arabia

Key companies profiled

Dentiflow; Dentidesk; Cd Nevco, LLC (Curve Dental); Tab32; Henry Schein One; Planet DDS; Carestack; Carestream Dental LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country; regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cloud-Based Dental Practice Management Software Market Report Segmentation

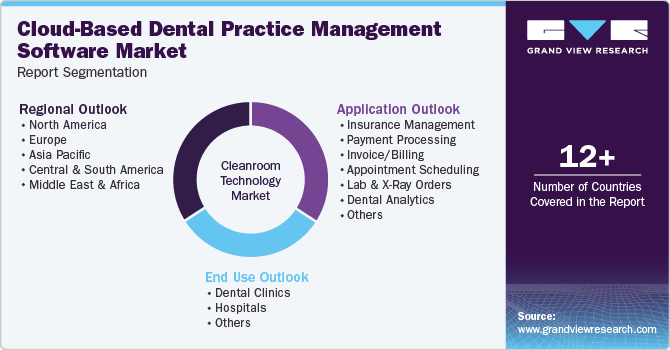

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global cloud-based dental practice management software market report based on application, end use, region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Insurance Management

-

Payment Processing

-

Invoice/Billing

-

Patient Record Management

-

Appointment Scheduling

-

Treatment Planning and Charting

-

Lab & X-Ray Orders

-

Dental Analytics

-

Digital Imaging and Radiography Integration

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Dental Clinics

-

Hospitals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.