- Home

- »

- Next Generation Technologies

- »

-

Cloud Compliance Market Size, Share, Industry Report, 2030GVR Report cover

![Cloud Compliance Market Size, Share & Trends Report]()

Cloud Compliance Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Software, Services), By Application (Audit And Compliance Management), By Model, By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-577-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cloud Compliance Market Summary

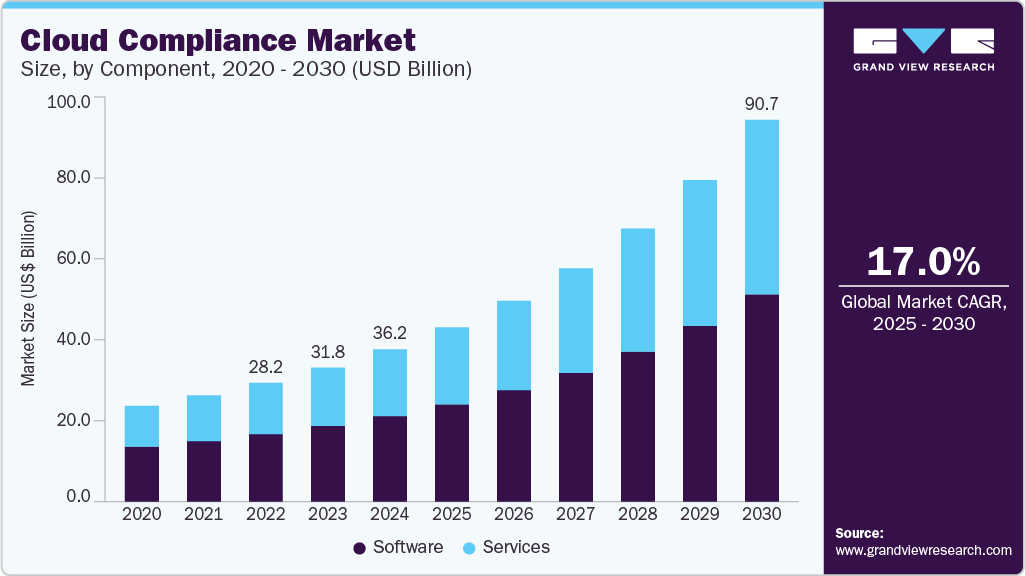

The global cloud compliance market size was estimated at USD 36.16 billion in 2024 and is expected to reach USD 90.67 billion by 2030, growing at a CAGR of 17.0% from 2025 to 2030. The growing regulatory landscape is a major driver of the market growth.

Key Market Trends & Insights

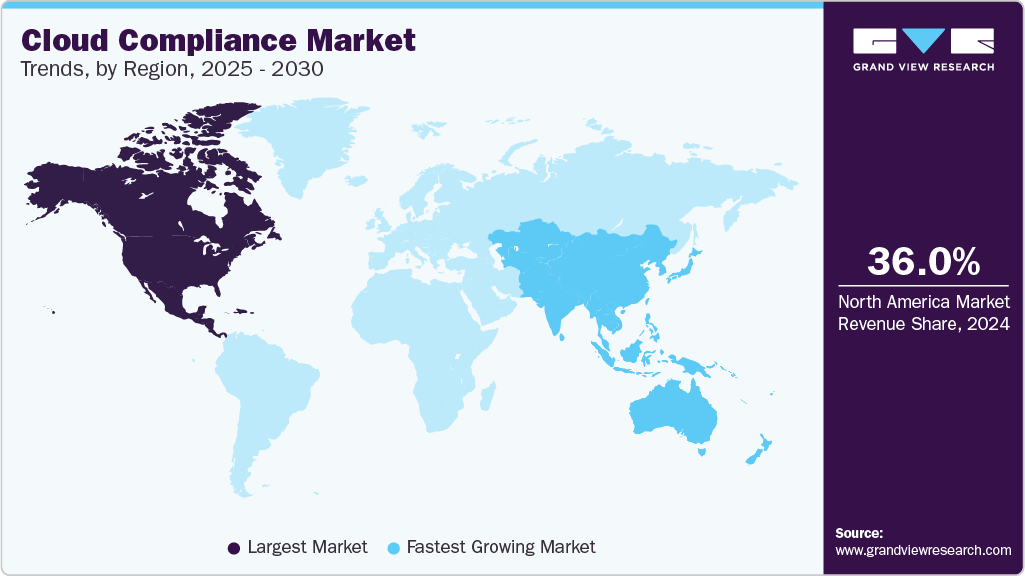

- The North America cloud compliance industry held a global share of over 36.0% in 2024.

- The U.S. cloud compliance industry is projected to grow during the forecast period.

- Based on component, the software segment held the largest market share of over 56.0% in 2024.

- Based on application, the audit and compliance management segment dominated the market with a revenue share of over 34.0% in 2024.

- Based on model, the software-as-a-service (SaaS) segment held the largest market share of over 51.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 36.16 billion

- 2030 Projected Market Size: USD 90.67 Billion

- CAGR (2025-2030): 17.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

As governments and regulatory bodies around the world enact stricter data protection and privacy laws, such as the General Data Protection Regulation (GDPR) in the European Union and the California Consumer Privacy Act (CCPA) in the U.S. Organizations are under increasing pressure to comply with these regulations. Cloud service providers are expected to offer solutions that help businesses meet these compliance requirements. The complexities associated with maintaining compliance in a cloud environment, particularly across multiple jurisdictions, have led to a rising demand for cloud compliance solutions that can help businesses manage their legal obligations and avoid penalties for non-compliance.The increased adoption of cloud computing is another key driver fueling the demand for cloud compliance solutions. As more organizations move their workloads to the cloud, they face new challenges related to managing compliance across diverse cloud environments. Cloud compliance solutions offer organizations the tools they need to ensure that their cloud environments meet industry standards and regulatory requirements, making it easier for companies to adopt cloud technologies without compromising compliance. As businesses continue to migrate mission-critical applications and sensitive data to the cloud, they require robust compliance frameworks to ensure data security and privacy.

The rise in cyber threats and data breaches is driving the cloud compliance industry. With an increasing number of cyberattacks targeting cloud environments, the need to ensure robust security measures has become paramount. Cloud compliance solutions play a critical role in mitigating the risk of data breaches by enforcing security policies, conducting audits, and ensuring that data protection mechanisms are in place as organizations face mounting pressure to protect customer data and avoid costly security incidents. Cloud compliance solutions offer a means to align security practices with industry standards and regulatory mandates.

The growing emphasis on data privacy and protection is another driver for the cloud compliance industry. As consumer awareness of data privacy issues rises, there is an increasing demand for organizations to implement stringent data protection measures, particularly in cloud environments. Data protection regulations, such as GDPR and the Health Insurance Portability and Accountability Act (HIPAA), require businesses to safeguard personal and sensitive data, and failure to comply with these regulations can result in heavy fines and reputational damage. Cloud compliance solutions help businesses ensure that they are meeting the necessary privacy and data protection standards, enabling them to operate in a secure and legally compliant manner.

Furthermore, cloud service providers’ compliance certifications are becoming an important consideration for businesses seeking cloud solutions. Many cloud providers are offering certifications for their services, ensuring that they meet specific regulatory and security standards. This is particularly important for businesses in highly regulated industries, such as finance, healthcare, and government, where compliance is not only a matter of legal obligation but also operational integrity. As more cloud providers offer compliance-specific features, businesses are more likely to adopt these solutions to simplify their compliance efforts and reduce the burden of managing compliance internally.

The growth of remote work is influencing the cloud compliance industry. With the global shift toward remote and hybrid work environments, organizations are relying more heavily on cloud-based tools and platforms to support collaboration, communication, and data access. As employees access sensitive data from various locations and devices, the need for strong cloud compliance practices has intensified. Companies are turning to cloud compliance solutions to secure their remote work environments, ensure proper access control, and meet regulatory requirements for data protection, particularly in industries that handle sensitive personal or financial information.

Component Insights

The software segment held the largest market share of over 56.0% in 2024. The complexity of multi-cloud and hybrid cloud environments is a major driver for cloud compliance software. Many organizations today are adopting multi-cloud or hybrid cloud strategies to avoid vendor lock-in and optimize their cloud infrastructure. However, managing compliance across multiple cloud platforms, each with its own set of tools, services, and security measures, can be extremely challenging. Cloud compliance software solutions designed for multi-cloud environments provide a centralized platform for managing compliance across disparate cloud providers, streamlining the process of maintaining regulatory compliance. These solutions enable businesses to implement consistent compliance policies across all cloud environments, reducing the risk of non-compliance and simplifying compliance audits.

The services segment is anticipated to register the fastest CAGR during the forecast period. The rise of cloud-native technologies, such as containerization and microservices, has introduced new compliance challenges for organizations. To address these challenges, companies are turning to services that offer security assessments, vulnerability management, and compliance automation tools, which help organizations maintain compliance without sacrificing operational efficiency. The demand for these specialized services is likely to increase as businesses continue to integrate more advanced cloud technologies into their operations.

Application Insights

The audit and compliance management segment dominated the market with a revenue share of over 34.0% in 2024. The move toward automation in compliance management is a significant driver for this segment. Automation tools help streamline the audit process by reducing the need for manual intervention, improving the accuracy and speed of compliance assessments, and providing businesses with real-time, actionable insights into their compliance status. As organizations increasingly look to integrate AI, machine learning, and automation into their operations, these technologies will play a crucial role in enhancing the efficiency and effectiveness of audit and compliance management processes.

The threat detection and remediation segment is anticipated to expand at a CAGR of 18.3% during the forecast period. The growing number of cyberattacks targeting cloud environments is driving the segment's growth. With more data being stored and processed in the cloud, attackers are increasingly targeting vulnerabilities in cloud infrastructure, applications, and services. The rise of sophisticated threats such as ransomware, advanced persistent threats (APTs), and insider threats has highlighted the need for advanced threat detection and response capabilities. As a result, organizations are investing in cloud-based threat detection solutions that can identify suspicious activities, anomalies, and potential vulnerabilities in real time, helping them to respond quickly to prevent or minimize the impact of security breaches.

Model Insights

The software-as-a-service (SaaS) segment held the largest market share of over 51.0% in 2024. The expansion of the SaaS market itself is also a major driver for cloud compliance solutions. As organizations increasingly rely on SaaS providers for a variety of business functions, ranging from customer relationship management (CRM) to enterprise resource planning (ERP), the need for robust compliance features within these applications is growing. SaaS providers are responding to this demand by embedding compliance frameworks and security protocols directly into their services, allowing customers to meet regulatory requirements more effectively. In addition, the ability of SaaS providers to continuously update and improve their compliance tools ensures that businesses can stay ahead of evolving regulations, making SaaS a valuable solution for organizations navigating the complexities of cloud compliance.

The infrastructure-as-a-service (IaaS) segment is anticipated to grow at a CAGR of 18.3% during the forecast period. The complexity of managing compliance in a multi-cloud environment is another driver of this segment's growth. Many businesses adopt multi-cloud strategies to avoid vendor lock-in and optimize their cloud infrastructure for different workloads. This complexity increases the need for centralized compliance management solutions that can span multiple IaaS providers. These solutions help organizations monitor their infrastructure and data across different cloud platforms, ensuring compliance is maintained throughout their entire cloud ecosystem. As the adoption of multi-cloud environments continues to rise, the demand for effective compliance tools and solutions for IaaS will grow correspondingly.

Enterprise Size Insights

The large enterprises segment held the largest market share of over 56.0% in 2024. The need for advanced threat detection and risk management is another significant driver for large enterprises in adopting cloud compliance solutions. With the increasing frequency and sophistication of cyberattacks, including data breaches and ransomware, large enterprises are focusing more on strengthening their security posture within the cloud. Cloud compliance tools now offer integrated threat detection capabilities that automatically identify and address vulnerabilities across complex infrastructures, reducing the potential for a security incident that could compromise sensitive data. This proactive approach to security and compliance helps large enterprises mitigate risks, meet regulatory obligations, and avoid disruptions to business operations.

The small and medium enterprises (SMEs) segment is expected to register the fastest CAGR during the forecast period. SMEs are increasingly aware of the benefits of outsourcing compliance management to cloud service providers with specialized expertise. Many cloud compliance solutions offer integrated security features, such as encryption, identity and access management, and audit logs. These help SMEs protect sensitive data and maintain compliance across multiple regulatory frameworks. The expertise and automation that these solutions provide help reduce the burden on SMEs, allowing them to focus on their core operations while remaining compliant with evolving regulations.

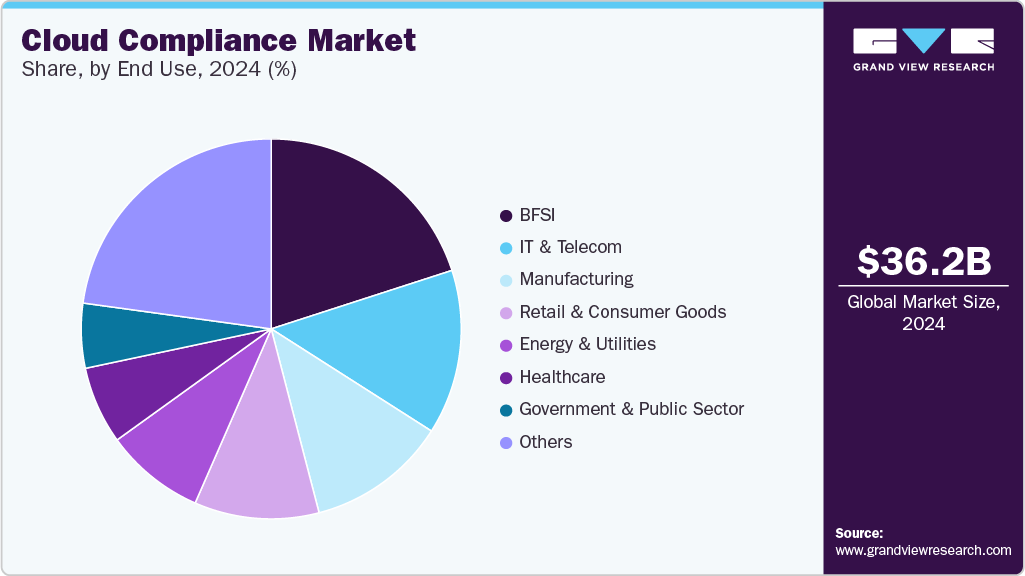

End Use Insights

The BFSI segment dominated the market with a revenue share of over 20.0% in 2024. The rise of remote work and the digitalization of services has further accelerated the need for cloud compliance solutions in the BFSI industry. As more employees work remotely and clients demand 24/7 access to banking and insurance services, organizations must ensure that cloud environments are functional and secure, and compliant. The pandemic has heightened the focus on securing cloud-based systems to mitigate the risks associated with remote work, such as unauthorized access to sensitive information or non-compliance with regulations due to misconfigurations.

The manufacturing segment is anticipated to grow at a CAGR of 20.3% during the forecast period. The growing use of Internet of Things (IoT) devices in manufacturing has also been a major driver for cloud compliance. IoT devices generate massive amounts of real-time data, which is increasingly stored in the cloud for analysis and decision-making. These devices, ranging from sensors on production lines to connected machines, collect valuable insights into the performance, condition, and quality of equipment and products. Cloud solutions must ensure that this data is stored securely and remains compliant with relevant regulations, such as data privacy laws or industry-specific safety standards. Manufacturers need cloud platforms that can handle large-scale data storage while offering robust compliance features that support traceability and auditability, ensuring adherence to regulatory guidelines.

Regional Insights

The North America cloud compliance industry held a global share of over 36.0% in 2024. Digital transformation initiatives contribute to the growth of the regional market. As businesses modernize their operations and migrate legacy systems to the cloud, they often encounter challenges in ensuring that their new cloud-based systems are compliant with existing industry regulations and security protocols. This digital transformation involves not only shifting workloads to the cloud but also rethinking how data is managed, accessed, and protected. Companies are seeking cloud compliance solutions that can ensure their digital transformation is executed securely and in compliance with the relevant regulations, especially when it comes to highly regulated industries like healthcare, finance, and manufacturing.

U.S. Cloud Compliance Market Trends

The U.S. cloud compliance industry is projected to grow during the forecast period. The rise of cloud-native applications and DevOps practices is driving market growth. Cloud-native development, which leverages microservices, containers, and serverless computing, is gaining momentum as organizations seek to modernize their applications for scalability and flexibility. DevOps practices, which emphasize continuous integration and continuous delivery (CI/CD), are becoming standard in cloud application development. Cloud compliance solutions are evolving to support these agile environments by automating compliance checks and integrating compliance controls directly into the development pipeline. By embedding compliance into the DevOps process, businesses can ensure that applications remain compliant throughout their lifecycle, even as they scale and evolve rapidly.

Europe Cloud Compliance Market Trends

The cloud compliance industry in Europe is anticipated to grow significantly during the forecast period. The globalization of European businesses drives the growth of the cloud compliance industry. As European organizations expand their operations internationally, they must comply with various regulatory frameworks outside the EU, such as the California Consumer Privacy Act (CCPA) in the U.S. and other regional data protection laws. To effectively manage cross-border data transfers and ensure compliance across multiple jurisdictions, companies require cloud compliance solutions that can handle multiple regulatory environments simultaneously. These solutions allow businesses to meet the different compliance requirements of various countries, helping them avoid legal and financial risks while maintaining global operations.

The cloud compliance industry in the UK is anticipated to grow during the forecast period. The increasing use of third-party vendors and SaaS solutions is driving the demand for cloud compliance solutions in the UK. As businesses increasingly rely on external service providers for critical functions such as software-as-a-service (SaaS), infrastructure-as-a-service (IaaS), and platform-as-a-service (PaaS), they must ensure that these third-party providers comply with the same rigorous standards they are required to meet. Organizations are adopting cloud compliance platforms that enable them to assess and monitor the compliance posture of their third-party vendors, ensuring that their cloud ecosystems are secure and compliant. This third-party risk management is particularly important in highly regulated sectors like finance and healthcare, where compliance failures by a vendor can result in significant legal and financial repercussions for the organization.

The cloud compliance industry in Germany is growing significantly during the forecast period. The rise of cloud marketplaces and hybrid cloud architectures is further driving the demand for cloud compliance solutions. Many businesses in Germany are adopting hybrid cloud environments, combining on-premises data centers with public and private cloud services. This hybrid approach allows for greater flexibility and scalability, but also creates additional challenges in maintaining compliance across multiple platforms. Hybrid environments often involve managing different regulatory requirements for data stored both on-premises and in the cloud. Cloud compliance platforms are addressing this need by offering tools that can seamlessly manage compliance across both private and public cloud environments, ensuring that businesses can meet diverse regulatory requirements, including those related to data residency, privacy, and security.

Asia Pacific Cloud Compliance Market Trends

The cloud compliance industry in Asia Pacific is expected to grow at the fastest CAGR of 19.1% from 2025 to 2030. The increase in cross-border data flows within the APAC region is another key driver of cloud compliance. As APAC becomes an increasingly interconnected market, businesses are dealing with data that crosses national borders, making it essential to navigate the various regulatory frameworks across the region. The Asia-Pacific Economic Cooperation (APEC) has been working on harmonizing data protection standards across its member countries. Countries like Australia and Singapore have data residency requirements, which stipulate that certain data must remain within their borders. Cloud compliance solutions are crucial in managing these complex data flows, ensuring that businesses comply with local data sovereignty laws while maintaining efficient cross-border operations.

The cloud compliance industry in China is projected to grow during the forecast period. The growth of e-commerce and financial services in China is also driving cloud compliance adoption. China is a hub for some of the world’s largest e-commerce and financial companies, and these industries handle vast amounts of personal and financial data, which are subject to strict regulatory requirements. In addition, the rise of digital payments and mobile banking in China has made it necessary for companies in the fintech sector to adopt cloud compliance solutions that adhere to both security and regulatory standards. These solutions help organizations in the financial services sector ensure that their cloud environments meet the specific requirements of China’s financial regulations, ensuring both data protection and compliance.

The cloud compliance industry in India is projected to grow during the forecast period. The increased adoption of cloud services across various industries in India is another key driver of cloud compliance. India has become one of the fastest-growing markets for cloud services, with businesses across sectors like banking, finance, healthcare, e-commerce, and manufacturing leveraging cloud solutions to enhance operational efficiency, scalability, and innovation. As businesses migrate to the cloud, they must ensure that they comply with industry-specific regulations and standards. For example, the Reserve Bank of India (RBI) has issued guidelines for the financial sector that require financial institutions to adopt appropriate security measures when using cloud services. These industry-specific requirements are pushing businesses to adopt cloud compliance solutions that help them meet regulatory standards while benefiting from the flexibility and cost-efficiency of the cloud.

Key Cloud Compliance Company Insights

Some of the key companies operating in the market include Microsoft Corporation, IBM Corporation, and AT&T, among others. These are some of the leading participants in the cloud compliance industry.

-

Microsoft Corporation is a global technology company. Microsoft offers products and services across various domains, including operating systems, productivity software, cloud computing, and artificial intelligence. Its flagship cloud platform, Azure, competes with other major providers like Amazon Web Services (AWS) and Google Cloud, delivering a comprehensive suite of cloud services to businesses worldwide. As organizations increasingly migrate to the cloud, compliance with regulatory standards becomes paramount. Microsoft addresses this need through a robust framework designed to help customers meet various legal, regulatory, and industry-specific requirements.

-

AT&T Inc. is a prominent American telecommunications and media conglomerate. The company offers a comprehensive range of services, including wireless communications, broadband, digital television, and cloud solutions, catering to both consumer and business markets. AT&T's cloud compliance strategy is integral to its business operations, especially as it provides cloud services to enterprises and government entities. The company emphasizes a multi-layered approach to cybersecurity, encompassing monitoring, active prevention, and rapid response to security threats. This approach is supported by tools such as near-real-time data correlation, situational awareness reporting, and predictive security alerting.

ClearDATA and Nutanix are some of the emerging market participants in the cloud compliance industry.

-

ClearDATA is a privately held company specializing exclusively in healthcare. ClearDATA offers cloud security and compliance software and services designed to protect sensitive healthcare data. The company's flagship solution, the CyberHealth Platform, provides cloud security posture management (CSPM), managed detection and response (MDR), and continuous compliance monitoring tailored to the unique needs of the healthcare industry.

-

Nutanix is an American enterprise cloud computing company. Nutanix has evolved into a comprehensive provider of hybrid and multi-cloud solutions. The company's platform integrates computing, storage, networking, and virtualization into a unified software-defined architecture, enabling organizations to run applications and manage data seamlessly across on-premises data centers, public clouds, and edge environments. As enterprises increasingly adopt cloud technologies, ensuring compliance with various regulatory standards becomes paramount. Nutanix addresses this need through its robust cloud compliance framework, which encompasses a range of certifications and adherence to industry best practices.

Key Cloud Compliance Companies:

The following are the leading companies in the cloud compliance market. These companies collectively hold the largest market share and dictate industry trends:

- Amazon Web Services (AWS)

- AT&T

- Cisco Systems, Inc.

- ClearDATA

- Google LLC

- IBM Corporation

- Microsoft Corporation

- Nutanix

- Oracle Corporation

- Palo Alto Networks

- Qualys

Recent Developments

-

In April 2025, DNX Solutions partnered with Amazon Web Services (AWS) by entering into two new Strategic Collaboration Agreements (SCAs) aimed at empowering businesses to leverage generative AI technologies and drive VMware modernization. As an AWS Premier Tier Consulting Partner, DNX Solutions is now firmly positioned as a leading provider of transformative AI solutions, utilizing services like Amazon Bedrock, Amazon Q, and Amazon SageMaker. Specializing in modernizing infrastructure and applications, DNX maintains a strong emphasis on cloud security, cloud compliance, and delivering practical results. The new SCAs formalize and expand DNX’s collaboration with AWS through joint go-to-market strategies, technical enablement, and co-funded project initiatives.

-

In March 2025, Experis signed a strategic partnership with ClearDATA. Through this collaboration, Experis will have reseller rights to ClearDATA’s CyberHealth Platform and Managed Services advanced solutions, recognized for their HITRUST certification and HIPAA compliance. These offerings provide top-tier cloud security posture management and Managed Detection & Response capabilities.

-

In February 2025, Palo Alto Networks launched Cortex Cloud, the latest development of Prisma Cloud. This new offering seamlessly integrates updated versions of its leading cloud detection and response (CDR) and cloud native application protection platform (CNAPP) capabilities within the unified Cortex platform. By rebuilding its cloud security solution on the AI-powered Cortex SecOps platform, Palo Alto Networks advances its platformization strategy, delivering a robust, unified user experience enhanced with persona-driven dashboards and workflows.

Cloud Compliance Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 41.39 billion

Revenue forecast in 2030

USD 90.67 billion

Growth Rate

CAGR of 17.0% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, application, model, enterprise size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Microsoft Corporation; IBM Corporation; AT&T; Oracle Corporation; Qualys; Nutanix; Amazon Web Services, Inc.; Google LLC; Cisco Systems, Inc.; Palo Alto Networks; ClearDATA

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cloud Compliance Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cloud compliance market report based on component, application, model, enterprise size, end use, and region.

-

Cloud Compliance Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Cloud Compliance Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Audit and Compliance Management

-

Threat Detection and Remediation

-

Activity Monitoring and Analytics

-

Visibility and Risk Assessment

-

Others

-

-

Cloud Compliance Model Outlook (Revenue, USD Million, 2018 - 2030)

-

Infrastructure-as-a-Service (IaaS)

-

Platform-as-a-Service (PaaS)

-

Software-as-a-Service (SaaS)

-

-

Cloud Compliance Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small and Medium Enterprises

-

-

Cloud Compliance End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

IT & Telecom

-

Retail & Consumer Goods

-

Manufacturing

-

Energy & Utilities

-

Healthcare

-

Government & Public Sector

-

Others

-

-

Cloud Compliance Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The cloud compliance market size was estimated at USD 36.16 billion in 2024 and is expected to reach USD 41.39 million in 2025.

b. The cloud compliance market is expected to grow at a compound annual growth rate of 17.0% from 2025 to 2030 to reach USD 90.67 billion by 2030

b. North America held the major share of 36.6% of the cloud compliance industry in 2024. Digital transformation initiatives contribute to the growth of the cloud compliance market.

b. Some key players operating in the market include Microsoft Corporation, IBM Corporation, AT&T, Oracle Corporation, Qualys, Nutanix , Amazon Web ServicesInc., Google LLC, Cisco Systems, Inc., Palo Alto Networks, ClearDATA

b. Factors such the growing regulatory landscape and increased adoption of cloud computing are anticipated to accelerate the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.