- Home

- »

- Next Generation Technologies

- »

-

Cloud FinOps Market Size & Share, Industry Report, 2033GVR Report cover

![Cloud FinOps Market Size, Share & Trends Report]()

Cloud FinOps Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Solution, Services), By Application (Cost Management & Optimization, Budgeting & Forecasting), By Deployment Mode, By Organization Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-622-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cloud FinOps Market Summary

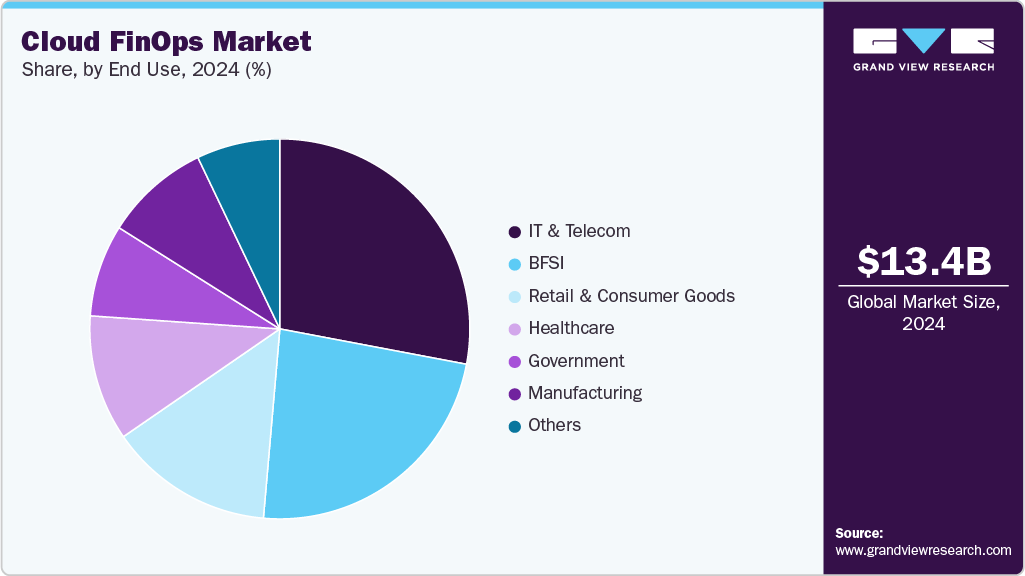

The global cloud FinOps market size was estimated at USD 13.40 billion in 2024 and is projected to reach USD 32.54 billion by 2033, growing at a CAGR of 11.0% from 2025 to 2033. A key driver of the cloud FinOps market is the growing emphasis on managing and optimizing cloud expenses, especially as organizations adopt pay-as-you-go models.

Key Market Trends & Insights

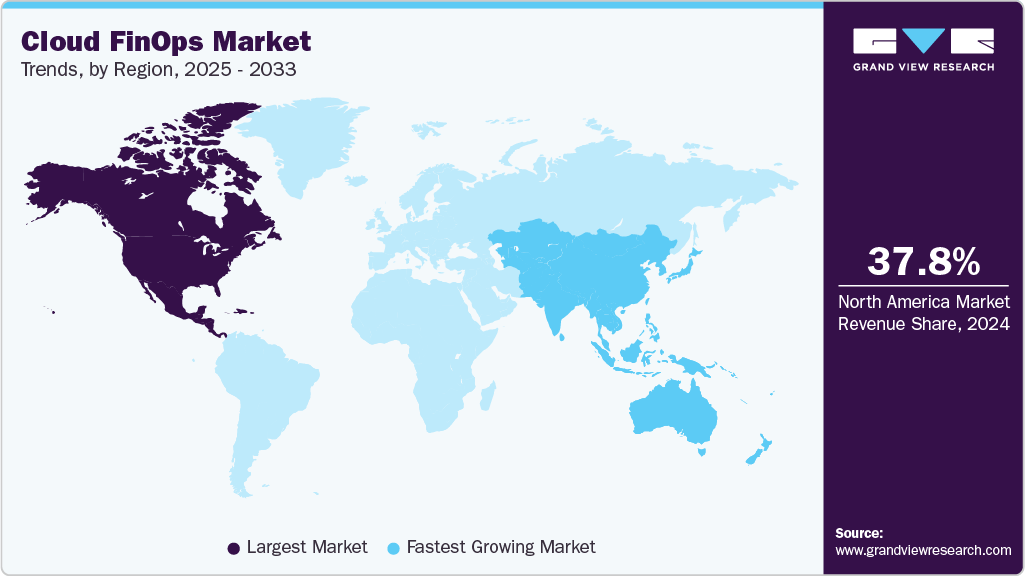

- North America cloud FinOps dominated the global market with the largest revenue share of over 37.8% in 2024.

- The cloud FinOps market in the U.S. led the North America market and held the largest revenue share in 2024.

- By component, solution segment led the market and held the largest revenue share in 2024.

- By end-use, the BFSI segment is expected to grow at the fastest CAGR of 11.7% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 13.40 Billion

- 2033 Projected Market Size: USD 32.54 Billion

- CAGR (2025-2033): 11.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

This billing structure often leads to unexpected costs, prompting businesses to seek FinOps solutions that enhance cost visibility, accountability, and efficient resource utilization across cloud environments. The exponential rise in cloud adoption across various industries has significantly increased the complexity of managing cloud-related expenses. With businesses leveraging public, private, and hybrid cloud environments, they are now encountering highly dynamic and unpredictable consumption patterns along with intricate and often opaque billing structures. These challenges make it difficult to monitor, control, and forecast cloud costs effectively.Consequently, organizations are turning to cloud FinOps tools to gain real-time visibility into their cloud usage and spending. These tools enable greater transparency and accountability across departments, helping stakeholders make informed decisions and collaborate efficiently. By leveraging cloud FinOps, enterprises can optimize resource utilization, reduce unnecessary expenditures, enforce governance policies, and ensure cloud investments are aligned with broader financial and strategic business objectives.

The growing adoption of multi-cloud strategies where organizations use multiple cloud providers has introduced new layers of complexity in managing costs and usage. Each provider has unique pricing models, billing formats, and performance metrics, making it difficult to track and control expenses across environments. This shift demands centralized financial governance to ensure visibility and accountability. As a result, FinOps practices have become essential, enabling organizations to standardize cost management, improve collaboration across teams, and optimize spending across diverse cloud platforms.

One of the key challenges in implementing FinOps lies in the significant cultural and organizational transformation it requires. As FinOps operates at the intersection of finance, engineering, and operations, successful adoption depends on cross-functional collaboration an area where many enterprises face resistance due to entrenched departmental silos. Aligning key performance indicators (KPIs) and fostering shared accountability across teams can be difficult. Additionally, the absence of standardized frameworks and tools often results in inconsistent implementation, leading to fragmented cost visibility and ineffective reporting.

Component Insights

The solution segment accounted for a revenue share of over 63.0% in 2024. The rapid adoption of multi-cloud and hybrid cloud architectures has introduced significant complexity in managing cloud environments, especially from a financial standpoint. Each cloud provider has unique billing models, usage metrics, and service structures, making manual cost tracking both time-consuming and error-prone.

As a result, organizations struggle to gain a unified view of cloud expenditures, leading to inefficiencies and overspending. FinOps solutions address this challenge by offering centralized dashboards, automated cost allocation, and real-time visibility across all cloud platforms. These tools enable finance, operations, and engineering teams to collaborate effectively, ensure accurate budgeting, and enhance accountability, making them indispensable for enterprises aiming to achieve financial governance in increasingly diverse cloud ecosystems.

The services segment is anticipated to grow at a significant CAGR of 13.0% during the forecast period. Many organizations, particularly small and mid-sized enterprises or legacy firms, lack the internal expertise required to implement and manage FinOps practices effectively. This skills gap creates strong demand for external service providers who offer consulting, training, governance frameworks, and strategic guidance. These managed services play a critical role in ensuring successful adoption, enabling organizations to optimize cloud spending and build a sustainable FinOps culture across finance, operations, and engineering teams.

Application Insights

The cost management & optimization segment accounted for the largest revenue share in 2024. As enterprises increasingly adopt cloud services to scale operations and enhance agility, they are encountering a sharp rise in cloud-related expenses. The dynamic, pay-as-you-go pricing models offered by cloud providers often lead to unanticipated costs, making budgeting and forecasting difficult.

Without proper controls, organizations face budget overruns and inefficiencies due to idle resources, overprovisioned instances, and a lack of visibility into usage patterns. This unpredictability has created a strong demand for cost management and optimization tools within FinOps platforms. These tools empower businesses with real-time insights, automated alerts, and actionable recommendations, enabling them to reduce waste, gain financial visibility, and establish governance mechanisms that align cloud spending with organizational goals and budgets.

The budgeting & forecasting segment is expected to register a significant CAGR during the forecast period. Cloud spending fluctuates significantly due to dynamic workloads and on-demand resource provisioning, making accurate budgeting a challenge for enterprises. Traditional financial planning tools often fall short in capturing this variability. FinOps platforms address this gap by offering advanced budgeting and forecasting capabilities that analyze usage patterns, predict future costs, and align expenditures with business objectives. This enables organizations to gain better financial control and optimize long-term cloud investment strategies.

Deployment Type Insights

The public cloud accounted for the largest revenue share in 2024. Organizations are rapidly shifting to public cloud platforms such as AWS, Microsoft Azure, and Google Cloud because these platforms offer unmatched scalability, flexibility, and cost-effectiveness compared to traditional IT infrastructure. Public clouds allow businesses to quickly scale resources up or down based on demand, support remote workforces, and reduce upfront capital expenses. However, the dynamic and usage-based billing models of public clouds create complexities in managing costs. This drives the need for FinOps tools that help organizations gain real-time visibility, enforce budgeting controls, and optimize cloud spending to maximize their return on investment.

The hybrid cloud segment is expected to grow at a significant CAGR during the forecast period. Organizations increasingly adopt hybrid cloud architectures by combining private and public clouds to achieve the right balance of control, security, and scalability. This approach allows sensitive data to remain on private clouds while leveraging the flexibility of public clouds for other workloads. However, managing the complex cost structures across these environments is challenging. As a result, dedicated FinOps management is essential to provide clear visibility, optimize spending, and ensure efficient financial governance in hybrid cloud setups.

Organization Size Insights

The large enterprises segment accounted for the largest revenue share in 2024. Large enterprises typically manage extensive and complex multi-cloud environments, hosting a wide variety of workloads across platforms like AWS, Azure, and Google Cloud. This complexity leads to challenging billing and cost management issues, as different cloud providers have unique pricing models and usage patterns. To navigate these complexities, advanced FinOps solutions are essential, providing comprehensive visibility and control over cloud spending.

Additionally, large enterprises usually have significant cloud budgets, making cost optimization a critical priority to avoid unnecessary overspending. FinOps tools help these organizations monitor expenses in real-time, identify inefficiencies, and implement cost-saving strategies, thereby enhancing overall financial efficiency and ensuring better allocation of cloud resources.

The SMEs segment is expected to grow at a significant CAGR during the forecast period. Small and medium-sized enterprises (SMEs) are increasingly adopting cloud services to benefit from scalable infrastructure and reduced upfront costs. This growing reliance on the cloud enables SMEs to quickly adjust resources based on demand while saving on capital expenses. However, managing and forecasting cloud expenses can be challenging for smaller organizations, driving a need for effective financial management solutions like FinOps to optimize spending, improve cost transparency, and ensure alignment with business budgets.

End Use Insights

The IT & Telecom segment accounted for the largest revenue share in 2024. Telecom companies are significantly investing in cloud infrastructure to support the growing demand for data and digital services. As consumers and businesses increasingly rely on cloud-based applications, streaming, and communication services, telecom providers must expand and upgrade their cloud capabilities to maintain performance and scalability.

For instance, in FY2024, Telecom Italia announced an investment worth USD 135 million to expand its data center network near Rome, enhancing its cloud infrastructure to handle higher traffic volumes and provide improved service reliability. Such investments reflect the critical role of cloud technology in IT & Telecom operations, driving the need for effective financial management tools like FinOps to optimize these substantial cloud expenditures and ensure cost efficiency.

The BFSI segment is expected to grow at a significant CAGR during the forecast period. The BFSI sector is rapidly migrating to cloud platforms to improve operational efficiency, scalability, and business agility. Cloud adoption enables faster innovation and flexible resource management, but also introduces complex and variable costs. To manage these expenses effectively, financial institutions require strong cloud financial management practices. Implementing FinOps helps them monitor, control, and optimize cloud spending, ensuring budgets are aligned with business goals while maximizing the value of their cloud investments.

Regional Insights

North America cloud FinOps market dominated and represented a revenue share of 37.8% in 2024. North America’s early and widespread adoption of cloud technologies, driven by major providers like AWS, Microsoft, and Google, has created a mature cloud ecosystem. This leadership enables organizations to leverage advanced cloud services and face complex cost management challenges. As a result, many enterprises in the region are increasingly adopting FinOps practices to gain better visibility, control, and optimization of their cloud spending, ensuring efficient use of resources and improved financial outcomes.

U.S. Cloud FinOps Market Trends

The cloud FinOps market in the U.S. is expected to grow significantly from 2025 to 2033. The U.S. federal government allocated approximately USD 60 billion to cloud services in 2023, recognizing the potential of FinOps to save up to USD 1 billion annually. Such investments underscore the importance of effective cloud financial management in public sector operations.

Europe Cloud FinOps Market Trends

The cloud FinOps marketin Europe is expected to grow at a CAGR of 11.0% from 2025 to 2033. According to Eurostat, 45.2% of enterprises across Europe adopted cloud computing services in 2023, reflecting a 4.2 percentage point increase from 2021. This widespread adoption across various sectors necessitates robust financial management practices to optimize cloud expenditures.

The UK cloud FinOps market is expected to grow rapidly in the coming years. UK businesses are increasingly migrating to cloud platforms like AWS, Azure, and Google Cloud to enhance scalability and agility. This widespread adoption necessitates effective financial management practices to optimize cloud expenditures. For instance, UK-based organizations are progressively embracing cloud solutions, with platforms such as SAP, AWS, Azure, and Google Cloud becoming integral to their operations. However, the complexity of cloud billing and the need for cross-functional collaboration make adopting a Cloud FinOps model essential to address these challenges.

The Germany cloud FinOps market held a substantial revenue share in 2024. German enterprises across sectors like finance, healthcare, and manufacturing are undergoing digital transformation, increasing their reliance on cloud services. This shift necessitates effective financial management to control and optimize cloud spending, driving the adoption of Cloud FinOps practices.

Asia Pacific Cloud FinOps Market Trends

The cloud FinOps market in the Asia Pacific is expected to be the fastest growing region, with a CAGR of 12.4% from 2025 to 2033. Countries like China, India, Japan, and Southeast Asian nations are experiencing a surge in cloud adoption due to rapid digital transformation across industries such as telecom, retail, and manufacturing. This expansion increases the complexity of cloud expenditures, necessitating robust financial management solutions like Cloud FinOps to optimize costs and enhance visibility.

The China cloud FinOps market held a substantial revenue share in 2024. China’s “Digital China” policy mandates cloud adoption among SMEs, emphasizing strict cost accountability. Additionally, data sovereignty laws like PIPL and CSL necessitate hybrid cloud deployments, driving demand for FinOps tools that can manage and optimize costs across diverse cloud environments while ensuring regulatory compliance and financial transparency.

The Japan cloud FinOps market held a substantial revenue share in 2024. Leading tech companies are investing heavily in Japan's cloud infrastructure. For instance, Oracle plans to invest over USD 8 billion in Japan over the next decade to address the rising demand for artificial intelligence (AI) and cloud infrastructure. Similarly, Microsoft is planning to invest USD 2.9 billion in AI data centers in Japan by 2025, marking its largest investment in the country. These investments underscore the growing demand for cloud services and the need for effective financial operations management.

India cloud FinOps market is growing due to India’s Digital India initiative that promotes widespread cloud adoption while emphasizing financial accountability. Additionally, RBI guidelines mandate that banks using cloud services maintain audit-ready cost tracking and financial transparency. These regulations are driving demand for cloud FinOps solutions that offer detailed cost visibility, compliance, and optimized financial operations.

Key Cloud FinOps Company Insights

The key market players in the global cloud FinOps market include Amazon Web Services (AWS), Flexera, Google, HCL Technologies, IBM Corporation, Microsoft Corporation, Oracle, SAP, ServiceNow, VMware, Alibaba Cloud, and CloudBolt Software, Inc. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In March 2025, Flexera completed the acquisition of Spot from NetApp, enhancing its Cloud Financial Management offerings. This acquisition integrates AI-powered FinOps technologies, including Spot Eco, Ocean, Elastigroup, and CloudCheckr, into Flexera's portfolio. The expanded suite enables organizations and managed service providers to manage cloud financial commitments, automate billing and invoicing, reduce workload costs, and optimize containers, addressing growing cloud cost and usage challenges, particularly in AI-driven environments.

-

In December 2024, AWS introduced Custom Billing Views within its Billing and Cost Management suite. This feature enables organizations to create tailored cost and usage views for specific stakeholders, such as application or business unit owners, without granting them access to the management account. Users can filter data by cost allocation tags or specific AWS accounts and share these views using AWS Resource Access Manager. This approach supports decentralized cloud cost management and enhances financial transparency across multiple AWS accounts.

-

In January 2024, CloudBolt announced the launch of its Augmented FinOps capabilities to enhance cloud financial management. These advancements leverage AI and machine learning to provide real-time cost insights, automate decision-making, and unify control across public and private clouds. The goal is to shift organizations from a "Cloud First" to a "Cloud Right" approach, optimizing cloud ROI throughout the entire resource lifecycle.

Key Cloud FinOps Companies:

The following are the leading companies in the cloud FinOps market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services (AWS)

- Flexera

- HCL Technologies

- IBM Corporation

- Microsoft Corporation

- Oracle

- SAP

- ServiceNow

- VMware

- CloudBolt Software, Inc.

Cloud FinOps Market Report Scope

Report Attribute

Details

Market size in 2025

USD 14.12 billion

Market Size forecast in 2033

USD 32.54 billion

Growth rate

CAGR of 11.0% from 2025 to 2033

Actual data

2021 - 2023

Base year estimation

2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Market Size forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, application, deployment mode, organization size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; and South Africa

Key companies profiled

Amazon Web Services (AWS); Flexera; Google; HCL Technologies; IBM Corporation; Microsoft Corporation; Oracle; SAP; ServiceNow; VMware; CloudBolt Software, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cloud FinOps Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global cloud FinOps marketreport based on component, application, deployment mode, organization size, end use, and region.

-

Component Outlook (Market Size, USD Billion, 2021 - 2033)

-

Solution

-

Native Solutions

-

Third-Party Solutions

-

-

Services

-

Professional Services

-

Managed Services

-

-

-

Application Outlook (Market Size, USD Billion, 2021 - 2033)

-

Cost Management & Optimization

-

Resource Allocation & Planning

-

Budgeting & Forecasting

-

Billing & Chargeback

-

Others

-

-

Deployment Mode Outlook (Market Size, USD Billion, 2021 - 2033)

-

Public Cloud

-

Private Cloud

-

Hybrid Cloud

-

-

Organization Size Outlook (Market Size, USD Billion, 2021 - 2033)

-

SMEs

-

Large enterprises

-

-

End Use Outlook (Market Size, USD Billion, 2021 - 2033)

-

Government

-

Consumer Goods and Retail

-

Healthcare

-

Banking, Financial Services, and Insurance (BFSI)

-

IT and Telecom

-

Manufacturing

-

Others

-

-

Regional Outlook (Market Size, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cloud finOps market size was estimated at USD 13.40 billion in 2024 and is expected to reach USD 14.11 billion in 2025.

b. The global cloud finOps market is expected to grow at a compound annual growth rate of 11.0% from 2025 to 2033 to reach USD 32.54 billion by 2033.

b. The solution segment accounted for a market share of over 63% in 2024. The rapid adoption of multi-cloud and hybrid cloud architectures has introduced significant complexity in managing cloud environments, especially from a financial standpoint. FinOps solutions address this challenge by offering centralized dashboards, automated cost allocation, and real-time visibility across all cloud platforms. These tools enable finance, operations, and engineering teams to collaborate effectively, ensure accurate budgeting, and enhance accountability, making them indispensable for enterprises aiming to achieve financial governance in increasingly diverse cloud ecosystems.

b. The key market players in the global cloud finOps market include Amazon Web Services (AWS), Flexera, Google, HCL Technologies, IBM Corporation, Microsoft Corporation, Oracle, SAP, ServiceNow, VMware, Alibaba Cloud, and CloudBolt Software, Inc.

b. A key driver of the cloud finOps market is the growing emphasis on managing and optimizing cloud expenses, especially as organizations adopt pay-as-you-go models. This billing structure often leads to unexpected costs, prompting businesses to seek FinOps solutions that enhance cost visibility, accountability, and efficient resource utilization across cloud environments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.