- Home

- »

- IT Services & Applications

- »

-

Cloud Microservices Market Size, Industry Report, 2033GVR Report cover

![Cloud Microservices Market Size, Share, & Trend Report]()

Cloud Microservices Market (2025 - 2033) Size, Share, & Trend Analysis By Component (Solution, Services), By Deployment (Public, Private, Hybrid), By Enterprise Size (Large Size Enterprise), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-678-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cloud Microservices Market Summary

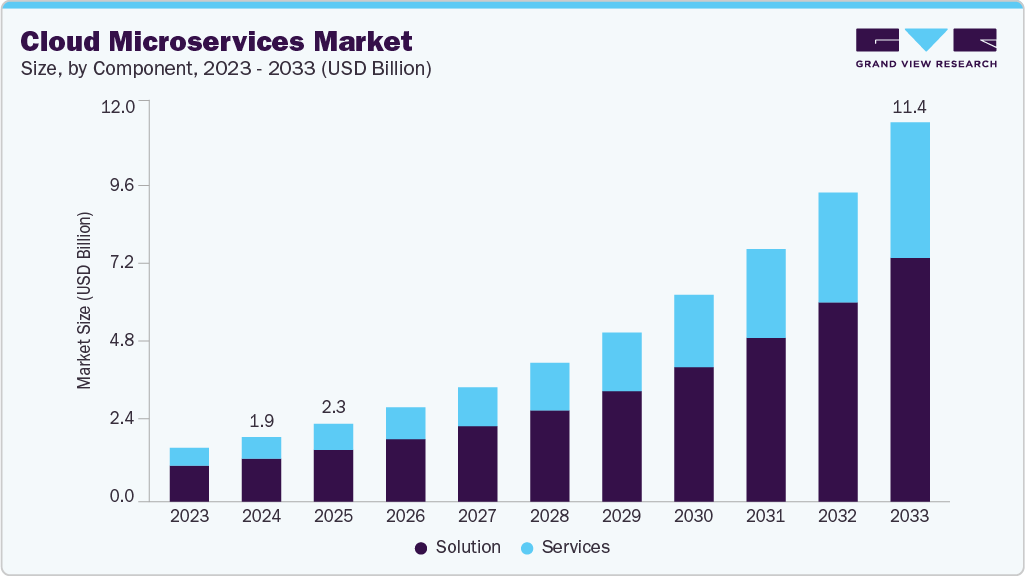

The global cloud microservices market size was estimated at USD 1.93 billion in 2024 and is projected to reach USD 11.36 billion by 2033, growing at a CAGR of 21.9% from 2025 to 2033. The market growth is attributed to the rapid transformation as enterprises shift from monolithic architectures to agile, modular, and cloud-native application environments.

Key Market Trends & Insights

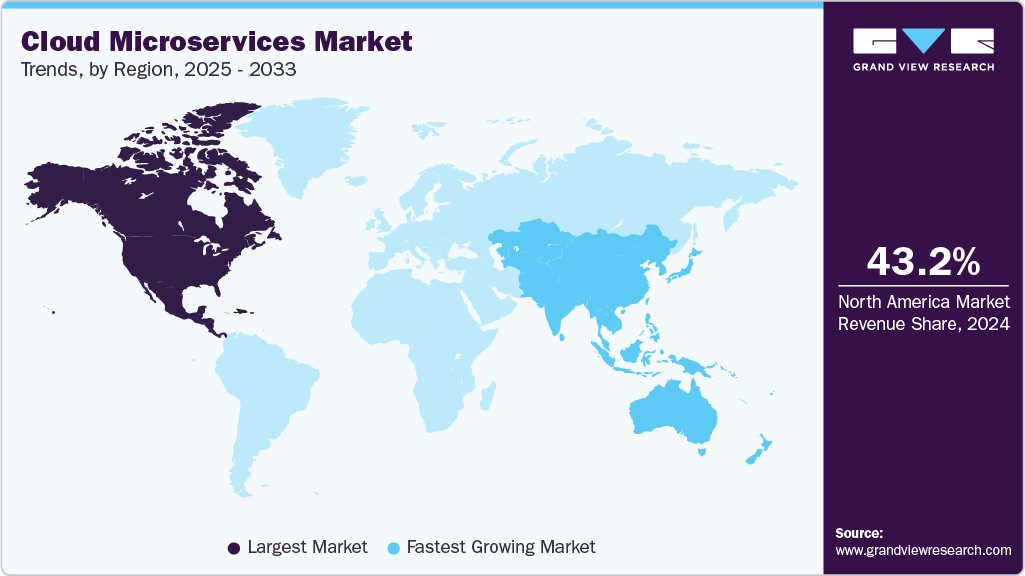

- North America dominated the market with the largest revenue share of 43.2% in 2024.

- The UK cloud microservices market is poised to grow at a significant CAGR from 2025 to 2033.

- By component, the solution segment led the market with the largest revenue share of 66.9% in 2024.

- By deployment, the public segment accounted for the largest market revenue share in 2024.

- By enterprise size, the large size enterprise segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.93 Billion

- 2033 Projected Market Size: USD 11.36 Billion

- CAGR (2025-2033): 21.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Organizations across various sectors, including IT, telecom, and BFSI, are moving toward decoupled service models that enable continuous delivery, real-time scalability, and faster innovation. This demand is fueled by the growing reliance on API-first development, container orchestration tools like Kubernetes, and DevOps methodologies. In addition, enterprises are also investing in microservices to improve system resiliency and reduce time-to-market, especially in response to evolving consumer expectations and competitive pressures. For instance, e-commerce platforms are leveraging microservices to support dynamic pricing engines, personalized shopping experiences, and multi-region deployment strategies with minimal downtime or reconfiguration.

Moreover, the cloud microservices industry is intersecting with advancements in confidential computing and AI-powered observability, as enterprises prioritize secure, scalable, and intelligent service operations. Businesses are integrating service mesh telemetry, AI-driven anomaly detection, and zero-trust policies into their microservices architecture to meet compliance, performance, and security demands. Therefore, to support these evolving needs, leading cloud providers are embedding confidential computing into their microservices platforms to protect data-in-use and enhance workload isolation.

For instance, in September 2023, Microsoft announced the availability of Azure Confidential Containers, allowing Kubernetes-based container workloads to run with full memory encryption and hardware-based isolation, ensuring end-to-end data confidentiality, even from cloud providers. This advancement enables enterprises to deploy sensitive microservices securely in highly regulated industries like finance and healthcare. Consequently, these innovations are positioning microservices platforms not only as tools for modularization and scale but also as trust-centric execution environments that support the next generation of secure, AI-enhanced applications.

Component Insights

The solution segment led the market with the largest revenue share of 66.9% in 2024, driven by increasing enterprise demand for scalable, modular platforms that enable rapid application development, deployment, and orchestration. These solutions, encompassing container management, API gateways, service mesh frameworks, and observability tools, are critical for supporting microservices-based architectures that prioritize agility, scalability, and real-time responsiveness. In addition, solution offerings provide repeatable, enterprise-wide functionality and long-term operational value, further contributing to the market share.

For instance, in March 2025, Tata Communications introduced CloudLyte Vayu. This AI-powered cloud-native platform enables intelligent enterprises to shift from monolithic systems to event-driven architectures through secure containerization, real-time analytics, and multi-cloud orchestration. Subsequently, such innovations highlight the growing preference for comprehensive microservices platforms that unify performance, resilience, and security, strengthening the solution segment’s dominance in the market.

The services segment is expected to register at the fastest CAGR during the forecast period, driven by the increasing complexity of microservices deployments and the growing demand for specialized support in integration, consulting, and ongoing maintenance. As organizations shift from monolithic to cloud-native architectures, they require expert guidance to navigate service orchestration, API management, security configuration, and DevOps alignment. In addition, the rise of hybrid and multi-cloud environments has made microservices adoption more intricate, boosting the demand for services that ensure interoperability, compliance, and performance optimization across diverse infrastructures.

In addition, enterprises are also investing in managed microservices and support frameworks to reduce operational overhead and accelerate time-to-market. This trend is particularly important for SMEs and regulated industries like healthcare and finance, where internal resources are limited, and external expertise is crucial for successful microservices implementation and scaling.

Deployment Insights

The public cloud segment accounted for the largest market revenue share in 2024, driven by its improved scalability, flexible cost structures, and expanding ecosystem of containerized microservices solutions. Public cloud providers such as AWS, Microsoft Azure, and Google Cloud continue to strengthen their offerings with managed Kubernetes services, serverless computing, AI integration, service mesh frameworks, and advanced observability tools, making the public cloud the preferred environment for deploying modern, cloud-native applications.

For instance, in November 2024, Nutanix announced the expansion of its Enterprise AI platform to public cloud environments, allowing enterprises to deploy NVIDIA-optimized AI inference microservices on AWS Elastic Kubernetes Service, Azure Kubernetes Service, and Google Kubernetes Engine. In conclusion, the widespread adoption of public cloud for microservices is being fueled by its ability to support agile development, rapid scalability, and advanced cloud-native capabilities, making it the backbone of digital transformation across industries.

The hybrid segment is expected to register at the fastest CAGR over the forecast period, propelled by the increasing demand for deployment flexibility, data sovereignty, and regulatory compliance across multi-cloud and on-premises environments. Enterprises are increasingly turning to hybrid architectures to balance the scalability of public cloud with the control and security of private infrastructure, enabling them to modernize legacy applications without compromising on compliance or latency requirements. Major players such as Google Cloud, Microsoft, and Red Hat have advanced their hybrid microservices ecosystems by offering tools like Anthos, Azure Arc, and OpenShift, which support uniform policy enforcement, multi-environment Kubernetes orchestration, and seamless service connectivity.

For instance, in June 2025, Red Hat announced new updates to OpenShift Platform Plus, enhancing support for hybrid microservices through integrated observability, multi-cluster governance, and AI-powered workload optimization across on-prem, public cloud, and edge locations. In conclusion, the hybrid model is rapidly gaining traction as it empowers enterprises to unify operations, accelerate innovation, and meet jurisdictional demands, making it the fastest-growing segment in the cloud microservices industry.

Enterprise Size Insights

The large size enterprise segment accounted for the largest market revenue share in 2024, owing to their complex IT environments, extensive application portfolios, and greater financial capacity to invest in modernizing systems through microservices architecture. These organizations operate across multiple regions and require scalable, resilient, and distributed application frameworks to support omnichannel customer engagement and continuous innovation. In addition, microservices enable large enterprises to improve agility, streamline DevOps, and accelerate time-to-market by allowing teams to develop, deploy, and scale services independently.

Furthermore, large organizations are at the forefront of adopting cloud-native technologies such as Kubernetes, API gateways, and service meshes, which are essential for effective microservices deployment. Moreover, strategic partnerships with major cloud providers and ecosystem integrators empower these enterprises to build sophisticated hybrid and multi-cloud microservices infrastructures. Consequently, the scale, complexity, and innovation of large enterprises make them the primary drivers of cloud microservices adoption globally.

The small and medium-sized enterprise (SMEs) segment is expected to register at the fastest CAGR during the forecast period, due to rising cloud adoption, the affordability of microservices-based infrastructure, and the growing availability of managed, low-code platforms that minimize technical complexity. SMEs are adopting microservices to improve legacy applications, accelerate time-to-market, and scale efficiently without the need for large in-house IT teams. In addition, cloud providers like AWS, Microsoft Azure, and Google Cloud are offering simplified entry points such as preconfigured Kubernetes clusters, API integrations, and DevOps automation tools, making microservices adoption more feasible for small to medium organizations.

For instance, in April 2025, ClearScale signed a strategic collaboration agreement with AWS under its Small Business Acceleration Initiative to help SMEs transition to cloud-native architectures. This initiative offers co-funded tooling, AI, and data analytics integration, and prebuilt microservices blueprints designed to help small businesses retire legacy systems and unlock long-term digital value. In conclusion, the convergence of tailored cloud solutions, cost efficiency, and targeted partner initiatives is accelerating the adoption of microservices among SMEs, which in turn is driving the market growth.

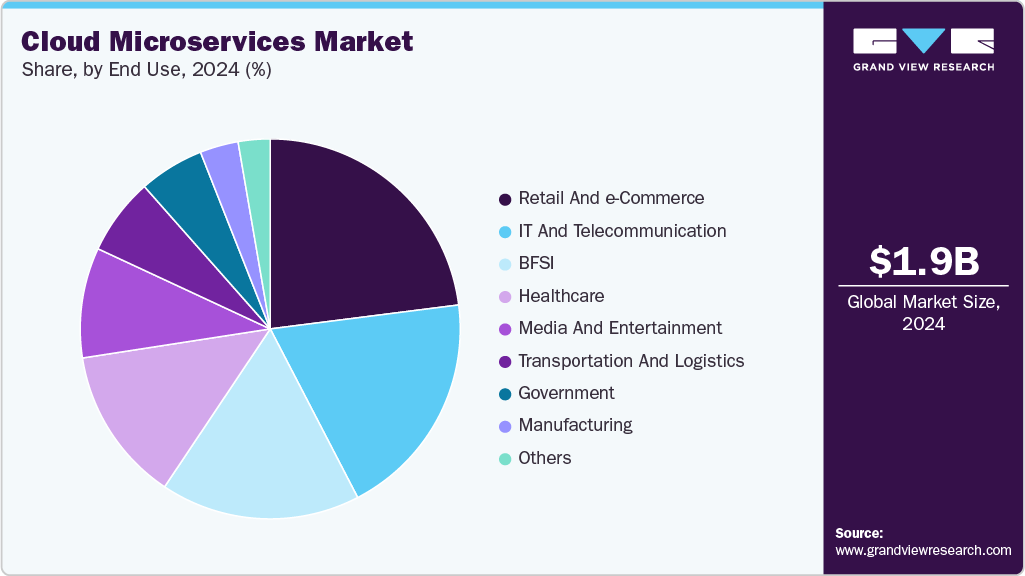

End Use Insights

The retail and e-commerce segment accounted for the largest market revenue share in 2024, driven by the sector’s need for modular and resilient architectures to deliver personalized, omnichannel customer experiences. Microservices enable retail and e-commerce enterprises to decouple key application functionalities such as inventory management, payment processing, user authentication, and product recommendation engines, allowing faster development cycles and real-time adaptability without risking full system outages. In addition, major industry players are embracing microservices to improve time-to-market and operational agility in the face of growing consumer demands and intense competition.

For instance, in May 2023, Landmark Retail adopted Broadleaf Commerce’s cloud-native, MACH-compliant microservices solution to streamline its multi-brand, multi-region e-commerce operations. Deployed on a self-managed public cloud, the platform supports composable architecture for personalized content delivery, checkout optimization, and scalable order orchestration across its Emax Electronics brand and broader retail portfolio. In conclusion, the surge in demand for personalized, scalable, and agile digital commerce infrastructure has made retail and e-commerce the leading end-use segment in the cloud microservices industry.

The healthcare segment is expected to register at the fastest CAGR during the forecast period, driven by the increasing digitization of medical systems, growing demand for personalized care, and the need to process and analyze massive healthcare datasets securely and efficiently. Microservices allow healthcare organizations to modularize and independently scale applications such as electronic health records (EHR), clinical decision support, patient monitoring, telemedicine, and AI-powered diagnostics, enabling more agile updates, regulatory compliance, and fault-tolerant operations. Also, leading cloud vendors and healthtech platforms are advancing this trend by integrating GPU-accelerated microservices and containerized pipelines that support data-intensive clinical workloads.

For instance, in March 2024, DNAnexus announced the integration of NVIDIA NIM and CUDA-X microservices into its Precision Health Data Cloud platform to enhance genomic data processing, accelerate drug discovery, and improve clinical decision-making. These AI-optimized microservices support real-time, scalable analysis of petabyte-scale genomic datasets in a secure, compliant environment. In conclusion, as the healthcare sector increasingly prioritizes agility, data interoperability, and AI-powered diagnostics, the adoption of cloud microservices is rapidly accelerating, positioning healthcare as the fastest-growing end-use segment in the global cloud microservices industry.

Regional Insights

North America dominated the cloud microservices market with the largest revenue share of 43.2% in 2024, primarily due to the region’s well-established cloud infrastructure, early adoption of microservices-based architecture, and the presence of leading technology providers such as Amazon Web Services, Microsoft Azure, and Google Cloud. Enterprises across industries including banking, healthcare, and retail are increasingly leveraging microservices to modernize legacy applications, enhance scalability, and accelerate digital transformation.

In addition, there is also a growing emphasis on hybrid and multi-cloud strategies, with organizations deploying advanced orchestration platforms, service mesh frameworks, and observability solutions to manage distributed environments efficiently. Furthermore, the region is experiencing an increase in strategic collaborations, mergers, and acquisitions aimed at expanding microservices capabilities in areas such as edge computing, private cloud infrastructure, and real-time analytics, reinforcing North America's leadership in cloud-native application development.

U.S. Cloud Microservices Market Trends

The cloud microservices market in the U.S. is driven by its mature digital infrastructure, high concentration of cloud-native enterprises, and rapid advancements in software development methodologies. U.S.-based organizations are at the forefront of adopting microservices to support modular, scalable application architectures that align with agile and DevOps practices. Also, the financial services and healthcare sectors in the U.S. are utilizing microservices to enhance real-time data processing, ensure regulatory compliance, and improve customer personalization.

In addition, the growing adoption of composable commerce in retail, combined with the expansion of edge computing and artificial intelligence applications, is fueling demand for flexible, containerized microservices platforms. Continuous investments in cloud innovation, coupled with federal and state-level digital transformation initiatives, are further strengthening the U.S. position as a global leader in the cloud microservices industry.

Europe Cloud Microservices Market Trends

The cloud microservices market in Europe is anticipated to register at a significant CAGR from 2025 to 2033, driven by increasing enterprise focus on application modernization, regulatory-compliant cloud adoption, and the rising demand for modular digital services. In addition, European organizations are transitioning from monolithic to microservices-based architectures to enhance agility, reduce time-to-market, and support evolving customer experiences. Moreover, the region's strong emphasis on data protection, particularly under the General Data Protection Regulation (GDPR), has accelerated the adoption of secure, containerized microservices environments deployed across private and hybrid clouds. Countries such as Germany, the United Kingdom, and France are investing in cloud-native innovation through government-backed digital transformation programs, while European technology firms and hyperscalers are forming strategic alliances to expand local cloud availability zones and microservices toolchains. The growing maturity of DevOps practices, adoption of open-source platforms like Kubernetes, and increasing use of microservices in AI and IoT workloads are further propelling market momentum across Europe.

The UK cloud microservices market is poised to grow at a significant CAGR from 2025 to 2033, supported by robust digital transformation efforts across government, finance, and enterprise sectors. British public institutions are increasingly leveraging the G‑Cloud framework and Government Digital Service platforms to procure secure, cloud-native microservices at scale, driving adoption among SMEs. In addition, the UK financial sector continues migrating legacy banking systems to microservices to reduce outage risk, enhance customer experience, and increase resilience. Furthermore, UK enterprises are prioritizing cloud optimization and FinOps to control spending, prompting increased interest in compartmentalized microservices architectures that improve visibility, governance, and cost-efficiency across hyperscaler environments. This convergence of government-led cloud procurement and digital modernization of financial services is positioning the UK as a leading European market for cloud microservices innovation.

The cloud microservices market in Germany is anticipated to grow at a notable CAGR from 2025 to 2033, driven by strong national investment in sovereign cloud infrastructure, strategic adoption within manufacturing and industrial sectors, and regulatory emphasis on data sovereignty. German organizations such as Deutsche Telekom are advancing their public cloud services through initiatives like the Open Telekom Cloud based on OpenStack to satisfy GDPR and domestic regulatory requirements. Meanwhile, global players like Amazon Web Services have pledged substantial investments in German cloud operations, including €8.8 billion by 2026 for the European Sovereign Cloud in Brandenburg. Consequently, the aforementioned factors are contributing notably in spurring the market growth in Germany.

Asia Pacific Cloud Microservices Market Trends

The cloud microservices market in Asia Pacific is expected to register at the fastest CAGR of 22.9% from 2025 to 2033, driven by digital transformation, widespread adoption of AI and DevOps, and substantial infrastructure investments across key markets like China, India, Japan, Southeast Asia, and Australia. Organizations throughout the region are replacing older monolithic systems with containerized microservices to enhance scalability, resilience, and time‑to‑market. In addition, ASEAN nations, especially Malaysia and Singapore, are leading with government and telecom initiatives deploying edge‑computing microservices for use cases like smart cities and industrial IoT. Moreover, major cloud providers are reinforcing this shift through significant capital deployment. AWS announced nearly S$12 billion for new infrastructure in Singapore and over US$13 billion in Australia and Taiwan to support AI‑driven workloads. Furthermore, Alibaba Cloud is expanding its footprint by launching new data centers in Malaysia and the Philippines and opening an AI innovation hub in Singapore as part of a broader US$52 billion investment plan. Subsequently, these factors are collectively responsible for driving the market growth in the Asia Pacific countries.

The Japan cloud microservices market is anticipated to grow at a robust CAGR from 2025 to 2033, driven by ongoing digital transformation, workforce optimization efforts, and major investments in sovereign cloud infrastructure. In addition, Japan’s aging population and labor shortages are prompting enterprises to adopt automation, cloud-native practices, and scalable microservices to improve operational efficiency. Moreover, the government’s launch of the Digital Agency in 2021 underscored this shift, centralizing cloud adoption across public sector services and endorsing platforms like AWS and Google Kubernetes Engine.

The cloud microservices market in China is projected to expand at a significant CAGR from 2025 to 2033, supported by strong domestic investment in cloud infrastructure, AI-driven microservices innovation, and emerging sovereign tech strategies. Leading Chinese cloud providers, including Alibaba Cloud, Tencent, and Huawei, are building hyperscale data centers and microservices platforms to enable scalable, containerized workloads across industries such as finance, healthcare, e-commerce, and manufacturing. In addition, the proliferation of “AI-in-a-box” systems, modular microservices paired with on-premises AI hardware, reflects a unique trend in the Chinese market where hybrid microservices are increasingly leveraged for data sovereignty and chip-level autonomy.

The India cloud microservices market is anticipated to grow at a rapid CAGR from 2025 to 2033, propelled by significant infrastructure investment, supportive government initiatives, and an accelerating shift toward digital transformation. The Reserve Bank of India plans to launch the Indian Financial Services (IFS) Cloud in 2025-26, specifically addressing the cloud needs of financial institutions through affordable, localized microservices platforms deployed in Mumbai and Hyderabad to ensure data sovereignty and regulatory compliance. In addition, Indian tech and cloud firms are embracing microservices architectures, driven by DevOps adoption, Kubernetes orchestration, and cloud-native deployments, as highlighted in industry analyses on emerging deployment patterns and infrastructure modernization.

Key Cloud Microservices Company Insight

Key players operating in the cloud microservices industry are Amazon Web Services, Inc., Microsoft Corporation, Google LLC, and others. Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Cloud Microservices Companies:

The following are the leading companies in the cloud microservices market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services, Inc.

- Microsoft Corporation

- Google LLC

- IBM Corporation

- Oracle Corporation

- SAP SE

- Red Hat, Inc.

- VMware, Inc.

- Salesforce, Inc.

- Infosys Limited

- Tata Consultancy Services Limited

- Cisco Systems, Inc.

- Broadcom Inc.

- Atos SE

- Cognizant

Recent Developments

-

In June 2025, Databricks and Microsoft extended their strategic alliance around Azure Databricks. The agreement covers deep integrations with Azure AI Foundry, Power Platform, and SAP data services, further enabling enterprises to build microservices architectures centered on data and AI.

-

In January 2025, Microsoft entered several strategic partnerships to boost AI-first transformation across India’s core sectors, including RailTel, Apollo Hospitals, Bajaj Finserv, Mahindra Group, and upGrad, alongside a Memorandum of Understanding with India AI to establish AI Centres of Excellence, scale cloud‑based Copilot solutions, and jointly train employees in cloud and AI technologies.

-

In November 2024, AWS expanded its strategic collaboration with Anthropic, naming them as the primary AI training partner for its Trainium chips and confirming AWS as the preferred platform for deploying Anthropic’s Claude models on Amazon Bedrock, reinforcing its leadership in generative AI and microservices infrastructure.

Cloud Microservices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.33 billion

Revenue forecast in 2033

USD 11.36 billion

Growth rate

CAGR of 21.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report Coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Amazon Web Services, Inc.; Microsoft Corporation; Google LLC; IBM Corporation; Oracle Corporation; SAP SE; Red Hat, Inc.; VMware, Inc.; Salesforce, Inc.; Infosys Limited; Tata Consultancy Services Limited; Cisco Systems, Inc.; Broadcom Inc.; Atos SE; Cognizant

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Enterprise Size and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cloud Microservices Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global cloud microservices market report based on component, deployment, enterprise size, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Solution

-

Services

-

Consulting Services

-

Integration Services

-

Training, Support and Maintained Services

-

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

Public

-

Private

-

Hybrid

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Large Size Enterprise

-

Small and Medium Sized Enterprise (SMEs)

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

IT and Telecommunication

-

BFSI

-

Government

-

Healthcare

-

Retail and e-Commerce

-

Media and Entertainment

-

Transportation and Logistics

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cloud microservices market size was estimated at USD 1.93 billion in 2024 and is expected to reach USD 2.33 billion in 2025.

b. The global cloud microservices market is expected to grow at a compound annual growth rate of 21.9% from 2025 to 2033 to reach USD 11.36 billion by 2033.

b. The solution segment accounted for the largest revenue share of 66.85% in the global cloud microservices market in 2024, driven by increasing enterprise demand for scalable, modular platforms that enable rapid application development, deployment, and orchestration.

b. Some key players operating in the market include Amazon Web Services, Inc., Microsoft Corporation, Google LLC, IBM Corporation, Oracle Corporation, SAP SE, Red Hat, Inc., VMware, Inc., Salesforce, Inc., Infosys Limited, Tata Consultancy Services Limited, Cisco Systems, Inc., Broadcom Inc., Atos SE, Cognizant and Others.

b. Factors such as the rapid transformation as enterprises shift from monolithic architectures to agile, modular, and cloud-native application environments plays a key role in accelerating the cloud microservices market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.