- Home

- »

- Communications Infrastructure

- »

-

Cloud Migration Services Market Size, Industry Report, 2030GVR Report cover

![Cloud Migration Services Market Size, Share & Trends Report]()

Cloud Migration Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Platform, By Deployment (Private, Public, and Hybrid), By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-032-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cloud Migration Services Market Summary

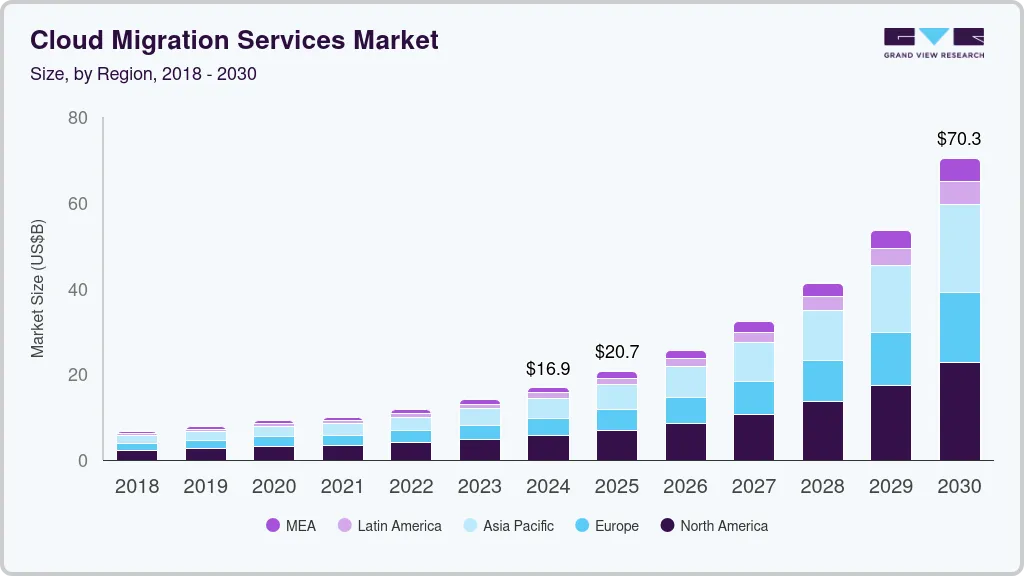

The global cloud migration services market size was estimated at USD 16.90 billion in 2024 and is projected to reach USD 70.34 billion by 2030, growing at a CAGR of 27.8% from 2025 to 2030. The growing adoption of hybrid cloud solutions is fueling the global demand for cloud migration services.

Key Market Trends & Insights

- The cloud migration services market in North America held a largest share of over 33.0% in 2024.

- The cloud migration services market in the U.S. is expected to grow significantly at a CAGR of 26.2% from 2025 to 2030.

- Based on platform, the solutions segment dominated the market and accounted for the revenue share of nearly 66.0% in 2024.

- Based on deployment, the public segment dominated the market and accounted for the revenue share of over 46.0% in 2024.

- Based on enterprise size, the large size enterprise segment dominated the market and accounted for the revenue share of 64.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 16.90 billion

- 2030 Projected Market Size: USD 70.34 billion

- CAGR (2025-2030): 27.8%

- North America: Largest market in 2024

The need for greater business agility and the rising implementation of automation solutions are anticipated to be key drivers of market expansion in the coming years. In addition, the increasing preference for rapid and streamlined application deployment through a pay-as-you-go model, along with the widespread integration of cloud-based migration into business operations, is expected to further accelerate market growth.

The increasing adoption of hybrid cloud solutions is also a significant driver of the cloud migration services market. Organizations are shifting towards hybrid cloud environments to enhance flexibility, scalability, and operational efficiency. By leveraging hybrid cloud models, businesses can optimize workloads, improve data management, and reduce costs, leading to a surge in demand for cloud migration services.

Another key factor fueling market growth is the rising need for business agility. Companies across various industries are prioritizing digital transformation initiatives to remain competitive in a rapidly evolving business landscape. Cloud migration enables organizations to respond quickly to market changes, enhance collaboration, and streamline operations, making it an essential component of modern business strategies.

The growing adoption of automation solutions is also playing a crucial role in accelerating cloud migration. Businesses are increasingly integrating automation tools to simplify migration processes, reduce downtime, and minimize operational risks. Automation-driven cloud migration enhances efficiency, lowers costs, and improves security, making it a preferred choice for enterprises looking to modernize their IT infrastructure. For instance, in December 2024, Amazon Web Services, Inc. launched AWS Migration Hub Automation, a new feature designed to streamline cloud migrations by automating common tasks. This enhancement reduces manual effort, minimizes errors, and improves efficiency, making migrations more cost-effective and scalable. The automation integrates seamlessly with existing AWS migration tools, including AWS Application Migration Service, enabling businesses to adopt AWS best practices and accelerate their transition to the cloud.

In addition, the demand for faster and more straightforward application deployment is propelling market growth. The pay-as-you-go model offered by cloud service providers allows businesses to scale resources based on demand while minimizing upfront costs. This model supports cost-effective IT infrastructure management and also facilitates seamless migration of applications, thereby driving increased adoption of cloud migration services.

Platform Insights

The solutions segment dominated the market and accounted for the revenue share of nearly 66.0% in 2024. The rising demand for real-time data migration and analytics-driven decision-making is fueling the expansion of the solutions segment. Businesses are prioritizing solutions that enable real-time data synchronization and analytics-driven insights to ensure seamless operations during migration. These solutions help organizations maintain data integrity, improve performance monitoring, and make data-driven decisions to enhance operational efficiency. The segment is further bifurcated into infrastructure, migration, platform migration, database migration, application migration, and storage migration.

The service segment is expected to register a significant CAGR of 28.8% over the forecast period due to the rising demand for managed services. Businesses are increasingly opting for end-to-end cloud migration services that include continuous monitoring, performance optimization, and security management. Managed service providers (MSPs) offer expertise in handling multi-cloud and hybrid cloud environments, allowing enterprises to focus on core business operations while ensuring seamless migration and cloud management. The segment is further bifurcated into professional services, and managed services.

Deployment Insights

The public segment dominated the market and accounted for the revenue share of over 46.0% in 2024 due to the increasing adoption of Software-as-a-Service (SaaS) applications. Enterprises are migrating their workloads to the public cloud to take advantage of cloud-native applications that support remote work, data sharing, and real-time collaboration. The rise of cloud-based productivity tools, customer relationship management (CRM) software, and enterprise resource planning (ERP) solutions is contributing to the demand for public cloud deployment.

The hybrid segment is expected to grow at a significant CAGR over the forecast period. Security and compliance concerns are also fueling the expansion of hybrid cloud deployment. Industries such as finance, healthcare, and government must adhere to strict data protection regulations, making full reliance on public cloud less viable. Hybrid cloud solutions enable businesses to store sensitive data in a private cloud while utilizing public cloud resources for non-sensitive workloads, ensuring compliance with regulatory standards while maintaining operational flexibility.

Enterprise Size Insights

The large size enterprises segment dominated the market and accounted for the revenue share of 64.0% in 2024. The increasing need for digital transformation is a primary driver of cloud migration adoption among large enterprises. As global competition intensifies, organizations are prioritizing cloud-first strategies to modernize IT infrastructure, enhance operational efficiency, and improve customer experiences. Cloud migration services enable large enterprises to streamline business processes, automate workflows, and optimize resource utilization, making them a critical component of corporate digital initiatives.

The small and medium sized enterprises (SMEs) segment is expected to grow at a significant CAGR over the forecast period. The increasing adoption of cost-effective cloud solutions is a key driver of cloud migration among SMEs. Unlike large corporations with extensive IT budgets, SMEs often face financial constraints in maintaining on-premises infrastructure. Cloud migration enables these businesses to reduce capital expenditures on hardware and software, replacing them with a more affordable, pay-as-you-go model that improves cost efficiency and operational flexibility.

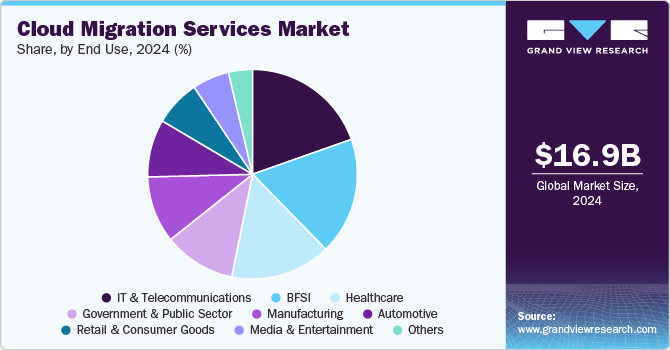

End Use Insights

The IT & telecommunications segment dominated the market and accounted for the revenue share of over 19.0% in 2024. The increasing use of artificial intelligence (AI), big data analytics, and Internet of Things (IoT) in the IT and telecommunications sectors is fueling the demand for cloud migration services. These technologies require powerful cloud infrastructure to process large volumes of data, run advanced analytics, and support connected devices. Cloud migration allows IT and telecommunications companies to integrate these technologies more effectively, enhancing their ability to offer smarter services and drive efficiencies in operations.

The healthcare segment is expected to grow at a significant CAGR over the forecast period. The growing volume of healthcare data, driven by the expansion of electronic health records (EHR), patient monitoring systems, and diagnostic technologies, is fueling the adoption of cloud migration services. As the volume of data continues to grow, healthcare organizations need cloud-based solutions to store, process, and analyze data securely and efficiently.

Regional Insights

The cloud migration services market in North America held a largest share of over 33.0% in 2024. A significant trend in North America is the increasing adoption of hybrid and multi-cloud strategies. Businesses are leveraging a mix of public, private, and multi-cloud deployments to optimize workload performance, improve data governance, and ensure business continuity. This approach allows organizations to balance security, compliance, and operational flexibility while mitigating vendor lock-in risks. The rise of advanced cloud orchestration and management tools further supports this trend, enabling seamless integration and interoperability between diverse cloud environments.

U.S. Cloud Migration Services Industry Trends

The cloud migration services market in the U.S. is expected to grow significantly at a CAGR of 26.2% from 2025 to 2030. With the rising volume of data and increasing cyber threats, security and compliance are top priorities for U.S. organizations. Cloud migration services offer enhanced security features, such as encryption, identity and access management (IAM), and continuous monitoring, which help businesses secure sensitive data and ensure compliance with stringent regulations like the Health Insurance Portability and Accountability Act (HIPAA), the General Data Protection Regulation (GDPR), and the California Consumer Privacy Act (CCPA).

Europe Cloud Migration Services Industry Trends

The cloud migration services market in Europe is anticipated to register a considerable growth from 2025 to 2030. Cloud platforms are becoming key enablers of big data analytics and business intelligence (BI) tools in Europe. As businesses accumulate vast amounts of data, migrating to the cloud enables them to store and analyze this data with greater efficiency. Cloud services provide powerful data processing and storage capabilities that allow organizations to utilize BI tools and machine learning models to extract actionable insights and make data-driven decisions. The growing use of cloud-based data lakes, analytics platforms, and reporting tools is driving further migration to the cloud, as businesses realize the value of using data analytics to stay ahead of competitors.

The UK cloud migration services market is expected to grow rapidly in the coming years. As cybersecurity becomes a critical concern, businesses in the UK are increasingly turning to cloud migration services that can offer a higher level of protection and ensure compliance with stringent data protection laws. The move to the cloud helps mitigate risks associated with data breaches, system downtimes, and cyberattacks, providing businesses with greater confidence in their IT security.

The Germany cloud migration services market held a substantial market share in 2024. As German businesses increasingly digitize their operations to integrate smart factories, IoT devices, and real-time analytics, they require scalable, flexible cloud infrastructure to support these advanced technologies. Cloud migration is seen as a key enabler of Industry 4.0, allowing companies to optimize production processes, improve supply chain management, and enhance overall operational efficiency. This drive toward automation and digitalization is a key factor driving demand for cloud migration services in Germany.

Asia Pacific Cloud Migration Services Industry Trends

Asia Pacific is expected to register the highest CAGR of 29.1% from 2025 to 2030. Asia Pacific is witnessing rapid digital transformation across various sectors, including manufacturing, retail, finance, and healthcare. Companies in the region are increasingly adopting cloud-based solutions to modernize their IT infrastructure, improve operational efficiency, and enhance customer experience. Cloud migration is a key enabler of this transformation, allowing businesses to transition from legacy systems to more flexible, scalable, and cost-efficient cloud environments. As digitalization becomes a priority for organizations across APAC, the demand for cloud migration services is expected to increase significantly.

The Japan cloud migration services market is expected to grow rapidly in the coming years. Key initiatives such as the "Society 5.0" vision aim to leverage advanced technologies, including cloud computing, IoT, and AI, to modernize industries and improve the quality of life. The government has been providing support for businesses to adopt cloud-based solutions through subsidies, regulations, and public-private partnerships.

The China cloud migration services market held a substantial market share in 2024. China’s enterprises, especially state-owned enterprises (SOEs) and large private companies, are actively seeking to modernize their IT infrastructures. Legacy systems, which have been in place for decades, are often inflexible, costly, and difficult to scale. Cloud computing offers a more agile and scalable solution to replace these outdated infrastructures. The shift from on-premises legacy systems to cloud-based systems is a significant growth driver for cloud migration services, as businesses look for efficient and flexible cloud environments to support business expansion and innovation.

Key Cloud Migration Services Company Insights

Key players operating in the cloud migration services industry are Amazon Web Services, Inc., Capgemini, Google, IBM Corporation, and Hewlett Packard Enterprise Development LP. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In December 2024, Capgemini completed acquisition of Syniti, a provider of enterprise data management software and services in the U.S. The acquisition supports Capgemini’s data-driven digital transformation offerings, with a focus on large-scale SAP transformations, including migrations to SAP S/4HANA. Syniti’s expertise in managing complex data quality, migration, and governance initiatives is expected enhance Capgemini’s capacity to support in optimizing their data management and enterprise software strategies, particularly for large companies.

-

In March 2024, Accenture collaborated with Microsoft to introduce a Cloud Modernization and Migration Factory on Microsoft Azure Government, designed to fulfill the rigid security demands of national security operations, including the Special Access Program community. This integrated service will support federal agencies and partners securely migrating from any environment.

Key Cloud Migration Services Companies:

The following are the leading companies in the cloud migration services market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture

- Amazon Web Services, Inc.

- Capgemini

- Google LLC

- Hewlett Packard Enterprise Development LP

- IBM Corporation

- Kyndryl Inc.

- Microsoft

- NTT DATA Americas, Inc.

- SAP SE

- TATA Consultancy Services Limited

- Veritis Group Inc.

- VMware, Inc.

- Vodafone Limited

- Wipro

Cloud Migration Services Report Scope

Report Attribute

Details

Market size in 2025

USD 20.67 billion

Revenue forecast in 2030

USD 70.34 billion

Growth rate

CAGR of 27.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report services

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Platform, deployment, enterprise size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Sweden; Finland; Netherlands; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Accenture; Amazon Web Services, Inc.; Capgemini, Google LLC; Hewlett Packard Enterprise Development LP; IBM Corporation; Kyndryl Inc.; Microsoft; NTT DATA Americas, Inc.; SAP SE; TATA Consultancy Services Limited; Veritis Group Inc.; VMware, Inc.; Vodafone Limited; Wipro

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cloud Migration Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the cloud migration services market report based on platform, deployment, enterprise size, end use, and region:

-

Cloud Migration Services Platform Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solution

-

Infrastructure Migration

-

Platform Migration

-

Database Migration

-

Application Migration

-

Storage Migration

-

-

Service

-

Professional Services

-

Managed Services

-

-

-

Cloud Migration Services Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Public

-

Private

-

Hybrid

-

-

Cloud Migration Services Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Size Enterprises

-

SMEs

-

-

Cloud Migration Services End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

IT & Telecommunications

-

BFSI

-

Healthcare

-

Government & Public Sector

-

Manufacturing

-

Automotive

-

Retail & Consumer Goods

-

Media & Entertainment

-

Others

-

-

Cloud Migration Services Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Sweden

-

Finland

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cloud migration services market size was estimated at USD 16.90 billion in 2024 and is expected to reach USD 20.67 billion in 2025.

b. The global cloud migration services market is expected to grow at a compound annual growth rate of 27.8% from 2025 to 2030 to reach USD 70.34 billion by 2030

b. North America dominated the cloud migration services market with a market share of over 33.0% in 2024. This is attributed to the large presence of market players and the availability of technological resources in the region

b. Some key players operating in the cloud migration services market include Accenture, Amazon Web Services, Inc., Capgemini, Google LLC, Hewlett Packard Enterprise Development LP, IBM Corporation, Kyndryl Inc., Microsoft, NTT DATA Americas, Inc., SAP SE, TATA Consultancy Services Limited, Veritis Group Inc., VMware, Inc., Vodafone Limited, Wipro

b. The growing adoption of hybrid cloud solutions is fueling the global demand for cloud migration services. The need for greater business agility and the rising implementation of automation solutions are anticipated to be key drivers of market expansion in the coming years.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.