- Home

- »

- Next Generation Technologies

- »

-

Cloud Monitoring Market Size & Share, Industry Report, 2030GVR Report cover

![Cloud Monitoring Market Size, Share & Trends Report]()

Cloud Monitoring Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Cloud Storage Monitoring, Database Monitoring, Website Monitoring), By Service Model, By Enterprise Size, By Industry Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-165-5

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cloud Monitoring Market Summary

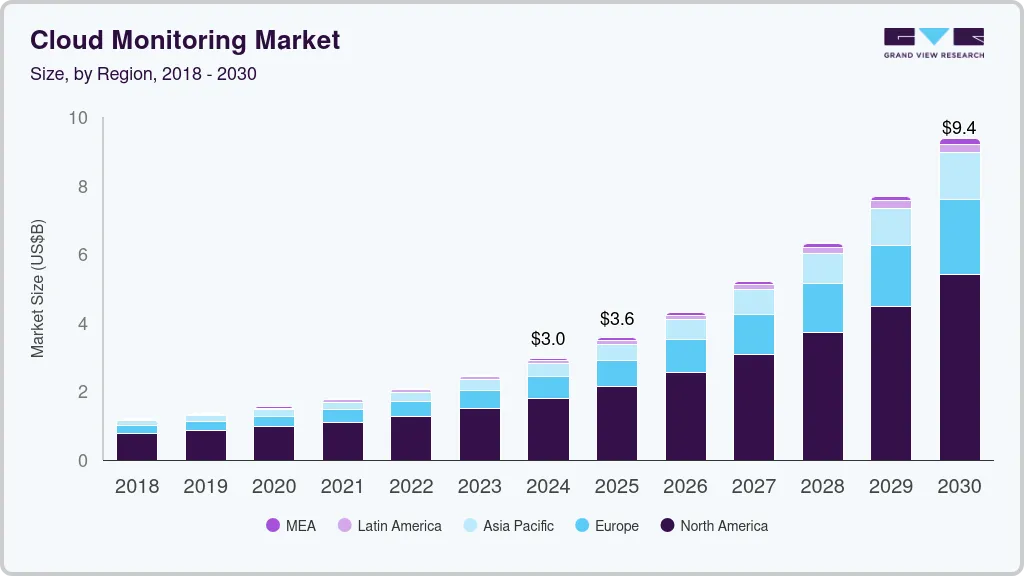

The global cloud monitoring market size was estimated at USD 2.96 billion in 2024 and is projected to reach USD 9.37 billion by 2030, growing at a CAGR of 21.4% from 2025 to 2030. The increasing adoption of DevOps and Site Reliability Engineering (SRE) practices is contributing to market growth.

Key Market Trends & Insights

- North America dominated the market and accounted for a revenue share of over 60.0% in 2024.

- Asia Pacific is anticipated to register the highest CAGR from 2025 to 2030.

- Based on a service model, the SaaS segment held the largest revenue share of over 51.0% in 2024.

- Based on enterprise size, the SME segment held the largest revenue share of over 70.0% in 2024.

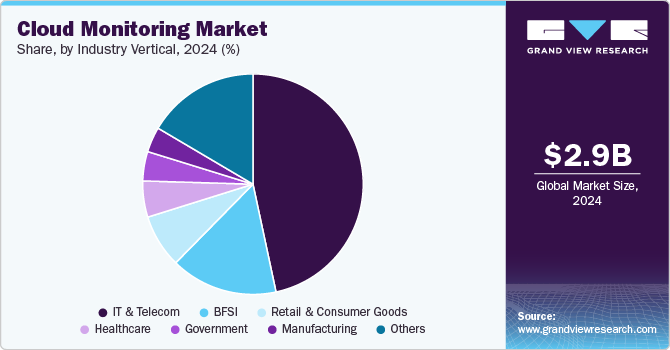

- Based on industry vertical, the IT & telecom segment dominated the market and accounted for a revenue share of over 46.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.96 Billion

- 2030 Projected Market Size: USD 9.37 Billion

- CAGR (2025-2030): 21.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Modern IT teams are embracing DevOps methodologies to accelerate software development and deployment cycles. Cloud monitoring plays a crucial role in this process by providing observability into application performance, infrastructure health, and deployment success. It enables DevOps teams to identify and resolve issues quickly, ensuring seamless software releases and improved system reliability. As more organizations shift to DevOps and SRE frameworks, the demand for cloud monitoring solutions with automated alerting, log management, and performance analytics is rising.The increasing adoption of cloud computing and hybrid IT environments is driving demand for cloud-based enterprise monitoring solutions. Organizations are shifting from traditional on-premise monitoring tools to scalable, cloud-native solutions that offer greater flexibility and real-time insights. With businesses adopting multi-cloud and hybrid cloud strategies, monitoring tools must provide seamless visibility across distributed IT infrastructures. Enterprises are prioritizing cloud-based solutions that support proactive issue detection, automated troubleshooting, and integration with various cloud service providers. This trend reflects the growing need for comprehensive monitoring solutions that ensure seamless performance across diverse digital ecosystems. According to the European Union (EU), in 2023, 45.2% of enterprises in the EU purchased cloud computing services, primarily for hosting email systems, storing electronic files, and using office software. Among them, 75.3% adopted cloud computing for advanced cloud services, including security software applications, enterprise database hosting, and computing platforms for application development, testing, or deployment.

The adoption of DevOps and observability practices is transforming enterprise monitoring approaches globally. Businesses are embracing continuous monitoring and observability frameworks to enhance software development, deployment, and IT operations. Modern monitoring solutions are integrating log management, distributed tracing, and real-time analytics to provide end-to-end visibility into application and infrastructure performance. This emphasis on proactive issue resolution, automation, and real-time observability aligns with DevOps principles, enabling faster software releases and improved system reliability. As businesses prioritize agility and innovation, the integration of DevOps with enterprise monitoring is becoming a key trend driving market growth.

The increasing demand for IoT devices and the rising complexities in monitoring databases are expected to provide significant growth opportunities for the cloud monitoring market. Integrating artificial intelligence (AI) and machine learning (ML) into cloud monitoring solutions further improves their capabilities. AI and ML algorithms can analyze vast amounts of data and identify complex patterns, enabling cloud monitoring solutions to provide deeper insights into performance trends, resource utilization, and potential threats. This intelligent monitoring approach helps businesses optimize their IT operations, improve decision-making, and reduce the risk of outages and security incidents. For instance, in November 2023, Datadog, a cloud application monitoring and security solutions provider, expanded its partnership with Google Cloud to provide enhanced observability and security for cloud-native and hybrid applications. This integration empowers AI operators and developers to monitor, analyze, and optimize the performance of their machine learning models in production effectively.

Type Insights

In terms of type, the cloud monitoring market is further segmented into cloud storage monitoring, database monitoring, website monitoring, virtual network monitoring, virtual machine monitoring, and others. The cloud storage monitoring segment dominated the market and accounted for a revenue share of over 27.0% in 2024. The growth of the cloud storage monitoring segment is attributed to many businesses' increased adoption of cloud storage solutions, and the need to monitor and optimize these resources becomes essential to ensure efficient and cost-effective operations. The 2023 Global Networking Trends Report indicates that more and more organizations are turning towards cloud platforms. Around 78% of survey respondents claimed that their organizations plan to move over 40% of their workloads to the cloud by 2025. It is a significant increase from the earlier percentage of 63% of organizations already using cloud hosting.

The website monitoring segment is anticipated to register the highest CAGR during the forecast period. Website monitoring is experiencing growth due to factors such as increased reliance on online presence, growing complexity of online processes, e-commerce and its transactions, and global accessibility of companies. Many online platforms are shifting to cloud-based infrastructure, making monitoring essential to track the performance and availability of distribution systems and services. According to Organization for Economic Cooperation and Development (OECD) statistics, as of November 2023, customer relationship management (CRM) is used by most businesses in OECD countries, with usage ranging from 10% to 55% of all businesses currently running. Website monitoring tools provide insights into user behavior, website performance, and user issues. Integrating the data with CRM systems allows businesses to understand customer interaction, preferences, and issues better. Website monitoring identifies technical glitches, downtime, or errors affecting user experience.

Service Model Insights

Based on a service model the market is segmented into SaaS, IaaS, PaaS, and others. The SaaS segment held the largest revenue share of over 51.0% in 2024. The Software as a Service (SaaS) model allows customers to pay only for the required software service and access it via a web browser on their computer or mobile devices. As users are not required to look for the hosting & maintaining of the product, backend database, and security, it has become a popular choice for monitoring resources among businesses.

The preference for automation over traditional manual processes and legacy software has driven the SaaS industry's unprecedented growth in recent decades. In 2022, early-stage SaaS companies received more than USD 30 billion in V.C. investment, indicating a promising future for this sector. The IaaS segment is anticipated to grow at a significant CAGR of 22.6% during the forecast period. Growth in demand for low-cost IT infrastructure and faster data accessibility fuels the growth of IAAS. The adoption of cloud computing in various industries is also one of the key factors for the demand for Infrastructure as a Service (IaaS), as it offers fast data accessibility regardless of the data center's location. In addition, IAAS has a low-cost investment requirement as it does not need on-premise capabilities to be built up, and maintenance costs are low. Business sectors such as BFSI, retail, banking, and telecommunication are rapidly adopting such services due to cost savings, data security, and disaster management. For instance, in April 2022, NTT DOCOMO, one of the biggest mobile operators in Japan, adopted Oracle Cloud Infrastructure (OCI) to build a new development system for ALl Around DoCoMo Information System (ALADIN), one of the world's largest customer information management systems. OCI system's 300 developers can build modern applications faster and cost-efficiently, allowing DOCOMO to benefit from highly available and secure computing resources, which is crucial as the company expands to broader internet, telecom, and smart life services.

Enterprise Size Insights

Based on the enterprise size, the global cloud monitoring market is segmented into large enterprises and SMEs. The SME segment held the largest revenue share of over 70.0% in 2024. Small and medium enterprises (SMEs) use cloud monitoring tools for various essential functions, including cost-effective infrastructure management, scalability, performance optimization, gaining competitive advantage, and security compliance. Utilizing cloud monitoring tools enables SMEs to compete effectively by providing better services, maintaining high uptime, and delivering consistent customer performance. According to the Organization for Economic Co-operation and Development (OECD) report, as of 2022, around 42% of small and medium-sized companies in OECD countries have purchased cloud services. In the UK, cloud technology has been increasingly adopted by businesses over the past few years, with an estimated 53% of all businesses in the country now purchasing cloud services, including cloud monitoring tools for data protection and smooth functioning.

The large enterprises segment is expected to register a highest CAGR from 2025 to 2030. Large enterprises use cloud monitoring tools due to several factors such as scalability, complexity management, optimization of performance, cost efficiency, optimal resource utilization, and security compliance assurance. Large enterprises ' vast and complex IT infrastructure often rely on cloud monitoring to manage the scalability of their systems. These tools offer insights into resource allocation, performance management, and system health, ensuring the smooth scalability of the infrastructure.

Industry Vertical Insights

Based on the industry vertical, the global cloud monitoring market is segmented into BFSI, IT & telecom, healthcare, government, retail & consumer goods, manufacturing, and others. The IT & telecom segment dominated the market and accounted for a revenue share of over 46.0% in 2024. The growth of cloud monitoring in the IT and telecom sector is driven by increased cloud adoption, complexity in infrastructure, performance, security, compliance requirements, network optimization, and the evolution of 5G and edge computing. Developing the 5G network and expanding edge computing led to monitoring such advanced technologies, ensuring efficient operations and reliable connectivity. For instance, in July 2023, RADCOM Ltd. made its 5G assurance solution available on Google Cloud. This innovative solution aims to enable telecom operators to benefit from an automated, cloud-native assurance offering that smoothly integrates with Google Cloud. The solution is expected to help enhance the customer experience and proactively improve the quality of 5G service through sealed, zero-touch operations on the cloud.

The healthcare segment is anticipated to grow at a highest growth rate during the forecast period. Cloud monitoring tools play an essential role in remote patient monitoring solutions due to the increasing adoption of telemedicine and remote monitoring devices. According to the Centers for Disease Control and Prevention, in 2021, 35.3% of adults aged 18 to 64 had a telemedicine visit with a healthcare professional in the past 12 months.

Regional Insights

North America dominated the market and accounted for a revenue share of over 60.0% in 2024. The regional market is anticipated to maintain its dominance over the forecast period. The cloud monitoring industry in North America is growing significantly due to the high adoption of cloud-based solutions across industries. The region's emphasis on digital transformation across various industries is driving the adoption of cloud-based services, including cloud monitoring, to optimize operations and improve efficiency. Businesses in the region are also increasingly migrating their operations and services to the cloud, leading to a higher demand for cloud monitoring tools to ensure the reliability, security, and performance of cloud-based infrastructure.

U.S. Cloud Monitoring Market Trends

The U.S. dominated the cloud monitoring industry in 2024. Growing substantial investments in IT infrastructure and a strong emphasis on innovation are major factors driving market growth. The country’s advanced technological landscape and early adoption of cloud services create a robust market for cloud monitoring solutions. The presence of major cloud service providers and a mature regulatory environment further bolster the demand for sophisticated monitoring tools.

Europe Cloud Monitoring Market Trends

The cloud monitoring market in Europe is anticipated to register considerable growth from 2025 to 2030. A notable trend is the integration of AI into cloud monitoring services. Companies like Datadog have launched AI-driven cybersecurity solutions to protect cloud environments, reflecting the industry's shift towards intelligent monitoring systems. This integration enhances the ability to detect anomalies and respond to threats in real-time, thereby improving overall system reliability.

The UK cloud monitoring industry held a substantial market share in 2024. The businesses in the UK faces increasing cybersecurity threats and data breaches, prompting organizations to prioritize network security and compliance with data protection regulations. Cloud monitoring solutions play a pivotal role in identifying vulnerabilities and providing real-time insights into network traffic, thus increasing demand for the market. Moreover, initiatives promoting cloud adoption, such as the "Cloud First" policy, encourage public sector organizations to consider cloud solutions, thereby driving the demand for effective cloud monitoring tools

Asia Pacific Cloud Monitoring Market Trends

Asia Pacific is anticipated to register the highest CAGR from 2025 to 2030. Several countries in the region are experiencing rapid digital transformation across various industries. The region is witnessing notable growth in cloud adoption across enterprises of all sizes and varying technological advancement levels, including small and medium enterprises (SMEs) that utilize cloud monitoring solutions. An increase in spending on cloud infrastructure and technology is also one of the essential factors for the demand for cloud monitoring services. The ongoing evolution of IT infrastructure and adoption of hybrid and multi-cloud strategies in the region require monitoring solutions capable of managing diverse cloud data smoothly.

The China cloud monitoring industry held a substantial market share in 2024. The government in China emphasis on digital transformation and initiatives like "New Infrastructure" stimulate the adoption of cloud services, thereby increasing the need for robust monitoring solutions. Additionally, the rapid growth of sectors such as e-commerce, fintech, and online entertainment contributes to the expanding cloud ecosystem in China.

The India cloud monitoring industry is expected to grow rapidly during the forecast period. Enterprises in India are increasingly leveraging AI-powered monitoring solutions to enhance IT performance and security. AI-driven analytics enable real-time anomaly detection, predictive maintenance, and automated issue resolution, reducing system downtime and operational disruptions. Businesses are also integrating machine learning (ML) algorithms into monitoring platforms to analyze vast amounts of data and detect patterns that indicate potential system failures or security threats. This shift toward AI-powered observability tools is transforming IT operations, allowing enterprises to optimize performance, improve decision-making, and ensure business continuity. As AI and automation technologies continue to advance, their role in enterprise monitoring is expected to expand further.

Key Cloud Monitoring Company Insights

The market has a consolidated competitive landscape featuring several global and regional players. Industry players are undertaking strategies such as new developments related to product launches, product updates, partnerships, mergers & acquisitions, and collaborations to survive the highly competitive environment and expand their business footprints.

Key Cloud Monitoring Companies:

The following are the leading companies in the cloud monitoring market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services, Inc.

- Microsoft

- Alphabet Inc. (Google Cloud)

- Cisco Systems, Inc.

- Oracle

- International Business Machines Corp.

- Datadog

- Dynatrace LLC.

- New Relic, Inc.

- LogicMonitor Inc.

- Splunk Inc.

- AppDynamics

- Zenoss Inc.

- SolarWinds Worldwide, LLC.

- Netreo

Recent Developments

-

In April 2024, Dynatrace LLC partnered with Google Cloud to enable more customers worldwide to utilize the Dynatrace platform on Google Cloud. This collaboration focuses on AI-driven analytics and automation for cloud-native environments, supporting digital transformation efforts. As the demand for cloud-based monitoring and observability solutions grows, the combined expertise of Dynatrace and Google Cloud offers businesses the opportunity to enhance digital performance and drive innovation.

-

In November 2023, the Oracle Cloud Infrastructure (OCI) Monitoring team announced updates to the RetrieveDimensionStates and ListAlarmStatus APIs. These enhancements empower users to filter alarms based on resource I.D. and status. These modifications streamline the process of generating visualizations, offering a holistic perspective of alarms and their status within the framework of a specific resource or the entire resource stack.

-

In January 2022, Datadog partnered with Amazon Web Services, Inc. (AWS) to enhance product alignment and collaboration in the future. Through this partnership, Datadog empowers leading organizations to achieve their digital transformation goals with confidence. Customers can take advantage of Datadog’s comprehensive full-stack security, which covers all layers of their cloud environment. This enables seamless analysis of applications, workloads, and infrastructure with just a few clicks while enriching security insights with Datadog-managed threat intelligence feeds.

Cloud Monitoring Market Report Scope

Report Attribute

Details

Market size in 2025

USD 3.56 billion

Revenue forecast in 2030

USD 9.37 billion

Growth rate

CAGR of 21.4% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, service model, enterprise size, industry vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Netherlands; China; India; Japan; Australia; South Korea; Brazil; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Amazon Web Services, Inc.; Microsoft; Alphabet Inc. (Google Cloud); Cisco Systems, Inc.; Oracle, International Business Machines Corp.; Datadog; Dynatrace LLC.; New Relic, Inc.; LogicMonitor Inc.; Splunk Inc.; AppDynamics; Zenoss Inc.; SolarWinds Worldwide, LLC.; Netreo

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cloud Monitoring Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cloud monitoring market report based on type, service model, enterprise size, industry vertical, and region:

-

Type Outlook (Revenue in USD Million, 2018 - 2030)

-

Cloud Storage Monitoring

-

Database Monitoring

-

Website Monitoring

-

Virtual Network Monitoring

-

Virtual Machine Monitoring

-

Others

-

-

Service Model Outlook (Revenue in USD Million, 2018 - 2030)

-

SaaS

-

IaaS

-

PaaS

-

Others

-

-

Enterprise Size Outlook (Revenue in USD Million, 2018 - 2030)

-

Large Enterprises

-

SMEs

-

-

Industry Vertical Outlook (Revenue in USD Million, 2018 - 2030)

-

BFSI

-

IT & Telecom

-

Healthcare

-

Government

-

Retail & Consumer Goods

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cloud monitoring market size was estimated at USD 2.96 billion in 2024 and is expected to reach USD 3.56 billion in 2025

b. The global cloud monitoring market is expected to grow at a compound annual growth rate of 21.4% from 2022 to 2030 to reach USD 9.37 billion by 2030

b. North America dominated the cloud monitoring market with a market share of 60.7% in 2022. Cloud monitoring market in North America is growing significantly due to the high adoption of cloud-based solutions across industries. The region’s emphasis on digital transformation across various industries is driving the adoption of cloud-based services, including cloud monitoring, to optimize operations and improve efficiency.

b. Some key players operating in the cloud monitoring market include Amazon Web Services, Inc., Microsoft, Alphabet Inc. (Google Cloud), Cisco Systems, Inc., Oracle, International Business Machines Corp., Datadog, Dynatrace LLC., New Relic, Inc., LogicMonitor Inc., Splunk Inc., AppDynamics, Zenoss Inc., SolarWinds Worldwide, LLC., and Sumo Logic.

b. Factors such as the growing complexity of cloud environments, the increasing size of datasets, and the need for better visibility and control over cloud resources are expected to drive market growth. Moreover, the growing adoption of hybrid and multi-cloud environments presents significant growth opportunities for the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.