- Home

- »

- Alcohol & Tobacco

- »

-

Clove Cigarettes Market Size, Share & Trends Report, 2030GVR Report cover

![Clove Cigarettes Market Size, Share & Trends Report]()

Clove Cigarettes Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Hand Rolled, Machine Made Kreteks (full-flavored), Machine Made Kreteks (Low Tar nicotine)), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-174-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Clove Cigarettes Market Size & Trends

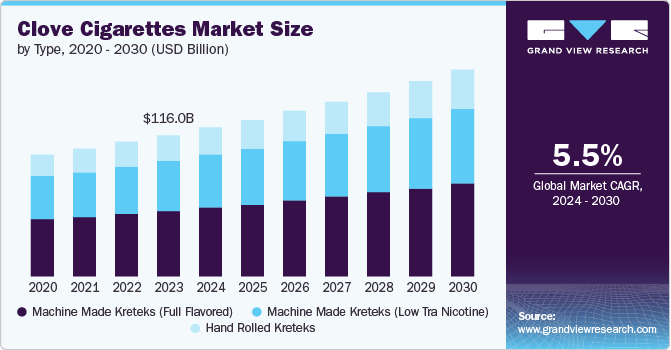

The global clove cigarettes market size was valued at USD 116.0 billion in 2023 and is projected to grow at a CAGR of 5.5% from 2024 to 2030. This growth is driven by increasing consumer demand for flavored tobacco products, including clove cigarettes. In addition, the expansion of distribution channels, particularly online retail platforms, could make these products more accessible to a global customer base. Furthermore, targeted marketing strategies by manufacturers aimed at young adults and the middle-aged population might also contribute to the market growth.

The growth of the global clove cigarettes market can also be attributed to the cultural significance of clove cigarettes, particularly their traditional consumption at social gatherings in Southeast Asian countries. Moreover, the unique taste, aroma, and distinctive flavors of these products are appealing to smokers. Effective marketing strategies targeting specific demographics are also significantly shaping the market. These strategies increase consumer engagement and enhance brand visibility, thereby contributing to market growth. It's important to note that these factors are considered within the context of the global clove cigarettes market.

In response to growing concerns regarding public health and youth smoking rates, governments in various jurisdictions have implemented rigorous regulations targeted at flavored tobacco products, including clove cigarettes. These measures commonly encompass advertising bans, sales restrictions, and increased taxes designed to curtail consumption. The legality of clove cigarettes also varies from country to country. For instance, clove cigarettes are illegal in the U.S. Furthermore, there has been a trend towards increasing regulation and taxation of clove cigarettes in many jurisdictions, making them more expensive and less accessible, which has negatively impacted sales. It’s essential for manufacturers and consumers to be aware of and comply with these local regulations regarding the production, sale, and use of clove cigarettes.

Type Insights

The machine-made kreteks (full-flavored) dominated the market and accounted for 46.5% revenue share of in 2023 owing to shifting consumer preferences towards rich flavors and perceived quality. In addition, regulatory impacts on product availability, rising general market demand leading to increased manufacturing, and cultural factors promoting the continued consumption of traditional herbs have all contributed to this segment’s growth.

On the other hand, the machine-made kreteks (low-tar nicotine) segment is projected to experience the fastest growth, with a CAGR of 6.0% from 2024 to 2030. The growth of this segment is influenced by increasing health considerations among cigarette consumers, which in turn drives demand for innovative product development. Furthermore, these health considerations are prompting major companies to diversify their product portfolios by introducing low-tar products, thereby increasing product demand. Stringent regulations and government policies on tobacco products are also pushing tobacco companies to innovate and adapt, further driving growth in this segment.

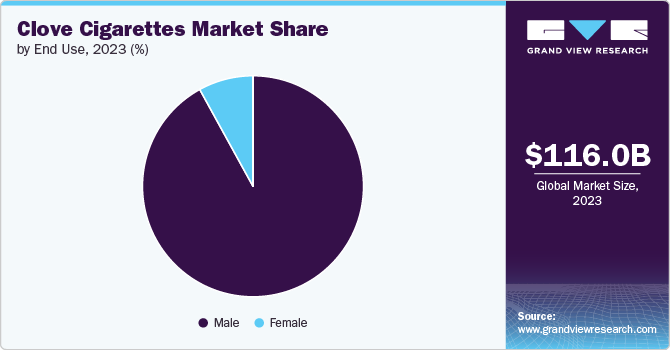

End Use Insights

The male end use segment held a dominant position in the global clove cigarettes market in 2023. This dominance can be attributed to cultural factors in countries such as Indonesia, the birthplace of clove cigarettes, where smoking is often associated with social status among males. This association increases the demand for these products among men who wish to be perceived as sophisticated. The growing social influence among men also plays a significant role in increasing smoking consumption, thereby driving the demand for clove cigarettes. Furthermore, enhanced marketing strategies targeting men with themes such as adventure and lifestyle choices are appealing to male consumers.

The female end use segment is projected to witness significant growth from 2024 to 2030. This growth can be attributed to cultural influences in regions such as Southeast Asia, where female smoking is encouraged as a social norm. The growing acceptance of female smokers in various cultures, seen as a sign of freedom of expression, is also driving product demand in this segment. In addition, major brands are offering unique flavor profiles, such as menthol, cherry, and vanilla, which provide a distinctive aroma and taste, thus appealing to female smokers and significantly driving segment growth.

Regional Insights

North American clove cigarettes market accounted for a significant market share in 2023. This growth can be attributed to several factors. Innovative product launches offering new flavors and blends have appealed to smokers in the region. Moreover, innovative marketing strategies targeting younger consumers, including collaborations with social media influencers for product promotion, have increased clove cigarette sales. The expansion of distribution channels, including online sales platforms and specialty tobacco shops, has also attracted non-smokers, contributing to market growth in the region.

U.S. Clove Cigarettes Market Trends

The U.S. dominated the North American clove cigarettes market in 2023. This dominance can be attributed to the growing acceptance of flavored tobacco products among the younger generation. Changing consumer perceptions of clove cigarettes, viewed as a less harmful alternative compared to traditional cigarettes, have also increased the product’s popularity among smokers, significantly driving market growth in the country.

Europe Clove Cigarettes Market Trends

Europe clove cigarettes market was identified as a lucrative region in 2023 attributed to the rise of social media marketing and digital campaigns promoting clove cigarettes, particularly among younger demographics. In addition, the adoption of more lenient stances towards flavored tobacco in many countries, compared to other types of cigarettes, has increased growth opportunities for these products in the region.

The UK clove cigarettes market is anticipated to experience rapid growth in the coming years. This growth can be attributed to an increasing variety of products with innovative flavors and diverse tastes, which appeal to smokers. Furthermore, growing awareness about the lower nicotine content in clove cigarettes, compared to traditional cigarettes, is changing health perceptions among smokers and increasing demand for these products.

Asia Pacific Clove Cigarettes Market Trends

Asia Pacific clove cigarettes market is anticipated to witness the fastest growth with a CAGR of 6.1% from 2024 to 2030. This growth can be attributed to several factors. Cultural acceptance and traditions in many countries, such as Indonesia, have led to increased demand for these products among both men and women. Shifting trends towards flavored cigarettes among younger demographics, due to their unique taste and aroma, are also playing a major role in market expansion. Furthermore, economic growth in several countries in the region, including China, Japan, and India, is increasing demand for premium quality tobacco products, thereby driving the market growth.

China Clove Cigarettes market held a substantial market share in 2023. This can be attributed to the desire to conform to cultural and social norms involving the use of cigarettes. The growth in consumption rate among youths, innovations introducing new products in the market, and increased disposable income spent on quality products such as flavored clove cigarettes have all contributed to this market share. Additionally, effective marketing strategies targeting different customer categories and changes in regulatory policies that favor the industry have also played a significant role.

Key Clove Cigarettes Company Insights

Some of the key companies in the clove cigarettes market include Gudang garam, JT international, Bentoel group, and other companies. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Philip Morris Products S. A. is a tobacco company, popularly associated with the Marlboro brand, specializing in smoking options and conventional tobacco products. Looking at the clove cigarettes market and its specifics, Philip Morris has taken part in the manufacturing and selling of these specific sorts of cigarettes that contain tobacco combined with cloves and other spices, which meets the particular preferences of smokers who search for the specific experiences linked with smoking.

-

PT. Gudang Garam Tbk operates in clove cigarettes, which are called kretek locally. These are a combination of tobacco and cloves that are popular in Indonesia. The company has a great product portfolio that covers several Kretek cigarettes, following the different segments of consumers, enabling it to deal with competition in the clove cigarettes market.

Key Clove Cigarettes Companies:

The following are the leading companies in the clove cigarettes market. These companies collectively hold the largest market share and dictate industry trends.

- Philip Morris Products S.A.

- PT. Gudang Garam Tbk

- PT Djarum.

- Nojorono Tobacco Indonesia

- JT International SA.

- Bentoel Group

- Wismilak Group.

- Kretek International, Inc.

Recent Developments

-

In February 2024, Kretek International announced the nicotine-free Djarum Bliss clove smokes with 2 flavors, aiming to capture the U.S. and Canada market share by 2024 end.

-

In November 2023, Global Investment Holding Co. (GIHC) successfully finalized the acquisition of a 30 percent stake in Eastern Co. This transaction is a component of Egypt’s struggling privatization initiative.

Clove Cigarettes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 122.0 billion

Revenue forecast in 2030

USD 168.6 billion

Growth Rate

CAGR of 5.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, South Africa

Key companies profiled

Philip Morris Products S.A.; PT. Gudang Garam Tbk; PT Djarum.; Nojorono Tobacco Indonesia; JT International SA.; Bentoel Group; Wismilak Group.; Kretek International, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clove Cigarettes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global clove cigarettes market report based on type, end use, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hand Rolled Kreteks

-

Machine Made Kreteks (Full Flavored)

-

Machine Made Kreteks (Low Tra Nicotine)

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Male

-

Female

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.