- Home

- »

- Homecare & Decor

- »

-

Co-living Market Size And Share, Industry Report, 2030GVR Report cover

![Co-living Market Size, Share & Trend Report]()

Co-living Market (2025 - 2030) Size, Share & Trend Analysis Report By Occupancy (Single Occupancy, Double Occupancy, Tripple/Multi Occupancy), By Type (Economy, Midrange, Luxury), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-503-9

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Co-living Market Summary

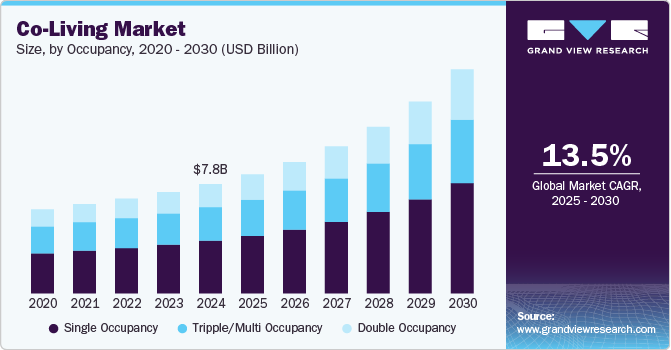

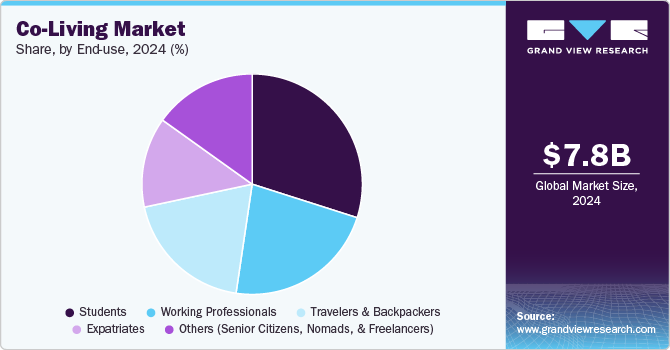

The global co-living market size was estimated at USD 7.82 billion in 2024 and is projected to reach USD 16.05 billion by 2030, growing at a CAGR of 13.5% from 2025 to 2030. The rising cost of living in urban areas drives the demand for co-living spaces. As cities continue to expand and housing becomes more expensive, co-living offers an affordable alternative, especially for young professionals and students.

Key Market Trends & Insights

- The co-living market in North America accounted for a revenue share of 17.9% in 2024.

- The co-living market in the U.S. accounted for a significant revenue share in 2024.

- By occupancy, the single occupancy segment led the market with the market with the largest revenue share of 48.23% in 2024.

- By type, the economy segment led the market with the largest revenue share of 53.36% in 2024.

- By end use, the students segment led the market with the largest revenue share of 29.92% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.82 Billion

- 2030 Projected Market Size: USD 16.05 Billion

- CAGR (2025-2030): 13.5%

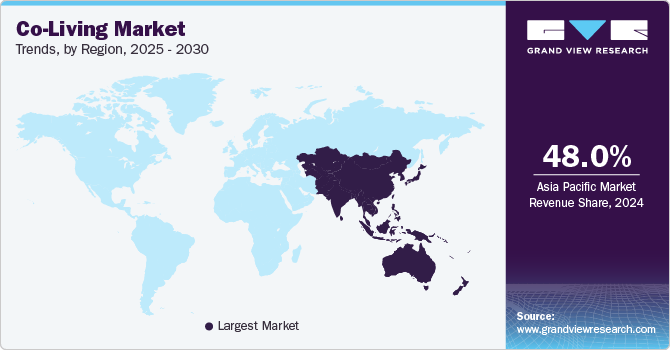

- Asia Pacific: Largest market in 2024

By sharing living spaces and communal facilities, residents can significantly reduce expenses such as rent, utilities, and maintenance, making city living more accessible to those with limited budgets.

Co-living spaces are designed to foster a sense of belonging by emphasizing shared experiences and interactions. Residents often benefit from communal areas such as kitchens, lounges, and coworking spaces, which encourage collaboration and networking. This appeal is particularly strong among millennials and Gen Z, who value experiences and relationships over material possessions.

As more people migrate to cities in search of better career opportunities, education, and quality of life, the demand for housing in urban centers often outstrips supply, leading to skyrocketing rents and property prices. For young professionals, students, and early-career individuals, securing affordable housing in prime city locations is often a significant challenge. Co-living addresses this by offering shared housing models where residents can split costs such as rent, utilities, and maintenance. By pooling resources, residents enjoy lower individual financial burdens while still accessing desirable locations close to work, education, and cultural hubs.

Unlike traditional rental housing, which often requires long-term leases, high deposits, and commitments, co-living spaces typically provide shorter, more flexible terms. This arrangement is particularly attractive to people with transient lifestyles, such as digital nomads, remote workers, expatriates, and freelancers, who prioritize mobility and adaptability. Furthermore, co-living spaces often come fully furnished and equipped with amenities such as high-speed internet, housekeeping, and maintenance services, making them a convenient, hassle-free option for those who prefer a "move-in ready" experience.

The shift toward sustainable and shared consumption has amplified the appeal of co-living. Many of these spaces are designed with sustainability in mind, incorporating energy-efficient appliances, shared resources, and eco-friendly practices. By reducing individual consumption and encouraging shared use of resources, co-living aligns with the values of environmentally conscious individuals and contributes to a more sustainable urban living model.

Occupancy Insights

Based on occupancy, the single occupancy segment led the market with the market with the largest revenue share of 48.23% in 2024. While co-living fosters social interaction and shared experiences, many residents, particularly working professionals and students, value having their own private space to relax, work, or focus on personal activities without interruptions. This trend is also driven by rising income levels and a preference for higher-quality living arrangements, allowing individuals to afford single occupancy while still enjoying shared amenities and a sense of community. The increasing emphasis on health and hygiene post-pandemic has heightened the demand for private spaces within shared housing, making single occupancy an appealing choice for those seeking a balance between independence and connectivity.

The double occupancy segment is anticipated to grow at the fastest CAGR of about 14.6% from 2025 to 2030. Sharing a room allows residents to significantly reduce their expenses on rent while still accessing premium co-living amenities such as furnished spaces, utilities, and community events. In addition, the double occupancy setup fosters close social connections, making it attractive to individuals seeking companionship or an opportunity to live with friends or like-minded peers. As housing affordability remains a challenge in urban centers, the double occupancy model strikes a balance between affordability and community living, making it a practical and appealing choice for many.

Type Insights

Based on type, the economy segment led the market with the largest revenue share of 53.36% in 2024. This segment allows residents to enjoy essential amenities and community living at a lower cost, making it an attractive alternative to traditional rental options in expensive cities. The economy type also caters to individuals who prioritize functionality over luxury, offering shared spaces and services that meet basic living needs without incurring high expenses. As urbanization and housing costs continue to rise, the economy segment offers a sustainable solution for those seeking affordable accommodations without compromising on connectivity, convenience, and access to communal experiences.

The midrange segment is expected to grow at a significant CAGR from 2025 to 2030. The midrange segment caters to professionals and students who are willing to invest slightly more in better amenities, private or semi-private spaces, and higher-quality furnishings while still enjoying the benefits of a co-living community. Midrange co-living spaces often include additional perks such as coworking areas, social events, and improved facilities that enhance the overall living experience. As urban populations grow and disposable incomes increase, many residents are opting for midrange options that provide comfort and convenience without the premium price tag associated with luxury accommodations, making it a popular and sustainable choice.

End Use Insights

Based on end use, the students segment led the market with the largest revenue share of 29.92% in 2024. Co-living spaces offer an affordable, convenient, and community-focused alternative to traditional student housing, which is often limited in availability or expensive. These spaces provide fully furnished accommodations, shared amenities, and a supportive environment that fosters social interaction and collaboration, aligning with the needs of students seeking both comfort and connection. In addition, co-living spaces often prioritize proximity to universities, public transportation, and essential services, making them an ideal choice for students seeking convenience.

The working professionals segment is projected to grow at the fastest CAGR of 14.4% from 2025 to 2030. Co-living spaces cater to the lifestyle of working professionals by offering fully furnished accommodations, flexible lease terms, and amenities like high-speed internet and coworking spaces, which align with the needs of remote workers and hybrid job roles. In addition, these spaces foster a sense of community through networking opportunities and social events, helping professionals build connections in a new city or environment.

Regional Insights

The co-living market in North America accounted for a revenue share of 17.9% in 2024. Major cities in the U.S. and Canada, such as New York, Los Angeles, and Toronto, are experiencing a housing affordability crisis, driving students, young professionals, and remote workers to seek cost-effective living arrangements. Co-living spaces address these challenges by offering shared housing options with modern amenities, flexible lease terms, and a built-in sense of community. In addition, the rise of remote and hybrid work models has increased the demand for living arrangements that combine convenience with features like coworking spaces and networking opportunities.

U.S. Co-Living Market Trends

The co-living market in the U.S. accounted for a significant revenue share in 2024. As cities like New York, San Francisco, and Chicago become more expensive, co-living offers an affordable alternative, allowing individuals to share costs while accessing prime locations and modern amenities. The growing popularity of remote work has also contributed to the need for spaces that combine living and working environments, such as co-living communities with coworking areas. In addition, younger generations value experiences, connections, and convenience over traditional housing models, and co-living aligns with these priorities by fostering a sense of community and providing flexible lease terms.

Asia Pacific Co-Living Market Trends

Asia Pacific dominated the co-living market for the largest revenue share of 48.02% in 2024. The region's rising disposable incomes, coupled with the integration of smart technologies and premium amenities in co-living spaces, have driven their popularity. With governments and private players investing in urban housing infrastructure, co-living continues to thrive as a preferred solution to meet the growing housing demand in the region. Co-living spaces address these challenges by providing cost-effective and flexible accommodations in prime city locations. The region's younger population, especially millennials and Gen Z, prefer community-oriented and convenience-focused living arrangements, which co-living spaces are designed to offer.

Europe Co-Living Market Trends

The co-living market in Europe accounted for a revenue share of over 21.8% in 2024. Co-living offers a practical solution, providing cost-effective accommodations in central locations while addressing the needs of students, young professionals, and expatriates. In addition, Europe’s highly mobile population, with many individuals relocating across countries for education or work, creates a demand for flexible housing with shorter leases and minimal upfront costs. The cultural emphasis on sustainability and community in Europe also aligns well with the co-living model, which promotes resource sharing, eco-friendly designs, and social engagement.

Key Co-Living Company Insights

Some of the key companies include Habyt., Selina, Outsite Co., and Common Living. Stanza Living is a leading managed accommodation provider in India, specializing in co-living spaces designed for students and working professionals. The company offers fully furnished accommodations equipped with modern amenities such as high-speed Wi-Fi, housekeeping, security, and nutritious meal plans. Stanza Living focuses on creating community-centric living environments, offering services like app-based management, social events, and recreational facilities to enhance the resident experience.

Habyt is a provider in the co-living and flexible housing market, offering modern, fully furnished accommodations designed to meet the needs of urban dwellers, remote workers, and digital nomads. The company provides a range of housing solutions, including private studios, shared apartments, and community-oriented co-living spaces equipped with premium amenities such as high-speed internet, shared lounges, coworking areas, and event spaces. With a presence in multiple cities across Europe and Asia, Habyt focuses on creating hassle-free, sustainable, and community-driven living environments tailored to the dynamic lifestyles of its residents.

Key Co-Living Companies:

The following are the leading companies in the co-living market. These companies collectively hold the largest market share and dictate industry trends.

- Habyt.

- Selina

- Outsite Co.

- Common Living.

- Stanza Living

- Zolo Stays

- Colive

- MyTurf Hospitality Pvt Ltd.

- Sun and Co.

- Nomadico

Recent Developments

-

In March 2024, Habyt announced the launch of a new co-living development in Leipzig, Germany. Located in the vibrant Zentrum-Nord district, the five-story building at Berliner Strabe 22-30 comprises 185 fully furnished units, including 75 private studios and shared apartments with two to five bedrooms. Amenities feature a rooftop terrace with city views, a courtyard, an outdoor lounge, and a spacious community area for work and socializing. This development marked Habyt’s entry into the Leipzig market and reinforced its position in the flexible housing industry.

-

In March 2024, Zolo Stays announced the launch of 'Zolo Diya,' a women-only co-living property in Mathikere, Bengaluru, managed entirely by women. Launched on International Women's Day, the initiative aligns with the theme 'Invest in Women: Accelerate Progress,' aiming to empower women through safe and inclusive living spaces. The property had already achieved 50% occupancy during its pre-launch phase. Zolo Diya offers fully furnished accommodations with amenities such as high-speed Wi-Fi, 24/7 security, and regular housekeeping, catering to students and professionals seeking a supportive community environment.

Co-Living Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.53 billion

Revenue forecast in 2030

USD 16.05 billion

Growth rate

CAGR of 13.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Category, price range, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; and South Africa

Key companies profiled

Habyt.; Selina; Outsite Co.; Common Living.; Stanza Living; Zolo Stays; Colive; MyTurf Hospitality Pvt Ltd.; Sun and Co.; and Nomadico

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Co-living Market Report Segmentation

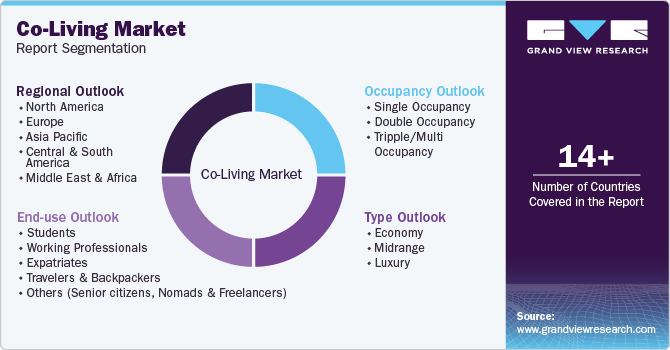

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global co-living market report based on occupancy, type, end use, and region:

-

Occupancy Outlook (Revenue, USD Million, 2018 - 2030)

-

Single Occupancy

-

Double Occupancy

-

Tripple/Multi Occupancy

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Economy

-

Midrange

-

Luxury

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Students

-

Working Professionals

-

Expatriates

-

Travelers and Backpackers

-

Others (Senior citizens, Nomads and Freelancers)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.