- Home

- »

- Advanced Interior Materials

- »

-

Coated Fabrics Market Size, Share & Trends Report, 2030GVR Report cover

![Coated Fabrics Market Size, Share & Trends Report]()

Coated Fabrics Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Polymer Coated Fabrics, Rubber Coated Fabrics), By Application (Transportation, Protective Clothing, Industrial), By Region, And Segment Forecasts

- Report ID: 978-1-68038-140-5

- Number of Report Pages: 79

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Coated Fabrics Market Summary

The global coated fabrics market size was estimated at USD 20.75 billion in 2022 and is projected to reach USD 33.57 billion by 2030, growing at a CAGR of 6.2% from 2023 to 2030. This growth is attributed to the growing use of such rubber-coated fabrics in the production of military wear and protective clothing.

Key Market Trends & Insights

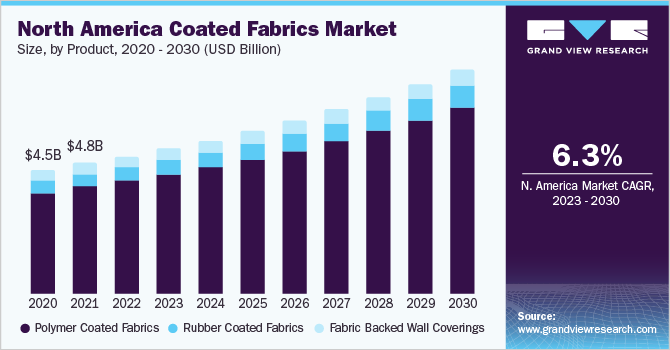

- The North America region is also expected to register robust growth with a CAGR of 6.3% over the forecast period.

- By product, the polymer-coated fabrics segment dominated the market with a revenue of USD 17,329.1 million in 2022.

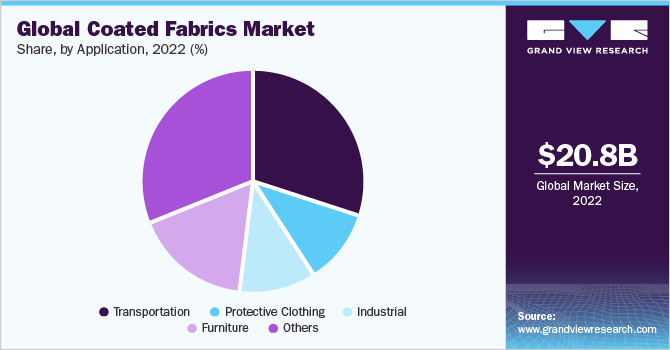

- By application, the transportation segment accounted for the largest revenue share or precisely 29.5% in 2022.

Market Size & Forecast

- 2022 Market Size: USD USD 20.75 Billion

- 2030 Projected Market Size: USD 33.57 Billion

- CAGR (2023-2030): 6.2%

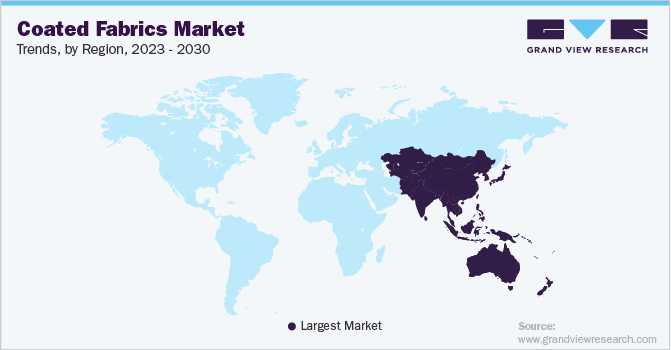

- Asia Pacific: Largest market in 2022

This is expected to drive market growth over the forecast period.The vast majority of coated fabrics used in motor vehicles are in the original equipment manufacturer (OEM) applications, airbags in particular. Coated fabrics can also be used in motor vehicle upholstery, headliners, convertible tops, pickup-truck bed covers, heavy-truck covers, and sides, nose covers, and spare tire covers. Due to the importance of airbags, nylon is the largest substrate - in area terms - used in the light vehicle market.

The growth can also be attributed to the increasing use of the product for the manufacturing of industrial products such as conveyor belts and PTFE tapes. In addition, the market is expected to benefit from the increasing use of coated fabrics as low-cost alternative leather for trims and upholstery. Factors such as volatile raw material prices and stringent environmental protection regulations are expected to encourage the manufacturers to focus on research & development of an alternative to leather. In addition, technological innovations aimed at the reduction of raw material prices and achieving faster and more efficient production are expected to drive growth.

As with the rest of the textile processing and finishing industry, the manufacturing of coated fabrics generates problematic waste materials, including fabric scraps, scrap resins, and wastewater containing potentially toxic pollutants, including solvents, dyes, pigments, and other chemical residues. Additionally, coating processes that involve the application of polymeric or elastomeric materials onto fabrics are prone to the release of toxic substances.

The industry is highly capital-intensive which is expected to present barriers to new market entrants. The presence of a large number of substitutes is expected to result in low bargaining power for buyers. However, emerging technologies such as plasma coating, nanomaterials, and inkjet deposition are expected to provide excellent growth opportunities to the market.

Product Insights

The polymer-coated fabrics segment dominated the market with a revenue of USD 17,329.1 million in 2022. The segment is further expected to grow at a CAGR of 6.2% over the forecast period owing to the surging demand for airbags in automobiles coupled with increasing demand for protective clothing. The market demand for polymer-coated fabrics is expected to rise significantly over the forecast period owing to the increasing automobile production in Asian countries such as China and India.

The rubber-coated fabrics segment dominated the market with a revenue of USD 1,937.1 million in 2022. The demand for rubber-coated fabric in this industry is growing by factors such as the increased level of industrial activity, technological advancements, and regulations regarding worker safety and environmental impact. The growing focus on sustainability and eco-friendly policies are also driving market demand for rubber-coated fabrics. Many manufacturers are now using recycled rubber and other sustainable materials to create rubber-coated fabrics, which reduce their environmental impact.

The fabric-backed wall covering segment is expected to grow at a CAGR of 5.9% over the forecast period owing to the growing focus on sustainability and eco-friendliness. Many manufacturers are now using recycled rubber and other sustainable materials to create rubber-coated fabrics, which reduces their environmental impact. They can also provide insulation, providing much-needed warmth during winter and cooler temperatures in summer. As a result, the demand for the product is expected to increase substantially.

Fabric-backed wall coverings are generally easy to install, especially compared to other types of wall coverings like wallpaper. They can be applied using simple techniques such as paste-the-wall or peel-and-stick, which save time and money on installation costs. They are highly durable and can withstand wear and tear, making them ideal for high-traffic areas such as hotels, restaurants, and offices.

Application Insights

The transportation segment accounted for the largest revenue share or precisely 29.5% in 2022. It is also expected to be the fastest-growing segment by 2030. The growth in the demand for coated fabric in the transportation sector can be attributed to increasing automobile sales over the past few years coupled with the development in rail and roadway transportation.

The protective clothing application accounted for 11.1% of the total revenue in 2022, which is expected to reach USD 3,918.2 million by 2030. Factors such as an increase in industrialization and government initiatives for the implementation of safety standards in China and India for the use of protective clothing are expected to contribute to the growth in demand for coated fabrics industry over the forecast period.

The industrial application market segment was valued at USD 2,289.8 million in 2022 and is expected to reach USD 3,553.4 million by 2030. The demand for coated fabrics in industrial applications is growing as they are increasingly used to make industrial curtains that can be used to separate different areas of a factory or warehouse. These curtains are used because they are resistant to chemicals, dust, and other environmental hazards. Coated fabrics are used to make seals and gaskets for industrial equipment. The demand for the product is expected to grow at a substantial rate for this application.

The furniture application accounted for 17.4% of the total revenue in 2022 and is expected to grow at a CAGR of 7.4% during the forecast period. The demand for coated fabrics in furniture applications is driven by the need for materials that are durable, stain-resistant, versatile, customizable, easy to maintain, and cost-effective. As the furniture industry continues to evolve and consumers demand more sustainable and eco-friendly materials, coated fabrics are likely to remain a popular choice for furniture manufacturers.

Regional Insights

Asia Pacific was the largest market for coated fabrics in 2022 with a revenue of USD 8,132.9 million, on account of the growing automotive industry in developing countries. Furthermore, increasing product usage in the production of household furniture is further expected to augment the demand for coated fabrics in various applications. As a result of the increasing rate of automotive manufacturing in the region, the coated fabrics industry is expected to register the highest rate of growth in the Asia Pacific region.

The Europe region is expected to register robust growth with a CAGR of 5.7% over the forecasted period. This growth is likely to contribute significantly to the enormous rise and demand for coated fabrics in both regions. In addition to this, the presence of numerous major vehicle manufacturers in Europe is the primary factor driving factor behind the growth of the market.

The North America region is also expected to register robust growth with a CAGR of 6.3% over the forecast period. The growing oil and gas activities in North America along with the stringent FDA regulation have augmented the protective clothing applications in the region. This is expected to contribute substantially to the demand for coated fabrics. Furthermore, the presence of major automobile manufacturers in North America is majorly driving the growth in this area.

The Central & South America region is expected to witness promising growth with a CAGR of 6.5% over the forecast period. The presence of some of the leading players will continue to support growth in the region. Implementation of stringent regulations by organizations such as the Occupational Safety and Health Administration aimed at curbing the risk of accidents in workplaces and ensuring a safer environment will fuel the demand for protective clothing.

Key Companies & Market Share Insights

Companies in the industry maintain a strong focus on mergers and acquisitions to increase their market share. In addition, companies such as International Incorporated use the strategy to enter into new markets thereby eliminating the need for the setup of manufacturing or distribution channels.

Omnova Solutions accounts for the largest share, followed by Spradling International Inc., and Takata Corporation. The major players in the industry make large investments in the research and development of new products. Some prominent players in the global coated fabrics market include:

-

Omnova Solutions

-

Saint-Gobain S.A.

-

Spradling International Inc.

-

Takata Corporation

-

Trelleborg AB

-

Bo-Tex Sales Co.

-

Mauritzon Inc.

-

ContiTech AG

-

Isotex S.p.A

-

Graniteville Specialty Fabrics

Coated Fabrics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 21.88 billion

Revenue forecast in 2030

USD 33.57 billion

Growth rate

CAGR of 6.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in million square meters, revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Mexico, Canada, UK, Germany, UK, France, Spain, Italy, China, Japan, India, Australia, South Korea, Brazil, Argentina, Saudi Arabia, UAE

Key companies profiled

Omnova Solutions; Saint-Gobain S.A.; Spradling International Inc.; Takata Corporation; Trelleborg AB; Bo-Tex Sales Co.; Mauritzon Inc.; ContiTech AG; Isotex S.p.A; Graniteville Specialty Fabrics

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Coated Fabrics Market Report Segmentation

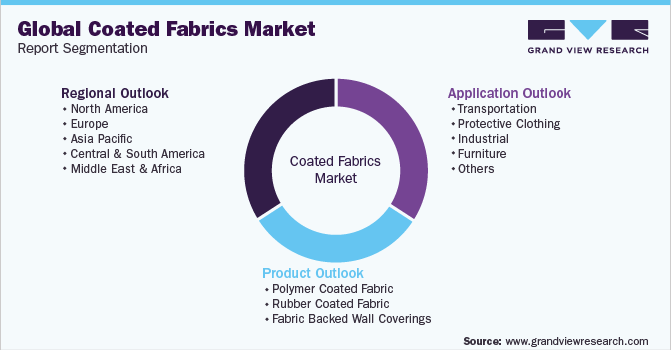

This report forecasts volume & revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global coated fabrics market report based on product, application, and region:

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Polymer Coated Fabric

-

Rubber Coated Fabric

-

Fabric Backed Wall Coverings

-

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Transportation

-

Protective Clothing

-

Industrial

-

Furniture

-

Others

-

-

Regional Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global coated fabrics market size was estimated at USD 20.74 billion in 2022 and is expected to reach USD 21.88 billion in 2023.

b. The global coated fabrics market is expected to grow at a compound annual growth rate a CAGR of 6.2% from 2023 to 2030 to reach USD 33.57 billion by 2030.

b. The polymer coated fabrics accounted for the largest revenue share in 2022 to the increasing automobile production in Asian countries such as China and India..

b. Some key players operating in the coated fabrics market include Omnova Solutions, Saint-Gobain S.A., Spradling International Inc., Takata Corporation, Trelleborg AB, Bo-Tex Sales Co., Mauritzon Inc., ContiTech AG, Isotex S.p.A, Graniteville Specialty Fabrics.

b. The key factors driving the market growth are the growing industrialization coupled with infrastructure development expected to present lucrative growth opportunities to the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.