- Home

- »

- Medical Devices

- »

-

Cochlear Implant Market Size, Share & Growth Report, 2030GVR Report cover

![Cochlear Implant Market Size, Share & Trends Report]()

Cochlear Implant Market (2024 - 2030) Size, Share & Trends Analysis Report By Age Group (Adult, Pediatric), By End-use (Hospitals, Clinics), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-720-9

- Number of Report Pages: 145

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cochlear Implant Market Summary

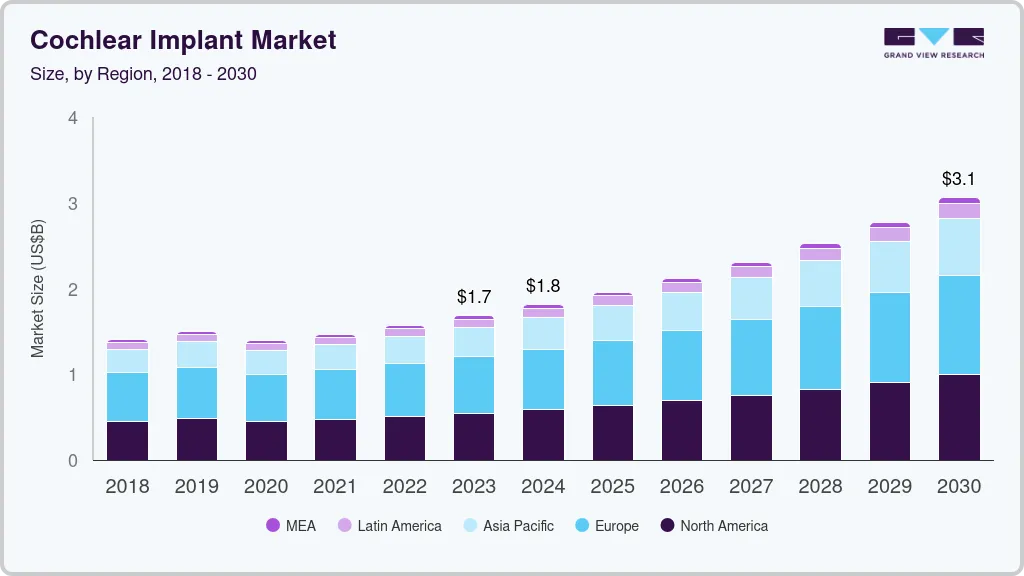

The global cochlear implant market size was estimated at USD 1.86 billion in 2023 and is anticipated to reach USD 2.77 billion by 2030, growing at a CAGR of 6.02% from 2024 to 2030. Increasing awareness regarding hearing impairment, growing diagnosis rate, rising preference for bilateral fittings, and favorable government initiatives are some factors expected to drive this growth.

Key Market Trends & Insights

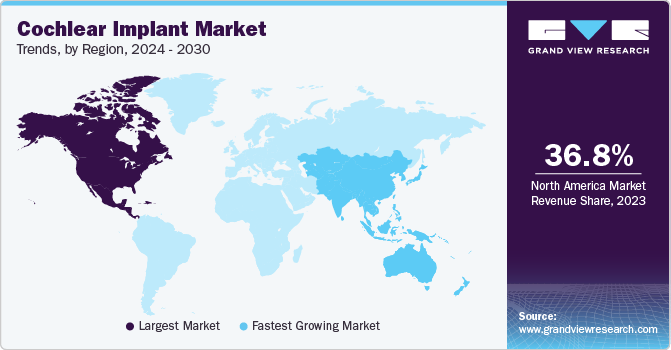

- North America held the largest market share of 36.83% in 2023.

- The U.S. accounted for the largest share in North America in 2023.

- By age group, the adult segment held the largest revenue share of 57.70% in 2023.

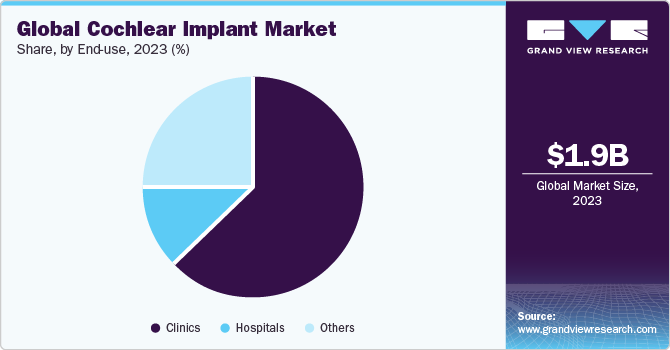

- By end-use, the clinics segment is anticipated to dominate the global market with maximum share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.86 Billion

- 2030 Projected Market Size: USD 2.77 Billion

- CAGR (2024-2030): 6.02%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

An increase in coverage for cochlear implants in the U.S. is majorly due to increased awareness about its clinical utility and other federal & state laws, such as Americans with Disabilities Act, against discrimination faced by individuals with disabilities. The increasing prevalence of hearing impairment among elderly is a significant factor driving market growth. The rising burden of hearing impairment in this age group is expected to drive this growth. According to the UN's World Social Report 2023, 761 million people globally are aged 65 years and above in 2021. According to the WHO, the geriatric population is expected to nearly double from 12% in 2012 to 22% in 2050, reaching two billion by 2050 from 900 million in 2015. This is expected to drive the demand for both short and long-term demand for auditory impairment devices have increased, driving the market growth.

There has been a noticeable increase in the adoption of cochlear implants in recent years due to technological advancements and the introduction of insurance & funding schemes to cover these devices. For instance, in March 2023, MED-EL Medical Electronics launched a new feature in its latest cochlear implant systems, enabling direct streaming for patients. Cochlear implantation surgeries are now performed using minimally invasive surgical techniques with next-generation implants & speech processors. Thus, improvements in the surgical process to make it safer are likely to boost their demand.

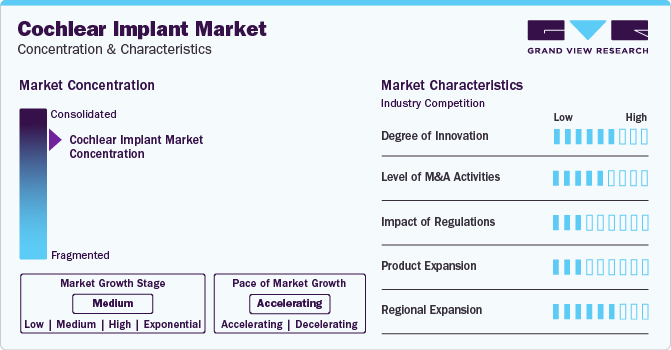

Market Concentration & Characteristics

Cochlear implant sound processor technology has significantly improved recipients' quality of life. Wearability, streaming/connectivity, and sound processing are some key areas that have seen major advancements. The device is now more comfortable to wear for extended periods, can connect to other devices, and provides clearer sound, making speech comprehension and music appreciation easier. These advancements are expected to boost market growth.

Market players such as Cochlear Ltd., MED-EL Medical Electronics are involved in merger and acquisition activities. Companies can expand their geographic reach and enter new territories through mergers and acquisitions (M&A) activities. For instance, in March 2022, Sonova Holding AG acquired Sennheiser electronic GmbH & Co. KG's consumer division. This acquisition will add a new business unit to Sonova and provide growth opportunities in fast-growing audiophile headphones market.

In U.S., the FDA regulates manufacturing and selling of cochlear devices. In addition, manufacturers must demonstrate to the U.S. FDA that cochlear implants are effective and safe. Further, the implant is classified as a class III device due to the high risk associated with it. Hence, stringent regulations for approval are likely to restrain market growth.

There is limited demand side substitution for cochlear implants and hence companies are launching several technologically advanced products in the market to increase the market share. For instance, in December 2023, Advanced Bionics received FDA approval for their cochlear implant technology and expanded their Marvel CI sound processor product offerings with new features to improve hearing care delivery and patient outcomes.

The level of regional expansion is prominent in the market as various government programs and initiatives to promote treatment of hearing loss in different countries such as Argentina. For instance, in September 2022, WS Audiology expanded its regional presence by opening Americas manufacturing and distribution center in Mexico and to support Signia customers throughout Latin America, Canada, and U.S.

Age Group Insights

The adult segment held the largest revenue share of 57.70% in 2023 and is expected to maintain its dominance from 2024 to 2030. However, adult cochlear implant segment’s growth is slower than pediatric segment. The high patient pool with severe-to-profound hearing loss, advancements in adult cochlear implants, and increasing number of speech therapy centers are some of the key factors likely to boost the growth.

The adult segment is further divided intoadult unilateral implant adult and bilateral implants. In 2023, the adult unilateral implants segment dominated market due high demand. When patients receive a single cochlear implant for one ear, it is referred to as a unilateral implant. The preference for unilateral implantation is increasing among them. Moreover, unilateral implants are popular in low- and middle-income countries as bilateral implants are expensive.

The pediatric segment is expected to register the fastest CAGR from 2024 to 2030. The high utilization of cochlear implants by children due to their cost-effectiveness is likely to drive this growth. Since 2000, cochlear implants have been approved for use in children older than 12 months. According to National Institute on Deafness and Other Communication Disorder (NIDCD), in March 2021, two out of three of every 1,000 children in the U.S. are born with hearing loss in either or both ears. Moreover, over 90% of children with hearing loss are born to parents with no hearing impairment.

End-use Insights

The clinics segment is anticipated to dominate the global market with maximum share in 2023. Cochlear implant surgery is increasingly being performed in outpatient clinics, as opposed to hospitals. This is due to advancements in surgical techniques and development of smaller, more portable cochlear implant devices.

Clinics offer patients a more convenient and personalized experience than hospitals. For instance, clinics can offer shorter wait times for appointments and more flexible scheduling options. In December 2023, Montreal Children’s Hospital (MCH) and McGill University Health Centre (MUHC) announced the start of a second cochlear implant point of service in Quebec. The clinic’s purpose is to provide children & adults with hard of hearing & hearing loss living in western part of province with chance to benefit from complete, state-of-the-art hearing health care near home.

The others segment is expected to register the fastest CAGR from 2024 to 2030. This segment includes rehabilitation centers, auditory implant centers, and University Medical Centers (UMCs). The demand for auditory implant centers and rehabilitation centers is growing. These centers are dedicated to hearing restoration procedures, including cochlear implantation. These centers often have the expertise and equipment specifically tailored to such surgeries.

Regional Insights

North America held the largest market share of 36.83% in 2023. Some of the key drivers for this growth include technological advancements, reimbursement coverage, and greater spending capacity, resulting in high adoption of cochlear implant devices. In addition, the availability of skilled surgeons and well-equipped clinics is another factor propelling the regional growth. Moreover, key companies are developing products that can provide profound treatment to cochlear implant patients, along with developing sound processors with dual microphones.

The U.S. accounted for the largest share in North America in 2023, due to the introduction of several implants & sound processors, supportive government policies, private insurance coverage, and high awareness about hearing aids. As per the study conducted by Otology & Neurotology, Inc. in July 2023, the number of adults above 20 years undergoing cochlear implantation increased from 244 per 100,000 to 350 per 100,000 in 2019. Moreover, the age group of 80 years and older had lower incidence of cochlear implantation, from 105 per 100,000 person-year to 202 during the study period.

Asia Pacific is expected to register the fastest CAGR from 2024 to 2030. The rising urbanization within developing nations, characterized by increased noise levels from vehicles & industrial activities and lack of noise pollution regulations, are contributing to the prevalence of hearing loss across Asia Pacific. Hence, cochlear implants, benefiting individuals with severe to profound sensorineural hearing loss, are becoming increasingly essential.

Key Companies & Market Share Insights

Some of the key market players include Sonova, Cochlear Ltd., MED-EL Medical Electronics, and Demant A/S.

-

Cochlear Ltd. is engaged in developing and commercializing cochlear implants, bone conduction implants, & acoustic implants to treat hearing-impaired individuals. It is a global company with major manufacturing facilities in Sweden and Australia.

-

MED-EL Medical Electronics (MED-EL) is a privately held company focusing on R&D to create a rich product pipeline. It develops and commercializes cochlear, bone conduction hearing, middle ear, auditory brainstem, and electric-acoustic stimulation hearing implants.

Amplifon S.p.A. (GAES) and Zhejiang Nurotron Biotechnology Co., Ltd. (Nurotron) are some of the emerging participants in the cochlear implant market.

-

Zhejiang Nuoerkan Neuroelectronics Technology Co., Ltd. (Nurotron) is headquartered in China, while its R&D center is in California. It is a medical device company engaged in designing, developing, and commercializing neurostimulation systems.

-

Amplifon S.p.A. (GAES) offers customizable hearing solutions and services through a distribution system of association affiliates, shop-in-shops, corporate shops, and franchises. It operates based on geography in three segments: the MEA & Asia Pacific, the Americas, and Europe.

Key Cochlear Implant Companies:

- Cochlear Ltd.

- Sonova

- MED-EL Medical Electronics

- Demant A/S

- Zhejiang Nurotron Biotechnology Co., Ltd. (Nurotron)

- Amplifon S.p.A. (GAES)

Recent Developments

-

In March 2023, MED-EL Medical Electronics provided direct streaming to their cochlear implant patient in their new MED-EL cochlear implant systems.

-

In November 2022, Cochlear Ltd. expanded its manufacturing facility plant in Kuala Lumpur, Malaysia. The expansion involved an asset of more than USD 6.28 million (RM 30 million) to help the growing demand for acoustic and cochlear hearing implants.

Cochlear Implant Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.95 billion

Revenue forecast in 2030

USD 2.77 billion

Growth Rate

CAGR of 6.02% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Age group, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Cochlear Ltd; Sonova; MED-EL Medical Electronics; Demant A/S; Zhejiang Nurotron Biotechnology Co. Ltd.; Amplifon S.p.A. (GAES)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cochlear Implant Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cochlear implant market report based on age group, end-use, and region.

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Adult

-

Adult Unilateral Implants

-

Adult Bilateral Implants

-

-

Pediatric

-

Pediatric Unilateral Implants

-

Pediatric Bilateral Implants

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinics

-

Hospitals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cochlear implant market size was estimated at USD 1.86 billion in 2023 and is expected to reach USD 1.95 billion in 2024.

b. The global cochlear implant market is expected to grow at a compound annual growth rate of 6.02% from 2024 to 2030 to reach USD 2.77 billion by 2030.

b. The adult unilateral implants segment dominated the cochlear implant market and accounted for the largest revenue share of 72.4% in 2023.

b. Some of the key players operating in the cochlear implant market are Cochlear Ltd; Sonova; MED-EL Medical Electronics; Demant A/S; Zhejiang Nurotron Biotechnology Co. Ltd.; Amplifon S.p.A. (GAES)

b. Key factors that are driving the cochlear implant market growth include several initiatives being undertaken by governments & various organizations to support research & increase adoption of cochlear implants and the rising number of clinical trials.

b. The clinics segment dominated the cochlear implant market and accounted for the largest revenue share of 63.4% in 2023.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.