- Home

- »

- Consumer F&B

- »

-

Cocoa Beans Market Size And Share, Industry Report, 2033GVR Report cover

![Cocoa Beans Market Size, Share & Trends Report]()

Cocoa Beans Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Cocoa Butter, Cocoa Powder, Cocoa Liquor), By Application (Confectionery, Functional foods & beverages), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-087-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cocoa Beans Market Summary

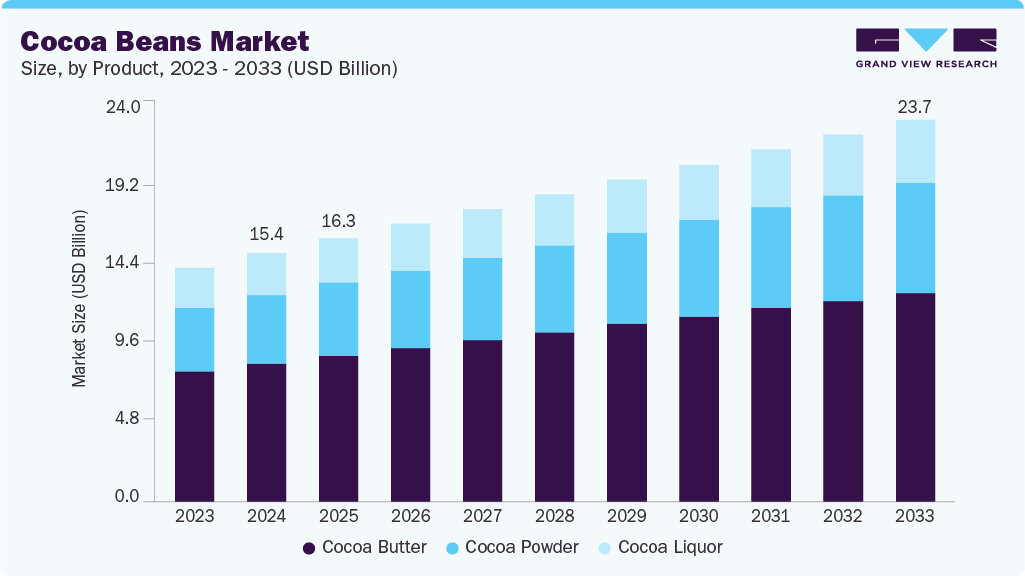

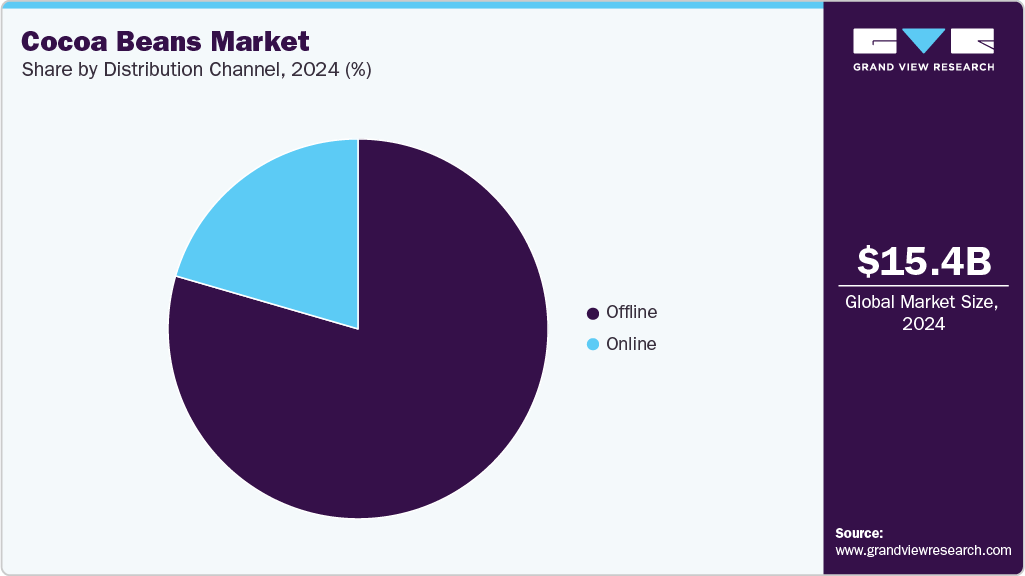

The global cocoa beans market size was estimated at USD 15.40 billion in 2024 and is projected to reach 23.68 billion in 2033, growing at a CAGR of 4.8% from 2025 to 2033. Rising disposable incomes in these regions enable greater purchasing power for chocolate and cocoa-based products, which are widely perceived as accessible indulgences.

Key Market Trends & Insights

- North America cocoa beans market dominated the global market and accounted for the largest revenue share of 29.2% in 2024.

- Asia Pacific cocoa beans market is anticipated to register the fastest CAGR over the forecast period.

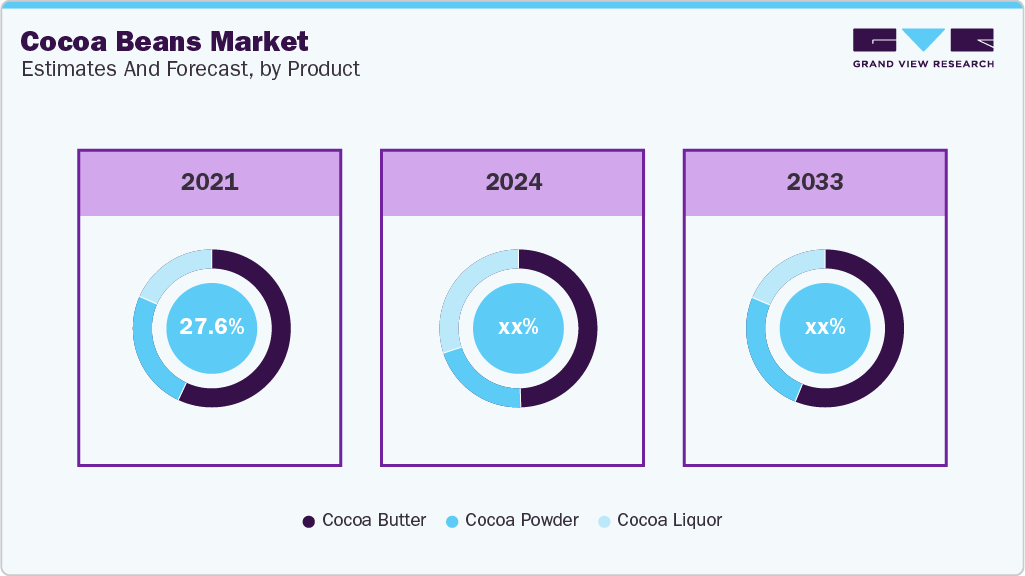

- By product, the cocoa butter segment dominated the market with a revenue share of 55.5% in 2024.

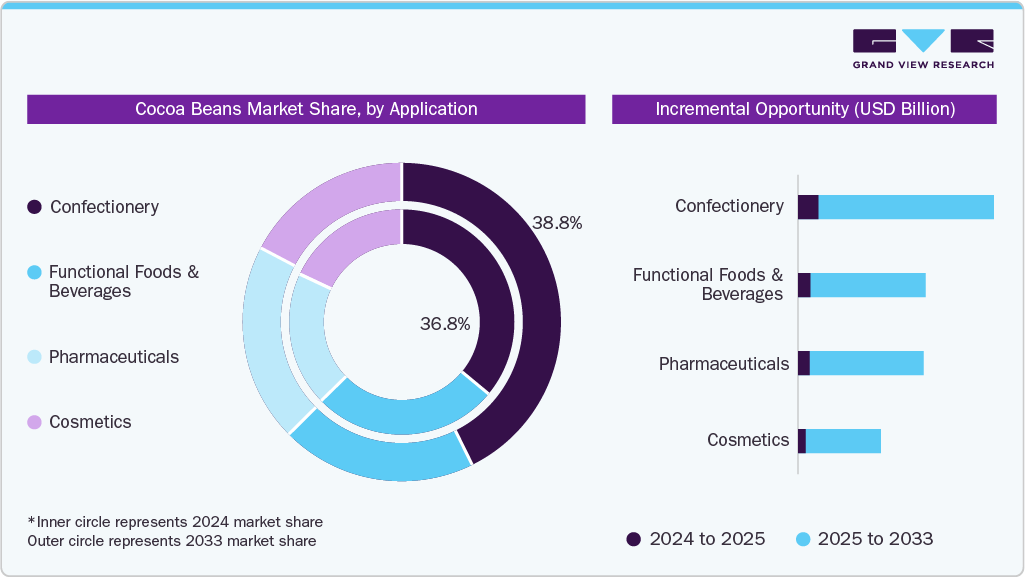

- By application, the confectionery segment dominated the market and accounted for the largest revenue share in 2024.

- By distribution channel, sales through offline channels accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 15.40 Billion

- 2033 Projected Market Size: USD 23.68 Billion

- CAGR (2025-2033): 4.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Furthermore, a growing awareness of the perceived health benefits of dark chocolate, such as its antioxidant properties, is bolstering demand, leading to its incorporation into new functional foods and beverages. Cocoa beans consumption reduces high blood pressure, manage chronic fatigue syndrome, provide protection from sunburn, and offer additional health advantages to the body. Cocoa is rich in polyphenols, which safeguard the body's tissues from oxidative stress and diseases such as cancer and inflammation. As consumer preferences shift towards indulgent treats, the global chocolate market has seen significant expansion. This trend is particularly pronounced in emerging economies, where rising disposable incomes enable consumers to purchase premium chocolate products. The growing popularity of dark chocolate, which contains higher cocoa content, further fuels this demand as health-conscious consumers seek out products perceived to have health benefits.

Governments, non-governmental organizations, and private companies are investing in infrastructure projects that improve the efficiency of cocoa transport and trade. These investments reduce costs and increase supply reliability, making the cocoa market more attractive to global buyers. In addition, efforts to combat issues such as cocoa supply chain disruptions and price volatility contribute to a more stable and predictable market environment. For instance, a June 2025 news article from The Hindu says the Indian government is providing subsidies to cocoa farmers, reinforcing its commitment to sector support and ensuring farmers can benefit from financial incentives to enhance productivity.

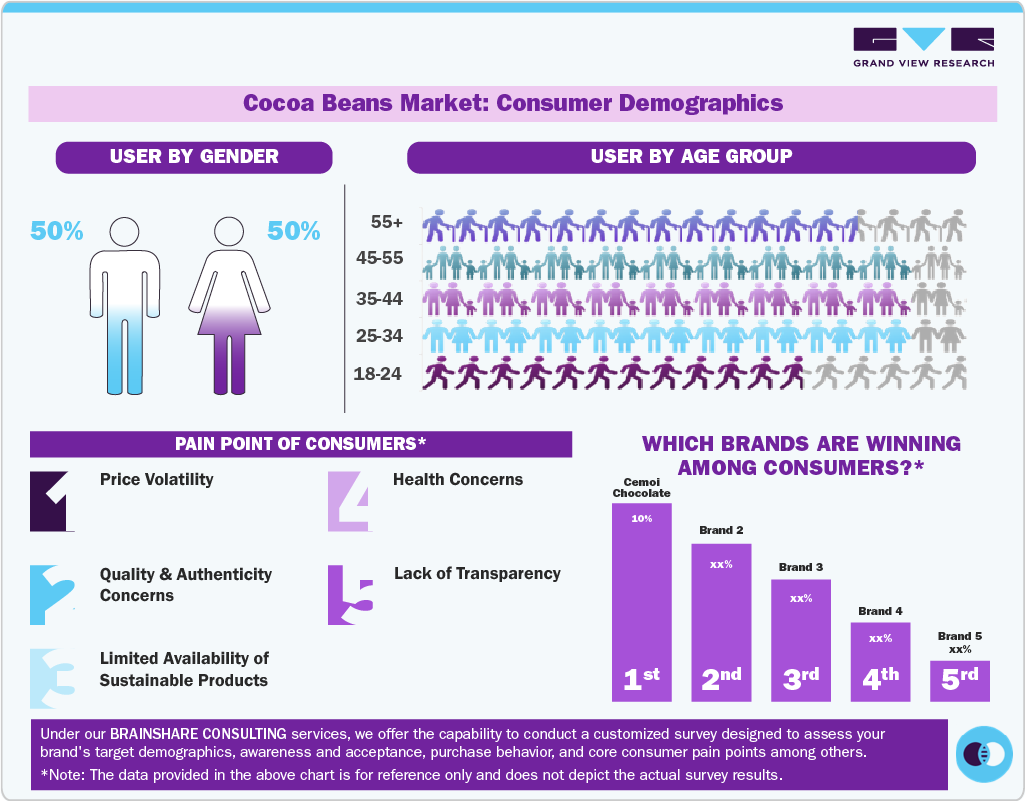

Consumer Insights for Cocoa Beans

In the cocoa marketplace, consumers prefer cocoa beans due to growing awareness of quality, health benefits, and sustainability. Traditional chocolate consumption continues to be the primary factor influencing demand, especially in Europe and North America, where there is a rising popularity of premium and artisanal chocolates. Consumers are more interested in dark chocolate due to its perceived health advantages, including antioxidants and lower sugar content. At the same time, younger demographics in Asia-Pacific are expanding demand for cocoa-based products, ranging from bakery items to beverages. Health-conscious buyers also seek products containing natural cocoa powders or minimally processed chocolate, reflecting a broader movement toward clean-label and functional food choices.

Sustainability and ethical sourcing are central in shaping consumer insights for cocoa beans. Shoppers are becoming more conscious of the social and environmental challenges of cocoa farming, such as deforestation, farmer poverty, and child labor. As a result, demand for Fairtrade, Rainforest Alliance, and organic-certified cocoa products is rising steadily across global markets. Many consumers are willing to pay a premium for products that guarantee traceability and fair compensation for farmers. In addition, increasing disposable incomes and urban lifestyles are fueling a taste for indulgent cocoa-based confectionery and beverages. This balance of ethical awareness and indulgence strongly influences purchasing behavior and market growth.

Product Insights

The cocoa butter segment dominated the market with a revenue share of 55.5% in 2024. The rising consumer preference for natural and organic ingredients in food products proliferates the market. As health consciousness among consumers continues to grow, there is a shift towards products perceived as healthier alternatives to synthetic or heavily processed ingredients. Cocoa butter, a natural fat derived from cocoa beans, is widely used in various food applications, including chocolates, baked goods, and confectionery items. It serves as a flavor enhancer and a textural agent that improves mouthfeel.

The cocoa powder segment is anticipated to register the fastest CAGR of 5.4% from 2025 to 2033. The demand for cocoa powder has surged with the growing consumption of chocolate products across various age groups and demographics. Manufacturers in the chocolate and confectionery sector are constantly seeking high-quality cocoa powder to meet the escalating demand for their products, thereby contributing to the expansion of the cocoa powder market.

Application Insights

The confectionery application dominated the market and accounted for the largest revenue share of 36.8% in 2024. The increasing consumer demand for premium and artisanal chocolates has led to a surge in the use of high-quality cocoa beans. As consumers become more discerning about their chocolate choices, they are willing to pay a premium for products made with superior cocoa beans. This trend has prompted manufacturers to invest in high-quality cocoa sources and sustainable practices to cater to this growing market segment, thereby driving the overall demand for cocoa beans.

The pharmaceuticals segment is expected to register the fastest CAGR of 5.5% from 2025 to 2033. With a rising trend towards holistic and preventative healthcare, there is a strong interest in natural products that complement traditional medicine. Cocoa beans, known for their potential to support heart health, manage blood pressure, and improve mood, align well with this trend. Pharmaceutical companies are leveraging these properties to develop supplements and medications that appeal to health-conscious consumers, further stimulating the demand for cocoa beans in the pharmaceutical sector.

Distribution Channel Insights

Sales of cocoa beans through offline channels accounted for a market share of 79.5% in 2024. As lifestyles become busier, consumers seek one-stop shopping experiences to purchase various products, including cocoa-based goods such as chocolate, snacks, and baking ingredients. Hypermarkets and supermarkets cater to this need by offering a wide range of cocoa products under one roof, making it easier for consumers to find what they need without visiting multiple stores.

The online distribution channel is expected to register the fastest CAGR of 5.7% during the forecast period. The rise of the online cocoa marketplace and specialty e-commerce platforms dedicated to cocoa and chocolate products has expanded suppliers' market reach and visibility. Companies increasingly leverage digital platforms to showcase their products, offer detailed product information, and engage with a global audience. This digital presence helps suppliers capture a larger market share, reaching both niche and mainstream customers who prefer the convenience of online shopping.

Regional Insights

The North American cocoa beans market accounted for the largest revenue share of 29.2% in 2024. North American consumers increasingly seek high-quality, gourmet chocolates featuring exotic and unique cocoa bean varieties. This trend towards premiumization is fueled by a growing appreciation for sophisticated flavors and a willingness to pay a premium for luxury chocolate experiences. As a result, manufacturers focus on sourcing high-quality cocoa beans to meet this demand, thereby driving regional market growth.

U.S. Cocoa Beans Market Trends

The U.S. cocoa beans market is anticipated to grow significantly over the forecast period. The U.S. market relies heavily on imports to meet the growing consumer preference for various cocoa varieties and formulations. American consumers seek premium and exotic chocolate experiences, so U.S. companies import cocoa beans from key producing countries such as Ivory Coast, Ghana, and Indonesia. This demand for high-quality and diverse cocoa inputs supports market growth by encouraging robust import activities. According to the U.S. Department of Agriculture (USDA), the country's import value of cocoa beans averaged more than USD 1.1 billion annually.

Europe Cocoa Beans Market Trends

Europe cocoa beans market was identified as a lucrative region in 2024. The European cocoa marketplace is known for its innovative approach to confectionery and food products, including developing new cocoa-based ingredients and formulations. Innovations such as reduced-sugar chocolates, cocoa-infused beverages, and health-oriented products are gaining popularity. This continuous product development creates new opportunities for cocoa beans as manufacturers seek diverse, high-quality varieties to meet evolving consumer preferences and dietary trends.

The UK cocoa beans market is expected to grow rapidly over the forecast period. The UK boasts one of the highest per capita chocolate consumption rates globally, with an average of approximately 8.1 kg per person annually. With approximately 56% of British adults consuming chocolate more than once a week, manufacturers are motivated to source high-quality cocoa beans to meet consumer preferences for diverse chocolate products ranging from bars to gourmet confections.

Asia Pacific Cocoa Beans Market Trends

Asia Pacific cocoa beans market is anticipated to register the fastest CAGR of 5.8% from 2025 to 2033. The rising population and the increasing disposable income levels in many Asian countries have made premium cocoa-based products more affordable and accessible to a more extensive consumer base. Consumers spend more on high-quality chocolates with superior taste, texture, and convenience. Furthermore, there is a rise in online stores in the region selling cocoa-based products, simplifying the process for customers to purchase them from their residences.

The China cocoa beans market is growing significantly, driven by the country’s growing appetite for chocolate and cocoa-based products, supported by rising disposable incomes and Western lifestyle adoption. Increased demand for premium chocolates, bakery items, and flavored beverages is accelerating cocoa imports. In addition, China’s expanding middle class and growing interest in gifting culture during festivals are boosting chocolate consumption, creating a steady demand for quality cocoa beans.

Latin America Cocoa Beans Market Trends

The Latin America cocoa beans market is growing significantly over the forecast period, driven by its dual role as a production hub and an emerging consumer market. The region’s rich biodiversity and favorable climate support large-scale cocoa cultivation, especially in Ecuador and Peru. Rising local consumption of chocolate, combined with a growing global demand for specialty and organic cocoa, is encouraging investment in sustainable farming practices and export-oriented production, strengthening Latin America’s market presence.

The Brazil cocoa beans market is fueled by the country’s strong production base and government initiatives to revive cocoa farming in Bahia and Pará. Growing domestic demand for chocolate and confectionery, along with increasing exports of premium cocoa, is creating market growth. Brazil also benefits from global interest in traceable and sustainable cocoa, encouraging investments in agroforestry and certification programs supporting farmer incomes and environmentally friendly cultivation practices.

Middle East & Africa Cocoa Beans Market Trends

The cocoa beans industry in the Middle East and Africa region is showing a steady growth over the forecast period, driven by Africa’s position as the world’s leading cocoa producer, with the Ivory Coast and Ghana supplying the majority of global demand. Rising investments in processing facilities and infrastructure are strengthening export capabilities. In the Middle East, growing chocolate consumption among young, urban populations and the increasing popularity of luxury confectionery are fueling imports of high-quality cocoa beans for domestic processing and retail.

The UAE cocoa beans market is driven by rising demand for premium chocolates, artisanal confectionery, and cocoa-based beverages among expatriates and affluent consumers. The country’s role as a trade hub enhances cocoa bean imports and re-exports to neighboring regions. Luxury retail culture, frequent gifting traditions, and growing tourism are boosting chocolate sales. In addition, the increasing presence of global chocolate brands and specialty chocolatiers in the UAE supports market expansion.

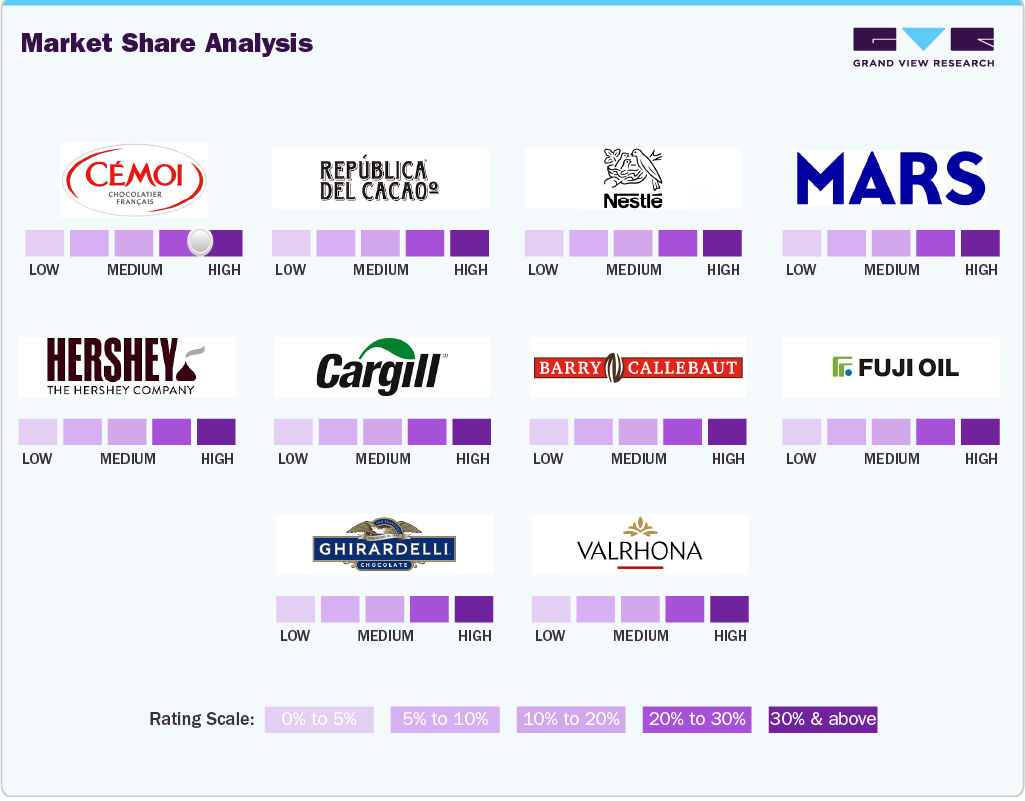

Key Cocoa Beans Company Insights

Some of the key companies in the cocoa beans market include Cemoi Chocolatier, Republica del Cacao, Nestlé S.A., Mars Incorporated, and others. Organizations in the cocoa marketplace are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

Key Cocoa Beans Companies:

The following are the leading companies in the cocoa beans market. These companies collectively hold the largest market share and dictate industry trends.

- Cemoi Chocolatier

- República del Cacao

- Nestlé S.A.

- Mars, Incorporated

- THE HERSHEY COMPANY

- Cargill, Incorporated

- Barry Callebaut

- FUJI OIL CO., LTD.

- Ghirardelli Chocolate Company

- Valrhona

Recent Developments

-

In May 2024, a Hyderabad-based craft chocolate company sought to elevate Indian cacao globally, combining scientific precision with farmer collaboration. It delivered traceable, single-origin chocolate, meticulously cultivated, fermented, and transformed from bean to bar under a disciplined, business-centric framework.

-

In April 2024, Nestlé S.A. partnered with Cargill, Incorporated, to achieve net-zero emissions by 2050 through an innovative agroforestry scheme focused on cocoa communities. This collaboration is part of a broader commitment to enhance environmental practices within the cocoa supply chain, addressing climate change and cocoa farmers' socio-economic challenges.

-

In March 2023, Utah State University’s Aggie Chocolate Factory became one of the first U.S. facilities to process Catongo, rare albino cocoa beans sourced from Fazenda Santa Teresa in Bahia, Brazil. The beans, known for their pale appearance, distinctive citrus-nutty-spice flavor, and low acidity, were roasted into a unique, mild 70% cacao chocolate. The initiative, conducted in collaboration with Fulbright Scholar Luciana Monterio of Ara Cacao, also emphasized sustainable, agro-ecological farming practices such as cabruca agroforestry.

Cocoa Beans Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 16.32 billion

Revenue Forecast in 2033

USD 23.68 billion

Growth rate

CAGR of 4.8% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; and UAE

Key companies profiled

Cemoi Chocolatier; República del Cacao; Nestlé S.A.; Mars, Incorporated; THE HERSHEY COMPANY; Cargill, Incorporated; Barry Callebaut; FUJI OIL CO., LTD.; Ghirardelli Chocolate Company; Valrhona

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cocoa Beans Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the cocoa beans market based on product, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Cocoa Butter

-

Cocoa Powder

-

Cocoa Liquor

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Confectionery

-

Functional foods & beverages

-

Pharmaceuticals

-

Cosmetics

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Online

-

Offline

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Specialty Stores

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global cocoa beans market size was estimated at USD 15.40 billion in 2024 and is expected to reach USD 16.32 billion in 2025.

b. The global cocoa beans market is expected to grow at a compounded annual growth rate of 4.8% from 2025 to 2033 to reach USD 23.68 billion by 2033.

b. Cocoa butter dominated the global cocoa beans market with a share of 55.5% in 2024. This product is increasingly used as a lubricant in pharmaceutical industry. Furthermore, cocoa butter finds use as anti-oxidant, flavor enhancer, and preservative in food & beverage industry.

b. Some key players operating in the global cocoa beans market include Cemoi Chocolatier; República del Cacao; Nestlé S.A.; Mars, Incorporated; THE HERSHEY COMPANY; Cargill, Incorporated; Barry Callebaut; FUJI OIL CO., LTD.; Ghirardelli Chocolate Company; and Valrhona.

b. The rising awareness and knowledge about the positive health effects of cocoa-rich beans is leading to the growth of the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.